Managing your money shouldn’t feel like a chore. In a world where convenience meets technology, Ally Bank is redefining how we handle everyday spending. The Ally checking account blends the best of digital banking with smart savings features.

But is it really worth switching your checking account? Can you truly earn interest, avoid fees, and still get great service, all without stepping into a branch? Let’s take a closer look at Ally checking account to see if it fits your lifestyle.

What Is the Ally Checking Account?

The Ally checking account, also called the Ally Spending Account, is a modern, online-only checking account designed to make managing your money simple and stress-free. Offered by Ally Bank, it’s packed with features that put you in control of your everyday spending, without the hassle of traditional banking.

Since Ally is a fully digital bank, it doesn’t have physical branches. But that’s not a drawback. Instead, it offers a powerful mobile app, a user-friendly website, and 24/7 customer service to support you whenever you need help. Best of all, there are no hidden fees or complicated terms. You can open and manage your account entirely online, whether you’re at home or on the go.

With useful tools like Spending Buckets, free overdraft protection, and interest on your balance, Ally checking account is a great option for anyone who wants a smarter way to manage daily finances.

Ally Checking Account Interest Rates and Fees

When choosing a personal checking account, it’s important to understand not just how much you can earn, but also how much you might pay. Let’s break down Ally’s interest rates and fees to see where it stands.

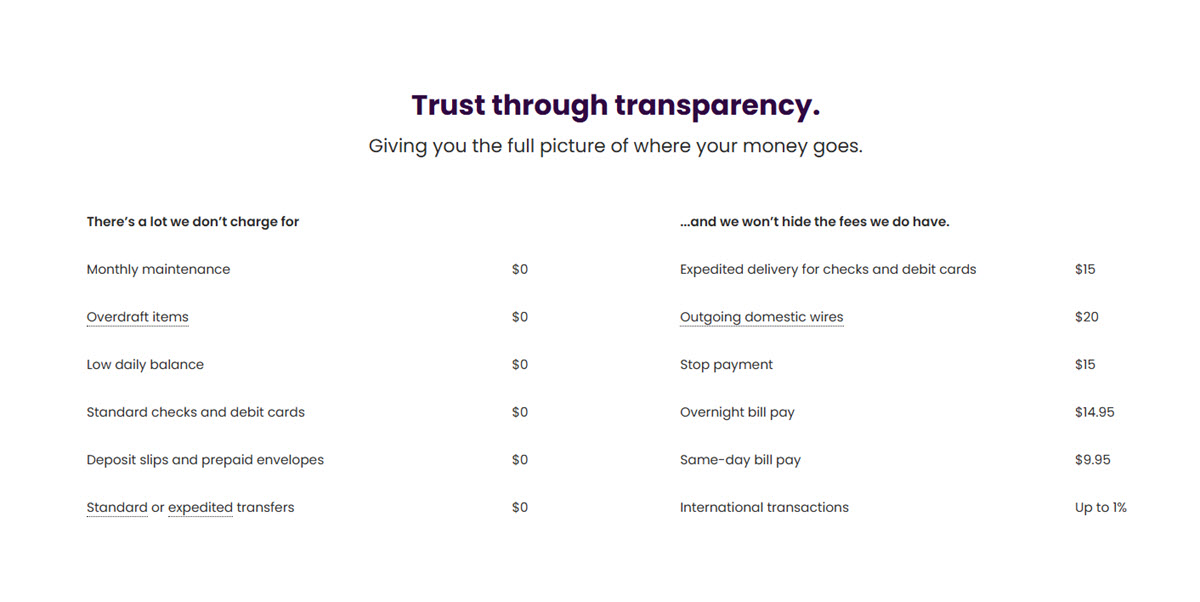

Zero Monthly Fees

Ally believes banking should be easy and affordable. That’s why they don’t charge fees for basic services that other banks often nickel-and-dime you for. Here’s what you won’t have to pay:

- No monthly maintenance fee

- No overdraft item fees

- No minimum balance requirement

- No fees for standard checks or debit cards

- No charge for online Bill Pay or standard transfers

While most services are free, Ally does charge for a few specialty services, and they’re always clear about it. Here’s a breakdown:

| Service | Fee |

|---|---|

| Stop payment request | $15 per item |

| Outgoing domestic wire transfer | $20 per wire |

| Expedited delivery (cards, checks) | $15 per item |

| Overnight bill pay (by mail) | $14.95 per item |

| Same-day electronic bill pay | $9.95 per item |

| International transaction fee | Up to 1% |

With Ally, what you see is what you get. There are no surprise charges, and they’re upfront about the few fees they do have, like wire transfers or overnight delivery. This transparency is one of the biggest reasons people choose Ally.

Earn Interest on Your Money

Most checking accounts at traditional banks pay little (if any) interest. But with Ally, your checking account balance actually grows.

Here’s how much you can earn:

| Daily Balance | Annual Percentage Yield (APY) |

|---|---|

| Less than $15,000 | 0.10% APY |

| $15,000 or more | 0.25% APY |

Note: These APYs are accurate as of July 23, 2025, but they may change over time. There’s no minimum balance required to earn interest.

These rates are competitive compared to other major banks. While it won’t replace your savings account, it’s nice to know your checking balance can earn interest too, especially with no effort on your part.

Top Features and Benefits of the Ally Checking Account

Here’s a closer look at the standout features that make the Ally Bank checking account a smart, user-friendly choice for modern banking.

Ally Checking Account Minimum Balance

One of the best parts of the Ally checking account is that it’s easy to open and maintain, no big balance required.

- $0 minimum deposit to open the account

- $0 minimum balance required to keep it open

- $0 balance required to avoid monthly fees

That means whether you’re starting out with $500 or just $5, you’ll still get access to all the same great features, including interest on your balance, free tools like Spending Buckets, and no-fee overdraft protection.

This flexibility makes Ally a great choice for students, first-time account holders, or anyone who wants a worry-free banking experience without account balance stress.

Use ATMs Without Worry

You can withdraw cash for free at over 43,000 Allpoint® ATMs across the U.S., found in places like pharmacies, convenience stores, and major retailers.

Can’t find an Allpoint ATM nearby? No problem. Ally will reimburse up to $10 per month for fees charged by other ATM networks. That gives you flexibility and saves you money, even when you’re not close to a partner ATM.

Two Layers of Overdraft Protection

Ally understands that overdrafts happen. That’s why they offer two free ways to protect you:

- Overdraft Transfer Service: Link your Ally savings or money market account to your checking. If your balance dips below zero, Ally will automatically move money in $100 increments to cover the shortfall at no cost to you.

- CoverDraft Service: This feature acts as a backup for common transactions. Once you’re eligible (after depositing $100), Ally will cover overdrafts up to $100. With qualifying direct deposits, you can increase that coverage to $250.

And here’s the best part: no overdraft fees. If you go over your limit, your transaction is simply declined. There’s never a penalty or extra charge.

Budget Smarter with Spending Buckets

Managing money is easier when it’s organized. With Ally’s Spending Buckets feature, you can divide your checking balance into up to 30 mini-buckets for different purposes — like rent, groceries, travel, or subscriptions.

It’s like having digital envelopes inside your account. You don’t need multiple accounts to stay organized. This tool gives you a visual way to track spending and helps you stay in control of your money.

Fast, Digital Banking Tools

Ally offers a full suite of tools to make everyday banking convenient:

- Zelle lets you send and receive money in minutes using just a phone number or email

- Online Bill Pay helps you schedule and manage payments directly from your account

- Ally eCheck Deposit lets you deposit checks from anywhere. Just snap a photo using your phone

- Ally Snapshot Dashboard gives you a clear, visual summary of your financial activity. You can quickly see where your money is going, review your spending patterns, and spot trends over time.

- Free access to your credit score and credit report details. You can log in anytime to check your score, see what factors are helping or hurting it, and track how it changes over time without hurting your credit.

These tools make banking with Ally just as easy or easier than using a traditional bank.

Strong Security and FDIC Insurance

Your money is safe at Ally. Deposits are FDIC-insured up to the legal limit, giving you peace of mind.

You’ll also benefit from strong security features, including:

- Real-time alerts for suspicious activity

- Instant card lock/unlock in case your debit card is lost or stolen

- Secure messaging to reach customer support right through the app

The bank puts your safety first, so you can focus on your finances without worrying about fraud or hidden risks.

Ally Checking Account Bonus

Ally Bank often rewards new customers with generous cash bonuses for opening a Spending Account, which is their version of a checking account. These bonuses are part of promotional offers and can be a great way to earn extra money just for switching your everyday banking.

Current Offers (as of mid‑2025):

- $100 Bonus: You can earn a $100 cash bonus when you open a new Ally Spending Account and fund it with any amount within 30 days. Then, just receive at least one qualifying direct deposit (like a paycheck or government benefit) within 60 days of opening. The bonus will be credited to your account within 30 days after the direct deposit arrives.

- $200 Bonus: Want to earn even more? Use the promo code GET200 when opening your account. To qualify for the $200 bonus, you must:

- Fund your new account within 30 days

- Receive at least $2,000 in direct deposits per month for three months in a row

- Once you meet these conditions, the $200 will be deposited into your Ally account shortly after the third qualifying deposit. This offer is valid through August 7, 2025.

Things to Keep in Mind:

- These promotions are for new customers only

- You can’t combine multiple bonuses. Choose the one that fits you best.

- Make sure your account stays open and in good standing to receive your reward.

Ally Bank Checking Account Requirements

Opening a Spending Account with Ally is a quick, online process, and you can do it from anywhere. You don’t need to visit a branch or fill out stacks of paperwork.

What You Need to Get Started:

- Be at least 18 years old

- Have a valid U.S. mailing address

- Provide your Social Security number

- Share your full name, address, birthdate, phone number, and email

If you get fully prepared, it only takes a few minutes to apply online.

Extra Requirements for Bonus Offers:

- You must be a new Ally customer for checking accounts. If you’ve had one recently, you may not qualify for the bonus.

- To earn a bonus, you’ll need to set up qualifying direct deposits within the time limit stated in the promotion.

If you don’t make a deposit within 30 days of opening, Ally will automatically close your account.

How to Open an Ally Checking Account

Starting your Ally checking account is quick and hassle-free. Everything is done online, and the whole process usually takes just a few minutes.

Here’s a step-by-step guide:

- Share your personal details: You’ll need to provide your full name, home address, Social Security number, and a few other basic pieces of information to verify your identity.

- Add money to your new account: Ally doesn’t require a minimum opening deposit, but you’ll need to make your first deposit to activate your account. Until you fund it, your debit card and checks won’t be sent out.

- Wait for your card and checks: Once your deposit is in, Ally will send your debit card and checkbook by mail. These typically arrive within 10 business days.

- Make sure to deposit within 30 days: If no money is added within 30 days of opening, Ally will automatically close the account, so don’t forget to fund it.

It’s that simple. There are no in-person visits, no paperwork to print, and no hidden steps, just easy online banking from start to finish. Once approved and funded, your debit card and starter checks will be mailed out, typically arriving within 10 business days.

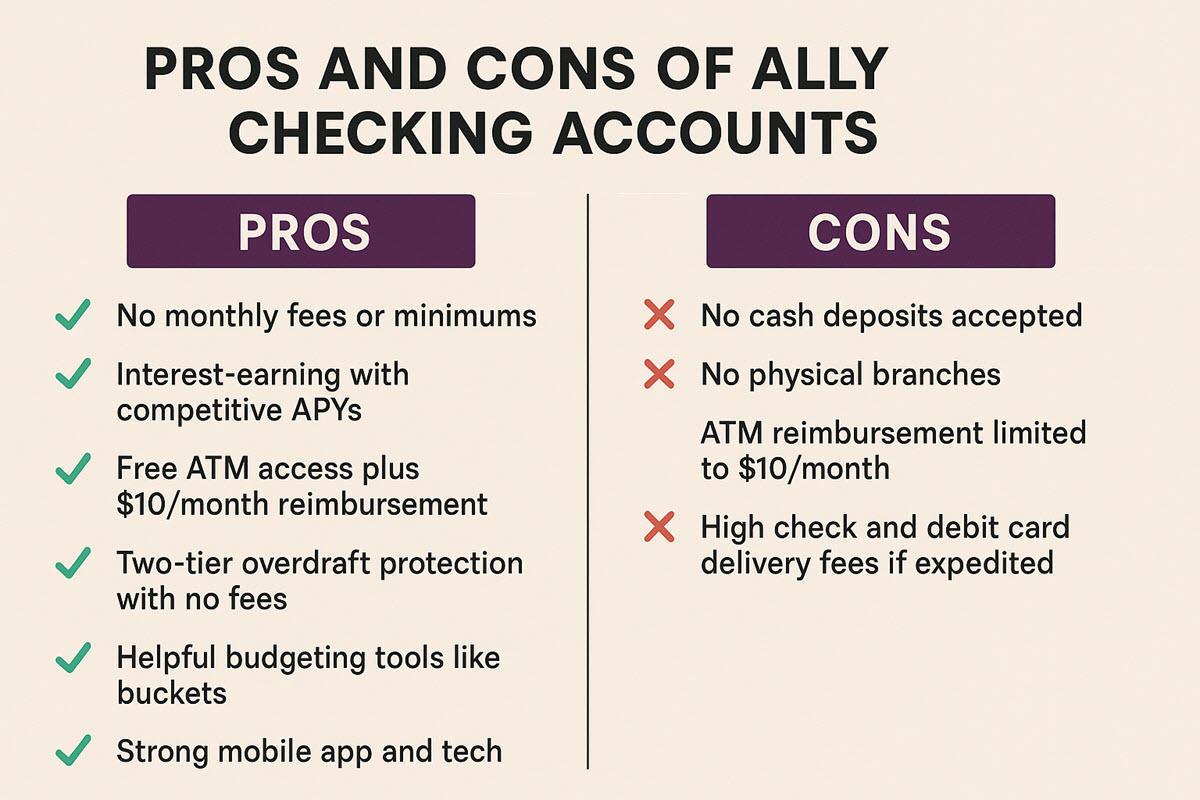

Pros and Cons of Ally Checking Accounts

Like every banking product, the Ally checking account has its strengths and some limitations. Here’s a clear breakdown to help you decide if it’s the right fit for your needs:

Pros:

- No monthly fees or minimums

- Interest-earning with competitive APYs

- Free ATM access plus $10/month reimbursement

- Two-tier overdraft protection with no fees

- Helpful budgeting tools like buckets

- Strong mobile app and tech

- 24/7 customer support

- FDIC-insured

Cons:

- No cash deposits accepted

- No physical branches

- ATM reimbursement limited to $10/month

- High check and debit card delivery fees if expedited

How Ally Compares to Other Banks

When choosing a checking account, it’s important to look beyond just the name of the bank. You want a mix of good interest rates, low fees, and features that make everyday banking easier. So how does Ally Bank stack up against other big names?

Here’s a side-by-side comparison of some well-known banks:

| Bank | APY (Interest Rate) | Monthly Fee | ATM Fee Reimbursements |

|---|---|---|---|

| Ally Bank | 0.10% – 0.25% | $0 | Up to $10/month for out-of-network |

| Capital One 360 | 0.10% | $0 | Free at partner ATMs |

| Chase | 0.01% | Up to $12 | None unless enrolled in premium |

| Bank of America | 0.01% | Up to $12 | None unless enrolled in premium |

| Citibank | 0.01% | Up to $30 | Limited |

If you’re comparing checking accounts based on value, Ally Bank comes out ahead of most traditional banks and even beats some online competitors. With its strong interest rates, no fees, flexible ATM access, and smart digital tools, the Ally Spending Account is a solid choice for anyone looking to simplify their financial life and make the most of their money.

FAQs About Ally Checking Account

Can I deposit cash into my Ally checking account?

- No, Ally does not accept cash deposits. You can fund your account using mobile check deposit, online transfer, or wire transfer.

How do I qualify for CoverDraft protection?

- You qualify for $100 coverage after depositing $100. To unlock the full $250, set up two consecutive qualifying direct deposits of at least $250.

How do I deposit cash into an Ally checking account?

- Ally doesn’t accept cash deposits. You can deposit a check using the app, set up direct deposit, or transfer money from another bank.

Can I use Zelle with Ally checking?

- Yes, you can send or receive money with Zelle directly from your Ally account using the mobile app or website.

How do I close my Ally checking account?

- You can close it by calling Ally at 1-877-247-2559 or sending a secure message. Make sure your balance is $0 and all transactions are complete.

How many Ally checking accounts can I have?

- You can open up to three Ally Spending Accounts (checking accounts) under your name. Each one works separately, and you can give them different names or use them for different goals, like bills, savings, or travel.

The Ally checking account is a modern, no-fee, interest-earning option that makes everyday banking easy. From overdraft protection and strong tech tools to no hidden fees and useful budgeting features, Ally offers excellent value for those who prefer to bank online.