KeyBank checking account options are built to match your lifestyle, whether you’re managing daily expenses or planning long-term goals. With choices ranging from hassle-free to interest-earning accounts, KeyBank offers flexible solutions for all kinds of banking needs.

In this guide, we’ll break down each account type, highlight their key features, and help you pick the one that fits best. Clear, concise, and up-to-date, everything you need to know is right here.

Overview of KeyBank Checking Account

KeyBank is a regional bank that’s been around for over 190 years. Headquartered in Cleveland, Ohio, it operates more than 1,000 branches across 15 U.S. states, mostly in the Midwest and Northeast. Even though it’s not a national giant like Chase or Bank of America, KeyBank is well-known for its personal customer service and local banking experience.

What Makes KeyBank Different?

KeyBank focuses on making banking easy and stress-free for everyday people. They offer both in-person service and full digital banking, so you can choose what works best for you. From checking accounts to savings, credit cards, loans, and investment products, they aim to provide everything you need to manage your money in one place.

But what really sets KeyBank apart is its focus on simplicity and transparency. Most of its checking accounts have no monthly fees, and its overdraft policies are much more forgiving than many other banks. Plus, KeyBank offers helpful tools like Early Pay (get paid faster) and EasyUp (automatically save as you spend) to help customers build better financial habits.

Why Choose A KeyBank Checking Account?

KeyBank offers several types of checking accounts, each designed for a different type of customer. Whether you’re just starting out with your first account, managing a tight budget, or looking to earn interest on your money, there’s an option for you.

Here’s why people choose KeyBank checking accounts:

- Simple to open online in just a few minutes

- No hidden fees on most accounts

- FDIC insurance to protect your money

- Mobile and online banking with all the features you’d expect

- Access to 40,000+ ATMs through the KeyBank and Allpoint networks

- Overdraft fee forgiveness on small balances

- $300 bonus offer for new Key Smart Checking customers (limited-time).

KeyBank is especially a good fit for people who want a modern banking experience backed by a community-focused bank. Whether you’re banking in a branch, online, or through the app, you’ll find that KeyBank checking accounts offer a mix of flexibility, convenience, and value.

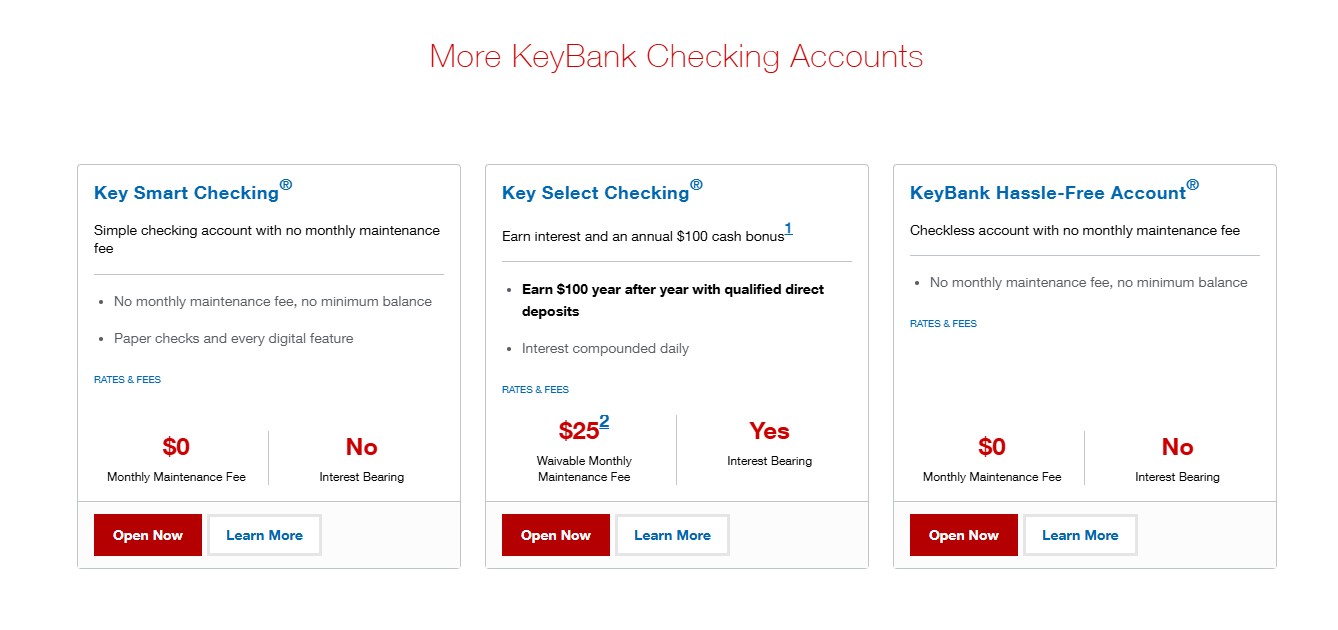

KeyBank Checking Account Options

Next, let’s take a closer look at the main types of checking accounts KeyBank currently offers.

Key Smart Checking

Smart Checking is KeyBank’s most popular everyday account. It has no monthly maintenance fee, no paper checks, and no minimum balance. It’s a fully digital-forward option that pairs well with the mobile app and online banking platform.

Key Features:

- $0 monthly maintenance fee

- No minimum balance required

- $10 minimum opening deposit

- $300 welcome bonus (with qualifying direct deposits)

- Early Pay and EasyUp features included

- Overdraft grace for negative balances under $20

- Digital tools included (mobile check deposit, bill pay, alerts)

- Paper checks available

Keybank Checking Account Bonus Offer: Earn a $300 cash bonus when you open a Key Smart Checking account and receive $2,000 or more in eligible direct deposits within 90 days.

Drawbacks:

- No interest earned

- Overdraft fees of $20 per item if the balance goes below -$20

If you want no-fuss, low-cost banking, this KeyBank checking account is the go-to option.

Key Select Checking

If you maintain a high balance or receive regular direct deposits, Key Select Checking offers more features, including interest and yearly cash bonuses.

Minimum to Open: $50

Fees:

$25 monthly fee, which can be waived if you meet one of these:

- Maintain a $15,000 combined balance across all KeyBank accounts

- Receive $5,000 or more in direct deposits monthly

- You hold a KeyBank mortgage

Key Features:

- Tiered interest (APY around 0.05%)

- ATM fee refunds (up to $6/month)

- One overdraft fee waived per year

- $100 annual relationship bonus

- Free paper checks

- Relationship rates on savings and loans

Drawbacks:

- Monthly fee if you don’t meet the waiver criteria

- Low interest rate compared to online banks

This account makes sense if you carry a larger balance and want your money to work a bit harder.

KeyBank Hassle-Free Account

As the name suggests, the Hassle-Free account is streamlined and stress-free. There are no checks, no minimum balance, and no overdraft fees, because you simply can’t overdraft.

Key Features:

- $0 monthly maintenance fee

- No overdraft fees

- No paper checks

- No minimum balance

- $10 minimum opening deposit

- Free debit card, mobile app, and alerts

- Ideal for seniors, students, and new bank users

Drawbacks:

- No checks

- No interest earned

- Limited to online and debit card usage

This KeyBank checking account is great if you want basic functionality without the risk of overspending.

Key Private Client Checking

This is KeyBank’s premium checking tier, aimed at individuals who need both personal and business-level financial tools. You get access to dedicated financial advisors, investment services, and custom banking solutions.

However, Key Private Client Checking requires maintaining $250,000 or more in combined balances (including deposit, savings, and investment accounts) to avoid fees and remain eligible.

Monthly Fee: $0, requires maintaining $250,000 or more in combined balances.

Minimum Opening Deposit: $50

Key Benefits:

- Dedicated relationship manager

- Enhanced transaction limits

- Customized fees and perks

- Integration with Key Investment Services

Drawbacks:

- Not publicly available; invitation or qualifying assets required

- Details vary based on the financial relationship

If you’re looking for a white-glove banking experience, this account is the top tier.

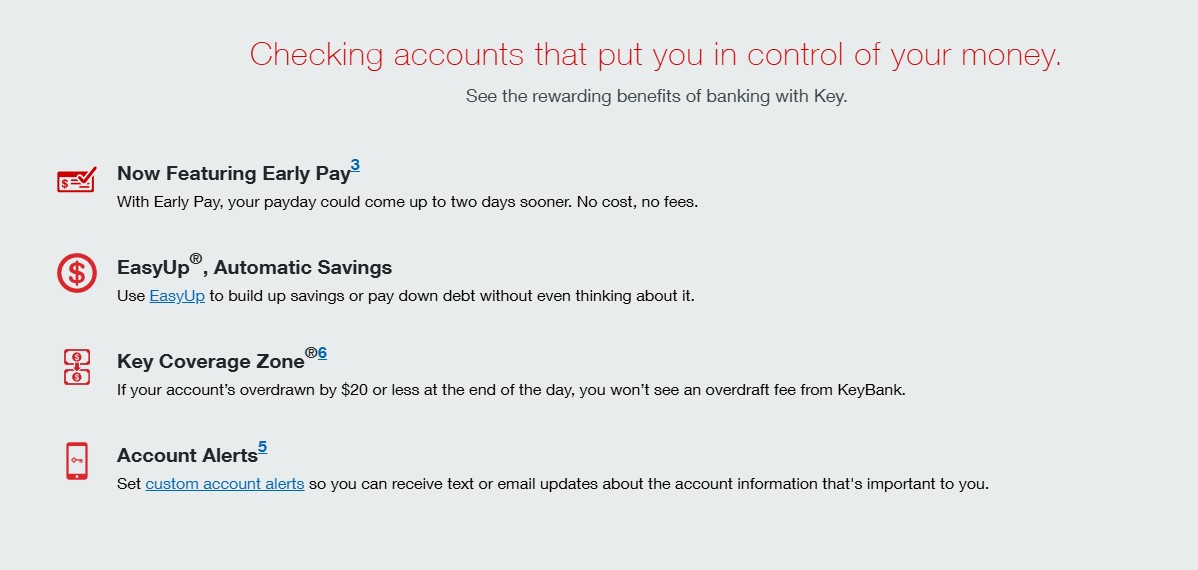

Standout Features Across All KeyBank Checking Accounts

Whether you choose Smart Checking, Select Checking, or Hassle-Free, here are the standout benefits all KeyBank customers enjoy:

- Early Pay: With Early Pay, you can receive your paycheck up to two days early if you set up direct deposit. There are no additional fees, and it applies automatically once you opt-in.

- EasyUp Automatic Savings: Link your checking account to your savings account and automatically round up each purchase to the nearest dollar. The extra charge is transferred to your savings account, helping you save without thinking about it.

- Key Coverage Zone: If your account is overdrawn by $20 or less, you won’t be charged an overdraft fee.

- Standard Overdraft Services are included for checks and automatic payments.

- Optional Overdraft Protection lets you link a savings or credit account to cover overdrafts, without a transfer fee.

- Mobile and Online Banking: KeyBank’s digital banking platform includes:

- Check the deposit via the app

- Real-time alerts via text or email

- Bill pay and transfers

- Zelle integration for peer-to-peer payments

- Nationwide ATM Access: Use any of the 40,000+ KeyBank and Allpoint ATMs nationwide without fees (Select Checking even reimburses third-party ATM fees).

- Debit Card Perks: With your KeyBank Debit Mastercard, enjoy chip security, Tap & Go, and worldwide access wherever Mastercard is accepted.

KeyBank Checking Account Fees

One of KeyBank’s strengths is its transparent fee structure. Here’s a quick breakdown of KeyBank checking account fees by account type:

| Fee Type | Key Smart Checking® | Key Select Checking® | Hassle-Free Account® | Key Private Client® Checking |

|---|---|---|---|---|

| Monthly Maintenance Fee | $0 | $25 (waivable) | $0 | $0 (if $250K in combined balances) |

| Fee Waiver Conditions | N/A | $15,000+ balance OR $3,000+ direct deposits/month | N/A | Maintain $250,000+ across eligible accounts |

| Interest Earning | ❌ No | ✅ Yes | ❌ No | ✅ Yes |

| Overdraft Fee | $20/item over $20 | $20/item over $20 | ❌ None (transactions may decline) | $20/item over $20 |

| Recurring Overdraft Fee | $20 after 5 days | $20 after 5 days | ❌ Not applicable | $20 after 5 days |

| Max Overdraft Charges per Day | 3 items/day (max $60) | 3 items/day (max $60) | ❌ Not applicable | 3 items/day (max $60) |

| Returned Item Fee | $0 | $0 | $0 | $0 |

| ATM Use – KeyBank ATMs | Free | Free | Free | Free |

| ATM Use – Allpoint Network | ✅ Yes | ✅ Yes | ❌ Not eligible | ✅ Yes |

| ATM – Non-KeyBank (Domestic) | $3/transaction | Free (plus $6/month refund) | $3/transaction | ✅ Free Unlimited |

| ATM – International | $5/transaction | $5/transaction | $5/transaction | ✅ Free Unlimited |

| Paper Statement Fee | $3/month | $3/month | $3/month | ❌ Free |

| Wire Transfer – Incoming | Free | Free | Free | ✅ Free |

| Wire Transfer – Outgoing Domestic | $20 | 1 Free/month, then $25 | $20 | ✅ Free |

| Wire Transfer – Outgoing International | $45 | 1 Free/month, then $45 | $45 | ✅ Free |

| Debit Card Replacement (Standard) | Free | Free | Free | ✅ Free |

| Debit Card Replacement (Rush) | $25 | $25 | $25 | ✅ Free |

| Foreign Transaction Fee (Card use) | 3% | 3% | 3% | ❌ None |

| Immediate Funds (Mobile Check Deposit) | 2% (min $2) | 2% (min $2) | 2% (min $2) | 2% (min $2) |

| Stop Payment Fee | $34 | $34 | $34 | ✅ Free |

| Official Bank Check | $8 | $8 | $8 | ✅ Free |

| Money Order | $5 | $5 | $5 | ✅ Free |

How to Choose the Right KeyBank Checking Account

Not sure which KeyBank checking account is best for you? Don’t worry, here’s a quick guide to help you choose based on your lifestyle and banking habits.

- If you’re a student or want a simple, no-fee account, the KeyBank Hassle-Free Account is perfect. It has no monthly fees, no overdraft charges, and no KeyBank checking account minimum balance required. Great for anyone who wants basic banking with no surprises.

- If you get regular paychecks by direct deposit, go with Key Smart Checking. It’s a digital-first account with no monthly fee, plus you may qualify for a $300 KeyBank checking account bonus when you set up direct deposit. It also includes helpful tools like Early Pay and EasyUp.

- If you keep higher balances and want extra benefits, the Key Select Checking account is made for you. While it does have a $25 monthly fee, you can avoid it by maintaining certain deposit or investment balances. In return, you get interest, ATM fee refunds, and even an annual bonus.

- If you manage large assets or need personalized service, consider the Key Private Client Checking account. You’ll work directly with a dedicated advisor and gain access to wealth management tools and custom account solutions.

Taking a moment to think about your spending habits, income flow, and financial goals will help you land the account that fits best. And if your situation changes? You can always switch later.

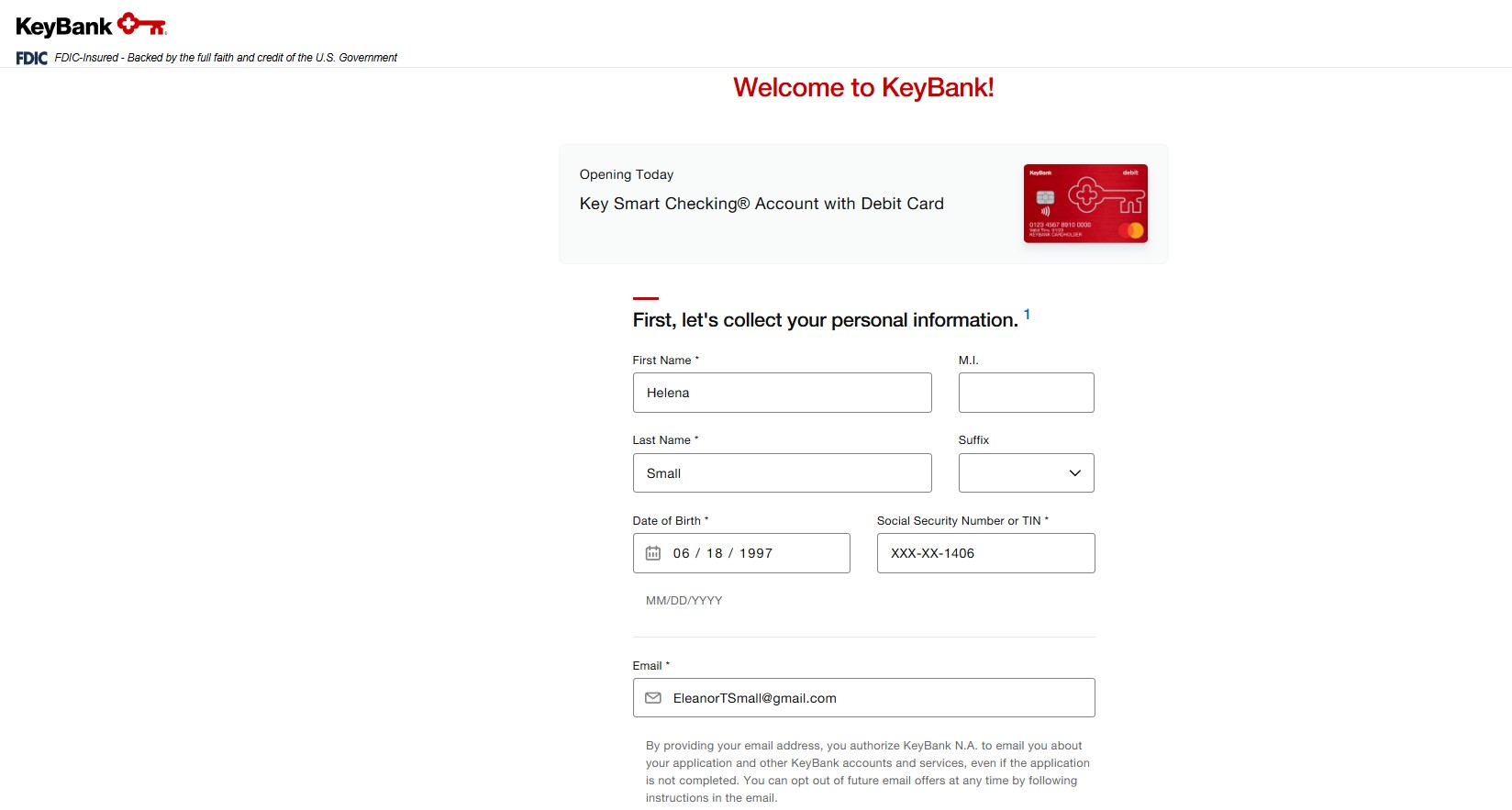

How to Open a KeyBank Checking Account

Opening a KeyBank checking account is fast and straightforward. You have the option of applying online or visiting your nearest branch. Either way, the process typically takes less than 10 minutes if you have the right information ready.

KeyBank Checking Account Requirements

Here’s what you’ll need:

- A valid government-issued photo ID (like a driver’s license or passport)

- Your Social Security Number or Tax ID

- An initial deposit, if your account requires one:

- $10 for Key Smart Checking or Hassle-Free Account

- $50 for Key Select Checking

You can fund your new account using a debit card or transfer from another bank.

Who Can Apply Online?

You can apply for a KeyBank checking account online if you meet all of the following:

- You are 18 years or older

- You are a U.S. citizen

- You live in one of these eligible states: Alaska, Colorado, Connecticut, Idaho, Indiana, Maine, Massachusetts, Michigan, New York, Ohio, Oregon, Pennsylvania, Utah, Vermont, Washington

If you live outside these areas or don’t meet the criteria, that’s okay! You can still apply by visiting a local KeyBank branch near you.

What Happens After You Apply

Once your online application is submitted and approved, you’ll receive a confirmation message with your new account number. Here’s what happens next:

- You can immediately enroll in online and mobile banking, so you can start managing your money right away.

- If you ordered a debit card, expect it to arrive in 5–7 business days.

- If you requested paper checks, they usually arrive in 10–14 business days.

Need help during the process? You can contact KeyBank checking account customer service or visit a branch for in-person support.

How to Use Your KeyBank Checking Account

Once your KeyBank checking account is active, take a few quick steps to make the most of it:

- Enroll in Online Banking: Visit KeyBank’s website or mobile app and look for the “Enroll” or “Enroll in Online Banking” section. Set your username and password, then verify your identity.

- KeyBank Checking Login: Use your credentials to sign in at key.com or on the KeyBank mobile app. You can also use Face ID or fingerprint login for faster access.

- Set Up Direct Deposit: In this way, your paychecks arrive faster (and help you qualify for bonuses)

- Enroll in EasyUp: This feature automatically rounds up your purchases and moves the spare change into savings

- Download the KeyBank Mobile App: Install the free KeyBank mobile app from the App Store or Google Play for easy account management, alerts, and mobile check deposit.

And that’s it, you’re ready to bank smarter with a KeyBank checking account.

FAQs About KeyBank Checking Accounts

Does KeyBank offer overdraft forgiveness?

- Yes. With KeyBank’s Key Coverage Zone, you won’t be charged an overdraft fee if your negative balance is $20 or less at the end of the day.

Can I open a KeyBank checking account with bad credit?

- Yes, you can still qualify. KeyBank doesn’t require a credit check for most checking accounts, but a history of unpaid bank fees may impact approval.

What is the KeyBank routing number for direct deposit?

- KeyBank’s routing number is 041001039, but it’s best to confirm this on your checks or with your local branch, as it varies by region.

How do I qualify for the KeyBank $300 checking bonus?

- To earn the $300 bonus, open a Smart Checking account and receive at least $1,000 in direct deposits within the first 60 days of opening. Terms apply.

Does KeyBank checking come with Zelle?

- Yes, all KeyBank checking accounts include Zelle, allowing you to send and receive money quickly using just an email address or mobile number.

How to close a KeyBank checking account?

- To close your account, visit a local branch or call customer service at 1-800-539-2968. Make sure your balance is $0 before closing.

KeyBank checking accounts offer a solid mix of traditional banking convenience and modern features. Whether you’re just starting out, looking to streamline your finances, or managing wealth, there’s likely an option that fits.