BNY Mellon business banking is built for companies that need more than just basic financial tools. With over 235 years of experience, BNY Mellon provides secure, reliable, and highly customized banking services for businesses operating at a global scale.

In this article, we’ll explore everything you need to know about BNY Mellon business banking solutions: how they work, who they’re for, and why they stand out in today’s competitive financial world.

Introduction to Bank of New York Mellon Corporation

The Bank of New York Mellon Corporation, widely known as BNY or BNY Mellon, is a global financial powerhouse. It helps clients manage, move, and secure trillions in assets. As of March 2025, it oversees more than $53 trillion.

History of Bank of New York Mellon Corporation

Originally founded in 1784 by Alexander Hamilton, the Bank of New York was the first company to be publicly traded on the New York Stock Exchange. Later in 1869, Mellon Financial was established as a separate institution.

Eventually in 2007, these two financial powerhouses merged, forming The Bank of New York Mellon Corporation. Since then, BNY Mellon has blended centuries of banking tradition with innovative financial strategies.

Today, BNY Mellon is one of the oldest and most trusted names in finance. Headquartered in New York City, it has over $45 trillion in assets under custody and/or administration (AUC/A) and serves clients in more than 35 countries worldwide.

General Services of BNY Mellon

Unlike typical retail banks, BNY Mellon primarily serves institutional clients, offering a comprehensive suite of services, including:

- Custody & Asset Servicing: BNY Mellon is the world’s largest custodian bank. It helps institutions securely hold, track, and service assets, from equities to fixed income and alternative investments.

- Investment Management & Wealth Services: Through subsidiaries like BNY Mellon Investment Management and Pershing, the bank provides actively managed portfolios, advisory services, and retirement planning for institutional and high-net-worth clients.

- Treasury and Payment Solutions: From cross-border payments to real-time liquidity, BNY’s treasury services ensure efficient global money movement and cash management.

- Clearing, Settlement, and Foreign Exchange (FX): BNY Mellon plays a central role in global clearing houses and FX markets, offering multi-currency capabilities and back-end infrastructure for financial institutions.

- Private & Business Banking: Through its wealth and private banking arms, BNY Mellon offers tailored checking, lending, and digital tools for executives, family offices, and select business clients.

- Technology & Digital Platforms: Clients benefit from powerful tools like NEXEN, a digital ecosystem offering secure account access, reporting dashboards, APIs, and data-driven insights.

All of these services, designed for top-tier clients like Fortune 100 companies and global institutions, help businesses manage capital efficiently and grow globally.

About BNY Mellon Business Banking

While BNY Mellon is not a traditional business bank for small shops or local entrepreneurs, it does offer highly sophisticated business banking services tailored to mid-size to large corporations, financial institutions, and multinational firms.

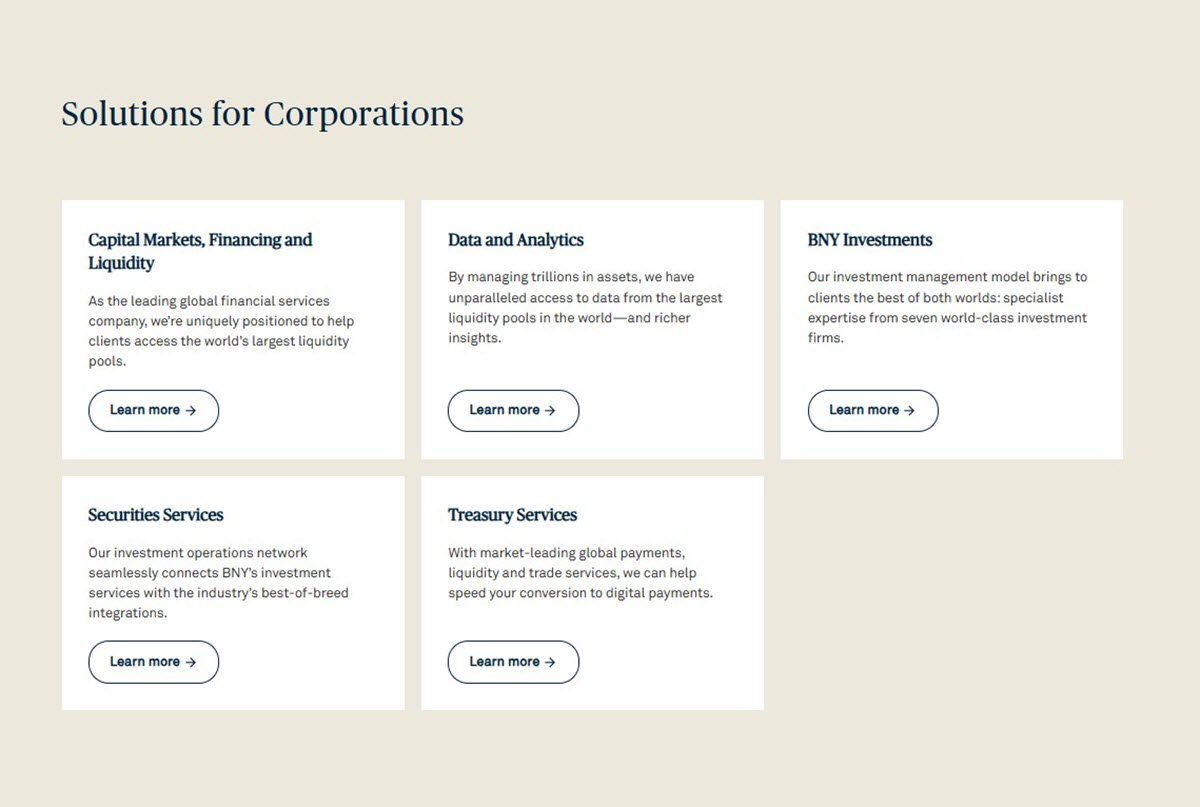

Key offerings in BNY business banking portfolio include:

- Liquidity and cash management

- Trade finance and foreign exchange solutions

- Payment processing on a global scale

- Working capital optimization

- Commercial custody accounts

In short, for businesses that operate internationally or require institutional-grade banking tools, BNY Mellon stands out as a strategic financial partner, not just a service provider.

Types of BNY Mellon Business Services

BNY Mellon business banking goes far beyond basic checking accounts or commercial loans. It delivers a wide array of enterprise-grade solutions tailored for large corporations, institutional investors, and multinational organizations. These services are designed to help businesses manage liquidity, move funds globally, and safeguard assets at scale.

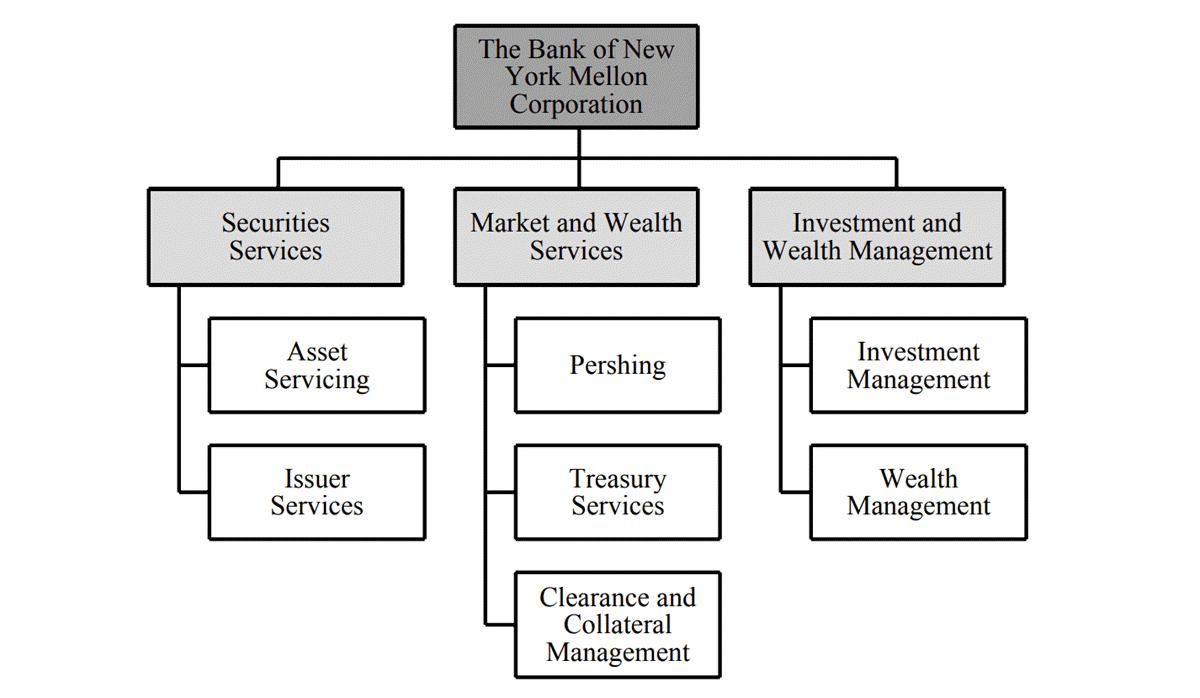

BNY Mellon’s core business banking services fall into three strategic categories:

Treasury and Liquidity Services

BNY Mellon offers powerful tools to help companies monitor, manage, and optimize their cash positions in real time across currencies, time zones, and banking partners.

Key Offerings:

- Real-Time Liquidity Reporting: Access up-to-the-minute data on cash positions, available balances, and intercompany transfers across global accounts.

- Multi-Currency Account Structures: Manage cash in multiple currencies within one consolidated framework. This helps reduce FX risk and simplifies reconciliation.

- Global Cash Concentration: Automatically sweep funds into a central account for more efficient interest earnings and improved visibility of working capital.

- Automated Investment Sweeps: Idle balances can be automatically swept into approved investment vehicles, helping businesses put excess liquidity to work without manual intervention.

These solutions are ideal for corporations with complex cash flows, global operations, and a need for centralized treasury oversight.

Payments and Trade Finance

BNY Mellon helps businesses move money across borders efficiently and securely. Its trade finance and global payment infrastructure is trusted by financial institutions and multinational firms worldwide.

Core Services:

- Global Payment Gateways: Process high-volume payments across borders using a unified platform with robust compliance features.

- SWIFT-Enabled Connectivity: BNY Mellon is fully integrated with the SWIFT network, allowing businesses to communicate with banks globally in a secure, standardized format.

- Cross-Border ACH & Wire Transfers: Send and receive payments in multiple currencies with fast execution and real-time tracking capabilities.

- Letters of Credit & Documentary Collections: Support international trade with document-backed guarantees that reduce payment risk and increase buyer/supplier confidence.

These services help businesses streamline international transactions, manage trade risk, and improve cash flow in global supply chains.

Custody and Collateral Management

As the world’s largest custodian bank, BNY Mellon delivers advanced asset protection, seamless transaction processing, and high-level collateral services. Specifically, these solutions are designed for institutional investors, pension funds, and corporations with significant investment exposure.

Highlights Include:

- Safe Custody of Securities: Securely hold and administer a broad range of financial instruments, including equities, bonds, and alternative assets.

- Collateral Optimization for Trading Desks: Identify and allocate collateral more effectively for margin and regulatory needs, improving capital efficiency across portfolios.

- Clearing and Settlement Infrastructure: Benefit from BNY Mellon’s robust global network to settle trades accurately and efficiently across markets and asset classes.

These services are deeply integrated with enterprise systems such as ERP (Enterprise Resource Planning) and TMS (Treasury Management Software), ensuring seamless data flow and operational control for large-scale organizations.

BNY Mellon Business Banking: Eligibility

Not every business is a perfect fit for BNY Mellon and that’s by design. BNY Mellon business banking is tailored for organizations that operate at scale, require specialized financial solutions, or manage significant capital across borders.

So, who qualifies?

BNY Mellon typically serves:

- Publicly traded corporations with complex financial operations

- Institutional investors, including pension funds and asset managers

- Government agencies and multinational organizations

- Private equity and venture capital firms

- Fortune 1000 companies managing global cash and securities

- Large non-profits, universities, and endowment funds

In most cases, these clients need tailored treasury management, cross-border payment infrastructure, or advanced custody services for managing high-value assets.

But what about small businesses?

While BNY Mellon is not a traditional small business bank, there are exceptions. Some startups or mid-sized firms may qualify if they:

- Operate within larger financial networks

- Handle cross-border payments

- Require institutional-level banking for treasury or capital market operations

If your business falls outside these categories, you may be better served by a commercial bank that offers standardized business checking or lending packages.

BNY Mellon Business Banking: Documents & Procedures

Applying for business banking at BNY Mellon is not your average online form submission. Instead, the bank adopts a relationship-driven, consultative onboarding process that aligns your firm’s structure and needs with custom banking solutions.

Required Documents

To begin the process, your business will typically need to prepare the following:

- Legal entity formation documents (e.g., articles of incorporation)

- Board resolutions or authorized signatory approvals

- Federal Tax ID (EIN or TIN) for business verification

- List of authorized users for account access and transaction approval

- Recent audited financial statements to establish financial strength

- KYC (Know Your Customer) and AML documentation, especially for cross-border or high-risk sectors

- Details of operational and financial activity, including global cash flow patterns, currencies used, and payment volumes

These documents help BNY Mellon assess your eligibility and risk profile according to both U.S. and international banking regulations.

Application Procedure for BNY Mellon Business Account

BNY Mellon uses a step-by-step onboarding process, guided by experienced relationship managers.

Initial Consultation

You’ll begin by meeting with a dedicated BNY Mellon relationship manager, who will review your company’s goals, structure, and global banking needs.

Solution Mapping

BNY Mellon does not offer pre-packaged products. Instead, they create a customized solution based on your liquidity requirements, payment needs, investment operations, and account structure.

Due Diligence

A detailed due diligence phase follows, where BNY’s compliance team reviews your submitted documents. This includes KYC checks, anti-money laundering (AML) screening, and verification of all business stakeholders.

Onboarding and Integration

Once approved, BNY Mellon facilitates the technical onboarding process. This may include:

- SWIFT/BIC setup for global payment messaging

- Integration with your ERP or Treasury Management System (TMS)

- Assignment of secure digital credentials

- Configuration of permissions and reporting structures

Account Activation

After successful compliance review and integration setup, your business account is officially activated. You’ll receive:

- Access to BNY Mellon’s digital platforms

- Secure transaction protocols

- Ongoing support from a dedicated client service team

NY Mellon Business Banking Pricing and Fee Structure

BNY Mellon doesn’t follow the traditional fee schedules that most retail banks publish online. Instead, they use a custom pricing model tailored to each client’s size, services used, and global financial footprint. This is because BNY Mellon serves large-scale institutions, not small or mid-sized businesses with off-the-shelf solutions.

Why Pricing is Customized

BNY Mellon structures its rates and fees based on the complexity, scale, and services required by each client. The bank takes a holistic view of the relationship, which may include cash management, custody, global payments, collateral services, and technology integration.

Several key factors influence pricing:

- Average and peak account balances

- Monthly or annual transaction volume

- Use of multi-currency services or global liquidity tools

- Custody and collateral management requirements

- Technology integration level, such as API connectivity, ERP/TMS system links, or SWIFT modules

In this model, businesses are only charged for the services they use at rates that reflect their usage scale, risk profile, and infrastructure needs.

Common Fees and Cost Structures

Although BNY Mellon doesn’t disclose rates publicly, these are typical charges:

Custody Account Maintenance Fees

Regular charges for the safekeeping, servicing, and reporting of securities held with BNY Mellon.

Transaction-Based Fees

Charges applied per instruction or payment, such as:

- SWIFT wire transfers

- Cross-border ACH payments

- Foreign exchange conversions

Liquidity Service Spreads

For services like automated investment sweeps or overnight cash pooling, clients may be quoted interest spreads based on current market conditions and account structure.

Integration and Platform Fees

For businesses that integrate directly with BNY Mellon systems (e.g., through APIs or SWIFT), fees may apply for:

- Custom system onboarding

- Secure connectivity and maintenance

- Ongoing data access or reporting modules

Ultimately, each business receives a pricing structure that reflects its unique operating environment, service usage, and relationship size with BNY Mellon.

Here is the estimated pricing and fee schedule for BNY Mellon business banking, compiled from various trusted sources:

| Service Category | Typical Fee Type | Estimated Range / Notes |

|---|---|---|

| Custody Services | Monthly maintenance fee | $500–$2,000+ depending on asset class and volume |

| Asset-based fee | 0.01%–0.06% annually of total assets under custody | |

| Liquidity Management | Interest spread | Varies based on volume, typically 0.10%–0.40% |

| Sweep investment fees | Tiered or performance-based; may be embedded in returns | |

| Treasury and Cash Services | Per transaction fee (ACH, wire, FX) | $5–$50 per domestic/intl transaction |

| Platform access or dashboard licensing | Custom pricing; often waived for large-volume clients | |

| Collateral Management | Collateral optimization fee | Fixed or % based on exposure; tailored to trading needs |

| Margin call services | Negotiated based on agreement and automation levels | |

| Integration/API Services | SWIFT connectivity setup | $1,000–$10,000 initial setup, plus potential monthly fees |

| ERP/TMS system integration | Custom implementation fee; support included in onboarding | |

| FX and Global Payments | Currency conversion spread | ~0.10%–1.00% depending on volume and currency pair |

| Letter of credit/documentary collection fees | $100–$1,000+ per instrument | |

| Onboarding & Due Diligence | Initial onboarding and compliance screening | Often included; may incur legal or third-party KYC pass-through costs |

Note: Please note that the information provided is for reference only. All fees are negotiated individually based on client size, service complexity, and transaction volume. BNY Mellon does not list prices publicly due to its high-end, customized approach. To receive accurate and customized pricing for your business, you should contact BNY Mellon directly.

Pros and Cons of BNY Mellon Business Banking

No financial institution is a perfect fit for every business. Understanding the strengths and weaknesses of BNY Mellon Business Banking is key to making an informed decision.

Pros:

- Unparalleled Financial Stability & Trust: With over 235 years of experience and trillions of dollars under custody, BNY Mellon offers a level of security and reliability few other banks can match.

- Comprehensive Treasury Management: This is arguably their strongest suit. If your business needs advanced cash flow optimization, sophisticated payment processing (both receivables and payables), or robust liquidity management, BNY Mellon provides world-class solutions.

- Advanced Security Features: From real-time data dashboards to SWIFT integration and cybersecurity controls, BNY is built to meet the demands of modern finance and compliance.

- Dedicated Relationship Management: Having a specific point of contact who understands your business deeply is invaluable. It streamlines communication, ensures tailored advice, and fosters a long-term partnership.

- Sophisticated Digital Tools: Their online portal and mobile app provide powerful reporting, control, and management features, particularly beneficial for businesses with complex financial operations.

- Scalability: BNY Mellon’s services are designed to grow with your business. As your company expands in complexity or geographic reach, their solutions can adapt to your evolving needs.

- Global Capabilities: For businesses with international operations, BNY Mellon’s extensive global network and foreign exchange services simplify cross-border transactions and reduce associated risks.

Cons:

- Potentially Higher Fees/Minimums: Compared to community banks or challenger banks, BNY Mellon’s comprehensive services often come with higher associated fees or require higher minimum balances.

- Not Geared Towards Very Small Businesses/Startups: Their offerings can be overly complex and expensive for micro-businesses or those just starting out.

- Onboarding Time: Setting up more intricate treasury management services can involve a more detailed and potentially longer onboarding process compared to opening a basic business account at a retail bank.

FAQs about BNY Mellon Business Banking

If you’re considering BNY Mellon for your business banking needs, then the following answers to frequently asked questions will help guide your decision with more clarity and confidence.

Can small businesses open an account with BNY Mellon?

- BNY Mellon primarily serves institutional and corporate clients. Small businesses are not its target audience.

Are BNY Mellon business services available globally?

- Yes. BNY Mellon operates in 35+ countries with integrated global payment, liquidity, and custody solutions.

Does BNY offer online business banking?

- Yes. Clients access secure, real-time platforms for liquidity management, payment tracking, and reporting tools.

How are fees structured?

- Fees are customized based on your company’s activity level, service usage, and global requirements.

Is BNY Mellon safe for business banking?

- Absolutely. BNY Mellon is a highly regulated, Tier 1 global bank with rigorous security protocols and compliance standards.

If your business requires global-scale banking solutions, not just transactions, BNY Mellon is a partner worth serious consideration. With deep experience, world-class technology, and a focus on institutional-grade services, it’s built for enterprises that manage complex, high-volume financial operations.

Whether you need custody, capital markets access, or liquidity intelligence, BNY Mellon delivers tailored solutions to match the scale and sophistication of your business.