In today’s dynamic business landscape, selecting the right banking partner is more than a financial decision. However, Wells Fargo Business Services stands out within the American financial ecosystem, for their comprehensive product suite, nationwide accessibility, and innovative tools

In this post, we’ll walk you through everything Wells Fargo offers business customers, such as account types, application requirements, fees, and hidden benefits. So you can make an informed choice tailored to your company’s goals.

Introduction to Wells Fargo Bank

Wells Fargo is one of the most well-known financial institutions in the United States, serving millions of customers with various banking and financial services. With a strong national presence and nearly two centuries of history, the bank has built a reputation for both reliability and innovation.

History of Wells Fargo

Wells Fargo was founded in 1852 by Henry Wells and William Fargo during the height of the California Gold Rush. The bank originally provided express mail and banking services, using stagecoaches to transport gold, money, and parcels across the western frontier of the United States. That’s why its signature stagecoach logo remains a symbol of its pioneering legacy.

Over the decades, Wells Fargo evolved through multiple mergers and acquisitions, becoming one of the “Big Four” banks in the U.S. It played an instrumental role in supporting economic development across various regions of the country, especially the American West.

Despite encountering regulatory and reputational challenges in the 2010s, Wells Fargo has since undertaken significant reforms and regained customer trust. Due to improved transparency, customer service, and digital innovation. Today, it continues to be a key player in the global financial system, offering services in personal, commercial, and business banking.

General Services of Wells Fargo

Wells Fargo provides a full spectrum of banking services designed to meet the needs of individuals, families, and businesses. These services include:

- Personal Banking: Checking and savings accounts, debit and credit cards, and everyday financial tools.

- Lending Solutions: Home mortgages, auto loans, personal loans, and credit lines for both individuals and businesses.

- Wealth & Investment Management: Financial advisory, retirement planning, and investment platforms like WellsTrade.

- Corporate Banking: Treasury management, commercial lending, and institutional financial services.

- Business Banking: Dedicated products such as business checking accounts, credit and financing solutions, merchant services, and digital tools like Zelle for Business.

With a focus on digital transformation and customer-first innovation, Wells Fargo continues to support both personal and commercial clients through accessible, secure, and comprehensive financial solutions.

Types of Business Services at Wells Fargo

Wells Fargo offers a comprehensive suite of business banking services to meet the financial needs of small and medium-sized businesses. Wells Fargo ensures that businesses have the right resources to grow, manage operations, and streamline finances. So, this section provides a clear overview of what business banking is and how Wells Fargo supports entrepreneurs through its specialized services.

What are Wells Fargo Business Services?

Business banking includes a range of financial services specifically designed for businesses, as opposed to individuals. These services help organizations manage daily operations, process payments, access funding, and monitor cash flow efficiently.

For small and medium enterprises (SMEs), business banking is essential. Because it allows the separation of business and personal finances, provides access to credit, and supports payroll processing. It also offers tools to manage incoming and outgoing payments securely. In essence, business banking is the financial infrastructure every company needs to operate effectively.

Business Checking Accounts

Wells Fargo provides three main types of business checking accounts, each designed to serve businesses at different stages of growth, such as:

- Initiate Business Checking: Ideal for startups and solo entrepreneurs with fewer monthly transactions. This account comes with basic features and a low minimum balance requirement.

- Navigate Business Checking: A step up for growing businesses that need more flexibility, higher transaction limits, and cash deposit allowances.

- Optimize Business Checking: Tailored for established businesses with complex financial needs, this account offers analysis tools and earnings credit options to help offset fees.

Business Credit and Loans

Wells Fargo offers a wide range of financing solutions to help businesses manage cash flow, invest in equipment, or expand operations, such as:

- Small Business Line of Credit: Flexible funds for short-term working capital.

- Business Advantage Line of Credit: Specifically for newer businesses or those building credit history.

- SBA Loans: Government-backed loans with favorable rates and terms, great for expanding or purchasing real estate.

- Equipment and Vehicle Financing: Loans for acquiring machinery, tools, or company vehicles.

Merchant Services

Accepting payments securely and efficiently is important to any business. Wells Fargo offers merchant services that support, such as:

- Point-of-sale (POS) systems: In-store payment terminals integrated with sales software.

- Online and Mobile Payment Processing: For e-commerce and mobile-first businesses.

- Secure Card Transactions: Accept credit and debit card payments with fraud protection tools.

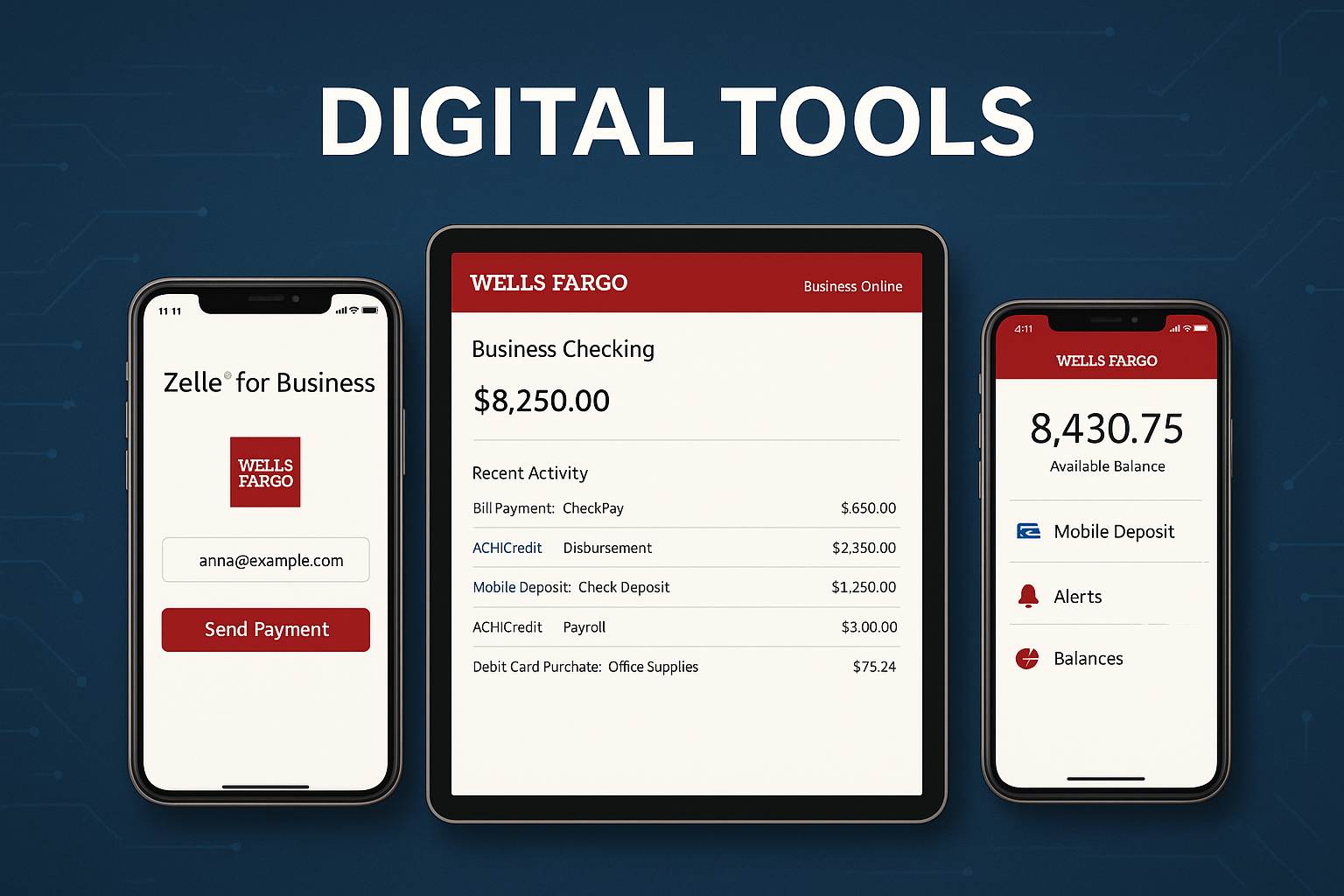

Digital Tools

Wells Fargo enhances the business banking experience with user-friendly, secure digital platforms, such as:

- Zelle for Business: Send and receive payments instantly using email or mobile numbers.

- Wells Fargo Business Online: A robust platform for managing accounts, paying bills, and tracking cash flow.

- Mobile Banking & Alerts: Access accounts on the go, deposit checks, set alerts, and track balances in real time.

Why Choose Wells Fargo Business Services?

Choosing business services, Wells Fargo offers several competitive advantages for entrepreneurs and growing companies, such as:

- Nationwide Access: Over 4,500 branches and 12,000+ ATMs for convenient service and deposits.

- Reliable Digital Banking: Top-tier business mobile app and online platform for 24/7 access to your finances.

- Cash Flow Forecasting: Tools and alerts help you stay ahead of expenses and incoming revenue.

- Business Credit Cards: Options with cashback and rewards to match your spending habits.

- Flexible Lending Options: From lines of credit to SBA-backed loans, financing is tailored to business stages.

- Accounting Integration: Sync your accounts with QuickBooks and other popular software for smooth bookkeeping.

Besides, don’t forget to explore Wells Fargo auto loans—an excellent choice if you’re also planning to upgrade your vehicle.

Wells Fargo Business Services: Eligibility

Before opening a business bank account with Wells Fargo, applicants must meet specific eligibility conditions. These requirements ensure that businesses are properly registered, authorized to operate in the U.S., and that account holders are legally able to manage financial services on behalf of the company.

Who can apply for Wells Fargo Business Services?

Wells Fargo accepts applications from the following types of legal business entities, such as:

- Sole Proprietors: Individuals operating a business in their capacity.

- Partnerships: Two or more individuals or entities jointly managing a business.

- Limited Liability Companies (LLCs): Legally separate entities offering liability protection for owners.

- Corporations (S-Corp and C-Corp): Fully incorporated businesses recognized by the state and federal government.

- Non-Profits or Trusts: Organizations with a valid Employer Identification Number (EIN) and appropriate legal documentation.

These structures allow a wide range of businesses to access Wells Fargo services, regardless of size or industry.

Other Conditions to Note

In addition to entity type, applicants must also meet the following general requirements, such as:

- Minimum Age: The account holder or applicant must be at least 18 years old.

- Identification: A valid government-issued photo ID (such as a driver’s license or passport) is required.

- U.S. Registration: The business must be legally registered in the United States, either at the local, state, or federal level.

- Operating History: For certain credit services, especially lines of credit or SBA loans, the business may need to show proof of being in operation for at least two years.

Meeting these conditions is essential for accessing the full suite of products available through Wells Fargo’s business banking services. Another way to maximize benefits? Consider investing in or exploring referral programs for additional perks.

Wells Fargo Business Services: Documents & Procedures

Wells Fargo makes the application process for business banking straightforward and accessible, offering both online and in-branch options to accommodate different preferences and business needs. Whether you’re opening a new account or applying for a line of credit, preparing the required documents in advance ensures a smoother and faster experience.

Required Documents for Wells Fargo Business Services

However, specific requirements may vary depending on your business type.

Personal Identification: Government-issued ID, such as a driver’s license or passport

Business Formation Documents

- Articles of Incorporation (for Corporations)

- Articles of Organization (for LLCs)

- Business license (for Sole Proprietors)

- Partnership agreement (for Partnerships)

Tax Identification

- Employer Identification Number (EIN) issued by the IRS

- Social Security Number (SSN) if operating as a sole proprietor

Ownership Structure

- Names and contact information of individuals with 25% or more ownership

- Beneficial owner certification forms (to comply with federal regulations)

Application Process for Wells Fargo Business Services

You can apply for a business bank account from Wells Fargo by following these steps:

- Visit the Wells Fargo website or stop by a Wells Fargo branch

- Select the desired account or credit product for your business

- Submit the required documentation either digitally or in person

- Make an initial deposit if required (via ACH transfer or in-branch)

- Applications are typically reviewed within one to two business days, with accounts becoming active shortly after approval

Being fully prepared with the appropriate documentation not only speeds up the process but also minimizes the risk of delays or follow-up requests from the bank. Besides, to simplify your financial management after closing, consider opening a Wells Fargo checking account.

Wells Fargo Business Services: Terms, Fees & Rates

Understanding the terms, fees, and interest rates associated with business banking products is essential for choosing the right financial partner. Wells Fargo provides transparent pricing across its business accounts and lending solutions. Therefore, this allows business owners to make informed financial decisions based on their company’s needs and activity levels.

Account Fees and Waiver Conditions

Wells Fargo offers tiered business checking accounts, each with specific features and monthly service fees. However, these fees can often be waived by meeting minimum balance or transaction requirements.

| Account Type | Monthly Fee | Waiver Conditions |

| Initiate Business Checking | $10 | Maintain a $500 minimum daily balance or link to a Wells Fargo personal account |

| Navigate Business Checking | $25 | Maintain a $10,000 average balance or $15,000 combined across eligible accounts |

| Optimize Business Checking | Custom Pricing | Fees are determined based on account activity and volume through account analysis |

Additional Notes:

- Fees may apply for overdraft protection, incoming wire transfers, cash deposits exceeding free limits, and returned items.

- Merchant services are priced separately and vary depending on processing volume, industry type, and selected solutions.

Credit and Loan Rates

Wells Fargo offers competitive financing options for small and mid-sized businesses, with rates determined by product type, credit history, and business performance, such as:

- Lines of Credit: Variable interest rates typically start at Prime + 1.75%, depending on creditworthiness and account type.

- SBA Loans: These government-backed loans often feature more favorable terms, with rates starting at Prime + 2.75% or lower based on the loan program.

- Business Credit Cards: Annual Percentage Rates (APRs) range from 17% to 27%, varying by the specific card and the applicant’s credit profile.

Businesses should review current rate disclosures and consult with a Wells Fargo representative to receive personalized estimates based on their financial position.

Wells Fargo Business Services: Bonus Features

Beyond core banking products, Wells Fargo business services include various value-added services designed to support small businesses. These tools go beyond basic transactions in order to help entrepreneurs improve financial management, boost security, and gain insights. Here are some of the key extras that set Wells Fargo apart:

Wells Fargo Works for Small Business

This dedicated platform provides small business owners with a wide range of educational resources, tools, and planning materials, all at no additional cost. Whether you’re starting a business or managing growth, this hub offers:

- Step-by-step business planning guides

- Interactive financial calculators for budgeting, loan forecasting, and cash flow analysis

- Articles and videos covering marketing, staffing, and financial strategy

- Templates for business plans, expense tracking, and financial statements

This platform is especially valuable for new entrepreneurs seeking hands-on guidance in managing their business finances effectively. Besides, maybe you are individuals interested in home loan services, there are many options for you.

Zelle for Business

Zelle is integrated directly into Wells Fargo’s digital banking platform, allowing business customers to send and receive payments quickly using only an email address or mobile phone number.

- Ideal for vendor payments, service provider invoices, or client refunds

- Funds are typically transferred within minutes between enrolled users

- Offers a fast, secure alternative to checks and slower ACH payments

- Helps streamline accounts payable and receivable processes without additional fees

This feature is especially beneficial for businesses with frequent small transactions or remote vendor relationships.

Business Credit Cards with Rewards

Wells Fargo offers a selection of business credit cards that not only provide purchasing power but also deliver valuable rewards and expense controls:

- Earn cashback, points, or travel rewards on everyday business spending

- Options available with no annual fees or introductory APR offers

- Set customized spending limits for employee cards

- Easily track and categorize expenses, improving budgeting and tax reporting

These cards are integrated with online banking tools, so it’s convenient for monitoring and management.

Security and Support Features

Wells Fargo prioritizes the safety and operational continuity of its business customers by providing advanced security measures and responsive support:

- Real-time fraud monitoring to detect suspicious activity and prevent unauthorized transactions

- Customizable alerts for account balances, large transactions, and login activity

- Dedicated small business customer support team, available online and by phone, to resolve issues quickly and professionally

- Secure mobile and online access, using industry-standard encryption and authentication methods

For businesses handling sensitive transactions or customer data, these safeguards provide essential peace of mind.

FAQs for Wells Fargo Business Services

Here are some of the popular FAQ about Wells Fargo business services.

Can I apply for a business account online?

- Yes, Wells Fargo allows you to start your application online and complete it by uploading documents or visiting a branch for final verification.

What’s the minimum deposit to open a business checking account?

- The Initiate Business Checking account has a $25 minimum opening deposit.

Does Wells Fargo offer business credit cards?

- Yes, they offer multiple business credit cards with reward options, including the Business Platinum Card and the Business Elite Signature Card.

How is Zelle integrated into business accounts?

- Zelle can be accessed via the Wells Fargo Mobile app or Business Online portal. So, it allows you to send payments directly to vendors or contractors using their mobile number or email.

What if my business is new and has no credit history?

- Wells Fargo offers the Business Advantage Line of Credit for newer businesses and also evaluates the personal credit score of the business owner for qualification.

Choosing the right financial partner can give your business the momentum it needs to grow confidently and efficiently. However, with decades of experience and a service portfolio tailored to entrepreneurs, Wells Fargo Business Services presents a compelling option for startups and mature enterprises alike.