In a world where interest rates fluctuate with every FED meeting, choosing the right mortgage partner can make a significant difference in your financial future For high-value buyers, BNY blends tradition, innovation, and personalized service. But how do BNY Mellon mortgage rates stack up?

In this comprehensive guide, we’ll explore BNY Mellon mortgage rates, what types of loans they offer, and whether their services are the right fit for your needs in 2025.

About Bank of New York Mellon

Founded in 1784 by Alexander Hamilton, BNY Mellon (The Bank of New York Mellon Corporation) is one of the oldest banks in America. After its merger with Mellon Financial Corporation in 2007, the bank emerged as a global leader in asset servicing and wealth management.

Today, BNY Mellon operates in over 35 countries and holds more than $52 trillion in assets under custody and administration. As a Global Systemically Important Bank (G-SIB), it plays a crucial role in maintaining global financial stability.

But despite its institutional strength, BNY Mellon also offers a highly specialized mortgage platform for high-net-worth individuals, private clients, and family offices.

How BNY Mellon Sets Its Mortgage Rates

BNY Mellon doesn’t operate like a retail bank with fixed, daily-posted interest rates. Instead, it offers customized rates based on your credit profile, assets, loan amount, and overall relationship with the bank.

However, several key factors still influence their base pricing:

Federal Reserve Benchmark Rates

BNY Mellon adjusts its mortgage rates according to changes in the Federal Funds Rate. Over the past two years, the Fed’s rate hikes have pushed average mortgage rates from around 3% in early 2022 to over 6.5% in 2024.

BNY Mellon’s rate adjustments tend to follow these trends, but with a slightly more stable margin due to its access to capital markets and diversified funding sources.

Loan Type and Term

A 15-year mortgage will naturally come with a lower rate than a 30-year mortgage. BNY Mellon also provides adjustable-rate mortgages (ARMs) and hybrid options, which often feature lower initial rates.

Client Risk Profile

BNY Mellon serves borrowers with strong credit, high income, and significant assets under management. This allows them to offer below-market rates for qualified clients, especially those with large down payments or who use other BNY services (investment, trust, etc.).

Types of BNY Mellon Mortgage Rates

When it comes to mortgage financing, BNY Mellon offers a level of flexibility rarely seen in traditional banking. Rather than offering a one-size-fits-all product line, they provide a wide range of mortgage rate structures tailored to each client’s financial situation, goals, and risk appetite.

Whether you’re seeking predictability, short-term savings, or strategic leverage, there’s likely a BNY Mellon mortgage rate model designed to suit your needs.

Fixed-Rate Mortgages

This is the most traditional and widely used mortgage type, where the interest rate remains unchanged throughout the life of the loan. BNY Mellon offers fixed-rate options for both 15-year and 30-year terms.

Best for:

- Buyers seeking predictable monthly payments

- Long-term homeowners

- Those locking in rates during low-interest environments

Typical rate range (as of 2025):

- 30-year fixed: ~6.27%

- 15-year fixed: ~5.93%

These BNY Mellon interest rates tend to be slightly lower than national averages, especially for borrowers with strong credit profiles and sizable down payments.

Adjustable-Rate Mortgages (ARMs)

An ARM begins with a lower fixed interest rate for an initial period, commonly 5, 7, or 10 years, and then adjusts periodically based on a market index (e.g., SOFR or Treasury).

Best for:

- Borrowers planning to sell or refinance before the fixed period ends

- Buyers expecting future income growth

- Investors managing short- to mid-term property holdings

For example, a 7/1 ARM may offer a starting rate ~1% lower than a 30-year fixed mortgage, with the rate adjusting annually after year 7.

Jumbo Loans

These are mortgages that exceed conforming loan limits (e.g., over $766,550 in most areas in 2025). BNY Mellon specializes in jumbo loans, often offering customized terms and more favorable rates than retail lenders.

Best for:

- High-net-worth individuals purchasing luxury or high-value properties

- Borrowers with complex income sources (business owners, executives)

- Clients bundling loans with wealth or trust services at BNY Mellon

BNY Mellon jumbo mortgage rates are negotiated case-by-case and are often competitive with or lower than market averages, thanks to the bank’s strong underwriting and access to capital markets.

Interest-Only Mortgages

With this structure, borrowers pay only the interest for a set number of years (typically 5–10), followed by a period where both principal and interest are due.

Best for:

- Clients with variable or seasonal income (e.g., entrepreneurs)

- Investors prioritizing cash flow

- Borrowers who expect significant liquidity in the near future (e.g., sale of another asset)

Interest-only options require excellent credit, strong financials, and often a higher down payment. BNY Mellon offers them selectively for qualified clients.

Construction-to-Permanent Loans

These loans are designed for clients building a new home. Initially structured to fund construction phases, the loan later converts into a permanent mortgage with either a fixed or adjustable rate.

Best for:

- Clients building custom homes

- Real estate developers or investors

- Buyers looking for convenience and a seamless transition from construction to ownership

BNY Mellon allows borrowers to lock in a long-term rate during construction, protecting them from future rate hikes.

Hybrid Loans and Customized Structures

For complex borrowers with trusts, foreign income, or multi-property holdings, BNY Mellon may structure hybrid mortgage solutions that combine elements of fixed, adjustable, and interest-only models.

These bespoke arrangements are typically available to ultra-high-net-worth individuals and offer maximum flexibility with competitive terms.

Current BNY Mellon Mortgage Rates

BNY Mellon is not your typical mortgage lender. Unlike big banks that cater to the mass market, BNY Mellon focuses on wealthier clients, often in high-cost metro areas like New York, Miami, and San Francisco.

BNY Mellon Mortgage Snapshot

It’s a boutique experience. Their loans tend to be large, more than half are over $1 million. Borrowers often have high incomes and strong credit. That said, Bank of New York Mellon mortgage rates and fees are surprisingly competitive.

| Feature | Detail |

|---|---|

| Loan Types | Conventional (30- and 15-year), Refinance, Cash-Out |

| Simulated 30-Year Purchase Rate (June 2025) | 6.55% |

| Simulated 15-Year Refi Rate (June 2025) | 6.00% |

| Average Rate in 2024 | 6.27% |

| National Average in 2024 | 6.55% |

| Average Closing Costs | $6,844 (lower than national average of $8,356) |

| Top Markets | NYC, Boston, Miami, LA, SF |

| Main Loan Purpose | Home Purchase |

| Typical Borrower Income | $250k+ |

| Average Loan Size | $1.2M+ |

| Approval Rate | 93.3% (Above average) |

| Pick Rate | 82.65% (Below average) |

Note: BNY Mellon does not officially publish its mortgage rates. This table of BNY Mellon mortgage rates are simulated estimates based on past data. Actual rates will vary depending on your credit profile, loan details, and market conditions.

Are BNY Mellon Mortgage Rates Competitive?

Yes, overall they are. Based on 2024 data and forward-looking simulations:

- The average 30-year fixed mortgage rate at BNY Mellon was 6.27%, which is 0.28% lower than the national average of 6.55%.

- Their 15-year refinance rate is simulated at 6.00%, slightly below market benchmarks.

Rates tend to vary by location, borrower profile, and market conditions, but BNY Mellon has a track record of offering better-than-average pricing.

These are not promotional rates. They’re based on actual origination data and BNY Mellon’s behavior over time, modeled using SimulatedRates.

BNY Mellon’s Mortgage Fees

Closing costs are one of the hidden burdens of getting a mortgage. Fortunately, BNY Mellon is a low-fee lender. On average:

- Total closing costs: $6,844

- National average: $8,356

- Most loans fall in the “less than $1,000 in direct origination fees” bucket

Even for larger loans (over $1 million), BNY Mellon keeps fees low, especially compared to jumbo loan competitors.

How BNY Mellon Compares to Other Big Lenders

Let’s see how BNY Mellon stacks up against large institutions like JPMorgan Chase, Wells Fargo, and Bank of America.

| Feature | BNY Mellon | JPMorgan Chase | Wells Fargo | Bank of America |

|---|---|---|---|---|

| 30-Yr Fixed Rate (Avg) | ~6.27% | ~6.38% | ~6.42% | ~6.45% |

| Avg Closing Costs | ~$6,844 | ~$7,950 | ~$8,300 | ~$8,400 |

| Jumbo Loans | ✔ Competitive | ✔ | ✔ | ✔ |

| Relationship Discounts | ✔ Strong | ✔ | ✔ | ✔ |

| Digital Application | Limited | ✔ | ✔ | ✔ |

From the comparison table, we can see that while BNY Mellon doesn’t have the same digital infrastructure for mass-market applicants, it outperforms in rate competitiveness, fee savings, and custom financing for affluent clients.

BNY Mellon U.S. Mortgage Fund (GPGAX)

Though not a direct mortgage product, BNY Mellon also operates a U.S. Mortgage mutual fund (GPGAX). This fund primarily invests in agency mortgage-backed securities and serves as an indicator of broader mortgage trends.

Fund Highlights:

- 12-month return (Class A): –1.60%

- 30-day SEC yield: 3.20% (subsidized)

- Effective duration: ~6 years

- Expense ratio: 0.70% gross

- Management team: Newton Investment Management

In 2025, the fund is being merged into the Core Plus Fund, signaling BNY Mellon’s shift toward more diversified fixed-income strategies.

While this doesn’t affect mortgage borrowers directly, it provides a glimpse into how BNY Mellon views interest rate environments and risk, useful insights when evaluating fixed vs adjustable mortgage options.

How to Apply for a Mortgage at BNY Mellon

Applying for a mortgage at BNY Mellon is a more personalized and consultative process compared to standard retail banks. Instead of a fast online application, you’ll work closely with a dedicated advisor who tailors the loan to your financial goals and profile. Here’s a step-by-step look at what the process involves:

Step 1: Initial Consultation

Everything begins with a one-on-one conversation. You’ll schedule a meeting with a BNY Mellon mortgage specialist or relationship manager.

This first step often includes discussions about:

- Your intended property (primary residence, investment, vacation home)

- Desired loan type (fixed, ARM, jumbo, etc.)

- Financial objectives and long-term plans

This is your opportunity to ask questions and understand what type of mortgage solutions are available based on your profile.

Step 2: Documentation & Financial Review

Before moving forward, BNY Mellon will request a thorough set of documents to verify your income, assets, liabilities, and property details. Since they work with high-net-worth personal and business clients and complex financial portfolios, the review tends to be more detailed than a typical bank.

Common documents you’ll need:

- Proof of Income:

- Recent pay stubs (if employed)

- Two years of tax returns (personal and/or business)

- K-1s or 1099s (for partners and investors)

- Bonus or commission documentation (if applicable)

- Asset Statements:

- Bank account summaries

- Investment and brokerage account statements

- Retirement account balances

- Trust documentation (if assets are held in trust)

- Credit and Debt Details:

- Authorization for a credit report pull

- List of current liabilities (e.g., other mortgages, car loans, credit cards)

- Property Information:

- Purchase agreement or sales contract

- Estimated property value or appraisal (if already available)

- Legal property documents (if refinancing or owning outright)

If you are self-employed or own businesses, additional financials such as P&L statements, balance sheets, and business tax returns may be required.

Step 3: Loan Structuring and Strategy Session

Once all documents are reviewed, your BNY Mellon advisor will help design a custom mortgage plan that fits your needs. This includes:

- Choosing the right loan type (fixed, ARM, interest-only, jumbo)

- Deciding on term length (15-year, 30-year, or hybrid options)

- Discussing repayment strategies based on cash flow, tax planning, or liquidity goals

This stage is highly collaborative, BNY Mellon treats lending as part of your overall wealth strategy, not a one-off transaction.

Step 4: Rate Lock and Property Appraisal

After finalizing loan terms, you’ll lock in your interest rate, which protects you from market rate increases during the rest of the process.

At this stage, the property will also be professionally appraised to ensure the value supports the loan amount. BNY Mellon works with trusted, third-party appraisers for an accurate and fair assessment.

Step 5: Underwriting and Closing

Once the appraisal is complete and all documents are in, your loan moves to underwriting. This is where BNY Mellon’s team evaluates the full financial picture, ensures compliance, and finalizes the approval.

The final steps include:

- Legal review and preparation of loan documents

- Coordination with title and escrow companies

- Final signing and funding

BNY Mellon’s process is designed to be smooth, discreet, and well-managed. Your advisor remains involved until closing, and often beyond, as part of your long-term financial relationship.

BNY Mellon Mortgages: Eligibility

BNY Mellon typically serves borrowers with:

- Excellent credit (FICO score of 740+ preferred)

- High income and/or significant liquid assets

- Complex financial needs (business owners, investors, trust beneficiaries)

- Minimum loan sizes that exceed conforming limits (i.e., jumbo loans)

If your profile aligns with this, BNY Mellon can offer not only competitive mortgage rates, but also a smarter, more strategic borrowing experience.

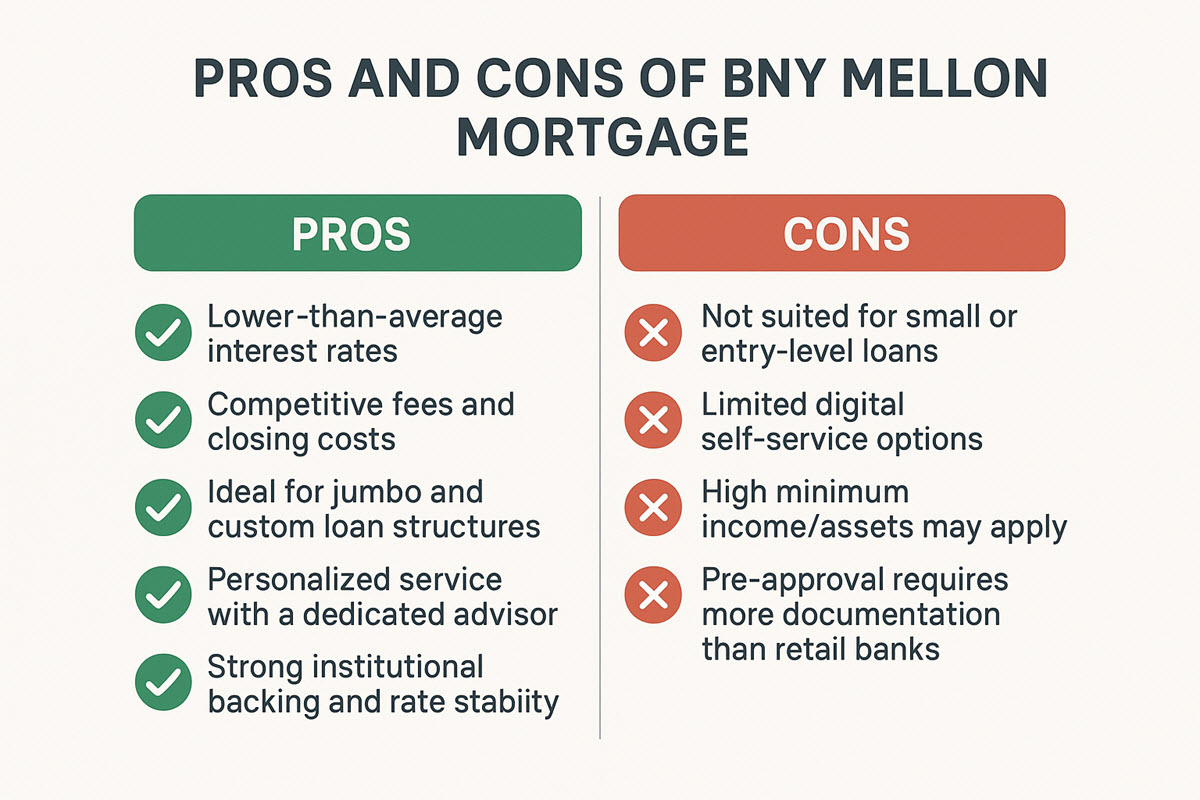

Pros and Cons of BNY Mellon Mortgage Rates

Pros

- Lower-than-average interest rates

- Competitive fees and closing costs

- Ideal for jumbo and custom loan structures

- Personalized service with a dedicated advisor

- Strong institutional backing and rate stability

Cons

- Not suited for small or entry-level loans

- Limited digital self-service options

- High minimum income/assets may apply

- Pre-approval requires more documentation than retail banks

Who Should Consider BNY Mellon Mortgages?

BNY Mellon mortgages are not for every borrower and that’s intentional. They’re best suited for:

- High-net-worth individuals buying properties over $1M

- Real estate investors seeking jumbo or portfolio loans

- Clients already working with BNY Mellon (investments, trust)

- Borrowers needing interest-only or construction financing

- Professionals with complex financials (e.g., business owners)

FAQs About BNY Mellon Mortgage Rates

What are the current BNY Mellon mortgage rates?

- As of 2025, BNY Mellon’s average 30-year fixed mortgage rate is around 6.27%, while the 15-year fixed rate is approximately 5.93%. Rates may vary based on your credit profile, loan amount, and relationship with the bank. Always consult a BNY Mellon advisor for a personalized quote.

Does BNY Mellon offer jumbo mortgage loans?

- Absolutely. BNY Mellon specializes in jumbo loans, which exceed conforming loan limits (e.g., $766,550 in most areas). These loans are customized, competitively priced, and ideal for high-net-worth individuals purchasing luxury or high-value properties.

Does BNY Mellon offer FHA or VA loans?

- No, BNY Mellon focuses on conventional mortgages. They do not offer FHA, VA, or USDA loans.

What credit score do I need to qualify?

- Most BNY Mellon borrowers have strong credit (700+). Rates are modeled based on that assumption.

BNY Mellon doesn’t just offer mortgage products, they design them. Whether you’re looking for long-term security, short-term savings, or a strategic real estate investment, their range of rate structures can be tailored to match your financial goals. Working closely with a BNY Mellon mortgage advisor allows you to explore which rate type makes the most sense for your current situation and your future.