Morgan Stanley credit cards stand out in a world full of credit card options by offering something a bit different. While most people think of Morgan Stanley as a top-tier wealth management firm, it also partners with American Express to offer exclusive credit card benefits that combine luxury, utility, and serious financial integration.

But are these cards worth it? And what can you expect in real life? In this comprehensive review, we’ll break down everything you need to know about Morgan Stanley credit cards in 2025.

Overview of Morgan Stanley Credit Cards

Morgan Stanley credit cards aren’t your average credit cards, they’re tailored financial tools designed to reward clients who already have a trusted relationship with the firm.

History of Morgan Stanley

Morgan Stanley was founded in 1935 after a separation from J.P. Morgan due to banking reforms during the Great Depression. The firm began by offering investment banking services and quickly earned a strong reputation on Wall Street.

Over time, it expanded its reach globally and now operates in more than 41 countries. With decades of experience, Morgan Stanley is widely known for its financial expertise, trusted client relationships, and forward-thinking approach to wealth management.

General Services of Morgan Stanley

Morgan Stanley provides a wide range of financial services to individuals, businesses, and governments. These include:

- Investment banking: Helping companies raise capital and manage mergers or acquisitions.

- Wealth and asset management: Offering financial planning and investment advice to personal clients and institutions.

- Brokerage and trading: Giving clients access to stocks, bonds, and other investment options.

- Cash management and debit card services: Including premium cash accounts with features like no foreign transaction fees and ATM reimbursements.

Whether you’re a high-net-worth individual or a growing business, Morgan Stanley offers personalized financial solutions backed by a team of experienced advisors.

About Morgan Stanley Credit Cards

Morgan Stanley credit cards are offered in partnership with American Express and are designed exclusively for eligible Morgan Stanley clients. These cards are not available to the general public, you must have a qualifying account, such as a brokerage or CashPlus account, to apply. The cards combine American Express’s powerful rewards system with Morgan Stanley’s elite banking experience.

There are three main options of Morgan Stanley Amex credit cards:

- Basic Morgan Stanley Credit Card from American Express – A no-annual-fee card that earns Membership Rewards points. It’s ideal for everyday purchases and great for keeping your AmEx points active without extra cost.

- Morgan Stanley Blue Cash Preferred Card from American Express – A great choice for earning high cash back on everyday spending.

- The Platinum Card from American Express Exclusively for Morgan Stanley – A luxury card with top-tier travel perks, concierge access, and valuable rewards.

These cards are ideal for clients who want more than just a credit card, they want integrated benefits, strong financial tools, and exclusive experiences.

Types of Morgan Stanley Credit Cards & Benefits

When it comes to credit cards, Morgan Stanley keeps it simple but premium, offering exclusive options tailored for its qualified clients.

The Basic Morgan Stanley Credit Card from American Express

This no-annual-fee card is a simple but valuable option for Morgan Stanley clients who want to earn Membership Rewards points without paying extra for luxury perks.

- Annual Fee: $0. This card used to have a $95 fee, but it has since been removed, making it one of the few Membership Rewards cards with no annual cost.

- Welcome Offer: Earn 10,000 Membership Rewards® points after spending $1,000 within the first 3 months of card membership.

Key Benefits of the Basic Morgan Stanley Card

2X points on:

- Airfare purchased directly from airlines

- U.S. restaurants

- Select U.S. department stores

- Car rentals from eligible rental companies

1X point on all other purchases

Anniversary Spend Bonus: Get a $100 statement credit each year you spend at least $25,000 on the card, effectively rewarding loyal users.

Membership Rewards Program: Points can be transferred to travel partners, used for shopping, or even invested into an eligible Morgan Stanley brokerage account.

Morgan Stanley Exclusive Perk

Unlike most no-fee cards, this one keeps your Membership Rewards points active, even if you close other AmEx cards. It’s one of the very few no-fee cards that offer this benefit, making it a strategic card for rewards point management.

Ideal User Profile

This card is perfect for casual travelers or point collectors who already have a Morgan Stanley account and want a simple way to earn and protect Membership Rewards points. It’s also a great secondary or backup card for AmEx users who want to avoid losing their rewards if they cancel other cards.

The Morgan Stanley Platinum Card

This card is an enhanced version of the American Express Platinum Card, built for those who want access to top-tier travel and lifestyle perks.

- Annual Fee: $695. However, if you meet certain account requirements, such as maintaining $25,000 in a CashPlus account and setting up direct deposits, you may qualify for a fee waiver.

- Welcome Offer: Up to 80,000 Membership Rewards points after meeting minimum spending.

Premium Benefits of Morgan Stanley Platinum Card

- 5× points on flights and hotels booked via AmEx Travel

- Access to the Global Lounge Collection

- $200 airline fee credit annually

- $240 digital entertainment credit

- Uber Cash ($15/month + $20 in December)

- Hotel perks through Fine Hotels & Resorts

Morgan Stanley Exclusive Perk

Morgan Stanley clients get a $695 Annual Engagement Bonus if they hold an eligible account. This benefit alone can offset the annual fee, effectively making the card free for many clients. You can also add additional Platinum cards with no extra charge, a benefit not offered on the standard Amex Platinum.

- CashPlus Monthly Fee: If you’re using a CashPlus account, there’s a $55 monthly service fee, but this can also be waived if you meet balance and deposit criteria.

- Rewards: The Platinum Card earns Membership Rewards points, which can be redeemed for travel, shopping, gift cards, and more. It also offers premium benefits for flights and hotels.

- APR: This card is usually pay-in-full, but if you use Pay Over Time features, higher interest rates may apply for carried balances.

Ideal User Profile

This Morgan Stanley credit card American Express is perfect for high-net-worth individuals who travel frequently and already work with Morgan Stanley. If you take full advantage of the perks and bonuses, the card more than pays for itself.

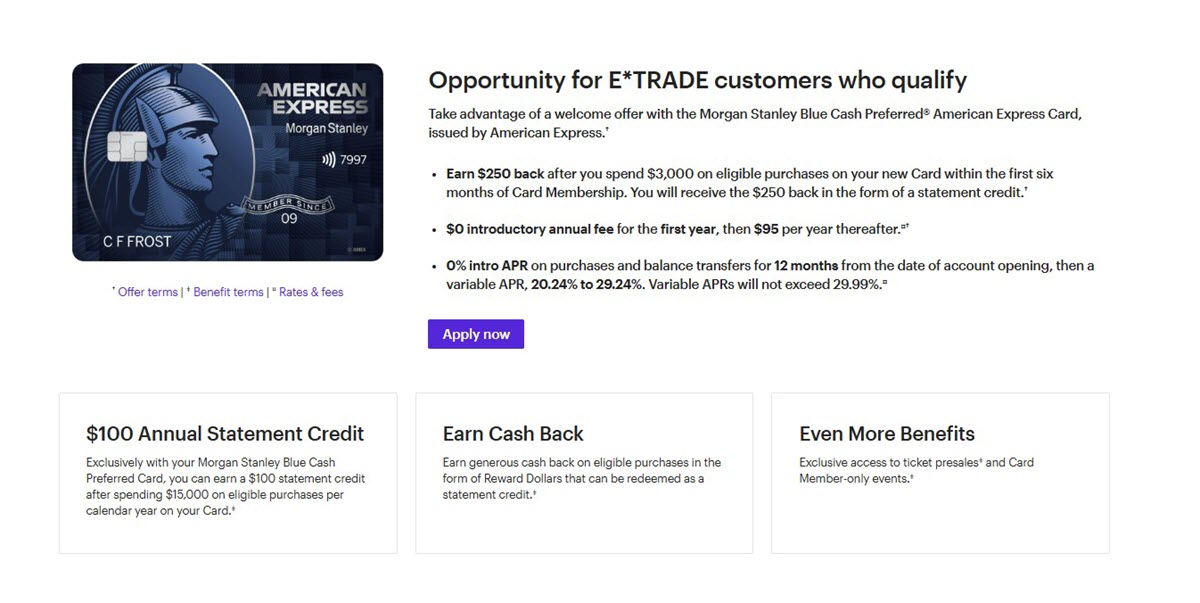

Morgan Stanley Blue Cash Preferred Card

This card is ideal for people who want strong cashback rewards on daily purchases.

Annual Fee: $0 for the first year, then $95

Welcome Bonus: New cardholders can earn a $250–$300 statement credit after spending $3,000 within the first 6 months.

Benefits of Morgan Stanley Blue Cash Preferred Card

- 6% cash back at U.S. supermarkets (up to $6,000/year)

- 6% cash back on select U.S. streaming subscriptions

- 3% cash back on U.S. gas stations and transit

- 1% cash back on all other purchases

- 0% intro APR for the first year

- Plan It & Global Assist programs included

Differences from the Standard Blue Cash Preferred

Although the rewards structure is similar to the public version, the Morgan Stanley card allows cashback redemption directly into your Morgan Stanley brokerage account. This makes managing your rewards simpler and more financially strategic.

Ideal User Profile

If you’re a Morgan Stanley client with moderate to high household expenses, this card gives you excellent value. It’s perfect for families, professionals, and anyone with significant grocery and transportation spending.

Credit Card Terms of Service

Morgan Stanley credit cards are issued by American Express National Bank, but Morgan Stanley helps with the servicing and account management. This means your card benefits come from AmEx, but your relationship stays with Morgan Stanley.

If you choose the Blue Cash Preferred Card, you’ll enjoy a 0% introductory APR on purchases for the first 12 months. After that, a variable APR ranging from 12.99% to 23.99% will apply, depending on your credit score and payment history.

Your account is reviewed regularly, usually every 6 months. If you miss a payment or your payment is returned, a penalty APR may be applied, which is typically higher than your normal rate.

What Is the Best Morgan Stanley Credit Card?

The best Morgan Stanley credit card for you depends on how you spend your money. If you spend a lot on groceries and everyday items, the Blue Cash Preferred Card is a great choice. Alternatively, if you travel often, the Platinum Card from American Express Exclusively for Morgan Stanley is likely the better option.

Here is a comparison table of the three Morgan Stanley credit cards in partnership with American Express, focusing on costs and key benefits to help you make an easier decision.

| Feature / Card Type | Basic Morgan Stanley AmEx | Blue Cash Preferred® from AmEx for Morgan Stanley | Platinum Card® from AmEx for Morgan Stanley |

|---|---|---|---|

| Annual Fee | $0 | $0 first year, then $95/year | $695/year (may be waived with CashPlus account) |

| Welcome Bonus | 10,000 Membership Rewards points after $1,000 spend in 3 months | $250–$300 statement credit after $3,000 spend in 6 months | Up to 80,000 Membership Rewards points (after qualifying spend) |

| Reward Type | Membership Rewards points | Cash back | Membership Rewards points |

| Bonus Categories | 2× points on: • Airfare booked directly with airlines • U.S. restaurants • Select U.S. department stores • Select car rentals | 6% on U.S. supermarkets (up to $6K/year), 6% on streaming, 3% on U.S. gas & transit, 1% others | 5× points on flights and hotels booked via AmEx Travel, 1× on other purchases |

| Other Key Perks | $100 anniversary bonus after $25K spend/year Maintains Membership Rewards® account | High cash back for families Good everyday spending card | Lounge access Travel credits Uber Cash Hotel upgrades Global concierge |

| APR | Variable APR applies (Pay Over Time available) | 0% intro APR for 12 months, then 12.99%–23.99% variable | Typically Pay in Full; Pay Over Time with high APR |

| CashPlus Account Requirement | Not required, but enables point deposit if linked | Not required | Required for $695 fee waiver ($25K balance + $5K monthly deposit) |

| Best For | Everyday users who want a free card to earn & keep points | Households with high grocery, streaming, and gas spending | High-net-worth travelers who want luxury perks and fee waivers |

How to Qualify for a Morgan Stanley Credit Card

To get a Morgan Stanley credit card, you need to meet a few specific requirements. These cards aren’t available to just anyone. They are designed for people who already have a relationship with Morgan Stanley.

Basic Requirements

To apply, you must:

- Have an eligible Morgan Stanley or E*TRADE brokerage account

- Be 18+, with a valid U.S. address, and a good to excellent credit score (usually a FICO score of 670 or higher)

- Maintain minimum balances, such as $25k in CashPlus and monthly $5k deposits for the Platinum card fee waiver

Because of these requirements, these cards are best suited to clients with existing Morgan Stanley relationships.

How to Apply for a Morgan Stanley Credit Card

Getting a Morgan Stanley credit card is a bit different from applying for a typical credit card. Here’s how the process works:

- Open or verify your Morgan Stanley or E*TRADE account if you don’t have one. You must have an eligible account before applying.

- Log in to your online portal or speak with your Morgan Stanley financial advisor.

- Choose the card you want, either the Blue Cash Preferred or the Platinum Card.

- Submit a new application. You must apply specifically for the Morgan Stanley version. You can’t switch from an existing American Express card.

Once approved, your card will be mailed to you. After you receive it, you can activate it online and begin using it.

The application process is usually quick. In many cases, if you’re an existing client in good standing, you could get approved within a few business days. Your creditworthiness, account history, and relationship with the firm may help speed up approval.

Morgan Stanley Credit Card Customer Service

Customer service for Morgan Stanley credit cards is provided by American Express National Bank, the official card issuer. This means you’ll get the same high-quality support that AmEx is known for, including 24/7 access to the Global Assist Hotline. This service can help with travel emergencies, such as lost passports, medical referrals, or emergency cash assistance while you’re abroad.

In addition to AmEx support, Morgan Stanley financial advisors can also assist you, especially if you hold a CashPlus or brokerage account. They can help you with account management, credit card questions, or combining card benefits with your broader financial plan.

If you have any issues with your card, such as billing questions or lost card reports, the fastest way to get help is to call the phone number on the back of your card. This connects you directly to the American Express support team, available around the clock.

Pros and Cons of Morgan Stanley Credit Cards

Morgan Stanley credit cards come with many attractive features, but they also have a few downsides. Let’s explore both the advantages and disadvantages so you can decide if these cards are right for you.

Advantages

- Client-Exclusive Rewards: Get perks like the $695 engagement bonus.

- Travel & Lifestyle Perks: Enjoy airport lounges, hotel upgrades, and more.

- Financial Integration: Easily redeem rewards into brokerage accounts.

- Family Sharing: Add additional Platinum cards for free.

Drawbacks

- High Annual Fees: Especially on the Platinum Card.

- Limited Access: Only available to existing Morgan Stanley clients.

- Benefits Need Maximizing: If you don’t use the perks, the cost may outweigh the value.

Who Should Consider a Morgan Stanley Credit Card?

These cards are not meant for everyone, but for the right person, they can offer incredible value. So, who are they best suited for?

- Existing Morgan Stanley clients who want integrated financial tools

- Frequent travelers and high spenders

- Personal customers looking for a streamlined way to combine rewards and wealth management

If you don’t already have a relationship with Morgan Stanley, it may be difficult to justify these cards.

FAQs About Morgan Stanley Credit Cards

Can non-clients apply for a Morgan Stanley credit card?

- No. You must have a qualifying Morgan Stanley or E*TRADE account.

What’s the main difference between Morgan Stanley and regular Amex cards?

- Morgan Stanley versions include exclusive perks like the engagement bonus and better card sharing options.

Do these cards have foreign transaction fees?

- No. Neither the Platinum nor the Blue Cash Preferred has foreign transaction fees.

Can I upgrade from Blue Cash Preferred to Platinum?

- You would need to apply for the Platinum card separately; they are not part of the same upgrade path.

What happens if I close my Morgan Stanley account?

- You may lose your card or its unique perks if the account is a requirement. Always check terms.

If you’re already a Morgan Stanley client, the answer is likely yes. The Platinum Card’s $695 engagement bonus alone can neutralize the fee, and the travel perks are top-of-the-line. The Blue Cash Preferred is one of the best cashback cards out there, especially if you prefer simplicity.

However, if you’re not a client, you’ll need to start a financial relationship with Morgan Stanley to even be eligible. That barrier limits access but also ensures that these Morgan Stanley credit cards remain exclusive and high-value.