One of the key factors homebuyers consider is the interest rate, especially Citi Mortgage Rates continue to attract attention for their flexibility and potential cost savings.

Whether you’re a first-time homebuyer, refinancing an existing loan, or investing in real estate, knowing the latest Citi mortgage offerings will help you make more informed and confident decisions. Let’s discover more detailed information about Citi Mortgage Rates in 2025!

General Introduction of Citi Mortgage Rates

A mortgage rate refers to the interest percentage applied to a home loan. In general, mortgage rates fluctuate based on prevailing economic trends. However, the specific rate offered to a borrower is set by the lender and influenced by several personal factors, including the applicant’s credit score, income stability, debt-to-income ratio, and overall financial profile,…

Citigroup Inc., commonly called Citi, is a leading global financial institution headquartered in New York City. Founded in 1812, Citi has grown to serve over 200 million customer accounts across more than 160 countries and jurisdictions. The bank offers a broad range of financial products and services, including retail banking, investment solutions, and mortgage lending. With its strong reputation for innovation and customer service, Citi remains a top choice for individuals seeking reliable, transparent lending options.

Citi mortgage rates represent the bank’s structured interest rates for various home loan products. Citi is known for offering competitive rates, especially for qualified borrowers with strong credit profiles. In addition, the bank provides flexible term options, personalized financial advice, and exclusive rate discounts for Citigold and Citi Priority customers. These features make Citi mortgage rates particularly attractive for homebuyers looking for both value and service excellence.

Different Types of Citi Mortgage Rates

Citi mortgage rates includes 2 main types, including: fixed-rate and adjustable-rate mortgages.

Fixed-rate Mortgage

A fixed-rate mortgage is a type of home loan where the interest rate stays the same for the entire loan term, typically 15 or 30 years. Consequently, this ensures consistent monthly payments, regardless of changes in the market.

Each month, borrowers pay a fixed amount that includes both principal and interest. The predictability makes budgeting easier and protects homeowners from rising interest rates in the future.

To qualify, borrowers generally need:

-

A stable income and employment history

-

A strong credit score (typically 620 or higher)

-

A reasonable debt-to-income (DTI) ratio

-

Down payment (often 3–20%, depending on the program)

Adjustable-rate Mortgage

An adjustable-rate mortgage (ARM) is a home loan with an interest rate that can fluctuate periodically based on the performance of a specific benchmark.

ARMs typically start with a fixed interest rate for an initial period, for example 3, 5, 7, or 10 years. After this period, the interest rate adjusts at regular intervals (such as annually) based on a benchmark index plus a set margin. These adjustments can cause monthly payments to increase or decrease, depending on market conditions.

To qualify for an ARM, borrowers generally need:

-

A minimum credit score of 620 for conventional ARMs.

-

A debt-to-income (DTI) ratio of 50% or less.

-

Proof of stable income and employment history.

-

A down payment, typically ranging from 3% to 5% of the home’s purchase price.

Fixed-rate Mortgage and Adjustable-rate Mortgage

When considering Citi Mortgage Rates, one of the first choices you’ll face is whether to go with a Fixed-Rate Mortgage or an Adjustable-Rate Mortgage (ARM). Both options offer distinct advantages, depending on your financial goals and how long you plan to stay in the home.

| Feature | Fixed-Rate Mortgage | Adjustable-Rate Mortgage |

|---|---|---|

| Interest Rate Stability | The interest rate remains the same for the entire loan term. | Offers a lower initial interest rate, then adjusts over time. |

| Monthly Loan Payments | Predictable and unchanged, ideal for long-term planning. | Payments can increase or decrease after the initial fixed period. |

| Rate Fluctuation Protection | Protects against rising interest rates; long-term cost predictability. | Includes rate caps to limit how much the rate can rise, but still subject to market movement. |

| Recommended For | Borrowers who want financial consistency and plan to stay long-term. | Buyers who expect to move, sell, or refinance within a few years. |

Different Factors Determine Your Citi Mortgage Rate

Your Citi mortgage rate is influenced by multiple variables that Citigroup consider to assess risk and loan affordability. Understanding these factors can help you prepare and potentially secure a better rate.

Credit Score

One of the most critical factors is your credit score which reflects your creditworthiness. A higher credit score signals to lenders that you are a low-risk borrower. As a result, this leads to a lower mortgage interest rate. Conversely, lower scores may lead to higher rates or even loan denial.

If you’re interested in improving your credit profile, explore credit cards offerings that can help build positive credit history.

Home Location

Citi mortgage rates can vary by geographic area. Different states, and even counties within states, may have varying average rates due to local economic conditions, housing markets, and regulatory environments.

Home Price & Loan Amount

The size of your Citi mortgage loan influences your rate. In particularly, very large loans (jumbo loans) or very small loans may come with higher interest rates. Citigroup Inc. often evaluates loan amounts relative to property value to determine risk.

Down Payment

Generally, the larger your down payment, the lower your interest rate. A significant down payment reduces the lender’s risk because you have more equity in the home upfront.

Loan Term

Shorter loan terms, such as 15 years, usually offer lower Citi mortgage rates compared to longer terms like 30 years. However, monthly payments are higher with shorter terms due to the faster repayment schedule.

Interest Rate Type

Fixed-rate mortgages have a consistent interest rate throughout the loan, while adjustable-rate mortgages (ARMs) start with lower rates that can fluctuate after an initial fixed period. Therefore, the choice impacts your initial rate and long-term payment stability.

Loan Type

Different loan programs have distinct rates and qualification rules. For example, conventional loans, FHA loans, and VA loans each come with unique interest rate structures and eligibility criteria.

Occupancy Status

Whether the property is your primary residence, a second home, or an investment property affects your mortgage rate. Primary residences typically qualify for the lowest rates due to lower default risk.

Home Type

The type of property you purchase also matters. Single-family homes usually have lower Citi mortgage rates because they are considered less risky than condos, townhouses, or multi-family properties.

Your Citi mortgage rate results from a combination of these factors. Improving your credit score, increasing your down payment, and choosing the right loan type and term can help you secure more favorable rates. When considering Citi Mortgage Rates, discuss your unique profile with a loan officer to find the best option for your situation.

Latest Citi Mortgage Rates in 2025

Citi Mortgage Rates remain competitive across multiple loan types, offering flexible solutions for homebuyers and those looking to refinance. These rates are subject to change based on market conditions and borrower qualifications such as credit score, loan amount, and property type,…

Citi Mortgage Rates Overview:

| Mortgage Type | Interest Rate | APR | Points |

|---|---|---|---|

| 15-Year Fixed | 5.875% | 6.119% | 1 |

| 30-Year Fixed | 6.750% | 6.903% | 1 |

Note: “Points” refer to upfront fees paid at closing, where 1 point equals 1% of the loan amount.

-

15-Year Fixed Mortgage

With a lower interest rate (5.875%), this loan allows you to pay off your mortgage faster and save on overall interest payments. However, monthly payments will be higher compared to a 30-year loan due to the shorter repayment period. For day-to-day banking needs while managing your mortgage, consider opening a Checking account with Citi. -

30-Year Fixed Mortgage

Offers lower monthly payments spread over a longer period, making it more affordable month-to-month, but comes with a higher interest rate (6.750%) and results in more interest paid over time.

These rates are typically available for borrowers with excellent credit scores and 20% or higher down payments on a primary residence. On the other hand, borrowers with lower credit scores or smaller down payments may face higher rates or additional mortgage insurance costs.

Additionally, Citi mortgage rates can fluctuate daily based on market conditions, so it’s advisable to lock in your rate promptly once you find an offer that suits your needs.

How To Apply For Citi Mortgage?

Applying for a Citi mortgage involves several important steps and requires specific documentation. Therefore, being well-prepared can help ensure a smooth and timely approval process. Additionally, this allows you to explore related financial products like Auto Loans or credit cards that might complement your financial situation.

Required Documents

To complete your mortgage application, Citi typically requires the following documents:

-

Proof of Identification: Government-issued ID such as a driver’s license or passport.

-

Income Verification: Recent pay stubs (usually last 2–3 months), W-2 forms, and most recent tax returns.

-

Asset Information: Bank statements, investment accounts, retirement savings, or other assets to demonstrate your financial stability.

-

Debt Details: Documentation of existing debts like credit cards, auto loans, student loans, etc.

-

Property Information: Purchase agreement or details about the home you intend to buy or refinance.

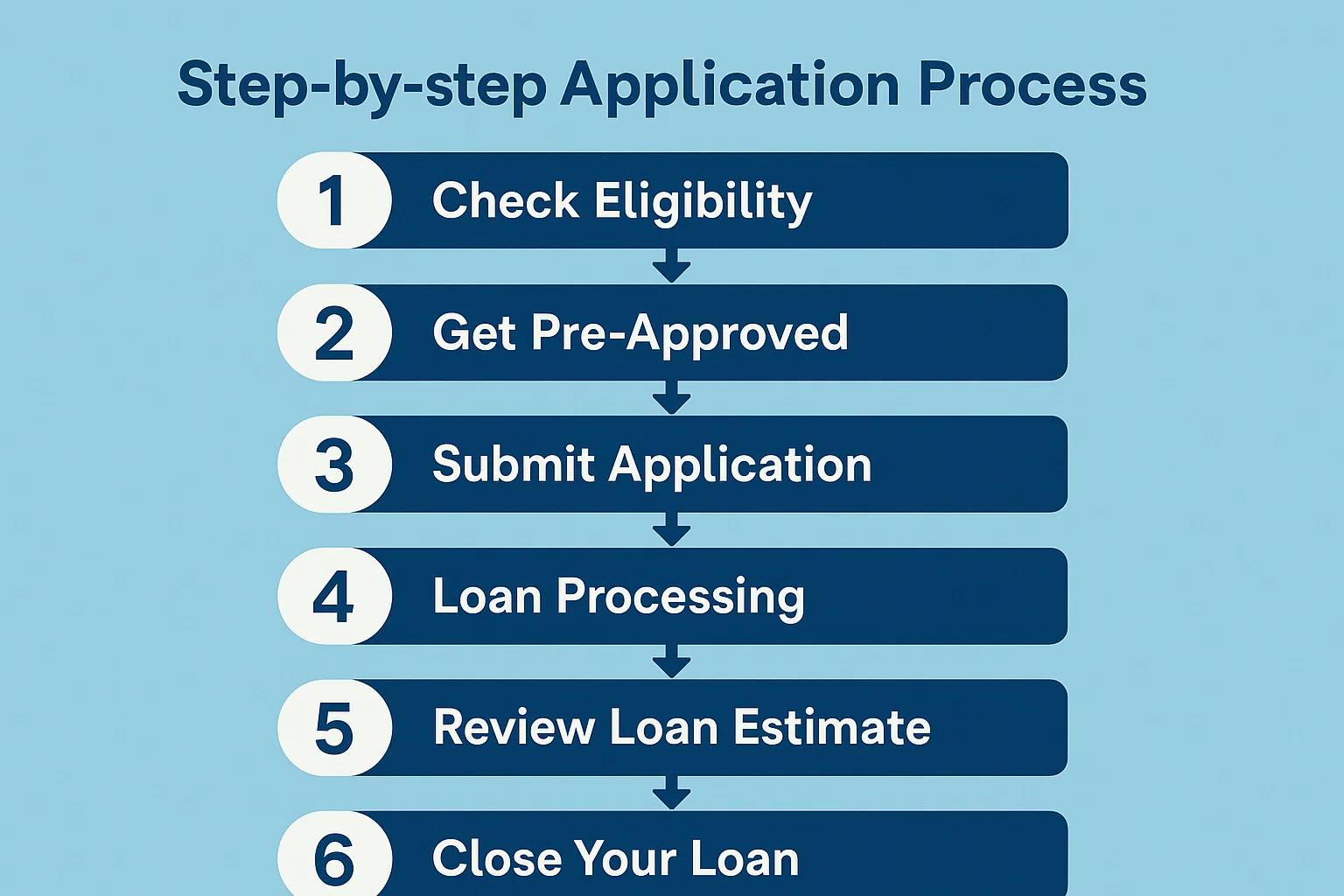

Step-by-step Application Process

The application process for a mortgage with Citi is a straightforward process designed to help you secure financing with confidence. Follow these steps to start your journey toward homeownership or refinancing:

Check Your Eligibility

Before applying, review Citi’s basic requirements:

-

Minimum credit score (usually 620 or higher): If your credit score is more than 620, you tend to be more reliable and in a relatively good shape.

- Your credit history: Lenders review your credit report to assess your past money management such as: payment timeliness, existing debts, and credit history length. Check your report carefully and fix any errors early to avoid delays in your loan process.

-

Stable income and employment history

-

Debt-to-income ratio within acceptable limits: Your DTI compares monthly debts to your gross income so you can calculate it by dividing total monthly debts by your gross monthly income. Lenders prefer a DTI of 36% or less. To improve a high DTI, increase income or reduce debt.

-

Decide on the size of your down payment

-

A traditional 20% down payment helps avoid private mortgage insurance (PMI) and may qualify you for lower Citi mortgage rates, reducing overall loan costs.

-

Lower down payments (as low as 3.5%) are available through programs like FHA loans, making homeownership more accessible but usually require paying PMI, increasing monthly expenses.

-

Some specialized loans offer zero down payment options, though they have specific eligibility requirements and may involve other fees.

-

- Decide how much house you can afford: It’s about balancing your desired features with financial reality, getting what you want without overstretching.

Get Pre-Approved

Start by submitting basic financial information to receive a pre-approval letter. This provides an estimate of how much you can borrow and signals to sellers that you are a serious buyer. In other word, a pre-approval involves a deeper credit and financial review and strengthens your position when making an offer on a home.

It’s a good idea to begin the pre-approval process early, about several weeks or even months before you start making offers. This timing gives you a chance to resolve any issues in your credit history and gather necessary documents.

Keep in mind, mortgage pre-approval letters typically expire after 60 to 90 days, so you should only get pre-approved when you are serious about buying. If your home search takes longer, you can update your documents and go through the process again more quickly, since your lender will already have most of your information on file.

Submit Your Application

You can apply online via Citi’s mortgage portal, over the phone, or in person at a local branch. However, remember to provide accurate and complete information to avoid delays.

Loan Processing and Underwriting

Once your application is submitted, Citi will verify your financial information and evaluate the property appraisal. This step determines final loan approval and Citi mortgage rate offers.

Review Loan Estimate and Closing Disclosure

You will receive detailed disclosures outlining loan terms, estimated costs, and closing details. Review these documents carefully and ask questions if needed.

Close Your Loan

Upon approval, schedule a closing appointment to sign your loan documents, pay closing costs, and finalize the mortgage. After closing, you’ll begin making your monthly payments according to the agreed terms.

Citi Mortgage Rates offer flexible, competitive options for homebuyers, whether you’re buying your first home, refinancing, or investing. Understanding the types of loans, factors affecting rates, and the application process will help you make informed decisions and secure the best terms. Start early, get pre-approved, and prepare your documents to ensure a smooth path to homeownership with Citi. For more details, explore our comprehensive resources on Home Loans.