If you’re a business owner, you know how important it is to manage your cash efficiently. Morgan Stanley, best known for its investment and wealth management services, has been expanding Morgan Stanley business banking services in recent years.

But how does it compare to traditional commercial banks? And more importantly, is it the right fit for your business? In this comprehensive review, we’ll explore everything about Morgan Stanley business banking.

Overview of Morgan Stanley Business Banking

Morgan Stanley may be best known for its investment expertise, but its business banking arm is quietly becoming a powerful tool for entrepreneurs and growing companies alike.

A Quick Look at Morgan Stanley

Morgan Stanley is a global financial services firm with roots dating back to 1935. Headquartered in New York, the firm operates in over 40 countries and manages over $1 trillion in client assets. While traditionally known for investment banking and wealth management, Morgan Stanley has increasingly stepped into the business banking space through Morgan Stanley Private Bank and Morgan Stanley at Work.

With this expansion, the firm now offers a full suite of financial tools tailored for businesses, including high-yield Morgan Stanley business account, digital banking, and lending solutions. These services are especially attractive to business owners who also want to integrate their personal and company finances under one roof.

What is Morgan Stanley Business Banking?

Actually, Morgan Stanley may not provide business banking like a regular commercial bank, but they still offer financial solutions for companies and organizations through their different departments.

Morgan Stanley business banking is delivered through two main channels:

- Morgan Stanley Private Bank: This is where traditional banking lives: checking, savings, CDs, lines of credit, and more.

- Morgan Stanley at Work: Designed for employers and their teams. This division focuses on workplace financial solutions, equity compensation, and retirement planning.

These banking services are integrated with Morgan Stanley’s broader wealth-management platform. That means seamless visibility and control across your Morgan Stanley business accounts, investment accounts, and even stock plans. For busy owners and executives, integration matters.

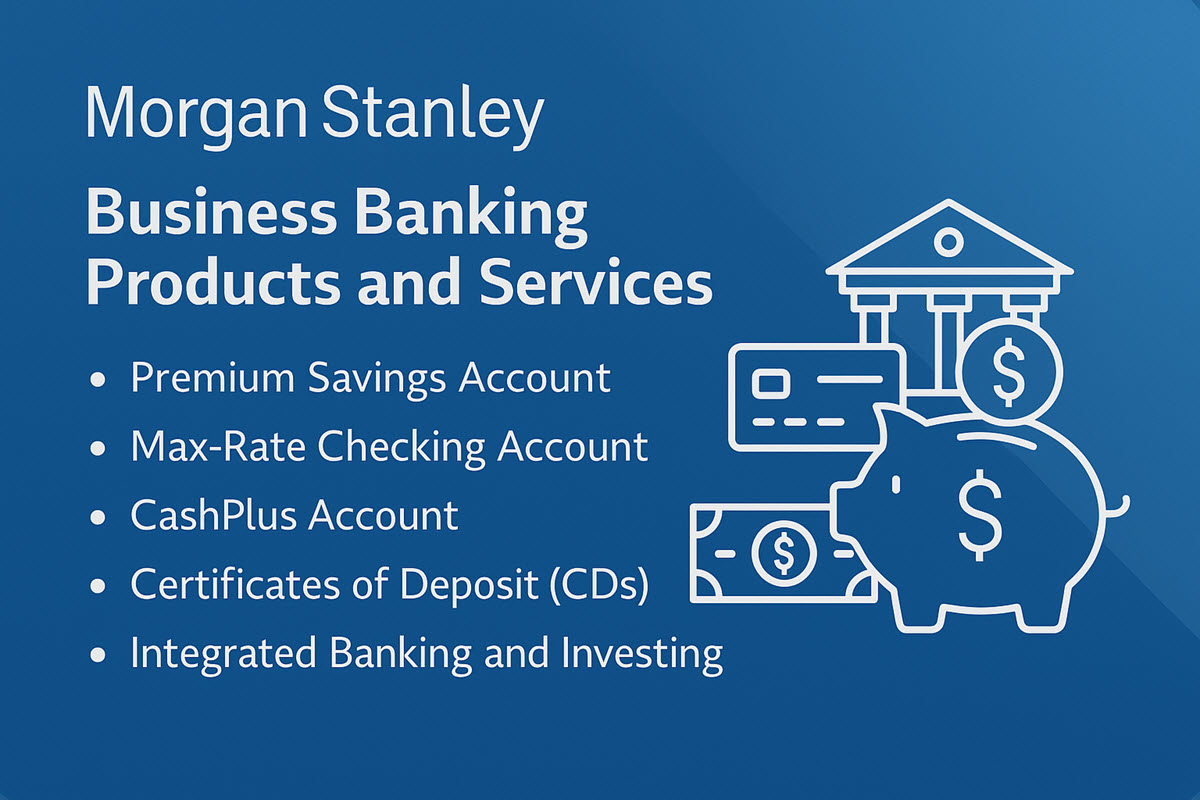

Morgan Stanley Business Banking Products and Services

Morgan Stanley offers a suite of business banking solutions designed to meet the evolving needs of modern companies:

High-Yield Savings and Checking

Morgan Stanley offers savings and checking accounts through its Private Bank.

Premium Savings Account

This savings account is designed for businesses that want to earn a high return without locking in funds. It currently offers a very competitive APY of around 4.00%, which is significantly higher than the national average. Unlike many traditional business savings options, there are no monthly maintenance fees and no minimum balance requirements. Your funds are also FDIC-insured, giving you peace of mind.

Max-Rate Checking Account

For businesses that keep a higher balance in their checking account, the Max-Rate Checking option stands out. It pays an APY of about 3.00%, which is exceptional for a checking account. Businesses enjoy unlimited free transactions, global ATM fee refunds, and no foreign transaction charges. While there is a $15 monthly fee, it’s easily waived if you maintain a minimum average balance of $5,000, making it a practical choice for businesses with regular cash flow.

CashPlus Account

The CashPlus Brokerage Account is another unique product. While technically a brokerage account, it acts like a hybrid between a checking account and an investment platform. It includes:

- Unlimited ATM fee rebates

- Identity theft protection

- Bill pay and mobile check deposit

- FDIC insurance through sweep programs

This account is especially useful for business owners who already have investment portfolios with Morgan Stanley. It offers a streamlined way to manage both personal and business cash flows.

Certificates of Deposit (CDs)

Businesses that want to lock in higher interest for a set period can choose from a range of CDs with fixed rates and no minimum deposit requirements. This option is great for setting aside funds you don’t need immediate access to, while still earning more than a typical business savings account.

Integrated Banking and Investing

One of Morgan Stanley’s key strengths is its ability to integrate business banking with investment services. Business owners can connect their checking, savings, and investment accounts for a complete view of their financial health. You can even manage cash flow and rebalance portfolios from a single platform.

This is ideal for entrepreneurs who want a centralized hub to oversee both company finances and personal wealth.

Morgan Stanley Business Banking Lending and Credit Options

Morgan Stanley makes it easy to access cash while keeping investments intact.

Securities-Based Line of Credit

Morgan Stanley offers securities-based lending, allowing you to borrow against your investment portfolio. This is useful for short-term liquidity needs like purchasing equipment, covering payroll, or funding expansion without needing to sell your investments.

Pros:

- Fast access to cash

- No need to liquidate assets

- Competitive interest rates

Cons:

- Market volatility can impact your credit line

- Margin calls may require additional collateral

Real Estate and Business Loans

The firm also offers customized lending solutions for real estate acquisitions and business expansion. These loans typically come with competitive rates and flexible terms. However, they are usually only available to clients who already have a strong relationship with Morgan Stanley.

Executive Lending Programs

Through its Private Bank, Morgan Stanley offers tailored credit solutions for executives and business owners. This includes loans against deferred compensation, concentrated stock positions, and other complex assets. If you’re looking for a high-touch, personalized lending experience, this is a strong plus.

Support for Business Owners

Beyond banking and investment, Morgan Stanley provides tailored support to help business owners grow, retain talent, and plan for the future:

Morgan Stanley at Work

Morgan Stanley at Work is designed to help small businesses and startups offer financial wellness programs to their employees. This includes:

- Retirement Planning: Flexible 401(k) and retirement plan options with fiduciary support, suitable for companies of all sizes.

- Equity Compensation: Tools like Shareworks help manage employee stock, options, 409A valuations, and liquidity.

- Financial Wellness: Webinars, coaching, and online tools boost employee financial confidence and engagement.

- Executive & Deferred Compensation: Custom plans for leaders to manage equity, bonuses, and taxes efficiently.

- Education & Giving Programs: Guidance on 529 college savings and corporate philanthropy support.

These services can be powerful retention tools. They help small businesses offer benefits that were once reserved for large corporations. If you’re looking to boost employee satisfaction while staying competitive, this platform can help.

Private Wealth Management for Business Owners

Morgan Stanley also provides strategic advisory for entrepreneurs. Whether you’re looking to sell your business, expand into new markets, or build an exit strategy, you can tap into their network of experts. This personalized guidance is rare among traditional banks.

- Exit Strategy & Monetization: Advisors support business sales, IPOs, and transitions from goal setting to deal execution.

- Integrated Advisory Teams: Access to legal, tax, estate, and investment experts, all working in sync.

- Post-Sale Planning: Help managing liquidity, reducing taxes, and building long-term wealth after a sale or major event.

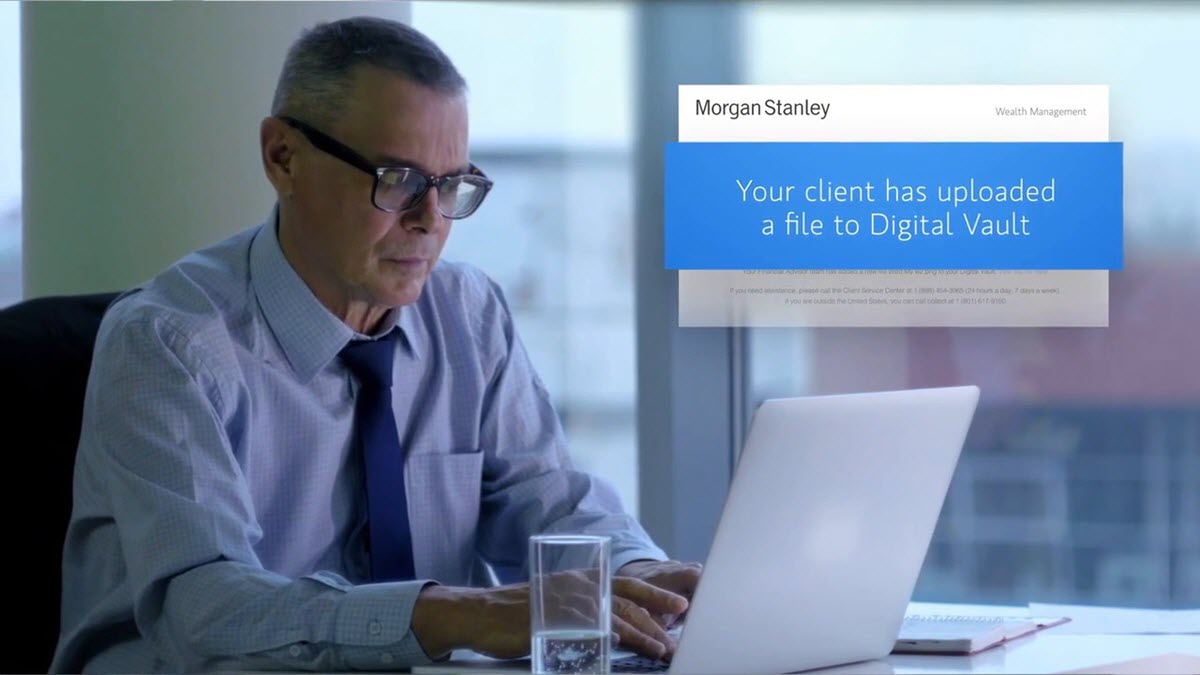

Digital Banking and Technology

Morgan Stanley has invested heavily in its digital infrastructure. Business clients can manage their accounts through a robust web platform and mobile app. Features include:

- 24/7 account access

- Real-time transaction tracking

- Mobile check deposit

- Automated alerts

- Budgeting tools

One standout feature is the Digital Vault. It allows you to store important documents securely, such as contracts, invoices, and tax records. The vault is encrypted and integrates with your accounts, making organization simple.

Their digital tools are intuitive and easy to use. Even if you’re not tech-savvy, you’ll find the navigation user-friendly and the interface clean.

Morgan Stanley Business Banking: Pricing & Fees

The bank offers competitive rates and a clear fee structure, making it a solid option for businesses that want to grow their money without unexpected charges.

- High APYs: Business savings and checking accounts come with attractive interest rates, often much higher than the national average.

- No Hidden Fees: Most core accounts, including standard checking, savings, and CDs, have no monthly maintenance fees or minimum balance requirements.

- No Transaction Fees: Morgan Stanley doesn’t charge for wire transfers or stop payments on business checking, helping you avoid extra costs on everyday banking tasks.

Morgan Stanley Business Banking Pricing & Fees Summary:

| Product / Service | Fee | Notes / Conditions |

|---|---|---|

| Premium Savings Account | $0 monthly fee | APY up to 4.00%; FDIC-insured through partner banks |

| Max-Rate Checking Account | $0 monthly fee | Interest-bearing; no minimum balance; includes ATM fee rebates |

| CashPlus Account | $0 monthly fee (with qualification) | Requires a qualifying Morgan Stanley relationship or minimum asset threshold |

| ATM Fee Rebates | Unlimited | Available with Max-Rate Checking or CashPlus Account |

| Wire Transfers (Domestic) | Included in certain plans | May require specific account tiers or advisory relationships |

| Wire Transfers (International) | May apply | Fee waivers depend on account level; standard rates may apply if not qualified |

| Overdraft Protection | $0 – $25 | May vary by account; some overdraft fees waived with linked accounts |

| Check Orders | Varies | Free with some accounts; cost depends on check style and quantity |

| Stop Payments | Typically $25 per item | Fee may be waived for certain relationship tiers |

| Minimum Opening Deposit | $0 – $5,000 | Depends on the account type and tier |

| Returned Deposited Item | Around $10–$15 | Charged if deposited check is returned unpaid |

| Cash Management Tools | Included | Budgeting, alerts, online bill pay, and mobile deposit included at no extra charge |

| Financial Advisory Services | No additional cost | Included for qualified clients with investment/advisory relationships |

Note: All fees and benefits are subject to eligibility and may vary based on the client’s relationship level, total assets under management, and account type. It’s best to confirm specific terms with a Morgan Stanley representative or advisor.

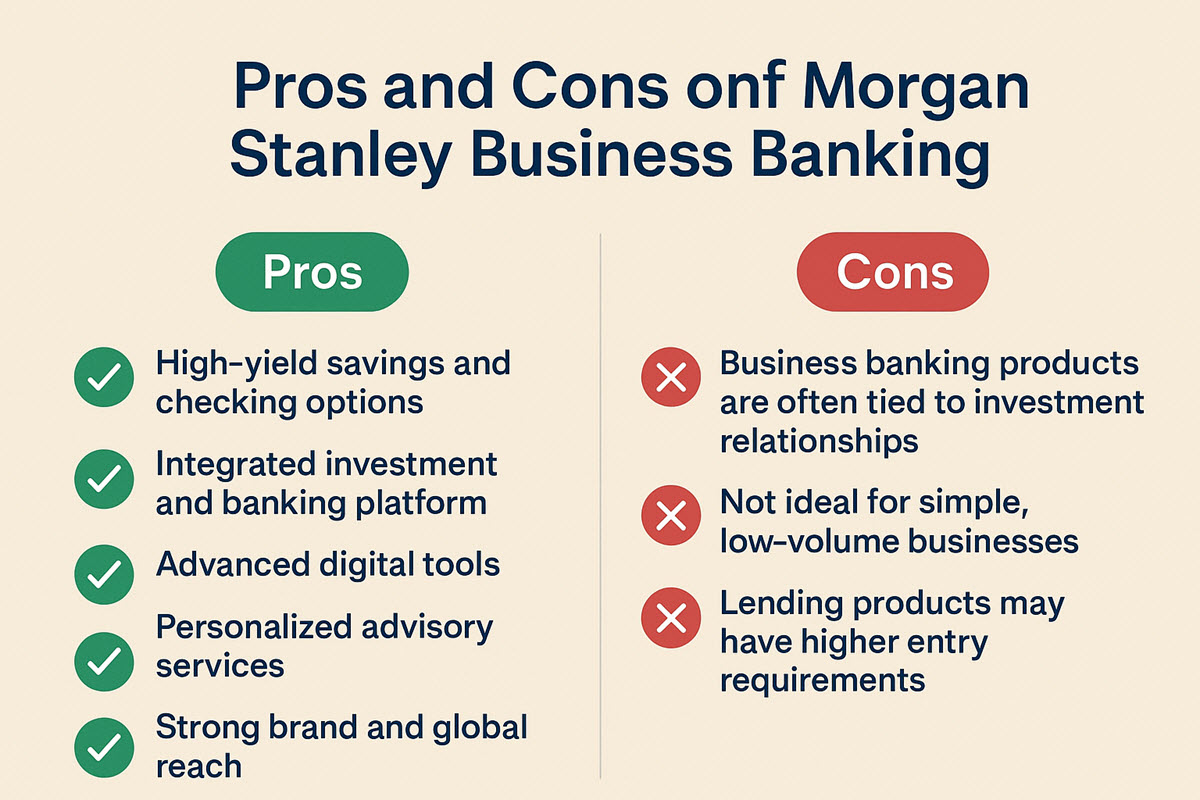

Pros and Cons of Morgan Stanley Business Banking

Like any financial solution, Morgan Stanley’s business banking comes with its strengths and trade-offs, understanding both can help you decide if it’s the right fit for your company:

Pros:

- High-yield savings and checking options

- Integrated investment and banking platform

- Advanced digital tools

- Personalized advisory services

- Strong brand and global reach

Cons:

- Business banking products are often tied to investment relationships

- Not ideal for simple, low-volume businesses

- Lending products may have higher entry requirements

Who Is It Best For?

Morgan Stanley business banking isn’t for everyone, but it’s perfect for:

- Entrepreneurs with investment portfolios

- Small business owners seeking personalized service

- Companies looking for high-yield savings solutions

- Firms offering employee benefit programs

It may not be the best fit for businesses that need basic checking accounts or high-volume cash transactions, such as restaurants or retail shops. In those cases, a traditional business bank might be more practical.

FAQs About Morgan Stanley Business Banking

What types of business accounts does Morgan Stanley offer?

- Morgan Stanley provides several options for business banking, including Premium Savings accounts, Max-Rate Checking accounts, and the CashPlus brokerage account.

Does Morgan Stanley offer small business loans?

- Yes. Morgan Stanley offers lending solutions such as securities-based loans, real estate financing, and customized credit programs for business owners and executives. However, these services are typically available to clients with existing advisory or investment relationships.

Does the FDIC insure Morgan Stanley business accounts?

- Yes. The FDIC insures funds in eligible Morgan Stanley accounts through its partner banks, up to the applicable limits. For brokerage accounts like CashPlus, Morgan Stanley protects funds using a bank sweep program that ensures FDIC coverage.

How do I qualify for a Morgan Stanley CashPlus Account with no fees?

- To waive the monthly fee on a CashPlus Account, you typically need to maintain a qualifying relationship with Morgan Stanley such as meeting a minimum asset level or being part of an advisory program.

Morgan Stanley brings something rare to the business banking world: a seamless blend of investment, banking, and advisory services. For business owners who want more than just a place to store cash, it offers real value. If you’re already working with a Morgan Stanley advisor, or you’re looking to build wealth alongside your business, their business banking platform deserves a serious look.