Managing your finances starts with a reliable Wells Fargo Checking Account. It allows you to handle daily transactions such as paying bills, receiving income, and accessing cash conveniently. Without the right account, these everyday needs can become unnecessarily complex.

Wells Fargo offers a range of checking account services tailored to different lifestyles and financial goals. Whether you’re a student, a working adult, or a high-balance customer, Wells Fargo has options to support your financial journey. In this post, we will explore the benefits, eligibility, and process of opening a Wells Fargo checking account.

Introduction to Wells Fargo & Co.

Wells Fargo & Co. has earned its place as one of America’s most trusted and established financial institutions. With decades of service to millions of customers across the nation, the bank delivers various comprehensive banking and financial solutions. What sets Wells Fargo apart is its unique combination of reliability and innovative financial strategies. Therefore, it gives customers the confidence of traditional banking with the advantages of modern financial tools.

History of Wells Fargo

Established in 1852 by Henry Wells and William Fargo, the bank emerged during the California Gold Rush era, initially providing express delivery and basic financial services. Using stagecoaches to transport gold and money across the expanding western territories, Wells Fargo quickly became a cornerstone of frontier commerce. The iconic stagecoach logo still represents the bank’s adventurous origins and commitment to service.

Through the years, Wells Fargo grew via strategic mergers and acquisitions, securing its place among America’s “Big Four” banks. It significantly contributed to the development of infrastructure and commerce, especially in the Western U.S.

While the bank faced scrutiny in the 2010s due to compliance and reputational issues, it has since made meaningful strides in restoring trust. These included improving customer transparency, digital systems, and internal governance. Today, Wells Fargo remains a significant presence in global finance, providing services across retail, business, and corporate banking.

Main Services of Wells Fargo

Wells Fargo delivers a wide array of services tailored to individuals, families, and businesses of all sizes. Key offerings include:

- Personal Banking: Everyday financial products such as checking and savings accounts, debit/credit cards, and budgeting tools.

- Lending Solutions: Flexible options for home loans, auto financing, personal credit lines, and small business lending.

- Wealth & Investment Services: Retirement accounts, investment portfolios, and access to platforms such as WellsTrade and Intuitive Investor.

- Corporate Banking: Solutions for institutional clients, including treasury services, credit, and asset management.

- Business Banking: Specialized services such as business checking, credit facilities, payment solutions, and digital integrations, including Zelle for Business.

Types of Wells Fargo Checking Accounts

Wells Fargo checking account services form the backbone of its personal banking solutions. These accounts are designed to support your daily spending, income management, and financial tracking.

What Is a Checking Account

A checking account is a type of bank account designed for frequent, day-to-day financial activities. It allows you to deposit money, withdraw cash, pay bills, transfer funds, and make purchases using a debit card. Most checking accounts also support online and mobile banking, enabling real-time account management from anywhere.

Unlike savings accounts, checking accounts are built for liquidity and easy access. You can use them for recurring expenses such as rent, groceries, subscriptions, or utility payments. They also serve as the primary link to direct deposits from your employer and automated payments.

Having a checking account is essential for staying on top of your finances. It helps you monitor your spending, manage cash flow, and build responsible banking habits. Whether you’re budgeting monthly expenses or managing multiple income sources, a checking account is the central hub for personal finance.

Everyday Checking Account

This is Wells Fargo’s standard and most versatile checking account, designed for everyday banking needs. It includes a contactless debit card, check-writing capabilities, and full access to online and mobile banking. You can use Zelle to send or receive money, set up automatic bill payments, and get real-time transaction alerts.

The $10 monthly service fee can be waived by:

- Maintaining a $500 minimum daily balance

- Receiving $500 or more in qualifying direct deposits

- Meeting certain age or card-linking criteria (e.g., campus card holders)

This account is ideal for working professionals, students, and anyone seeking a reliable, all-purpose checking option.

Clear Access Banking Checking Account

Clear Access Banking is a simplified account designed for younger users, particularly teens and students. It does not allow check writing, which helps prevent overdrafts. All transactions must stay within the available balance, and no overdraft fees are ever charged.

Key features include:

- A Wells Fargo debit card for purchases and ATM access

- Access to mobile banking, alerts, and budgeting tools

- A $5 monthly fee that is waived for primary account holders aged 13–24

It’s ideal for parents opening a starter account for teens or for young adults managing money for the first time.

Prime Checking Account

Prime Checking is a premium, interest-bearing account designed for customers who maintain higher balances. It includes all the standard features of Everyday Checking, with added perks:

- Earn interest on your balance

- Waived fees for incoming wire transfers, money orders, and cashier’s checks

- One fee waiver per period for non-Wells Fargo ATM usage (U.S. and international)

- Preferred interest rates on linked savings and CD accounts

- Interest rate discounts on eligible loans

The $25 monthly fee is waived if you maintain $20,000 or more in qualifying linked balances. It’s best for those who want more value and rewards for higher balances.

Premier Checking Account

Premier Checking is Wells Fargo’s highest-tier account, offering elite benefits for customers with substantial assets. This account provides benefits such as;

- Unlimited ATM fee reimbursements (domestic and international)

- No fees for incoming wires, cashier’s checks, or money orders

- Enhanced interest rates on linked savings, CDs, and investment accounts

- Access to dedicated Premier customer service and support teams

- Relationship benefits across the bank’s financial services

The $35 monthly fee is waived with $250,000 or more in qualifying linked balances. It’s ideal for high-net-worth individuals seeking a premium banking experience.

| Account Type | Monthly Fee | Waiver Options | Check Writing | Overdraft Services | Ideal for |

| Everyday Checking | $10 | $500 balance or $500 direct deposit | Yes | Available | Anyone seeking a reliable, all-purpose checking option. |

| Clear Access Banking | $5 | Owner age 13–24 | No | Not available | Teens or young adults managing money for the first time. |

| Prime Checking | $25 | $20,000 linked balances | Yes | Available | Who wants more value and rewards for higher balances |

| Premier Checking | $35 | $250,000 linked balances | Yes | Available | High-net-worth individuals seeking a premium banking experience |

Why choose Wells Fargo Checking Account?

Choosing the right bank for your everyday financial activities is an important decision. Wells Fargo checking accounts stand out for their flexibility, accessibility, and digital convenience, making them a dependable choice for a wide range of customers.

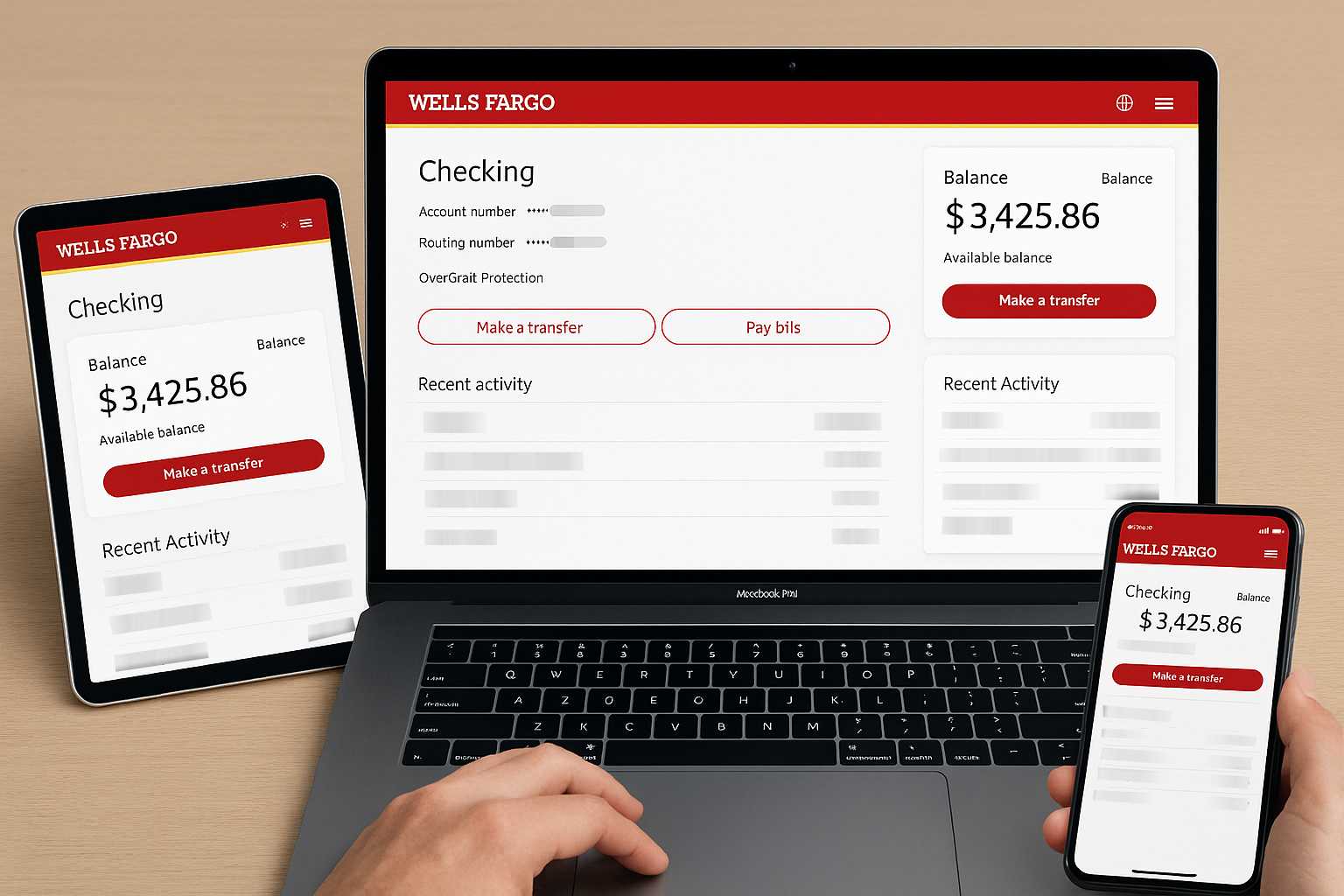

- Strong digital support: All Wells Fargo checking accounts include access to the Wells Fargo Mobile app and online banking. So, customers can easily manage transactions, transfer funds, pay bills, and set up account alerts. Integration with Zelle makes sending and receiving money simple and fast. Moreover, with the Early Pay Day feature, qualifying direct deposits may arrive up to two days sooner.

- Multiple account options: Whether you’re a teenager opening your first account or an experienced professional managing a high balance, Wells Fargo offers tailored choices. From Clear Access Banking for young users to Premier Checking for high-net-worth individuals, there’s an option to fit your lifestyle and financial goals.

- Trusted security and control: All checking accounts come with advanced security features such as two-factor authentication, real-time fraud monitoring, and customizable alerts. You can even turn your debit card on or off instantly via the mobile app for added protection.

- Customization options: You can select your account based on age, income, and financial needs. Features such as overdraft protection, mobile check deposit, and account linking give you more control over how you bank.

Once you’ve opened your Wells Fargo checking account, it’s easier to access other financial products. Consider exploring Wells Fargo Credit Card Services to grow and diversify your financial plan.

Wells Fargo Checking Account: Eligibility

Now that we’ve reviewed the types of Wells Fargo checking accounts, it’s important to understand who can open one and what requirements must be met. Eligibility varies slightly depending on the account type, age of the applicant, and method of application.

Eligibility Criteria for Applicants

Age-specific criteria: Wells Fargo checking accounts are available to a wide range of individuals, from teenagers to high-net-worth adults. Each account type has specific age-related rules:

- Everyday Checking: Applicants must be 17 years or older. Those who are 17 must apply in person at a branch.

- Clear Access Banking: Available to individuals aged 13 and above. Applicants between 13 and 16 must have a joint adult co-owner and complete the application in-branch.

- Prime and Premier Checking: These premium accounts are available to those 18 years and older.

Other Considerations

Here is the factor you need to consider: residency and documentation

- Applicants must provide a valid U.S. residential address.

- A government-issued photo ID, such as a driver’s license or passport, is required.

- Non-U.S. citizens may still be eligible but must apply in person and present additional documentation, such as immigration or visa papers, and proof of local residence.

Some states may have additional conditions depending on local banking regulations or account features.

After confirming your eligibility, it’s also worth exploring other services that may complement your account. For example, setting up a Wells Fargo savings account, enrolling in Online Business Banking, or linking a personal loan can help build a more complete financial strategy.

Wells Fargo Checking Account: Documents & Procedures

Opening a Wells Fargo checking account is a straightforward process. Whether you prefer to apply online or visit a local branch, the steps are clear, guided, and designed to make account setup easy for all applicants.

Documents to Open a Wells Fargo Checking Account

Essential identification: To successfully open your Wells Fargo checking accounts, you’ll need the following:

- A government-issued photo ID such as a driver’s license, passport, or state ID

- Your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

- A proof of current U.S. residential address (if not shown on your ID), such as a utility bill or lease agreement

- A minimum opening deposit of $25, which can be made by debit card, bank transfer, or check

Having all these documents ready helps ensure a quick and smooth application process.

How to Open a Wells Fargo Checking Account

Wells Fargo offers two convenient ways to open a checking account:

Online Application

- Visit the official Wells Fargo website

- Choose the checking account that fits your needs

- Fill in your details, including contact and identity verification

- Deposit at least $25 to activate the account

In-Branch Application

- Bring all required documents to a nearby Wells Fargo branch

- A banking specialist will guide you through the entire process, answer questions, and help tailor the account setup to your preferences

However, applicants under 18 or those applying for joint accounts must open the account in person.

Once your Wells Fargo checking account is active, you can easily link it to other services. For example, setting up automatic payments for your Auto Loan, mortgage, or even credit card balances can streamline your monthly finances.

Wells Fargo Checking Account: Terms and Fees

Each Wells Fargo checking account comes with its own set of fees, waivers, and service conditions. So, understanding these financial terms will help you select the most suitable account for your lifestyle and avoid unnecessary charges.

Monthly Service Fees and Waivers

Fees vary by account type: Depending on the type of checking account, you may be subject to a monthly maintenance fee. However, each account provides ways to waive it:

- Everyday Checking: $10 monthly fee. However, it can be waived with a $500 minimum daily balance or $500 in qualifying direct deposits

- Clear Access Banking: $5 monthly fee. It can be waived for customers aged 13 to 24

- Prime Checking: $25 monthly fee. You can get it waived with $20,000 or more in qualifying linked balances

- Premier Checking: $35 monthly fee. Be waived with $250,000 or more in qualifying linked balances

Overdraft and ATM Fees: Wells Fargo offers tools to help minimize unexpected costs:

- Overdraft Fee: $35 per item, with a limit of 3 fees per business day

- Overdraft Protection: Optional, and can be set up by linking eligible accounts

- Clear Access Banking: No overdraft fees – transactions exceeding your balance are automatically declined

- ATM Usage Fees: No charges at Wells Fargo ATMs; fees may apply when using non-Wells Fargo ATMs, especially internationally

Other Common Charges

- Incoming Wire Transfers: $15 for domestic wires and $16 for international wires

- Outgoing Wire Transfers: Start at $30, depending on the destination and currency

These terms can impact your banking experience, especially if you frequently use wire transfers or out-of-network ATMs. Therefore, it’s important to match the account features with your usage habits.

While evaluating checking account fees, also consider associated charges for other products such as savings accounts, credit cards, Mortgage Services, or investing platforms. Bundling services can often help reduce overall costs.

Wells Fargo Checking Account: Benefits

Wells Fargo checking account customers enjoy more than just everyday banking features. From welcome bonuses to digital tools and exclusive perks, these accounts offer added value that goes beyond basic transactions.

Current Sign-Up Bonuses

Welcome bonuses: Wells Fargo frequently provides promotional offers to new checking account customers.

- $300 Bonus for new Everyday Checking customers. To qualify, you must open a new account and receive qualifying direct deposits totaling $1,000 or more within a set time frame (typically 90 days).

- Up to $2,500 Bonus for Premier Checking customers. Available to those who deposit $250,000 or more in new qualifying linked accounts within 45 days and maintain that balance for at least 90 days. This bonus is ideal for high-balance customers seeking premium banking privileges.

These offers are subject to change and may require a promo code or application through a special link. Always check the latest terms on the official Wells Fargo website before applying.

Extra Perks and Digital Tools

More than basic banking: Wells Fargo checking account holders also gain access to a suite of smart features designed to improve their financial life:

- Campus ATM/Debit Card Program: Students attending participating colleges can link their school ID to their Wells Fargo account for added convenience and fee benefits.

- Mobile Budgeting Tools: Track spending, set financial goals, and view categorized transactions directly from the Wells Fargo Mobile app.

- Security Controls: Lock or unlock your debit card, receive real-time fraud alerts, and customize your notification settings.

- Zelle Integration: Quickly send and receive money from friends, family, or clients without needing to share bank details.

- Early Pay Day: Eligible customers may receive direct deposits up to two business days earlier than scheduled.

These features make Wells Fargo checking accounts not just functional, but also proactive in helping you stay in control of your money.

Once your account is set up, you’ll also unlock smoother access to other financial services such as credit cards, auto loans, Home Loans, personal loans, and investment platforms, all with the added benefits of being an existing customer.

FAQs about Wells Fargo Checking Account

Here are some popular questions about Wells Fargo checking account services

Q1: Can I open a Wells Fargo checking account online?

- Yes. If you are 18 or older and meet the ID and deposit requirements, you can apply online.

Q2: What is the minimum deposit to open a checking account?

- Most accounts require a $25 opening deposit.

Q3: Are there any age restrictions?

- Yes. Everyday Checking is for ages 17+, Clear Access is for 13+ with conditions, and Prime/Premier are for 18+.

Q4: How can I avoid monthly service fees?

- You can avoid fees by maintaining qualifying balances, setting up direct deposits, or meeting age criteria.

Q5: Is overdraft protection available?

- Yes, for most accounts except Clear Access. You can link other Wells Fargo accounts to cover overdrafts.

A Wells Fargo checking account is more than just a place to store your money—it’s a gateway to smarter financial management. With multiple account types, digital banking tools, security features, and exclusive perks, Wells Fargo makes it easy to choose an account that fits your lifestyle and goals.

Whether you’re just starting with your first account or looking to upgrade to a premium tier, the application process is straightforward, and the benefits are clear. By understanding your options, eligibility, and associated fees, you can confidently choose the Wells Fargo checking account that aligns with your financial needs.