First Citizens Auto Loans give car buyers a smart way to finance their next vehicle. Due to competitive rates and fast approvals, these loans help you get behind the wheel without unnecessary stress or delays. Whether you’re buying new, used, or looking to refinance, First Citizens offers solutions that fit your needs and budget.

First Citizens Auto Loans stand out in today’s crowded lending market. The process is streamlined, the support is personal, and the terms are flexible. If you’re ready to drive, this could be your fastest route to affordable car ownership.

First Citizens Auto Loans Overview

First Citizens Auto Loans are a type of secured financing which aim to help you purchase a new or used vehicle. Like most auto loans, they use the car itself as collateral. If the borrower fails to repay, First Citizens has the right to repossess the vehicle. These loans usually come with flexible terms, and in some cases, even up to 96 months.

Here’s how First Citizens Auto Loans work: First Citizens provides the funds needed to buy your vehicle. Then, you agree to repay the loan in monthly installments over a set term, typically 3 to 7 years. Each payment reduces both the principal balance and the interest owed. After paying fully the loan, you own the car outright. Following this standard structure makes auto financing straightforward and easy to manage.

Since its founding in 1898, the bank has grown from a single branch in North Carolina into one of America’s largest family-controlled financial institutions. Thanks to its long-standing relationships and conservative financial values, First Citizens now serves customers nationwide and manages over $200 billion in assets. With a firm focus on personalized support and financial strength, the bank continues to be a reliable choice for car buyers seeking stable, straightforward financing.

Key Benefits of First Citizens Auto Loans

First Citizens Auto Loans simplify the car-buying process while giving you greater control and flexibility. Whether you’re eyeing a brand-new model or a dependable used car, First Citizens auto loans offer different benefits that make your purchase both easier and more affordable.

To begin with, one major benefit is the ability to finance both new and used vehicles under one seamless loan structure. This gives you more freedom to shop where and how you prefer whether through a dealership or a private seller.

Moreover, First Citizens auto loans offers competitive fixed interest rates. These fixed rates lock in your monthly payments. Therefore, you can avoid fluctuations or unexpected costs over time. Especially, right now, you can enjoy rates as low as 5.99% APR. This makes it easier to plan your budget, particularly if you’re also handling credit card payments or saving for other financial goals.

For added convenience, you can bundle your auto loan with auto insurance in a single transaction. This all-in-one setup reduces paperwork, saves time, and ensures you’re fully covered before hitting the road. You won’t have to manage separate timelines or coordinate between providers. That means everything is streamlined through one trusted source.

Beyond that, you’re not restricted to dealer-only purchases. First Citizens supports private party purchases, auto refinancing, and even lease buyouts. Therefore, whether you’re replacing an older vehicle or simply aiming for better loan terms, the bank gives you options that adapt to your unique situation.

Most importantly, First Citizens backs every loan with personalized service and a century-long reputation for reliability. Their team works with you to secure fast approvals and tailor loan terms to your goals. Whether it’s your first car or your fifth upgrade, you’ll find peace of mind knowing you’re working with a lender committed to your success.

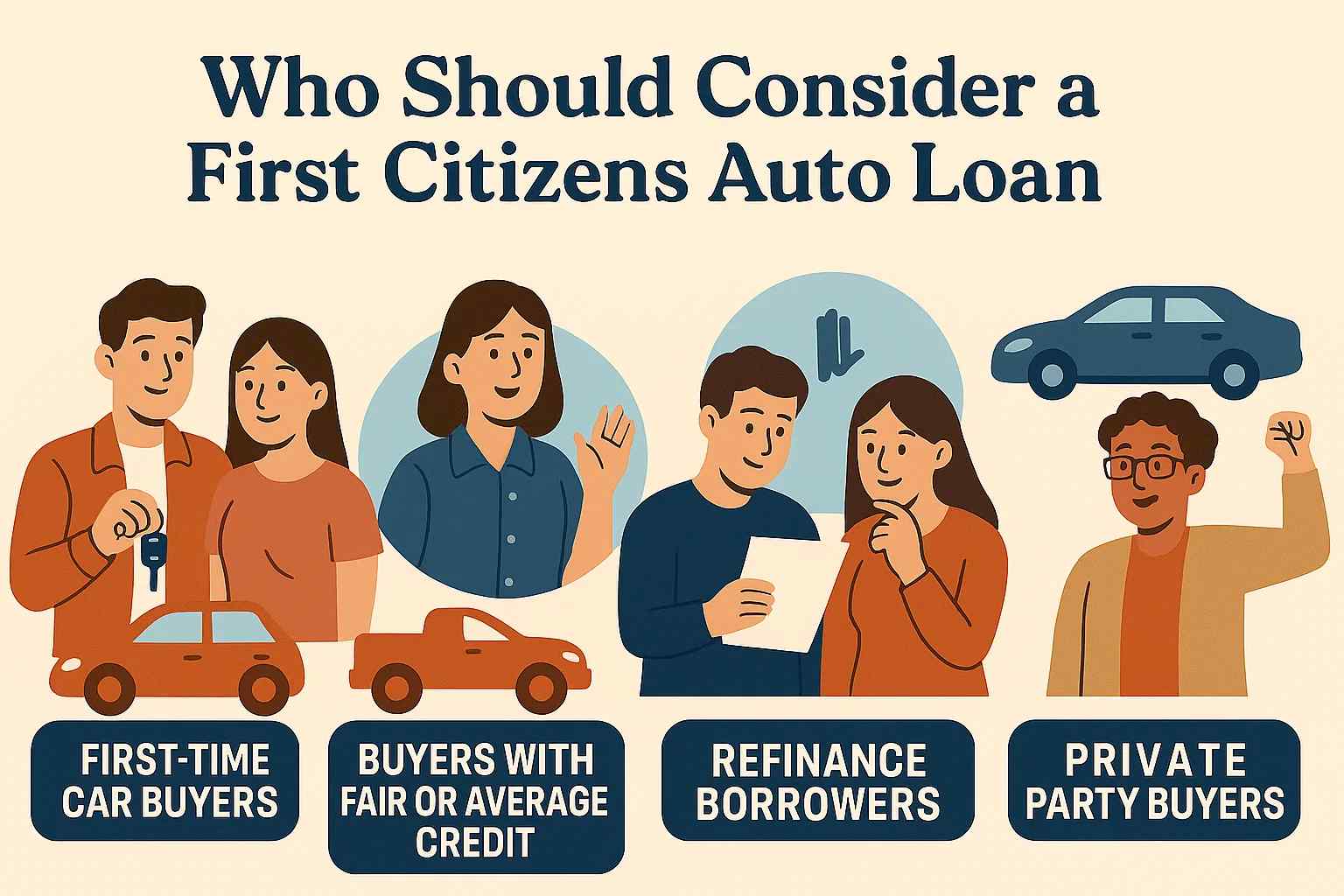

Who Should Consider a First Citizens Auto Loan?

Not every borrower has the same needs and that’s exactly where First Citizens Auto Loans excel. With flexible options and personalized service, these car loans are designed to serve a wide range of car buyers, not just those with perfect credit or traditional dealership purchases.

- First-time car buyers often benefit most. If you’re new to auto financing, First Citizens offers a guided, transparent process that helps you understand your loan terms and feel confident about your decision from day one.

- Buyers with fair or average credit can also find value here. While many lenders penalize anything below a top-tier score, First Citizens reviews your entire financial picture. With steady income and low debt, you could still secure competitive rates and terms.

- Growing families looking to upgrade to larger or safer vehicles may need longer terms to manage monthly costs. First Citizens offers up to 84-month terms, depending on the loan amount. Therefore, it’s easier to drive the car you need without straining your budget.

- Those refinancing an existing auto loan may also find major savings. If your current interest rate is high or your monthly payment feels overwhelming, switching to a First Citizens Auto Loan could lower your rate or extend your term.

- Private party buyers, those purchasing directly from an individual instead of a dealership will appreciate First Citizens’ flexibility. Not all lenders support these transactions, but First Citizens makes it easy to finance vehicles from private sellers with the same confidence you’d expect from a dealer-backed loan.

In short, if you want more control, better rates, or personalized support in your car-buying journey, First Citizens Auto Loans are likely a strong match for your needs.

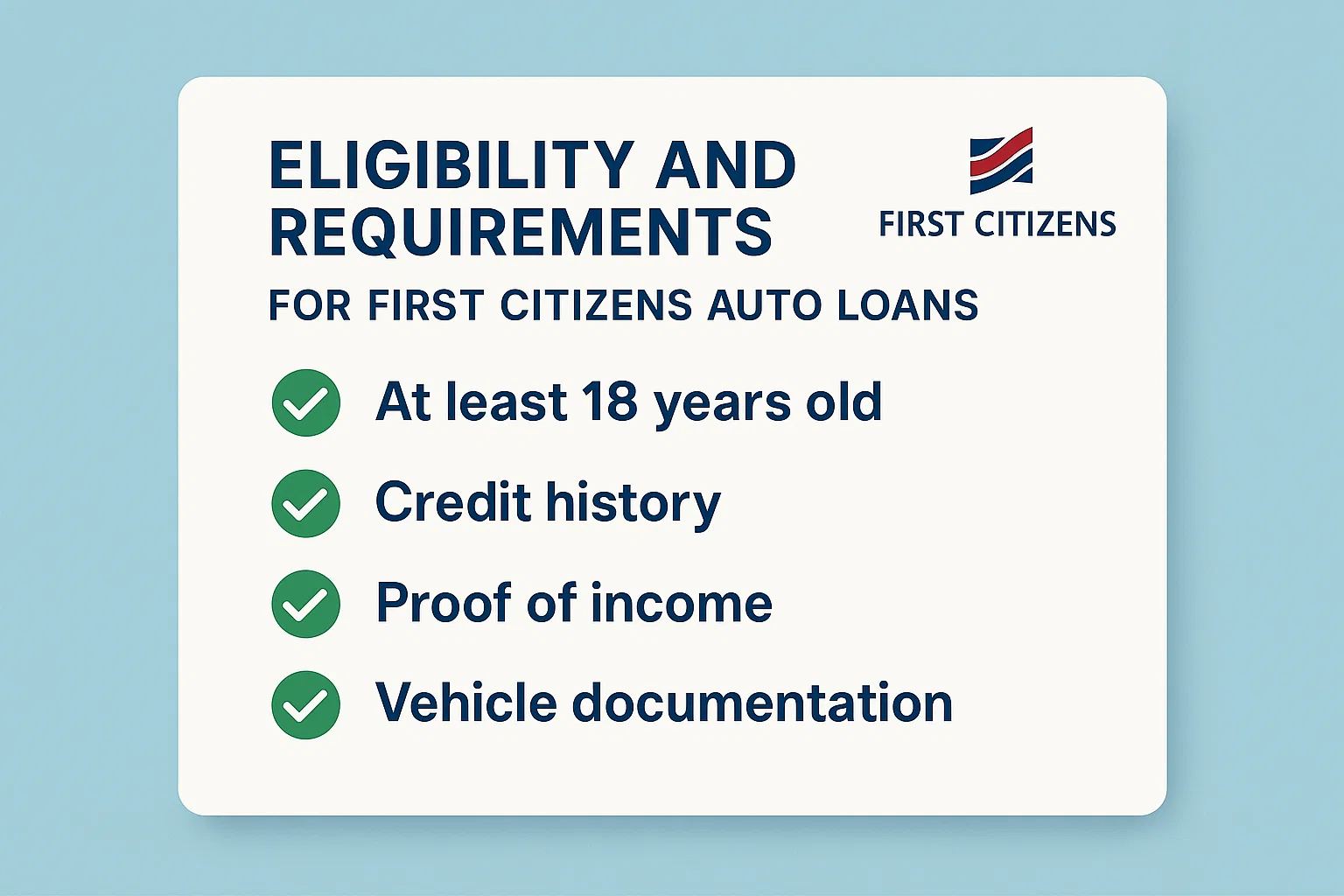

Eligibility and Requirements for First Citizens Auto Loans

Before applying for a First Citizens Auto Loan, it’s important to understand what the bank looks for in qualified borrowers. Meeting the basic requirements helps streamline your approval and gives you a better shot at favorable terms.

To start, you must be at least 18 years old and a U.S. citizen or permanent resident. You’ll also need a valid government-issued ID and a Social Security number for identity verification.

Next, First Citizens will review your credit history and credit score to assess your financial reliability. While higher scores may unlock better rates, the bank does consider applicants with limited or fair credit, especially those with stable income and a low debt-to-income ratio. Even if you’ve previously used short-term solutions like payday loans, a stronger credit record or recent progress can improve your chances.

In addition, you should demonstrate proof of income, such as recent pay stubs, W-2 forms, or bank statements. This ensures you have the financial capacity to repay the loan on time. If you’re self-employed, business tax returns or 1099 forms may be required.

Vehicle documentation is also necessary. If you’re buying from a dealership, most of this will be provided for you. However, for private party purchases or refinancing, you may need to submit a bill of sale, current title, or vehicle registration.

Moreover, Loan amounts must fall within First Citizens’ defined range. The minimum auto loan amount is $2,500, while the maximum reaches up to $200,000. Term limits depend on the loan amount:

-

For loans under $50,000, the maximum term is 72 months

-

For loans over $50,000, the term can extend up to 84 months

Finally, First Citizens may require a down payment, depending on the loan amount, vehicle value, and your credit profile. The more you’re able to pay upfront, the better your chances of approval and securing a lower rate.

Apply for First Citizens Auto Loans

Buying a new or used car becomes much easier when you understand how auto financing works. Even if you’re purchasing from a dealership, it doesn’t lock your into their financing options. Choosing First Citizens Auto Loans can often lead to better rates, flexible terms, and long-term savings, especially when you’re already managing checking accounts or planning ahead with smart investing strategies.

Shop for Your Vehicle

Start by identifying the car you want to buy. Whether it’s a brand-new model from a dealership or a pre-owned vehicle from a private seller, take time to compare prices and features. Doing your homework helps you make a smarter purchase and ensures your First Citizens auto loan amount matches the vehicle’s value.

Apply for an Auto Loan

Once you’ve chosen your vehicle, it’s time to apply. You can visit a local First Citizens branch or contact the bank online to get started. One of their auto financing specialists will walk you through the application and collect key details about you and your car. This step is fast, personalized, and designed to help you get approved without hassle.

Prepare for Closing

As your loan moves toward approval, First Citizens may request additional documents, such as: proof of income or insurance details. Don’t hesitate to ask questions. The bank’s team is here to guide you through every stage and ensure you feel confident before signing.

Close Your Loan and Receive Funds

To finalize the process, you’ll sign a few closing documents. After completing, First Citizens will release your funds, often within 24 hours. From there, you can return to the seller, complete your vehicle purchase, and drive away with financing you trust.

Navigating the car-buying process doesn’t have to be overwhelming, especially with First Citizens by your side. With competitive rates, flexible terms, and a commitment to personalized service, First Citizens Auto Loans offer more than just financing. They deliver peace of mind, financial clarity, and long-term value. Whether you’re buying your first car, upgrading for your family, or refinancing for better terms, First Citizens helps you drive forward with confidence.