For many growing businesses, finding the right financial partner is a challenge. M&T Bank investment banking offers a clear solution, focused support for mid-sized companies that need more than basic banking, but aren’t quite served by large Wall Street firms.

With services like M&A advisory, debt capital solutions, and strategic financial guidance, M&T helps businesses take their next big step with confidence.

Overview of M&T Bank Investment Banking

Before diving into what M&T Bank offers, let’s define investment banking in simple terms.

About M&T and Investment Banking

Investment banking helps businesses raise money, buy or sell companies, manage large financial transactions, and get advice on complex deals. These services are different from everyday banking. They’re focused on high-value financial strategies, often involving millions, or even billions, of dollars.

Founded over 165 years ago, M&T Bank has grown into one of the top 15 U.S.-owned commercial banks, with over $200 billion in assets and a footprint that includes more than 950 branches across 12 states.

While widely recognized for its retail and commercial banking services, M&T has quietly built an impressive investment banking division. This side of the business is designed specifically for privately held, closely controlled, and middle-market firms, often underserved by larger institutions.

The M&T Bank Investment Banking Model

Unlike many banks that segment services based on strict thresholds or boilerplate products, M&T takes a more collaborative and personalized approach. Their investment banking services are offered through M&T’s Commercial Bank and supported by M&T Securities, Inc.

At its core, the investment banking team focuses on understanding client objectives first, be it ownership transition, growth through acquisition, recapitalization, or capital restructuring. Then, the team builds strategies around those goals.

What sets M&T apart is its ability to blend the intimacy of relationship banking with the technical expertise of Wall Street-caliber advisory.

Here are a few reasons companies turn to M&T Bank investment services:

- One of the 15 largest U.S. commercial banks

- Decades of industry experience

- Personal, strategic guidance from real people

- Access to capital markets and private placement solutions

- Nationwide and regional expertise

- Strong support from M&T Securities and Wilmington Trust

Types of M&T Bank Investment Banking Services

M&T Bank offers a wide range of investment banking services designed to support businesses at every stage, from raising capital to navigating mergers, acquisitions, and long-term financial planning.

Mergers & Acquisitions (M&A)

Buying or selling a business is a big choice. It often marks a new chapter, whether it’s your retirement, expansion plan, or a shift in ownership.

A Tailored M&A Process

M&T Bank investment banking teams provide a customized M&A process that aligns with your company’s goals. From the first conversation to the closing table, they focus on stakeholder objectives and long-term outcomes.

Here’s what their M&A team offers:

- Clear understanding of all stakeholder goals

- Strategic buyer targeting (broad or limited auctions)

- Custom marketing materials to highlight your company’s value

- Comprehensive due diligence support

- Ongoing guidance through legal, financial, and closing processes

Sell-Side Advisory

fgM&T’s sell-side advisors help you unlock the full value of your company by structuring deals that protect your legacy.

Their disciplined process includes:

- Buyer analysis

- Market benchmarking

- Bid strategy

- Timeline management

- Stakeholder alignment

Buy-Side Advisory

If your business is looking to acquire another company, M&T Bank helps evaluate targets, arrange financing, and structure the deal. Their team provides detailed analysis, helping ensure each move fits your bigger picture.

Corporate Finance Advisory

Every growing business hits a point where capital is needed, whether for expansion, debt refinancing, or ownership change. That’s where M&T Bank’s Corporate Finance Advisory team comes in.

Strategic Capital Planning

M&T Bank investment banking works closely with business owners and finance leaders to understand:

- Your current capitalization

- Your ideal end goals

- Your business model and growth plans

They then craft a plan to raise capital that fits your needs, through loans, recapitalizations, equity, or a mix.

Common Use Cases

- Organic growth funding

- Business acquisitions

- Ownership transitions

- Dividend recapitalizations

Partnering with Experts

Clients also benefit from M&T’s long-standing relationships with private equity firms, institutional investors, and lenders. These connections give you access to real-time capital market trends and partner-ready opportunities.

Debt Capital Markets

Not all debt is the same. M&T Bank investment banking helps companies tap into Debt Capital Markets (DCM) to raise funds efficiently and smartly.

Capital Structure Advisory

It’s critical to have the proper balance of debt and equity. M&T helps businesses design a capital structure that:

- Balances cost and flexibility

- Aligns with short-term and long-term goals

- Reflects market conditions

- Their professionals provide guidance on capital for:

- Working capital

- Acquisitions

- Leveraged and management buyouts

- Equipment purchases and CapEx

Loan Syndication

When your borrowing needs go beyond what one bank can offer, M&T Bank investment banking can step in to arrange syndicated loans, multi-lender credit facilities that spread risk while giving your business the capital it needs.

The process includes:

- Coordinating with multiple financial institutions

- Structuring loan terms

- Ensuring timely closing and funding

- Ongoing facility management

M&T typically handles transactions starting at $40 million, with loan maturities up to 10 years.

Private Placement Financing

Looking for longer-term financing without going public? M&T’s DCM team can structure private placements, customized debt offerings sold to insurance companies or mutual funds. These offer:

- Fixed interest rates

- Maturities of 5–12 years

- Lower overall costs than public debt

- Flexibility in disclosure and repayment terms

It’s an excellent solution for businesses with solid financials that want to avoid the volatility and complexity of public debt offerings.

M&T Securities

M&T Securities plays a key role in delivering investment solutions. This division supports both institutional clients and business owners with access to:

- Equities and ETFs

- Fixed income securities (U.S. government, municipal, and corporate bonds)

- Mutual funds

- Online trading tools

M&T Business-Friendly Features:

- Account types with DVP (Delivery versus Payment) or margin trading

- M&T Bank investment options are tailored for business liquidity or employee benefit plans

- Access to professionals who can guide you through portfolio decisions

Wilmington Advisors & Wilmington Trust Partnership

M&T Bank also partners with Wilmington Advisors to offer customized investment and wealth planning for business owners and corporate leaders.

You get access to:

- Personalized financial planning

- Retirement, education, and insurance strategies

- Tax-aware investment strategies

- Stress-tested long-term goal planning

Clients can meet advisors in person at local branches or connect virtually. Wilmington Advisors brings the tools and expertise of a national firm, but with a community-bank feel.

For larger companies or public entities, M&T Bank investment banking extends services through Wilmington Trust, a highly respected institutional trust and investment company.

Services Offered:

- Corporate trust and agency solutions

- Institutional custody

- Investment management strategies for long-term capital preservation

- Escrow and restructuring support

- High-yield and bankruptcy transaction assistance

This partnership gives M&T Bank investment banking clients added flexibility for complex institutional deals and legacy planning.

Integration with M&T’s Broader Capabilities

One of the biggest advantages of choosing M&T Bank investment banking is how well it connects with the bank’s full suite of financial services. Unlike standalone investment firms, M&T offers a truly integrated approach, so your business can benefit from comprehensive support across every financial need.

Seamless Coordination Across Teams

When you work with the M&T Bank investment banking group, you’re not working in isolation. The investment team collaborates closely with other M&T departments, including:

- Commercial Lending

- Treasury Management

- Business Banking

- Wealth Management

- Wilmington Trust Institutional Services

This seamless coordination allows M&T to address your company’s capital structure, day-to-day operations, and long-term planning, all under one roof.

Multiple Solutions in One Bank

Whether your company needs help with a merger, a syndicated loan, or employee retirement plans, M&T can provide the right resources through its broader capabilities. This means:

- Faster execution because teams work in sync

- More personalized solutions thanks to shared knowledge of your business

- Fewer service gaps and stronger long-term planning

From Growth to Legacy Planning

As your business evolves, M&T can grow with you. After completing a major deal through the M&T investment banking group, you can transition to services like:

- Cash management and liquidity solutions

- Long-term investment strategies

- Succession or estate planning

- Employee stock ownership plans (ESOPs)

This kind of holistic support ensures that every phase of your business journey is supported by the right tools and experts.

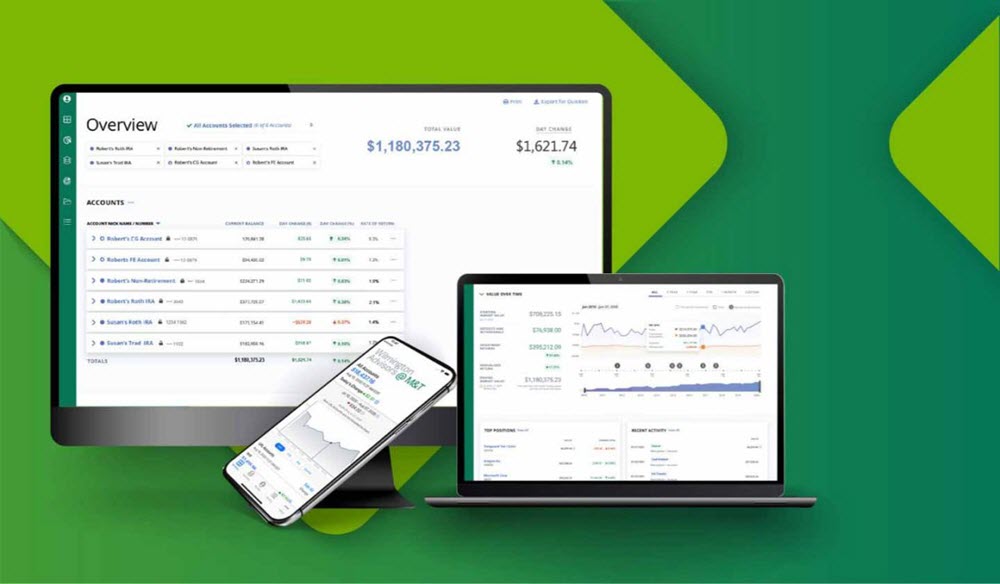

M&T Bank Investment Banking Digital Tools

One of M&T’s strengths is combining personal service with technology. Clients get 24/7 access to their investments through Account View, a secure digital platform.

With Account View, You Can:

- Monitor your portfolio in real-time

- View all investments in one place

- Download and analyze performance data

- Trade stocks, ETFs, and mutual funds

- Communicate directly with your advisor

- Store and retrieve key documents (like tax forms and statements)

This digital experience of M&T Bank investment banking helps you stay informed and in control, whether you’re running a business or managing a large investment.

M&T Bank Investment Banking Compliance and Transparency

In investment banking, trust is crucial, and M&T Bank takes this extremely seriously. Through M&T Securities, Inc., the bank upholds high standards of compliance, ethics, and transparency.

- As a registered broker-dealer with FINRA and a member of the SIPC, M&T follows strict rules designed to protect clients. This includes:

- Providing clear, detailed order-routing disclosures so you always know how your trades are being handled.

- Delivering advisory documentation that aligns with SEC regulations to ensure accuracy and fairness.

- Maintaining full transparency on fees and any potential conflicts of interest, so there are no surprises along the way.

These measures aren’t just about following rules, they’re about building long-term relationships based on honesty and reliability. For businesses making big decisions about their future, that trust matters more than anything.

Getting Started with M&T Bank Investment Banking

If you’re ready to take the next step toward growing your business or planning a major financial move, getting started with M&T Bank investment banking is easy. The bank’s team is known for being approachable, knowledgeable, and highly responsive.

How to Open an M&T Bank Investment Account

Starting an investment account with M&T Bank or its affiliates is easy and straightforward. Here’s what you need to know:

- Connect with an Advisor: Start by contacting M&T Financial Services or Wilmington Advisors @ M&T. You can call, visit a local branch, or fill out an online request form.

- Provide Basic Information: You’ll need to share your name, address, Social Security number, income details, and investment goals to help set up the right account for you.

- Complete the Application: Your advisor will walk you through a simple application. You’ll choose your account type and agree to the terms and disclosures.

- Review and Sign: You’ll review key documents and sign legal agreements. These are required to open your account through M&T’s partner, LPL Financial.

- Fund Your Account: Add money to your M&T Bank investment account by bank transfer, wire, or check. Your advisor can guide you on the best way to fund it.

- Start Investing: Once your account is set up, you can log in to Account View to track performance, trade investments, and manage your portfolio anytime.

How to Connect with M&T Bank Investment Advisors

M&T offers multiple ways to connect with their investment banking professionals:

- Email an Advisor: You can reach out directly to experienced team members for your specific needs, for example:

- Hugh Giorgio, Managing Director of Mergers & Acquisitions: hgiorgio@mtb.com

- Brian Dettmann, Head of Debt Capital Markets: bdettmann@mtb.com

- Call for a Consultation: Call M&T Bank investment banking division at 1-800‑724‑2240 to set up a free, no-obligation consultation. You’ll be matched with the right advisor for your industry and goals.

- Visit a Local Branch: M&T has a strong regional footprint. If you prefer an in-person meeting, you can visit one of their local branches to speak with a business banking representative.

- Online Inquiry: You can also start online by visiting www.mtb.com. Look under the business or investment banking sections to fill out a contact form or schedule a meeting.

What to Expect

When you first meet with the M&T Bank investment banking team, here’s what the process typically looks like:

- Discovery Conversation: A banker will learn about your company, goals, and financial needs.

- Customized Plan: The team will analyze your options and create a strategy tailored to your objectives.

- Collaboration: You’ll work together through every step, from due diligence to final execution.

- Ongoing Support: Even after the deal is done, M&T continues to support your business and future plans.

At M&T, investment banking is more than just a one-time service. It’s a long-term partnership designed to help your business succeed now and in the future. Whether you’re expanding, restructuring, or planning an exit, their advisors are there to guide you with experience and care.

When Should You Consider M&T Investment Banking?

You should consider working with M&T Bank investment banking division if:

- You’re exploring a business sale or acquisition. M&T offers step-by-step support to help you find the right buyer or target company, maximize value, and close with confidence.

- You need to raise debt or equity to fund growth. Whether it’s a loan, private placement, or bringing in investors, M&T helps you choose the right path based on your goals.

- Your company has outgrown traditional banking products. If standard loans or services no longer meet your needs, M&T provides more advanced financial strategies tailored to growing businesses.

- You’re planning for ownership transition or succession. M&T understands the complexity of handing over a business, whether to family, employees, or outside buyers, and can guide you through the process smoothly.

- You value advice over salesmanship. Instead of pushing products, M&T focuses on giving honest, expert advice that puts your long-term success first.

M&T thrives at the intersection of strategy and execution, making them an ideal fit for mid-market firms with ambition.

FAQs About M&T Bank Investment Banking

What services does M&T Bank investment banking offer?

M&T Bank investment banking provides a full range of services, including mergers and acquisitions (M&A), corporate finance advisory, debt capital markets solutions, loan syndication, and private placement financing. The bank also offers strategic guidance for business transitions and capital-raising efforts.

Does M&T Bank offer services for private companies?

- Yes. M&T Bank works with both public and private companies, including family-owned and founder-led businesses. They help with ownership transitions, growth financing, and long-term planning.

How do I get started with M&T Bank investment banking services?

- To get started, you can contact M&T Bank directly via email or phone to schedule a consultation with an investment banking advisor. You can also visit a local M&T branch or fill out a contact form on their official website.

Does M&T Bank offer help with selling or buying a business?

- Yes. M&T Bank’s M&A team provides end-to-end support for business sales, acquisitions, and ownership transitions. They guide clients through due diligence, valuation, negotiations, and closing, with a focus on maximizing value and minimizing risk.

How big does my company need to be to use M&T Investment Banking?

- M&T primarily serves mid-market businesses, typically with revenues between $10 million and $500 million. However, they also work with smaller firms that have complex financial needs.

How is M&T Bank different from other investment banks?

- Unlike many large investment banks, M&T combines strategic advice with the resources of a full-service commercial bank. Their approach is relationship-focused, not transactional, and they offer personalized service with local support.

In conclusion, M&T Bank investment banking offers smart, reliable solutions for businesses ready to grow, restructure, or plan for the future. With a focus on relationships and long-term success, M&T combines deep expertise with personalized service. Whether you’re raising capital or selling your company, their team guides you every step of the way. For mid-sized firms seeking more than just a transaction, M&T is a trusted partner. Explore your next move with confidence.