Citi personal loans have become a go-to solution for individuals seeking flexible and reliable funding whether it’s for home improvements, emergency expenses, or consolidating debt.

Among the leading providers, Citigroup Inc. stands out as a global financial powerhouse offering personal loan products designed to meet diverse customer needs with transparent terms and competitive interest rates. Personal loans from Citigroup are crafted not only for financial flexibility but also to enhance the customer experience.

General Introduction to Citigroup Inc. and Citi Personal Loans

Citigroup Inc.

Citigroup Inc. is a leading global financial institution headquartered in New York City, with a presence in about 180 countries and jurisdictions. With more than 210 years of formation and development, Citigroup Inc has succeeded in making a positive financial and social impact.

Citigroup Inc. provides a wide range of financial services, including: consumer banking, corporate and investment banking. During these years, it has served more than 200 million customers worldwide, consequently enabled growth and economic progress for them.

Personal Loan

A Citi Personal Loan offers a fixed interest rate. You need to repay through consistent monthly installments over a predetermined period. You have the flexibility to select both the loan amount and repayment term, allowing you to tailor a monthly payment plan that fits your financial situation.

Citigroup’s personal loans cater to a wide range of individuals looking for financial flexibility without the need for collateral. Whether you’re planning a major purchase, covering emergency expenses, or consolidating existing debts, it provides a convenient and trustworthy solution to meet your financial goals.

Types of Personal Loans

Citigroup provides a variety of personal loan options to meet diverse financial needs. Understanding these options can help you select the loan that best aligns with your financial goals.

Unsecured & Secured Personal Loans

- Unsecured Personal Loans: Most of Citi’s personal loans are unsecured, meaning they do not require collateral such as a home or car. Approval for these loans is based on factors like creditworthiness, income, and debt-to-income ratio. Unsecured personal loans are suitable for expenses like medical bills, home improvements, or consolidating high-interest debts .

- Secured Personal Loans: A secured personal loan is backed by collateral, which can include a savings account or certificate of deposit. Secured loans often come with lower interest rates due to the reduced risk for the lender. However, failure to repay the loan could result in the loss of the collateral

Variable & Fixed-rate Personal Loans

- Variable-rate Personal Loans: Variable-rate personal loans have interest rates that can fluctuate over time based on market conditions. While they may start with lower rates compared to fixed-rate loans, the payments can vary, making them less predictable. These loans might be suitable for borrowers who anticipate paying off the loan quickly or expect interest rates to decline

- Fixed-rate Personal Loans: Fixed-rate personal loans have an interest rate that remains constant throughout the loan term. This consistency allows for predictable monthly payments, making budgeting more straightforward. Fixed-rate loans are particularly beneficial when interest rates tend to rise.

Debt Consolidation Loans

Citi offers personal loans specifically designed for debt consolidation. These loans allow borrowers to combine multiple unsecured debts, such as credit card balances, into a single loan with a potentially lower interest rate. Consolidating debts can simplify repayment and may reduce the total interest paid over time.

Advantages of Citi Personal Loans at Citigroup Inc.

Choosing a Citi personal loan is more than just borrowing money, it’s about gaining access to a streamlined, secure, and customer-focused lending experience. Here are the key advantages that make Citi stand out among personal loan providers:

Secure and Easy Citi Personal Loan Application

Citi makes the loan application process simple, safe, and fully online. With a user-friendly interface and end-to-end encryption, customers can securely apply from the comfort of their homes. Most applications require just a few steps and can be completed in minutes, with real-time eligibility checks available for existing Citi customers.

Zero Fees on Citi Personal Loans

Unlike many lenders that charge application, origination, or prepayment fees, Citi personal loans come with zero fees. That means no hidden costs. Consequently, what you borrow is exactly what you manage. This transparent fee structure allows borrowers to better plan their finances without unexpected charges eating into their loan.

Lock in a Fixed Rate with Citi Personal Loans

All Citi personal loans offer a fixed interest rate that stays the same throughout the life of the loan. This allows borrowers to lock in a predictable monthly payment, making it easier to budget with confidence. Fixed-rate loans are especially beneficial during times of market volatility or rising mortgage rates.

Get Your Personal Loan Funds Fast with Citi

Citigroup Inc. understands that time-sensitive expenses can’t wait. Once approved, it will deposit funds from your personal loan directly into your bank account quickly, sometimes as fast as the same business day. Whether it’s a medical emergency, urgent home repair, or travel need, you can access the money you need without delay.

By combining flexibility, speed, and transparency, Citi personal loans provide a trusted solution for anyone seeking reliable financing without the stress of hidden costs or lengthy delays.

Eligibility Criteria and Required Documents for Citi Personal Loans

To qualify for a Citi personal loan, applicants must meet specific eligibility criteria and provide necessary documentation to verify identity, income, and financial standing.

Let’s discover the requirements and personal loan application process:

Age Requirement

Applicants must be at least 18 years old (21 in Puerto Rico) to apply for a Citi personal loan. Therefore, you need to confirm with your lender before applying.

Creditworthiness

Citi evaluates an applicant’s creditworthiness, which includes factors such as credit score, repayment history, credit utilization, and the average age of credit accounts. A strong credit profile can increase the likelihood of approval and may result in more favorable loan terms

Already managing other financial products like credit cards or checking accounts? Having a responsible track record with these may improve your personal loan eligibility.

Debt-to-Income Ratio (DTI)

The debt-to-income ratio, representing the percentage of gross monthly income allocated to debt payments. It is a critical factor in assessing an applicant’s ability to manage additional loan obligations.

Income Verification

Applicants must demonstrate a stable income to ensure they can meet monthly payments for personal loan. For employed individuals, recent pay stubs or W-2 forms are typically required. Self-employed applicants may need to provide tax returns or bank statements to verify income consistency.

Required Documentation

When applying for a Citi personal loan, prepare the following documents:

-

Proof of Identity: Government-issued ID such as a passport, driver’s license, or state ID.

-

Proof of Address: Documents like utility bills, lease agreements, or any official correspondence displaying your current address.

-

Proof of Income: Depending on employment status, this may include recent pay stubs, W-2 forms, tax returns, or bank statements.

Ensuring all documentation is accurate and up-to-date can expedite the application process.

A participants can meet these eligibility criteria and providing the necessary documentation, they certainly enhance their chances of securing a Citi personal loan tailored to their financial needs.

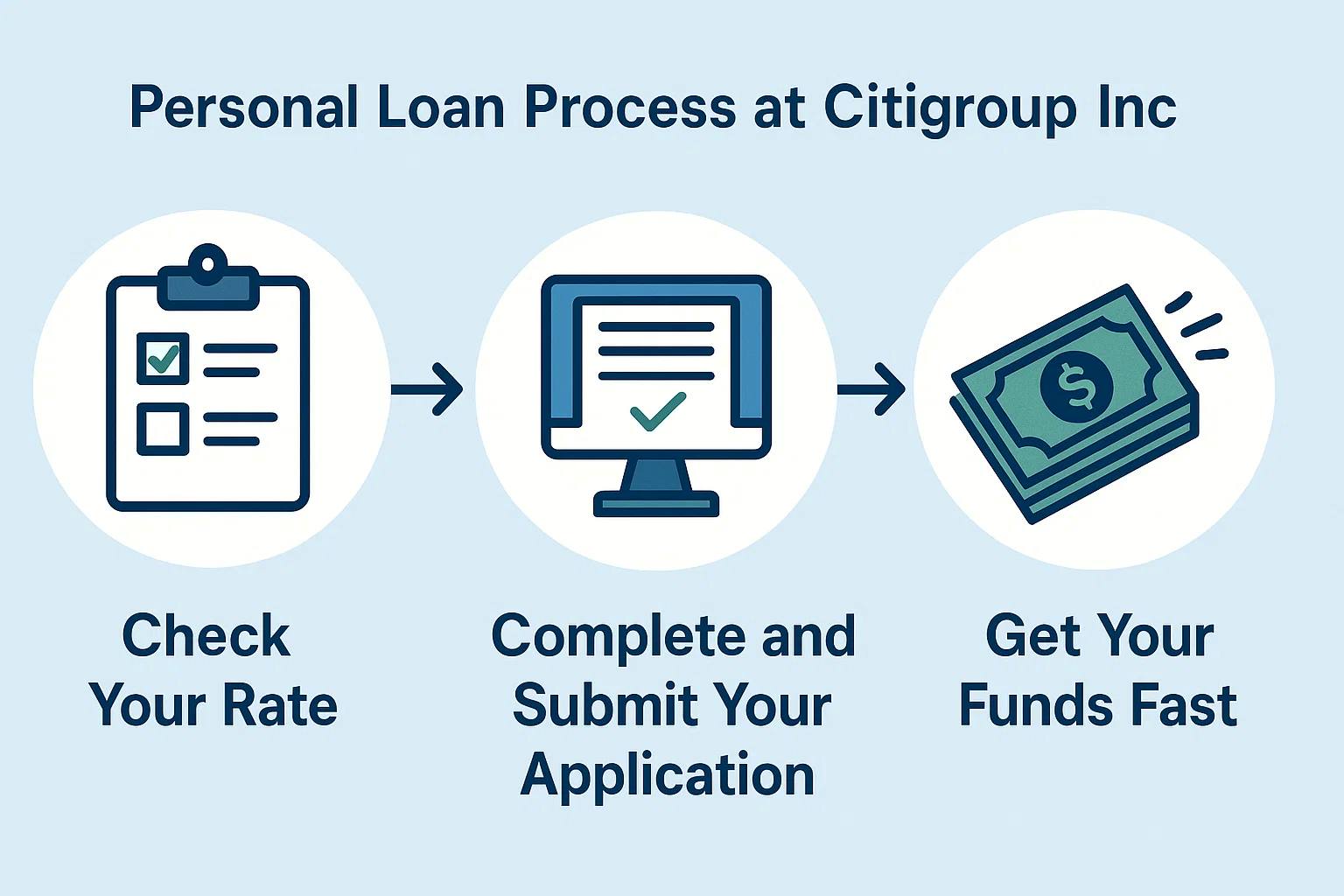

Easy Citi Personal Loan Process at Citigroup Inc.

Citigroup Inc. prioritizes customers’ experience. Consequently, personal loan process is straightforward and efficient with a few minutes, ensuring you can access funds when you need them most.

The personal loan process comprises 3 following simple steps:

Check your rate

First of all, you need to check your personalized loan rate online. This step involves a soft credit inquiry. However, it won’t affect your credit score. You’ll need to provide basic information such as your name, address, and income details. Within moments, you’ll receive an estimated interest rate and Citi personal loan terms tailored to your financial profile.

Complete and Submit Your Application

Before applying for a Citi personal loan, you should research and compare different requirements so you can find the best one suitable for your needs and current financial situations.

If you are satisfied with the estimated terms, proceed to fill out the application accurately online or in person. This will require more detailed information, including: social security number, employment details,… and all necessary documents as well.

Get Your Funds Fast

Once your personal loan application is submitted, Citigroup will provide you a decision relatively quickly. Additionally, if they approve your application, you can receive your funds soon after that.

Customers owning a Citi deposit account can receive their funds via direct deposit at the same day. On the other hand, applicants without Citi accounts can receive funds during two business day.

Citi’s fast disbursement process ensures that whether you’re managing cash flow for personal use or tied to small business operations, funding arrives without delay.

Citi Personal Loans: Interest Rates, Terms & Discounts

Citibank offers a competitive and transparent fixed-rate structure for its unsecured personal loans, helping customers access funding without collateral, hidden charges, or complex terms.

Competitive Fixed Annual Percentage Rate (APR)

-

Fixed APR range: from 11.49% to 20.49%, depending on your credit profile, loan term, and existing relationship with Citi.

-

Repayment terms: flexible loan durations from 12 to 60 months, allowing you to tailor your loan based on your budget and timeline.

-

Loan amount: up to $30,000, unsecured. Therefore, it’s no need for collateral.

For example, if you borrow $10,000 for 36 at a 15.99% APR, you need to pay approximately $351.52 monthly, with a fixed total repayment over the life of the loan.

Rate Reduction Opportunities

-

0.5% APR discount when you enroll in automatic payments at loan origination.

-

0.25% APR discount for existing Citigold and Citi Priority customers, making Citi’s personal loans even more affordable for loyal clients.

Note: If your account enters default, your APR may increase by 2.00%.

Zero Fees & Predictability

-

No origination fee, no prepayment penalty, and no hidden charges.

Because Citi personal loans are fixed-rate, your monthly payment remains the same for the entire loan term, making budgeting easier and more predictable. Especially, it’s more convenient for those balancing other commitments like investing or managing a small business.

Other Conditions

-

No collateral: The collateral is not required because loans are 100% unsecured.

-

Funds usage: Funds cannot be used for post-secondary education or business purposes. Additionally, certain Citi credit products are not eligible for consolidation under this loan.

With flexible terms, fixed interest, and transparent pricing, Citi’s personal loans are a smart solution for those seeking financial support whether it’s for debt consolidation, major purchases, or unexpected expenses.

Choose How to Use Your Citi Personal Loans

One of the greatest advantages of a Citi personal loan is its flexibility. Whether you’re managing debt, improving your home, or facing an unexpected bill, Citi gives you the freedom to use your loan the way that best fits your life. Here are some of the most common and practical ways borrowers use their personal loans:

Debt Consolidation

Managing multiple high-interest debts can be overwhelming. With a Citi personal loan, you can consolidate your balances into a single, fixed-rate monthly payment. Especially, it is often at a lower interest rate.

Not only can this strategy simplify your finances, but it may also save you money over time. Moreover, there are no fees, and you can use Citi’s debt consolidation calculator to explore your options before applying.

Ideal for: Credit card balances, medical debt, personal lines of credit.

Home Improvement

Your dream home deserves care and attention. If you’re planning a kitchen remodel, bathroom upgrade, or essential repairs, Citi personal loans provide the upfront funds you need at a fixed rate—so you can complete your project with confidence.

Alternatively, if you’re looking to finance a vehicle or property, Citi also offers dedicated options like car loans with competitive terms.

Ideal for: Renovations, roof repair, appliance upgrades, energy-efficient improvements.

Unexpected Expenses

Sometimes, you can meet unexpected situations in life. With no hidden fees and fast funding, a Citi personal loan can help you cover sudden costs without derailing your budget. Thus, Citigroup offers a safety net when you need it most even for medical bills or urgent car repairs,..

Ideal for: Emergency room visits, vehicle repairs, veterinary bills.

Other Personal Needs

A Citi personal loan isn’t just for emergencies but it’s also great for the moments that matter most. Whether you’re buying furniture, hosting a wedding, or planning a family reunion, Citi makes it easy to access funds quickly, with terms that work for your schedule.

Ideal for: Weddings, travel, furniture purchases,…

With Citigroup Inc., how you use your personal loan is entirely up to you. The process is fast, simple, and transparent, empowering you to take control of your finances with confidence.

Citi Personal loans have proven to be a reliable solution for individuals seeking fast, secure, and tailored funding options. Whenever you need, Citigroup Inc. offers a personal loan experience built on trust, transparency, and simplicity. Backed by strong eligibility support, multiple loan types, and highly competitive APRs, a Citi Personal Loan is about gaining control over your financial journey. Your goals just need to be practical, urgent, or aspirational, Citi helps make them achievable on your terms.