Buying a home is one of the biggest decisions you’ll ever make. It’s exciting, but it can also be stressful. That’s where a good lender makes all the difference. Bank of America home loans come from one of the biggest banks in the U.S., offering a variety of options to help you on your journey.

Whether you’re a first-time buyer or refinancing your current home, this review will help you understand what Bank of America home loans have to offer.

Introduction to Bank of America

Bank of America is a financial giant with a rich history deeply intertwined with the American economy.

History of Bank of America

Bank of America started over 100 years ago with a simple mission: to make banking easier for everyone. It began as the Bank of Italy in 1904, founded by Amadeo Giannini in San Francisco. The bank grew rapidly, and in 1930, it officially became Bank of America. Over the years, it expanded its services and customer base across the U.S. and around the world.

In 2008, during the financial crisis, Bank of America bought Countrywide Financial. This move turned Bank of America into one of the largest home loan providers in the country. In the vast and competitive mortgage landscape, Bank of America home loans occupy a unique position. Unlike smaller, specialized mortgage brokers, BoA offers the stability and extensive resources of a large national bank. This can be a major draw for borrowers who prefer the reassurance of a well-established entity.

While other lenders might offer niche products or highly personalized service, Bank of America often appeals to those looking for a broad range of options, competitive rates, and the convenience of integrating their mortgage with existing banking relationships.

General Services of Bank of America

Today, Bank of America is a full-service bank that offers many products:

- Checking accounts and savings accounts

- Credit cards

- Auto loans and business loans

- Investment services through Merrill

- Bank of America home loans, including mortgages and home equity products

With millions of customers and thousands of branches nationwide, it’s a trusted name in American banking.

Introduction to Bank of America Home Loans

Bank of America home loans is the mortgage lending division of the bank, known for providing reliable and accessible financing solutions across the country.

With more than 4,000 physical locations and service in all 50 states, Bank of America offers both in-person and online support. Whether you’re buying your first home, upgrading to a larger property, or refinancing your current mortgage, Bank of America home loans has options that are flexible and competitive. With strong digital tools, experienced loan officers, and special programs for qualified buyers, Bank of America home loans aim to make the dream of homeownership more achievable for more people.

From fixed and adjustable-rate mortgages to government-backed loans and exclusive in-house programs, Bank of America home loans offer something for every stage of your homeownership journey. With a mix of online convenience and personalized support, they combine the stability of a national institution with user-friendly features for modern borrowers.

A Deep Dive into Bank of America’s Home Loan Offerings

Bank of America offers several types of home loans. Each is designed for a different kind of borrower. Here’s a breakdown:

Conventional Loans

These are the most common type of mortgage and form the backbone of Bank of America home loans. Conventional loans are not insured or guaranteed by a government agency. Instead, they adhere to the lending guidelines set by Fannie Mae and Freddie Mac.

- Fixed-Rate Mortgages: The cornerstone of stability, fixed-rate loans offer a consistent interest rate and monthly principal and interest payments throughout the life of the loan. This predictability is highly valued by homeowners who prefer budgeting certainty. Bank of America home loans typically offer common terms like 15-year and 30-year fixed-rate mortgages, along with other less common terms like 20-year or 25-year options.

- Adjustable-Rate Mortgages (ARMs): With an ARM, your interest rate is fixed for an initial period (e.g., 5, 7, or 10 years), after which it adjusts periodically based on a predetermined index. ARMs can offer lower initial interest rates, which might be appealing if you plan to sell or refinance before the fixed period ends. However, they introduce the risk of higher payments if rates rise.

- Down Payment Requirements: For conventional loans, down payments typically range from 3% to 20% or more, depending on the loan program and your creditworthiness. If you put down less than 20%, you’ll generally be required to pay Private Mortgage Insurance (PMI), an added monthly cost that protects the lender in case you default.

- Jumbo Loans: For those eyeing high-value properties that exceed the conventional loan limits set by the Federal Housing Finance Agency (FHFA), Bank of America home loans include jumbo loans. These are designed for larger loan amounts and often come with stricter eligibility criteria, including higher credit score requirements and more substantial reserves.

FHA Loans

Designed to make homeownership more accessible, FHA (Federal Housing Administration) loans are government-insured mortgages that come with more flexible lending standards, particularly beneficial for first-time homebuyers or those with less-than-perfect credit.

- Key Benefits: The standout feature is a low minimum down payment, often as little as 3.5% of the purchase price. FHA loans also have more lenient credit score requirements compared to conventional loans (580 or 500 with a higher down payment)

- Eligibility: To qualify, you generally need to meet specific income and credit criteria, and the property must meet FHA’s appraisal standards.

- Mortgage Insurance Premiums (MIP): Unlike conventional loans where PMI can be canceled, FHA loans require both an upfront Mortgage Insurance Premium (UFMIP) and annual MIP, which remains for the life of the loan in most cases, adding to your monthly cost.

VA Loans

A well-deserved benefit for those who have served our nation, VA (Department of Veterans Affairs) loans are a powerful tool for eligible veterans, active-duty service members, and surviving spouses.

- Zero Down Payment: One of the most significant advantages of a VA loan is the ability to purchase a home with no down payment required.

- No Private Mortgage Insurance (PMI): Unlike other types of Bank of America home loans, VA loans do not require PMI, which can lead to substantial monthly savings.

- Funding Fee: While there’s no PMI, VA loans typically come with a VA funding fee, a one-time payment that helps offset the cost of the program. This fee can often be financed into the loan amount.

- Eligibility: Eligibility is based on service history, and a Certificate of Eligibility (COE) is required.

Bank of America’s Proprietary Programs & Specialty Loans

Beyond these standard offerings, Bank of America home loans also include a suite of proprietary programs:

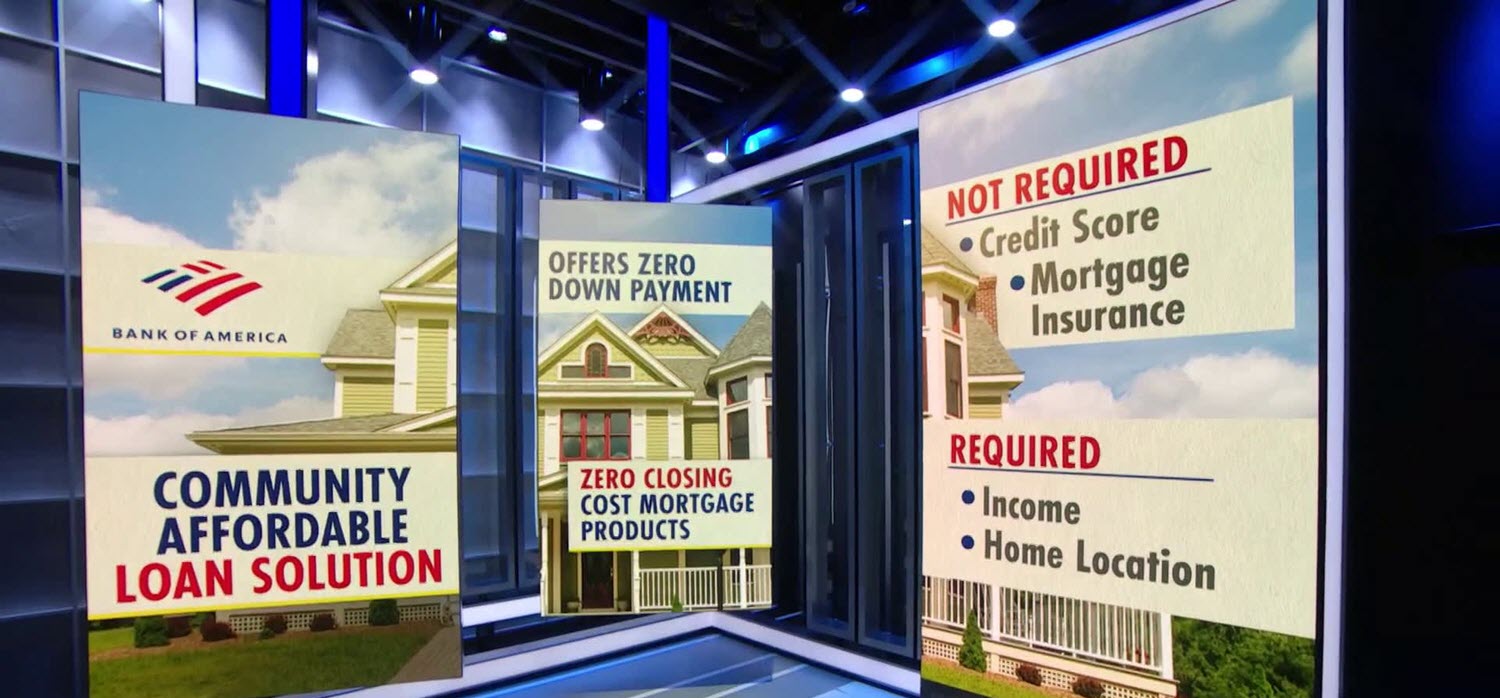

- Affordable Loan Solution Mortgage: This program is specifically tailored for low- and moderate-income borrowers, often featuring a low down payment (as low as 3%), no mortgage insurance (PMI), and competitive interest rates. It’s a significant benefit for first-time homebuyers looking for a more accessible path to homeownership.

- America’s Home Grant Program: This program offers eligible buyers a lender credit that can be used to reduce their interest rate or help with closing costs. This is essentially free money that doesn’t need to be repaid, providing a substantial financial boost.

- Down Payment Grant Program: Similar to the Home Grant, this program provides funds that can be used towards a down payment, making homeownership more attainable by reducing the upfront cash needed.

These unique programs highlight Bank of America home loans’ commitment to diverse borrower needs and offer potential financial advantages.

Home Equity Products

- HELOC (Home Equity Line of Credit): Like a credit card, but it’s tied to the value of your home. You can borrow as needed, and only pay interest on what you use.

- Cash-Out Refinance: Replace your current mortgage with a new one and get cash back based on your home’s equity.

These are key components of Bank of America home loans, helping homeowners tap into their property’s value. Besides, Bank of America also offers helpful tools like mortgage calculators, rate comparison charts, and educational resources on their website.

Bank of America Mortgage Application Process

Bank of America home loans uses a streamlined online platform called the Digital Mortgage Experience. Here are the steps:

Step 1: Prequalification or Preapproval

You can start by checking how much you might qualify for. Prequalification is quick and doesn’t affect your credit score. For a stronger offer, apply for preapproval by submitting income and credit info.

Step 2: Search for a Home

Use Bank of America’s online Real Estate Center to search for homes in your area. You can also estimate monthly payments.

Step 3: Apply Online

Once you find a home, complete your full mortgage application online. You’ll enter personal information, employment history, income details, and current assets and liabilities.

Be prepared to upload various documents. This typically includes:

- Pay stubs (last 30 days)

- W-2 forms (last two years)

- Tax returns (last two years)

- Bank statements (last two months)

- Investment account statements

- Identification (driver’s license, social security card)

- Proof of other income (if applicable)

Their online platform often includes tools to track your application status, upload documents securely, and communicate with your loan team.

Step 4: Loan Processing

A loan officer will help with the next steps: ordering an appraisal, reviewing documents, and submitting everything to underwriting.

They’re there to guide you through the complexities, answer your questions, help you choose the right loan product, and navigate any challenges that arise. Therefore, don’t hesitate to reach out to them with your own questions about Bank of America home loans.

Step 5: Closing the Loan

You’ll sign final documents either at a branch or online. After that, the loan is complete, and you can move into your new home.

Bank of America (or another servicer) will be responsible for collecting your monthly payments and managing your escrow account (for property taxes and insurance).

Step 6: Managing Your Mortgage

After closing, you can use online tools to manage payments, set up autopay, and keep track of your balance.

This end-to-end digital process is designed to make Bank of America home loans convenient and transparent for all applicants.

Bank of America Home Loans: Rates, Fees, and Customer Experience

Beyond the types of loans and the application process, understanding Bank of America home loans’ rates, fees, and what you can expect from their customer service is paramount. These are the elements that directly impact your wallet and your overall satisfaction.

Interest Rates of Bank of America Home Loans

Mortgage rates are highly fluid, influenced by market conditions, the Federal Reserve, and a host of other economic factors. Therefore, providing exact rates here isn’t feasible, as they change daily. You can check current rates on their website.

However, we can discuss how Bank of America’s rates generally position themselves.

Competitive Interest Rates

As a large lender, Bank of America generally offers competitive interest rates that are in line with other major national banks. They may not always have the absolute lowest rate compared to smaller online-only lenders, but their rates are usually strong contenders.

This is the summary table of current Bank of America home loan rates, based on the latest data available from their official site. The table reflects home loan rates at the time of writing and is for reference only. You should check the latest rates directly on the official website for the most accurate information before making any decisions.

| Loan Type | Rate | APR | Points | Typical Monthly Payment* |

|---|---|---|---|---|

| 30‑Year Fixed Mortgage | 6.75% | 7.038% | 0.803 | ~$1,297 per $200K loan |

| 20‑Year Fixed Mortgage | 6.625% | 6.994% | (not shown) | — |

| 15‑Year Fixed Mortgage | 5.75% | 6.225% | (not shown) | ~$1,661 per $200K loan |

| 10‑Year / 6‑Month ARM Rate | 6.875% | — | — | — |

| 7‑Year / 6‑Month ARM Rate | 7.083% | — | — | — |

| 5‑Year / 6‑Month ARM Rate | 7.197% | — | — | — |

| 30‑Year Fixed Refinance | 6.75% | 6.959% | — | — |

| 15‑Year Fixed Refinance | 5.75% | 6.039% | — | — |

| 5‑Year / 6‑Month ARM Refinance Rate | 6.875% | — | — | — |

| HELOC Introductory Rate | Prime – 0.25% variable | — | — | — |

* Monthly payment estimates are based on a $200,000 loan with principal and interest only; insurance and taxes not included

Factors Influencing Your Rate

The rate you qualify for will depend on several personal factors:

- Credit Score: A higher credit score signals less risk to lenders, often translating to a lower interest rate.

- Down Payment: A larger down payment can also lead to a more favorable rate.

- Loan Type: Different loan products (e.g., FHA vs. Conventional) will have different rate structures.

- Loan Term: Shorter loan terms (e.g., 15-year fixed) typically have lower interest rates than longer terms (e.g., 30-year fixed).

If you have a checking or savings account with Bank of America, you might qualify for lower rates through the Preferred Rewards program.

Fees and Closing Costs of Bank of America Home Loans

Of course, Bank of America home loans charge fees:

- Origination fee (usually 0.5% to 1% of the loan)

- Appraisal and title fees

- Government recording charges

However, their HELOCs have no closing costs in many cases, which can save you money.

Bank of America, like all lenders, is required by law to provide you with a Loan Estimate and a Closing Disclosure. These documents detail all your loan terms, projected payments, and itemized closing costs. It’s crucial to review these documents carefully and ask your loan officer about anything you don’t understand. Bank of America generally provides clear documentation, but it’s your responsibility to review it thoroughly.

Customer Experience on Bank of America Home Loans

Many customers find Bank of America home loans’ digital tools very helpful. The online mortgage tracker allows you to see each step of your loan process in real time, from application to approval. You can also upload documents, get alerts, and check the status of your loan on the go. Their mobile app is user-friendly and includes options to make payments, view loan details, and contact support easily.

If you prefer speaking with someone directly, Bank of America home loans give you multiple options. You can talk to a loan officer in person at one of their branches, speak to someone over the phone, or get help through online chat. This flexibility makes the process more comfortable for many borrowers.

- Phone: Call 800-270-5746 (Mon–Sat)

- Online Banking: Secure message center

- In-Person: Visit one of 4,000+ locations

However, not all experiences are the same. Some reviews mention slow processing or communication issues, but experiences vary depending on the local branch.

Is Bank of America the Right Mortgage Partner for You?

Choosing a mortgage lender is a big decision. It’s important to look at the benefits and possible drawbacks to see if Bank of America home loans service is the right fit for you.

Pros of Bank of America Home Loans

- Scale & experience: Over 4,000 branches nationwide, Serves all 50 states, wide mortgage expertise.

- Product variety: Options for fixed, ARM, FHA/VA, jumbo, low-down, HELOC, cash-out refinance.

- Digital tools: Modern online application, calculators, rate management.

- Program perks: Affordable solutions, rate/fee discounts through Preferred Rewards.

- Support infrastructure: Dedicated loan officers and in-branch access.

Cons of Bank of America Home Loans

- Less personal touch: Big-bank scale means some borrowers feel less individualized service.

- Limited physical branches: Physical branches only in 37 states

- Potentially limited jargon flexibility: Some programs like Affordable Loan Solutionrequire higher credit scores or documentation.

Who Should Consider Bank of America Home Loans

So, given all we’ve covered about the pros and cons of Bank of America home loans, let’s break down exactly which types of homebuyers are most likely to find their ideal mortgage solution here:

- Existing Bank of America Customers: If you already bank with BofA, the integration of your mortgage with your other accounts can be incredibly convenient, potentially offering relationship discounts or simply a streamlined financial management experience.

- Borrowers Who Value Stability and Brand Recognition: For those who prefer the reassurance of working with a large, well-established financial institution with a long track record, Bank of America provides that security.

- Borrowers Seeking Diverse Loan Products: With their wide array of conventional, government-backed, and proprietary loan programs, Bank of America is well-equipped to handle various borrower needs, from first-time homebuyers to those seeking jumbo loans.

- Those Comfortable with Digital Tools: Their robust online application portal and mortgage management tools cater well to tech-savvy borrowers.

With a wide product selection, competitive rates, and strong support tools, Bank of America home loans are a top choice for many types of borrowers. From first-time buyers to seasoned investors, Bank of America home loans deliver a mix of flexibility and reliability that can meet a broad range of needs.

FAQs about Bank of America Home Loans

If you’re considering a mortgage with Bank of America, these frequently asked questions about Bank of America home loans can help you understand what to expect:

1. Does Bank of America offer VA loans?

Yes, Bank of America is VA-approved and provides home loan options specifically for veterans and active-duty military members. These Bank of America home loans often come with no down payment and competitive terms.

2. Are Bank of America’s interest rates competitive?

Yes, Bank of America home loans generally offer competitive rates, especially for Preferred Rewards members.

3. Can I get a HELOC with Bank of America?

Yes, Bank of America home loans offer HELOCs nationwide. Many come with no closing costs, and you can manage your line of credit easily through their mobile app or online banking.

4. How good is Bank of America’s digital mortgage process?

BofA’s Digital Mortgage Experience is highly rated for its ease of use. It allows you to apply online, upload documents, and track your application status. Many users find it simple and convenient.

5. Is Bank of America a good choice for first-time homebuyers?

Yes. Bank of America offers several programs to help first-time buyers, such as the Affordable Loan Solution® and access to FHA and VA loans. These options require lower down payments and are designed to make homeownership more accessible.

In general, Bank of America Home Loans is a powerful option for borrowers seeking a full-service lender. With its extensive product lineup combined with digital tools and in‑branch support, BofA meets a wide range of home financing needs.