In the ever-evolving world of online investing, one name continues to rise quietly but confidently, and that is Ally Invest.

Known for its seamless digital experience, commission-free trades, and no-nonsense approach to fees, Ally Invest has become a top choice for both new investors and those seeking a fully integrated banking and investing platform. So, in this review, GateXFin will dive into what Ally investment banking offers and whether it’s worth your time and money.

What Is Ally Invest?

Ally Invest is the investment arm of Ally Financial, a well-known company in the digital banking world. You may not realize it, but Ally’s roots actually go way back, starting as GMAC in 1919. In 2010, it rebranded as Ally and focused on building a fully online, modern bank that puts the customer first.

With Ally Invest, the company brings that same “digital-first” mindset to the world of investing. Everything is designed to be simple, low-cost, and easy to access online.

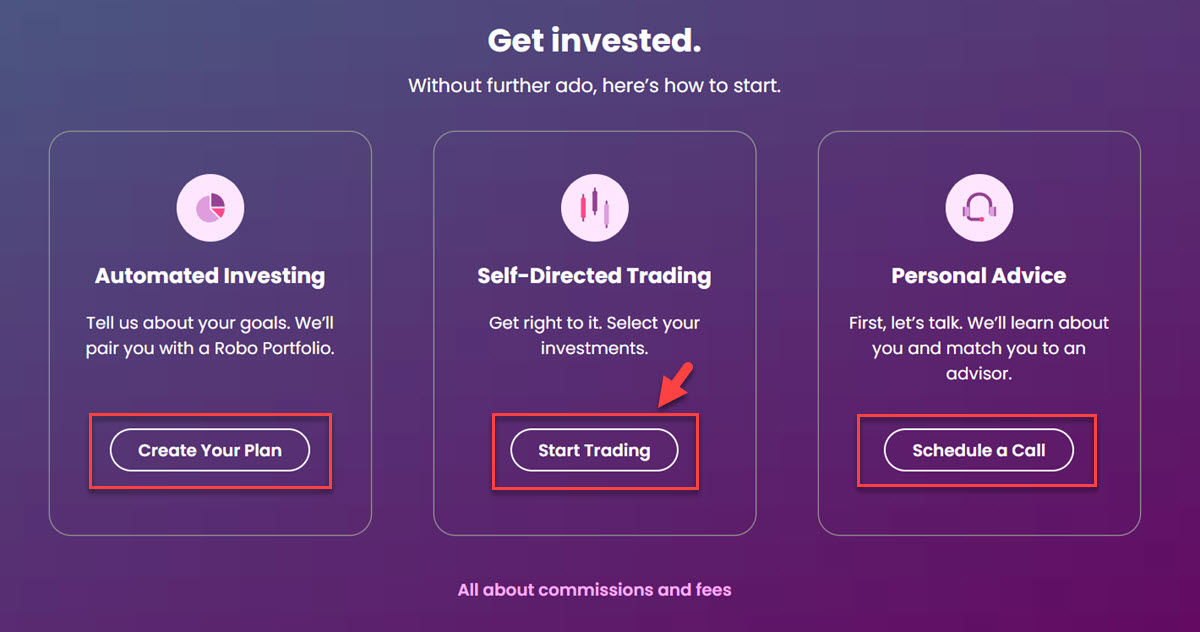

It gives people three main ways to invest:

- Self-directed trading for those who like to choose and manage their own investments.

- Robo portfolios are automated and managed for you based on your financial goals.

- Personal advice from human financial advisors for people with larger investment amounts.

Whether you want to trade stocks yourself, let a robo-advisor handle things, or speak to a financial expert, Ally makes it easy to start and manage everything in one place.

Ally Invest is fully licensed and follows strict U.S. financial rules. It’s regulated by the SEC and FINRA. It also offers SIPC insurance, which protects up to $500,000 of your investments (including up to $250,000 in cash) if Ally ever goes out of business, not if your investments lose value.

Key Features and Account Options

Ally Invest gives you three main paths to grow your wealth, depending on how hands-on or hands-off you want to be.

Self‑Directed Trading

If you like to be in charge of your own investment decisions, the self-directed trading account is a solid choice. You don’t need to meet a minimum deposit requirement to get started.

- $0 to open and no minimum balance

- No commissions on most U.S. stocks and ETFs

- Options contracts cost just $0.50 per contract

- Bonds cost $1 per bond

- Mutual funds must be no-load (no sales charge)

- Penny stocks (under $2) cost $4.95 + $0.01/share, up to 5% of the order value

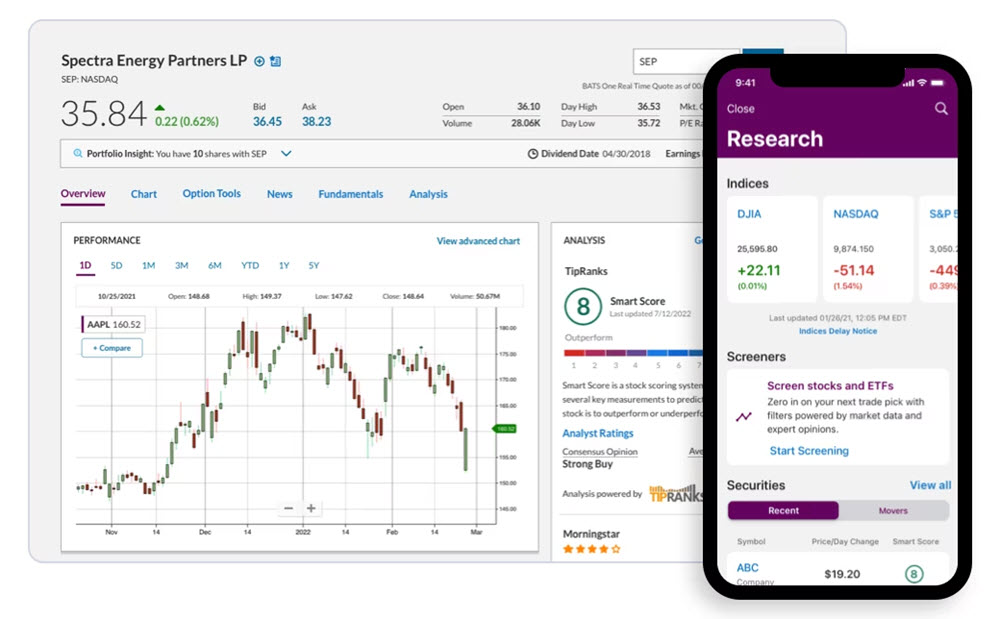

The trading tools are simple and helpful. You get access to:

- Live quotes and charts

- Watchlists to track your favorite investments

- Smart Score ratings through TipRanks

- Ally Invest Live for real-time market data

- Quotestream (advanced tool) for high-volume traders

Want to trade with borrowed money? Ally offers margin accounts, but you’ll need at least $2,000 to qualify. Just note that the interest rates for margin range from 7.5% to 12%, which is higher than many other brokers.

This Ally investment account is flexible, supporting both individual and joint taxable accounts, along with custodial accounts and retirement plans. It’s ideal for investors who enjoy doing their own research and want the freedom to build their own portfolio from scratch.

Automated Investing (Robo Portfolios)

This option is great if you want to invest without doing much work. You answer some questions about your goals, and Ally builds and manages a portfolio for you.

- $100 minimum to start

- No trading or rebalancing fees

- You earn interest on the cash in your portfolio (~3.8% as of 2025)

You can choose between two robo-investing styles:

- Cash-Enhanced Portfolio

- Keeps about 30% of your money in cash

- No management fee (0%)

- Great for people who want stability

- Market-Focused Portfolio

- Invests about 98% of your money

- Charges a small fee: 0.30% per year

- Ideal if you want more aggressive growth

There are also four types of portfolios you can choose from:

- Core: Balanced mix of U.S. and global stocks and bonds

- Income: Focused on dividend-paying investments

- Tax-Optimized: Helps reduce taxes for higher-income investors

- Socially Responsible: Invests in companies with strong environmental and ethical practices

Ally Auto Invest also rebalances your portfolio automatically and at no cost, so your investments stay on track without you needing to check every day.

Personal Advice Accounts

For investors with more money to manage, Ally offers a more hands-on service.

- Requires at least $100,000 to invest

- Annual fee ranges from 0.75% to 0.85%, depending on your Ally Invest account size

- You get your own licensed financial advisor

- Advisors help you create a personalized plan, set long-term goals, and track your progress

- All advisors are fiduciaries, which means they are legally required to act in your best interest

This option is great for people who want expert guidance, a long-term strategy, and peace of mind knowing their money is being handled with care.

IRA Accounts for Retirement

If your goal is to prepare for the future, IRA Ally investment options offer a simple and low-cost way to do just that. The platform gives you access to four main types of retirement accounts:

- Traditional IRA: Contribute pre-tax dollars now and pay taxes later in retirement.

- Roth IRA: Contribute after-tax dollars now and enjoy tax-free withdrawals later.

- Rollover IRA: Move an old 401(k) into an IRA to keep your retirement savings growing.

- Coverdell ESA: Save for a child’s education expenses in a tax-advantaged way.

What makes Ally especially appealing is that there are no annual maintenance fees on any of these IRAs. That means more of your money stays in your account, working for your future.

Even better, the IRA accounts at Ally let you invest in the same types of assets you’d have access to in a regular self-directed account, like stocks, ETFs, bonds, and more.

If you’re not sure which type of IRA is right for you, Ally also offers helpful online resources. Their educational guides are written in plain English and walk you through the pros and cons of each option, making it easier to choose based on your goals and income.

Ally Invest Fees and Commissions

Ally Invest is known for being budget-friendly, but here’s a closer look at what you might pay depending on the type of account you open:

| Account Type | Minimum to Open | Advisory Fee | Trading Fees |

|---|---|---|---|

| Self‑Directed | $0 | $0 | $0 commission for most U.S. stocks and ETFs; $0.50 per options contract |

| Robo Portfolios (Cash) | $100 | 0% | No trading fees, investments are managed for you |

| Robo Portfolios (Market) | $100 | 0.30% annually | No trading fees, fully automated |

| Personal Advice | $100,000 | 0.75%–0.85% annually | No trading fees, managed by a dedicated advisor |

From the table above, we can see that if you trade on your own, you’ll pay almost nothing in fees. If you prefer help from a robo-advisor, you can start with just $100. And if you want personalized help from a real advisor, you’ll need at least $100,000 invested.

While most of its investment accounts come with low or no basic fees, there are a few extra Ally Invest fees you should be aware of:

- IRA account closure or transfer: $25–$50

- Transfer-out fee: $50–$115 (this is waived for Personal Advice clients)

- Buying CDs (certificates of deposit) through the brokerage: $24.95 per transaction

- Vault storage for paper certificates: $60 per year

- Paper statements, broker stamps, and document copies: These may come with small fees, but most are waived if you have a Personal Advice account.

These fees are common across many investment platforms and mostly apply to less frequent services. Regular trading and portfolio management remain low-cost.

Ally Invest Bonus Offers

Ally Bank Invest sometimes uses cash bonuses and promotions to encourage new customers. These promotions are designed to make it more appealing to open an Ally investment account or move money from another brokerage.

In the past, Ally offered big cash bonuses up to $3,000 for people who deposited very large amounts. Those large‑tier offers are no longer available. They were tied to high balances and big transfers, but they appear to have expired.

Welcome Bonus for New Investors

Today, the bonus offers are smaller and more targeted. One common Ally Invest promotion available in early 2025 was a $100 sign‑up bonus. To get this, you needed to:

- Open a new Ally Invest account (either self‑directed trading or a robo portfolio).

- Set up an automatic monthly deposit of at least $50.

- Keep your Ally investment account active and in good standing for three full months.

Once you fulfill those requirements, Ally credits the $100 bonus to your account.

Transfer Fee Reimbursement

Ally Investment Banking also offers a transfer fee reimbursement. If you move at least $2,500 from another broker into Ally using an ACAT transfer, you may receive up to $75 back to cover transfer costs. This makes it easier for people who want to bring their investments over without worrying about losing money on fees.

Ally Invest Affiliate Program

There’s also a referral program. If you are an Ally Invest customer, you can invite friends or family to join. For each person who signs up through your referral link and meets the requirements, you earn $50. You can do this up to five times, which means you can receive a maximum of $250 in referral bonuses.

Investment Tools and Resources

Ally Invest may not be the platform of choice for professional day traders who need complex charts and advanced data feeds, but it offers an impressive set of tools that work extremely well for long-term investors. These tools focus on helping you plan, track, and manage your money with confidence, without making things complicated.

Tools for Self-directed Investors

For self-directed investors, Ally provides features that make it easier to analyze your decisions and stay informed:

- Profit and Loss Calculators: These tools show you how much you could earn or lose on a trade before you actually make it. This helps you weigh your risks and rewards in advance.

- Probability Calculator: This calculator gives you a percentage-based estimate, which is useful when dealing with options.

- Watchlists and Alerts: You can create custom watchlists for stocks and funds you care about and set alerts. The system notifies you when a stock hits a certain price or meets conditions you set.

- Real-Time Quotes: No need to wait for delayed numbers. You can see prices update instantly, giving you a clearer view of market activity.

- Maxit Tax Manager: Taxes can be tricky, but this tool tracks your gains and losses for you. When tax season arrives, it’s easier to pull the information you need.

Tools for Automated Investing

For those using Robo Portfolios, the platform includes different tools designed to guide you toward your goals:

- Goal Tracker: Helps you see how your portfolio is progressing toward the milestones you’ve set, whether that’s retirement, buying a house, or building an emergency fund.

- Wealth Forecasting: Offers a picture of where your money could be headed over time based on your contributions and market performance.

- Diversification Visuals: Simple charts show how your portfolio is spread across different asset types so you can easily understand your level of risk.

- Automatic Rebalancing: Once you set up your account, the system takes over. It adjusts your portfolio automatically to make sure you stay on track, even when the market moves up and down.

Together, these features allow investors to focus on long-term goals without constantly checking their accounts. The tools are simple enough for beginners but still provide the kind of insight that more experienced investors appreciate.

Ally Invest Customer Service and Banking Connection

Ally Investment Baking offers strong customer support with multiple ways to get help via live chat, phone support, and email assistance:

- Ally Invest phone number: 1-855-880-2559 (inside the U.S) and +1-818-459-4591 (outside the U.S)

- Working hours: Available during evenings until 10 p.m. and weekends, not just business hours

Another standout feature of Ally Invest is its seamless link with Ally Bank. You can move money between your Ally checking accounts and investment accounts quickly and easily, often within minutes. Even better, everything is accessible under one login, so there’s no need to remember multiple usernames or juggle different apps.

This smooth connection between saving and investing makes Ally a convenient choice for people who want to grow their money in one place.

How to Get Started with Ally Invest

Getting started with Ally Invest is quick and easy, no matter your experience level. Here’s how to begin:

- Pick Your Account Type: Decide if you want to manage your own investments (Self-Directed), let Ally manage them for you (Robo Portfolios), or work with a personal advisor (Personal Advice).

- Apply Online: Head to Ally Invest’s site and fill out the sign-up form. You’ll need to provide your personal details, Social Security number, and bank account info to verify your identity.

- Fund Your Account:

- $0 if you’re opening a self-directed account

- $100 for a robo-advisor portfolio

- $100,000 for personal financial advice from a real advisor

- Choose Investments or Portfolios:

- If you’re going the self-directed route, you can start trading right away.

- For robo accounts, pick a portfolio style (like Core, Income, or ESG).

- Track & Adjust Over Time: Robo accounts are managed for you, Ally handles rebalancing and monitors your investments. Self-directed users will need to track their own trades and make adjustments manually as goals change.

Whether you’re just starting out or looking to grow your existing investments, Ally makes the process simple and affordable.

Pros & Cons of Ally Invest

Like every financial service, Ally has strong points as well as areas where it might not meet every need.

What It Does Well:

- No account minimum for self‑directed users

- Commission‑free trading on most U.S. stocks, ETFs, and options contracts ($0.50 each)

- Very low robo‑advisor minimums and clear portfolio choices

- Automated rebalancing and cash interest in robo options

- Seamless banking/investing integration for Ally personal banking customers

- Reliable, regulated, and SIPC‑protected platform

Where It Falls Short:

- No fractional share trading, only whole shares

- Research and charting tools are basic, not advanced

- No tax‑loss harvesting in robo portfolios

- Limited tools for active day traders

So, how does Ally Invest compare to some of the biggest names in investing? Let’s take a quick look now:

| Broker | Commissions | Robo Fees | Fractional Shares | Tax-Loss Harvesting |

|---|---|---|---|---|

| Ally | $0 stock/ETF | 0% or 0.30% | ❌ | ❌ |

| Fidelity | $0 | 0.35% | ✅ | ❌ |

| Schwab | $0 | 0.30% | ✅ | ❌ |

| Betterment | N/A (robo only) | 0.25%–0.40% | ✅ | ✅ |

| Wealthfront | N/A (robo only) | 0.25% | ✅ | ✅ |

While Ally doesn’t include every feature these companies offer, it shines in two areas: low costs and convenience. If you already use Ally Bank, this connection makes the experience seamless.

FAQs about Ally Invest

Is Ally Invest good for beginners?

- Yes, it is an excellent choice for new investors. Ally is beginner-friendly thanks to $0 minimum for self-directed accounts, low-cost trades, and easy-to-use tools. It also offers robo-advisors for hands-off investing.

Does Ally Bank Invest have a mobile app?

Yes. You can trade, track investments, and manage your portfolio using the Ally Invest app, available for both iOS and Android. It also syncs with your Ally Bank account.

Does Ally Invest have account minimums?

- For self-directed accounts, there are no minimums. Robo portfolios have a $100 minimum if you choose the market-focused plan.

Is Ally Invest safe and legit?

- Yes. Ally Invest is regulated by the SEC and FINRA and offers SIPC protection up to $500,000 per account. It’s a trusted platform under Ally Financial, a well-established bank.

Can I buy cryptocurrency on Ally Invest?

- No. It does not currently offer direct crypto trading. However, you can invest in crypto-related ETFs or stocks, such as Coinbase or Bitcoin trusts.

Are Ally’s robo portfolios really free?

- The Cash-Enhanced portfolio has no advisory fee. The Market-Focused portfolio has a 0.30% annual advisory fee.

How long do Ally Invest transfers take?

Typically 1–3 business days. Transfers between Ally Bank and Ally Invest are often faster, sometimes same-day, thanks to internal system integration.

Ally Invest is a well‑rounded platform. It serves many types of investors and brings together banking and investing in one digital experience. If you want clean, simple tools, low fees, and the comfort of integrated banking, Ally fits well.