US Bancorp auto loans are a trusted choice for car buyers in 2025. It offers competitive rates, flexible repayment terms, and a hassle-free application process. Moreover, US Bancorp’s financing solutions can meet your diverse needs and budgets.

In this article, we’ll explore the key features of US Bancorp auto loans. In particularly, we walk through different types, eligibility requirements, how to apply, and expert tips to help you save more.

General Information of US Bancorp Auto Loans

US Bancorp is one of the largest banking institutions in the United States. It was founded in the 19th century. Today, it operates under the name U.S. Bank and serves millions of customers nationwide.

Moreover, with over 70,000 employees and thousands of branches across the country, US Bancorp is known for its stability, transparency, and customer focus. It has earned strong trust across both local and national markets. Thanks to thousands of branches and a solid digital presence, it offers convenient access from almost anywhere.

Now, let’s define what an auto loan is. An auto loan helps you finance a car by borrowing money from a lender. You then repay this amount through monthly payments over a fixed term. It’s one of the most common ways people buy cars today.

That’s where US Bancorp auto loans come in. They offer financing for both new and used vehicles. In addition, US Bancorp provides refinancing options for those who want to lower their current rates. Their auto loans are flexible, affordable, and backed by digital tools to simplify the process. Therefore, they are a great option for drivers who value convenience and competitive terms.

Key Features of US Bancorp Auto Loans

When choosing a car loan, it’s important to understand what each lender offers. Below are the standout features of US Bancorp auto loans that make them a reliable choice for many drivers.

- Competitive Interest Rates

US Bancorp offers interest rates that are competitive with national lenders. Rates may vary based on credit score and loan type. Moreover, in many cases, existing U.S. Bank customers especially those with checking accounts, receive additional rate discounts.

- Flexible Loan Terms

You can choose loan terms ranging from 12 to 72 months. Due to this flexibility, you can plan monthly payments that fit your budget. Longer terms mean lower payments, while shorter terms help reduce total interest.

- Multiple Loan Options

US Bancorp provides loans for new and used cars. Additionally, it also offers refinancing if you want to lower your current auto loan rate. Therefore, borrowers may have more choices based on their financial needs.

- Online Pre-Approval

You can apply for pre-approval online in just minutes. This process does not impact your credit score. It also gives you a better idea of how much you can borrow before shopping for a car.

- Auto Loan Calculators and Digital Tools

US Bancorp’s website includes helpful tools like loan calculators and payment estimators. These tools make it easier to plan your purchase. As a result, you can compare different loan scenarios with ease.

- Easy Account Management

Once approved, you can manage your loan online or through the U.S. Bank mobile app. You can set up autopay, check balances, and track payments anytime. This makes managing your loan simple and stress-free.

Before applying for an US Bancorp auto loan, it’s important to understand these above requirements. This makes managing your loan simple and stress-free, especially if you already use the app for other services like personal accounts.

Requirements of US Bancorp Auto Loans

To apply for a US Bancorp auto loan and secure the best rates, borrowers must meet both basic and premium-level eligibility criteria.

Basic Eligibility Requirements

U.S. Bank does not publicly disclose a minimum credit score or income threshold. However, to apply for a US Bancorp auto loan, you must:

-

Be a legal resident or U.S. citizen.

-

Be at least 18 years old at the time of application.

-

Have a qualifying vehicle and complete documentation.

These general requirements make the loan accessible to a wide range of borrowers. Still, loan approval and rates will depend on your individual financial profile. For example, it might be based on how you manage payday loans.

Requirements to Qualify for the Best Rates

To access the lowest interest rates, US Bancorp applies stricter conditions based on your loan type:

For new or used car purchases:

-

Choose a loan term of 60 months or less.

-

Have a credit score of 800 or higher.

-

The vehicle must be less than 1 year old.

-

The loan amount should be $40,000 or more.

-

Loan-to-value (LTV) ratio must fall between 111% and 115.99%.

-

Set up autopay from a personal U.S. Bank checking or savings account.

For refinancing an existing auto loan:

-

Loan term must also be 60 months or less.

-

US Bancorp auto loan amount should be $30,000 or more.

-

Credit score must be 800 or higher.

-

The vehicle must be less than 2 years old.

-

Autopay must be activated from a U.S. Bank personal account.

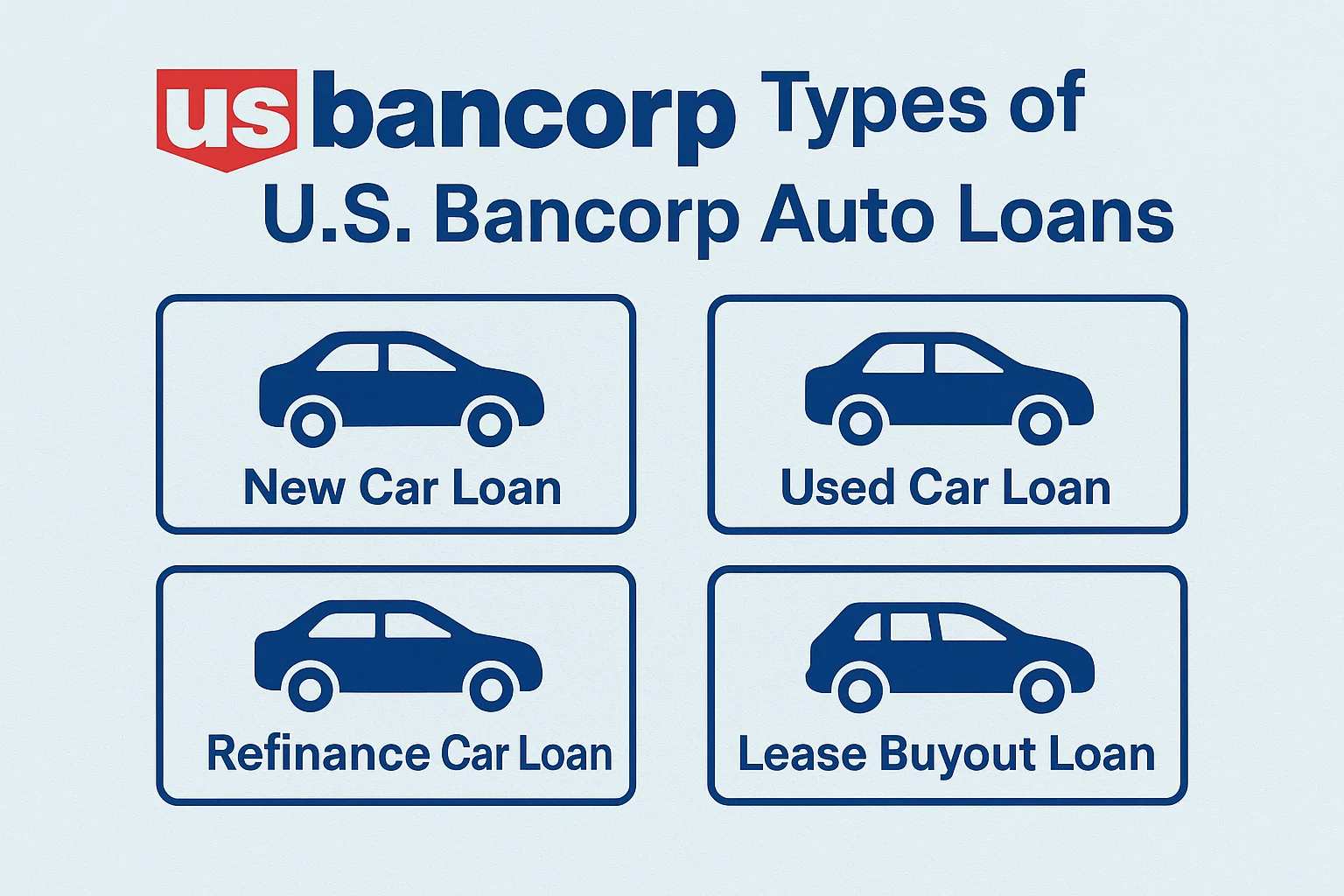

Types of US Bancorp Auto Loans

There are several types of US Bancorp auto loans to fit different vehicle financing needs. Whether you’re buying a new car, purchasing a used one, refinancing an existing loan, or buying out a lease, U.S. Bank provides competitive options with flexible terms and reliable service.

| Loan Type | Starting APR | Loan Amount | Loan Term |

| New Auto Loan | 6.58% | from $5,000 | 12-60 months |

| Used Auto Loan | 6.58% | from $5,000 | 12-60 months |

| Refinance Loan | 7.28% | from $5,000 | 12-72 months |

| Lease Buyout Loan | Varies | Depends on lease | Varies |

New Auto Loans

US Bancorp’s new auto loans are designed for buyers who want to finance a brand-new vehicle through a participating dealership. US Bancorp auto loans for amounts start at $5,000, with terms ranging from 12 to 60 months.

-

Starting APR: 6.58%

-

Loan Term: 12–60 months

-

Loan Amount: From $5,000

Especially, this starting interest rate is lower than the national average, which was 7.42% for 60-month new car loans (as of May 2025). However, to access these rates, you must purchase through a participating dealership within the 48 contiguous states.

Used Auto Loans

US Bancorp also finances used vehicles through the same network of dealerships. Like new auto loans, these start at $5,000, with the same term options.

-

Starting APR: 6.58%

-

Loan Term: 12–60 months

-

Loan Amount: From $5,000

While the interest rate is the same as for new vehicles, approval terms may vary based on vehicle condition and age. Keep in mind, you still need to purchase through a U.S. Bank-approved dealer.

Refinance Auto Loans

If you already have a car loan and want to lower your interest rate or change your term, US Bancorp refinance loans are available. These allow you to refinance existing loans on eligible vehicles.

-

Starting APR: 7.28%

-

Loan Term: 12–72 months

-

Loan Amount: From $5,000

Refinancing through U.S. Bank is a strong option if you have excellent credit. To get the best rates, you generally need a credit score of 800 or higher. Additionally, your vehicle should be less than two years old.

However, refinancing is not available in all states. U.S. Bank just offers refinance auto loans in 47 states. Therefore, if you don’t meet this requirement, you can consider exploring other car loan rates to find a better fit.

Lease Buyout Loans

If you’re nearing the end of your car lease and decide to purchase the vehicle, this US Bancorp auto loan type – lease buyout loans can help. While details on these loans are limited, they’re designed for drivers who want to keep their leased car.

-

You’ll need to prepare your lease agreement and vehicle information to apply.

-

These loans are ideal for those who have maintained their vehicle well and want to avoid starting a new lease or financing agreement elsewhere.

These flexible options make US Bancorp auto loans suitable for a wide range of drivers, from first-time buyers to those looking to refinance or retain a leased car. Be sure to compare each loan type and check eligibility before applying.

Things to Consider Before Financing a Car

Choosing a vehicle isn’t only about picking a color or model but also a financial decision that can affect your budget and US Bancorp auto loan process for years. If you’re planning to finance your purchase, taking the time to think through your priorities will help you avoid costly mistakes.

New Cars vs. Used Cars: Which Is Right for You?

Before browsing listings or visiting a dealership, ask yourself: Should I buy new or used?

New cars offer several advantages. You can often order them to your exact specifications and enjoy full manufacturer warranties. Moreover, you can also avoid concerns about previous damage or wear. Additionally, new vehicles typically require fewer repairs in the early years. However, they come with a higher price tag and depreciate quickly which could impact your long-term mortgage rates or savings plans.

On the other hand, used cars are generally more affordable. They avoid the steepest depreciation and may have lower registration and insurance costs. With the same budget, you might even afford a higher-end model or one with more features. Just be sure to verify the vehicle history and condition.

Finalize Your Budget Beyond the Sticker Price

Budgeting isn’t just about monthly payments but it means thinking holistically. Particularly, buyers should calculate their total financial readiness before car shopping. This includes:

-

Upgrades and options: Many new cars don’t include extras like upgraded infotainment or safety packages in the base price.

-

Insurance costs: Newer cars may raise your premiums depending on the model and features.

-

Fuel economy: Will your new car save or increase your fuel budget?

-

Trade-in value: Know what your current vehicle is worth if you plan to sell or trade it.

-

Loan structure: Loan terms such as length and interest rate directly affect your monthly payment and total cost.

Tip: Use online calculators to test different scenarios and understand what you can comfortably afford, including taxes and fees.

Match the Car to Your Lifestyle and Priorities

Once your budget is set, think beyond looks. Your lifestyle should determine what you drive. You can consider some following elements:

-

Fuel efficiency: Do you commute daily or want to lower your carbon footprint? Hybrid or electric models could be ideal.

-

Passenger space: Consider family needs, especially if you plan to add car seats or carry multiple passengers.

-

Safety ratings: Review crash test results, recall history, and safety technologies like blind spot detection or rear cameras.

-

Performance: Do you value power and agility? Some buyers prioritize turbocharged engines and responsive handling.

-

Weather compatibility: Heated seats, remote start, or AWD might be essential in colder regions.

-

Style and design: While practical factors matter, don’t ignore what you enjoy driving—color, trim, and design all impact long-term satisfaction.

Note: Some features may also impact credit card rewards or insurance rates tied to your vehicle type.

Understand Your Financing Options

Unless you’re paying cash, you’ll need to secure a car loan. This is where comparing lenders becomes critical.

Don’t settle for the first offer from a dealership. Instead, shop around and evaluate different financing options from banks, credit unions, and online lenders because each may offer different:

-

Interest rates

-

Loan terms

-

Down payment requirements

-

Fees or early repayment penalties

Most importantly, choose a lender that offers transparency, digital tools, and flexible terms to fit your needs.

Pro Tip: US Bancorp auto loans offer competitive rates, fast online approval, and financing for new, used, or refinanced vehicles. If you’re ready to apply, it’s worth exploring what they offer.

US Bancorp Auto Loan Application Process

Applying for an auto loan with U.S. Bank is a straightforward process designed to be convenient and efficient. Here’s a step-by-step guide to help you navigate through it:

Gather Necessary Information

Before initiating your US Bancorp auto loan application, ensure you have the following details ready:

-

Desired loan amount

-

Social Security number

-

Employer’s name and address

-

Annual gross income (before deductions)

-

Vehicle information, including lienholder name and payoff amount (if applicable)

Having this information on hand will streamline the application process. They are also relatively useful if you’re already managing related financial products like home loans through U.S. Bank.

Choose Your Application Method

U.S. Bank offers multiple convenient ways to apply for an US Bancorp auto loan:

-

Online Application: Complete a quick online form, which typically takes a few minutes. You may receive a decision within seconds.

-

Phone Application: Call 800-473-6372 or 800-685-5065 (TDD) to apply over the phone. Relay calls are accepted.

-

In-Person Application: Visit your local U.S. Bank branch for personalized assistance with your application.

Await Loan Approval

After submitting your application, U.S. Bank will process it promptly. Most applicants receive a credit decision within two hours during normal business hours. In some cases, you may be asked to provide additional documents, such as proof of income or automobile insurance information.

Receive Approval and Next Steps

When approved, you’ll receive an approval letter via email. This letter contains a code and instructions for you and the dealer to finalize the financing. The approval is typically valid for 30 days and can be used at participating dealerships.

Finalize Your Loan

Once you’ve selected your vehicle at a participating dealership, present your approval letter. The dealer will use the provided code to process the financing. Especially, you need to ensure that all necessary documents are signed, and set up your loan payments through U.S. Bank’s online banking or mobile app for easy management.