Looking to grow your money with a trusted name? American Express investment services offer simple, flexible options to help you save and invest smarter.

Whether you’re just starting out or want to earn more from your cash, Amex provides high-yield savings, CDs, and unique investing tools through Schwab. This guide breaks it all down in easy-to-understand steps.

Introduction to American Express Investment Services

When you think of American Express, credit cards probably come to mind first. But this well-known company also offers helpful tools to grow your money. Through American Express investment services, you can access a range of simple, low-risk options designed for both new and experienced savers. Whether you want to earn more on your savings, lock in a guaranteed return, or invest using credit card rewards, Amex has solutions for you.

In this review, GateXFin will walk you through:

- The high-yield savings account (HYSA)

- Certificates of Deposit (CDs)

- Investment options through a partnership with Charles Schwab

- A unique way to invest Membership Rewards points

- Beginner-friendly resources to help you get started

Here is a simple comparison:

| Product | Annual Fee | Rate / Reward | Liquidity | Best For |

|---|---|---|---|---|

| HYSA | $0 | ~3.50% APY | Instant access | Safe savings, emergency funds |

| CDs | $0 | ~3.25–4.00% APY (by term) | Locked (some penalty) | Goal‑based savings, rate locking |

| Schwab Investor Card from Amex | $0 | 1.5% cashback into Schwab | Depends on Schwab | Passive investing via spending |

| Platinum Card for Schwab (with points) | ~$695 | Points → invest at ~1.1¢/pt | Depends on Schwab | High‑spend travel & investing |

By the end, you’ll have a clear picture of what American Express investment services offer. Let’s get started now!

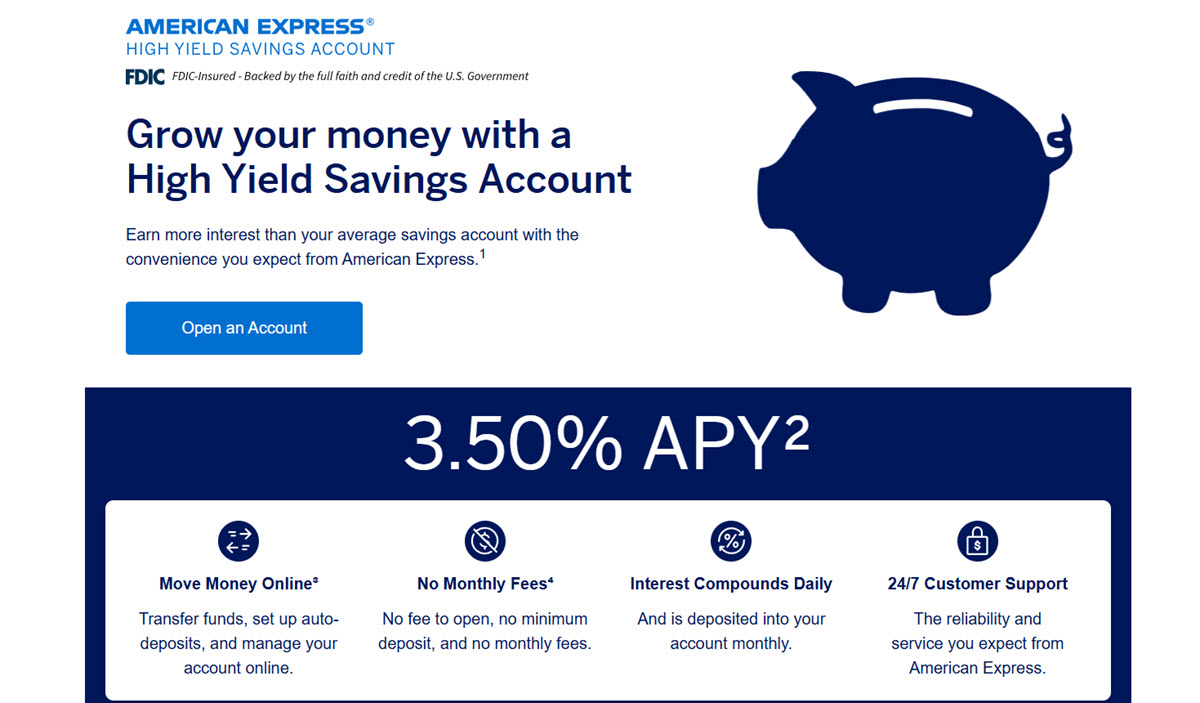

High-Yield Savings Account (HYSA)

The American Express High-Yield Savings Account is designed to help your money grow faster than it would in a traditional savings account. As of July 29, 2025, the annual percentage yield (APY) is around 3.50%, well above the national average of just 0.38%. That means more interest on your savings without taking on extra risk.

Here’s why it stands out:

- No minimum deposit. You can start using this type of American Express investment services even with just $0.

- No monthly fees. There are no hidden charges to worry about.

- Daily compounding interest. Your interest is calculated every day and added to your balance each month.

- FDIC insured. Your money is protected up to $250,000 per depositor, just like with most major banks.

Managing your savings is simple. You can link the account to your current bank, schedule automatic deposits, and move funds in or out online anytime. Most transfers take only 1–2 business days.

This HYSA is a smart option for people who want a safe place to store emergency funds or just earn more interest on their everyday savings. It’s flexible, fee-free, and easy to use, even for first-time savers.

Certificates of Deposit (CDs)

If you’re looking for a way to earn a fixed return and don’t mind keeping your money untouched for a while, American Express investment services also include Certificates of Deposit. CDs let you lock in a guaranteed interest rate for a set amount of time.

As of mid-2025, American Express offers a variety of CD terms, ranging from a few months to five years. The rates are competitive, with APYs between 3.25% and 4.00%, depending on how long you commit. For example, the 14-month CD currently earns 4.00% APY, which is a strong return for short-term savings.

Key benefits of this American Express investment account include:

- No minimum deposit required. Start saving with any amount.

- Fixed interest rates. You know exactly how much you will make because your rate is set.

- Daily compounding. Like the savings account, interest grows each day and is added monthly.

- No monthly fees. You won’t lose earnings to maintenance charges.

- Optional early withdrawal. If you need to withdraw your money before the CD matures, you may face a penalty (typically 90 to 540 days’ worth of interest). However, any interest already earned is usually yours to keep.

CDs are ideal for goal-based saving, like a future vacation, car purchase, or home down payment. If you’re sure you won’t need the funds right away, locking in today’s rates can help you grow your money with zero guesswork.

While other banks may offer slightly higher APYs, American Express CDs are still a solid pick, especially because they come with no minimum deposit requirement, which makes them more accessible for everyday savers.

Brokerage Access via Schwab

Although American Express no longer operates its own full-service brokerage (having sold American Express Bank Ltd. in 2008), it continues to assist cardholders with investing through trusted partnerships. The most notable of these American Express investment services is with Charles Schwab, one of the largest and most respected brokerage firms in the U.S.

Schwab Investor Card from American Express

This Amex credit card is designed especially for Schwab clients who want to grow their investments with everyday spending. It works like a typical rewards card but with a unique twist: all cash back automatically gets deposited into your linked Schwab brokerage or IRA account.

Key Features of This American Express Investment Card:

- 1.5% cash back on every purchase, no category restrictions.

- No annual fee.

- $200 welcome bonus after you spend $1,000 in the first 3 months.

- 0% intro APR for 6 months, then a variable APR (about 18.7%–29.7% based on your credit).

- Rewards are automatically transferred to your Schwab investment account.

- Includes Amex perks like purchase protection, extended warranty, car rental insurance, and travel benefits.

Pros:

- Simple and reliable 1.5% unlimited cash back.

- No fees to eat into your returns.

- Easy way to invest consistently through your spending.

- Great fit for existing Schwab users.

Cons:

- Requires an active Schwab brokerage or IRA account.

- 2.7% foreign transaction fee, not ideal for travelers.

- Cash back goes to only one linked account, and changing that account can be a hassle.

If you’re already investing with Schwab, this card is a no-brainer. You’ll earn while you spend and grow your investment account passively. But for those without a Schwab account, its value is limited.

American Express Invest with Rewards for Schwab

American Express also offers a Schwab-branded version of its premium Platinum Card, made for investors who prefer to use points rather than cash.

With this premium card, American Express investment services allow you to redeem Membership Rewards points into your Schwab investment account. It’s a smart way to turn points into long-term gains.

Key Features:

- Point-to-cash redemption rate: 10,000 points = $110 (1.10 cents per point).

- Welcome offer: Earn 80,000 points after spending $8,000 in 6 months (worth $880 in Schwab deposits).

- Includes premium travel perks like airport lounge access, airline fee credits, hotel elite status, and more.

- Comes with Uber credits, Concierge service, and extended warranty protections.

- Annual fee: Around $695, which is high but typical for premium travel cards.

Pros:

- Best way to convert Amex points into real investment cash.

- Great for frequent travelers who want both luxury perks and long-term investing.

- Flexible redemption with no need to book through travel portals.

Cons:

- Must have a Schwab brokerage account to use this benefit.

- High annual fee, so it’s best for those who will fully use the card’s perks.

This type of American Express investment services is ideal for high-income earners or frequent travelers who want to turn travel rewards into long-term investments without added steps. It combines lifestyle and financial growth in one.

Membership Rewards Points Investment

American Express Membership Rewards points are typically used for things like flights, hotels, gift cards, or statement credits. But with its Schwab partnership, American Express investment services let you convert points directly into cash.

Here’s how it works:

- You can deposit points into a Schwab account instead of spending them elsewhere.

- The standard rate is 10,000 points = $110 deposited into your brokerage account (1.10 cents per point).

- You can do this with up to 1 million points per year.

- After the first million points, the redemption rate drops slightly to $80 per 10,000 points (about 0.80 cents per point).

- This method is perfect for cardholders who want to grow wealth long-term without worrying about travel restrictions, fluctuating reward values, or complicated redemption portals.

Using your Membership Rewards points for investing is a smart and flexible option. Unlike travel redemptions, there are no blackout dates or limited availability, you don’t have to worry about finding a flight. Your points are simply converted into cash and deposited into your Schwab investment account, where they can start growing immediately. This approach also helps you balance your rewards between travel and long-term financial goals.

Resources for Beginner Investors

American Express understands that getting started with investing can feel overwhelming, especially for beginners. That’s why American Express investment services also include a collection of easy-to-follow online resources designed to help first-time investors build confidence and make smart choices with their money. These tools are available for free and are written in plain, simple English, no complex jargon or confusing charts.

On the American Express website, you’ll find step-by-step guides that walk you through how to begin investing. There are helpful articles that explain key topics like risk tolerance, setting financial goals, and how to choose the right investment product for your needs. You’ll also see clear comparisons between high-yield savings accounts, certificates of deposit (CDs), and brokerage options, so you can understand how each works and which might fit your situation best.

The platform also teaches about important financial concepts like fees, liquidity (how easily you can access your money), and expected returns, which are essential when deciding where to invest. These resources are perfect for people who are curious but unsure where to begin. They bridge the gap between thinking about investing and actually taking action, making it less intimidating for anyone new to managing their money.

Who Should Use American Express Investment Services?

Not sure if American Express investment services are right for you? Start by thinking about your financial needs and goals:

- Searching for a secure place to increase your savings?

Go with the High-Yield Savings Account (HYSA) or Certificates of Deposit (CDs). The HYSA gives you flexibility with easy access to your money, while CDs offer fixed interest and higher returns if you can leave your money untouched for a set time. - Already have a Schwab brokerage account and want to invest passively?

The Schwab Investor Card from American Express is a great match. You earn 1.5% cash back on every purchase, and it’s automatically deposited into your Schwab investment account. - Travel often and have a large balance of Membership Rewards points?

The Platinum Card for Schwab might be worth considering. You’ll enjoy premium travel benefits and can convert points into investment funds, giving you a way to grow your wealth without even using cash.

No matter your experience level, American Express investment services have something that can fit your needs, whether you’re just saving a little extra cash or looking for smart ways to build long-term wealth.

How to Open an American Express Investment Account

American Express offers two main ways to grow your money: through savings products like high-yield accounts and CDs, or by linking a credit card to your Schwab investment account. Here’s a step-by-step guide to help you get started with American Express investment services.

High‑Yield Savings & Certificates of Deposit (CDs)

Looking to earn more from your savings with no monthly fees? Opening a high-yield savings account or CD with American Express is quick and easy.

Here’s how to start using American Express investment services:

- Go to the American Express Savings Website: Start by visiting the official Amex savings page. From there, select either the High-Yield Savings Account or CD, and click the “Open an Account” button.

- Fill Out the Application: You’ll be asked to enter basic personal details: your full name, home address, date of birth, Social Security number, phone number, and email address. This is standard for any type of bank account.

- Verify Your Identity: Once you’ve submitted your information, Amex will verify your identity. If everything checks out, you’ll receive a confirmation email and get access to your new account dashboard.

- Fund Your Account: Next, connect your existing bank account to transfer money. You can also mail in a check if you prefer. There’s no minimum deposit required, so you can start with any amount you’re comfortable with.

- Watch Your Savings Grow: After funding your account, you’ll start earning interest right away. Interest is compounded daily and added to your account monthly. Plus, you can manage everything online or through the Amex mobile app with no monthly maintenance fees and no balance requirements.

Schwab Investor Card from American Express

If you already use Charles Schwab for investing, the Schwab Investor Card from American Express might be a great option for you.

- Make Sure You Have an Eligible Schwab Account: Before applying, you’ll need to have a qualifying Schwab account, which could be a general brokerage account, a Schwab One account, or a traditional/IRA account held under your name or certain types of trusts.

- Apply Online or Through the Amex App: Once you’ve confirmed eligibility, head to the American Express website or use their mobile app to apply. In some cases, you may get access to a digital version of the card instantly, so you don’t have to wait for the physical one to arrive.

- Pass a Credit Check and Link Your Accounts: You must be at least 18 years old and a U.S. resident. A good credit score (typically 700 or higher) increases your chances of approval. During the process, your Amex and Schwab accounts will be securely linked so rewards can be deposited automatically.

- Start Using the Card: After approval, use your card to earn 1.5% cash back on every purchase. That cash back is then automatically deposited into your linked Schwab investment account, usually within 8 to 12 weeks.

- Take Advantage of Welcome Offers: Depending on the current promotion, new cardholders may receive a bonus statement credit, such as $200 or more, after meeting a minimum spend requirement within the first few months. This gives you a head start on your investing journey.

FAQs about American Express Investment Services

Does American Express have its own investment platform?

- No, American Express no longer operates its own brokerage. It partners with Charles Schwab to offer investment options and financial advice to cardholders.

Can I use American Express Membership Rewards points to invest?

- Yes. If you have a Schwab brokerage account, you can redeem Membership Rewards points at a rate of 1.10 cents per point and deposit them directly into your investment account.

Is the American Express High-Yield Savings Account safe?

- Yes. The HYSA is FDIC-insured up to $250,000 per depositor, and it offers a competitive interest rate with no monthly fees or minimum balance requirement.

Who is eligible to apply for American Express’s Schwab Investor Card?

- You must have an eligible Schwab brokerage or IRA account to apply. The card is best for people who want to earn cash back and invest it automatically.

Does American Express charge fees for using its investment services?

- American Express doesn’t charge fees for its savings accounts or CDs. However, some partner services like Schwab investing may have fees based on account type or investment activity.

American Express investment services offer simple, low-risk ways to grow your money. Whether you prefer saving with a high-yield account, locking in rates with CDs, or investing through Schwab, Amex has flexible options. It’s easy to start, even if you’re new to investing. If you already trust Amex for spending, it might be time to trust them for saving and investing too.