Morgan Stanley personal loan options may be worth exploring if you’re considering personal loans. As a well‑known global firm, they offer various lending products, including unsecured and secured options.

In this review, I break down what they offer, how it works, the pros and cons, and whether it might be right for you. Let’s begin.

Overview of Morgan Stanley Personal Loan

Here’s a quick overview of what the Morgan Stanley personal loan offers:

What Is Morgan Stanley?

Morgan Stanley, founded in 1935, is one of the world’s leading financial institutions. The company manages over $1 trillion in assets and is well known for its expertise in wealth management and investment services. Beyond investing, Morgan Stanley also helps clients access money through tailored lending solutions.

They serve a broad client base, from individuals to ultra‑high‑net‑worth families. Their lending options often cater to clients with significant assets or brokerage accounts.

What Morgan Stanley Offers

Instead of offering loans to the general public, Morgan Stanley focuses on serving its wealth management clients, those who already have investments or financial accounts with the firm. The goal of Morgan Stanley personal loans is to help these clients borrow money efficiently without disrupting their long-term investment plans.

Here’s what Morgan Stanley Personal banking provides in terms of lending:

- Residential mortgages and home equity lines of credit: For buying a new home, refinancing an existing loan, or using your home’s equity to access cash.

- Securities-backed lending (SBL): Also called portfolio lines of credit, this allows clients to borrow against the value of their investment portfolios—without having to sell their stocks or bonds.

- Custom-purpose loans: These can be used for major life expenses such as paying off high-interest debt, funding education, covering business needs, or making large purchases.

All Morgan Stanley personal loan options are closely tied to the client’s overall wealth plan. That means you’re not just getting a loan, you’re getting advice and strategy from your financial advisor, who helps make sure your borrowing decisions support your long-term financial goals.

How the Morgan Stanley Personal Loans Work

Morgan Stanley offers three main types of personal lending solutions: Securities-Based Loans (SBL), Liquidity Access Lines (LAL), and Home Loans/HELOCs. However, it’s important to note that Morgan Stanley does not offer typical unsecured personal loans like many traditional banks such as Chase or Citi. Instead, their lending products are tied to either investment portfolios or real estate assets.

Securities-Based Loan (SBL)

With this type of Morgan Stanley personal loan, you can borrow money by using your investments, such as stocks, bonds, or mutual funds as collateral. Instead of selling your assets, you pledge them to secure a line of credit. This is helpful if you need cash but want to stay invested and avoid selling your holdings.

It works much like a credit line:

- You can borrow as needed, up to an approved limit.

- There’s no set schedule for paying off the principal.

- You only need to pay the interest monthly.

- You can repay and borrow again within the approved amount.

Morgan Stanley personal loan rates for this type vary, but they are often lower than rates on unsecured loans because the loan is backed by your investment assets. As of recent data, rates can start around 11.45% for smaller loans (under $100,000), and decrease to about 7.08% for larger loans (over $50 million). The bigger the loan, the better the rate.

Here’s how it works:

- The minimum loan amount is usually tens of thousands of dollars.

- You don’t have to sell your investments, you still own them and can benefit from any gains.

- You pay interest monthly, and you can repay the principal whenever you like or keep it outstanding.

If the market drops and the value of your investments falls below a certain level, Morgan Stanley may issue a margin call. That means you’ll have to deposit more money or assets to maintain the loan. If you don’t, they may sell part of your portfolio to cover the loan.

This type of loan is ideal for clients who want liquidity without disrupting their investment strategy.

Liquidity Access Line (LAL)

A Liquidity Access Line is a revolving line of credit also backed by your investment portfolio. Unlike a regular loan, this is more like a credit card for your assets, you can draw funds as needed, repay them, and borrow again without starting a new application each time.

- Fast Access to Cash: Once approved, you can access the funds quickly, often within 1 to 2 business days. There’s no need to go through a long approval process again if you want to borrow more later.

- Competitive Rates: Interest rates are generally lower than those on credit cards and traditional unsecured personal loans, especially if you have a strong portfolio. Rates are based on a benchmark like the prime rate or SOFR (Secured Overnight Financing Rate), plus a margin that depends on the size of your line and your relationship with Morgan Stanley.

- Flexible Use: Just like the SBL, you can use the funds for many purposes—covering personal expenses, investing in new opportunities, or bridging cash flow gaps. However, you cannot use it to buy more securities (no leverage trading).

- No Application Fees: There are typically no setup or annual fees for the LAL, which makes it an efficient and cost-effective borrowing option for qualified clients.

Home-Secured Loan

Morgan Stanley also offers traditional real estate lending, including:

- Mortgages for home purchases

- Refinancing options

- Home Equity Lines of Credit (HELOCs)

These Morgan Stanley personal loans are secured by your property, which means the house or real estate acts as collateral.

Clients who already have a relationship with Morgan Stanley may enjoy exclusive benefits such as:

- Lower interest rates

- Waived fees

- Faster approval processes

Depending on your needs, you can choose between fixed-rate loans (where the interest stays the same) or variable-rate loans (where the rate may change over time).

Reddit users and other online sources mention that Morgan Stanley’s mortgage rates are often very competitive, especially for high-net-worth clients. One big plus is that they tend to keep the loan in-house, meaning they don’t sell your mortgage to another bank. This can lead to better service and fewer surprises during the life of the loan.

These home-secured loans work just like those from other banks, but if you’re already a Morgan Stanley client, you may find the overall experience more personalized and cost-effective.

Interest Rates & Fees of Morgan Stanley Personal Loans

When you borrow from a Morgan Stanley personal loan backed by your investments or home, it’s important to understand how the interest rates and fees are structured. Based on official documents published by the firm, here’s a simple breakdown:

Securities-Based Loans & Liquidity Access Lines

For both SBLs and LALs, the interest you pay is based on a benchmark rate, usually the SOFR (Secured Overnight Financing Rate) or the prime rate, plus an additional margin, called a spread. This spread is determined by how much you borrow and the size of your investment portfolio.

- As of recent data, the base margin rate is around 10.70%.

- Tiered Spread: Borrowers with smaller loan amounts may pay a spread of +0.75%, while those with larger balances could receive a discounted rate as low as –3.625%.

- This means that wealthier clients with more assets in their accounts often get better interest rates, a benefit known as relationship pricing.

In short, the more money you manage through Morgan Stanley, the more favorable your loan terms may be.

Mortgages & HELOCs

If you’re applying for a mortgage or a Home Equity Line of Credit (HELOC) through Morgan Stanley Private Bank, interest rates work a bit differently.

- Customized Rates: These products offer relationship-based pricing, which can help you qualify for lower interest rates or reduced closing costs if you have significant assets invested with Morgan Stanley.

- Competitive Terms: Loan officers can customize the structure of your mortgage or HELOC to fit your financial situation, which includes deciding on fixed vs. variable rates and choosing a repayment schedule that works for you.

Fees to Expect

While some Morgan Stanley personal loans come with little to no upfront cost, others may have fees depending on your financial profile and the type of loan:

- No Application Fee for LAL: There are usually no fees to apply for a Liquidity Access Line, which makes it a convenient option for accessing cash quickly.

- Securities-Based Loans (SBLs):

- May include setup or maintenance charges, especially if your investment portfolio is below a certain size.

- These fees vary depending on the total assets under management and the terms of the loan agreement.

- Mortgages and HELOCs: Like most home lending products, these usually come with standard bank fees, including:

- Appraisal fee to assess the home’s value

- Origination fee for processing the loan

- Title fee for verifying ownership and legal documents

- Closing costs which can include taxes, insurance, and third-party service fees

Below is a summary of Interest Rates & Fees for Morgan Stanley personal loans:

| Loan Type | Interest Rate Structure | Rate Range (Est.) | Key Fees | Fee Details | Notes |

|---|---|---|---|---|---|

| Securities-Based Loan (SBL) | Variable rate = Base (e.g., SOFR or margin rate) + spread (tiered) | ~7.1% – 11.45%(Base: 10.70%; Spread: –3.625% to +0.75%) | Possible setup or maintenance fees | Depends on portfolio size and product structure | Lower rates for large portfolios; interest-only payments allowed |

| Liquidity Access Line (LAL) | Variable rate = SOFR or prime + relationship-based spread | Often lower than unsecured loans or credit cards(e.g., ~6% – 10%) | No application fee | No annual or draw fees in most cases | Fast access to funds; flexible draw and repayment; no reapplication needed |

| Mortgage Loans | Fixed or variable; based on credit + assets under management | Competitive market rates(often discounted for clients) | Standard mortgage fees | Appraisal, origination, title, closing fees | Relationship pricing may reduce rates and/or closing costs |

| Home Equity Line of Credit (HELOC) | Variable rate; tied to prime + spread | ~8% – 12% (varies by credit & region) | Standard HELOC fees | Appraisal, setup, title, annual fees (case-by-case) | Ideal for homeowners with strong equity; line of credit structure |

Key Notes:

- Tiered Interest Rates: The more assets you have under management, the lower your interest rate can be, especially for SBL and LAL products.

- No Unsecured Loans: Morgan Stanley does not offer standard unsecured personal loans; all lending products require collateral (securities or real estate).

- Fees May Vary: Rates and fees are subject to change and may vary by region, loan amount, and product terms. Always consult a Morgan Stanley personal advisor for exact figures.

Who Qualifies for a Morgan Stanley Personal Loan?

To qualify for Morgan Stanley personal loans, you’ll need to meet a few key requirements. These loans are designed for existing clients with investment assets, not for the general public. Here’s what you typically need:

- An active account with Morgan Stanley, such as a brokerage or wealth management relationship.

- Eligible investment assets in your account, like stocks, bonds, mutual funds, or other marketable securities.

- A minimum account balance, which can vary depending on the loan type and amount you want to borrow.

- A good credit and financial profile may also be required, especially for mortgage or HELOC products.

If you don’t already have a Morgan Stanley personal account or investment portfolio, you likely won’t be able to access these lending loans. These Morgan Stanley personal loan options are tailored for clients who want to borrow against their existing wealth.

Pros and Cons of Morgan Stanley Personal Loan

Before choosing any lending product, it’s important to understand both the advantages and potential downsides. Morgan Stanley’s lending options come with several benefits, but they also have limitations depending on your financial situation.

Key Benefits of Morgan Stanley Personal Loan

- Lower Interest Rates Than Unsecured Loans: If you borrow using a securities-based loan, you’ll likely pay a lower interest rate compared to credit cards or personal loans. That’s because your investments act as collateral, reducing the risk for the bank.

- Faster Approval Process: For existing Morgan Stanley clients, getting approved can be quicker. Since your financial profile is already on file, there’s less paperwork and fewer delays.

- Flexible Repayment Options: These Morgan Stanley personal loans don’t have a strict repayment schedule. You can choose to pay only the interest each month or pay off the principal early without penalty.

- Stay Invested: One big perk is that you don’t have to sell your stocks or funds to get cash. This helps you avoid triggering capital gains taxes and keeps your investment plan on track.

- Special Mortgage Benefits: Clients who use Morgan Stanley for home loans may get perks like discounted rates, lower fees, and direct servicing (instead of the loan being sold to another lender).

Drawbacks to Consider

- Risk of Margin Calls: If the value of your pledged investments drops, you might receive a margin call. That means you’ll need to add more cash or assets. If you don’t, Morgan Stanley can sell your investments to cover the shortfall, often at a loss.

- Only for Existing Clients: These Morgan Stanley personal loans are not available to the general public. You must already have an account with Morgan Stanley, and some products may require a high minimum balance.

- More Complex Than Standard Loans: Loan terms depend on many factors like the type and size of your account and the collateral used. This can make it harder to understand and manage than a traditional personal loan with fixed terms.

- Higher Rates Than Mortgages: While the rates are lower than unsecured loans, they’re often higher than traditional mortgages or home equity lines of credit (HELOCs), especially for smaller loan amounts.

- Service May Vary: Customer experiences are mixed. Some users report excellent service from their advisors, while others have complained about delays and poor communication. Your experience may depend on the advisor and office you work with.

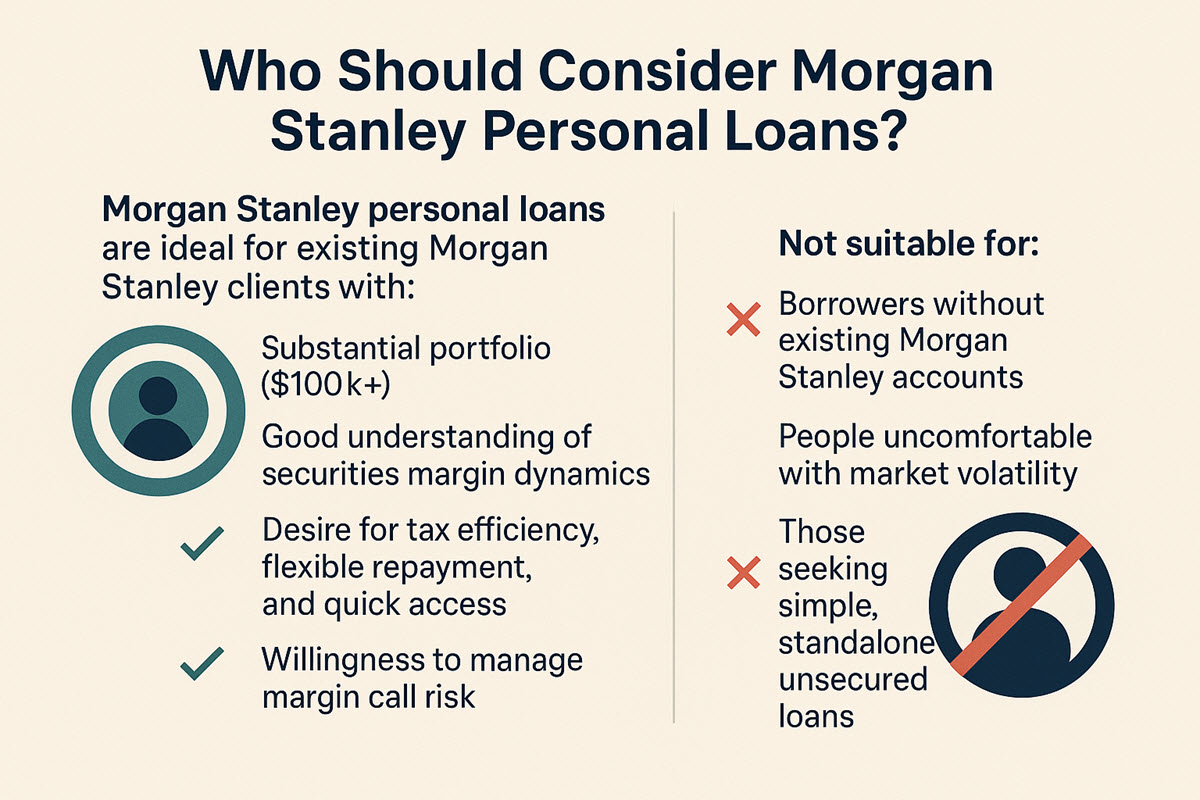

Who Should Consider Morgan Stanley Personal Loans?

Morgan Stanley personal loans are ideal for existing Morgan Stanley clients with:

- Substantial portfolio ($100k+)

- Good understanding of securities margin dynamics

- Desire for tax efficiency, flexible repayment, and quick access

- Willingness to manage margin call risk

Not suitable for:

- Borrowers without existing Morgan Stanley accounts

- People uncomfortable with market volatility

- Those seeking simple, standalone unsecured loans

5+ Tips for Borrowers

If you’re thinking about using one of Morgan Stanley personal loan options, here are some helpful tips to make sure you borrow wisely and protect your long-term financial health:

- Talk to a Financial Advisor: Before taking out a loan, it’s smart to sit down with your Morgan Stanley advisor. They can help you choose the right loan, explain how it fits into your long-term financial plan, and make sure you understand any tax effects—especially if you’re borrowing against investments.

- Watch Your Investments: If you’re using a Securities-Based Loan or Liquidity Access Line, your investments are the collateral. If the market drops, you might face a margin call, meaning you’ll need to deposit more funds or sell assets. Keep a safety cushion in your account to avoid surprises.

- Shop Around for Rates: If you’re a homeowner, a mortgage or home equity line of credit (HELOC) might offer lower rates than borrowing against your portfolio. Always compare your options before committing.

- Know the Costs: Interest rates for these loans can change monthly, especially if they’re tied to market benchmarks like SOFR or prime. Also, some loans have maintenance or setup fees. Make sure you understand what you’ll pay both now and over time.

- Use the Loan Wisely: These loans can be powerful tools, but they’re not meant for everyday spending. Don’t treat your investment account like a checking account. Use the funds for strategic purposes like real estate, business opportunities, or big financial goals.

Morgan Stanley offers unique, flexible borrowing options for clients comfortable leveraging investments. The perks of Morgan Stanley personal loans include lower rates, tax savings, and fast access. If you already bank or invest with Morgan Stanley and need a smarter, strategic loan, SBL or LAL may be worth it. But if you’re simply looking for a straightforward personal loan, a bank or online loan may be easier.