If you’re planning to buy or refinance a home this year, understanding Zions Bank mortgage rates is a smart first step. In 2025, the bank offers a mix of fixed and adjustable options to fit different needs and budgets.

Today, we’ll walk through how these rates work, what influences them, and ways you might lower your costs. The goal is to make the numbers easy to understand, even if mortgages aren’t your specialty. By the end, you’ll feel more confident about your next move.

Introduction to Zions Bank

Zions Bank is a long-standing financial institution with deep roots in the American West. Founded in 1873 in Salt Lake City, Utah, it has grown from a small local bank into a trusted regional lender serving customers across Utah, Idaho, and several other states. The bank is part of Zions Bancorporation, one of the nation’s largest regional banking companies, known for its strong community focus and customer service.

Over the years, Zions Bank has built a reputation for offering a broad range of financial products, from everyday Zions checking accounts to business loans, investment services, and specialized mortgage programs. What sets it apart is its combination of modern digital banking tools and a personal, relationship-driven approach. Whether you’re a first-time homebuyer or an experienced investor, Zions Bank aims to provide tailored solutions backed by local decision-making and a deep understanding of the communities it serves.

This strong foundation makes Zions Bank an appealing choice for borrowers who want both competitive rates and a banking partner they can trust for the long term. And with Zions Bank mortgage rates often aligning with market trends, many customers see them as a solid option for home financing.

What Are Zions Bank’s Current Mortgage Rates?

If you check Zions Bank’s website, you’ll see that they publish their current mortgage rates and refresh them often. Instead of listing everything in one chart, they break the Zions Bank mortgage rates down into separate tables for each home loan type: fixed-rate mortgages, adjustable-rate mortgages (ARMs), FHA and VA loans, plus jumbo loans. This makes it easier to compare options that fit your situation.

In early August 2025, Zions posted example figures showing a 30-year conventional fixed-rate mortgage at about 6.25% interest, with an APR around 6.43%. They also showed some adjustable-rate products, like a 7/1 ARM, with starting rates near 6.50%. However, keep in mind that these Zions Bank mortgage rates are just public sample rates. The exact one you receive could be higher or lower depending on your credit score, the amount you borrow, your down payment, the property location, and other fees.

Looking at the bigger picture, the average 30-year fixed rate in the U.S. sat in the mid-6% range during early August 2025. Freddie Mac’s weekly survey reported about 6.63%, which is very close to what many lenders, including Zions, were offering. Earlier in 2025, rates had been even higher, but recent weeks showed a slow but steady downward trend.

The numbers Zions publishes give you a general idea of market conditions. But the rate you can actually lock in depends on your personal application details and the underwriting guidelines for your specific state or region.

Zions Bank Mortgage Rates By Loan Types

Mortgage rates change over time due to market conditions, inflation, and Federal Reserve policies. Here’s a look at the current Zions mortgage rates as of August 9, 2025 including Zions Bank 30-year mortgage rates, 15-year mortgage rates, ARM rates, and more:

| Loan Type | Term | Interest Rate | APR | Best For |

|---|---|---|---|---|

| Fixed-Rate Mortgage | 15-Year Conventional Fixed | 5.500% | 5.782% | Homebuyers who want stability and plan to stay long-term |

| 30-Year Conventional Fixed | 6.250% | 6.429% | Homebuyers who want stability and plan to stay long-term | |

| Adjustable-Rate Mortgage (ARM) | 7/1 ARM | 6.375% | 6.980% | Buyers who expect to move or refinance before adjustment |

| 10/1 ARM | 6.625% | 6.986% | Buyers who expect to move or refinance before adjustment | |

| FHA Mortgage | 30-Year Fixed FHA Loan | 5.875% | 6.681% | First-time buyers or those with smaller down payments |

| Home Refinance Loan | 7-Year Refinance Loan | 7.375% | 7.909% | Homeowners seeking better loan terms or cash out |

| 10-Year Refinance Loan | 7.500% | 7.894% | Homeowners seeking better loan terms or cash out | |

| Jumbo Loan | 7/1 Jumbo ARM | 6.375% | 6.974% | Buyers purchasing homes above conventional limits |

| 10/1 Jumbo ARM | 6.625% | 6.980% | Buyers purchasing homes above conventional limits | |

| VA Mortgage | 30-Year VA Fixed | 6.000% | 6.307% | Eligible veterans, active-duty members, and some spouses |

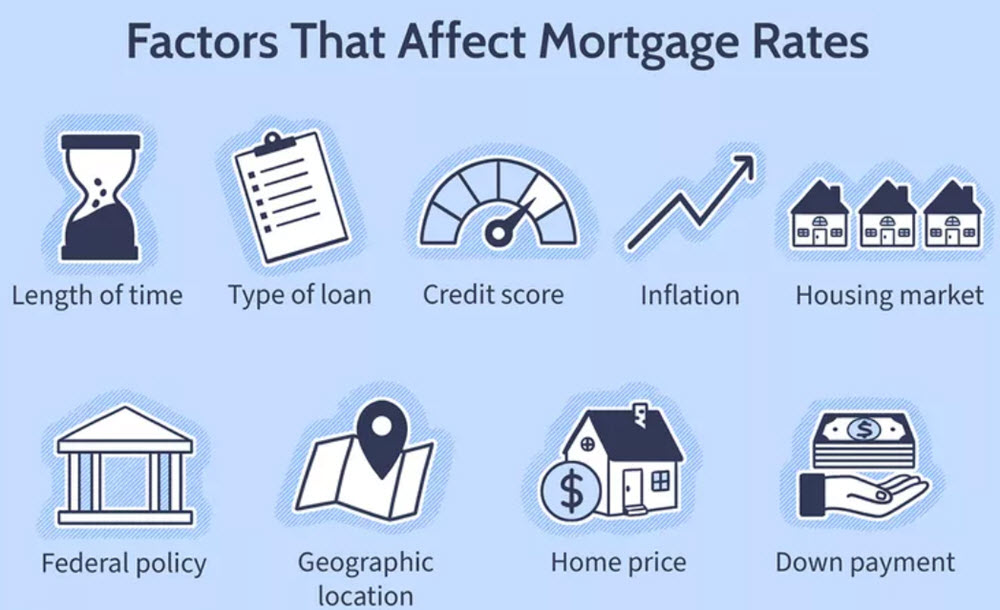

Factors That Affect Your Zions Bank Mortgage Rate

Your mortgage rate is influenced by more than just the national market or the Federal Reserve. At Zions Bank, several personal and financial factors play a big role in determining the Zions Bank mortgage rates you’ll be offered:

- Credit Score: A higher score shows you have a strong history of paying debts on time. This lowers the lender’s risk, which often means you’ll qualify for a lower interest rate. For example, someone with a score above 750 may get a noticeably better rate than someone with a score in the 600s.

- Down Payment: The amount you put down on your home can directly affect your rate. A larger down payment means you borrow less money, which reduces risk for the bank. As a result, you may get a more favorable interest rate. Even increasing your down payment by a few thousand dollars can sometimes make a difference.

- Loan Term: Shorter terms, such as 15 years, usually come with lower interest rates compared to longer terms like 30 years. While your monthly payment may be higher, you’ll save a significant amount in total interest paid over time.

- Loan Type: Not all loans are priced the same. Fixed-rate, adjustable-rate, FHA, VA, and jumbo loans each have their own structure and cost. For example, an ARM might offer a lower initial rate, while a fixed-rate loan offers long-term stability.

- Debt-to-Income Ratio (DTI): Your DTI compares how much you owe each month to how much you earn. Lenders use it to see if you can comfortably handle your mortgage payment along with other debts. A lower DTI suggests you have more room in your budget, which can help you qualify for a better rate.

In addition, many other factors can influence mortgage rates in general and Zions Bank mortgage rates in particular, especially economic and market factors such as Federal policy, the housing market, and more.

How to Get the Best Rate

If you want to secure the lowest possible rate, a little preparation can go a long way. Here are practical steps you can take:

- Boost Your Credit Score: Pay bills on time, pay down existing balances, and avoid taking on new debt before applying for a Zions Bank home loan.

- Increase Your Down Payment: Even an extra 5% can lower your loan-to-value ratio and improve your offer.

- Consider a Shorter Term: Choosing a 15-year fixed mortgage may mean higher monthly payments, but it usually comes with a lower rate and less interest paid overall.

- Look at Adjustable-Rate Options: If you know you’ll sell or refinance within a few years, an ARM can give you a lower starting rate.

- Compare Loan Programs: Even within Zions Bank, different products may have different rates and terms. Compare loan programs within Zions Bank to see which offers the best Zions Bank mortgage rates for your needs.

Using Zions Bank Mortgage Calculator

Before you choose a loan, it’s a smart idea to estimate what your monthly payment will be. Zions Bank offers an online mortgage calculator that makes this simple. You can also use the bank’s mortgage calculator to see how different Zions Bank mortgage rates affect your monthly payment.

You just need to enter:

- Home purchase price

- Down payment amount

- Loan term length

- Interest rate

- Estimated property taxes, insurance, and HOA fees (if any)

These numbers will determine how much you should pay each month for principal, interest, property taxes, and other costs. This helps you see the full cost of owning the home, not just the loan itself, so you can plan your budget with confidence.

Applying for a Mortgage at Zions Bank

Zions Bank makes it easy to start your mortgage application, whether you prefer doing it online, over the phone, or face-to-face. You can use the Zip Mortgage portal for a fast and convenient online process, call the mortgage services team for guidance, or visit a nearby branch if you want personal assistance.

The mortgage application process usually follows these steps:

- Pre-qualification: This is the first step where you get an estimate of how much you might be able to borrow. Zions Bank will ask for basic financial details like your income, debts, and credit score. Pre-qualification is not a final approval, but it gives you a clear starting point and helps you shop for homes within your budget.

- Loan Application: Once you’ve chosen a home, you’ll need to complete the official loan application. This requires more detailed information, such as your full employment history, bank statements, tax returns, and any other documents that show your financial stability.

- Loan Processing: After you submit your application, Zions Bank’s team will review everything. They will verify your income and employment, check your credit report, and order a professional appraisal to confirm the property’s value. This step ensures the bank has all the facts before making a decision.

- Approval and Closing: If your application meets all requirements, you’ll receive loan approval. The closing process includes reviewing and signing all final loan documents. Once the paperwork is complete, the funds are released, and you get the keys to your new home.

And if you encounter any issues during the application process, don’t hesitate to ask a bank representative for guidance or call the Zions Bank mortgage phone number at 800-727-8893.

Regardless of how you apply, your final Zions Bank mortgage rates will depend on a thorough review of your finances, credit history, and property details.

Pros and Cons of Getting a Zions Mortgage

Like any lender, Zions Bank has strengths and limitations. Understanding both can help you make a better decision.

Pros:

- Competitive Rates: Zions Bank often offers interest rates that are in line with or lower than national averages.

- Variety of Loan Options: You can choose from fixed-rate, adjustable-rate, FHA, VA, jumbo, and refinancing programs.

- Local Decision-Making: Loan approvals are handled locally, which can make the process faster and more personal.

- Easy Online Application: The Zip Mortgage portal makes it convenient to apply without visiting a branch.

Cons:

- Limited Branch Network: If you live outside Zions Bank’s main service areas, in-person access may be limited.

- Rates Depend on Credit and Down Payment: Borrowers with lower credit scores or smaller down payments may face higher Zions Bank mortgage rates.

FAQs About Zions Bank Mortgage Rates

How can I lock in Zions Bank mortgage rate, and when is the best time?

- Once Zions Bank gives you a personalized interest rate during your application, you can choose to lock it in. Locking early can protect you if rates go up before closing. If you wait, you might get a lower rate, but you also risk paying more if rates increase.

Does Zions Bank offer mortgage rate buy-downs, and what are the choices?

- Yes. You can choose a temporary 2-1 buydown, usually paid by the seller, which lowers your rate by 2% in the first year and 1% in the second. Another option is a permanent buydown, in which you pay up front to maintain a lower interest rate for the duration of the loan.

Do Zions Bank mortgage rates include private mortgage insurance (PMI)?

- No. Rates shown don’t automatically include PMI. If your down payment is less than 20%, you may need to pay PMI as an extra cost.

What economic factors can change Zions Bank mortgage rates?

- Rates often move based on the bond market and demand for mortgage-backed securities. While the Federal Reserve doesn’t set mortgage rates directly, its actions can still influence them through the broader economy.

Are Zions Bank’s mortgage rates competitive with other lenders?

- Yes. Zions Bank often offers slightly lower interest rates and closing costs than many other lenders, especially for conventional and FHA home loans.

Whether you are buying your first home, upgrading to a larger property, or refinancing your current mortgage, Zions Bank mortgage rates are worth a close look. With competitive pricing, a wide range of loan options, and experienced local mortgage officers, Zions Bank can help you finance the home you want. Taking the time to compare rates, understand the terms, and prepare your finances will help you secure a mortgage that fits your budget and long-term goals.