If you’re exploring options to finance a car or refinance your current vehicle, Fifth Third Bank auto loans might be worth a serious look. Known for their customer-first approach and strong presence across the Midwest and Southeast, Fifth Third Bank offers a blend of flexible loan terms, competitive rates, and local service that appeals to many borrowers.

In this review, we’ll cover everything you need to know, from available loan types and current APRs to how their process works. Let’s get started.

Introduction to Fifth Third Bank Auto Loans

When it comes to financing your next vehicle, understanding what Fifth Third Bank auto loans offer can help you make a smarter, more confident decision.

About Fifth Third Bank

Fifth Third Bank is a well-established regional financial institution headquartered in Cincinnati, Ohio. With a history dating back to 1858, it operates over 1,100 branches across 11 states in the Midwest and Southeast. The bank offers a wide range of financial products, including checking and savings accounts, credit cards, mortgages, and investment services.

Though not a national giant like Bank of America or Capital One, Fifth Third has built a solid reputation for personal service and reliable banking products.

Why Consider Fifth Third Bank for Auto Loans?

One of its popular offerings is auto financing. Fifth Third Bank auto loans are designed to help customers purchase new or used vehicles, or refinance existing loans. These loans come with flexible terms, spanning from 12 to 75 months, which gives borrowers the ability to structure payments according to their financial comfort level.

Loan Amounts range from $2,000 to $80,000, making this lender a solid option for both budget and luxury vehicles.

So, if you’re looking for a car loan with a local bank feel but national-level tools, Fifth Third auto loans could be a smart choice.

Types of Fifth Third Bank Auto Loans

Fifth Third Bank offers a few different types of auto loans, so you can choose the one that fits your needs best.

New Car Loans

If you’re buying a new car from a dealership, this is the standard option. You can borrow for a term ranging from 12 to 75 months. The rates are fixed, so your monthly payment will stay the same throughout the loan.

This option is great if you want a predictable budget and the latest car on the market.

Used Car Loans

Used car loans work similarly to new car loans, with terms of up to 75 months. Fifth Third will finance cars up to 10 years old. However, older cars or high-mileage vehicles may not qualify or may come with slightly higher rates.

Still, this loan type is perfect if you want a solid used car without paying the new car price.

Auto Loan Refinancing

Already have a car loan but want better terms? You can refinance through Fifth Third Bank. Fifth Third offers refinancing options that may help you save money. You can refinance a loan from another lender, or even one already with Fifth Third, if you qualify.

Whether you’re trying to lower your monthly payments, reduce your interest rate, or switch to a different term length, refinancing can help you save money.

Fifth Third Bank Auto Loans: Rates and Terms in 2025

Auto loan rates can change depending on the market, your credit profile, and the lender’s policies. Unfortunately, Fifth Third does not publish APR ranges on its website, making it difficult to estimate your interest rate without submitting a full application. But as of 2025, here’s what you can generally expect when applying for Fifth Third Bank auto loans:

- APR Range: Fifth Third Bank auto loans rates typically fall between 6.50% and 8.00%. The actual rate you receive depends on several factors, including your credit score, the length of your loan, the type of car you’re financing, and whether you choose to set up autopay.

- Loan Terms: You can choose a loan term between 12 and 75 months. Shorter terms usually come with lower interest rates but higher monthly payments. Longer terms can reduce your monthly bill but may increase the total interest you pay over time.

- Minimum Loan Amount: Most loans start at around $2,000, making them suitable for both lower-cost used vehicles and higher-end new models.

- Down Payment: Fifth Third does not require a down payment, but making one can improve your chances of approval and help you qualify for a better interest rate. A larger down payment also reduces how much you need to borrow, which means you’ll pay less in interest overall.

- Rate Discounts: You may be eligible for a 0.25% rate discount if you set up automatic payments from a Fifth Third checking account or you refinance a non-Fifth Third auto loan. This small change can make a noticeable difference in your long-term loan costs.

In general, if you have excellent credit, meaning a high score and a strong payment history, you’re more likely to qualify for rates closer to the 6.50% mark. If your credit is average or fair, you may see offers closer to the higher end of the range, around 8.00% or more.

Summary Table of Fifth Third Bank Auto Loan Rates

Here’s a summary table of Fifth Third Bank auto loan interest rates:

| Loan Type / Feature | APR Range | Loan Term | Notes |

|---|---|---|---|

| New & Used Car Loans | ~6.50% – 8.00% | 12 – 75 months | Rates depend on credit score, loan term, and vehicle age/condition |

| Rate Discount with Autopay | –0.25% | Applied to your APR | Requires automatic payments from a Fifth Third checking account |

| Refinance from Another Lender | ~6.50% – 8.00%* | Varies (12–75 mos typical) | Plus 0.25% autopay discount; actual APR depends on credit & loan details |

| Minimum Loan Amount | $2,000 | N/A | Standard minimum; can change based on vehicle and approval |

*Exact APR for refinancing depends on your credit profile, vehicle year/mileage, and loan term. The 6.50%–8.00% range reflects typical rates as of 2025 seen across Fifth Third Bank auto loans.

Disclaimer: This data is for informational purposes only. Before making any financial decisions, consult the bank for accurate real-time interest rates.

Multiple Ways to Make Payments

Fifth Third gives you several convenient options to stay on top of your loan payments:

- Mobile App: Make payments on the go, anytime.

- Online Banking: Manage your account and pay your loan from a computer.

- Phone: Call Fifth Third’s automated system or speak with a representative at 1-800-972-3030.

- Mail: Send checks or money orders directly to the bank (be sure to include your account number). The Fifth Third Bank mailing address for auto loans is:

Fifth Third Bank, N.A.

PO Box 630778

Cincinnati, OH 45263

Fifth Third Bank Auto Loan Requirements

The bank doesn’t list exact approval Fifth Third Auto Loan requirements on its website, but based on data from industry experts and borrower reviews, here’s what most applicants need to qualify:

- Fifth Third Bank Auto Loan Credit Score: Although Fifth Third doesn’t publicly state an exact minimum, sources suggest that most approved borrowers have a credit score of 660 or higher, with many customers having scores above 700.

- Employment and Income: You’ll need to show proof of a stable income, like recent pay stubs, tax returns, or a job offer letter. Lenders want to know that you can make your monthly payments on time.

- Debt-to-Income (DTI) Ratio: This is the percentage of your monthly income that goes toward paying debts. Fifth Third tends to prefer a DTI ratio of 40% or lower.

- Vehicle Age: The car you’re financing should usually be 10 years old or newer. Older vehicles may still qualify but might require additional inspection or come with different loan terms.

- Vehicle Mileage: In most cases, the car must have under 100,000 miles. Higher-mileage vehicles may not qualify for standard loan programs.

How to Apply for a Fifth Third Auto Loan

Unlike some lenders that offer instant online prequalification, Fifth Third does not let you check your rates upfront without a full application. To start your loan application, you’ll need to follow a few simple steps:

Step 1: Schedule an Appointment

You can apply by scheduling an appointment online at 53.com, calling 1-866-671-5353, or visiting a nearby branch in person. The bank offers 30- or 60-minute appointment slots, depending on your needs.

Step 2: Prepare the Required Documents

To speed up the process, have the following information ready when you apply for Fifth Third Bank auto loans:

- A valid government-issued photo ID

- Proof of income, such as pay stubs or tax forms (like W-2s)

- Vehicle information, including make, model, year, and VIN (for purchase or refinance)

- If refinancing, the payoff amount for your current loan

Step 3: Apply Through a Dealership (Optional)

If you’re buying a car through a dealership, ask if they work with Fifth Third. Many dealers partner directly with the bank, allowing you to complete your loan application at the dealership instead of through the bank itself. This can save you time and simplify the financing process.

How Long Does the Application Take?

Appointments typically last between 30 and 60 minutes, depending on how prepared you are and the complexity of your request. Once your application is submitted, approval times of Fifth Third Bank auto loans can vary, but most borrowers receive a decision relatively quickly within 1 to 2 business days, sometimes the same day.

Funds Disbursed To:

- For new or used car purchases, the funds are sent directly to the car dealership.

- For refinancing, the money goes to your current auto lender to pay off the existing loan.

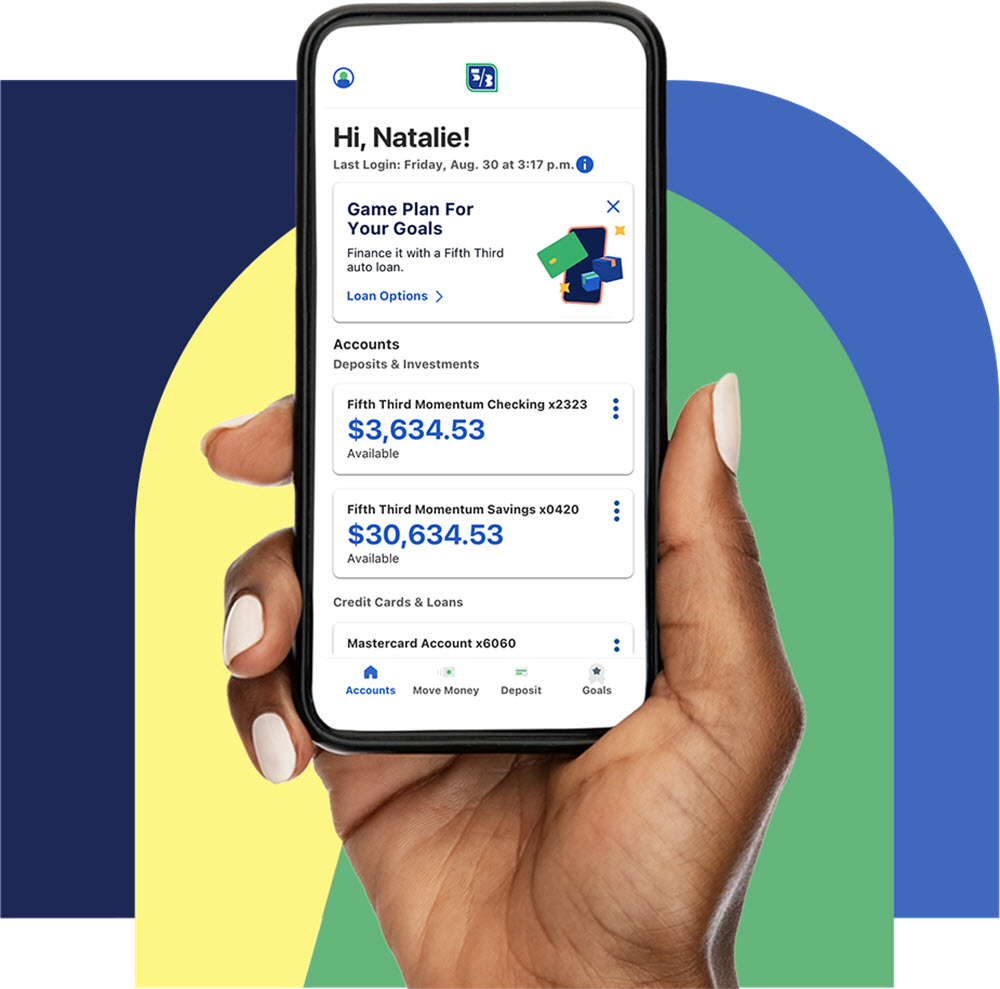

Once your loan is active, you can manage everything easily through Fifth Third’s mobile app or online banking platform, including checking your balance, making payments, and setting up autopay.

Digital and Customer Services

Beyond competitive car loan options, Fifth Third Bank also offers a range of digital tools and customer support services designed to make managing your auto loan easier and more convenient.

Online and Mobile Banking Access

Fifth Third Bank offers a strong digital experience for customers who prefer to manage their auto loans online or from their smartphones. Their mobile app is highly rated, with 4.6 stars on the Apple App Store and 4.8 stars on Google Play. Whether you’re at home or on the go, you can handle most of your loan tasks right from the app or the official website.

With just a few taps, you can:

- Make one-time or recurring loan payments

- Set up automatic payments to avoid missing due dates

- View your monthly statements and loan details

- Track your transaction history and monitor your account activity

The platform is user-friendly and built for convenience, making it easy even for first-time users to manage their finances digitally.

Online Loan Calculators

Not sure how much you can afford or what your monthly payment might look like? Fifth Third provides easy-to-use loan calculators on their website. These tools help you estimate:

- Monthly payments based on your loan amount and interest rate

- How much car can you afford based on your budget

- Whether buying or leasing makes more sense for you

- Using these calculators can help you plan ahead and avoid surprises later.

Customer Support Options for Fifth Third Bank Auto Loans

If you need personal assistance with Fifth Third Bank auto loans, the bank offers solid customer service over the phone:

- Fifth Third Bank Auto Loans Phone Number: 1-866-671-5353

- Monday to Friday: 8:00 a.m. – 6:00 p.m. ET

- Saturday: 10:00 a.m. – 4:00 p.m. ET

- Sunday: Closed

Their support team can help with questions about your loan, payment options, online access, or the application process.

Fifth Third Bank Auto Loan Fees

One of the advantages of borrowing from Fifth Third is that they keep fees low and transparent.

Here’s a breakdown of Fifth Third Bank auto loan fee structure:

- No application fee: You won’t be charged just for applying, even if you don’t accept the loan offer.

- No prepayment penalty: You’re free to pay off your loan early without being penalized, which can help save on interest.

- Late payment fees: If you miss a payment, you may be charged a fee, typically between $15 and $40, depending on your state.

- Returned payment fees: If your payment bounces due to insufficient funds, expect a fee of around $25.

The bank charges a few standard fees for Fifth Third Bank auto loans, which are outlined below:

| Fee Type | Typical Cost | Description |

|---|---|---|

| Loan Origination Fee | Varies (typically a flat or % charge) | One-time fee for processing and funding the loan; may be deducted at closing. |

| Late Payment Fee | Varies (per contract) | Charged when a payment is past due beyond the grace period |

| Phone Payment Fee | Around $15 | Fee for making a payment via phone, unless using a Fifth Third deposit account |

| Returned Payment (NSF) Fee | Up to $25 | Applied when a payment fails due to insufficient funds |

| Auto BillPayer Plus Transaction | Up to $1.50 per payment | For scheduled drafts made more than once a month |

| No Prepayment Penalty | $0 | Pay off your loan early without penalty |

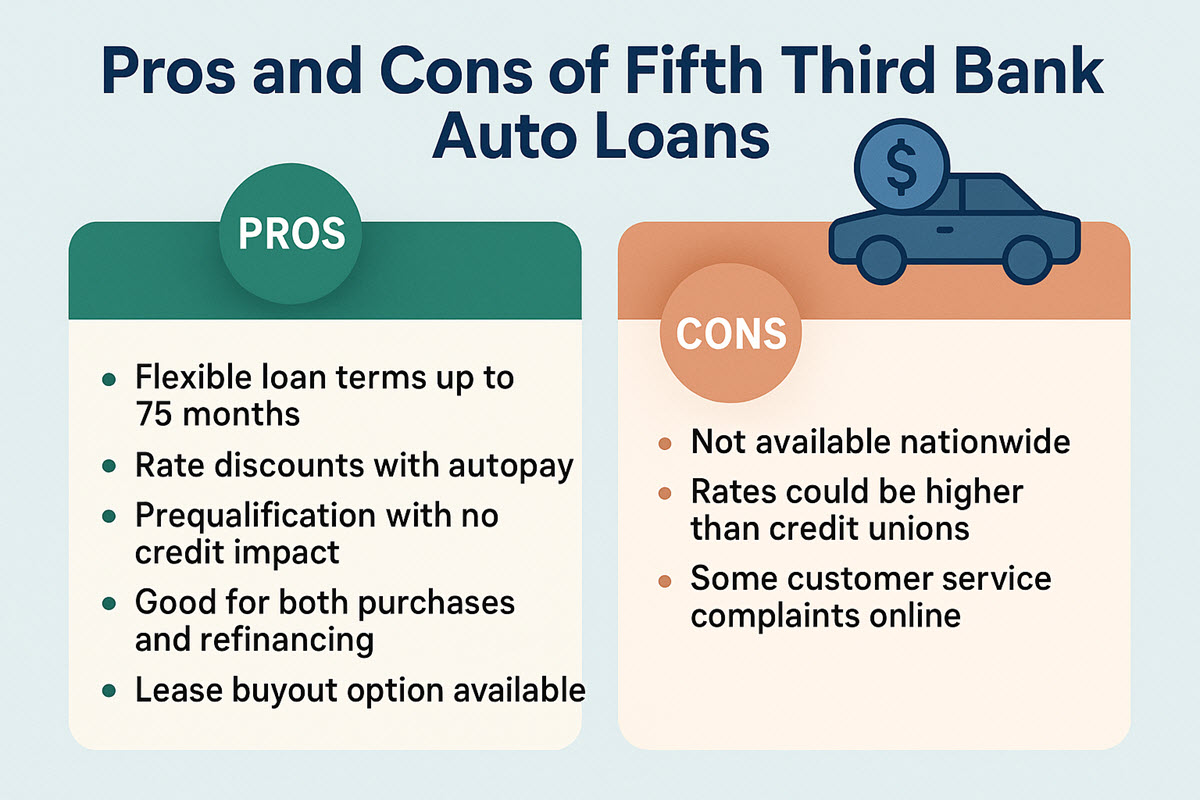

Pros and Cons of Fifth Third Bank Auto Loans

Before deciding whether Fifth Third Bank auto loans are right for you, it’s helpful to take a quick look at the biggest strengths and weaknesses of their offering. Here’s a clear summary to guide your decision:

Pros of Fifth Third Bank auto loans:

- Flexible loan terms up to 75 months

- Rate discounts with autopay

- Prequalification with no credit impact

- Good for both purchases and refinancing

- Lease buyout option available

Cons of Fifth Third Bank auto loans:

- Not available nationwide

- Rates could be higher than credit unions

- Some customer service complaints online

To sum up, Fifth Third Bank auto loans might be a good fit for:

- Current Fifth Third customers who can benefit from relationship discounts.

- Borrowers need flexible terms, from 12 to 75 months.

- Buyers of low-cost vehicles, as the $2,000 loan minimum is lower than many competitors.

- Anyone looking to refinance, even existing Fifth Third borrowers.

But if you have excellent credit and want the lowest possible rate, it’s worth checking your local credit union or comparing offers through a marketplace.

FAQs About Fifth Third Auto Loans

What is the minimum credit score for a Fifth Third auto loan?

- Fifth Third does not disclose a minimum score, but generally, a good credit score (660+) improves your chances.

Can I refinance an existing Fifth Third auto loan?

- Yes. Fifth Third is one of the few banks that allows in-house refinancing for eligible borrowers.

How do I make payments on my Fifth Third auto loan?

- You can pay online, via the mobile app, by phone, or by mail. You can also set up automatic payments.

How does daily simple interest affect my loan?

- Interest is calculated daily. Paying on time helps you avoid extra interest, while early payments reduce total interest.

How do I contact Fifth Third for support?

- Call 1-866-671-5353 or visit a local branch to speak with a loan specialist.

Fifth Third Bank auto loans offer solid flexibility, reliable customer service, and competitive tools for everyday borrowers. They may not have the absolute lowest APRs or the flashiest online platform, but they offer something just as valuable: trust. If you live in their footprint and want a lender that will walk with you, not just sell to you, Fifth Third is worth a close look.