Whether you’re purchasing your first ride, upgrading your vehicle, or refinancing your current auto loan, having the right lender matters. That’s where First Horizon auto loans come in.

With competitive rates, flexible terms, and a simple application process, First Horizon helps you drive off with confidence. In this guide, we’ll walk you through everything you need to know about First Horizon Bank auto loans.

Overview of First Horizon Auto Loan

If you’re looking for a trusted lender to help you finance your next car, it’s worth getting to know First Horizon Bank and what their auto loan program has to offer:

Who Is First Horizon Bank?

First Horizon Bank is a well-established financial institution in the United States. It is headquartered in Memphis, Tennessee, and mainly serves customers across 12 Southeastern states, including Florida, Georgia, Texas, and the Carolinas. As of 2025, it ranks as the fourth-largest regional bank in this area.

The bank has a rich history that dates back more than a century, but one of its most significant changes came in 2020, when it merged with IberiaBank. This merger helped First Horizon expand its footprint and customer base across the Southeast. In 2023, a potential merger with TD Bank was called off, meaning First Horizon remained independent and continued operating under its own name.

With a focus on personal service, community banking, and digital tools, First Horizon offers a wide range of products from checking accounts and mortgages to auto loans and small business support. Its blend of traditional values and modern convenience makes it a strong option for borrowers who want both local service and national-level resources.

What Is a First Horizon Auto Loan?

A First Horizon auto loan is a financing option offered by First Horizon Bank that helps you either buy a car or refinance an existing auto loan. Whether you’re looking for a brand-new vehicle or a gently used one, this loan can make the process easier and more affordable.

With competitive First Horizon auto loan rates and loan amounts ranging from $10,000 to $75,000, First Horizon gives you the financial support you need to make your purchase. You can also choose from flexible loan terms, starting at 12 months and going up to 72 months for qualifying loans. Plus, you can finance up to 90% of the car’s value, so you don’t have to come up with a large down payment.

First Horizon auto loans are great for buyers who want clear terms, reliable service, and a lender with a solid reputation. First Horizon has been around for over 150 years, and it continues to serve communities with trustworthy banking options, especially in the Southeastern U.S.

Key Features of First Horizon Auto Loans

First Horizon offers flexible auto loan options to help customers buy or refinance both new and used vehicles. Beyond cars, its financing also covers boats, recreational vehicles (RVs), and yachts, making it a good choice for lifestyle purchases.

Here are the key loan features:

| Feature | Details |

|---|---|

| Loan Amount | $10,000 – $75,000 |

| Loan Terms | 12 to 60 months (up to 72 months for larger loans) |

| Vehicle Type | New or used cars (≤ 4 years old) |

| Loan-to-Value Ratio | Up to 90% of the vehicle’s value |

| Financing Type | Purchase or refinance (no cash-out) |

| Minimum Age Requirement | 18 or older |

| Credit Check | Yes (hard inquiry required) |

| Application Method | Online or by phone |

| Eligibility | U.S. citizens and permanent residents |

These features are designed to make borrowing simple and manageable, no matter your vehicle goals.

Types of Vehicles You Can Finance

First Horizon auto loans are specifically for everyday passenger vehicles. You can use the loan to buy or refinance a car, truck, or SUV, as long as it meets the bank’s age and title requirements.

Vehicles You Can Finance:

- New cars: These are vehicles that have never been titled. You can also apply for a loan if you bought a new car with cash and want to reimburse yourself. This must be done within 180 days of the original purchase.

- Used cars: Vehicles that have already been titled but are 4 years old or newer.

Vehicles That Are Not Eligible:

- Motorcycles

- All-terrain vehicles (ATVs)

- Kit cars or custom-built cars

- Salvaged or rebuilt vehicles

- Cars purchased from another individual (private party sales)

First Horizon limits financing to vehicles sold through licensed dealerships. This reduces the risk for both the bank and the borrower, since dealership sales typically include verified histories, warranties, and clear title documentation.

Loan Terms and Monthly Payment Options

One of the benefits of choosing First Horizon Bank auto loans is how much control you have over your loan’s repayment plan.

- Standard terms of First Horizon auto loans range from 12 to 60 months, depending on the loan amount and vehicle age.

- If you’re borrowing $50,000 or more, you may qualify for a longer term of up to 72 months, as long as the car is no more than 3 years old.

Monthly payments are structured to be equal and fully amortizing. However, there are some things to consider:

- Longer terms often lead to lower monthly payments, which can be helpful if you’re on a tight budget. But keep in mind, you may end up paying more in total interest over time.

- Shorter terms have higher monthly payments, but they help you pay less interest overall and get out of debt faster.

Choose a loan term that fits both your monthly budget and your long-term financial goals.

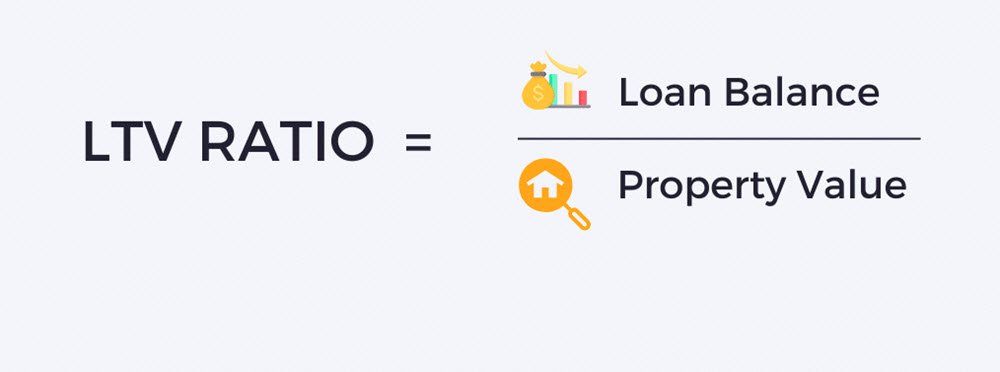

Understanding the Loan-to-Value Ratio (LTV)

How much of the car’s total value you can finance with your loan is shown by the loan-to-value ratio. With First Horizon auto loans, you can borrow up to 90% of the vehicle’s value. That means you may only need to make a 10% down payment.

But how is the car’s value calculated?

- For New Vehicles: The value is based on the purchase price plus any applicable taxes, title, and licensing fees.

- For Used Vehicles: The value is based on the lower amount between:

- The purchase price + taxes and fees

- The NADA (National Automobile Dealers Association) trade-in value

This conservative approach helps ensure you’re not borrowing more than what the car is realistically worth. It protects you from being “upside down” on your loan, owing more than your car is worth.

Rates, Fees and Insurance Requirements

The bank does not publicly list First Horizon Bank auto loan interest rates online, because your Annual Percentage Rate (APR) will depend on several factors, including:

- Your credit score and financial history

- The age and value of the vehicle

- The length of your loan term

- Your banking relationship with First Horizon

The bank also doesn’t list every fee upfront, however, there are a few important costs and requirements to be aware of before you apply. For starters, you may need to pay an application fee or an origination fee when your loan is processed. These are common charges that many banks apply to cover administrative work.

Another key requirement is insurance coverage. First Horizon auto loans require borrowers to carry comprehensive and collision insurance on the vehicle being financed. This helps protect both you and the bank in case of damage or accidents during the loan term.

It’s also important to know what isn’t covered by the loan. First Horizon will not finance:

- Extended warranties

- Dealer add-ons

- GAP (Guaranteed Asset Protection) insurance

… unless these extras are clearly listed in the dealership’s official sales contract.

To avoid any surprises, it’s a smart idea to ask your loan officer or car dealer to break down all potential fees and add-ons before you finalize your financing.

First Horizon Auto Refinance

If you already have a car loan but aren’t happy with the interest rate or monthly payments, refinancing with First Horizon might be a smart move. Here are some benefits you might get from refinancing:

- Lower monthly payments: If you’re struggling to keep up with your current loan, refinancing can spread out the remaining balance over a longer term, reducing what you pay each month.

- Better interest rate: If your credit score has improved or rates have dropped since you got your original loan, you may qualify for a lower rate, which could save you money over time.

- Flexible loan terms: You can choose a shorter term to pay off your loan faster and save on interest, or extend your term for lower payments if you need more breathing room in your budget.

Nonetheless, there are a few things that you need to remember:

- No cash-out refinance: When you refinance with First Horizon, you are not permitted to withdraw more funds. This loan is only intended to pay off the remaining balance of the car you are purchasing.

- Vehicle eligibility still applies: The car you’re refinancing must meet First Horizon’s requirements, which means it should be 4 years old or newer and in good condition.

If your car and credit meet the criteria, refinancing through First Horizon could help you take control of your finances and make your auto loan work better for your needs.

Eligibility and Documents for First Horizon Auto Loans

Here’s what you need to know about First Horizon car loans and its requirements:

- You must be at least 18 years old, or the legal age in your state, whichever is higher.

- There is no specific income requirement disclosed, so even if you have a modest income, you might still qualify.

- First Horizon does not publish a minimum credit score, but a hard credit check is required. This means your credit report will be reviewed in full, and the inquiry may temporarily affect your credit score.

- Only U.S. citizens and permanent residents (Green Card holders) are eligible to apply.

Even if you have average credit, you may still be approved. First Horizon looks at the full picture of your financial situation, not just your credit score.

Next, no matter how you apply, make sure to gather the following documents before starting the loan process:

- A state-issued photo ID (such as a driver’s license)

- Your Social Security Number

- Proof of income, like:

- Recent pay stubs

- Tax returns (Form 1040)

- W-2 forms or employment verification

- Vehicle details, including:

- Purchase order or invoice from the dealership

- Vehicle Identification Number (VIN)

- Vehicle title and registration (if refinancing)

- Proof of the vehicle’s age and mileage (used cars must meet bank age requirements)

Having these First Horizon auto loan requirements and documents ready will help avoid delays and make the approval process smoother.

First Horizon Auto Loan Application Process

Applying for a First Horizon auto loan is simple, and you have two options depending on whether you already bank with them online:

Apply Online (For Current Digital Banking Users)

If you already use First Horizon’s Digital Banking services, you can apply for First Horizon auto loans directly through your online account.

- Log in to your First Horizon online banking dashboard.

- Navigate to the auto loan section and click on the application form.

- Fill out the loan application. This usually takes about 10 minutes.

- Enter personal information and required documents.

- Upload your purchase agreement or buyer’s order from the dealership when you have it ready.

- Submit your application.

Once submitted, the bank will review your information. Most applicants receive a decision within 7 to 10 business days. If approved, the funds will be sent directly to the dealership.

Apply In Person (For New Customers)

If you’re new to First Horizon or prefer face-to-face service, you can apply for First Horizon auto loans at a local branch.

- Visit a First Horizon branch near you and speak with a loan officer.

- Bring all required documents with you (see list in the previous section).

- You may fill out either a short pre-approval form or the full application on-site.

- Once approved, the bank will either wire the funds to the dealership or give you a payment method to use with the seller.

This option is ideal if you want help during the process or need to ask questions in person.

Apply by Phone

Prefer to talk to someone directly? You can also start your application over the phone. Call 800-615-1933 to speak with a First Horizon representative.

They’ll guide you through the steps, explain what documents are needed, and may begin the process with you during the call.

If you choose this route, you may still need to send in paperwork via email or drop it off at a local branch.

First Horizon Auto Loan Customer Service

About customer support, First Horizon auto loans offer several ways to get in touch or find helpful tools:

- Phone: Call 800-615-1933 to speak with a loan specialist or ask about your application.

- Website: Visit the official First Horizon Bank website to explore auto loan details and apply online.

- Branch Locator: Use the branch locator tool on their website to find a First Horizon location near you.

- Auto Loan Calculator: Try out the auto loan calculator to estimate your monthly payments based on the loan amount, term, and interest rate.

- Learning Center: Explore articles and tools in the Learning Center to understand your financing options and make smart borrowing decisions.

Whether you’re ready to apply or just gathering information, First Horizon offers resources and real support to help guide you through the process with confidence.

Pros & Cons of First Horizon Auto Loans

Before applying, take a moment to review the key advantages and disadvantages of using First Horizon for your auto loan.

Pros of First Horizon auto loans:

- High loan limits (up to $75K for cars; even more for boats or RVs).

- Flexible repayment terms up to 72 months for larger loan amounts.

- Option to refinance and consolidate existing auto loans.

- Discounts available for customers who use autopay or maintain a deposit account.

- Financing available for delayed purchases within 180 days of the sale invoice.

- Covers a wide variety of vehicle types.

Cons of First Horizon auto loans:

- APR and fees are not published online, so you must contact the bank directly.

- Hard credit pull required (no prequalification without impact)

- Does not finance motorcycles, private party sales, or older vehicles

- Limited vehicle eligibility (≤4 years old for used cars)

How First Horizon Auto Loans Compare to Other Lenders

When you’re shopping for an auto loan, it’s important to compare your options, so let’s see how First Horizon auto loans stack up against other popular lenders:

| Feature | First Horizon | Capital One Auto Finance | LightStream |

|---|---|---|---|

| Loan Amounts | $10K – $75K | $4K – $75K | $5K – $100K |

| Terms Available | 12 – 72 months | 36 – 72 months | 24 – 84 months |

| Prequalification | No | Yes | No |

| Used Cars Accepted | Yes (≤ 4 years) | Yes | Yes |

| Motorcycle Financing | No | No | Yes |

| GAP Financing Included | No | No | No |

FAQs about First Horizon Auto Loans

Can I refinance my current auto loan with First Horizon?

- Yes, you can. If you already have an auto loan with another lender, First Horizon allows you to refinance it, as long as the vehicle meets their requirements for age and condition.

What’s the oldest car I can finance with First Horizon auto loans?

- For a used car loan, the vehicle should be no more than 4 years old. If you’re borrowing more than $50,000, the car usually needs to be 3 years old or newer.

Will I be charged for paying off my loan early?

- First Horizon typically doesn’t charge a fee for early payoff. That means you can pay off your loan ahead of schedule without any penalty, but it’s best to double-check with the bank just in case.

Can I buy a car from a private seller with First Horizon auto loans?

- No. First Horizon only offers auto loans for vehicles purchased from licensed dealerships. Private-party sales aren’t eligible for financing.

After being approved, how quickly can I have my car?

- Once your loan is approved and the paperwork is done, you can usually get your car within 7 to 10 business days. The bank sends the funds to the dealership, and you’re ready to drive off.

First Horizon auto loans are a strong choice if you want a straightforward and reliable way to buy or refinance a vehicle. With flexible terms, reasonable loan amounts, and no hidden catches, this is a lender that puts your financial confidence in the driver’s seat. However, make sure your vehicle qualifies and prepare for a hard credit inquiry. As always, compare with other lenders before signing any loan agreement.