A Comerica credit card can be a good choice if you bank with Comerica and want cards from a stable regional bank. Founded in 1849, Comerica now operates in several states and has been awarded for its small business banking in 2025.

In this review, we’ll walk you through each card, highlight key features, and help you pick the one that fits your needs best.

Comerica Credit Card Overview

Comerica Bank is a well-established financial institution with a strong focus on personal and business banking. Founded over 170 years ago, it has built a solid reputation for customer service, innovation, and financial strength. Comerica operates banking centers in key U.S. markets, especially in Texas, Michigan, California, Arizona, and Florida.

When it comes to credit cards, Comerica issues them in collaboration with one of the biggest card issuers in the nation, Elan Financial Services. This partnership allows Comerica to offer a wide range of credit card options, from basic secured cards to premium rewards cards. Whether you’re just starting to build credit or want to earn rewards on everyday purchases or business expenses, there are flexible Elan Comerica credit card solutions that are secure, easy to use, and packed with helpful features for you.

Personal Credit Cards from Comerica

Comerica provides a good range of personal credit cards. These Comerica credit card options are great for everyday spending, earning rewards, financing big purchases, or rebuilding credit.

Visa Platinum Card

The Visa Platinum Card is perfect if you’re planning a big purchase or need to pay off debt. It offers a long 0% intro APR period on purchases and balance transfers, which can help you save money on interest. However, this card doesn’t earn any rewards, so it’s better for short-term financial goals rather than daily use.

Pros:

- Long 0% intro APR period

- No annual fee

- Ideal for paying down existing debt

Cons:

- No cash back or rewards

- Not great for everyday spending

Visa Max Cash Preferred Card

This card gives you the chance to earn up to 5% cash back in two categories of your choice like gas, groceries, or utilities. You also earn 2% in a third category and 1% on everything else. It’s a solid option for people who want flexible Comerica credit card rewards tailored to their lifestyle.

Pros:

- Big cash back potential (up to 5%)

- Bonus offer for new cardholders

- Rewards don’t expire as long as the account is active

Cons:

- Must enroll to choose categories

- $2,000 quarterly cap on 5% categories

Visa Everyday Rewards+ Card

If your spending is spread across common categories like groceries, gas, dining, or streaming services, this card can help you rack up points fast. You earn extra points on those daily purchases, and you can redeem them for travel, merchandise, gift cards, or cash back.

Pros:

- Accelerated rewards in common categories

- No limit on total points earned

- Flexible redemption options

Cons:

- Not as strong for travel rewards

- Points expire after 5 years

Visa Travel Rewards+ Card

This Comerica credit card is ideal if you spend a lot on travel, gas, and entertainment. You earn up to 4X points in those categories, making it easy to earn rewards for your next vacation. You can redeem your points for flights, hotel stays, rental cars, and even cash back.

Pros:

- Big rewards in travel and entertainment

- No cap on points

- Great welcome bonus

Cons:

- Higher spending required to maximize rewards

- No airport lounge access or premium travel perks

Visa Reserve Rewards+ Card

This is Comerica’s top-tier personal rewards card. You’ll enjoy enhanced point earnings, a metal card design, and luxury benefits.

Pros:

- 6X points on bookings through Rewards Center

- Metal card with premium feel

- Exclusive benefits

Cons:

- May have an annual fee

- Best for frequent travelers and big spenders

Compare Personal Comerica Credit Card Options

Lastly, here’s a side-by-side comparison to help you find the card that fits your lifestyle best:

| Card Name | Best For | Key Benefits | Annual Fee | Rewards Program |

|---|---|---|---|---|

| Visa® Platinum Card | Paying down debt | 0% intro APR, no annual fee | $0 | ❌ No rewards |

| Max Cash Preferred Card | Custom cash back | 5% in 2 categories, 2% in 1 category, 1% on other purchases | $0 | ✅ Yes (cash back) |

| Everyday Rewards+ Card | Family or everyday spending | Bonus points on groceries, gas, dining, and streaming | $0 | ✅ Yes (points) |

| Travel Rewards+ Card | Travel and entertainment | Up to 4X points on travel, gas, EV charging, and entertainment | $0 | ✅ Yes (points) |

| Reserve Rewards+ Card | Luxury perks for big spenders | 6X points on travel booked via Rewards Center, metal card | May apply | ✅ Yes (premium points) |

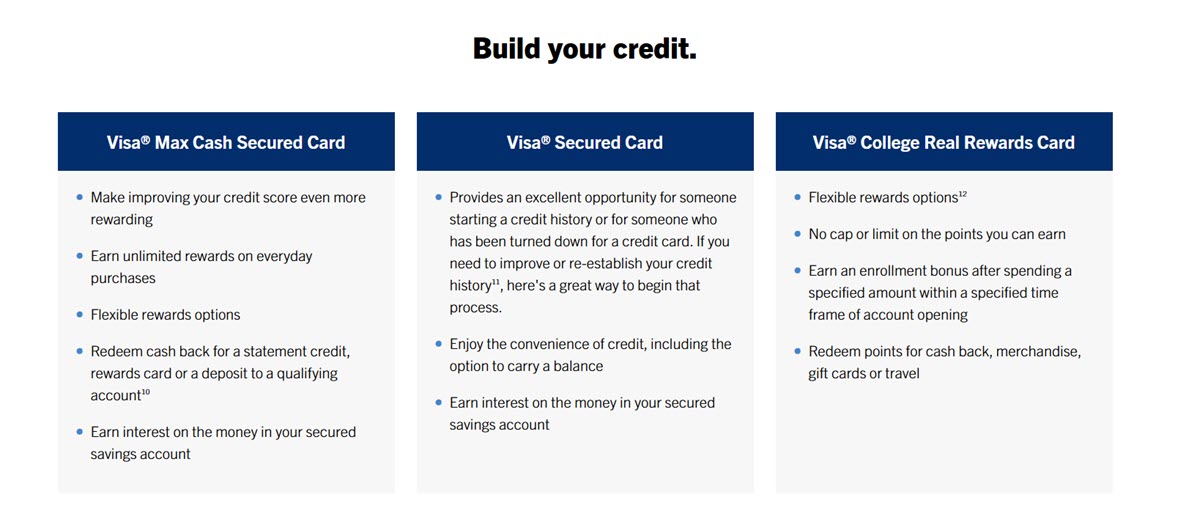

Secured & Student Credit Cards from Comerica

Not everyone has perfect credit, and that’s okay. Comerica also offers secured and student cards to help people build or rebuild their credit while enjoying some added benefits.

Visa Max Cash Secured Card

This Comerica credit card stands out because it’s a secured card that also earns up to 5% cash back, just like the regular Max Cash card. You’ll need to provide a security deposit, but your spending habits will be reported to all three credit bureaus, helping you improve your credit over time.

Pros:

- Up to 5% cash back in two chosen categories

- Earns interest on your secured deposit

- Redemption options include statement credit, deposit, or rewards card

Cons:

- Security deposit required

- Not eligible for overdraft protection

Visa Secured Card

This card is a good fit if you’ve been turned down for other credit cards or need a fresh start. It doesn’t offer rewards, but it’s a solid way to get back on track with your credit.

Pros:

- Reports to all three major credit bureaus

- Helps build or rebuild your credit

- Deposit earns interest over time

Cons:

- No rewards or cash back program

- Requires a security deposit up front

Visa College Real Rewards Card

A great first credit card, this one is built specifically for college students. You earn 1.5 points per $1 spent and get a small bonus after your first few purchases. There’s no annual fee, and it provides simple redemption options like cash back, gift cards, or travel.

Pros:

- Ideal for students building credit early

- No annual fee

- Earns bonus points for signing up and using the card

Cons:

- May require a credit check

- Fewer perks for travel or large purchases

Compare Secured & Student Comerica Credit Card Options

Whether you’re starting your credit journey or rebuilding after setbacks, Comerica’s secured and student cards offer helpful tools and even rewards. Below is a quick comparison to guide your choice:

| Card Name | Best For | Key Features | Security Deposit | Rewards Program |

|---|---|---|---|---|

| Max Cash Secured Card | Rebuilding with rewards | Earn up to 5% cash back, flexible redemption options | ✅ Required | ✅ Yes (cash back) |

| Visa® Secured Card | Basic credit building | Reports to all 3 bureaus, interest earned on deposit | ✅ Required | ❌ No rewards |

| College Real Rewards Card | Students new to credit | 1.5X points per $1 spent, bonus offer for new users | ❌ Not required | ✅ Yes (points) |

Each of these cards is designed to build credit while offering simple tools and real financial value. Whether you’re just starting out or getting back on track, Comerica gives you a strong foundation.

Comerica Business Credit Cards

Comerica also serves small businesses and entrepreneurs with credit cards built for business use. These cards come with expense management tools, employee card access, and mobile wallet compatibility.

Let’s dive into their top business card options.

Mastercard Business Platinum Card

This is the simplest Comerica business credit card. It doesn’t offer rewards, but it comes with a low introductory APR, which is great if you need to carry a balance or finance a large purchase over time. It’s also helpful for business owners who want to avoid fees and keep things straightforward.

Pros:

- 0% intro APR for a set period

- No annual fee

- Great for managing recurring or startup expenses

Cons:

- No points or cash back

- Doesn’t reward long-term spending

Mastercard Business Cash Preferred Card

This Comerica credit card lets you earn up to 3% cash back in categories like office supplies, phone services, gas stations, and restaurants, which most businesses already spend on. It’s perfect for companies that want real returns from their day-to-day purchases.

Pros:

- 3% back on select categories

- No cap on total rewards earned

- Welcome bonus for new cardholders

Cons:

- You’ll need to track which purchases earn more

- Bonus categories might not align with all business types

Mastercard Business Real Rewards Card

This card is all about ease. You earn 1.5 points per $1 spent on every purchase with no categories and no caps. It’s a great choice for businesses that want rewards without complexity.

Pros:

- Flat-rate rewards on all purchases

- No annual fee

- Flexible point redemption (cash, gift cards, travel)

Cons:

- No accelerated earning categories

- Not ideal for maximizing points

Smart Business Rewards Mastercard

This Comerica credit card automatically tracks your two highest monthly spending categories and gives you 2 points per $1 in those areas, plus 1 point per $1 on everything else. It adjusts as your business evolves, making it ideal for growing companies with changing needs.

Pros:

- Rewards adjust automatically based on your spending

- Higher earning potential than flat-rate cards

- Points can be used for many reward types

Cons:

- Some merchant categories might not qualify

- Points expire after five years if unused

Compare Comerica Business Credit Cards

You can use the table below to quickly see how Comerica’s business credit cards stack up:

| Card Name | Best For | Rewards | Annual Fee | Bonus Offer | Key Features |

|---|---|---|---|---|---|

| Business Platinum Card | Low-interest spending | ❌ None | $0 | ❌ No | Intro APR, simple to manage, ideal for financing |

| Business Cash Preferred Card | Everyday business expenses | ✅ Up to 3% cash back | $0 | ✅ Yes | Strong category-based rewards, no rewards cap |

| Business Real Rewards Card | Flat-rate points on everything | ✅ 1.5X points on all purchases | $0 | ✅ Yes | Easy to use, no category tracking needed |

| Smart Business Rewards Card | Custom rewards by spending habit | ✅ 2X on top 2 categories monthly | $0 | ✅ Yes | Adaptive rewards structure, flexible redemptions |

Whether you’re focused on managing costs or maximizing rewards, Comerica offers a business card that can work for your specific goals. If your business needs financial flexibility and practical perks, these cards are definitely worth a closer look.

Common Comerica Credit Card Benefits

No matter which card you choose, Comerica includes a set of core benefits that make everyday spending safer, more flexible, and easier to manage:

- Fast, Secure Checkouts: All Comerica cards come with contactless payment technology, so you can tap to pay in seconds with no swiping or inserting required.

- Built-In Fraud Protection: EMV chip technology provides enhanced security at in-person checkout, helping prevent counterfeit fraud.

- Mobile Wallet Compatibility: Add your card to Apple Pay, Google Pay, or Samsung Pay for easy, secure payments from your phone or smartwatch.

- Overdraft Protection: You can link your Comerica credit card to your Comerica checking account for automatic coverage if your balance gets too low.

- Travel Assistance Services: Whether you’re on the road for work or on vacation, Comerica offers travel help for emergencies, lost cards, and more.

- Elan Rewards Program Access: Many Comerica cards offer rewards in points or cash back that can be redeemed for merchandise, gift cards, travel, or even statement credits.

- Online and Mobile Account Management: Stay in control 24/7 with Comerica Web Banking and the mobile app. You can check balances, make payments, track spending, and view your rewards all in one place.

Comerica Credit Card Application & Activation

Applying for a Comerica Bank credit card is quick and simple. Here’s how it works:

- If you’re already a Comerica customer: Log in to your Comerica Web Banking account. Under the “Related Links” section, click on “Apply for a Comerica Credit Card.”

- If you’re new to Comerica: Visit your nearest Comerica banking center and speak with a representative to explore your options and start your application.

To apply, you’ll need to provide personal information such as your name, address, Social Security number (SSN), income, and employment details. You can also add authorized users if you want to share the card benefits. Keep in mind that Comerica does not offer online pre-qualification, so your credit score and credit history will play a key role in getting approved.

Once your card arrives in the mail, activating it is quick:

- Call the Comerica credit card activation number found on the sticker attached to your new card, usually 1‑888‑741‑1115.

- You’ll be asked to confirm details like your card number, the last four digits of your SSN, and your date of birth to verify your identity.

After activation, your Comerica Bank credit card is ready for use. It will work with contactless payments, EMV chip technology, and digital wallets.

Comerica Credit Card Payment

Comerica makes it easy for you to manage and pay Comerica credit card bills using several methods:

- Online & Mobile App: Log into Comerica Web Banking or use the mobile app to check your balance, pay Comerica credit card online, or set up automatic payments to avoid late fees.

- By Mail: You can mail your payment to the address listed on your monthly credit card statement. To prevent delays, make sure to provide your account number.

- By Phone: To make a payment or speak with a representative, call the Comerica credit card phone number (see in the following section) and adhere to the audio instructions.

Payments usually post within one business day. If your Comerica Bank credit card is linked to your checking account for overdraft protection, funds may be automatically transferred when needed, though fees may apply.

Comerica Credit Card Customer Service

Need help? Comerica has dedicated phone lines for different card types:

| Service Type | Phone Number | Availability |

|---|---|---|

| Personal Credit Cards | 1‑866‑486‑1017 | Mon–Fri, 8 a.m. – 9 p.m. ET |

| Business Credit Cards | 1‑866‑486‑1015 | Mon–Fri, 8 a.m. – 9 p.m. ET |

| General Banking Support | 1‑800‑266‑3742 | 24/7 (Live support: 8 a.m. – 9 p.m. ET) |

You can call these numbers to:

- Report a lost or stolen credit card

- Dispute transactions or check your balance

- Set up travel alerts

- Ask questions about your bill or account features

Customer service is handled in partnership with Elan Financial Services, so you may also hear their name during calls or on statements.

Comerica Credit Card FAQs

Are there any credit cards available from Comerica for those without a credit history?

- Yes, there are. Comerica provides secured and student credit cards, such as the Visa Max Cash Secured Card and Visa College Real Rewards Card, which are designed to help users build or rebuild credit.

Can I check my Comerica credit card balance online?

- Absolutely. You can view your credit card balance anytime through Comerica Web Banking or the mobile app, where you can also track transactions and set alerts.

How long does it take to get approved for a Comerica credit card?

- Most applications receive a decision within minutes when submitted online or by phone. Some cases may take a few business days if additional review is needed.

Can I use my Comerica Bank credit card internationally?

- Yes. Comerica credit cards are backed by Visa or Mastercard, making them widely accepted worldwide. Just be aware of potential foreign transaction fees, depending on the card.

What should I do if I lost my credit card?

- Immediately call Comerica Cardmember Services at 1‑866‑486‑1017 (for personal cards) or 1‑866‑486‑1015 (for business cards) to report the card lost or stolen and request a replacement.

With a wide range of personal, secured, student, and business options, Comerica offers flexibility and strong digital tools to support your financial journey. Their cards also come with trusted security features and convenient payment options. If you’re already a customer or planning to be one, a Comerica credit card could be a smart addition to your wallet. Take time to compare and pick the card that fits your needs best.