When it comes to buying or leasing a car, the right loan can make all the difference. In today’s digital world, consumers want convenience, transparency, and flexibility. That’s where Ally Auto Loans comes in.

As one of the largest digital banks in the U.S., Ally offers car buyers a fully online experience backed by decades of automotive financing expertise. Today, we’ll take a closer look at how Ally Bank auto loans work, their features, and whether they’re the right fit for your next ride.

About Ally Auto Loans

Ally Auto Loans is the vehicle financing division of Ally Financial, one of the largest digital-only banks in the U.S. Originally launched as GMAC (General Motors Acceptance Corporation), the company has decades of experience helping Americans get behind the wheel. Today, Ally has evolved into a fully online financial institution, and its auto loan services reflect that modern, tech-savvy approach.

Instead of walking into a traditional bank branch, customers can manage every part of their car loan entirely online or through the Ally Auto app. It’s built for people who prefer speed, convenience, and control over their financing experience.

With Ally auto loans, customers can:

- Finance both new and used vehicles

- Lease a car through the Ally SmartLease® program

- Track your loan progress, view your balance, and make payments through the Ally Auto mobile app

- Make extra or early payments without penalties

- Choose from several payment methods, including online, text, phone, or in person

Their services are available through select dealerships, and they work with both everyday drivers and those with special vehicle needs.

Types of Ally Auto Loans

Ally offers two main financing options: buying a vehicle or leasing one. Each option is designed to fit different driving needs and financial goals.

Buying a Vehicle with Ally Auto Loans

If you’re looking to own your car, Ally auto loans make it easy with flexible terms. Whether you’re buying a new car from the lot or a certified used car, Ally can help you spread the cost over time with monthly payments.

You don’t apply directly through Ally’s website. Instead, you go to a dealership that works with Ally car loan, select your vehicle, and let the dealer handle the application process.

Key Features:

- Flexible loan terms that can match your budget

- Fixed interest rates so your monthly payments stay the same

- No penalty for paying off your loan early

- Online access to check your balance, make payments, and see your statements anytime

You can also finance specialty vehicles, including those with accessibility features like wheelchair lifts or right-hand drive configurations.

Ally SmartLease Program

Not interested in owning a car long-term? The Ally SmartLease program could be a better fit. Leasing lets you drive a newer car for a few years without committing to ownership.

With Ally’s lease program, you usually have lower monthly payments than with a loan. Plus, since leases run for shorter terms (typically 2 to 3 years), you can upgrade to a newer model more often.

Lease Highlights:

- Shorter lease terms (usually 2–3 years)

- Lower monthly payments than a loan

- The ability to upgrade cars more frequently

When your lease ends, you can return the car, buy it out, or lease a new one. This option is great if you like having the latest model, want fewer upfront costs, or just don’t want to worry about selling your vehicle later.

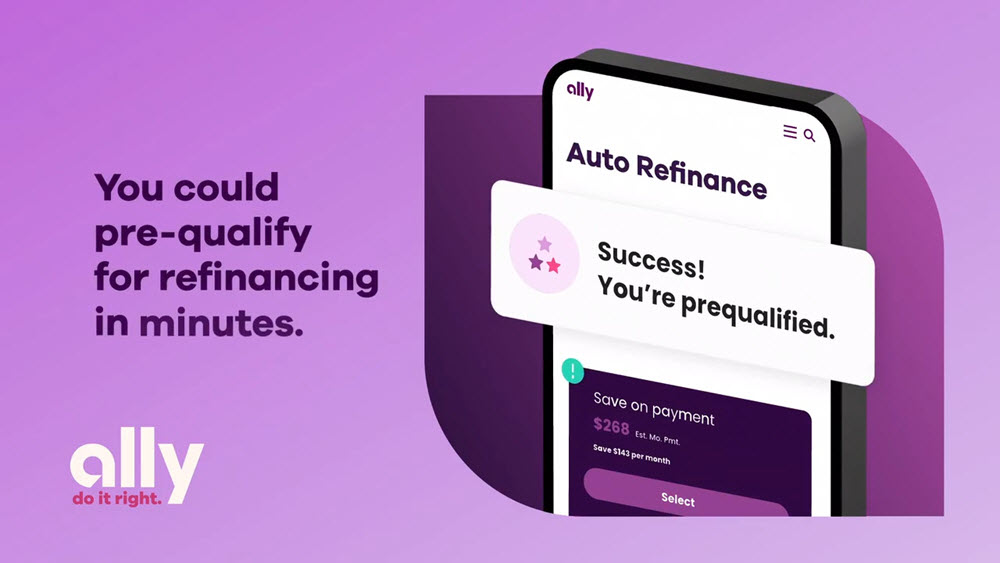

Refinance Loans & Lease Buyouts

If you already have a car loan and want a better deal, Ally auto loans allow you to refinance online. This is one of the few auto loan options Ally offers directly to consumers through its website. You can also refinance to buy out your current lease and keep the car. The process is fast, with no hard credit check upfront, so your credit score won’t be affected when you check your options.

Key Features & Benefits of Ally Auto Loans

Ally doesn’t just offer car loans, it offers a digital financing experience. Let’s explore the features that make Ally Auto Loans stand out from the competition.

Digital-First Experience

Ally is built for people who want to manage everything online. You don’t need to visit a branch or mail in payments. Once your loan is active, you can use Ally’s website or mobile app to:

- Make payments (manually or through auto-pay)

- Use online Ally auto loan calculator

- View your loan balance and interest charges

- Request a payoff quote instantly

- Set up alerts and reminders

- Download statements and documents

The platform is clean, simple to navigate, and designed with user-friendliness in mind. It’s perfect for busy individuals who want full control without the hassle of paper statements or long phone calls.

Flexible Loan Terms and Loan Amount

Ally auto finance offers loan amounts ranging from $1,000 to $300,000, depending on the type of loan and the car you’re financing.

Moreover, with Ally auto loans, you aren’t locked into one-size-fits-all terms. Loan durations typically range from 12 to 84 months (1 to 7 years), giving you the flexibility to choose what works for your budget.

- Want to keep monthly payments low? Choose a longer term (e.g., 60–72 months).

- Want to pay less interest over time? Opt for a shorter term (e.g., 24–36 months).

Note: Actual Ally auto loans rates are based on your credit score, loan amount, vehicle type, and term length. The dealership will provide the final numbers after working with Ally on your behalf.

Specialty Vehicle Financing

Ally isn’t just for everyday sedans and SUVs. They also offer financing options for unique vehicle needs, making them a more inclusive lender.

Here are some specialty vehicles that Ally auto loans support:

- Accessible Vehicles (for drivers with disabilities or mobility challenges)

- Electric Vehicles (EVs) such as Tesla, Rivian, or Ford Lightning

- In certain cases, they also offer loans for classic or collector cars

This flexibility makes Ally a good choice for buyers who don’t fit the typical car financing mold.

Ally Auto Mobile App

The Ally Auto app is a powerful tool that puts your entire loan in the palm of your hand. It’s available on both iOS and Android.

Key features of Ally auto loan app include:

- View statements, transaction history, and upcoming payments

- Set up or manage Auto Pay

- Get alerts when payments are due or if there’s an update to your account

- Track your progress toward paying off your loan

- Check your FICO Score without hurting your credit

- Update your contact or payment info securely

For borrowers who like to keep track of finances on the go, this Ally auto finance app is a huge advantage. You don’t need to log into a desktop or make calls to check your balance or due date.

Ally Auto Loan Rates & Fees

When it comes to rates and costs, Ally auto loans remain competitive, but what you qualify for depends on your credit, income, and loan type.

- Interest Rates (APR): Rates typically start around 2.65% for borrowers with excellent credit. For people with lower scores, Ally auto loan APRs can go above 14%. These rates are similar to national averages.

- Average Loan Rates (as of July 2025):

- New Car (60 months): Around 7.27%

- Used Car (48 months): Around 7.68%

- No Origination Fees: Ally doesn’t charge a fee just to apply or open a loan, which helps keep upfront costs low.

| Loan Feature | Details |

|---|---|

| Starting APR | From 2.65% (for excellent credit) |

| High-End APR | Up to 14%+ (for lower credit scores) |

| New Car Loan (60 months) | Around 7.27% average APR |

| Used Car Loan (48 months) | Around 7.68% average APR |

| Origination Fee | $0. No fee to apply or open the loan |

| Fee Transparency | No hidden application or setup fees |

| Rate Factors | Based on credit score, income, and loan type |

| Rate Policy | Rates may vary based on market trends |

Disclaimer: The rates and fees listed above are estimates based on publicly available information as of July 2025. Actual rates may vary depending on your credit profile, location, and Ally’s current lending policies. Always check directly with Ally for the most up-to-date and accurate loan terms.

These numbers are subject to change and depend on market conditions. It’s always smart to compare Ally’s offers with other lenders to make sure you’re getting the best deal.

Ally Auto Loan Requirements

While Ally doesn’t publish strict loan requirements on its website, there are a few general rules you should know before applying for Ally auto loans. Basic requirements include:

- Credit Score: You can qualify with a credit score as low as 520, depending on the loan type and your overall financial situation. But in most cases, a credit score of 650 or higher gives you a better chance of approval and may qualify you for a lower interest rate.

- Proof of Income: You’ll need to show that you can afford monthly payments. This means providing recent pay stubs, tax returns, or bank statements. For refinancing, you typically need a yearly income of at least $24,000.

- Age and Residency: You must be at least 18 years old and a legal resident of the United States.

- Vehicle Information: The dealership will submit details about the car you want to buy or lease, including:

- VIN (Vehicle Identification Number)

- Purchase price

- Vehicle type

- Dealer location

- Vehicle Restrictions:

- The vehicle can’t be more than ten years old.

- It must have under or equal to 120,000 miles to qualify for refinancing.

- Other Documents: Depending on the dealership and your financial situation, you might also need to show:

- A valid driver’s license

- Proof of insurance

- Recent utility bills or other documents showing your residential address

Finally, keep in mind that different dealerships may have slightly different requirements, especially for specialty vehicles or used cars.

How to Apply for Ally Auto Loans

Getting an Ally Bank auto loan is different depending on whether you’re refinancing, buying out a lease, or financing through a dealer.

Ally Auto Loan Application For New or Used Cars

Applying for an Ally auto loan is a little different from applying through a regular bank. You can’t go to Ally’s website and apply for a car loan directly. Instead, Ally works with select car dealerships across the country, and you apply for financing at the dealership.

Here’s a simple step-by-step guide:

- Find a dealership that partners with Ally Auto. Most major dealerships work with Ally, but it’s a good idea to ask in advance.

- Pick the car you want to buy or lease. Test drive a few vehicles and decide what fits your needs and budget.

- Negotiate the price of the car with the dealer, just like you normally would.

- Ask the dealer to submit your loan or lease application through Ally. They’ll collect your basic information and send it in.

- Wait for approval. This usually takes a short time, sometimes just minutes.

- Review and sign the paperwork if you’re approved. The dealer will go over your interest rate, monthly payments, and loan terms with you.

- Drive away in your new vehicle! Once everything is signed, the loan is finalized, and you can take the car home.

Moreover, some dealerships offer a prequalification check, which lets you see what rates or loan amounts you may qualify for. It’s a soft credit check, so it won’t affect your credit score.

For Refinance & Lease Buyouts

- You can apply directly online through Ally’s website.

- The process starts with a soft credit check, so there’s no impact on your credit score when you check your rates.

- You won’t need to enter your full Social Security number during the first steps.

- If you accept the offer and continue, a hard credit pull will be done during final approval.

- After approval, it usually takes a few days to a couple of weeks to complete the funding and finalize everything.

Paying Off Your Ally Auto Loans

Whether you prefer to pay online, by phone, or even in person, Ally makes it easy to manage your car loan in the way that works best for you.

Payment Options with Ally Auto Loans

One of the things that makes Ally auto loans stand out is how many payment options they offer.

- Online or Mobile App: Make one-time payments or set up Auto Pay with no extra fees. You can track your balance, view payment history, and check your FICO Score anytime.

- Text Payment: Reply “PAY” to a reminder text, and your payment will be processed automatically. Just opt in to text alerts first.

- Mail a Check: Send your payment to Ally Auto Loans address:

Payment Processing Center

P.O. Box 71119

Charlotte, NC 28272-1119

Include your vehicle account number and payment coupon. - Phone Payment: Call 1-888-631-8930 via ACI Payments, Inc. There’s a $4 fee per transaction. Have your account number and ZIP code ready.

- In-Person Payment: Visit MoneyGram or Western Union Quick Collect locations. These third-party services may charge a small fee.

Easy Payoff Process

Ready to pay off your loan completely? Ally makes that process simple too.

Follow these steps:

- Log in to your Ally Auto account online or in the app

- Choose your vehicle from the dashboard

- Go to Payments > View Payoff Quote

- Review the amount and follow the on-screen steps to make the final payment

Depending on the regulations in your state, Ally will either release your vehicle’s title or lien following the processing of your last payment.

Can You Make Extra or Early Payments?

Yes! Ally gives you the flexibility to pay extra, make more than one payment a month, or pay off your entire loan early.

Here’s what you need to know:

- Early payments are allowed and won’t cost you any penalties

- You can make extra payments at any time

- If you’re on Direct Pay, you’ll need to cancel it and switch to Auto Pay to make additional payments online

- You can also call 1-888-925-2559 for help making large or one-time extra payments

Making extra payments can help you pay off your loan faster and reduce the total interest you pay over time.

Ally Auto Loan Customer Service

If you ever need help with your auto loan, Ally’s customer support team is ready to assist you.

Ally auto loans phone number: 1-888-925-2559

Hours:

- Monday to Friday: 8 am – 11 pm ET

- Saturday: 9 am – 7 pm ET

Languages: Support is available in English and Spanish

For borrowers in New York City, Ally also offers links to helpful resources about debt collection terms in multiple languages through the NYC Department of Consumer Affairs.

FAQs about Ally Auto Loans

What credit score do I need for an Ally auto loan?

- You can get approved for an Ally auto loan with a credit score starting around 520. A higher score can help you qualify for lower interest rates, but Ally does work with people who have fair or average credit.

Can I get prequalified for an Ally auto loan online?

- Yes, you can prequalify online if you’re looking to refinance your current loan or do a lease buyout. It won’t affect your credit score. However, for new or used car loans, you’ll need to apply through a participating dealership.

Does Ally charge any fees to apply?

- No, Ally does not charge any application or setup fees for auto loans. You can apply or get prequalified without paying anything upfront.

How long does it take to get the loan funds?

- Once you’re approved, it usually takes a few days to a couple of weeks for the loan to be processed and funded. The timeline may vary based on your situation and the type of loan.

Can I apply with someone else?

- Yes, Ally lets you apply with a co-applicant. This could be a spouse, family member, or friend. Having a co-applicant with good credit may improve your chances of approval or help you get better loan terms.

In conclusion, whether you’re buying a new car, refinancing, or ending a lease, Ally offers simple terms and no hidden fees. While rates depend on your credit, the online tools and dealer network make the process easy to manage. If you’re looking for a straightforward way to finance your next car, Ally auto loans are worth considering.