Capital One Personal Savings is an ideal choice for those looking to save smarter in 2025. With economic uncertainty still present, building a stable financial cushion is more crucial than ever. A well-structured savings account can help you manage risk and stay prepared for both planned and unexpected expenses.

That’s why Capital One stands out as a reliable option. Offering convenience, competitive interest rates, and easy access, Capital One Personal Savings empowers you to grow your money confidently. In this guide, you’ll discover the account’s key benefits, different options, and smart ways to make the most of it.

General Information about Capital One Financial Corporation

Capital One Financial Corporation is one of the largest banks in the United States. Founded over 25 years ago, it has developed on the belief that banking should be accessible to everyone. The company is headquartered in McLean, Virginia, and operates across the U.S., Canada, and the U.K.

Today, Capital One serves more than 100 million customers. It is publicly traded on the New York Stock Exchange under the symbol COF. By 2025, the bank holds nearly $493 billion in total assets, making it a key player in the financial industry.

Through ongoing innovation and a strong customer-first approach, Capital One aims to “change banking for good.” Its commitment to inclusion, technology, and community investment sets it apart from traditional banks. Moreover, it also offers a wide range of financial products tailored for individuals, businesses, and commercial clients.

What Is Capital One Personal Savings?

Personal savings refer to the portion of an individual’s income that is set aside for future use rather than spent immediately. This practice is essential for long-term financial health. Therefore, people can build wealth, handle emergencies, and achieve personal goals like buying a home or preparing for home loans and retirement.

Capital One personal savings follows this same principle. It helps you grow your money by letting you deposit funds while earning interest along the way. It is considered as a safe, reliable place to grow your money over time. Specifically, it contains 3 main types of saving accounts: 360 Performance Savings, 360 CDs, Kids Savings.

Both the Capital One 360 Performance Savings and Kids Savings accounts offer variable interest rates and let you add or withdraw money anytime. In contrast, a 360 CD provides a fixed rate over a set term, allowing you to choose a time period that matches your financial goals while earning steady returns.

Unlike traditional savings accounts, Capital One’s accounts focus on flexibility and convenience. Plus, it supports features like: mobile deposits, automatic transfers, and savings goal tracking. These tools make it easier to stay consistent with your financial habits.

Capital One personal savings combines the essential function of personal savings with modern banking technology. It’s a smart, low-risk option for anyone looking to build a stronger financial future.

Compare Capital One Personal Savings & Growth Accounts

Capital One offers several options tailored to different financial goals, whether you’re saving for a home, planning for a major purchase, or simply looking to manage your personal finances better. All of Capital One Personal Savings and Growth Accounts share key features that make them accessible and user-friendly. First, neither account charges monthly or maintenance fees, which means every dollar you save stays in your account and continues to earn interest. Additionally, there are no minimum balance requirements to open or maintain either account.

While all of them help you build savings over time, they differ in structure, rates, and how you access your funds. Choosing the right type of Capital One personal savings account can impact how quickly your money grows and how much flexibility you have along the way.

360 Performance Savings

The Capital One 360 Performance Savings account is a high-yield, flexible savings solution built for people who want to grow their money with confidence. It’s a smart choice for anyone looking to save without the burden of fees or complicated rules.

With a high-yield 3.60% APY (as of June 10, 2025), it offers one of the most competitive savings rates available from a major U.S. bank. Moreover, it requires no fee to open, maintain, or use the account. Even better, there’s no minimum balance requirement, so you can start saving with any amount that fits your budget.

Moreover, your savings are also FDIC-insured, giving you added peace of mind. Funds are protected up to the federal limits, ensuring safety as your balance grows. Additionally, managing your Capital One 360 Performance Savings account is effortless, thanks to convenient digital tools and flexible banking options available:

-

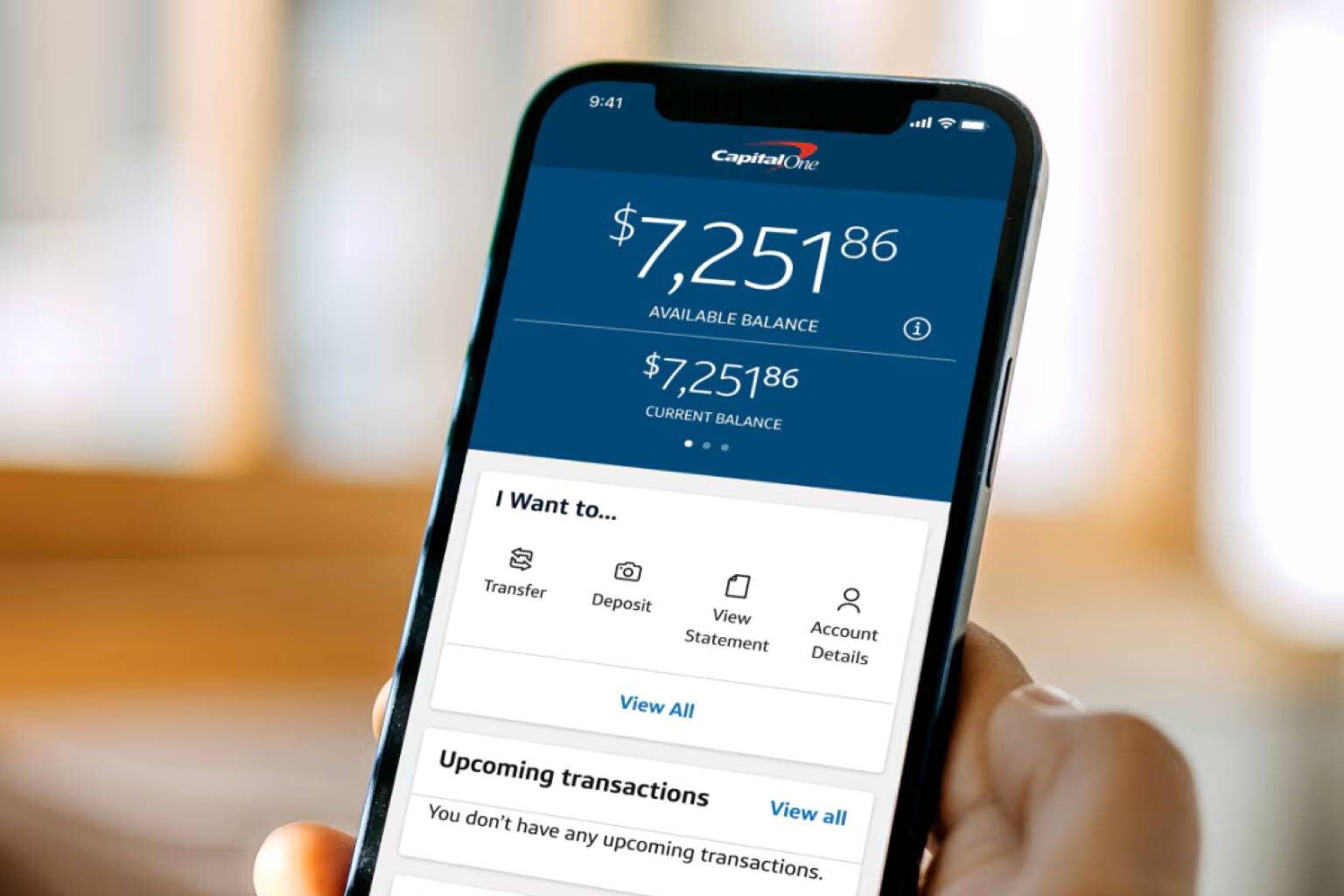

24/7 Mobile Banking: Access your account anytime, anywhere through the Capital One Mobile app or online dashboard. It’s more ideal if you’re also managing a checking account or credit monitoring.

-

AutoSave Setup: Automate your savings by choosing the amount and frequency that works for you. Capital One will take care of the rest.

-

Mobile Check Deposits: Deposit checks quickly and easily from your phone. Therefore, you don’t need to visit a branch.

-

Capital One Cafés: Enjoy a relaxed banking experience at a Capital One Café. Chat with Café Ambassadors or use self-service tools in a cozy space.

This Capital One personal savings account combines ease and security in one simple package. You can transfer money effortlessly between Capital One or external accounts like your checking accounts or even business accounts, giving you full control over your funds. giving you full control over your funds. To keep your information safe, Capital One provides robust digital security features. Plus, due to clear disclosures and helpful resources, you always know exactly how your account works.

360 CDs

A Certificate of Deposit (CD) is a savings account that holds a fixed amount of money for a fixed period (term). In return, you earn a guaranteed, fixed interest rate over that time. CD rates remain the same throughout the term, making them a dependable option compared to market-based investing or volatile income strategies.

Capital One 360 CDs allow you to choose terms ranging from 6 months to 60 months, depending on your savings goals. The longer the term, the higher the rate you can typically earn.

| CD TERM | Annual Percentage Yield (APY) | EARNINGS |

|---|---|---|

| 6 Months | 3.80% | $94 |

| 9 Months | 3.80% | $142 |

| 12 Months | 4.00% | $200 |

| 18 Months | 3.70% | $280 |

| 24 Months | 3.50% | $356 |

| 30 Months | 3.50% | $449 |

| 36 Months | 3.50% | $544 |

| 48 Months | 3.50% | $738 |

| 60 Months | 3.50% | $938 |

Note: The above earnings is applied to the deposit amount of $5000.

However, keep in mind: you cannot withdraw your funds before the CD matures without facing an early withdrawal penalty.

This Capital One personal savings account offers several key benefits that make it an attractive savings option. Your balance earns a strong, fixed interest rate, providing predictable growth over your chosen term. Moreover, there’s no minimum deposit required, so you can start saving with any amount that fits your budget.

Each CD is also FDIC-insured up to allowable limits, offering extra security. Additionally, you have the flexibility to choose interest payment method: monthly, annually, or at the end of the term. Since the rate is fixed, your returns are not affected by market fluctuations, eliminating investment risk. Best of all, your earnings are guaranteed from start to finish, making 360 CDs a reliable way to reach long-term savings goals.

Kids Savings Account

The Capital One Kids Savings Account is serves as a perfect introduction to banking for families who want to develop healthy financial habits together whether the goal is saving for a new toy, a school trip, or long-term plans,…

Child under 18 and one adult can jointly own this account. For children under 12, the adult must be the child’s parent or legal guardian. Kids can log in to view their balance anytime using the Capital One Mobile app or website. However, all transfers into or out of the account must be completed by the adult. Consequently, it creates a safe learning environment while encouraging financial responsibility.

This type of Capital One personal savings stands out with its competitive interest rate of 2.50% APY on any balance. Therefore, your child’s savings grow steadily, no matter how much they deposit. Moreover, it’s a truly fee-free account without minimum balance requirement. That’s reason it’s easy for families to get started with any amount even if they’re gradually moving away from relying on payday loans or starting to budget for future home loans.

Beyond its core features, the account offers several valuable benefits that enhance both functionality and learning.

-

High APY on All Balances: Earn interest daily and watch savings grow faster than with most traditional accounts.

-

Automatic Allowance Transfers: Parents can schedule regular deposits, like weekly allowance or reward savings.

-

Linked Parent Accounts: Easily transfer money between your Capital One or external bank account and your child’s savings.

-

Multiple Goal Accounts: Open separate Kids Savings Accounts for different goals, like birthday gifts, travel, or college savings.

-

Top-Rated Mobile App Access: Kids can track their own balance using the app, learning how money grows with every deposit.

-

Safe Parental Control: While kids can view balances, only adults can manage funds.

Process of Opening A Capital One Personal Savings Account

Opening a Capital One savings account is one of the smartest financial moves you can make. Here’s a simple guide to help you start from scratch.

Choose the Right Bank

When choosing the right bank to open a savings account, it’s important to consider different factors such as: terms, conditions fees,… You should choose the bank that has appealing features like: low or no monthly fees, competitive interest rates, user-friendly digital tools (such as mobile apps and online banking), and FDIC or NCUA insurance to protect your funds. While traditional banks offer the benefit of in-person service, online banks often provide higher interest rates and more flexible features.

A great option that balances both convenience and security is Capital One. Capital One personal savings offers a competitive APY, no monthly fees, and robust digital tools. Therefore, it’s an excellent choice for those looking to grow their savings with ease and confidence.

Gather Necessary Documents

To open a Capital One savings account smoothly, you’ll need to gather some essential personal information. This includes:

-

A valid government-issued photo ID (driver’s license or passport)

-

Your Social Security number or ITIN

-

Your date of birth

-

A valid email address and mailing address

Ensuring that all this information is accurate and up to date is crucial, as any errors can cause delays in the account verification process. With Capital One, the online application is fast and secure, so having your details ready upfront helps you complete the setup in just a few minutes.

This process also aligns well if you’re integrating your savings with other financial tools like checking accounts, credit cards, or even planning for larger milestones such as. Having a dedicated savings account is one of the smartest first steps toward long-term investing success and financial stability.

Open Capital One Personal Savings Account

Once you’ve chosen your bank and gathered the necessary information, the next step is to open your Capital One personal savings account either online or in person. Apply online in just a few minutes by clicking a clearly labeled button like “Open Account.” However, if you’re under 18, opening a joint account, or simply prefer face-to-face service, you can visit a local branch instead.

After the account is opened, it’s time to fund it. You can make an initial deposit via debit card, bank transfer, mobile check deposit, or even cash or check if you’re at a branch. With some Capital One Savings accounts, there’s no minimum deposit required so you can start saving at your own pace, even with just a few dollars.

Keep Track Spending & Savings

To reach your savings goals more efficiently, it’s essential to track both your spending and how much you’re saving. Capital One offers intuitive mobile apps that let you monitor your account balances, recent transactions, and savings progress in real time.

You can also explore third-party budgeting tools which help you categorize expenses, set savings goals and plan for large purchases such as home, education, or auto loans. Moreover, these tool also simulate future financial decisions to see how they might impact your budget. Regular tracking empowers you to stay within your spending limits, identify overspending early. Consequently, you can make smarter, more informed financial choices every day.

Capital One Personal Savings is a smart choice for anyone looking to save with confidence. With no fees, competitive interest rates, and easy online access, it offers a flexible and secure way to grow your money. Whether you’re saving for the short term or long term, Capital One makes it simple to start and rewarding to stay consistent.