PNC Mortgage Service helps you make one of life’s biggest financial decisions: buying a home. Property values continue to rise, making it more important than ever to understand how mortgage services work and choose the right lender. You may be a first-time buyer, moving to a new home, or refinancing your existing loan. Either way, you need a mortgage provider that offers clarity, flexibility, and reliability.

PNC steps in to meet these needs. The company brings years of experience to the table. Additionally, they offer a wide selection of mortgage products and digital tools that make the process simpler. These features help PNC stand out as a trusted partner for home financing. So, this post will give you everything about PNC Mortgage Service. You’ll discover how they work, what you need to apply, and why they might be the right choice for you.

Introduction to PNC Financial Services Group

Choosing a mortgage provider starts with understanding who you’re working with. Let’s take a closer look at PNC Financial Services Group and its background.

History of PNC Financial Services Group

PNC Financial Services Group has a rich history that dates back to 1852, when the company was originally established as the Pittsburgh Trust and Savings Company. Over the years, the bank expanded through a series of significant mergers, including the 1983 union of Pittsburgh National Corporation and Provident National Corporation. This pivotal moment gave rise to the name “PNC” and laid the foundation for PNC’s modern identity. Furthermore, this merger marked the beginning of its national growth strategy.

PNC is headquartered in Pittsburgh, Pennsylvania, and has since become one of the largest and most respected banks in the United States. The bank ranks among the top 10 U.S. banks by total assets and operates in more than 20 states. Additionally, it maintains a physical presence that includes over 2,600 branches and more than 9,000 ATMs. With its deep roots and financial strength, PNC continues to serve as a reliable partner for millions of individuals, families, and businesses across the country.

PNC Financial Services Group General Services

PNC operates as a full-service financial institution, providing an extensive range of banking products for individuals, businesses, and institutions. The bank designs its services to support everyday banking needs while also addressing long-term financial planning requirements. Key offerings include:

- Credit Cards: Options for both consumers and businesses, offering cashback, rewards, and travel benefits.

- Personal and Joint Checking Accounts: Feature-rich accounts with digital access, overdraft options, and spending tools.

- Mortgages and Home Equity Loans: Flexible terms for home purchases, refinancing, or borrowing against home value.

- Auto Loans: New and used car financing, as well as refinancing for better rates.

- Business Services: A complete suite of tools under the PNC Business Services, tailored to businesses of all sizes.

- Investment & Retirement Planning: Services for IRAs, mutual funds, and wealth management strategies.

Additionally, PNC’s digital infrastructure enhances customer experience through mobile apps, virtual wallets, and online financial planning tools, making banking both accessible and efficient.

Types of PNC Mortgage Service

When you consider buying a home or refinancing, you need to understand the types of loans available to you. PNC Mortgage Service offers many mortgage solutions that fit different financial needs, goals, and life stages. This section will start by explaining what a mortgage is. Then, we’ll compare it with general home loans and explore the eight main types of mortgages PNC provides. Each type has its unique advantages.

What is a Mortgage?

A mortgage is a specific type of loan that helps you purchase or refinance a home. The property itself acts as collateral for this loan. This means the lender has the legal right to foreclose and reclaim the property if you fail to make the required payments. Mortgages typically involve long-term repayment plans. They also feature fixed or adjustable interest rates.

What is the difference between a Mortgage and a Home Loan? People often use the terms “mortgage” and “home loan” interchangeably. However, they have subtle differences:

- Home Loan is a broader term that covers any loan used for residential purposes. This includes unsecured personal loans for renovation or home equity lines.

- A mortgage is a specific type of home loan that secures your property. This makes it more structured and subject to legal foreclosure terms if you default.

In short, all mortgages are home loans, but not all home loans are mortgages. PNC Mortgage Service focuses on structured, secured mortgages. These mortgages meet a wide variety of borrower needs.

Fixed-Rate Mortgages

Among the options available through PNC Mortgage Service, the Fixed-Rate Mortgage stands out as the most straightforward and dependable choice. This mortgage locks in your interest rate for the entire loan term, which commonly spans 15, 20, or 30 years. Your monthly payment stays the same, regardless of how market rates change.

Best for: Buyers who value stability and want to avoid surprises in their budgeting.

Key advantages:

- You get predictable payments from start to finish

- Planning household finances becomes easier

- You receive full protection from future rate increases

This mortgage type suits buyers planning to stay in their homes long-term. And if you’re looking for similar consistency in other areas, Auto Loans options also offer fixed-rate peace of mind.

Adjustable-Rate Mortgages (ARMs)

With PNC Mortgage Service, the Adjustable-Rate Mortgage (ARM) offers a flexible option that starts with a reduced interest rate for an initial period. This period commonly lasts 5, 7, or 10 years before the rate adjusts based on market conditions.

Best suited for: Buyers who expect to move, sell, or refinance before the rate adjustment period begins.

Key benefits:

- You enjoy lower monthly payments during the first few years

- You get the opportunity to maximize savings early on

- This becomes a smart choice for short-term ownership or financial planning

An ARM can be a cost-effective way to step into homeownership for those who prioritize lower upfront costs. Additionally, pairing your mortgage with Credit Cards may offer additional financial breathing room to manage other short-term expenses.

Jumbo Loans

For those purchasing high-end properties that exceed conventional loan limits, the Jumbo Loan from PNC Mortgage Service offers the right level of support. These loans cover amounts typically above $766,550, allowing buyers to finance premium homes that fall outside standard lending programs.

Best suited for: High-income earners investing in luxury real estate or properties in competitive markets.

Key benefits:

- Ability to borrow larger amounts for upscale homes

- Access to exclusive property markets not served by conventional loans

- Attractive interest rates even at higher borrowing levels

PNC brings years of experience in managing complex loan structures, helping simplify large transactions. And if you’re thinking beyond the mortgage, Wealth Management offers strategic guidance to align your home purchase with long-term financial goals.

FHA Loans

With support from the Federal Housing Administration, the FHA Loan offered through PNC Mortgage Service makes homeownership more accessible, particularly for buyers with limited savings or lower credit scores. It’s designed to lower the financial barriers that often prevent people from entering the housing market.

Best suited for: First-time homebuyers or moderate-income families who need a flexible, low-entry path to owning a home.

Key benefits:

- Down payments as low as 3.5%, making upfront costs more manageable

- Lenient credit requirements, often accepting scores as low as 580

- Extra protection with federal mortgage insurance, reducing lender risk

VA Loans

The VA Loan from PNC Mortgage Service is a government-backed mortgage tailored for active-duty military members, veterans, and eligible surviving spouses. Guaranteed by the Department of Veterans Affairs, it stands out as one of the most affordable and accessible financing options, offering valuable benefits to those who have served.

Best for: Military families seeking to buy a home with favorable terms.

Key benefits:

- No down payment required, reducing upfront financial pressure

- No PMI, which lowers monthly payments

- Competitive interest rates and reduced fees compared to conventional loans

USDA Loans

The USDA Loan, available through PNC Mortgage Service, provides a strong financing option for buyers in eligible rural and suburban areas. Backed by the U.S. Department of Agriculture, this program is specifically designed to help moderate- to low-income households achieve affordable homeownership with favorable terms and little to no upfront cost.

Best for: Buyers seeking affordable housing outside major urban centers.

Key benefits:

- 100% financing, meaning no down payment is required

- Lower mortgage insurance premiums than many other loan types

- Flexible loan terms and supportive eligibility criteria

Physician Loans

PNC Mortgage Service offers a dedicated Physician Loan program designed to meet the unique needs of medical doctors, dentists, and residents. This loan type recognizes the financial realities of those in the healthcare field, such as high student debt and delayed income.

Best for: Newly licensed or practicing medical professionals entering the housing market.

Key benefits:

- No PMI required, even with a low down payment

- Loan amounts of up to $1.5 million for qualifying borrowers

- Future income or signed employment contracts can be used for approval

Refinance and Cash-Out Loans

With PNC Mortgage Service, homeowners have the option to refinance their existing mortgage or access their home equity through cash-out refinancing. Therefore, these solutions are ideal for adjusting your loan terms or funding major expenses without taking on new unsecured debt.

Best for: Homeowners looking to improve loan terms or unlock the value of their home.

Key benefits:

- Potential to secure a lower interest rate than your current mortgage

- Flexibility to shorten or extend your loan term based on your goals

- Access equity to pay for education, renovations, or debt consolidation

Why choose PNC Mortgage Service

The PNC Mortgage Service combines smart technology, financial flexibility, and trusted support, so, making it a reliable choice for homebuyers across different needs.

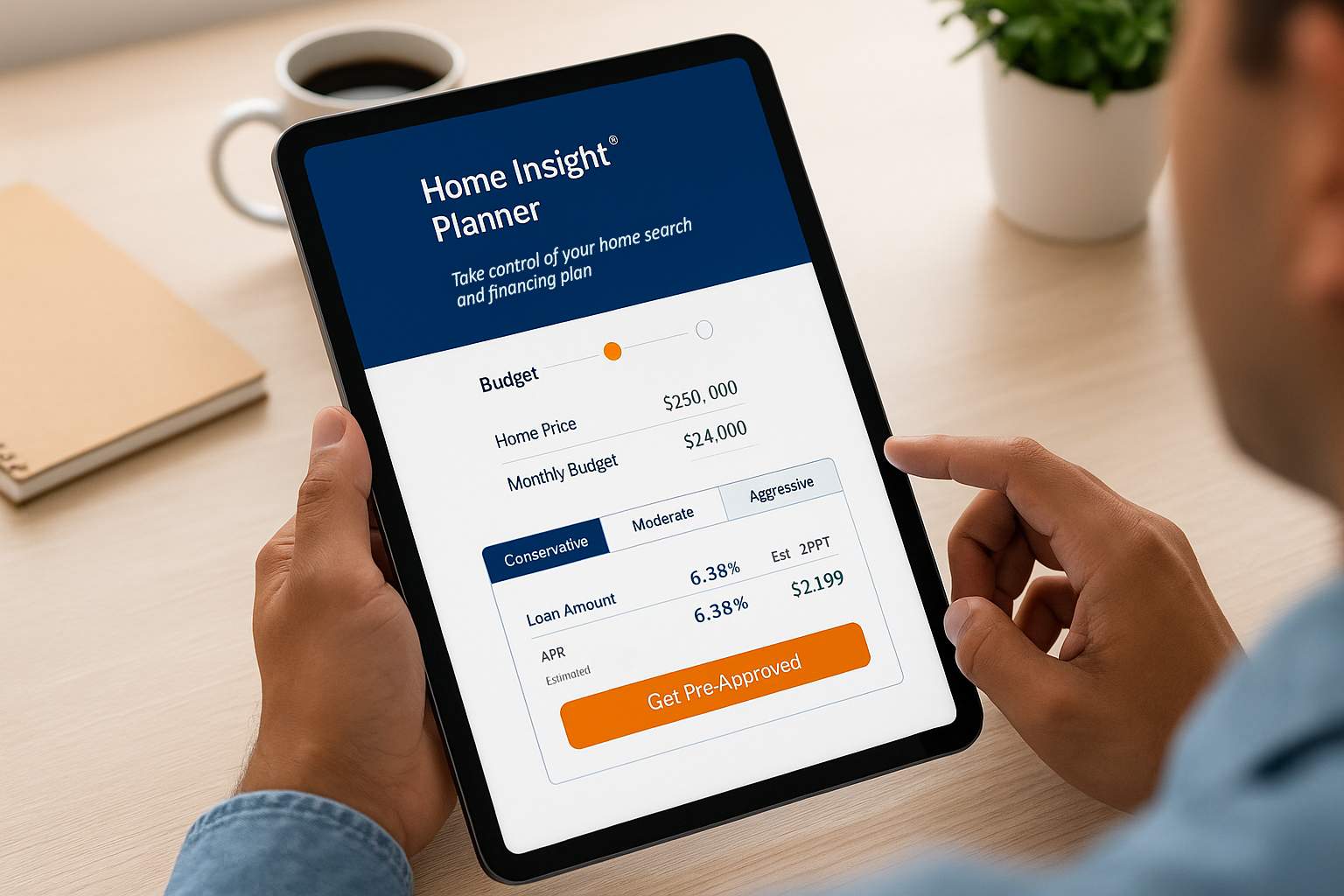

- Home Insight Planner gives you full control over your home search and financing plan. Besides, you can set a budget, compare loan options, and get pre-approved online without affecting your credit score.

- Grants for First-Time Buyers help reduce upfront costs, offering up to $5,000 to $15,000 for eligible borrowers to apply toward down payments or closing expenses.

- Competitive interest rates and lower-than-average origination fees mean you save both upfront and over the life of your loan. PNC is known for its transparent pricing and absence of hidden fees.

- The digital application process is streamlined and user-friendly. Therefore, you can apply, upload required documents, and track every step online, saving time and eliminating unnecessary paperwork.

- As an award-winning lender, PNC has been recognized by NerdWallet and other institutions for excellence in FHA loans, jumbo loans, and overall customer satisfaction.

PNC Mortgage Service: Eligibility

Before applying for a PNC Mortgage Service, it’s important to understand the key eligibility requirements, both for the borrower and the property being financed.

Borrowers’ Eligibility for Mortgage Service

To qualify, you’ll need to meet the following personal financial criteria:

- Steady income: Proof of consistent earnings is required, such as recent pay stubs, tax returns, or employment verification.

- Credit score: FHA loans require a minimum score of 580, while conventional loans generally need 620 or higher.

- Debt-to-Income (DTI) ratio: Typically, your DTI should be 43% or less, though exceptions may apply with strong financial factors.

- Residency status: Most PNC loan options are available to S. citizens or permanent residents only.

Property Eligibility for Mortgage Service

Not every property qualifies, so PNC applies the following guidelines:

- Property type: Eligible properties include primary residences, vacation homes, and certain investment properties.

- Appraisal requirement: The home must be evaluated by a PNC-approved appraiser to confirm its market value.

- Loan limits: These vary depending on location and loan type. For example, jumbo loans begin at $766,550 or more in most counties.

If you’re unsure about your eligibility, PNC Mortgage Consultants are available to guide you through the process. And if you’re planning a smaller renovation or home improvement, consider exploring Personal Loans Solutions for added flexibility.

PNC Mortgage Service: Documents and Procedures

Preparing the right paperwork in advance can save you time and stress. When you apply for PNC Mortgage Service, knowing what to gather and what to expect makes the process much smoother from start to finish.

Documents for PNC Mortgage Service

PNC asks for standard financial and personal documents to verify your identity and eligibility:

- Proof of identity: You need a valid driver’s license or government-issued ID.

- Proof of income: This includes recent pay stubs, W-2s, 1099s, and the last two years of tax returns.

- Bank statements: You typically need statements from the past 60 days for all active accounts.

- Credit information: PNC will run a credit check as part of the review.

- Debt summary: You provide a list of your ongoing financial obligations, such as credit cards, student loans, or car payments.

Note: If you’re applying for an FHA or VA loan, you may need to submit additional forms for verification or government-related requirements.

Application Process for PNC Mortgage Service

PNC simplifies the entire mortgage journey into five clear steps:

- Pre-Approval: You get started through the Home Insight Planner or with a loan officer to understand your borrowing power.

- Home Search and Offer: You choose properties that fit within your approved range and submit your offer.

- Full Loan Application: You provide complete financial documents and home details.

- Underwriting Review: PNC reviews, verifies, and assesses risk for approval.

- Closing: You finalize paperwork, pay closing costs, and receive the keys to your new home.

You can complete each step online, with dedicated consultants ready to assist if needed. For a fully digital experience across your finances, consider opening a Checking Account. This account offers paperless management and provides instant access 24/7.

PNC Mortgage Service: Terms and Rates

To make the most of your mortgage, you need to understand how the loan is structured, what payments look like, and what costs to expect along the way. However, PNC Mortgage Service offers clear terms and competitive rates that fit different financial situations.

Loan Terms of PNC Mortgage Service

PNC offers flexible term lengths based on the type of mortgage you choose:

- Loan durations typically include 15, 20, or 30 years for fixed-rate loans.

- You make payments monthly, and these usually include principal, interest, property taxes, and insurance (PITI).

- PNC generally does not apply prepayment penalties, which gives you the freedom to pay off your loan early without extra fees.

Interest Rates of PNC Mortgage Service

PNC mortgage service rates are competitive and vary depending on several key factors:

- Your credit score

- The loan type and amount

- The location of the property

- The down payment size

Here is a reference of PCN Mortgage Rates, based on a loan of $200,000 and a down payment of $40,000 with a credit score of 720-739, in California.

| Loan Type | Interest Rate | APR | Monthly Payment |

| 30-Year Fixed | 7.000% | 7.230% | $1,064.48 (P&I) |

| 20-Year Fixed | 6.875% | 7.173% | $1,228.50 (P&I) |

| 15-Year Fixed | 5.875% | 6.252% | $1,339.39 (P&I) |

| 10 Yr Fixed | 5.750% | 6.285% | $1,756.31 (P&I) |

|---|---|---|---|

| 10-Year SOFR ARM | 8.125% | 8.012% | $1,188.00 (P&I) |

| 7-Year SOFR ARM | 7.875% | 7.768% | $1,160.11 (P&I) |

Additional costs may include:

- Origination fees: These usually cost around 0.5% to 1% of your loan amount

- Appraisal and inspection fees: Costs vary by region and property type

- Closing costs: These typically range from 2% to 5% of the home’s purchase price

For an accurate breakdown, PNC provides a Loan Estimate early in the process. This allows you to review all fees in advance and plan your budget accordingly.

Need more financial flexibility during the move? Pairing your mortgage with Credit Cards can help you manage short-term expenses with ease.

PNC Mortgage Service: Bonus and Benefits

One advantage of choosing PNC Mortgage Service is the range of extra benefits available, especially when you also use other banking products from PNC. These perks can lower your costs, streamline your experience, and also provide long-term value beyond the mortgage itself.

Closing Cost Assistance and Grants

PNC supports homebuyers with targeted financial assistance:

- Through the PNC Community Lending Program, eligible borrowers can receive $5,000 to $15,000 in grants to help cover down payments or closing costs.

- For qualified medical professionals, PNC’s Physician Loan Program waives the need for private mortgage insurance (PMI). This reduces monthly payments significantly.

Home Insight Digital Tools

PNC’s digital platform makes managing your mortgage much easier:

- You can use real-time tools to track your loan progress, estimate payments, and also plan for future costs.

- You can link your checking and savings accounts to automate budgeting and payment scheduling.

Bundled Banking Perks

Customers who combine a mortgage with other PNC services enjoy more benefits:

- You can pair your mortgage with a PNC Checking or Business Account to unlock rate discounts, priority processing, and seamless fund transfers.

These bundled advantages make PNC Mortgage Service especially attractive for borrowers seeking an all-in-one banking relationship. If you’re running a business, consider how Business Banking Solutions can further streamline your financial management.

FAQs about PNC Mortgage Service

Here are some FAQs about Mortgage Service of PNC Financial Services Group

Can I apply online for PNC Mortgage Service?

- Yes, PNC offers full digital applications through its Home Insight Planner.

What’s the minimum credit score?

- It depends on the loan type. FHA loans start at 580, while conventional loans require 620+.

How long does the process take?

- Typically, 30 to 45 days from application to closing.

Are there special programs for first-time buyers?

- Yes, including grants and low-down-payment options.

Can I refinance through PNC?

- PNC offers rate-and-term refinancing and cash-out options.

What states does PNC operate in?

- PNC offers mortgage services in all 50 U.S. states.

Can I make extra payments?

- Most PNC mortgage types allow extra payments with no penalty.

Navigating the home-buying process doesn’t have to be overwhelming. With a wide range of options, digital tools, and award-winning support, PNC Mortgage Service provides a reliable path to homeownership. Whether you’re buying your first home, refinancing, or exploring special programs, PNC has the expertise and flexibility to guide you every step of the way.