Morgan Stanley is a major global financial powerhouse. It offers everything from investment banking to wealth management. Among its many services, Morgan Stanley home loans stand out as a key offering for clients looking to finance or refinance their homes.

In this post, we explore their home loan offerings. We cover what they are, how they work, who they serve, and their strengths and weaknesses. You’ll also find tips on application and rates.

Overview of Morgan Stanley Home Loans

To understand Morgan Stanley home loans, it’s important to first take a closer look at the company behind them:

History of Morgan Stanley

Morgan Stanley was founded in 1935 by Henry Morgan and Harold Stanley. The firm was created after the U.S. government passed the Glass-Steagall Act, which required a separation between commercial and investment banking. Morgan Stanley focused on investment banking from the start and quickly became a leader in the financial industry.

In 1997, it merged with Dean Witter, a retail brokerage firm, and for a few years operated under the name “Morgan Stanley Dean Witter.” By 2001, the company had returned to the simpler name “Morgan Stanley.”

Today, Morgan Stanley is one of the world’s largest financial institutions. It has more than 80,000 employees and operates in over 40 countries. The firm is consistently ranked among the Fortune 500 companies, showing its strong position in the global economy.

What Are Morgan Stanley Home Loans?

One of the key offerings in Morgan Stanley’s private banking suite is home lending. Morgan Stanley home loans are issued through Morgan Stanley Private Bank, N.A., a federally insured bank regulated by the FDIC.

The firm offers a wide selection of mortgage options tailored for its wealth management clients. Loan types offered include:

- Jumbo mortgages (typically over $1 million)

- Adjustable-rate and fixed-rate loans

- Securities-based loans (borrowing against investment portfolios)

- Investment property financing

These loans aren’t available to the general public. You need to be a client. But for those who are, the benefits are significant. Whether you’re financing a primary residence, vacation home, or investment property, Morgan Stanley provides mortgage products that fit seamlessly into a broader wealth management strategy.

Unlike many other lenders, Morgan Stanley services its own home loans. That means your loan stays with them for the entire life of the mortgage, they won’t sell it to another company. This gives clients a more consistent and streamlined experience, especially those who already have investments or accounts with Morgan Stanley.

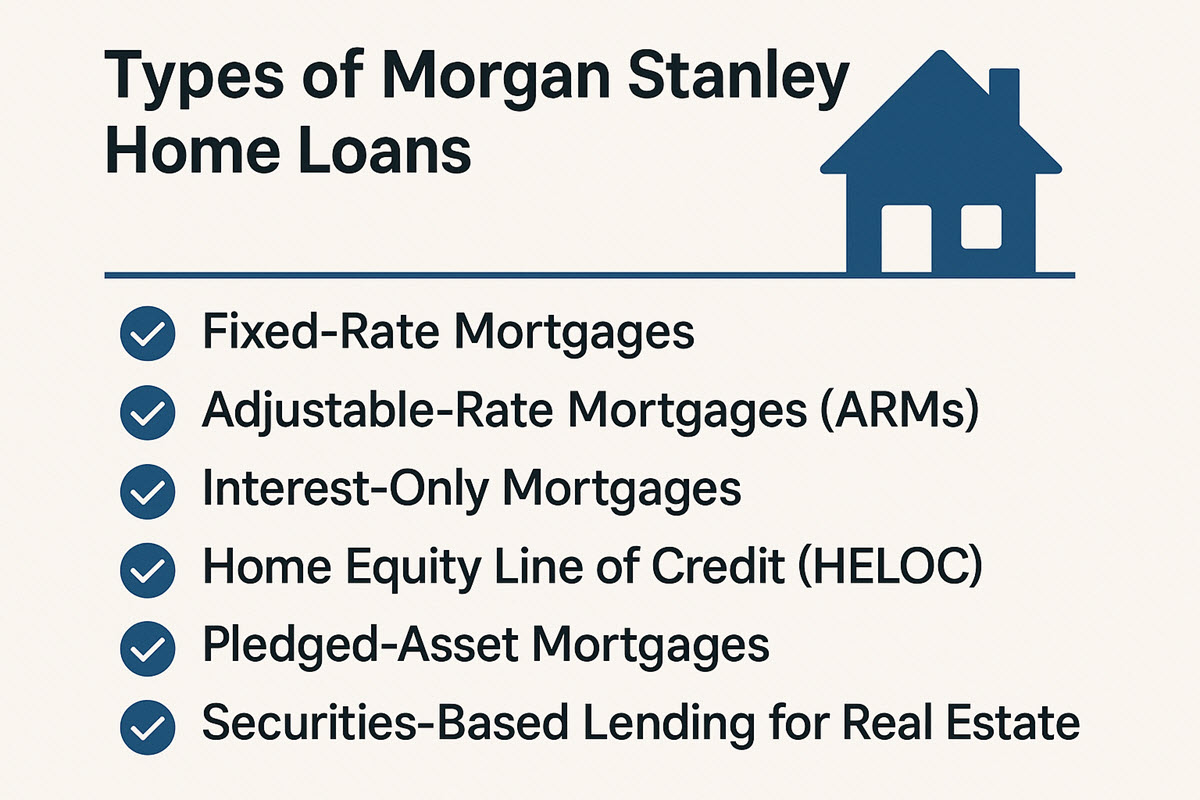

Types of Morgan Stanley Home Loans

Morgan Stanley offers several types of home loans designed to meet different financial needs and goals. Whether you’re buying a primary residence, a second home, or looking to refinance, there are flexible options available for qualified clients.

Fixed-Rate Mortgages

These Morgan Stanley home loans offer predictable monthly payments over the life of the loan, typically 15, 20, or 30 years. The interest rate stays the same, which makes budgeting easier and protects you from rising market rates.

Adjustable-Rate Mortgages (ARMs)

ARMs come with a lower interest rate for the first few years, followed by variable rates that adjust at regular intervals. Morgan Stanley offers options like 5/6M, 7/6M, and 10/6M ARMs, where the number before the slash indicates the fixed-rate period. These loans are tied to the SOFR index, which reflects short-term borrowing rates in the U.S.

Interest-Only Mortgages

With this option, borrowers pay only the interest for an initial period, usually the first 5 to 10 years. This lowers the monthly payment early on, making it ideal for clients expecting higher income or liquidity in the future. After the interest-only period, full principal and interest payments begin.

Home Equity Line of Credit (HELOC)

A HELOC allows you to borrow against the equity in your home, similar to a credit card. It offers flexibility, borrow what you need, when you need it, and only pay interest on the amount used. This is a good option for home improvements, large expenses, or consolidating debt.

Pledged-Asset Mortgages

This unique product lets you use eligible securities from your Morgan Stanley investment account as collateral instead of making a traditional cash down payment. It can help preserve your investment strategy and avoid selling assets that might trigger capital gains taxes.

Securities-Based Lending for Real Estate

If you want to purchase real estate without selling investments, Morgan Stanley also offers loans backed by your portfolio. The bank secures these loans with your brokerage assets, rather than your home’s value, giving you greater financial flexibility.

It also designs each loan type to support clients with complex financial needs, offering custom solutions that integrate with their broader investment strategy.

Key Features and Benefits

Morgan Stanley doesn’t offer cookie-cutter loans. Instead, they provide personalized lending solutions. Here are the main features that set them apart:

- Competitive Jumbo Rates: One of the biggest advantages is competitive interest rates on large loans. Since these mortgages often exceed $1 million, even a slight difference in rate can save hundreds of thousands over time. Morgan Stanley is known to beat many traditional lenders in this space.

- Securities-Based Lending: Rather than liquidating investments to make a down payment or show cash reserves, you can use your existing portfolio as collateral. This approach preserves your investment strategy and potential growth.

- Customizable Terms: Terms are often tailored to fit your needs. Want interest-only payments for a few years? Prefer a 7-year ARM that converts later? Morgan Stanley’s flexibility in structuring your loan is a major advantage.

- Integrated Wealth Strategy: Mortgages aren’t treated as isolated financial tools. They’re woven into your larger wealth plan. This allows for:

- Tax strategy optimization

- Cash flow planning

- Asset preservation

Morgan Stanley Home Loans Requirements

To qualify for a Morgan Stanley home loan, borrowers must meet several financial and account-related conditions. These requirements help ensure that applicants are a good fit for the firm’s private banking services.

Here’s what you typically need:

- A Morgan Stanley Private Bank Account (MSPBNA): You must have or be eligible to open an account with Morgan Stanley Private Bank, which is the institution that offers the home loan.

- Strong Credit Score: A FICO score of 740 or higher is usually required to access the most competitive interest rates. Lower scores may still qualify, but the loan terms may not be as favorable.

- Proof of Income and Employment: You’ll need to provide documents showing that you have a steady income. This may include pay stubs, W-2 forms, tax returns, or business financials for self-employed borrowers.

- Property Appraisal: The home you’re buying or refinancing must be appraised by a certified professional to confirm its market value. This helps the bank determine how much it’s willing to lend.

- Down Payment or Pledged Assets: Most borrowers will need to make a down payment, at least 20%. However, if you have investments with Morgan Stanley, you may be able to use those assets as collateral instead of cash.

- Relationship-Based Criteria: Morgan Stanley prioritizes existing clients or their immediate family members. If you or a close relative has significant assets with the firm, you may qualify for better rates and terms.

- Asset-Based Rate Discounts: Bringing in new assets, ranging from $500,000 to $50 million or more, can earn you interest rate reductions of up to 1.00%. The more you invest with Morgan Stanley, the greater the potential discount on your mortgage.

Morgan Stanley designed these requirements to serve high-net-worth clients who already use the firm for investment or wealth management services.

How to Apply for a Morgan Stanley Home Loan

If you’re already a client, applying for a Morgan Stanley home loan is surprisingly smooth. Here’s how it typically works:

- Schedule a Consultation: Start by speaking with your Morgan Stanley Financial Advisor. If you don’t already have one, you can contact the Morgan Stanley home loans team directly to set up a meeting.

- Get Pre-Approved & Submit a Full Application: Your financial advisor will work closely with the mortgage team to begin pre-approval. You’ll need to submit:

- Income statements

- Tax returns

- Asset details

- Property information

- Loan Review and Underwriting: Morgan Stanley’s underwriting team will review your documents, verify your income and assets, order an appraisal, and assess your creditworthiness. They may reach out if they need additional information.

- Approval, Rate Lock, and Closing: Closings can take 30–45 days, depending on complexity. If your application is approved, you’ll receive a final loan offer. You can lock in your interest rate, sign the loan documents, and proceed to closing. At closing, you’ll finalize the purchase or refinance and receive the funds.

Morgan Stanley Home Loans Rates and Fees

The interest rate you get on a Morgan Stanley home loan depends on a few key things:

- Your credit score: The higher your score, the better your chances of getting a lower rate. A strong credit history shows you’re good at managing money.

- Loan amount: Larger loans, especially jumbo loans over $1 million, may have different rate structures.

- Your down payment: Putting more money down upfront usually helps lower your interest rate.

- Your relationship with Morgan Stanley: Clients who already have a strong financial relationship with the firm like holding investment accounts or working with a Financial Advisor can often unlock better rates.

One of the biggest advantages is the opportunity to get a lower interest rate by moving new assets to Morgan Stanley. If you bring in between $500,000 and $50 million or more in new eligible assets, you may qualify for a rate discount ranging from 0.125% to 1.00%. The more assets you bring, the bigger the potential savings.

Moreover, for those with big investment portfolios or long-term connections to Morgan Stanley, the bank may offer more favorable rates than traditional lenders. Also, you can lock in your interest rate for a set period such as 30, 45, or 60 days, so you won’t be affected if rates go up before your loan closes.

As for fees, here are some common ones you should expect:

- Loan origination fee: This is the cost of setting up your mortgage.

- Appraisal fee: A professional checks the value of the home you want to buy.

- Title and legal fees: These cover the paperwork and legal processes to make sure the property title is clear and transferred properly.

However, Morgan Stanley may offer you lower fees or even waive some of them completely if you’re a high-net-worth client or have significant assets with the firm.

Last but not least, the mortgage rates and fees are not “one-size-fits-all” at Morgan Stanley and are not updated publicly on the website. It’s best to contact a Morgan Stanley Financial Advisor to get the most up-to-date information.

Morgan Stanley Home Loans Customer Service

Morgan Stanley takes a different approach than many traditional lenders when it comes to servicing their home loans. Unlike banks that sell your mortgage to another company after closing, Morgan Stanley services its loans in-house. This means that from start to finish, and for the life of your loan, you’ll be dealing directly with Morgan Stanley.

Key features of Morgan Stanley home loans customer service:

- Morgan Stanley Home Loans Phone Number: If you need help with your mortgage, you can contact the Morgan Stanley Home Loans team at 1‑855‑646‑6951, available Monday through Friday from 8:30 AM to 8:00 PM (EST), and Saturday from 8:30 AM to 1:00 PM (EST).

- Online Account Access: Borrowers can log in to Morgan Stanley’s secure mortgage portal to make payments, review account details, download documents, and send messages to support staff. This makes it easy to manage your loan without needing to visit a branch.

- No Loan Transfers: Because Morgan Stanley keeps its loans instead of selling them, you don’t have to worry about dealing with multiple companies over the life of your mortgage. This consistency is especially helpful for clients who already work with Morgan Stanley for investments or banking.

Morgan Stanley Home Loans: Pros & Cons

Before choosing a lender, it’s important to weigh the advantages and disadvantages:

| Pros | Cons |

|---|---|

| Pledged‑asset loans let you leverage your portfolio without selling. | Service quality varies, and not as personalized as smaller lenders. |

| Relationship‑based rate discounts up to 1.0% savings. | High qualification bar: high credit score & significant assets needed. |

| Fixed & ARM products, interest-only, and HELOCs—versatile options. | Limited availability: not offered in all states or territories . |

| No prepay penalties on fixed‑rate loans | Documentation heavy, and complex asset pledging rules. |

| Servicer stays for life, no servicing transfer | Digital experience can be inconsistent; some users report delays. |

| Online tools: pre‑approval, application, document uploads | Not ideal for low‑asset borrowers; minimum assets are high. |

FAQs About Morgan Stanley Home Loans

Where is Morgan Stanley Home Loans available?

- Available nationwide, but excludes Guam, Puerto Rico, and the U.S. Virgin Islands.

Do they sell off my loan?

- No. Loans are serviced in-house throughout the term

Is there a minimum loan amount?

- Typically $500,000 or more. Jumbo loan thresholds apply.

Can I refinance with Morgan Stanley?

- Yes, refinancing options are available to existing clients.

Are there mobile tools to manage my loan?

- Yes. Loans integrate with Morgan Stanley’s online banking and financial dashboard.

Morgan Stanley home loans stand out for affluent clients with sizable portfolios and strong ties to the firm. The pledged‑asset feature is unique, letting you finance a home without liquidating investments. Relationship-based pricing can slash your rate considerably. However, service may not match the personal touch of local lenders. If you have significant assets and want streamlined portfolio-backed financing, Morgan Stanley is worth serious consideration.

Disclaimer: This content is for informational purposes only. Mortgage terms and availability may vary. Contact Morgan Stanley directly for personalized advice.