If you’re looking for a lending experience that goes beyond the basics, BNY Mellon home loans might be what you need. Known for managing trillions in assets, BNY offers something different in the world of mortgages.

This isn’t your everyday bank. Their services are personal, strategic, and tailored for clients who expect more. Whether you’re buying a luxury property or investing in real estate, this review helps you understand if BNY Mellon home loans are right for you.

Introduction to Bank of New York Mellon

Before we dive into their home loan services, let’s take a quick look at who BNY is and why this bank stands out.

Brief History of BNY

The Bank of New York was founded in 1784 by Alexander Hamilton. Over time, it became a pillar of American finance. In 2007, it merged with Mellon Financial to form what we now know as BNY Mellon or BNY. Today, the bank manages over $53 trillion in assets and offers services in over 35 countries.

Focus on High-Net-Worth Clients

Unlike traditional banks, BNY Mellon isn’t focused on walk-in retail customers. Instead, they cater to high-net-worth individuals and institutional clients. Their mortgage solutions are highly personalized. If you need a $2 million mortgage and want to link it with your investment strategy, they can help.

They don’t just approve loans, they design them around your life.

What Is a BNY Mellon Home Loan?

A BNY Mellon home loan is a personalized mortgage designed for individuals with complex financial needs, especially high-net-worth clients. Unlike traditional banks that offer one-size-fits-all loans, BNY Mellon structures each mortgage based on your income, assets, investment strategy, and long-term financial goals.

These loans often include large borrowing amounts (jumbo loans), interest-only options, or custom repayment terms. In short, it’s part of a broader wealth management strategy tailored to your unique situation.

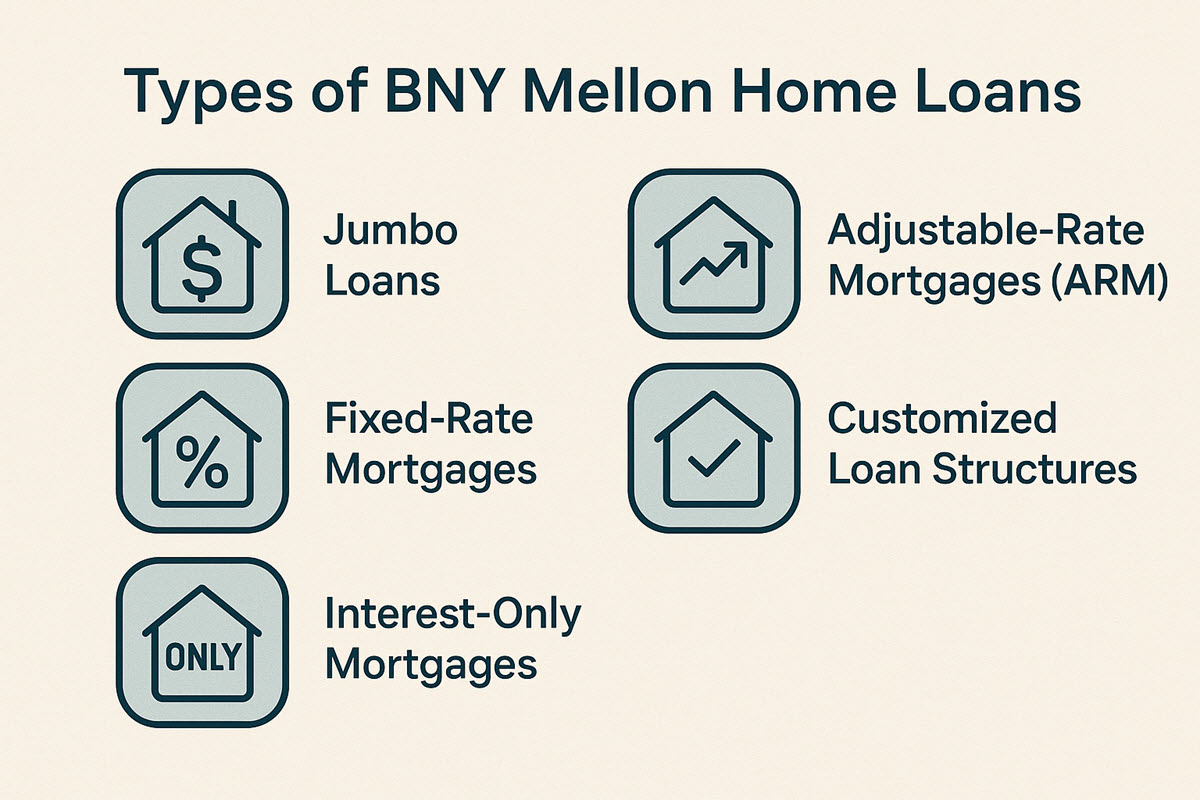

Types of BNY Mellon Home Loans

BNY Mellon offers a range of home loan products. But they often come with a distinct flavor. They are designed for their specific client base. Let’s break down what’s available.

Jumbo Loans

BNY Mellon specializes in jumbo loans. These are mortgages that exceed the conforming loan limits set by Fannie Mae or Freddie Mac. In 2025, that limit is $766,550 in most areas. So, if you’re buying a $1.5 million property, this is where jumbo loans come in.

These loans usually require a strong credit profile and significant assets. BNY Mellon often goes further by reviewing your entire portfolio, not just income statements.

- Loan amounts: Often $1 million+

- Ideal for: High-value property purchases

- Benefits: Access to larger loan amounts than conforming loan limits

Fixed-Rate Mortgages

These are standard. You get a set interest rate. Your monthly payment stays the same. This is good for stability. Terms are usually 15 or 30 years. It’s great if you want predictable payments. It suits those who plan to stay in their home long-term.

- Terms: Commonly 15- and 30-year

- Ideal for: Buyers seeking predictability

- Benefits: Stable monthly payments, good for long-term residences

Adjustable-Rate Mortgages (ARM)

With an ARM, your interest rate can change. It starts fixed for a few years. Then it adjusts periodically. This can be beneficial. Maybe you only plan to live in the home for a short time. Or you expect your income to grow significantly. But there’s risk. Your payments could go up.

- Terms: Typically 5/6, 7/6, or 10/6 ARM structures

- Ideal for: Buyers who plan to move or refinance in a few years

- Benefits: Lower initial rates, flexibility

Interest-Only Mortgages

With an interest-only mortgage, you pay just the interest for a set period, usually 5 to 10 years. After that, you begin paying both principal and interest. This is a useful tool if you want lower initial payments or plan to sell or refinance before the full term.

Customized Loan Structures

This is where BNY Mellon stands out. They don’t just give you a list of loan options. Their advisors look at your income, assets, tax situation, and long-term goals. Then, they help design a loan structure that works for you, not the other way around.

BNY Mellon Home Loans: Current Terms & Rates

BNY Mellon doesn’t publish set rates online. Why? Because their rates depend on your profile. They evaluate your credit score, asset levels, debt-to-income ratio, and more. This flexible pricing lets qualified borrowers get more competitive rates than what you’d find on aggregator sites.

How Rates of BNY Mellon Home Loans Are Determined:

- Creditworthiness

- Loan amount

- Property location and type

- Income structure (W2, K-1, or asset-based)

- Relationship with the bank

That said, BNY Mellon’s rates tend to be competitive, especially for clients who maintain investment accounts with them.

As of mid-2025, national averages for 30-year fixed loans sit around 6.8%. For jumbo loans, the average is slightly higher. However, BNY Mellon’s rates can be lower if you have strong financials and a broader relationship with the bank.

Here’s a table summarizing BNY Mellon Home Loan Rates & Terms with current market context to help you compare and understand:

| Loan Type | Interest Rate (Approx.) | Term Options | Typical Loan Size | Notes |

|---|---|---|---|---|

| 30‑Year Fixed (Conventional) | ~ 6.27% (BNY Mellon avg. 2024) | 30 years | $1M+ (typically jumbo) | About 0.28% below average retail rate |

| 30‑Year Fixed (Jumbo) | ~ 6.80%–6.90% (market avg) | 30 years | > $806,500 (national conforming cap) | Jumbo rate rise to ~6.90% April 2025 |

| 15‑Year Fixed (Jumbo) | ~ 6.26%–6.35% (market avg) | 15 years | > $806,500 | Jumbo 15‑yr avg ~6.33% |

| Interest‑Only Jumbo | Varies (ARM‑based) | 5–10 years interest only, then amortizing | Custom large loans | Tailored based on structure and strategy |

| Adjustable‑Rate Mortgage (ARM) | ~ 7.24%–7.29% (5/6 to 7/6 ARM) | 5/6, 7/6, or 7/6 year initial, then adjusts | Jumbo | National jumbo ARM rates avg 7.24%–7.29% |

Disclaimer: Bank of New York Mellon does not publicly provide its rates. The table above is based on trusted third-party sources and is for reference only. Please contact the bank directly to get the actual rates and fees at the time you use their services.

Application Process for BNY Mellon Home Loans

The application process for BNY Mellon home loans is high-touch and consultative. Here’s how it works:

Step 1: Initial Consultation

You start by scheduling a meeting with a mortgage specialist or relationship manager. They get to know you, your assets, and your goals. This isn’t just paperwork, it’s a financial strategy session.

Step 2: Required Documentation

You’ll need to provide:

- Income documents (W-2s, 1099s, tax returns)

- Proof of assets (bank statements, investment accounts)

- Credit history

- Property details (if applicable)

If you own a business or have foreign income, expect additional documentation.

Step 3: Custom Loan Structuring

Here, your advisor works with underwriters to create a loan plan. This could include:

- Interest-only periods

- Balloon payments

- Tax-optimized terms

Step 4: Underwriting and Legal Review

BNY Mellon’s team thoroughly vets your file. They verify assets, check title history, and ensure regulatory compliance. Expect a deeper review than you might find at a retail lender.

Step 5: Closing and Disbursement

Once approved, your loan moves to closing. BNY Mellon coordinates with attorneys, title companies, and agents to finalize everything. After signing, funds are disbursed directly.

Typical Eligibility Criteria for BNY Mellon Home Loans

In particular, when considering a home loan from BNY Mellon, it’s important to understand the typical qualifications they look for in a borrower:

- Credit score: 700+

- DTI: Preferably 20–30%

- Income: $250K+ is common

- Down payment: 20%+ is typical, often higher for jumbo loans

Pros and Cons of BNY Mellon Home Loans

Like any financial product, BNY Mellon home loans come with both advantages and potential drawbacks. It’s important to weigh these carefully.

Pros of BNY Mellon home loans:

- Highly personalized service with dedicated advisors

- Flexible loan structures tailored to your finances

- Discreet and private process

- Access to integrated wealth and tax planning

Cons of BNY Mellon home loans:

- Not available to general public

- No online pre-qualification tools

- May require large asset balances to qualify

Comparison to Other Lenders:

| Feature | BNY Mellon | JPMorgan | Wells Fargo |

|---|---|---|---|

| Public Rate Info | ❌ | ✅ | ✅ |

| Relationship Required | ✅ | ✅ | ✅ |

| Typical Loan Size | $1M+ | $750K+ | $500K+ |

| Online Application | ❌ | ❌ | ✅ |

BNY Mellon excels in handling unique financial structures and ultra-high-net-worth portfolios. If you need a standard FHA or VA loan, other banks are a better fit.

Who Should Consider BNY Mellon Home Loans?

From the analysis above, we can see that BNY Mellon home loans aren’t for everyone. Here’s who will benefit most:

- High-net-worth individuals (HNWI): If you have $1M+ in liquid assets or a significant investment portfolio, you fit their ideal client profile.

- Business owners: Especially those with complex income streams.

- Real estate investors: People buying multiple properties or managing wealth through real estate.

- Foreign nationals: If you have global assets or income, BNY Mellon can offer specialized solutions.

If you have substantial assets under management (AUM) with BNY Mellon, you’ll likely receive faster service, more favorable terms, and lower fees.

BNY Mellon Mortgage Customer Service

BNY Mellon places a strong emphasis on providing attentive and reliable customer service for its mortgage clients, especially those engaged through private banking. If you’re a homeowner or planning to become one, you can reach dedicated support by contacting BNY customer service line at your region. For example, if you’re in New York, you can contact the BNY Head Office hotline at +1 212 495 1784.

For added convenience, BNY Mellon maintains a robust online support center at bny.com/contact-us and FAQ section, where clients can submit service requests about BNY Mellon home loans or review helpful guides before calling.

Moreover, if you already have a relationship with BNY Mellon, you likely have a dedicated advisor. This person is your direct line of support for questions about BNY Mellon home loans. You can reach out to them via phone or secure email to schedule consultations, discuss rate options, or start a loan application.

Last but not least, BNY Mellon has offices across major financial hubs in the U.S. and internationally. You can book a private appointment at office locations. These meetings are ideal for high-value loan discussions, document review, or personalized financial planning tied to your mortgage.

FAQs About BNY Mellon Home Loans

What is the minimum loan amount for BNY Mellon home loans?

- Most BNY Mellon mortgages start at $1 million. Exceptions exist, but they cater to large loan sizes.

Does BNY Mellon offer FHA or VA loans?

- No, BNY Mellon does not offer government-backed loans. Their products are designed for affluent clients seeking conventional or jumbo financing.

Can non-U.S. residents get a BNY Mellon home loan?

- Yes. BNY Mellon serves international clients, especially those investing in U.S. real estate. You’ll need to provide proof of identity, source of funds, and often tax compliance documentation.

Are their mortgage rates competitive?

- Yes, they are, especially if you have strong financials and an existing relationship with the bank.

How long does the mortgage process take?

- Typically 30 to 60 days, depending on property type and complexity of your financials.

Is there an online mortgage calculator?

- Third-party calculators exist, but BNY Mellon does not provide one directly.

BNY Mellon offers more than a home loan. They offer a financial solution designed around you. If you value tailored service, discretion, and strategic loan structuring, this bank could be an excellent partner. For high-net-worth individuals or investors who want white-glove service and a mortgage that fits into a broader financial plan, BNY Mellon home loans deliver at every level.