Looking for a car loan that fits your life? Truist Auto Loans may be just what you need. With competitive interest rates, flexible terms, and fast approval, Truist delivers a modern and reliable auto‑financing experience.

In this blog, we take you through everything you should know before choosing a Truist auto loan. Whether you’re buying new, used, or refinancing, you’ll find clear, concise answers here.

Introduction to Truist Financial Corporation

First of all, let’s take a moment to understand who Truist is:

The History of Truist Financial Corporation

Truist Financial Corporation is one of the newest yet fastest-growing banks in the United States. It officially came into existence in December 2019, following the historic merger between two major regional banks: BB&T and SunTrust Bank. It was a strategic “merger of equals” designed to build a stronger, more innovative financial institution that could serve millions of customers with enhanced technology and a broader network.

Despite being a relatively young brand, Truist quickly made its mark. As of today, the bank provides services to clients across 17 U.S. states and the District of Columbia, operating through a vast network of branches and digital platforms. Headquartered in Charlotte, North Carolina, Truist blends the long-standing reputations of its founding banks with a forward-looking mission: to inspire and build better lives and communities.

From day one, Truist has focused on simplifying banking while delivering personalized experiences, making them a trusted partner for both individuals and businesses.

Core Services Offered by Truist Bank

Truist Bank offers a wide variety of financial products and services that support every stage of life and business. Whether you’re opening your first checking account or looking to fund a business expansion, Truist has you covered. Key services include:

- Everyday Banking: Checking and savings accounts, debit cards, overdraft protection, and digital banking tools.

- Credit Services: Personal loans, credit cards, and lines of credit tailored to your financial goals.

- Home Financing: Mortgages, home equity loans, and refinancing options with competitive rates.

- Business Banking: From small business loans to treasury management and merchant services.

- Wealth and Investment Management: Guidance on retirement, investing, and financial planning.

- Insurance Services: Personal and commercial insurance solutions to protect what matters most.

Truist also embraces digital innovation. Through tools like Truist One Checking, Zelle money transfers, and the LightStream platform (for fast personal loans), the bank allows customers to manage their finances anytime, anywhere.

With over 1,900 branch locations nationwide, Truist strikes a balance between face-to-face service and seamless digital access, giving customers convenience and confidence at every turn.

What Are Truist Auto Loans?

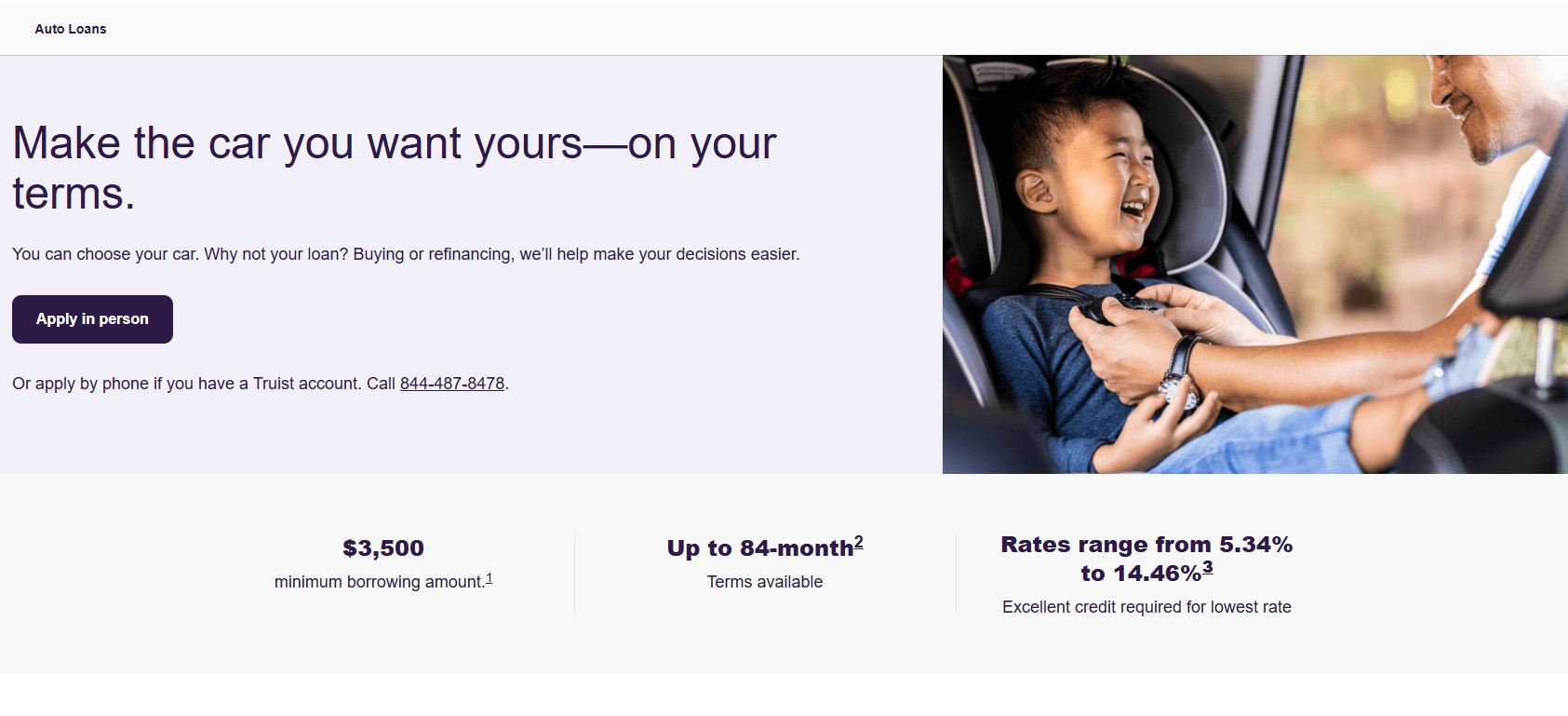

One of Truist’s standout services is its auto loan offering, which is designed to help individuals and businesses purchase or refinance vehicles with ease. Whether you’re buying your first car, upgrading to a newer model, or looking to reduce your monthly payments, Truist Auto Loans offer practical solutions with:

- Loan amounts starting at just $3,500

- Flexible terms of up to 84 months

- Competitive annual percentage rates (APRs) ranging from approximately 5.34% to 14.46%, depending on your credit profile

Truist finances both new and used vehicles and provides refinancing options if you already have a car loan with another lender. Qualified borrowers with excellent credit scores may be eligible for the lowest rates available, making Truist a smart choice for cost-conscious drivers.

The bank also ensures a smooth application process, with pre-approval decisions often made within minutes, a 30-day rate lock, and support from knowledgeable loan specialists ready to help you at every step.

Types of Truist Auto Loans

Truist offers a diverse range of auto loan options to match the needs of individuals and businesses alike. Whether you’re looking to buy a new car, refinance an existing loan, or finance vehicles for your business, Truist provides flexible solutions with competitive terms.

New and Used Auto Loans

This is Truist’s core auto loan product. It’s designed for borrowers who are purchasing either a brand-new vehicle or a used car from a dealership or private party.

Key Features:

- Loan Amounts: Starting from as low as $3,500, making it accessible for a wide range of buyers.

- Loan Terms: Flexible repayment options up to 84 months (7 years), allowing for more affordable monthly payments.

- Eligibility: Available to qualified borrowers with a solid credit profile and proof of income.

This option is perfect for first-time buyers or anyone upgrading to a newer model. Whether it’s a compact sedan or a family SUV, Truist helps make car ownership easier with transparent lending and quick approvals.

Auto Loan Refinancing

If you already have a car loan, Truist makes it simple to refinance your existing auto loan. This option is ideal for those looking to:

- Lower their interest rate

- Reduce monthly payments

- Extend or shorten the loan term

What You Get:

- Same loan amounts and terms as the original product (starting at $3,500 and terms up to 84 months)

- Potential savings on total interest paid

- No hidden fees or prepayment penalties

This refinance solution can be a smart financial move, especially if your credit score has improved since you first financed your vehicle.

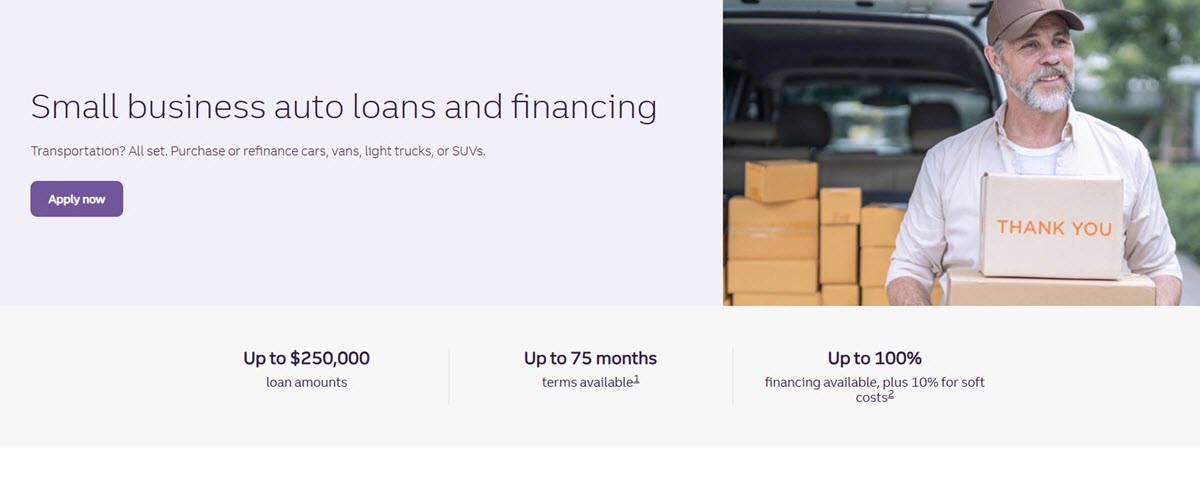

Small Business Auto Loans

Business owners also have access to Truist’s tailored financing for company vehicles. Whether you’re running a delivery service, real estate agency, or construction firm, these loans help fund your fleet or company car needs.

Highlights:

- Loan Amounts: Borrow up to $250,000

- Loan Terms: Up to 75 months for repayment

- Financing Coverage: Up to 100% of vehicle cost, including soft costs like tax, title, and registration

With this option, Truist supports small to mid-sized businesses looking to grow efficiently without draining their capital reserves.

Lease Buyout Loans

If you’re nearing the end of your car lease and have fallen in love with the vehicle, you might be considering buying it out. Truist offers lease buyout loans specifically for this purpose. This type of loan helps you finance the remaining value of the leased vehicle, allowing you to transition from leasing to owning. It’s a convenient option if you’re happy with your current car and want to avoid the hassle of finding a new one.

Why Choose Truist Auto Loans?

Truist stands out in the auto lending space for its affordability, speed, and personalized service. Here’s why more drivers and businesses are turning to Truist for their vehicle financing needs:

- Competitive Rates: APRs start around 5.34%–5.42% and go up to 14.46%

- Long Terms: Up to 84 months allows lower monthly payments

- Low Minimum Borrowing: Just $3,500, lower than many other banks

- Rate Lock Guarantee: Approved rate holds for 30 days

- Quick Approval & Funding: Decisions in about 10 minutes; funding can be same-day

- Hardship Assistance: Programs exist for natural disaster or income loss .

- Convenient Service: Over 1,900 branches, plus phone support for existing customers

However, there are still some cons you should be aware of:

- No fully online auto‑loan application, new customers must apply in person

- Requires excellent credit for best rates

- Branches are limited to select states; check availability in your area.

Truist Auto Loans: Eligibility Requirements

Thinking about financing your next vehicle with Truist? Here’s what you need to know about eligibility before you apply:

- Good to Excellent Credit: To qualify, you should have good to excellent credit. Most approved applicants have a FICO score of 660 or higher. The better your credit, the more likely you are to receive a lower interest rate and favorable loan terms.

- Be a Truist Customer or Visit a Branch: If you already bank with Truist, you can apply easily online or by phone. New customers will need to visit a local Truist branch in person to start the application process.

- Live in a Truist Service Area: Truist auto loans are only available in states where the bank operates. This includes 17 U.S. states plus Washington, D.C., so make sure your residence falls within their service area.

- Business Auto Loans: For business-related vehicle loans, your company should meet Truist’s minimum revenue and credit guidelines. You may be eligible to borrow up to $250,000, provided your business is in good financial standing and operates within the supported regions.

Truist Auto Loans: Required Documents and Application Process

Applying for a Truist Auto Loan is simple when you’re prepared. Whether you’re purchasing a vehicle or refinancing, having the right paperwork can speed up your approval process.

Documents for Personal Auto Loans

To apply, prepare the following:

- Proof of income: Recent pay stubs, tax returns, or employment verification

- Government-issued ID: Driver’s license or passport

- Proof of address: Utility bill, lease agreement, or bank statement

- Vehicle information: Buyer’s order, purchase agreement, or bill of sale

- VIN number: Vehicle Identification Number, especially for used car purchases

These documents help Truist verify your financial status and ensure you’re borrowing responsibly.

Refinance Applications

If you’re refinancing an existing loan, you’ll also need:

- Current loan details: Including lender name, payoff amount, and remaining term

- Vehicle registration: Must be up-to-date and in your name

- Payoff letter: Often required to settle the current balance with your existing lender

Having this information ready can make refinancing fast and hassle-free.

How to Apply

For existing Truist customers:

- Call 844-487-8478 to start your application.

- Provide your documentation electronically or in person.

- Receive a loan decision in as little as 10 minutes.

- E-sign loan documents for faster processing.

- Your rate will be locked for 30 days, giving you time to shop.

For new customers:

- Visit a Truist branch near you.

- Present the required documents.

- Work with a loan specialist to submit your application.

Once approved, your loan rate is locked in for 30 days, giving you time to shop around confidently. Truist also allows you to e-sign documents and choose how you’d like to receive the funds, often with same-day funding if completed before the bank’s processing cutoff.

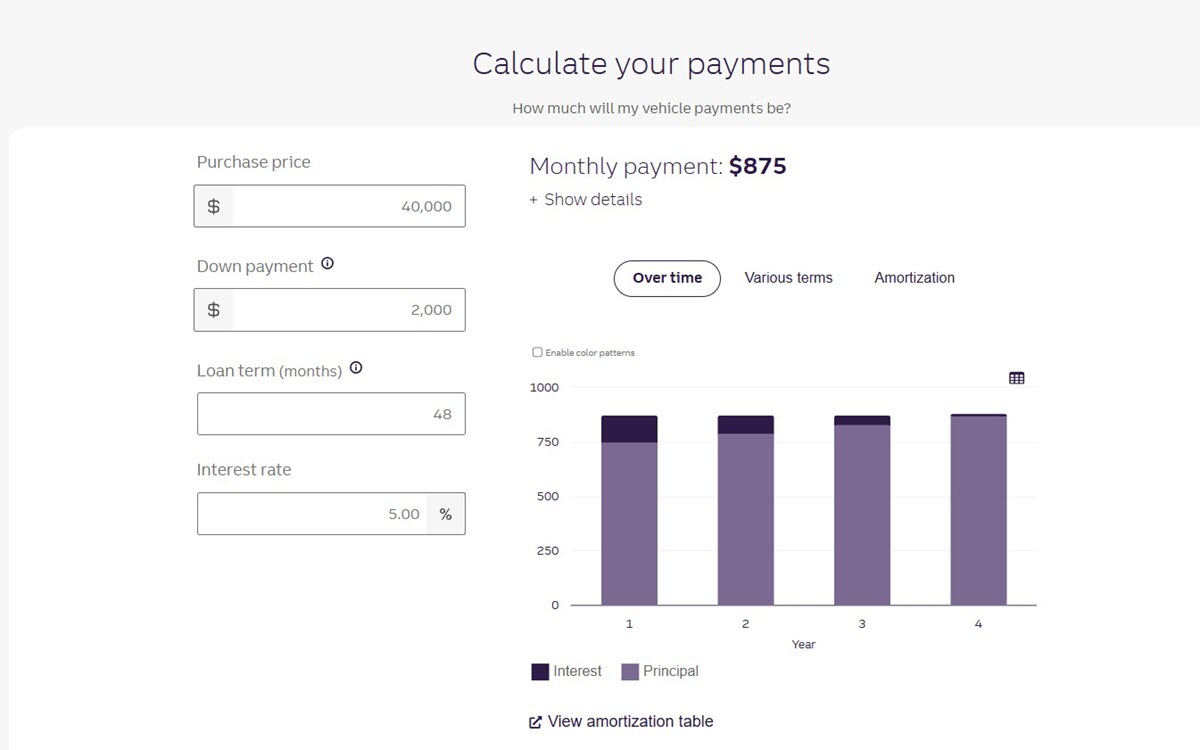

Truist Auto Loans: Rates & Terms

Understanding the numbers behind your loan is critical. Here’s what you need to know about interest rates:

Factors Influencing Interest Rates

Your interest rate isn’t just pulled out of thin air. Several key factors determine the rate Truist will offer you:

- Credit Score: This is arguably the most significant factor. Borrowers with excellent credit scores (typically 720+) will qualify for the lowest rates, as they are considered the least risky. As your credit score decreases, the interest rate you’re offered will generally increase.

- Loan Term: Shorter loan terms (e.g., 36 or 48 months) usually come with lower interest rates because the lender gets their money back faster. Longer terms (e.g., 72 or 84 months) often have higher interest rates but lower monthly payments.

- Loan Amount: While not always a direct correlation, very small or very large loan amounts can sometimes influence rates.

- Vehicle Type (New vs. Used): As mentioned, new cars typically secure lower rates than used cars due to their higher resale value and lower perceived risk.

- Down Payment: Making a substantial down payment reduces the amount you need to borrow, which can often translate to a lower interest rate, as it signals less risk to the lender.

- Current Market Rates: The overall economic environment, including the federal interest rates set by the Federal Reserve, influences all lending rates.

Understanding Truist’s Rates

Understanding the terms and rates can help you compare options and budget with confidence. Truist offers flexibility, transparent pricing, and no prepayment penalties.

Loan Amounts

- Minimum loan: $3,500 for both purchases and refinancing

- Business loan max: Up to $250,000 for company vehicle purchases

Loan Terms

- Personal auto loans: Choose terms up to 84 months (7 years)

- Business auto loans: Terms up to 75 months available

Longer terms may lower your monthly payment but can increase total interest paid.

Annual Percentage Rates (APR)

Rates typically range from 5.34% to 14.46% APR. Your rate depends on:

- Credit score

- Loan term

- Vehicle type and age

- Whether you enroll in AutoPay

Truist rewards consistent payments and good credit with better rates. Those with strong financial profiles can access the lowest rates.

AutoPay Discount

Save 0.50% off your interest rate when you enroll in automatic payments—a great way to reduce your monthly cost.

30-Day Rate Lock

Once approved, your APR is secured for 30 days, giving you peace of mind while you finalize your vehicle purchase.

No Prepayment Penalty

You can pay off your loan early without any extra fees, ideal for those who want to save on interest over time.

Here is a table summarizing the Truist auto loan terms and key features:

| Feature | Details |

|---|---|

| Minimum Loan Amount | $3,500 |

| Loan Terms | – Up to 84 months (personal auto loans) – Up to 75 months (business auto loans) |

| APR Range | Approximately 5.34% to 14.46% (varies by credit, loan amount, and term) |

| AutoPay Discount | 0.50% APR reduction when enrolled in automatic payments |

| Rate Lock Period | 30 days after loan approval |

| Prepayment Penalty | None – pay off your loan early with no additional fees |

| Example: $25,000 Loan | – 6.16% APR over 84 months = ~$367/month – 7.24% APR over 36 months = ~$774.67/month |

FAQs About Truist Auto Loans

Before you apply for a Truist auto loan, it’s normal to have a few questions. Here are clear, helpful answers to the most common inquiries borrowers have.

What credit score do I need to qualify for a Truist auto loan?

- While Truist doesn’t publish a minimum credit score, generally, borrowers with good to excellent credit (typically 670 FICO score and above) will have the best chance of approval and qualifying for their most competitive rates. If your score is lower, you might still qualify, but expect a higher interest rate.

Is there a penalty if I pay off my loan early?

- No, there are no prepayment penalties. Truist gives you the freedom to pay off your loan early without any extra fees.

Can I refinance my car loan later if rates drop?

- Yes, you can refinance with Truist. Whether your credit improves or market rates go down, Truist allows refinancing of existing car loans. This can lower your monthly payments or total interest cost.

Are there any fees associated with Truist auto loans?

- While auto loans generally have fewer fees than other loan types, it’s always wise to ask. Truist may charge late payment fees if you miss a due date. It’s rare for standard auto loans to have origination fees or prepayment penalties, but you should always confirm these details in your specific loan agreement.

How quickly will I get a loan decision?

- Most applicants receive a decision in just 10 minutes. In many cases, loan approval happens within minutes. For qualified borrowers with all documents ready, funding can even happen on the same day.

In conclusion, Truist Auto Loans are a strong choice for individuals and businesses looking for a trustworthy, flexible, and supportive lender. It combines the convenience of modern banking with the personal service of a community-focused institution. If you value competitive rates, quick funding, and the ability to speak with a real person when you need help, Truist could be the ideal partner for your next auto loan.