Opening a reliable and convenient checking account is essential for managing your daily finances efficiently. The Citi Checking Account offers a range of features designed to simplify your banking experience.

In this blog, we will provide a comprehensive overview of the Citi Checking Account. We’ll start by explaining the definition and highlighting its key benefits. Then, we’ll explore the different types of checking accounts offered by Citi. Next, we’ll walk through the step-by-step process of opening an account. By the end, you’ll have a clear understanding of why the Citi Checking Account could be the ideal banking solution for your financial needs in 2025

Introduction to Citi Checking Account

A Citi Checking Account is a type of bank account that Citigroup Inc. offers. It allows you to deposit and withdraw funds at ATMs or different Citibank branches. Once you open a Citi checking account, you can pay bills online, transfer money to other accounts, and deposit checks using the Citi mobile app.

The main goal of this account is to help you manage daily expenses efficiently. Additionally, it allows you to receive direct deposits, such as your salary. Furthermore, it helps automate bill payments to ensure you never miss a deadline.

Depending on your banking preferences, you can select either an Access Checking or a Regular Checking account. While the Regular Checking account includes the option to write checks against your balance, the Access Checking account does not provide check-writing capabilities.

Benefits of Citi Checking

Discover the key advantages that make the Citi checking account a smart choice for managing your everyday finances with convenience, security, and flexibility.

Access Cash Easily

With a Citi Checking Account, you can withdraw cash conveniently from over 65,000 fee-free ATMs nationwide. This extensive ATM network means you can avoid extra fees and access your money almost anywhere across the country, providing flexibility and convenience whenever you need cash on hand.

Citibank offers a strong protection policy where you won’t be held responsible for any unauthorized transactions made on your checking or credit cards accounts. This zero-liability guarantee ensures peace of mind, safeguarding your funds from fraudulent activities and unauthorized charges.

Mobile Check Deposits

When you use the Citi Mobile App, you can easily deposit checks from anywhere without visiting a branch. Therefore, you just need to take a photo of your check through the app, and Citi securely and quickly credits the funds to your account, saving you time and effort.

Seamless Money Movement

Managing your money is hassle-free with Citi’s integrated digital tools. You can send and receive money instantly using Zelle payments, perform real-time transfers between accounts, and handle other transactions smoothly. Especially, all from your mobile device or computer. This seamless money movement empowers you to stay in control of your finances anytime, anywhere.

Main Types of Citi Checking Account

There are two main types of Citi checking accounts tailored to meet different banking preferences and needs. They are Regular Checking and Access Checking. Both accounts come with various benefits and features:

Regular Checking Account

The Regular Checking account is ideal for customers who want full banking capabilities including unlimited check writing. Key features include:

-

Unlimited check writing: Customers can write as many checks as needed without restrictions.

-

Monthly service fee: Citigroup Inc. charges a $15 monthly fee but waives it if you qualify for the Relationship Tier or make at least $250 in Enhanced Direct Deposits each month.

-

ATM fees: There is a $2.50 fee for using ATMs outside the Citi network.

-

No overdraft or returned item fees: Citi waives overdraft fees and fees for returned items, providing additional financial protection similar to benefits in payday loans services

-

Relationship Tier benefits: New customers open this type of Citi checking account and maintain a $30,000 balance within 3 calendar months. Consequently, they can gain Relationship Tier status, unlocking fee waivers and extra perks.

Access Checking Account

The Access Checking account has some following main features include:

-

Checkless banking: This account does not allow check writing, focusing instead on electronic transactions.

-

Monthly service fee: A $5 fee applies but is waived for Relationship Tier members or when monthly Enhanced Direct Deposits exceed $250.

-

ATM fees: Like Regular Checking, a $2.50 fee applies when using non-Citi ATMs.

-

No overdraft or returned item fees: Citigroup also waives overdraft and returned item fees for this account.

-

Transaction restrictions: Certain transactions may not be authorized with Access Checking to help avoid overdrafts and fees.

Choosing the Right Account

-

Regular Checking suits those who need traditional banking features such as unlimited check writing and more flexibility in transactions.

-

Access Checking is best for customers seeking a streamlined, mostly digital banking experience without check-writing, plus lower monthly fees.

Both types of Citi checking accounts provide access to Citi’s extensive ATM network. Additionally, they offer both convenient mobile banking services and include protections against overdraft fees. Therefore, you can manage your finances securely whether linked to car loans or investing. As a result, handling your money becomes more efficient and stress-free.

Citi Checking Account Opening Process

Learn how simple and flexible it is to open your Citi Checking Account whether online, by phone, or in person so you can start managing your finances quickly.

Online Process

Opening a Citi Checking Account is a straightforward and convenient process that can be completed online, by phone, or in person at a branch. Citi offers flexible options to suit your preferences and get you started quickly.

You can easily apply online to open a new Citi checking account. The online application requires you to provide basic personal information such as your residential address and Social Security number.

During the application, you’ll also select your preferred funding options to deposit money into your new account. After submitting your application, Citi will review and approve your request. Once approved, you’ll receive an email confirmation, and your account will be ready for use.

Most accounts can be opened within minutes, although receiving your debit card may take additional time for shipping.

If you prefer personal assistance, you can open a Citi Checking Account by calling 1-800-321-2484 (TTY: 711 or Relay Service) to speak with a representative.

Offline Process

You can visit any Citi branch to open your Citi checking account with the help of a banking representative. They will guide you through choosing the right account, verify your ID and documents, and set up your account on the spot. Your debit card will be mailed to you afterward. Visiting a branch is ideal if you prefer personal assistance or have questions during the process.

Some Notes Relating Account Opening Process

-

No Minimum Deposit Required

Citi does not require a minimum deposit to open a new Citi checking account, making it accessible for most customers. However, be aware that accounts with a zero balance for 90 consecutive calendar days may be subject to closure, so maintaining some funds in your account is recommended. Especially, if you also have auto loans or mortgage rates linked to your banking profile.

- Debit Cards

When you open your first Citi checking account, Citi will mail you a Citibank debit card once your application is approved. This debit card is contactless-enabled for quick tap payments and chip-enabled to provide enhanced security during transactions.

You can use this card worldwide at millions of merchants and grants access to over 65,000 fee-free ATMs in the U.S. You may also withdraw cash at participating merchants using your PIN when making debit purchases.

If you open additional checking accounts with Citi, these may be linked to your existing debit card, providing you with seamless access across multiple accounts without needing additional cards.

For customers who prefer limited access, Citi offers an ATM-only card option. You can request this card by calling the number above or visiting a branch. Note that ATM-only cards do not support contactless payments and are restricted to cash withdrawals at ATMs.

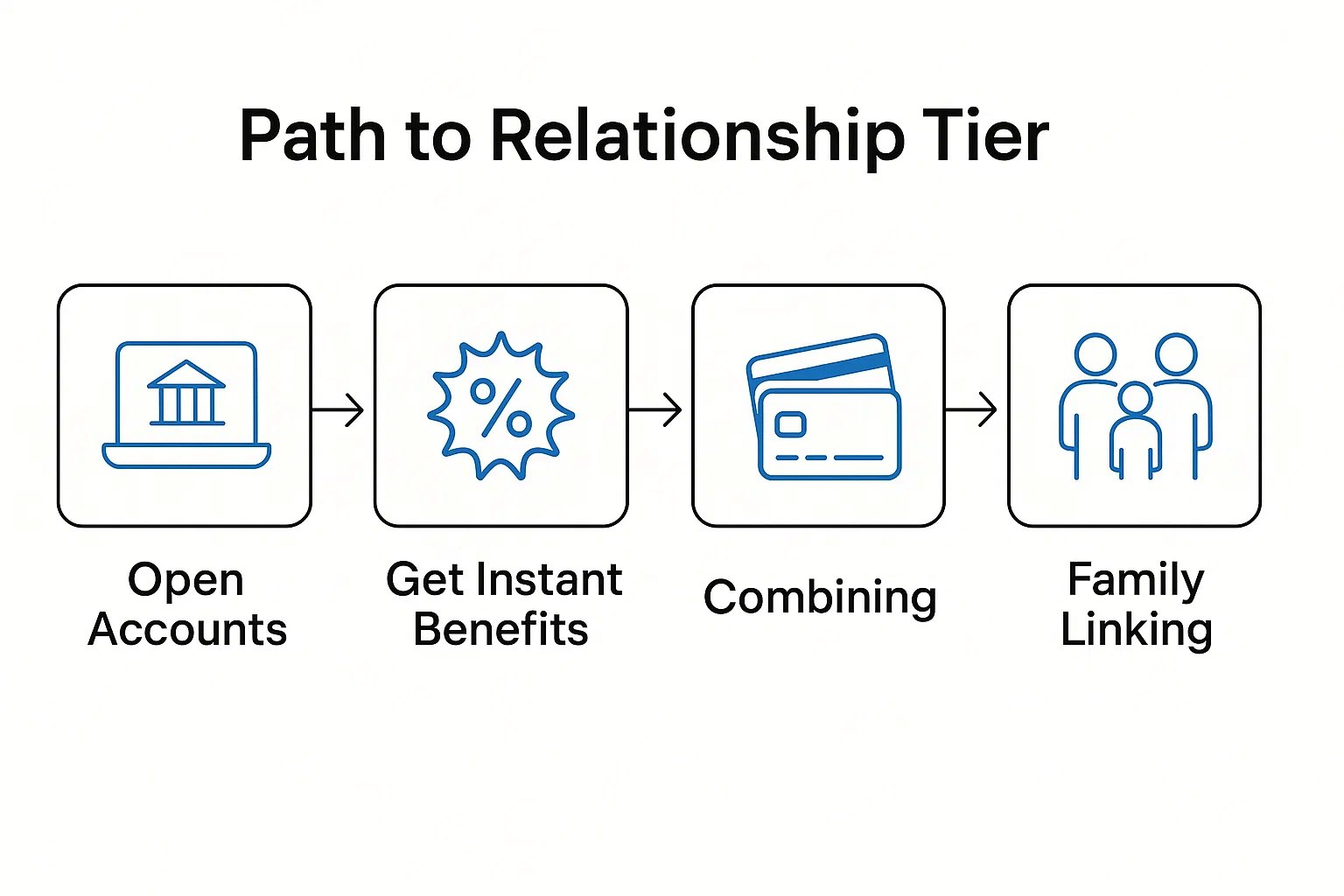

Path to Relationship Tier

Citigroup Inc. offers Relationship Tiers, which is special status levels that provide customers with enhanced banking benefits and fee waivers. To qualify for these tiers, customers need to meet certain minimum balance requirements by opening and linking Citi checking accounts.

Open Accounts

To start your journey toward relationship tier benefits, you can open a Citi checking account or saving account. Importantly, you can combine balances from multiple eligible Citi deposit and investment accounts to meet the required minimum balance. This flexibility allows you to manage your funds across accounts while still qualifying for tier status.

Get Instant Benefits

Once you open an account within a relationship tier, you immediately unlock exclusive benefits such as waived monthly fees and added service features. This means you don’t have to wait long to enjoy the perks of your relationship tier membership but benefits take effect right away.

Combining Citi Checking Accounts for Balance Qualification

Citigroup Inc. allows customers to count balances from various eligible accounts, including Citi checking accounts, deposit accounts, business accounts and investment products, toward the minimum required balance. This encourages holistic financial management by rewarding your total relationship with Citi, not just individual accounts.

Family Linking to Accelerate Tier Access

To further help customers qualify sooner, Citi offers Family Linking, which lets immediate family members living at the same address combine their eligible account balances. By pooling resources, families can access relationship tier benefits faster and enjoy the associated privileges as a group.

Grow Your Citi Relationship with Your Citi Checking Account

No matter where you start with your Citi Checking Account, your relationship with Citigroup Inc. can grow progressively, unlocking more valuable benefits as your combined balance reaches higher Relationship Tiers. This tiered system rewards loyal customers by offering different advanatges.

Citi Relationship Tier and Benefits

Citi relationship tiers provide everyday benefits to customers at every level of their banking journey. These tiers are determined by your Combined Average Monthly Balance (CAMB) — the total average balance across eligible Citi deposit and investment accounts, including your Citi checking account.

Everyday Benefits Tier

-

Balance Range: $0 to $29,999.99

-

Key Features:

-

Full access to the Citi Mobile App and online banking platform.

-

Use of over 65,000 fee-free ATMs nationwide for convenient cash withdrawals.

-

No overdraft or returned item fees.

-

A promotional savings interest rate of 4.35% for up to 3 months (1.13% – 1.20% APY)† for new funds of $25,000 or more deposited with Citibank.

-

Citi Priority Tier

-

Balance Range: $30,000 to $199,999.99

-

Enhanced Benefits:

-

Waived Citi fees for non-Citi ATM usage, money orders, and stop payments.

-

Increased limits for Zelle payments, debit card purchases, and ATM withdrawals.

-

Waived fees for incoming domestic and international wire transfers.

-

Citigold Tier

-

Balance Range: $200,000 to $999,999.99

-

Premium Features:

-

Unlimited reimbursement of non-Citi ATM fees worldwide.

-

Access to a dedicated Wealth team and investment guidance through Citi Personal Wealth Management.

-

Increased limits on ATM withdrawals, purchases, and Citibank Global Transfers.

-

Citigold Private Client Tier

-

Balance Range: $1,000,000+

-

Premier Services:

-

Fee-free banking services, including waived transfer fees for all wire transfers.

-

Higher limits on mobile check deposits, ATM withdrawals, and other transactions.

-

Advanced wealth planning and exclusive support from Citi Personal Wealth Management experts.

-

Maintaining Your Relationship Tier

To continue enjoying your Citi relationship tier benefits, your Combined Average Monthly Balance must stay within your tier’s minimum balance range for three consecutive calendar months. If your balance falls below the threshold, you may be moved to a lower tier with fewer benefits. Citigroup Inc. provides re-tiering notifications on your account statements and allows opting out of the tier program if desired.

Important Terms and Fees for Citi Checking Accounts

Monthly Service Fees

Citibank charges a monthly service fee for maintaining Citi checking account, billed monthly from the date your account opens. This fee may be waived if you qualify for a relationship tier or have at least $250 in Enhanced Direct Deposits (EDD) each month.

EDDs include electronic payroll, pensions, social security, government benefits, and Zelle incoming payments processed through the ACH network. Other deposits like cash, check deposits, wire transfers, and instant P2P transfers (e.g., Venmo, PayPal instant transfers) do not qualify as EDDs.

Overdraft and Transaction Fees

Citibank does not charge overdraft fees or fees for returned items. However, customers should avoid overdrawing their accounts, as the bank may decline or pay transactions causing negative balances. Access Citi Checking accounts can prevent transactions that would cause overdrafts, particularly for personal banking customers.

ATM Access and Fees

You can access over 65,000 fee-free ATMs across the U.S. through Citibank branches, partner retail locations, and the MoneyPass Network. Non-Citi ATM usage fees may apply unless waived by your relationship tier. Higher tiers, such as Citigold, offer unlimited reimbursement for non-Citi ATM fees worldwide.

Account Closure

Citi may close accounts maintaining a zero balance for 90 consecutive calendar days.

Maximizing Your Citi Checking Account Benefits

-

Combine balances from eligible deposit and investment accounts to reach higher relationship tiers faster.

-

Use Family Linking to pool balances with immediate family members living at the same address.

-

Maintain consistent balances above tier thresholds to keep your benefits and fee waivers active.

By understanding and actively managing your Citi relationship tiers along with the associated terms and fees, you can maximize the value of your Citi Checking Account and enjoy a tailored banking experience designed to grow with your financial needs.

A Citi Checking Account offers you a reliable and convenient way to manage your daily finances with access to extensive features and benefits. Moreover, by understanding the relationship tier system and maintaining your account balances, you can unlock additional perks and fee waivers tailored to your financial needs. Additionally, with simple application process, starting your Citi banking journey has never been easier. Let’s choose Citigroup Inc. for a banking experience designed to grow with you in 2025 and beyond.