If you’re thinking about buying a home, refinancing, or tapping into your home’s equity, Comerica Bank offers a wide range of flexible lending options to meet your needs. From conventional mortgages to jumbo loans, Comerica home loans are built for your different life stages.

In this guide, we’ll walk you through Comerica home mortgage and HELOC options, explain how they work, and help you decide if they’re the right fit for your goals.

Overview of Comerica Home Loans

To better understand what makes Comerica home loans unique, it’s helpful to start with a quick look at the bank behind them and how its lending services have evolved over time.

About Comerica Bank

Comerica Bank was started in Detroit in 1849 under the name Detroit Savings Fund Institute. At a time when very few banks offered interest on savings, Comerica stood out by helping everyday people grow their money. From the beginning, the bank focused on supporting individuals and working families.

Over the years, Comerica continued to grow. It made it through the Great Depression and merged with several local banks in Michigan. In the 1980s and 1990s, the bank expanded into new states like Texas, California, Florida, and Arizona, often by teaming up with smaller banks in those areas.

In 2007, Comerica moved its headquarters to Dallas, Texas, to be closer to more of its customers in the southern U.S. Even so, it still has a strong presence in Michigan, where it all began. Today, Comerica has over 400 branches and offers a wide range of services, including personal banking, business banking, investment advice, and home loan solutions.

Comerica Home Loans Today

Comerica home loans are created to give you choices and support at every step. You can pick from fixed-rate or adjustable-rate mortgages, and they also offer programs like FHA, VA, conventional, and jumbo loans. No matter if you’re a first-time buyer, a veteran, or a seasoned homeowner, there’s likely a loan that fits your needs.

For homeowners looking to use their home’s equity, Comerica offers a Home Equity FlexLine, a type of revolving credit line. You can borrow only what you need and pay interest on just that amount. The line comes with competitive rates and even limited-time introductory offers for new customers.

Comerica provides home loan services in several key states, including Texas, Michigan, California, Florida, and Arizona. Since they understand each local market, their team is able to offer personalized support, whether online or in person at a nearby branch.

Types of Comerica Home Loans Available

When it comes to financing a home, Comerica offers a variety of loan options to fit different needs and financial situations:

Home Mortgage Loans

Comerica provides several mortgage solutions for people who want to buy a home:

Conventional Mortgages

A conventional mortgage is a popular choice for people who have good credit, a reliable income, and a solid financial history. These Comerica home loans are not backed by the government and come in two main types:

- Fixed-rate mortgages: Your interest rate and monthly payment stay the same for the entire loan term. This gives you stability and makes budgeting easier.

- Adjustable-rate mortgages (ARMs): These start with a lower interest rate for a set number of years, then adjust annually. ARMs can save you money in the short term but may rise later.

Best for: Buyers who want predictable payments or plan to stay in their home for a long time.

FHA Loans

FHA loans, backed by the Federal Housing Administration, are designed for people who may not qualify for conventional mortgages. They’re easier to get approved for and require a smaller down payment.

- Down payments as low as 3.5%

- More relaxed credit score requirements

- Great for buyers who are new to the market or rebuilding after past credit issues

Best for: First-time homebuyers or people with limited savings and less-than-perfect credit.

VA Loans

VA loans are a great option for U.S. veterans, active-duty military members, and eligible surviving spouses. Backed by the Department of Veterans Affairs, these Comerica home loans offer powerful benefits.

- No down payment required

- No private mortgage insurance (PMI)

- Competitive interest rates

VA loans help make homeownership more affordable for those who have served our country.

Jumbo Loans

If you’re buying a high-value property, a jumbo loan may be what you need. These are for mortgages that exceed the conforming loan limit, currently $766,550 in most areas.

- Designed for large or luxury home purchases

- Often require a strong credit score and more income verification

- May have stricter requirements than standard loans

Best for: High-income buyers or those purchasing real estate in expensive markets.

Comerica Mortgage Refinancing

Already own a home and want to improve your financial situation? Refinancing with Comerica can help you save money or tap into your home’s equity.

Comerica refinancing options include:

- Lowering your current interest rate

- Reducing your monthly payments

- Shortening your loan term (e.g., from 30 to 15 years)

- Switching from an adjustable-rate to a fixed-rate mortgage

- Cashing out equity to pay for large expenses like renovations, tuition, or debt consolidation

Benefits of Refinancing:

- Lower your monthly payments by securing a lower rate

- Switch to a fixed-rate mortgage for more predictable costs

- Drop PMI (Private Mortgage Insurance) if your loan qualifies

- Cash-out refinance gives you access to funds for big expenses

Comerica home refinancing can be a smart move if you want more breathing room in your monthly budget or are working toward long-term savings.

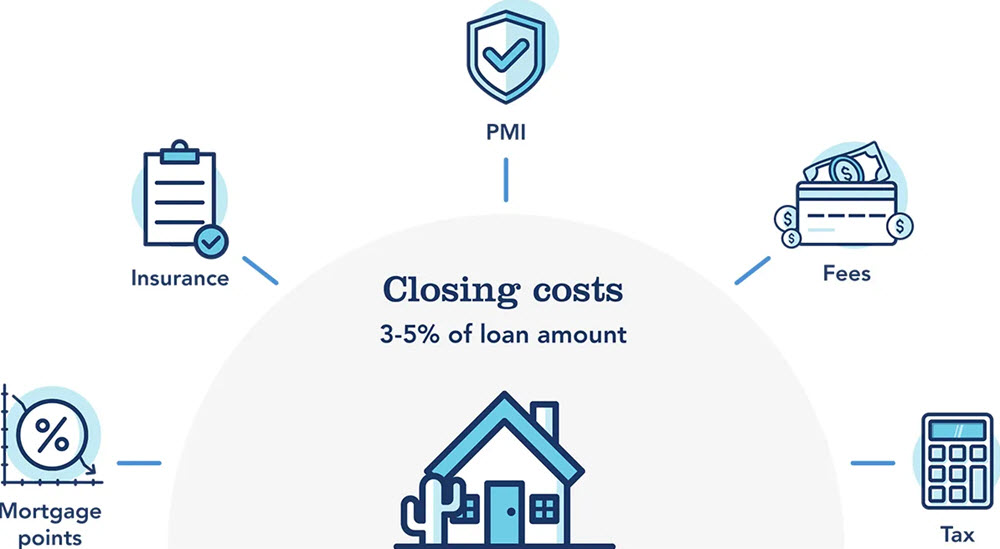

Costs to Consider When Refinancing:

- Application and processing fees

- Loan origination charges

- Title search and insurance, credit reports, and appraisal fees

Understanding the whole picture is crucial before making any refinancing choice. Therefore, you should use Comerica’s online calculators and refinancing checklists to figure out if the savings from refinancing will be worth the upfront costs.

Comerica Home Equity Loans

If you already own your home and have built up equity, Comerica’s Home Equity FlexLine is a powerful financial tool. It’s a revolving line of credit that lets you borrow money as you need it, similar to a credit card, but with much lower rates.

Key Features:

- Borrow up to 80% of your home’s value (minus your mortgage balance)

- Introductory APR as low as 6.24% for the first 6 months

- Ongoing variable APR as low as 8.25% (with automatic payments)

- No annual fee the first year

- Interest-only payments during the 10-year draw period

- Up to 20 years for repayment

What Can You Use a HELOC For?

- Home renovations: Upgrade your kitchen, bathroom, or roof

- Debt consolidation: Pay off high-interest credit cards or loans

- Education: Help fund college tuition or continuing education

- Major purchases: Buy a car, RV, or even fund a wedding

- Emergency funds: Be prepared for unexpected costs

Rates, Fees & Special Offers

Before choosing a Comerica home loan or HELOC, it is important to understand how their interest rates, fees, and occasional promotional offers work, as these factors can affect your total borrowing cost:

Comerica Home Loan Rates & Fees

Here’s a helpful breakdown to guide your decision before speaking with a loan officer and comparing Comerica home loans.

Comerica mortgage rates may vary based on credit score, down payment, and other personal factors:

| Loan Type | Estimated APR | Typical Fees & Closing Costs | Key Details |

|---|---|---|---|

| 30-Year Fixed – Purchase | ~7.02% | Around $4,700 total on average | Great for buyers who want long-term stability and lower monthly payments. |

| 30-Year Fixed – Refinance | ~6.79% | Similar to purchase (approx. $4.7K–$5K) | Good choice if you want to reduce your rate or change loan terms. |

| 30-Year Fixed – Cash-Out Refi | ~7.15% | Slightly higher than standard refinance | Useful for accessing your home’s equity, though rates and costs may be higher. |

| 15-Year Fixed – Purchase | ~6.40% | Usually lower than 30-year options | Faster payoff, less interest over time, but higher monthly payments. |

| 15-Year Fixed – Refinance | ~6.28% | Similar to purchase 15-year | Ideal for homeowners who want to pay off the loan sooner. |

| 15-Year Fixed – Cash-Out Refi | ~6.28% | Comparable to other 15-year options | Lets you tap into equity while securing a shorter-term loan. |

Comerica Home Equity Loan Rates & Fees

From July 1 to August 31, 2025, Comerica is offering a special deal on its FlexLine HELOC. New applicants can get a lower introductory interest rate for the first six months. If you set up automatic payments from a Comerica checking account, you could get an additional discount on your rate.

After the intro period ends, your Comerica home equity loan rate will adjust based on current market rates. Comerica helps lower upfront costs by covering title and appraisal fees for lines of credit up to $500,000. However, other fees may apply depending on your location.

| Feature | Description |

|---|---|

| Intro APR (First 6 Months) | Typically ranges from 6.00% to 6.24%, depending on when you apply and your financial profile. |

| Standard APR (After Intro Period) | Variable rate based on the Prime Rate plus a margin (usually between 0.25% to 3.75%). Minimum APR is 3.50%, with a cap at 18%. |

| CLTV Limit | You can borrow up to 80% of your home’s combined loan-to-value ratio. |

| Draw & Repayment Period | 10 years to borrow (interest-only minimum of $100/month), followed by up to 20 years to repay with principal and interest. |

| Fixed-Rate Conversion | Option to lock in a fixed rate: $100 fee per conversion in AZ, CA, FL, MI (no fee in TX). Minimum transfer is $2,500; up to 3 active fixed-rate balances allowed. |

| Annual Fee | $50 in AZ, FL, and MI (waived the first year), $80 in CA (waived the first year), and no fee in TX. |

| Early Closure Fee | If you close the line within 2 years (3 years in CA), you may pay the lesser of 2% of the credit line or a set fee ($350 in AZ/FL/MI, $500 in CA). No early termination fee in TX. |

| Appraisal & Title Fees | No fees for property valuation on credit lines up to $500,000 (for the first valuation only). |

| Insurance Requirement | Homeowners insurance is required. Flood insurance is also needed if your home is in a designated flood zone. |

Costs of Refinancing Your Mortgage

If you choose to refinance your mortgage through Comerica, expect to pay standard refinancing costs. These may include a loan origination fee, application and processing charges, a home appraisal, credit report fees, title insurance, and final closing costs. Some borrowers choose to pay for “points” to get a lower interest rate, but it’s important to compare the upfront cost with the long-term savings before deciding.

Who Should Consider Comerica Home Loans?

Comerica home loans are designed to fit many types of homebuyers and homeowners. Whether you’re buying your first home or looking to tap into your equity, there’s a loan option that can work for you:

| Borrower Type | Recommended Product |

|---|---|

| First-time buyer | FHA loan or fixed-rate mortgage |

| Veteran/military | VA loan |

| Investor | Jumbo loan or HELOC |

| Renovator | HELOC or cash-out refinance |

| Refinancer | Conventional refinance or rate reduction |

How to Qualify for Comerica Home Loans

Before you apply for Comerica Bank home loans, it’s important to understand what the bank looks for in a qualified borrower.

Credit Score & Income Requirements

To get approved for Comerica home loans or HELOCs, you will need a good credit score. Usually, a score of 680 or higher helps you get the best Comerica loan rates. Your chances of being accepted and receiving advantageous terms will increase with your score.

You’ll also need to show proof that you earn a steady income. Lenders will ask for things like recent pay stubs, tax returns, and documents that show your employment status.

Equity and Debt Limits

With Comerica’s FlexLine, you can borrow up to 80% of your home’s total value, including your existing mortgage. This is called the combined loan-to-value ratio (CLTV). Some banks may allow you to borrow more, up to 85% or even 90%, but that depends on the lender.

Comerica will also look at how much of your income goes toward debt. If your debt-to-income ratio (DTI) is above 43%, your chances of approval may drop.

Property Location and Collateral

Your home will serve as collateral, which means Comerica can take legal action against your property if you don’t repay the loan.

At the moment, Comerica FlexLine is only available in five states: Arizona, California, Florida, Michigan, and Texas. However, the bank is working on expanding into other states like North Carolina and Colorado in the near future.

How to Apply for a Comerica Home Loan

Getting started with a Comerica home loan is simple and straightforward. Here’s what to expect:

- Talk to a Mortgage Loan Officer: They’ll help you understand your options and get pre-qualified.

- Gather Your Info: Get together all the paperwork you’ll need. This includes proof of income, tax returns, current mortgage details, homeowners insurance, property taxes, and HOA (if applicable).

- Pick the Right Loan: Choose between fixed, adjustable, FHA, VA, jumbo, or refinancing options.

- Apply: You can apply online (only with HELOC options), call a loan officer, or visit a local branch for help.

- Get Approved: Comerica will review your info and give you a decision. For some Comerica home loans like HELOC or refinance, the bank may need to appraise your home’s value. The good news? They waive the appraisal fee for credit lines up to $500,000.

- Close the Loan: Sign the final documents and get the keys to your new home!

Comerica Home Loan Customer Service

When you apply for Comerica home loans, customer service is an important part of the journey. Comerica Bank ensures that you are supported at all times:

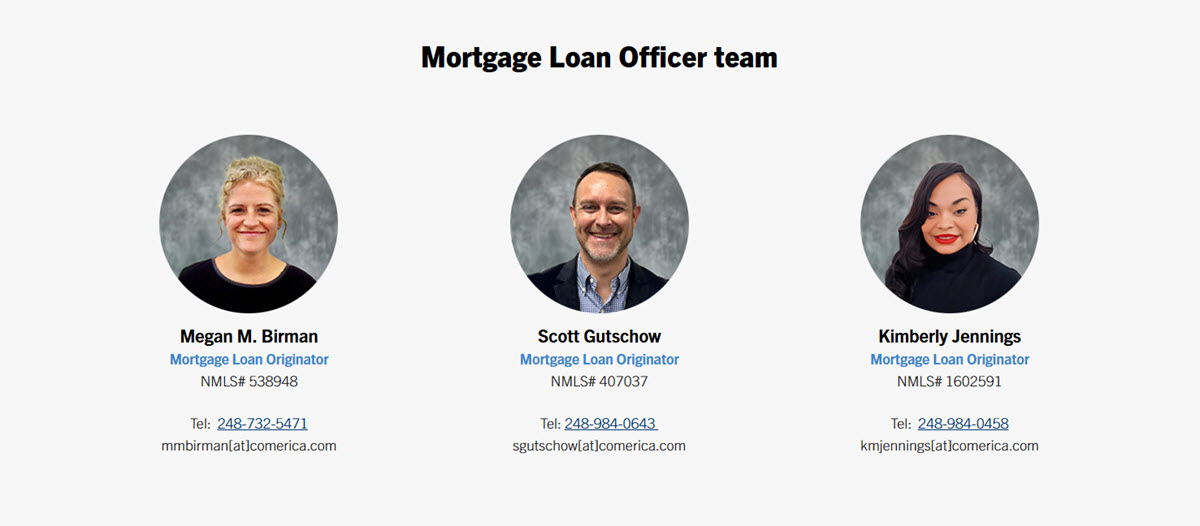

Personalized Help from Comerica Mortgage Loan Officers

One big advantage of working with Comerica Bank is its team of friendly, knowledgeable Mortgage Loan Officers (MLOs). These experts guide you step by step, helping you choose the right loan, gather your documents, and get through closing smoothly.

Some MLOs, like Natalie Verdin, also speak Spanish, making the process easier for bilingual families.

You can talk to an MLO by phone, email, or in person at a nearby Comerica banking center.

Phone Support

Comerica offers dedicated phone lines for both new and existing mortgage customers. If you’re looking to apply for a new home loan or refinance an existing one, you can speak directly with a Mortgage Loan Specialist by calling 1-800-867-5188. They will walk you through your options and answer any questions.

If you already have a Comerica loan and need help with your account, payments, or paperwork, you can call the customer service line at 855-451-9201. This line is available Monday through Friday during business hours.

For those who prefer self-service, Comerica also provides a 24/7 automated phone system. You can check your account, make payments, and manage your Comerica home loans using voice commands through their IVR system. For extra security, they offer VoiceSafe authentication, so only you can access your account.

In-Person Help at Comerica Branches

If you like face-to-face support, Comerica has you covered. You can visit a nearby Comerica banking center to meet with a Mortgage Loan Officer. These local experts offer personalized advice and help you gather documents, understand your loan terms, and prepare for closing. Moreover, they help you stay on course during the loan procedure and respond to any concerns you may have.

Helpful Tools and Resources

If you’re thinking about applying for Comerica home loans or HELOCs, it’s a good idea to check out the helpful tools and resources they provide. These tools are designed to make the process easier and help you understand what to expect:

- Refinance Calculator and Planning Checklist: Comerica offers a simple refinance calculator that helps you compare your current loan to a new one. You can see how much money you might save, estimate monthly payments, and decide if refinancing is worth it. There’s also a checklist that walks you through each step, so you don’t miss anything.

- Easy-to-Follow Loan Guides: Whether you’re new to home equity loans or want to learn more about HELOCs, Comerica provides easy guides that explain how it all works. You’ll find clear information about draw periods, repayment timelines, and how to lock in a fixed rate if you need more stability.

- Printable Checklists and Loan Documents: To help you stay organized, Comerica offers helpful checklists and forms you can download. These include home loan application steps, budgeting tips, and tools for comparing mortgage options. You can also find information on working with mortgage loan officers who can guide you through the process.

- Online and Mobile Banking Access: Once your loan is approved, you can manage it easily through Comerica’s online and mobile banking. You can make payments, check your balance, set up alerts, and even deposit checks through your phone. This makes it convenient to stay on top of your loan anytime, anywhere.

FAQs About Comerica Home Loans

What types of home loans does Comerica offer?

- Comerica offers a range of loans, including conventional fixed-rate and adjustable-rate mortgages, FHA loans for first-time buyers, VA loans for veterans, and home equity lines of credit (HELOC).

What credit score is needed for a Comerica home loan?

- Most Comerica home loans require a credit score of at least 620. However, FHA loans may accept lower scores. Your rate and approval will depend on your full credit profile.

How long does it take to get a home loan from Comerica closed?

- Closing times vary, but most Comerica Bank home loans close within 30 to 45 days, depending on the type of loan, documentation, and appraisal timelines.

Can I make extra payments or pay off my Comerica mortgage early?

- Yes. Comerica allows early or extra payments on most home loans without prepayment penalties, helping you pay off your mortgage faster and save on interest.

Does Comerica offer down payment assistance?

- While Comerica does not currently offer its own down payment assistance programs, some loan types (like FHA or VA) require lower or no down payment. You may also qualify for state or local assistance.

Overall, Comerica home loans offer a wide range of options for different needs, from first-time buyers to experienced homeowners. With flexible terms, in-person support, and refinancing solutions, Comerica provides tools to help you reach your homeownership goals. However, it’s important to compare rates and fees carefully before making a decision. Every borrower’s situation is unique, so take time to explore your choices.