In today’s digital world, credit cards have become essential financial tools that do more than just help you spend money. Among the top providers, PNC Credit Card offerings stand out because they offer variety, user-friendly benefits, and strong support from a trusted U.S. bank. Whether you want cashback, balance transfer options, or business rewards, PNC provides solutions that fit different financial needs.

If you’re looking for reliable credit cards, the PNC Credit Card lineup gives you flexibility. Additionally, it provides strong support through mobile tools, security features, and customer service. In this article, we’ll explain everything you need to know about PNC’s credit cards. We’ll cover definitions and types, then move on to eligibility, terms, and unique rewards. By the end, you’ll know how to pick the card that works best for your lifestyle. Furthermore, you can explore more of PNC’s helpful services like checking accounts, home loans, and auto financing.

Introduction to PNC Financial Services Group

Before choosing a PNC credit card, it’s important to understand the bank behind it. Let’s begin with a quick background of PNC and what it offers its customers.

History of PNC Financial Services Group

PNC Financial Services Group has a rich history that dates back to 1852, when the company was originally established as the Pittsburgh Trust and Savings Company. Over the years, the bank expanded through a series of significant mergers, including the 1983 union of Pittsburgh National Corporation and Provident National Corporation. This pivotal moment gave rise to the name “PNC” and laid the foundation for PNC’s modern identity. Furthermore, this merger marked the beginning of its national growth strategy.

PNC is headquartered in Pittsburgh, Pennsylvania, and has since become one of the largest and most respected banks in the United States. The bank ranks among the top 10 U.S. banks by total assets and operates in more than 20 states. Additionally, it maintains a physical presence that includes over 2,600 branches and more than 9,000 ATMs. With its deep roots and financial strength, PNC continues to serve as a reliable partner for millions of individuals, families, and businesses across the country.

PNC Financial Services Group General Services

PNC operates as a full-service financial institution, providing an extensive range of banking products for individuals, businesses, and institutions. The bank designs its services to support everyday banking needs while also addressing long-term financial planning requirements. Key offerings include:

- Mortgages and Home Equity Loans: Flexible terms for home purchases, refinancing, or borrowing against home value.

- Credit Cards: Options for both consumers and businesses, offering cashback, rewards, and travel benefits.

- Personal and Joint Checking Accounts: Feature-rich accounts with digital access, overdraft options, and spending tools.

- Auto Loans: New and used car financing, as well as refinancing for better rates.

- Business Services: A complete suite of tools under the PNC Business Services, tailored to businesses of all sizes.

- Investment & Retirement Planning: Services for IRAs, mutual funds, and wealth management strategies.

Additionally, PNC’s digital infrastructure enhances customer experience through mobile apps, virtual wallets, and online financial planning tools, making banking both accessible and efficient.

Explore Types of PNC Credit Cards

PNC credit cards work well for different spending habits, making them a flexible choice for many types of users. Whether you’re someone who watches your budget and wants to build credit or a business owner handling daily expenses, PNC offers card options that fit your goals. Moreover, PNC credit cards provide generous cashback programs, long 0% APR periods, and strong security features. As a result, these cards give you both good value and flexibility.

What Are PNC Credit Cards?

A PNC Credit Card is a revolving credit account that PNC Bank issues to help you make purchases, transfer balances, or get cash advances. These cards also come with extra features such as cashback rewards, fraud protection, mobile and online account tools, and special introductory APR offers.

PNC divides its credit card offerings into two main types:

- Personal Credit Cards: Made for individual consumers who focus on everyday purchases, savings, or building credit

- Business Credit Cards: Created for entrepreneurs and companies to manage cash flow and earn rewards on business expenses

Each category offers multiple options. Therefore, there’s a suitable card for every financial need.

Personal PNC Credit Card

These are intended for everyday consumers and offer various benefits depending on lifestyle and credit behavior.

PNC Cash Rewards Visa Credit Card

Ideal for everyday spending, this card is perfect if you want higher rewards in common categories like gas, dining, and groceries. Great for users who track their expenses and want to maximize cash back in rotating lifestyle areas.

Key benefits:

- 4% cash back on gas station purchases, 3% cash back on dining (including takeout and delivery), 2% cash back on groceries

- 1% cash back on all other purchases

- Up to $8,000 combined spend per year in bonus categories

- $200 bonus after spending $1,000 in the first 3 months

- $0 annual fee

PNC Cash Unlimited Visa Signature Card

This card is ideal for users who prefer a flat-rate reward structure without the need to track categories. It offers unlimited cash back on every purchase and suits those with consistent monthly spending patterns.

Key benefits:

- 2% unlimited cash back on all purchases

- $250 welcome bonus after spending $1,000 in the first 3 months

- 0% intro APR on balance transfers for 15 months

- No annual fee

- Visa Signature benefits, including travel protection and concierge service

PNC Spend Wise Visa Credit Card

Perfect for disciplined budgeters, this card rewards users who pay on time and spend responsibly. It’s great for those looking to lower their APR over time while enjoying valuable lifestyle perks.

Key benefits:

- APR reduction of up to 2% after making $3,000+ in annual purchases and on-time payments

- 0% intro APR for 18 months on purchases and balance transfers

- Up to $800 in cell phone protection

- $25 annual credit for eligible subscriptions (Netflix, Spotify, etc.)

- Price protection and extended warranty benefits

- No annual fee

PNC Core Visa Credit Card

This is the best option for users who want low interest rates and a long introductory APR period. It’s a top pick for balance transfers and large upcoming purchases that need time to pay off.

Key benefits:

- 0% introductory APR for 18 months on purchases and balance transfers

- Variable APR after intro: 18.24%–29.24% based on credit

- $0 annual fee

- No rewards program, purely focused on low-interest savings

- Ideal for debt consolidation or financing a major expense

PNC Secured Visa Credit Card

Designed for individuals building or rebuilding credit, this card is backed by a refundable security deposit. It reports to all three major credit bureaus, making it a smart step toward a stronger credit profile.

Key benefits:

- Requires a refundable security deposit as collateral

- Helps establish or repair credit history

- Monthly reporting to major credit bureaus

- Access to online tools and spending alerts

- $0 annual fee

- No rewards program; focused on credit-building

Business PNC Credit Card

For entrepreneurs and businesses, PNC provides options tailored to operational and travel needs.

PNC Cash Rewards Visa Signature Business Card

This card is suitable for small businesses that want straightforward cash rewards on operational spending. It offers high cashback in the first year, making it a strong incentive for startups and freelancers.

Key benefits:

- 3% cash back on all purchases for the first 12 months

- 1.5% unlimited cash back afterward

- No annual fee

- Track spending and manage employees with business account tools

- Visa Signature benefits for business travel and purchases

PNC Visa Business Credit Card

A low-interest option for business owners who prioritize cash flow over rewards. This card is best for managing operational costs, making it a smart tool for everyday business needs.

Key benefits:

- 0% intro APR on purchases and balance transfers for 13 billing cycles

- No rewards program, purely focused on interest savings

- $0 annual fee

- Detailed reporting and spending management tools

- Ideal for companies looking to streamline working capital

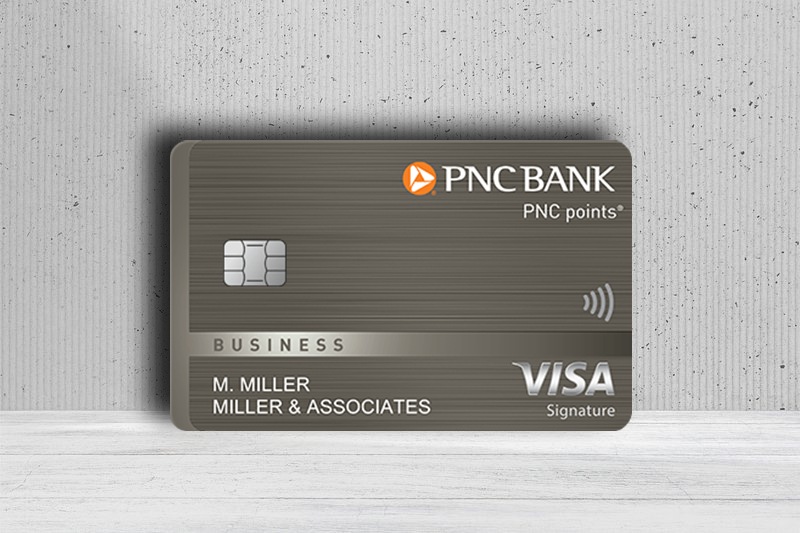

PNC points Visa Business Credit Card

Great for businesses that want flexibility in how they redeem rewards. This card offers high point-earning potential and suits those who prefer redeeming for travel, merchandise, or cash equivalents.

Key benefits:

- 5 points per $1 spent on eligible purchases

- Redeem points for travel, gift cards, or merchandise

- No annual fee

- Online access and employee spending controls

- Additional cardholder benefits for travel and purchase protection

PNC Travel Rewards Visa Business Credit Card

Designed for business owners who travel frequently. This card rewards travel spending and avoids foreign transaction fees, making it a valuable tool for international operations.

Key benefits:

- 2x miles on the first $2,500 of monthly purchases

- 1 mile per $1 after that

- No foreign transaction fees

- No annual fee

- Built-in travel insurance and rental car coverage

PNC BusinessOptions Visa Signature Card

Best for medium to large businesses with more complex needs. It offers customizable reward structures and advanced expense management tools.

Key benefits:

- Choose between cash back, points, or travel rewards

- Manage multiple employee cards with individual limits

- Visa Signature travel privileges and insurance

- Variable APR: 18.49%–24.49% depending on credit

- $0 annual fee

- Expense tracking and account summary tools

Choosing the Right PNC Credit Card for Your Needs

With multiple options available, PNC Credit Cards make it easy to find one that fits your financial goals. Whether you want high cashback, a long introductory APR, or to build credit, there’s a card made for you. Here’s a quick guide to help you choose the best fit:

- Get the most cashback in common categories: Go with the PNC Cash Rewards Visa Credit Card. It works well for those who often spend on gas, dining, and groceries.

- Want a simple rate with no tracking needed: Choose the PNC Cash Unlimited Visa Signature Card, which gives you 2% back on all purchases without rotating categories.

- Want to build good habits and get rewards for smart spending: The PNC Spend Wise Visa helps careful spenders with possible APR reductions and lifestyle perks.

- Need time to pay off purchases or transfers: The PNC Core Visa Credit Card gives you a helpful 0% APR period for 18 months, perfect for large expenses or combining debt.

- Want to rebuild or build credit: Start with the PNC Secured Visa Credit Card, backed by a refundable deposit and monthly credit bureau reporting.

- Run a business and want rewards or travel perks: Look at the PNC Business Credit Card lineup, which includes options for cashback, points, and travel rewards.

PNC designs each card to work well with your spending habits. Furthermore, once you find the right one, consider pairing it with other PNC services like Business Banking, Checking Accounts, or Auto Loans to manage your finances more easily.

Why Choose a PNC Credit Card?

There are several good reasons why a PNC Credit Card stands out in the busy credit card market. Whether you’re getting your first card or want to switch from another provider, PNC offers benefits that bring together convenience, savings, and reliability:

- No Annual Fees: Most PNC credit cards come with a $0 annual fee, helping you save money every year.

- Flexible Rewards: Whether you want a simple 2% cashback on all spending or higher rewards in specific categories like gas and dining, there’s a card that matches what you want.

- Digital Access: You can manage your card anytime with the PNC Mobile App and Virtual Wallet, which give you real-time spending alerts, payment options, and budget tools.

- Welcome Offers: You can take advantage of good cashback sign-up bonuses and 0% APR on purchases or balance transfers—perfect for new users or those combining debt.

- Trusted Company: PNC backs these cards with over 170 years of financial experience, so they deliver reliable service and nationwide support.

Next, we’ll explain who can get a PNC Credit Card and what documents you’ll need to apply. Meanwhile, if you’re thinking about broader financial planning, don’t forget to check out PNC’s Checking Accounts, Home Loans, and Personal Loan options to go with your credit solution.

Who Can Apply for a PNC Credit Card?

Before applying for a PNC Credit Card, you should understand what you need to qualify. These requirements help make sure that people who apply can handle their credit responsibly and get the most from the card’s features.

Eligibility for Individuals

To apply for a PNC credit card, you must meet the following criteria:

- Age Requirement: You must be at least 18 years old to qualify.

- Residency: You must be a U.S. citizen or permanent resident with a valid Social Security number.

- Credit Score: For most regular cards, PNC recommends a credit score of 670 or higher to boost your chances of getting approved.

- Income: You’ll need to show a steady income that supports your ability to pay back any money you owe.

Property, Region, and Other Considerations

Besides individual requirements, there are other factors to keep in mind:

- State Availability: You can get PNC credit cards nationwide. However, in-branch services may be different depending on your region.

- Security Deposit: If you’re applying for the PNC Secured Visa Credit Card, you need to put down a refundable deposit as security.

- Bank Account: While not required, having a PNC checking or savings account can make your credit card application and management process easier.

Knowing these requirements helps you apply with confidence. Additionally, it prepares you for a smoother approval experience.

If you’re ready to grow your financial options, PNC also offers Mortgage Services, Home Loans, and more solutions that fit your needs.

How to Apply: Documents and Procedures

Getting a PNC Credit Card is a simple process, but having the right documents ready can save you time and boost your chances of getting approved. Here’s what you’ll need and how the application process works.

Required Documents

Before starting your application, collect these standard documents:

- Government-issued ID: You need a valid driver’s license, passport, or state ID to confirm who you are.

- Social Security Number: PNC requires this for identity check and credit history review.

- Proof of Income: Recent pay stubs, W-2 forms, or tax returns help show your ability to pay back what you owe.

- Address Verification: A utility bill, lease agreement, or bank statement showing your current address may be needed.

Application Process

PNC gives you multiple ways to apply for a credit card, so you can choose based on what you prefer:

- Online Application: Go to the official PNC website to complete the application in as little as 10 minutes.

- In-Branch Option: Talk with a PNC banker for personal help and suggestions.

- Phone Support: Call customer service to apply by phone or to ask questions before you start.

Once you submit your application, you’ll usually get a decision right away. However, in some cases, it may take up to 7 business days for review and approval.

To make managing your new credit card even easier, consider opening an Investing or Savings account. Furthermore, these accounts can work smoothly with your card through PNC’s mobile and online banking tools.

PNC Credit Cards: Terms, Rates, and Fees

Before choosing any credit card, you need to understand the terms and conditions that come with it. With a PNC Credit Card, you’ll find clear billing practices, good APR offers, and normal fees that match what other companies charge. Below is a detailed breakdown of what you can expect when it comes to payments and interest rates.

PNC Credit Card Service Terms

These are the general rules that apply to most PNC credit cards:

- Billing Cycle: Your account works on a monthly billing cycle, which means PNC creates a new statement every 30 days.

- Minimum Payment Due: You need to pay at least 1%–3% of your balance each month, depending on which card you have.

- Payment Due Date: You must make payments 21 to 25 days after each billing cycle ends. Therefore, this gives you time to avoid interest on new purchases if you pay the full amount.

Interest Rates and Fees of Credit Cards

The following table shows the typical rates and fees that come with PNC’s most popular personal credit cards:

| Card Type | Intro APR | Regular APR | Balance Transfer Fee | Foreign Transaction Fee |

| Cash Rewards | 0% for 15 months | 19.24% – 29.24% | 3% (min $5) | 3% |

| Cash Unlimited | 0% for 15 months | 19.24% – 29.24% | 3% (min $5) | 3% |

| Spend Wise | 0% for 18 months | 20.24% – 30.24% | 3% | 3% |

| Core Visa | 0% for 18 months | 18.24% – 29.24% | 3% | 3% |

These rates may change based on your credit score, and all APRs are tied to the current Prime Rate. You should review your specific card’s terms when you apply.

Additionally, PNC offers helpful tools for budgeting, tracking spending, and doing balance transfers, making it easier to manage debt or plan large purchases.

To improve your financial flexibility even more, consider pairing your PNC Credit Card with long-term solutions like Personal Loans or Mortgage Services. Furthermore, these can support your bigger financial goals.

Bonuses and Perks for PNC Cardholders

One of the most attractive features of a PNC Credit Card is the variety of perks it offers to both personal and business users. PNC delivers more than just credit access through welcome bonuses, ongoing protections, and travel privileges. Instead, it provides added value with every transaction.

Personal Credit Card Perks

PNC credit cards offer competitive rewards and useful everyday protections for individuals:

Cash Rewards: New cardholders can earn up to $250 in sign-up bonuses when they meet initial spending requirements.

APR Reduction: With the Spend Wise Visa, you can reduce your APR by 2% after 12 months of consistent use and on-time payments.

Protection Features: Most cards include important security and purchase protections:

- Extended warranty on eligible purchases

- Purchase protection against damage or theft

- Cell phone insurance when you pay the bill using your card

- Lost/stolen card support with zero fraud liability

Therefore, these features make PNC cards practical for day-to-day use while also adding peace of mind.

Business Card Benefits

PNC builds business credit cards to support growing companies with flexible rewards and management tools:

Flexible Rewards: You can choose between cashback, points, or travel miles depending on which business card you select.

Visa Signature Privileges: Many business cards offer extras like travel insurance, concierge services, and merchant discounts.

Account Controls: You can set spending limits for employee cards, track expenses, and manage statements with ease.

Therefore, these benefits prove especially useful for small business owners who want to streamline spending while gaining more from their operational costs.

Furthermore, PNC provides a wide range of complementary services like Home Loans, Personal Loans, and Business Banking Solutions in addition to credit cards. This ensures that PNC supports all your financial needs under one roof.

FAQs about PNC Credit Card

If you’re considering applying for a PNC Credit Card, you probably have questions. Here are the most common inquiries with clear answers to help guide your decision.

Does PNC offer pre-qualification for credit cards?

- You can check your eligibility online without affecting your credit score. It’s a simple and risk-free way to see which offers you qualify for.

Can I manage my PNC credit card through mobile apps?

- The PNC Mobile app and Online Banking let you check balances, make payments, set alerts, and monitor transactions in real time.

What credit score do I typically need for approval?

- Most unsecured PNC credit cards require a FICO score of 670 or higher. However, PNC offers the PNC Secured Visa card for those with limited or rebuilding credit histories.

How do I redeem rewards?

- For personal cards, you can redeem cashback as a statement credit, direct deposit, or mailed check. For business cards, you can use reward points toward travel, merchandise, or cash equivalents.

Can I upgrade my card later?

- With responsible usage and on-time payments, PNC may offer you the option to upgrade to a higher-tier credit card that better suits your evolving needs.

In today’s financial landscape, choosing a credit card that matches your goals is essential. The PNC Credit Card portfolio offers something for nearly everyone—students establishing credit, professionals earning cashback, or business owners streamlining expenses. With transparent terms, digital banking tools, and trusted service, PNC cards provide reliable choices for both convenience and long-term growth.