BNY Mellon Investment Management, now rebranded as BNY Investments, stands as one of the world’s largest asset managers. With nearly $2 trillion in assets under management (AUM) as of 2025, the firm plays a central role in helping individuals, institutions, and advisors manage and grow their wealth.

In this review, we’ll explore how BNY Mellon Investment Management operates, its investment strategies, and what sets it apart.

Overview of BNY Mellon Investment Management

First of all, let’s begin by taking a closer look at BNY Mellon Investment Management and what makes it a distinct player in the world of finance:

What Is BNY Mellon Investment Management?

BNY Mellon Investment Management is the investment arm of The Bank of New York Mellon Corporation, a global financial powerhouse headquartered in New York. With roots tracing back to 1784, BNY Mellon is one of the oldest continuously operating financial institutions in the U.S.

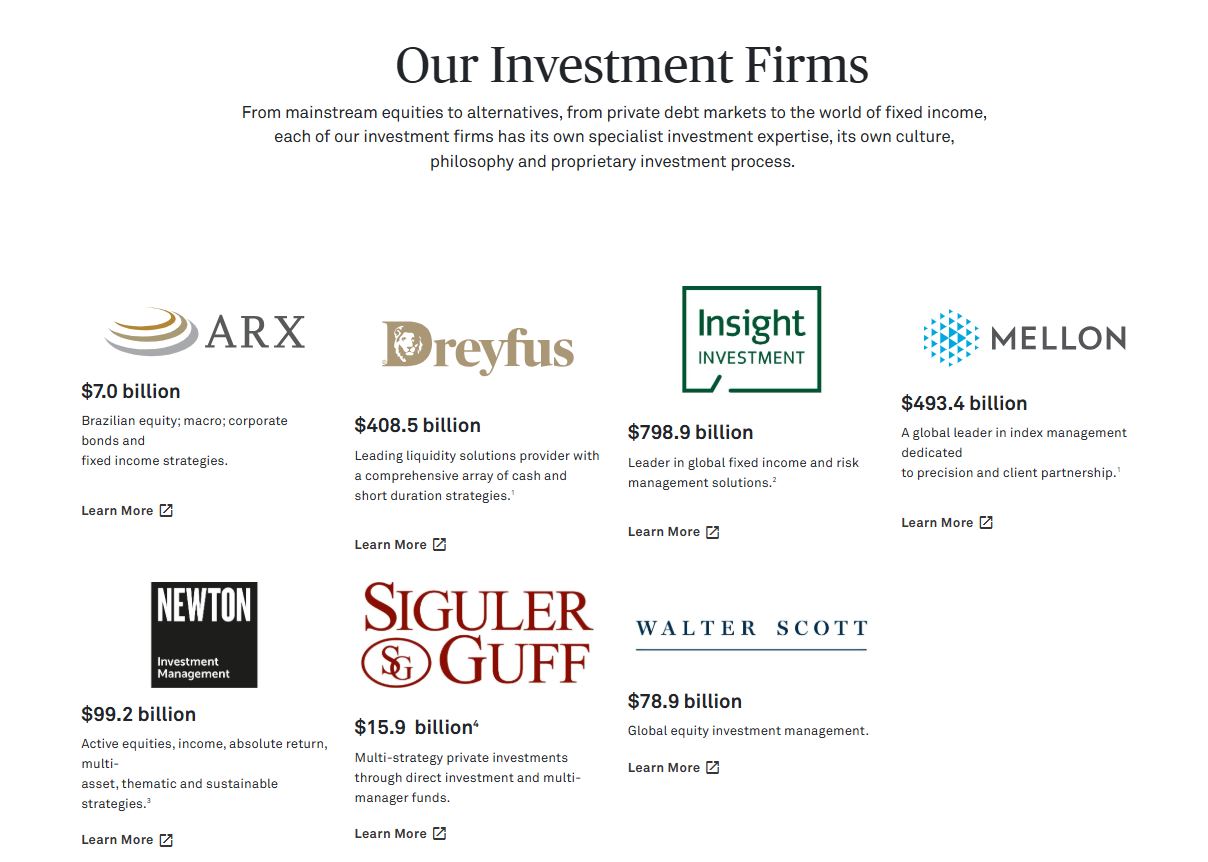

The investment division operates as a multi-boutique asset management model. This means it owns and oversees several specialist investment firms, each with its own philosophy, approach, and client base. Instead of forcing all teams into a single strategy, BNY Mellon empowers each to do what they do best.

With more than $2 trillion in AUM (as of late 2024), BNY Mellon Investment ranks among the top 15 asset managers globally.

A Brief History of BNY Investments

BNY Mellon Investment Management was born from the 2007 merger between The Bank of New York and Mellon Financial Corporation, combining two institutions with deep investment roots. Mellon Financial, at the time, already owned several asset management subsidiaries such as Dreyfus, Newton, and Walter Scott.

Post-merger, the newly formed BNY Mellon rapidly expanded its investment operations by acquiring:

- Insight Investment (2009), a major fixed-income manager

- ARX Investimentos in Brazil

- A minority stake in Siguler Guff, a private equity and alternatives specialist

Over the years, these acquisitions created a broad and diversified network of asset managers, each retaining autonomy while supported by BNY Mellon’s infrastructure and global reach.

Assets Under Management (AUM) and Structure

Unlike firms with a centralized investment team, BNY Mellon uses a multi-boutique model. Each affiliate firm manages its own portfolios, research, and investment decisions. The parent company provides resources, oversight, and global distribution.

The firm consists of several well-known boutiques, including:

- Mellon Investments Corporation (MIC): Specializes in index investing and quantitative equity strategies.

- Insight Investment: Focused on fixed income, liability-driven investing (LDI), and risk management.

- Newton Investment Management: Known for thematic and sustainable investing.

- Walter Scott & Partners: Global equity boutique with a long-term, high-conviction strategy.

- Siguler Guff: Private equity and alternative investments.

- Dreyfus: A leading brand in money market funds and cash management.

This model allows personal and business clients to access focused expertise in specific areas while enjoying the scale and stability of a global firm.

As of Q4 2024, BNY Mellon Investment Management reported over $2.0 trillion in AUM, placing it among the top 15 global asset managers. It operates across:

- 35+ countries with offices in the U.S., UK, Europe, Asia, and the Middle East

- 8+ specialized investment boutiques

- Clients including pension funds, endowments, sovereign wealth funds, insurers, and high-net-worth individuals

Its custody and administration division, separate from investment management, holds over $53 trillion in assets, making it one of the largest in the world.

Services and Investment Strategies

BNY Investments covers the full range of asset classes. Clients can access equities, fixed income, multi-asset solutions, alternatives, and cash management. These include:

Types of Investment Products

BNY Mellon’s investment products fall into several categories, each offering a different level of customization and risk:

- Mutual Funds: These are professionally managed funds that pool money from many investors to invest in stocks, bonds, or other assets. They are easy to access and suitable for individual investors.

- Exchange-Traded Funds (ETFs): Similar to mutual funds, but traded on stock exchanges like individual stocks. ETFs typically have lower fees and are ideal for those who prefer flexibility and cost efficiency.

- Money Market Instruments: Short-term, low-risk investments that help preserve capital. These are often used for cash management or by conservative investors who want liquidity.

- Separately Managed Accounts (SMAs): Customized portfolios managed by professional investment teams, tailored to the client’s goals, risk tolerance, and time horizon. SMAs are often used by high-net-worth individuals or institutions seeking a personalized touch.

- Institutional Mandates: Large-scale, bespoke investment solutions created for pensions, endowments, foundations, and other institutional clients. These mandates often involve complex strategies and direct collaboration with BNY Mellon’s investment managers.

Types of Investment Strategies

BNY offers a variety of investment strategies across asset classes and regions. Each strategy is handled by a specialized affiliate firm within the BNY Mellon group:

- Active Equity: This includes strategies focused on U.S., global, or emerging market stocks. Managers carefully select companies they believe will outperform the market based on research and analysis.

- Fixed Income: Investments in bonds and debt instruments, including corporate bonds, government bonds, high-yield securities, and global macro strategies. Insight Investment is a key player here.

- Multi-Asset Portfolios: A blend of different asset classes to reduce risk and improve overall performance. These are ideal for balanced, long-term growth.

- Liability-Driven Investing (LDI): A strategy that aligns investments with future liabilities, often used by pension funds and insurance companies. Insight is a leader in this highly specialized space.

- Thematic and ESG Investing: Investment strategies focused on long-term global trends like climate change, technology, or social impact. Newton Investment Management leads BNY Mellon’s efforts in ESG (Environmental, Social, and Governance) investing.

- Indexing and Quantitative Strategies: Offered through Mellon, these strategies track market indexes or use mathematical models to make investment decisions. They are typically more cost-effective and suitable for investors seeking broad market exposure.

What Sets BNY Mellon Investment Management Apart

What makes BNY Investments truly unique is its ability to offer both active and passive investment strategies under one roof.

- Deep Specialization: Each boutique has deep sector knowledge and research capacity, allowing for sophisticated investment decisions.

- Institutional-Grade Infrastructure: From trade execution to compliance and reporting, clients benefit from BNY Mellon’s bank-level security and global reach.

- Diversified Approach: Clients can access both traditional and alternative investments across different styles, markets, and risk levels.

- Commitment to ESG and Innovation: NY Mellon Investment Management continues to integrate ESG (Environmental, Social, Governance) across many offerings, especially via Newton and Insight. It also invests in AI and analytics to enhance decision-making.

Risk Management and Compliance

BNY Investments places strong emphasis on compliance, operational risk, and transparency. While each boutique operates independently, BNY enforces a consistent governance structure across the organization.

In 2022, BNY Mellon was fined by the SEC for misstating ESG integration in some of its funds. While the fine was relatively small, around $1.5 million, it highlighted the challenges firms face when ESG standards and disclosures are not clearly documented. Since then, BNY has improved its ESG disclosures and strengthened oversight.

Clients today benefit from enhanced risk monitoring tools, independent audits, and strict regulatory compliance. The firm has also been actively investing in tools that help track ESG impact and fund-level transparency.

Technology and Innovation

BNY has invested heavily in technology, not only in Investment services, but also in others like personal banking, business banking, home loans, etc. Much of the firm’s future growth is tied to becoming a platform-based service provider, with investment management as just one component.

- Digital Tools for Advisors: In 2025, BNY continues to roll out technology for wealth managers and financial advisors. These tools help with reporting, account aggregation, and investment analytics.

- Eagle Investment Systems: BNY also owns Eagle, a leading provider of data and performance reporting systems for asset managers and institutions. This adds another layer of sophistication to BNY’s back-office infrastructure.

- Crypto and Tokenization: The company made headlines when it launched digital asset custody services. BNY now supports crypto custody for select institutional clients and is exploring tokenized assets, a sign of its commitment to innovation.

Fees and Performance

When it comes to investing, two things most people care about are how much it costs and how well it performs. BNY Mellon makes both of these areas clear and competitive, though exact figures can vary depending on what you invest in.

BNY Mellon Investment Management Fees

The bank offers a variety of investment products, and the fees you pay will depend on the type of strategy and level of customization involved:

- Passive or index funds usually have the lowest fees, ranging from 0.05% to 0.25% per year. These funds aim to track market indexes like the S&P 500 and don’t require active stock picking, which helps keep costs low.

- Active strategies, where professional managers research and choose specific investments, typically come with higher fees, usually between 0.5% and 1.5% per year. These fees cover the cost of portfolio research, management, and ongoing oversight.

- Institutional mandates, which are custom-built portfolios for large organizations like pension funds or endowments, don’t have set prices. Instead, fees are negotiated based on the size of the investment, the complexity of the strategy, and the level of service needed.

BNY Mellon Investment Management Fees Overview:

| Product/Service Type | Fee Range (Annual) | Details & Notes |

|---|---|---|

| Index Funds / Passive ETFs | 0.05% – 0.25% | Low-cost options aim to track market indexes like the S&P 500. Managed by Mellon. |

| Actively Managed Mutual Funds | 0.50% – 1.50% | Higher fees due to research and stock selection; varies by strategy and boutique. |

| Money Market Funds | 0.10% – 0.30% | Typically lower cost; used for capital preservation and liquidity. |

| Separately Managed Accounts (SMAs) | 0.30% – 1.00% | Personalized portfolios; fees depend on size, style, and manager. |

| Institutional Mandates | Negotiated individually | Tailored strategies for pensions, endowments, etc., pricing based on complexity. |

| Thematic / ESG Strategies | 0.60% – 1.20% | Often offered via Newton, it may involve active equity or sustainable focus. |

| Liability-Driven Investing (LDI) | 0.15% – 0.50% | Managed by Insight; lower cost structure relative to customization and scale. |

| Quantitative Strategies | 0.20% – 0.70% | Managed by Mellon; uses data models and automation; mid-range fee structure. |

- Additional Notes:

Fees are annual and typically expressed as a percentage of assets under management (AUM). - Lower fees apply to larger investment amounts or clients using institutional services.

- Some funds may also charge performance-based fees or additional expenses (e.g. fund administration, custody) depending on the structure.

BNY Mellon Investment Management Performance

While active strategies often cost more, many clients are willing to pay for the potential of stronger performance or more tailored advice, especially in niche areas like ESG, thematic investing, or liability-driven investing.

Performance depends on each boutique and market conditions. For instance, Insight’s fixed-income portfolios have outperformed peers in LDI strategies over the last decade.

BNY Mellon Investment Management provides transparent reporting and third-party benchmark comparisons in most mandates.

How to Get Started with BNY Investments

To invest with BNY Mellon, you can:

- Contact a financial advisor affiliated with BNY Mellon Wealth Management

- Browse fund offerings via Dreyfus or Newton websites

- Open an account with a partner brokerage that distributes BNY Mellon funds

- Explore institutional solutions directly if you’re a large investor or organization

The onboarding process is guided, and the firm often conducts a full risk and objective analysis before recommending allocations.

Pros and Cons of BNY Investments

Like any major financial institution, BNY Mellon Investment Management presents a compelling proposition, but it’s essential to consider both its strengths and potential considerations.

Pros of BNY Mellon Investment Management

- Large and reputable global institution

- Strong range of strategies and specialists

- Flexible model: active, passive, ESG, alternatives

- Great for custom institutional mandates

- Backed by advanced tech and custody services

Cons of BNY Mellon Investment Management

- Fee structures vary and may be higher for active funds

- Not as retail-friendly as firms like Vanguard

- Access to some strategies requires minimum investment levels

- Performance depends heavily on boutique execution

Who Should Invest with BNY Mellon?

BNY Mellon is ideal for:

- Institutions (pensions, insurance companies, endowments)

- High-net-worth individuals and families

- Intermediaries and advisors seeking global fund access

- Investors seeking ESG, fixed-income, or custom portfolios

It may not be the best fit for beginner investors with small capital or those seeking only low-cost passive funds.

FAQs About BNY Mellon Investment Management

Can individual investors access BNY Mellon funds?

- Yes, through select mutual funds, ETFs, or advisor channels.

What makes BNY Mellon different from Vanguard or BlackRock?

- BNY Mellon Investment Management uses a boutique model with focused expertise, while Vanguard and BlackRock are more centralized and passive-focused.

Are BNY Mellon funds good for ESG investing?

- Yes. Newton Investment, one of its core boutiques, is a leader in ESG strategies.

How can I invest with BNY Mellon?

- You can invest via your financial advisor, brokerage accounts, or directly through BNY Mellon’s fund platforms.

How does BNY Mellon ensure transparency in its investment performance?

- BNY Mellon provides third-party benchmark comparisons, detailed performance reports, and regular client updates. Many of its strategies are also publicly rated by independent research firms like Morningstar or Lipper.

If you’re looking for a customized, globally integrated investment partner with specialist expertise, BNY Mellon Investment Management deserves serious consideration. With a strong foundation, boutique structure, and forward-looking vision, BNY Mellon balances old-school credibility with modern investment needs. Whether you’re growing institutional capital or securing a family legacy, this is one firm worth talking to.