Morgan Stanley, a trusted name in investment and wealth management, offers more than just brokerage accounts. Through its acquisition of E*TRADE in 2020, the bank now provides Morgan Stanley checking account service that aims to blend modern banking with investment convenience.

In this review, we’ll dive into the Morgan Stanley checking account options, covering features, fees, pros and cons. By the end, you’ll know if this account fits your needs.

About Morgan Stanley and E*TRADE

To understand what sets Morgan Stanley checking accounts apart, it helps to first look at the history and strengths of the two financial powerhouses behind them: Morgan Stanley and E*TRADE.

Morgan Stanley Private Bank Overview

Morgan Stanley is one of the most well-known names in global finance. Founded in 1935, the firm has built a strong reputation in investment banking, wealth management, and asset management. It works with large companies, government institutions, and high-net-worth individuals around the world. For decades, Morgan Stanley focused mainly on financial professionals and corporate clients. But in recent years, it has expanded its reach to include regular individuals and families looking for smart ways to manage their money.

One of the biggest steps in this direction was the acquisition of E*TRADE in 2020. This move allowed Morgan Stanley to offer full-service banking to everyday customers.

E*TRADE’s Role in Retail Checking

ETRADE started back in 1982 and was one of the first platforms to bring stock trading online. It became especially popular among self-directed investors, people who like to manage their own money without needing a full-time advisor. Over the years, ETRADE developed a powerful digital platform that made investing easy and accessible.

When Morgan Stanley acquired ETRADE, it gained a user-friendly system that was already trusted by millions. Today, Morgan Stanley checking accounts are offered through the ETRADE platform, which means users get access to digital tools, investment options, and banking features all in one place. Customers now have the benefit of a checking account that combines modern online banking with Wall Street-level support and security.

Overview of Morgan Stanley Checking Accounts

Morgan Stanley currently offers two main types of checking accounts, available through the E*TRADE website and mobile app:

- Max-Rate Checking Account: Designed for customers who keep higher balances and want to earn interest on their funds.

- Basic Checking Account: A simpler, no-frills option ideal for everyday spending and money management.

Both ETRADE Morgan Stanley checking account types are fully digital and managed through E*TRADE’s easy-to-use platform. They connect smoothly with investment accounts, allowing users to move money between banking and investing quickly and conveniently.

Morgan Stanley Max-Rate Checking Account

The Max-Rate Checking account from Morgan Stanley is a great choice for people who want to earn interest on their money and enjoy premium banking benefits. It’s designed for customers who keep a higher balance or use their account actively. Here’s a closer look at what you get:

- Earn 3.00% APY (Annual Percentage Yield) on your balance. There’s no minimum balance required to start earning this interest, which is a rare perk for a checking account.

- Unlimited ATM fee refunds. No matter where you are in the world, if an ATM charges you a fee, Morgan Stanley will pay you back.

- No overdraft fees. If you accidentally spend more than what’s in your account, you won’t be charged a fee.

- Free first checkbook, which helps if you still write paper checks occasionally.

- Your money is FDIC insured through Morgan Stanley Private Bank, up to the legal limit. That means your funds are protected in case the bank ever fails.

Morgan Stanley also offers a feature called Coverdraft Protection. If you spend more than you have in your account, the bank will automatically transfer money from a linked backup account to cover the difference. These transfers happen in $100 chunks, and best of all, there’s no fee for the transfer. It’s a simple way to avoid overdraft charges and declined payments.

Morgan Stanley Basic Checking Account

If you don’t need interest or premium features and just want a basic, no-hassle checking account, the Basic Checking account could be the right fit. It’s perfect for everyday banking. Here’s what the basic Morgan Stanley checking account includes:

- No monthly maintenance fees, you won’t be charged just for having the account.

- No minimum balance requirement, you can keep as little or as much money in the account as you want.

- Full access to E*TRADE’s mobile app and online banking, you can manage your money, pay bills, transfer funds, and more from your phone or computer.

However, there are a few things it doesn’t offer compared to the Max-Rate account:

- It does not offer the same high Morgan Stanley checking account interest rates as the Max-Rate option.

- There are no ATM fee refunds, so if you use an out-of-network ATM, you’ll pay the fee out of pocket.

This account is best for people who want simplicity and zero fees, especially if you don’t maintain a high balance and don’t mind skipping interest or premium perks. It gives you the essentials without any added costs.

Morgan Stanley Checking Account: Key Features

Morgan Stanley Bank checking accounts come with a range of helpful features designed to make everyday banking easier, smarter, and more secure:

ATM Access & Fee Reimbursements

When you open a checking account through Morgan Stanley and E*TRADE, you get access to the Allpoint ATM network, which includes over 55,000 ATMs nationwide. This means you can withdraw cash for free at any ATM in the network, no fees at all.

If you happen to use an ATM that’s outside the Allpoint network, don’t worry. The bank will reimburse up to $15 per month in out-of-network ATM fees. So even if you’re traveling or in a location without Allpoint machines, you won’t have to eat the extra cost.

This feature is especially helpful for people who travel frequently, live in areas with limited ATM options, or simply prefer the freedom to withdraw money anywhere without worrying about fees.

Mobile and Online Banking Tools

E*TRADE’s mobile app and online banking system are designed to be simple, fast, and user-friendly. Whether you’re an experienced investor or someone new to online banking, you’ll find the tools easy to use.

Key features include:

- Mobile check deposit: Just snap a photo of your check to deposit it—no need to visit a branch.

- Real-time balance tracking: You’ll always know exactly how much money you have in your account.

- Custom alerts: Set up notifications for low balances, large transactions, or deposits so you’re always in the loop.

- Internal transfers: Move money between your checking and investment accounts with just a few clicks.

The app is well-designed with a clean layout and smooth navigation, making it convenient to manage your finances anytime, anywhere.

Bill Pay, Transfers & Zelle

Paying bills and sending money is straightforward with a Morgan Stanley checking account. Through the E*TRADE platform, you can:

- Use free online bill pay to schedule payments to utilities, subscriptions, or any service provider.

- Transfer money to accounts at other banks quickly and securely.

- Use Zelle to send money to friends, family, or anyone with a U.S. bank account, often in minutes.

These features are especially useful for day-to-day money management, whether you’re paying rent, splitting dinner with a friend, or setting up automatic payments for monthly expenses.

FDIC Insurance & Security

Your money is safe with Morgan Stanley checking accounts. All of them are FDIC insured up to $250,000 per depositor, which means that even in worst-case scenarios, your funds are protected.

In addition to that, the platform has strong security measures in place:

- Two-factor authentication: Adds an extra layer of protection when you log in.

- Biometric login: Use your fingerprint or facial recognition on mobile for faster, safer access.

- 24/7 fraud monitoring: The system constantly scans for suspicious activity to keep your account secure.

- Zero-liability protection: If someone makes unauthorized charges on your account, you won’t be held responsible, so long as you report it promptly.

Altogether, these tools make Morgan Stanley checking accounts a secure and trustworthy choice for managing your day-to-day finances.

Morgan Stanley Checking Account Fees and Requirements

Understanding the fees and requirements of a checking account is important before you decide to open one. With Morgan Stanley checking accounts, there are two different fee structures depending on which account you choose: the Max-Rate Checking Account or the Basic Checking Account.

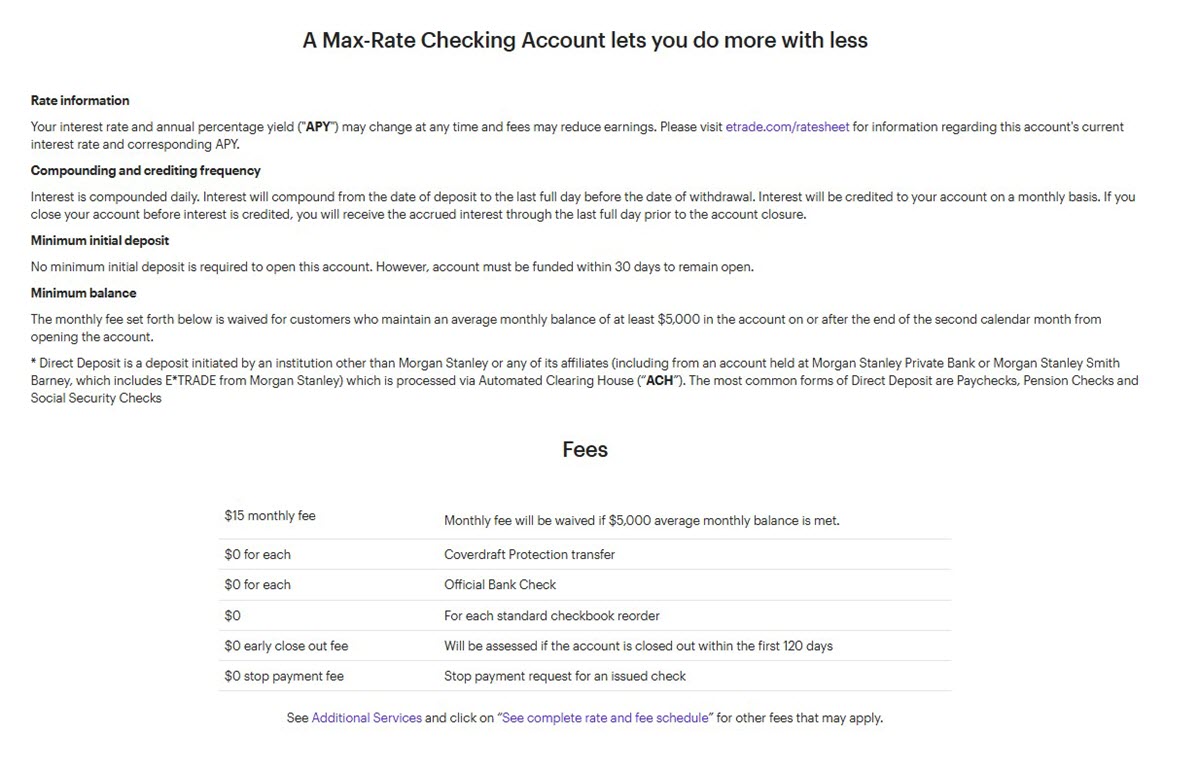

Max-Rate Checking Account Fees

The Max-Rate Checking account offers many premium features, but it also comes with a $15 monthly maintenance fee. The good news is that you can avoid this fee by meeting one of the following conditions:

- Set up a monthly direct deposit of $200 or more, such as your paycheck or government benefits.

- Keep an average monthly balance of at least $5,000 in your checking account.

- Hold at least $50,000 in a linked investment or premium Morgan Stanley account.

- Complete 30 or more stock trades using your linked brokerage account during the previous quarter.

If you qualify for any of these, Morgan Stanley will waive the monthly fee. This setup makes the account attractive for people who already use Morgan Stanley for investing or who can meet the balance requirements easily.

Other costs and fee-related notes:

- Overdraft Fees: There are no overdraft charges. If you enroll in Coverdraft Protection, Morgan Stanley will automatically transfer funds from a linked account to cover any shortfall, with no transfer fee.

- ATM Fees: Morgan Stanley refunds all ATM fees with this account, which is ideal if you frequently withdraw cash while traveling or using out-of-network ATMs.

- Checkbook Fee: The first checkbook is free. Additional checkbooks may come with a fee, depending on the style and quantity you choose.

- Wire Transfers: Outgoing domestic and international wire transfers may have additional charges, which vary based on the type of transfer and destination.

Basic Morgan Stanley Checking Account Fees

The Basic Checking account is designed to be simple and low-cost. It has no monthly fees and no minimum balance requirements. This makes it a great choice for everyday banking, especially if you don’t want to worry about maintaining a high balance or setting up direct deposits.

Here’s a quick summary of its cost structure:

- Monthly Maintenance Fee: $0

- Minimum Opening Deposit: $0

- ATM Fee Refunds: Not included, you’ll pay ATM fees if you use a non-network machine.

- Overdraft Fees: Like the Max-Rate account, no overdraft fees if you use Coverdraft Protection.

- Checkbook: May be available upon request but is not included for free like with the Max-Rate account.

Here is a detailed comparison table of the fees and requirements between the two types of Morgan Stanley checking accounts:

| Feature | Max-Rate Checking Account | Basic Checking Account |

|---|---|---|

| Monthly Maintenance Fee | $15 | $0 |

| Ways to Waive Monthly Fee | – $200+ monthly direct deposit – $5,000 average balance – $50,000 in linked investment account – 30+ stock trades in prior quarter | Not applicable |

| Minimum Opening Deposit | $0 | $0 |

| Minimum Balance Requirement | $0 to open $5,000 to waive monthly fee | None |

| ATM Fee Refunds | Unlimited worldwide refunds | Not included |

| Interest (APY) | 3.00% APY (no minimum balance required) | Does not earn interest |

| Overdraft Fees | No fees (Coverdraft Protection available) | No fees (Coverdraft Protection available) |

| Checkbook | First checkbook is free | Not included for free |

| FDIC Insurance | Yes, via Morgan Stanley Private Bank | Yes, via Morgan Stanley Private Bank |

| Ideal For | Customers who want interest, ATM refunds, and can meet fee waiver requirements | Customers who want a simple, no-fee checking account |

Morgan Stanley Checking Account: Eligibility and Application Process

Next, before opening a checking account with Morgan Stanley, it’s important to know who it’s best for and how the sign-up process works.

Minimum Requirements to Open an Account

Opening either a Max-Rate or Basic Checking account with Morgan Stanley is easy and can be done online through the E*TRADE platform. Here’s what you’ll need:

- A valid ID

- Your Social Security number

- Basic employment and income information

- Your address

- No minimum opening deposit required for either account

Once your account is open, you can fund it by linking another bank account, depositing checks via mobile, or setting up a wire transfer.

Who Should Pay Attention to These Requirements?

Morgan Stanley checking accounts aren’t made for everyone, but they’re a great fit for people who want more than just a basic place to keep money. These accounts work best for:

- Investors with E*TRADE or Morgan Stanley accounts who want all-in-one account visibility.

- Customers with high balances who can easily waive the monthly fee.

- Frequent travelers who benefit from unlimited ATM fee refunds.

- People who prioritize digital banking over in-person service.

If you want a checking account that works well with your investment goals, Morgan Stanley provides strong options.

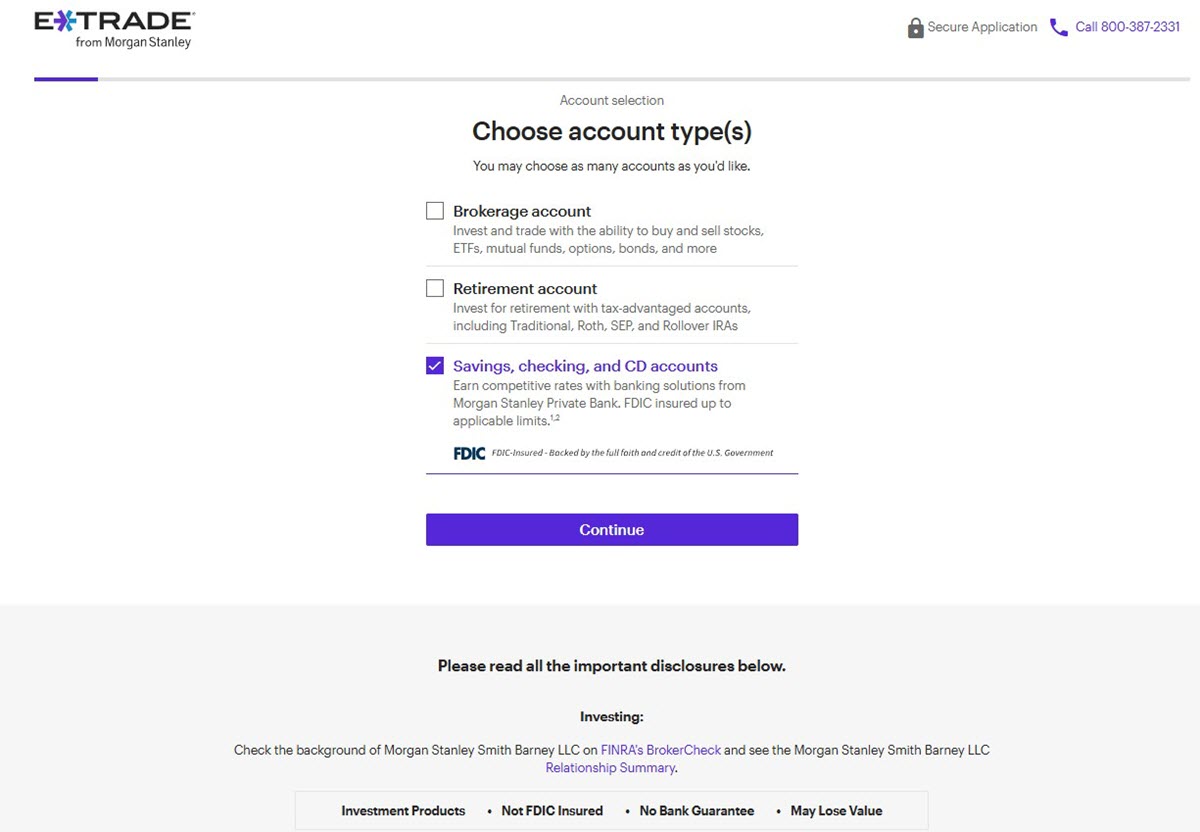

How to Open a Morgan Stanley Checking Account

Opening a checking account with Morgan Stanley through E*TRADE is easy and doesn’t require you to visit a physical branch. You can do everything online from your phone or computer, and it usually takes less than 10 minutes.

Here’s what the process looks like:

- Go to the E*TRADE website or download the app on your smartphone.

- Choose your preferred account: either the Premier Cash Management Account or the Access Investing Cash Account.

- Fill in your personal information, including your full name, home address, Social Security number, phone number, and email address.

- Link an external bank or brokerage account to fund your new checking account.

- Upload a valid photo ID, such as your driver’s license or passport, to confirm your identity.

Once submitted, your application will usually be approved in minutes, and you’ll receive confirmation by email.

Morgan Stanley Checking Account Funding and Activation

After your account is open, you’ll need to add money to start using it. There are several simple ways to fund your new account:

- Online bank transfer from another account.

- Mobile check deposit using your phone’s camera.

- Wire transfer from another bank.

- Mailing a paper check to E*TRADE (though this option takes longer).

If you fund your account via online transfer, it’s usually activated almost immediately. If you send a check by mail, it may take several business days to process.

Once your account is funded, your debit card will be shipped out, and you can expect it to arrive within 7 to 10 business days. After that, you’re all set to start using your new account for spending, saving, and investing.

Customer Service and Support

You can access support for Morgan Stanley checking accounts via:

- Phone & Chat Support

- 24/7 toll‑free support.

- Spoken by reps trained in banking and investing.

- Available via phone, in‑app chat, and secure email.

- FAQs and Help Center: Both Morgan Stanley and ETRADE websites provide detailed FAQs and Help Center, which cover common topics like deposits, transfers, fees, and account setup.

FAQs About Morgan Stanley Checking Account

Does Morgan Stanley have physical branches for checking accounts?

- No, checking services are offered online through E*TRADE, and there is no in-person branch access for typical banking needs.

How can I avoid the $15 monthly fee on the Max-Rate Checking account?

- You can avoid the fee by setting up a $200 direct deposit, keeping a $5,000 monthly balance, or meeting trading activity requirements.

Are ATM fees refunded?

- Yes, the Max-Rate Checking account offers unlimited worldwide ATM fee refunds.

Is there a minimum deposit to open a checking account?

- No, there is no minimum deposit required to open either checking account.

Is the Morgan Stanley checking account FDIC insured?

- Yes, through Morgan Stanley Private Bank, your funds are insured by the FDIC up to the standard limit.

Morgan Stanley checking account options stand out for their integration with investment platforms, high interest rates, and no-fee structure (if you meet requirements). Overall, these accounts cater to tech-savvy, investment-minded individuals who value convenience and want to avoid unnecessary banking fees.