Opening a checking account shouldn’t feel like a puzzle. If you’re looking for a straightforward option that works well for everyday use, a Zions Bank checking account might be what you need.

With easy online access, clear features, and multiple account types, Zions Bank makes it simple to manage your money without the stress. This guide breaks down everything you need to know about Zions Bank checking accounts. Let’s find out now!

Who Is Zions Bank?

Zions Bank is part of a larger network of banks under the Zions Bancorporation umbrella, one of the most trusted regional banking companies in the western United States. Headquartered in Salt Lake City, Utah, this financial institution has been around for over 150 years, building a strong reputation for customer service and community involvement.

What makes Zions unique is its ability to combine the feel of a hometown bank with the tools and technology of a modern financial provider. Whether you prefer walking into a branch or banking from your phone, Zions Bank offers the flexibility and reliability to match your lifestyle.

What makes the Zions Bank checking account stand out:

- Multiple account options for different financial goals

- Low opening deposits starting at $25

- Free digital tools like mobile banking, eStatements, and Zelle

- Access to over 500 ATMs in their network

- U.S.-based customer support available 6 days a week

- Let’s explore the checking account options available.

Zions Bank Checking Account Choices

Zions Bank checking accounts are designed with different lifestyles and financial goals in mind. Whether you’re opening your very first account or upgrading to something with more benefits, Zions has several personal checking options to choose from:

Anytime Checking

Zions Bank Anytime Checking is the basic personal checking account. It’s designed for everyday use and perfect for anyone who wants simplicity, flexibility, and access to online tools.

Key Benefits:

- $0 monthly service fee

- Only $50 to open

- 24/7 digital banking access

- Mobile check deposit & Zelle

- No-fee ATM access at Zions Bank ATMs

- Visa debit card included

This Zions Bank checking account is best for people who want no-fuss banking. You don’t need to worry about maintaining a balance or meeting special requirements.

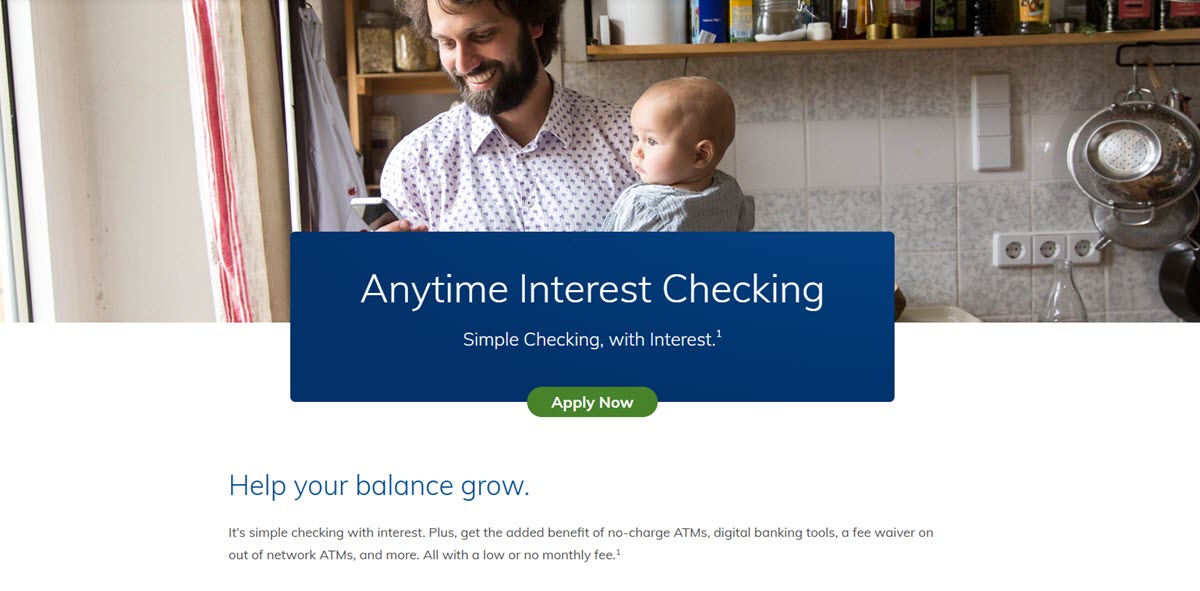

Anytime Interest Checking

Want to earn a little extra on your balance? Anytime Interest Checking gives you all the same features of the basic account, plus interest on your money.

Key Benefits:

- Earn interest (tiered rates starting at 0.05% APY)

- Low $10 monthly fee

- Avoid a fee by keeping a $1,500 balance or $10,000 in combined deposits/loans

- $50 minimum deposit to open

- Free ATM use at Zions Bank and one non-Zions ATM per month

- Mobile banking with Zelle & alerts for suspicious activity

This is a great option for savers who want convenience and growth without opening a separate savings account.

Premium Interest Checking

If you maintain a larger balance and want extra perks, Premium Interest Checking is the top-tier choice. You get better rates and more benefits.

Key Benefits:

- Earn up to 0.13% APY on checking balance

- Premium rates on linked savings or CDs

- $20 monthly charge waived with a $10,000 deposit or a loan amount of $25,000.

- No fees for up to 3 non-Zions ATM withdrawals/month

- No overdraft transfer fees

- Free incoming domestic wire transfer each month

- Discounts on checks & safe deposit boxes

- U.S.-based support & digital access

Premium Interest Checking is ideal for customers who want to make their money work harder and save on banking extras.

OnBudget Banking

If you’re trying to avoid overdraft fees and stick to a clear budget, OnBudget Banking might be for you. It’s a straightforward account with fewer risks.

Key Benefits:

- No overdraft fees, ever

- Flat $5 monthly fee

- Only $25 to open

- Full digital banking features

- Zelle for sending and receiving money

- Paperless statements & mobile alerts

- No ATM fees at Zions Bank ATMs

This Zions Bank checking account is great for students, young adults, or anyone who wants predictability and control.

Military Advantage Checking

Exclusively for active military members, veterans, and their families, this account honors your service with real banking benefits.

Key Benefits:

- $0 monthly fee

- $50 minimum deposit

- Free safe deposit box or $10 off large box

- 3 free withdrawals from non-Zions ATMs per month

- No overdraft transfer fees

- Full mobile and online banking access with Zelle

- Support designed around your needs

This is one of the best military-friendly accounts out there. It combines flexibility, convenience, and cost savings for those who serve.

How to Choose the Right Zions Bank Checking Account

Zions Bank offers several checking options. Here’s a simple side-by-side chart to help you decide which one fits your needs:

| Account Type | Monthly Fee | Can You Avoid the Fee? | Interest Earned? | Minimum Balance | Best For |

|---|---|---|---|---|---|

| Anytime Checking | $0 | No fee to avoid | ❌ No | $0 | Everyday banking |

| Anytime Interest | $10 | ✅ Yes, with $1,500 balance or $10K combined balance | ✅ Yes, up to 0.08% APY | $1,500 | People who want to earn a little interest |

| Premium Interest | $20 | ✅ Yes, with $10K deposit or $25K combined balance | ✅ Yes, up to 0.13% APY | $10,000 | Higher earners or savers |

| OnBudget Banking | $5 | ❌ No waiver available | ❌ No | $0 | Students or budget-focused users |

| Military Advantage | $0 | No fee to avoid | ❌ No | $0 | Active duty or veteran families |

Think about how you use your account and what matters most, such as no fees, no Zions Bank checking account minimum balance, interest, military perks, or spending control. There’s an option for just about everyone.

Shared Features of Every Zions Bank Checking Account

No matter which Zions checking account you choose, you’ll enjoy a solid set of tools that make everyday banking easier. These built-in features are designed to help you manage your money safely, quickly, and conveniently:

- Visa Debit Card: Every Zions Bank checking account comes with a free Visa debit card. You can use it to shop in stores, withdraw cash at ATMs, or make contactless payments. It’s fast, secure, and accepted almost anywhere.

- Zelle for Fast Money Transfers: With Zelle, you can send money to friends, pay your babysitter, or split dinner with your roommate in just minutes. There is no need to download an additional app because it is directly integrated into Zions Bank’s online and mobile banking.

- Online & Mobile Banking: You’re in control 24/7. Check your balance, transfer funds, pay bills, or deposit checks using your smartphone, tablet, or computer. It’s banking that fits your lifestyle, whether you’re at home or traveling.

- Easy Bill Pay: Say goodbye to writing checks. Use the Online Bill Pay feature to schedule one-time or recurring payments for rent, utilities, streaming services, and more. It’s fast, secure, and free with most accounts.

- Go Paperless with eDocuments: Choose to receive electronic statements, tax forms, and account notices instead of paper versions. It’s better for the planet and helps keep your records organized in one place.

- Always-On Access: Even if your branch is closed, your bank isn’t. You can access your account anytime through the mobile app or online banking portal, giving you full control day or night.

- Friendly, U.S.-Based Customer Support: Need help? Zions Bank offers support from real people based in the U.S. You can call or chat with a representative Monday through Saturday, or use their automated phone service 24/7 for account info and basic tasks.

Zions Bank Checking Fees and Cost-Saving Tips

Banking fees can eat away at your money if you’re not careful, but Zions Bank makes it easier to avoid them, especially if you know what to look for.

Zions Bank Checking Account Fees:

| Fee Type | Amount / Condition |

|---|---|

| Monthly Maintenance Fee | $0 – $10 (depends on account type; waivable) |

| Overdraft Fee | $30 per item |

| Returned Item Fee (NSF) | $30 per item |

| Stop Payment Fee | $25 per request |

| Paper Statement Fee | $3 per month (can be avoided with eStatements) |

| Incoming Wire Transfer (Domestic) | $15 per transfer |

| Outgoing Wire Transfer (Domestic) | $25 per transfer |

| Incoming Wire Transfer (International) | $15 per transfer |

| Outgoing Wire Transfer (International) | $45 per transfer |

| ATM Withdrawal (Non-Zions ATM) | $2.50 per transaction + ATM operator fees |

| Debit Card Replacement Fee | $5 per card |

Here are some easy tips if you want to save money:

- Choose e‑statements to avoid the paper fee.

- Use Zions Bank ATMs to skip out-of-network surcharges.

- Set up overdraft protection because it’s cheaper and safer.

- Monitor your account regularly with the mobile app to avoid accidental overdrafts.

Zions Bank Checking Account Requirements (2025)

Before you can open a checking account at Zions Bank, here’s what you’ll need to prepare:

- Valid ID: Provide a valid government-issued photo ID (like a driver’s license, passport, or state ID) and your Social Security Number (SSN) or Taxpayer Identification Number (TIN).

- Basic Personal Information: You’ll need to share your full name, date of birth, address, phone number, email, and SSN. This info is needed whether you open your account online or at a branch.

- Opening Deposit: Each account type has a small minimum deposit to get started:

- Anytime Checking: $50

- OnBudget Banking: $25

- Premium Interest Checking, Anytime Interest Checking, and Military Advantage Checking: $50

- Online Application: Most Zions Bank checking accounts can be opened online in just a few minutes. You’ll need to upload your ID and enter your personal details during the process.

- Fresh Start Option: If you’ve had trouble opening an account before, maybe due to past overdrafts, Zions Bank may offer you a Fresh Start Checking account. Approval depends on your situation and the bank’s review.

How to Open a Zions Bank Checking Account

Getting started with Zions Bank is quick and simple, both online and in-person at a branch. Here’s how:

- Pick the Account That Fits You: Visit the Zions Bank website or speak with a banker in person. Take a moment to compare accounts based on fees, benefits, and interest options.

- Prepare Your Information: You’ll need a few things to apply, which are mentioned in the previous section.

- Apply Online or In-Person: Many accounts can be opened online in just a few minutes. If you prefer face-to-face help, visit a local branch where a banker can walk you through the process.

- Add Money to Your Account: You can fund your account by:

- Transferring money from another bank

- Depositing a check

- Using cash at a branch

- Download the Mobile App: Once your account is open, install the Zions Bank mobile app. This lets you:

- Check balances and deposits

- Send money using Zelle

- Set up bill payments

- Get alerts for suspicious activity

You can also enable paperless statements and manage your finances on the go, all in one app.

Bonuses & Perks of Premier and Interest Checking

If you want more than just the basics, Zions offers upgraded accounts with added value.

With Anytime Interest Checking, your balance earns interest, so your money is working for you, even while it’s sitting in your account. This account also gives you access to Zions’ loyalty benefits, like discounts on other services and priority customer support. It’s a smart pick if you tend to keep a steady balance and want a little something extra in return.

Then there’s Premier Checking, Zions Bank’s premium checking option. This account is designed for customers who want a more complete banking experience. Not only does it offer a higher Zions Bank checking account interest rate, but it also waives monthly service fees on certain linked accounts, like savings or money market accounts. That means if you bundle your accounts under the Premier plan, you could end up saving even more.

Premier Checking also gives you access to special financial tools, personalized banking support, and other perks that make your everyday finances easier to manage. It’s a great option for those who want convenience, rewards, and better rates all in one place.

In short, if you keep a higher balance or want to unlock extra benefits, these upgraded checking accounts can offer real value beyond just basic banking. Zions Bank gives you the flexibility to start simple or level up when you’re ready.

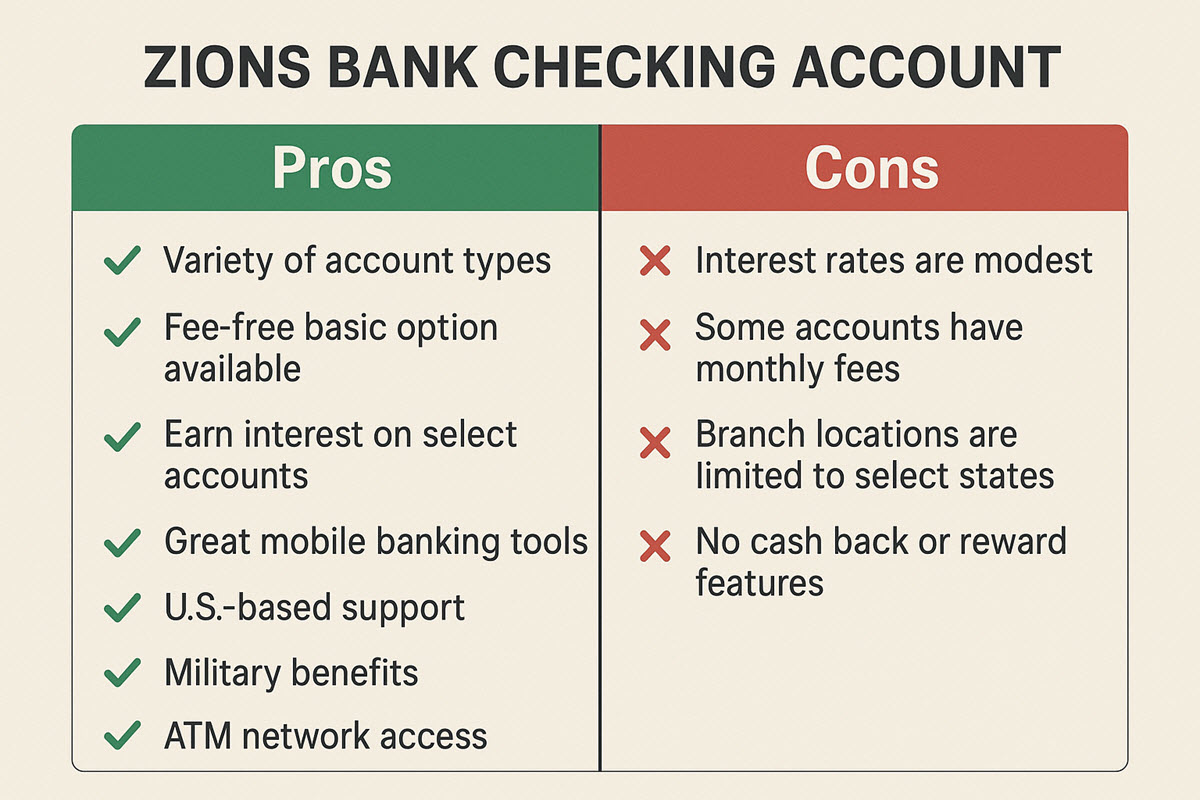

Pros and Cons of Zions Bank Checking Accounts

Before opening a checking account with Zions Bank, it’s smart to weigh the pros and cons to see if it’s the right fit for your needs:

Pros

- Variety of account types

- Fee-free basic option available

- Earn interest on select accounts

- Great mobile banking tools

- U.S.-based support

- Military benefits

- ATM network access

- Zelle included

Cons

- Interest rates are modest

- Some accounts have monthly fees

- Branch locations are limited to select states

- No cash back or reward features

Zions Bank Checking Account FAQs

What is the Zions Bank checking routing number?

- Zions Bank uses the routing number 124000054 for direct deposits, wire transfers, and other electronic payments.

Does Zions Bank cover out-of-network ATM fees?

- Yes, some Zions Bank accounts, like Premium or Premier Checking, offer fee refunds for a few non-Zions ATM withdrawals each month.

How fast are Zelle transfers with Zions Bank?

- Most Zelle transfers go through within minutes, as long as both people are enrolled and their banks support instant transfers.

Is Online Bill Pay included with Zions Bank checking accounts?

- Yes, every Zions Bank personal checking account comes with free Online Bill Pay through online and mobile banking.

Can I open a Zions Bank checking account online?

- Yes, you can open most Zions checking accounts online in just a few steps. You can also choose to open one at a local branch.

In conclusion, a Zions Bank checking account could be the next smart step. With modern features, fair fees, and a range of account choices, it’s built to work for the way you live today. Take a moment to consider your options, and you might just find your ideal fit.