If you’re searching for flexibility, reliability, and no surprise fees, a Fifth Third Bank checking account might be exactly what you need. With more than 160 years in business and over 1,100 branches across 10 states, this bank offers a solid mix of traditional support and modern tools.

So, is a Fifth Third checking account the best choice for your everyday banking? In this full review, we’ll walk through account types, features, fees, digital tools, and customer perks to help you decide with confidence.

Introduction to Fifth Third Bank Checking Account

Whether you’re new to Fifth Third or just comparing options, this section will break down the bank’s background and the core checking accounts they offer, so you know what to expect.

Is Fifth Third a Good Bank?

Fifth Third Bank is one of the oldest and most trusted regional banks in the United States. It was founded all the way back in 1858, giving it more than 160 years of experience in serving customers. The bank is headquartered in Cincinnati, Ohio, and operates more than 1,100 branch locations across 10 states. That means if you live in the Midwest or Southeast, there’s a good chance there’s a branch near you.

In addition to physical branches, Fifth Third offers access to over 2,400 fee-free ATMs, so you can withdraw cash without extra charges. And like most major banks, it is FDIC-insured. That means your money is protected up to $250,000 per account holder, giving you peace of mind.

Overview of Fifth Third Bank Checking Account Types

Fifth Third Bank offers several checking account options to fit a wide range of needs and lifestyles. Whether you’re a student opening your first account, a professional looking for premium perks, or someone who just wants a simple way to manage money without fees, there’s something for you here.

Here are all the types of Fifth Third Bank checking account options:

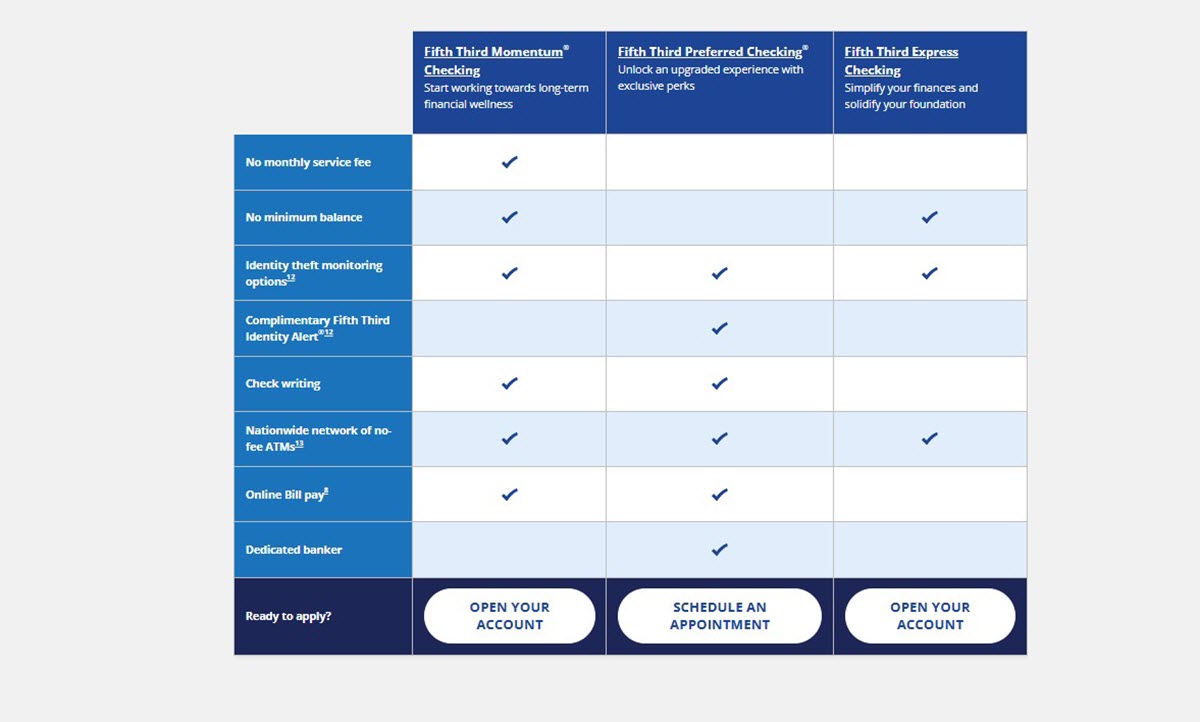

- Momentum Checking: A free checking account for everyday use with no monthly fees or minimum balance.

- Preferred Checking: A premium account that includes special benefits, such as better loan rates and identity protection.

- Student Checking: Made for teenagers and college students, this account is simple, fee-free, and easy to manage.

- Military Checking: Designed for military families, this account includes unique perks like ATM fee waivers and loan discounts.

- Express Banking: A straightforward account that helps you manage cash and avoid overdraft fees.

- ABLE Checking: For individuals with disabilities, this account offers financial flexibility while protecting access to government benefits.

Each Fifth Third Bank checking account is built with specific customers in mind, and we’ll go over the details of each option in the next section to help you decide which one fits you best.

What Fifth Third Bank Checking Accounts Offer

Now, let’s break each one down in detail.

Momentum Checking

Momentum Checking is Fifth Third’s most popular checking account. It’s one of the few truly free checking accounts left in 2025.

Features:

- No monthly service fee

- No minimum opening deposit

- No Fifth Third Bank checking account minimum balance requirement

- Access to 2,400+ fee-free ATMs

- Extra Time overdraft grace period

- Early Pay – Access your paycheck up to two days early

- Free online bill pay and mobile check deposit

- MyAdvance cash advance option

This account is perfect if you want stress-free banking with zero monthly fees. Plus, the Extra Time feature gives you until the next business day at midnight to make a deposit and avoid overdraft fees.

However, the Fifth Third Bank checking account interest rate for this account type is 0.00%, making it more suitable for spending and daily use rather than saving.

Preferred Checking

If you keep higher balances or use other services like investment accounts, Preferred Checking might be the right fit.

Features:

- $25 monthly fee, waived with $100,000+ combined balance in deposit/investment accounts

- Unlimited check writing

- Complimentary Fifth Third Identity Alert

- Better loan rates

- Dedicated banker access

- Secondary checking account available

- APY: 0.01%, it provides a small return on balances.

Preferred Checking is ideal for professionals, families with growing assets, or any personal customer managing multiple accounts.

Student Checking

Designed for students aged 13 and older, this Fifth Third Bank checking account helps younger users build smart financial habits without annoying fees.

Features:

- No monthly fees

- No minimum deposit or balance

- Fifth Third debit card

- Unlimited check writing

- Mobile and online banking access

- Free online bill pay

It’s a great choice for high schoolers, college students, or young adults getting their first taste of financial independence.

Military Checking

Fifth Third Bank honors military families with tailored benefits on their checking accounts.

Features:

- No monthly fee for Momentum Checking

- $5 discount on Preferred Checking monthly fee

- 10 free out-of-network ATM transactions per month

- Special VA home loan rates

- Available to all branches of the military, veterans, and certain government services

- Military Checking makes it easier to manage money while on the move or deployed.

Express Banking

Looking for a simple, no-overdraft checking option? Express Banking may be the answer.

Features:

- $5 monthly fee

- No overdraft fees or balance requirement

- Get paid up to two days early

- Instant check cashing and deposits

- Tools to build credit

- Mobile app access and debit card

This Fifth Third Bank checking account is especially helpful for those who prefer a cash-first lifestyle or want to avoid unexpected fees.

ABLE Checking

ABLE Checking helps people with disabilities save for future expenses without losing government benefits.

Features:

- $2 monthly fee, waived if:

- You maintain a $250 average monthly balance

- Or enroll in paperless statements

- Unlimited check writing

- No overdraft or NSF fees

- Tax-free withdrawals for qualified expenses

- Available through participating state ABLE plans

This Fifth Third Bank checking account is designed for accessibility and long-term financial support.

Fifth Third Bank Checking Account Fees

While Fifth Third offers no-fee options, some accounts come with extra charges. Here’s what you need to know.

Fifth Third Bank Checking Account Maintenance Fees

Fifth Third offers a variety of accounts with different fee structures:

Momentum Checking comes with no monthly maintenance fees. You don’t need to keep a certain balance or make regular deposits, just open the account and use it as needed.

Preferred Checking, on the other hand, is designed for customers with more complex financial needs. It has a $25 monthly fee, but there are two main ways to waive it:

- Maintain a combined balance of $100,000 or more across all your Fifth Third deposit and investment accounts.

- Set up at least $500 in direct deposits into the account each month.

If you don’t meet one of those requirements, the $25 fee will apply, so this Fifth Third Bank checking account is better suited for those with higher balances or regular income.

| Monthly Maintenance Fee | Amount |

|---|---|

| Momentum Checking | $0 |

| Express Checking | $5 per month (flat fee, no overdraft charges) |

| Preferred Checking | $25 per month (waived if you hold $100,000+ in eligible accounts) |

| ABLE Checking | $2 per month (can be waived with a $250 average monthly balance or paperless statements) |

Overdraft Fees

Thanks to the Extra Time feature, you can avoid overdraft fees by covering the negative balance by midnight the next business day. If not, it’s:

- $37 per item, max 3 fees/day ($111).

- No charge if overdrawn by $5 or less.

- Opt-in required for debit card overdraft coverage.

ATM Fees

When it comes to using ATMs, knowing where and how much you’ll be charged can save you money over time:

- Fifth Third & partner ATMs: Free.

- Other ATMs: $3.50 per transaction (plus operator fees).

- Foreign ATMs (Express only): $3.00 per use.

Other Fees

- Dormancy Fee: $5/month if no activity on the Momentum account for 12 months.

- Paper statements: May incur a fee unless enrolled in eStatements.

- Check orders, stop payments, wires: Vary by service.

- MyAdvance cash advance: Includes interest and fees based on usage.

Fee Summary & How to Avoid Extra Charges

To sum up, here are some common Fifth Third Bank checking account fees:

| Fee Type | Cost | Waiver/Notes |

|---|---|---|

| Monthly Maintenance | $0–$25/month | Preferred waived with $100K balance or $500 deposit |

| Overdraft Fee | $37/item (max 3/day) | Waived if balance fixed by midnight; no fee under $5 |

| ATM Withdrawal (in-network) | Free | Use Fifth Third or partner ATMs |

| ATM Withdrawal (out-of-net) | $3.50 + operator fees | Applies to most accounts, first 10 free for Military Checking |

| Foreign ATM (Express) | $3.00 | Per transaction |

| Dormancy Fee (Momentum) | $5/month after 12 months inactivity | Activity resets the clock |

| Paper Statement | Varies | Go paperless to avoid fee |

| MyAdvance® Cash Advance | Varies by loan amount and timing | Short-term cash borrowing option |

How to avoid extra charges for your Fifth Third Bank checking account:

- Stick to in-network ATMs: Fifth Third has over 2,400 fee-free ATMs. Using partner machines helps you steer clear of extra ATM fees.

- Go paperless: Opting for electronic statements may waive certain monthly maintenance fees.

- Use overdraft protection tools: Features like Extra Time give you a grace period to cover overdrafts before a fee kicks in.

- Keep an eye on account balances: Especially for Preferred Checking, to avoid the $25 fee.

While Fifth Third gives you the tools to reduce or eliminate many fees, it’s still wise to read the fine print and monitor your activity.

Fifth Third Bank Checking Account: Customer Services and Promotions

Fifth Third Bank offers several ways to get help when you need it. Whether you prefer to talk to someone on the phone or chat online, support is accessible and generally responsive.

Customer Services

Contact Options:

Phone Support:

- Weekdays: 8:00 AM – 6:00 PM (ET)

- Saturdays: 10:00 AM – 4:00 PM (ET)

- Phone Number: 800-972-3030

Live Chat: Available 24/7 through the Fifth Third website and mobile app

Most customers say they receive quick and helpful answers from agents, especially through chat. However, if you rely on physical branches, keep in mind that opening hours can vary by location, and some services may not be available on Sundays.

If you prefer self-service, the website and app both offer useful FAQs, how-to guides, and tools to handle basic tasks without needing to call.

Promotions & Sign-Up Bonuses

If you’re thinking about opening a Fifth Third checking account, there’s more good news: you may be eligible for a cash bonus just for getting started.

Fifth Third Bank often runs promotions for new checking customers. Right now, you can earn up to $350 when you open a Momentum Checking or Express Banking account and meet a few simple requirements.

To earn the bonus for your Fifth Third Bank checking account, you’ll usually need to do the following:

- Open a new, eligible checking account through a specific promotional link or by visiting a local branch.

- Set up direct deposit, which means having your paycheck or government benefits sent directly into the account.

- Make a few debit card purchases or meet a total deposit amount within the required time frame (often 60–90 days).

Make sure to read the fine print, as each offer has specific eligibility criteria and deadlines. You may also need a promo code, which is sometimes available on Fifth Third’s website or from promotional mailers.

How to Open a Fifth Third Bank Checking Account

Opening a Fifth Third Bank checking account is a quick and easy process, whether you prefer doing things online or want help from a banker in person. Just follow these simple steps:

- Choose your account: Select from Momentum, Preferred, Student, or Express based on your needs. If you’re not sure which one is best, Fifth Third’s website has a comparison table, or you can speak to a banker at a local branch for guidance.

- Apply online or in-branch: You can open a Fifth Third Bank checking account in about 10–15 minutes on 53.com or by visiting a local branch.

- Provide basic info: While each account type may have small differences, the core

Fifth Third Bank checking account requirements are similar to most personal checking accounts. To complete your application, you’ll need:- A valid government-issued ID (like a driver’s license or passport)

- Your Social Security Number (SSN) or Tax ID

- A current address

- A funding method (bank transfer, debit card, or cash deposit if in person)

- Fund the account: No minimum deposit is required, but be sure to add money within 90 days to keep the account active. This can be done by:

- Transferring money from another bank

- Depositing a check

- Adding cash at a local branch or ATM

- Set up direct deposit or make debit purchases: This helps you qualify for any sign-up bonuses or fee waivers.

- Download the mobile app: Download the Fifth Third mobile app to access your account anytime, anywhere. So you can manage your money, deposit checks, set alerts, and use Zelle right from your phone.

- Wait for activation: Once your Fifth Third Bank checking account is funded and your identity is verified, activation usually takes just a few business days. You’ll receive your new debit card by mail, typically within 5–7 days.

You’re now ready to start banking, whether online, through the app, or in person at your nearest branch.

Fifth Third Bank Checking: Pros and Cons

Here’s a quick comparison of the good and the not-so-good:

Pros of Fifth Third Bank checking accounts:

- Free Momentum Checking with no minimums

- Get your paycheck early with Early Pay

- Extensive ATM network with 2,400+ fee-free machines

- Excellent mobile banking app

- Special programs for students, military, and individuals with disabilities

- Overdraft grace period (Extra Time)

- Strong social and environmental policies

Cons of Fifth Third Bank checking accounts:

- High overdraft fee ($37) if you don’t use overdraft protection

- Limited branch network (only in 10 states)

- Premium accounts require high balances to waive fees

- No 24/7 phone support (chat only after hours)

FAQs About Fifth Third Bank Checking Account

Is Fifth Third Bank FDIC insured?

- Yes. All checking accounts are insured up to $250,000 per depositor.

How do I find my routing and account number?

- You can find both via online banking, the mobile app, or printed checks. Each region may have a different routing number.

What is the overdraft policy for Fifth Third Bank checking accounts?

- Fifth Third offers Extra Time, giving you until midnight the next business day to fix a negative balance before a fee is charged. If not covered, the overdraft fee is $37 per item, with a max of 3 fees per day. There’s no charge if you’re overdrawn by $5 or less.

Can I open a Fifth Third Bank checking account online?

- Yes. Most checking accounts are available for online application through the Fifth Third Bank website.

How long does it take to receive a Fifth Third debit card?

- After opening a checking account, your debit card typically arrives within 5 to 7 business days by mail. You can also request expedited delivery for an additional fee.

Fifth Third Bank checking accounts are a great blend of flexibility, affordability, and accessibility. While the geographic footprint is limited, the bank delivers a modern and customer-friendly experience, especially for mobile-first users. If you fit the footprint and want straightforward banking with a few smart perks, Fifth Third checking deserves a spot in your wallet.