If you’re looking to buy a car or refinance an existing auto loan, choosing the right lender can make a huge financial difference. M&T Bank auto loans might be just what you need.

As a trusted regional lender, M&T offers straightforward financing options for new purchases and refinancing. In this review, we’ll break down the key features, rates, pros and cons, and help you decide if it’s the right fit for your auto financing needs in 2025.

Overview of M&T Bank Auto Loans

M&T Bank is a well-established regional bank that’s been serving customers since 1856. Its headquarters are located in Buffalo, New York, and today it operates across 13 states in the Eastern U.S. as well as Washington, D.C. Over the years, M&T has built a strong reputation for offering reliable personal and business banking services.

Among its loan offerings, M&T Bank auto loans are a standout option for people looking to buy a car, whether it’s brand new, pre-owned, or for those who want to refinance an existing auto loan.

One of the reasons M&T Bank stands out is its strong reputation for customer service and its willingness to work with borrowers who need smaller loan amounts. Unlike some lenders that require you to borrow a large sum, M&T allows you to finance as little as $2,000. This makes it a great fit for buyers with modest vehicle needs or people nearing the end of their current car loan. The bank also provides competitive M&T Bank auto loan interest rates and flexible repayment terms, helping customers find a loan that fits their budget.

Types of Auto Loans Offered by M&T Bank

M&T Bank offers three primary types of auto loans, all with the same starting loan amount and APR range. These options are designed to meet the different needs of today’s car buyers.

- New Auto Loans: Planning to purchase a brand-new car from a dealership? M&T Bank offers new car loans starting at just $2,000. Loan terms are flexible and can extend up to 84 months. Keep in mind that to apply, you’ll need to provide key details about the vehicle, including the make, model, year, and VIN.

- Used Auto Loans: If you’re considering a pre-owned car, M&T Bank used car loans are also available starting at $2,000. You can use the funds to buy from either a licensed dealership or a private seller. As with new car loans, you’ll need to provide all the necessary vehicle information at the time of application.

- Refinance Auto Loans: Already have a car loan? If your credit has improved or you just want a better interest rate or lower monthly payment, M&T Bank auto loan refinancing could be a smart move. The bank offers a fast decision process and terms that can help you save money over time.

Key Features of M&T Bank Auto Loans

M&T Bank auto loans come with a variety of useful features designed to support different types of car buyers. Here are some of the top benefits:

- Low Starting Loan Amount: You can borrow as little as $2,000, making this a great option if you’re buying a budget-friendly vehicle or need a small refinance.

- Flexible Loan Terms: Choose a repayment term that fits your financial situation, up to 84 months (7 years).

- Competitive Interest Rates: M&T auto loan rates start at a competitive 6.14% APR, but only if you qualify for autopay from an M&T checking account. The highest rates can go up to around 15.69%, depending on things like your credit score, the car you’re buying, and how long your loan lasts. Overall, M&T’s rates are fair, especially when compared to larger banks.

- 30-Day Purchase Window: Once approved, you have up to 30 days to shop around and choose your vehicle.

- Rate Discounts for Bank Customers: If you have an eligible checking account with M&T Bank, you might qualify for a lower interest rate.

- Works with Private Party Purchases: Not all lenders allow this, but M&T does, which is great if you’re buying from a friend or online seller.

- Fast, Simple Process: The application and approval process is designed to be quick and hassle-free.

- Strong Customer Support: With 24/7 phone service and over 700 physical branches, M&T is there when you need help, something many online-only lenders can’t offer.

Together, these features make M&T Bank auto loans a convenient and flexible choice, especially if you’re a first-time buyer, refinancing, or working with a smaller budget.

M&T Bank Auto Loans: Rates and Terms

Here’s a clear breakdown of the interest rates and terms available through M&T Bank auto loans:

| Loan Type | APR Range | Minimum Loan | Maximum Term |

|---|---|---|---|

| New Auto Loans | 6.14% – 15.69% | $2,000 | Up to 84 months |

| Used Auto Loans | 6.14% – 15.69% | $2,000 | Up to 84 months |

| Refinance Loans | 6.14% – 15.69% | $2,000 | Up to 84 months |

It’s important to understand that your final rate will depend on a few key factors. If you want to qualify for the lowest possible APR (6.14%), you’ll need to meet all of the following conditions:

- Choose a loan term of 48 months or less

- Finance a car that’s a 2024 model year or newer

- Have (or open) a MyChoice Premium or Power Checking account at M&T

- Set up automatic loan payments from your M&T checking account

Meeting these criteria can make a big difference in how much interest you pay over the life of the loan.

Relationship Discounts:

If you already have an M&T checking account, or you’re open to opening one, you can take advantage of a relationship discount. When you set up automatic payments from that account, M&T will reduce your loan’s interest rate, typically by 0.25% to 0.50%. This could save you hundreds of dollars over the life of the loan.

This built-in reward makes M&T Bank auto loans especially appealing to current customers or anyone looking to consolidate their banking services.

Who Can Apply for M&T Bank Auto Loans?

Unlike some lenders, M&T Bank does not list a specific minimum credit score required to apply for M&T Bank auto loans. Despite of that, most approvals are likely granted to applicants with a FICO score of 620 or higher. That said, your exact rate and approval chances will depend on multiple factors, including:

- Your credit history and score

- Your monthly income and debt-to-income ratio

- The loan amount you’re requesting

- The age, make, and condition of the vehicle you want to finance

Basic Eligibility Requirements

To be eligible for an auto loan from M&T Bank, you must:

- Be at least 18 years old

- Be a legal U.S. resident

- Live in one of the 13 states where M&T Bank operates

These states include:

Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Vermont, Virginia, Washington D.C., and West Virginia

If you don’t live in one of these states, you won’t be able to get an M&T Bank auto loan. However, many national lenders do offer similar products, so it’s worth exploring your options.

What You’ll Need

When applying for M&T Bank auto loans, make sure you have the following information ready:

- Details about the car (VIN, model year, current mileage, etc.)

- A valid photo ID (like a driver’s license)

- Proof of where you live (such as a utility bill)

- Employment or income verification

- Your Social Security Number (SSN)

Having these documents in advance will help you move through the process quickly and improve your chances of getting approved.

How to Apply for an M&T Bank Auto Loan

Applying for an M&T auto loan is simple and convenient, giving you three ways to get started:

- Online: Visit the M&T Bank website and complete the online loan application.

- By Phone: Call the loan department at 1-877-686-8424 to apply with the help of a representative.

- In Person: Stop by any M&T Bank branch to apply face-to-face with a loan officer.

The M&T Bank Auto Loan Application Process

The process is so simple, therefore, you don’t need to be a financial expert to get started. Just follow these easy steps:

- Get Your Car Info Ready: Before you apply, gather all the important details about the vehicle you want to buy or refinance. Having this information ready will speed up the application process and reduce delays. This includes:

- The year of the car

- The make and model

- The Vehicle Identification Number (VIN)

- Seller information, whether it’s a dealership or a private party

- Submit Your Application: Once you have everything in place, you can apply for an M&T Bank auto loan in one of three ways: online, by phone, or in person.

- Get a Quick Decision: In most cases, M&T Bank gives you a lending decision within a few minutes. If you’re approved, you’ll know your rate, loan amount, and terms right away. From there, you’ll have up to 30 days to use the loan. This gives you some breathing room to finalize your decision without rushing.

- Finalize Your Loan and Drive Away: Once you choose your car and finalize the loan documents, the bank will disburse the funds. You can then move forward with the purchase and drive home in your new ride.

M&T Bank Auto Loan Customer Service & Payment

M&T Bank is known for its friendly and helpful customer service. Whether you need help during the loan process or have questions after getting approved, they’re ready to assist.

Customer Support Availability

You can reach M&T’s support team 24 hours a day, 7 days a week by calling 800-724-2440. If you prefer face-to-face service, there are over 960 M&T Bank branches you can visit across the states they serve.

Flexible Payment Methods

Once your auto loan is active, M&T Bank offers multiple easy ways to make your monthly payments:

- Online: Log into your M&T Online Banking account to make one-time or recurring payments.

- By Phone: Call the M&T Bank auto loans phone number 1-877-686-8424 to set up automatic payments or make a manual payment.

- In-Person: Visit any M&T branch to pay at the counter or speak with a banker.

- By Mail: Send your monthly payment to the official M&T Bank address for auto loans listed on your loan statement. M&T Bank auto loan payment address:

- Regular mail payment each month to M&T Bank, P.O. Box 64679, Baltimore, MD 21264-4679, and

- Paying off an account or making a monthly payment overnight to M&T Bank, 1800 Washington Blvd., 8th floor, Baltimore, MD 21230, P.O. Box 69003

These flexible options let you choose the method that’s most convenient for your lifestyle.

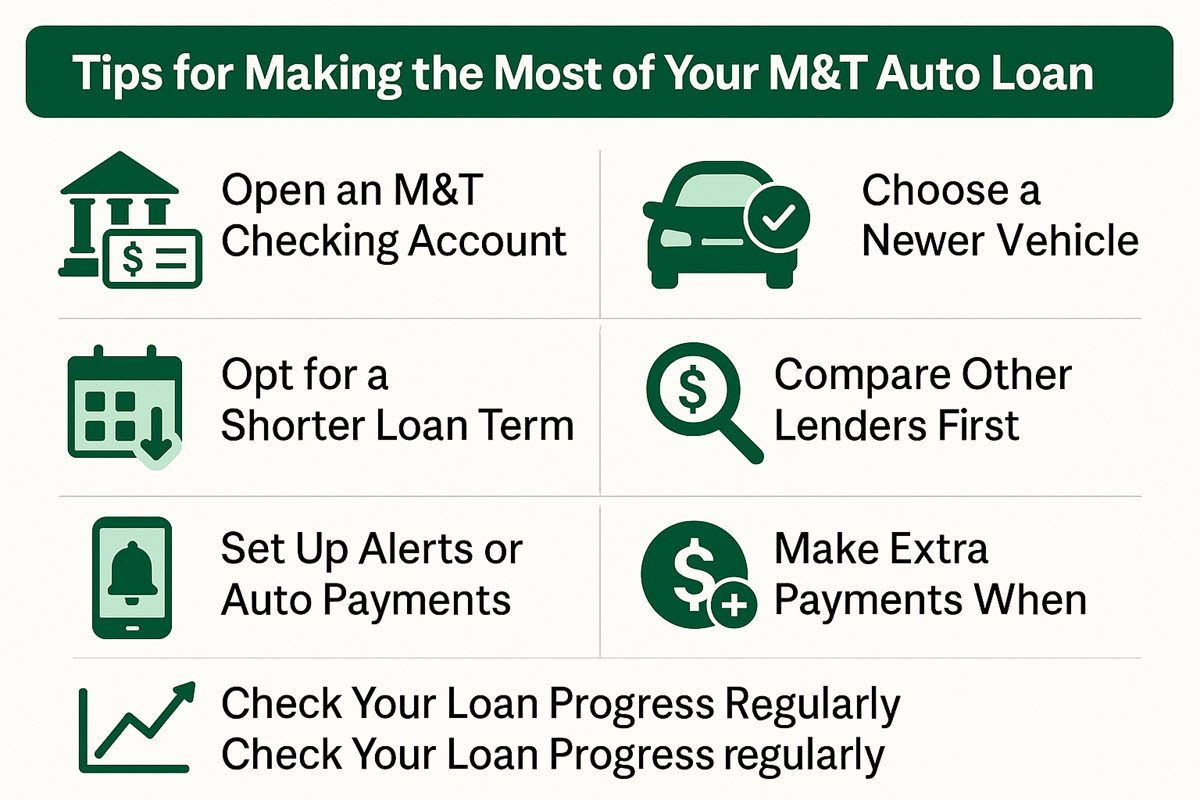

6 Tips for Making the Most of Your M&T Auto Loan

Getting approved for an auto loan is only the first step, how you manage it can make a big difference in what you pay over time and how smoothly the process goes. If you’re considering or have already been approved for an M&T auto loan, here are some smart tips to help you save money and reduce stress:

- Open an M&T Checking Account: If you don’t already bank with M&T, consider opening a checking account before finalizing your loan. This step can unlock an automatic payment discount of 0.25% to 0.50% on your interest rate. Plus, autopay ensures you’ll never miss a payment.

- Choose a Newer Vehicle: Newer cars, especially model years 2024 or newer, often come with lower interest rates and better financing terms. They also hold their value longer, which is useful if you plan to refinance or sell before the loan is paid off.

- Opt for a Shorter Loan Term: While a 72- or 84-month loan may lower your monthly payment, it increases the total interest you’ll pay over time. If your budget allows, go with a shorter term, like 36 or 48 months, to pay off your car faster and save more in the long run.

- Compare Other Lenders First: Even if you plan to go with M&T, it’s still smart to shop around. Comparing quotes from other banks gives you a clearer picture of what a good deal looks like.

- Set Up Alerts or Auto Payments: Besides autopay, set up text or email alerts to remind you about upcoming due dates. This small tip will help you avoid late penalties.

- Check Your Loan Progress Regularly: Use M&T’s mobile app or online banking to track how much you’ve paid, how much is left, and whether you’re on schedule. Seeing your progress can motivate you to stick to your plan or even accelerate it.

By following these tips, you can get the most value out of your M&T Bank auto loan and keep control over your financial journey.

FAQs About M&T Bank Auto Loans

What’s the minimum loan amount for M&T Bank auto loans?

- M&T Bank allows you to borrow as little as $2,000, making it a great choice for buyers who need a small loan or want to refinance a low balance.

What is the current APR for M&T Bank auto loans?

- The Annual Percentage Rate (APR) ranges from 6.14% to 15.69%, depending on your credit score, loan term, and whether you qualify for relationship discounts.

Can I refinance my existing car loan through M&T Bank?

- Yes! M&T Bank offers refinance auto loans starting at $2,000. If your financial situation or credit has improved, refinancing could lower your interest rate or monthly payments.

How fast will I know if I’m approved for a loan?

- Most borrowers receive a decision within minutes of submitting their application. However, if more documentation is required, it could take longer.

Does M&T Bank offer loan prequalification?

- Unfortunately, M&T does not offer prequalification. You’ll need to submit a full application and undergo a hard credit check to see your final rate and terms.

M&T Bank auto loans are a great fit for borrowers looking for flexibility, small loan amounts, and competitive rates, especially in the eastern U.S. If you’re already a customer or live in one of M&T’s service areas, you could benefit from relationship discounts and fast approvals. Before applying, don’t forget to compare your options to ensure you’re getting the best deal based on your credit and vehicle.