When it comes to growing your wealth, choosing the right financial partner matters. Whether you’re planning for retirement, saving for your child’s education, or building a diversified investment portfolio, Citizens Bank Investment Services offers a wide range of solutions.

But are they worth it? In this review, we’ll take a deep dive into Citizens Bank investment services. We’ll break down their products, tools, fees, and who they’re best suited for.

Introduction to Citizens Bank Investment Services

If you’re currently exploring ways to grow your wealth with the support of a trusted financial institution, Citizens Bank Investment Services offers a comprehensive suite of solutions tailored to investors at every stage.

Who Is Citizens Bank?

Citizens Bank is part of Citizens Financial Group, one of the largest banks in the U.S. Headquartered in Providence, Rhode Island, it serves more than 5 million customers. They offer everything from personal and business banking to wealth management and investment services.

What Is Citizens Bank Investment Services?

Citizens Bank Investment Services (legally known as Citizens Securities, Inc.) is a financial advisory firm headquartered in Johnston, Rhode Island. It’s part of the broader Citizens Financial Group, Inc., which owns Citizens Bank, N.A., and operates as the investment division of Citizens Bank. With over $9.1 billion in assets under management (AUM) and more than 400 advisors, it’s a sizable player in the U.S. investment services space.

The firm was founded in 1995 and became an SEC-registered investment advisor in 2003. It provides financial planning, retirement services, and wealth management through in-branch advisors, digital platforms, and third-party investment managers. It primarily serves individuals below the high-net-worth threshold, although it also works with some wealthy clients, businesses, trusts, nonprofits, and estates.

Unlike fee-only advisors, Citizens operates as a fee-based firm. That means advisors may earn commissions from selling certain financial products, introducing potential conflicts of interest. However, the firm is still bound by a fiduciary duty when offering advisory services, meaning it must act in your best interests.

Overview of Citizens Bank Investment Services

Citizens offers three primary platforms depending on your needs and investment size:

- Citizens Advisory Solutions

- Citizens Advisory Connect

- Citizens Digital Advice (robo-advisor)

Each Citizens Bank investment services platform is designed to serve a specific type of investor, whether you prefer a hands-on approach or fully automated portfolios.

Types of Investment Advisory Services Offered

Citizens offers several structured investment programs to meet different client needs. Let’s break down the three primary Citizens Bank investment services:

Unified Managed Accounts (UMAs) and Citizens Integrated Portfolios Program

Best for: Investors with $50,000+ looking for personalized portfolio management.

This is the bank’s core managed account service. With this solution, you work directly with a Citizens Financial Consultant who assesses your goals, risk tolerance, and investment timeline. From there, they build a Unified Managed Account (UMA), blending mutual funds, ETFs, and separately managed accounts.

You get:

- Customized portfolios

- Regular performance reviews

- Tax-efficient investing

- Access to third-party institutional managers

In short, this is a great fit for those who want more than a cookie-cutter plan but still want expert guidance.

Citizens Advisory Connect Program

Best for: Investors who prefer digital access with human insight

Advisory Connect is a hybrid model. Your portfolio is professionally managed, but you also get online tools to monitor performance and progress. Additionally, you’ll have access to financial professionals, though most communication happens via phone, video, or app instead of in-branch.

The strategy is set by seasoned third-party managers. You can choose portfolios based on your comfort with risk (conservative to aggressive). This Citizens Bank investment service combines convenience and professional oversight, ideal for investors who want to stay connected but hands-off.

Citizens Digital Advice Program

Best for: Beginners or hands-off investors with a smaller budget.

If you’re looking for an automated, low-maintenance way to invest, this robo-advisor platform is a good starting point. This is the firm’s robo-advisor solution, powered by SigFig Wealth Management. With a minimum investment of just $2,000, it uses algorithms to allocate your money based on your goals and risk level.

Key features:

- 0.50% annual management fee

- Automated, algorithm-driven investment portfolios

- Low minimum balance ($2,000)

- Tax-loss harvesting

- Powered by SigFig technology

- Easy-to-use mobile and desktop interface

All in all, it’s a simple, intuitive way to start investing, even if you’re not quite ready to speak with an advisor.

Wealth and Private Wealth Management

If your financial picture is more complex, Citizens also provides wealth management and private client services.

Wealth Management is ideal for those who want help planning for big-picture goals. This includes creating a retirement plan, preparing for future education expenses, reviewing insurance coverage, and even planning your estate. Advisors take time to understand your entire financial life so they can build a strategy that fits your specific situation. It’s a hands-on approach with personalized advice.

For clients with higher net worth, usually those with $500,000 or more in assets, Citizens offers Private Client Services. This level of service includes more sophisticated tools and opportunities, such as:

- Citizens Bank alternative investments, like private equity or hedge funds

- Global asset allocation across multiple regions and sectors

- Custom-built portfolios tailored to your personal risk level and goals

- Trust and estate services to help protect and transfer wealth efficiently

Ultimately, these Citizens Bank investment services are highly personalized and designed to preserve and grow wealth across generations.

Citizens Bank Investment Banking Products Offered

Citizens Bank offers a wide range of investment products:

- Mutual Funds

- Exchange-Traded Funds (ETFs)

- Individual stocks and bonds

- Annuities

- Alternative Investments (in Private Wealth)

The bank doesn’t follow one strict investment model. Instead, they combine in-house strategies with insights from third-party investment managers. This flexible approach gives advisors room to customize, but it also means that your experience may vary depending on which advisor you work with and which strategies they prefer.

Citizens Bank Investment Services Minimum Investment Requirements

Minimum account sizes of Citizens investment services vary by program:

| Program | Minimum Investment |

|---|---|

| Citizens Digital Advice | $2,000 |

| Citizens Advisory Connect | $2,000 |

| Citizens Integrated Portfolios | $100,000 |

| Private Wealth Portfolios | $250,000+ (typical) |

Certain third-party managers may require up to $500,000, depending on the investment strategy.

Citizens Bank Investment Services: Fee Structure

Fees at Citizens Bank Investment Services also vary based on the program and assets under management. Here’s a general overview:

Unified Managed Accounts (UMA) – Citizens Integrated Portfolios

| AUM Tier | Annual Fee |

|---|---|

| First $250K | 1.41% |

| Next $250K | 1.26% |

| Next $500K | 1.11% |

| Next $1M | 1.06% |

| Next $3M | 1.01% |

| Over $5M | 0.96% |

Advisory Connect Program

| AUM Tier | Annual Fee |

|---|---|

| First $250K | 1.35% |

| Next $250K | 1.25% |

| Next $500K | 1.13% |

| Next $1M | 1.08% |

| Next $3M | 1.03% |

| Over $5M | 0.98% |

Digital Advice Program

Flat Fee: 0.50% AUM annually

This is a competitive rate for automated investment services.

Also note that these fees do not include fund expenses, transaction costs, or third-party manager fees. Some fees may be negotiable depending on the advisor and account size.

Pros and Cons of Citizens Bank Investment Services

Here’s a quick summary of the strengths and weaknesses of Citizens Bank investment banking:

Pros of Citizens Bank Investment Services

- Multiple investment programs for different investor levels

- Low entry points (as low as $2,000)

- Access to both human advisors and robo-advisors

- Wide service offerings, including estate and trust planning

- Backed by Citizens Bank, a major financial institution

- The fiduciary standard applies to advisory accounts

Cons of Citizens Bank Investment Services

- A fee-based model may introduce conflicts of interest

- Higher fees than many independent financial advisors

- No unified investment strategy across accounts

- Limited access to advanced planning tools for smaller accounts

- 19 regulatory disclosures as of this writing

How Citizens Bank Compares to Others

| Feature | Citizens Bank | Vanguard | Merrill Edge | Betterment |

|---|---|---|---|---|

| Robo Advisor Fee | 0.50% | 0.30% | 0.45% | 0.25% |

| Advisor Access | Yes | Limited (Vanguard) | Yes | Optional |

| In-Branch Service | Yes | No | Yes (Bank of America) | No |

| Private Wealth | Yes | Yes | Yes | No |

Citizens Bank investment services may be a strong fit if:

- You’re a beginner or intermediate investor looking for guidance

- You need full-service planning, not just investing

- You value a mix of digital tools and human advice

- You’re already banked with Citizens Bank or prefer working with a large, established institution

However, if you’re a high-net-worth investor looking for ultra-personalized service or lower management fees, an independent advisor or fee-only fiduciary might better suit your needs.

Who Are the Advisors of Citizens Bank Investment Services

Citizens employs over 400 financial advisors across the U.S. for Citizens Bank investment services. Most of them specialize in working with everyday investors rather than ultra-high-net-worth individuals.

These advisors are available in Citizens Bank branches and can help with:

- Retirement planning

- Education funding

- Trust and estate planning

- Investment and insurance solutions

- Business succession strategies

Some advisors receive incentives or commissions for recommending certain products. This means it’s essential to ask whether their recommendations are fee-based or commission-based.

How to Open a Citizens Bank Investment Account

Getting started with Citizens Bank investment services is easy, even if you’ve never worked with a financial advisor before. The process is designed to be quick, user-friendly, and supportive every step of the way. Here’s how you can open your Citizens Bank investment account:

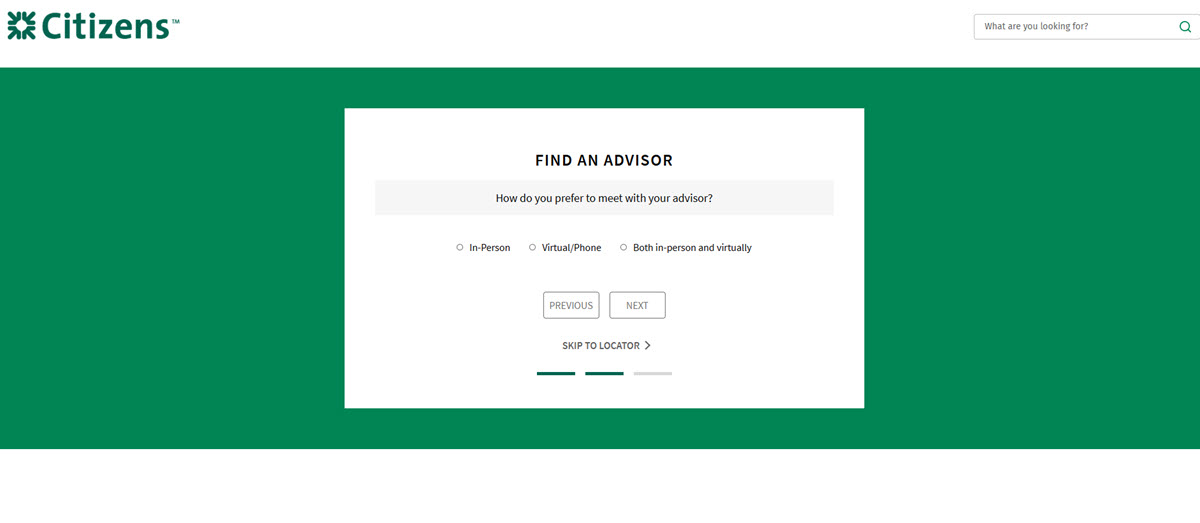

Step 1: Connect with an Advisor

In this very first step, you have two easy options:

- Visit a local Citizens Bank branch to speak with an advisor in person.

- Or use the “Find an Advisor” tool on the Citizens Bank website to schedule a virtual or phone consultation. This feature helps connect you with a nearby consultant based on your location and financial needs.

Step 2: Schedule a Free Consultation

Once you’ve found a Citizens Bank Investment Services advisor, you can book a free consultation online. This is your chance to ask questions, talk about your goals, and see if Citizens is the right fit for you. Prefer to speak with someone right away? No problem. Just call (866)-919-4520 to connect with a representative who can help you set up an appointment or answer any immediate questions.

Step 3: Choose the Right Investment Platform

Next, the bank offers three main Citizens investment services as mentioned above, including:

- Digital Advice, for automated investing with a low minimum.

- Advisory Connect, which combines online convenience with advisor support.

- Unified Managed Accounts (UMAs) and Citizens Integrated Portfolios, for more personalized, in-depth portfolio management.

Pick the one that best matches your investment style and comfort level.

Step 4: Define Your Financial Goals

Once you’ve selected a platform that fits your comfort level, think about your financial goals. Some common goals include:

- Saving for retirement

- Building an education fund

- Planning for wealth transfer or estate needs

- Growing long-term investment income

Your Citizens Bank Investment Services advisor will help you clarify these goals and design an investment strategy that fits.

Step 5: Review the Fees of Citizens Bank Investment Services

Before opening an account, be sure to review the fees carefully. Each platform has its own pricing, and some services may involve additional costs depending on the investment products you choose. Ask for clear, written details on:

- Annual advisory fees

- Investment product costs (like mutual fund expense ratios)

- Any other charges (transaction, custodial, etc.)

Understanding the fees upfront helps you avoid surprises later.

Step 6: Ask the Right Questions

Lastly, don’t be afraid to ask questions. Before signing anything, ask your advisor:

- Are you a fiduciary? (Do you always act in my best interest?)

- Do you earn commissions? (Could this affect what you recommend?)

- What happens if I want to change plans or withdraw money early?

Being informed means being empowered.

Step 7: Start with a Planning Session (Optional)

There’s no pressure to invest right away. In fact, you can begin with a free financial planning conversation to understand all Citizens Bank investment options and decide if Citizens is the right fit.

Citizens Bank Investment Services offers a wide range of financial planning and investment solutions for everyday investors. From digital robo-advisors to customized wealth management plans, there’s something for nearly every type of client. With a clear understanding of what you’re signing up for, Citizens can be a convenient and trustworthy partner in your long-term financial journey.