When it comes to choosing a checking account, simplicity, access, and cost are key. With over 1,000 branches and 3,000+ ATMs across the Northeast, Midwest, and beyond, Citizens is a strong regional player in the U.S. banking scene. But how do Citizens Bank checking accounts actually stack up in 2025?

Whether you’re a student, working professional, or high-balance customer, this in-depth guide will help you decide if Citizens Bank checking account is the right fit.

About Citizens Bank

Citizens Bank, officially known as Citizens Financial Group, is one of the oldest and largest regional banks in the U.S. Founded in Rhode Island and now headquartered in Providence, Citizens Financial Group serves customers in 14 states and Washington D.C, heavily focus on the Northeast and Midwest. The bank manages over $220 billion in assets and offers a full suite of financial products, from checking and savings accounts to loans, investment services, and credit cards.

With more than 1,078 branches and 3,200 ATMs, Citizens offers a physical presence that many online banks don’t. The bank also invests heavily in digital tools, offering a solid mobile experience.

You may want to consider Citizens Bank if:

- You live in one of the 14 states (or D.C.) where it operates.

- You prefer traditional banking with branch access.

- You’re looking for easy ways to avoid monthly fees.

- You don’t prioritize high savings interest rates.

- You want basic checking with early direct deposit.

However, while Citizens Bank offers excellent in-person banking experiences in its coverage areas, it doesn’t operate branches in 36 U.S. states. If you live outside its footprint, this can be a major limitation.

Citizens Bank Checking Account Options

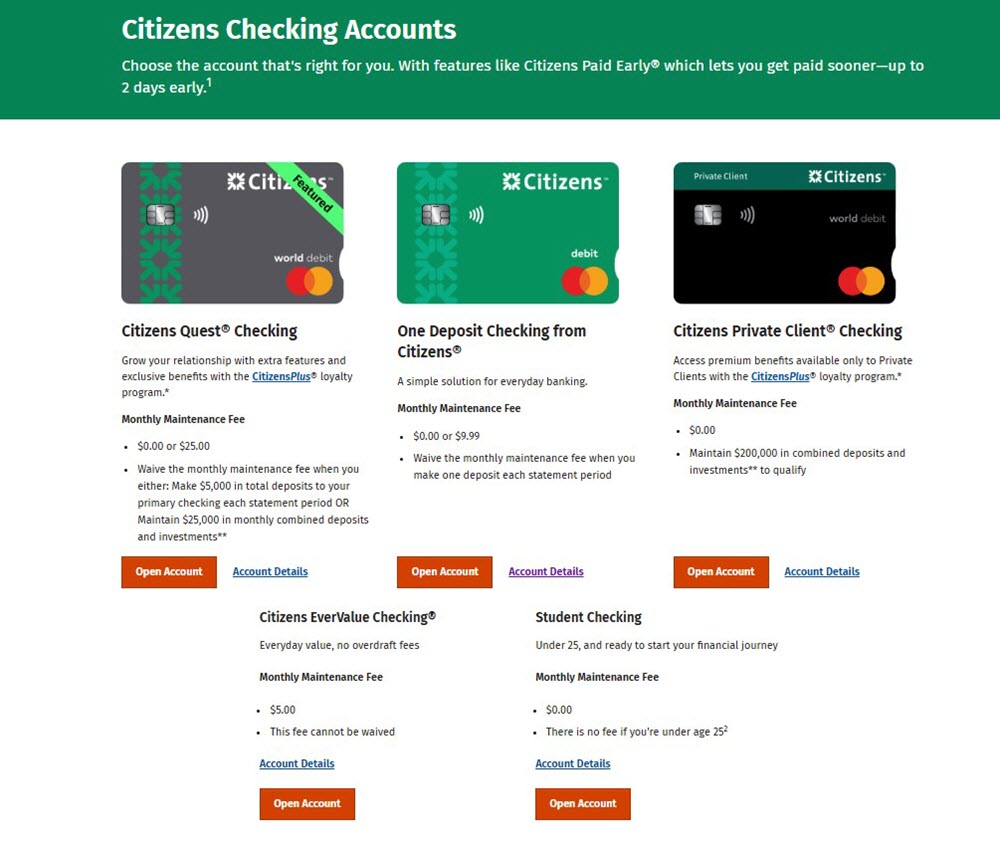

Citizens Bank offers five main personal checking accounts. Each Citizens Bank checking account serves different financial needs. Let’s break them down one by one:

One Deposit Checking from Citizens

This is Citizens’ most popular and accessible account. It charges a $9.99 monthly fee, but that fee is waived if you make just one deposit per month of any amount. Yes, even $5 counts.

- Monthly Fee: $9.99

- How to Waive It: Make just one deposit of any amount per statement cycle.

- Minimum Opening Deposit: None

- Overdraft Protection: Optional, via linked accounts or lines of credit

- ATM Fee: $3 at non-Citizens ATMs

Key Benefits:

- Free online banking and mobile deposits

- Easy to waive monthly fee

- No Citizens Bank checking account minimum balance required

- Supports early direct deposit (get paid up to 2 days early)

- Access to Citizens Peace of Mind, a feature that gives extra time to resolve overdrafts

Best For: People looking for a basic, low-maintenance checking account with low requirements.

EverValue Checking

Built for those who want a low-cost, low-risk Citizens Bank checking account. The monthly fee is $5, and it does not include overdraft fees, a huge win if you live paycheck to paycheck.

- Monthly Fee: $5 (cannot be waived)

- Minimum Balance: None

- Overdraft Fees: $0

- Other Fees: Lower fees on paper statements and external ATM usage

Key Benefits:

- No overdraft fees at all

- Great for budgeters or anyone who wants predictable monthly costs

Best For: People who want a simple account and never want to worry about overdraft penalties.

Citizens Quest Checking

This mid-tier Citizens Bank checking account offers rewards and discounts, but at a price. The fee is $25/month, waived if you meet either: $5,000 in monthly direct deposits OR $25,000 combined balance across all your Citizens accounts.

- Monthly Fee: $25

- ATM Fees: None at any ATM

- Overdraft Fee: $35 per item (up to 5 per day)

Benefits include:

- Earn interest (variable rate)

- Fee waivers on services like overdraft protection

- CitizensPlus loyalty perks (e.g., better rates on CDs, loans)

- Free checks, no foreign transaction fees

Best For: Customers with higher income or larger deposits who want premium benefits without upgrading to private client status.

Citizens Private Client Checking

The top-tier Citizens Bank checking account, designed for high-net-worth customers. You’ll need $200,000 in combined Citizens assets to qualify.

- Monthly Fee: None, but you must qualify with $200,000+ in combined balances across deposits and investments

- ATM Fees: None; third-party ATM charges are fully refunded

Features:

- Access to a dedicated financial advisor

- Lower loan and mortgage rates

- Priority customer service

- Earns higher interest than Quest

- Free wire transfers, foreign exchange, paper statements, and customizable checks

This account also unlocks enhanced CitizensPlus perks and discounts across the board.

Best For: Wealthy clients who want top-tier perks and concierge-like banking service.

Student Checking

For customers under 25, this is the best option by far. There’s no monthly fee, no overdraft fees, and access to features like Citizens Paid Early.

- Monthly Fee: $0

- Overdraft Fees: None

Key features:

- Unlimited fee-free transactions at any ATM, including non-Citizens ATMs

- Free customizable checks

Best For: College students and young adults looking for fee-free, low-risk checking.

Elite Checking (select markets only)

In some areas, Citizens offers a premium account called Elite Checking. It includes interest-bearing features and a $15 monthly fee, waived with $25,000 balance.

It sits somewhere between Quest and Private Client in terms of features and access.

Citizens Bank Checking Account Monthly Fees

Here’s a summary of Citizens Bank checking account fees and how to waive them:

| Account Type | Monthly Fee | How to Waive It |

|---|---|---|

| One Deposit Checking | $9.99 | Make one deposit per month |

| Quest® Checking | $25 | $5K direct deposit or $25K balance |

| Private Client® | $0 | Must maintain $200K assets |

| EverValue® Checking | $5 | Fee is fixed; no waivers |

| Student Checking | $0 | Automatically waived under age 25 |

| Elite Checking | $15 | Maintain $25K in combined accounts |

However, there are still a few costs to be aware of:

| Fee Type | Cost |

|---|---|

| Non-Citizens ATM Use | $2.50–$3 per transaction |

| Overdraft Fee (Most Accounts) | $35 per item (max 5/day) |

| Wire Transfer (Domestic) | Varies by account type |

| Paper Statement Fee | May apply to some accounts |

| Foreign Transaction Fee | Waived for Quest & Private |

Citizens Bank Checking Account: ATM Access & Branch Access

When you open a checking account at Citizens Bank, you get access to over 3,200 ATMs that are part of their own network. These ATMs are usually free to use, so you can withdraw cash or check your balance without paying anything extra.

If you live in New England, the Mid-Atlantic, Midwest, or Florida, Citizens is easy to access. Many branches are located inside Stop & Shop or other local supermarkets, which is super convenient. They also offer extended weekday hours in some markets.

But if you’re outside their footprint, ATM access is limited, and customer support may feel distant.

So what if you use an ATM that doesn’t belong to Citizens Bank? That’s where fees can start to add up.

- You’ll be charged $3 per transaction just for using an out-of-network ATM.

- On top of that, the owner of that ATM (like another bank or store) may charge their own fee, which is often $2 to $4.

So if you use the wrong ATM, you could end up paying $5 to $7 or more just to get your money.

However, if you have a Quest Checking or Private Client Checking account, you may get these ATM fees refunded. The number of refunds and how much you get back depends on your specific account benefits, so it’s worth checking the details if you travel a lot or often need cash.

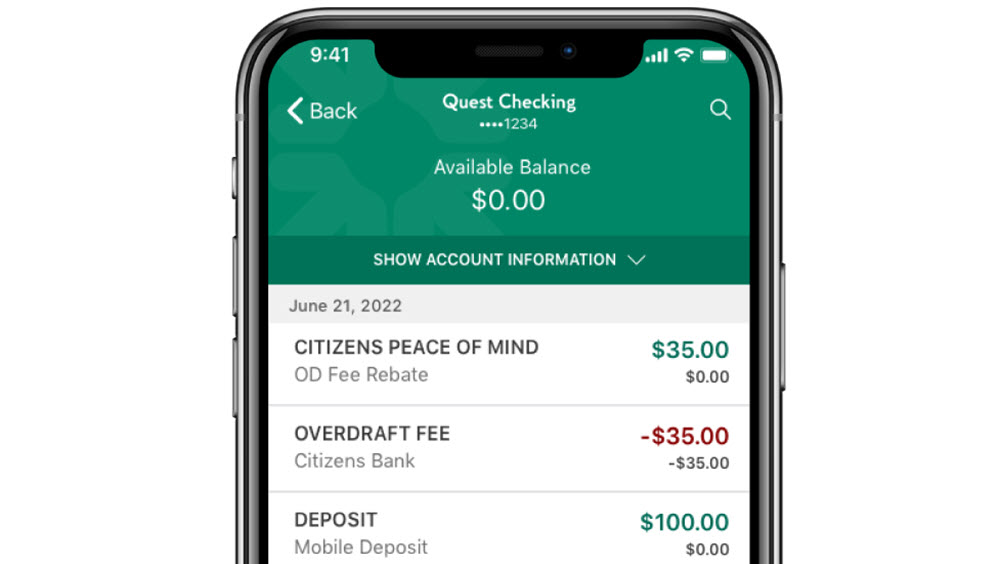

Citizens Bank Overdraft Policies

If your Citizens Bank checking account balance drops below zero and you spend more money than you have, that’s called an overdraft. Unfortunately, Citizens Bank charges a high fee when that happens, unless you have certain special accounts.

Here’s how it works for most standard checking accounts:

- You’ll be charged $35 for each overdraft transaction.

- This can happen up to 7 times a day, which means you could pay as much as $245 in one day just in overdraft fees.

That can really hurt your wallet if you’re not paying attention to your balance.

But there’s some good news: If you open a Student Checking or EverValue Checking account, you won’t be charged any overdraft fees at all. These Citizens Bank checking accounts are designed to be more forgiving, especially for young adults or people who want to avoid extra charges.

Citizens also offers overdraft protection, which lets you link a savings account to your checking. If you don’t have enough money in your checking account, funds will automatically transfer from your savings to cover the shortfall. This can help you avoid the $35 overdraft fee, but keep in mind that:

The transfer itself may come with a small fee, unless you’re in a Quest or Private Client account, which may waive it.

Interest Rates of Citizens Bank Checking Account

If you’re hoping to make money on the cash in your checking account, Citizens Bank may not be the best option. Most of their checking accounts either don’t pay interest or offer very low interest rates.

Here’s a breakdown:

- One Deposit Checking earns no interest at all (0%).

- Quest Checking earns some interest, but the exact rate isn’t listed, and it’s generally very low.

- Elite or Private Client Checking accounts offer variable interest rates, but even those are still lower than the national average.

So if growing your money is important to you, especially on a daily balance, you may want to consider putting your funds in a high-yield savings account or look at online banks that offer better interest on checking.

In short, Citizens Bank is a good choice if you care about reliable service, helpful tools, and local branch access. But it’s not the place to go if you’re looking to earn more from your balance.

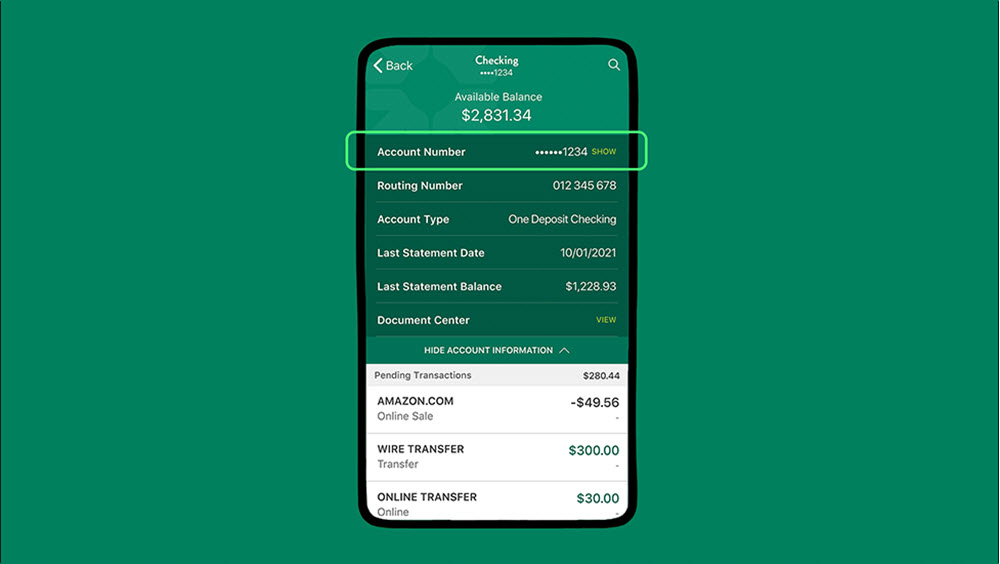

Digital Tools & Mobile App

Citizens Bank has built a strong reputation for its mobile banking experience. Their app is available on both iOS and Android, and it comes packed with features that make managing your money easier than ever.

With the Citizens mobile app, you can:

- Send and receive money instantly using Zelle

- Deposit checks just by taking a photo

- Pay bills online without writing a check

- Set up real-time alerts to track your balance and spending

- Log in quickly and securely using fingerprint or Face ID

- Use Citizens Paid Early® to access your paycheck up to 2 days sooner

Customers seem to love the app. It has earned 4.7 out of 5 stars on the Apple App Store and 4.5 out of 5 stars on Google Play. That’s higher than the average for many regional and even some national banks.

If you’re someone who prefers to bank on the go, Citizens offers a reliable and user-friendly mobile experience.

Extra Perks for Citizens Bank Checking Account Users

Beyond basic banking, Citizens Bank checking accounts come with some programs designed to make managing your money easier and more rewarding:

Loyalty Program: CitizensPlus

If you have a Quest Checking or Private Client account, you automatically get access to CitizensPlus, the bank’s exclusive loyalty program.

This program offers a range of valuable benefits:

- Lower interest rates on loans like mortgages or personal loans

- Higher returns on CDs and savings accounts

- Fee waivers on services like overdrafts, wire transfers, and more

- Discounts on mortgage closing costs

In short, CitizensPlus rewards Citizens Bank checking account customers who keep larger balances or use multiple products. It’s like getting VIP treatment just for being a more committed customer.

If you qualify, these perks can add real value, especially if you borrow, save, or invest with Citizens.

Citizens Paid Early

All Citizens Bank personal checking accounts are eligible for the Citizens Paid Early program. With direct deposit, your paycheck can arrive up to two days earlier than normal. This feature is automatic once direct deposit is set up, and it’s especially helpful for managing cash flow.

How to Open a Citizens Bank Checking Account

You can open a Citizens Bank checking account in three ways:

- Online – Fastest option; go to CitizensBank.com and select the account type.

- Phone – Call their 24/7 support to apply by phone.

- In Branch – If you live in one of the 14 states served, walk into a local branch.

You’ll need:

- A valid ID (driver’s license or passport)

- Your Social Security Number

- Your mailing address

- A mobile number or email for verification

- Most accounts don’t require an opening deposit.

Right now, Citizens Bank is offering a generous bonus for new checking (and savings) account holders, up to $400 in total. Here’s how it works:

How to Get the Citizens Bank Checking Account Bonus:

- Open a new checking and savings account on the same day.

- Get at least $500 in direct deposits into your new checking account within 60 days to earn $300.

- Deposit at least $100 into your savings each month for 3 months to earn another $100.

- That’s it, $400 total just for setting up and using your accounts.

A Few Notes:

- The promotion is set to expire on July 3, 2025, so act before then.

- Must be a new customer (no Citizens checking in the past 6 months).

- Available in Citizens Bank’s service area (14 states).

Pros and Cons of Citizens Bank Checking Account

Pros:

- Easy to avoid fees on basic checking

- Early direct deposit available

- Strong in-person service in Northeast, Midwest, and Florida

- Free student account and ATM use for young adults

- No minimum deposit required for most accounts

Cons:

- No physical branches in 36 states

- Low APY on checking and savings accounts

- High overdraft fees (unless using EverValue or Student accounts)

- Small ATM network compared to national banks

- Premium accounts require high balances.

Comparing Citizens Bank to Other Major Banks:

| Feature | Citizens Bank | Bank of America SafeBalance | Chase Total Checking |

|---|---|---|---|

| Monthly Fee | $5–$25 | $4.95 | $12 (waivable) |

| Minimum Deposit | $0 | $25 | $0 |

| Overdraft Fees | $0–$35 | No overdraft (transactions decline) | $34 per item |

| Free ATM Access | ~3,200 ATMs | ~16,000 ATMs | ~15,000 ATMs |

| Paid Early Deposit | Yes | No | No |

| Best For | Regional customers | Fee-avoidant users | Widespread access seekers |

Citizens holds its own in terms of usability and simplicity. However, it lags behind national banks in ATM coverage and overdraft flexibility.

You should choose Citizens Bank checking account if:

- You live in a state with Citizens branches.

- You want fee-free or low-fee checking.

- You are a high-balance customer who want loyalty perks

- You like early access to your paycheck.

- You prefer regional banking with a personal touch.

But it’s not ideal for:

- Frequent travelers (ATM fees outside region)

- People who frequently overdraft (unless using EverValue or Student)

- Savers looking to earn interest

Smart Tips to Make the Most of Your Citizens Bank Checking Account

To get the best value from your Citizens checking account, it helps to be a little strategic:

- Choose an account with no monthly fee or make sure you meet the waiver.

- If you’re a student, go with Student Checking, no fees, no overdraft.

- Avoid out-of-network ATMs to dodge high fees.

- Use direct deposit to get paid early and help with fee waivers.

- Keep track of your balance using the mobile app to avoid overdrafts.

In short, Citizens Bank checking account is a good choice if you’re a student, someone who likes visiting branches, or you keep a large amount of money in your accounts. It offers helpful tools, solid customer support, and a few great perks for loyal users. However, if you prefer digital-only banking, travel a lot, or want to earn interest on your balance, you may want to consider other banks that better match those needs.