Choosing the right lender for your home loan is one of the biggest financial decisions you’ll make. Fifth Third Bank home loans are designed to support a wide range of borrowers, from first-time buyers to seasoned homeowners.

In this guide, we’ll dive deep into Fifth Third Bank home loans. Whether you’re a first-time buyer, a medical professional, or someone looking to refinance, this post will help you figure out if Fifth Third is a good fit.

Overview of Fifth Third Bank Home Loans

Fifth Third Bank, headquartered in Cincinnati, Ohio, is one of the largest regional banks in the U.S. It has been in operation for over 160 years and serves customers across 11 states, primarily in the Midwest and Southeast. In 2024, the bank earned the top spot in J.D. Power’s customer satisfaction ranking for retail banking in Florida.

While it may not be a nationwide giant like some other banks, Fifth Third has built a strong reputation in the regions it serves. Its long track record, combined with its public listing on the stock market, gives customers a sense of stability and trust. For those who still value walking into a branch, sitting down with a loan officer, and getting personal service, Fifth Third Bank continues to be a reliable and community-focused choice.

Here’s how Fifth Third Bank home loans stand out in the current mortgage market:

- Wide Range of Loan Types: You’ll find everything from fixed-rate mortgages and adjustable-rate mortgages (ARMs) to government-backed loans like FHA and VA, plus jumbo loans for more expensive properties.

- Tailored Programs for Special Borrowers: Fifth Third offers unique loan options for first-time buyers, active-duty military and veterans, and even doctors and medical professionals who are just starting their careers.

- Extra Features That Benefit You: They offer borrower-friendly perks like the Rate Drop Protector (so you can refinance at a lower cost if rates go down), down-payment assistance, and simplified refinancing programs for those looking to lower monthly payments or tap into home equity.

All these features give borrowers more freedom and fewer financial roadblocks. With Fifth Third home loans, instead of having to settle for a standard loan that may not fit quite right, you can explore different paths and choose the one that aligns with your lifestyle, budget, and future plans.

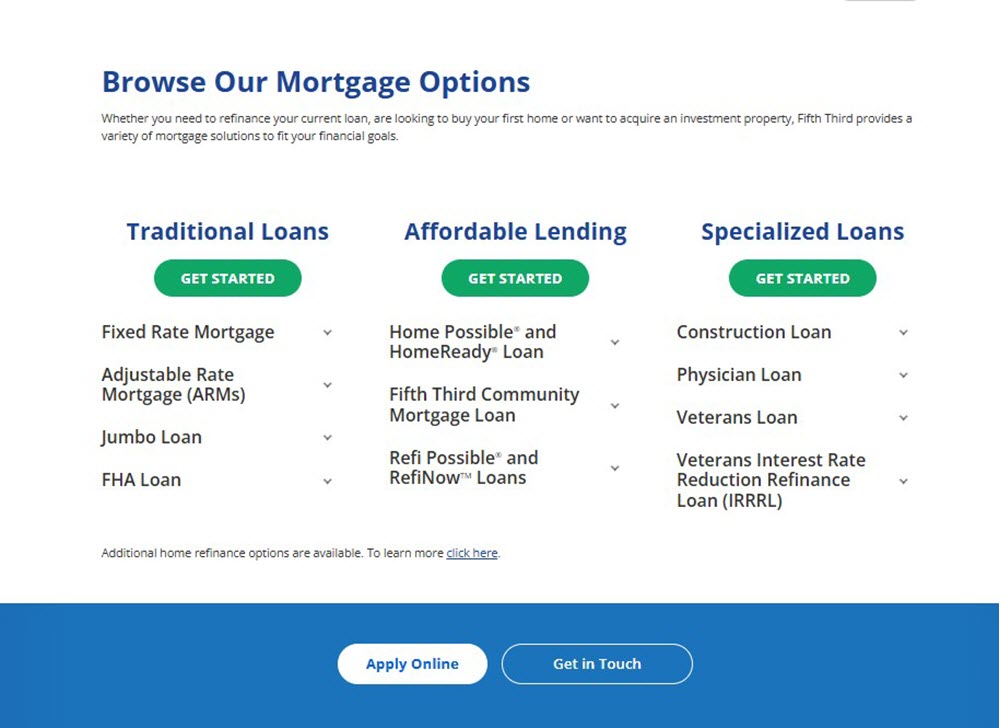

Types of Fifth Third Bank Home Loans

Fifth Third Bank offers a wide range of home loan products to meet different needs. Whether you’re buying a new home, building one, or refinancing, there’s likely a solution for you.

Core Fifth Third Home Mortgage Products

Firstly, the bank provides a full lineup of mortgage products tailored to suit various financial situations and property types:

Fixed-Rate Mortgages

A fixed-rate mortgage keeps your interest rate and your monthly payment the same for the entire loan term, which can range from 10 to 30 years. This option gives you predictability and peace of mind, especially if you plan to stay in your home long-term.

- Minimum credit score: 620

- Down payment: As low as 3%

- Best for: Buyers who want stable monthly payments with no surprises.

Once your rate is locked in, it doesn’t change, even if interest rates rise. That’s a big plus in today’s uncertain market.

Adjustable-Rate Mortgages (ARMs)

If you’re planning to move or refinance within a few years, an adjustable-rate mortgage (ARM) might make more sense. With this type of loan, you get a lower fixed interest rate for the first 5, 7, 10, or even 15 years. After that, your rate adjusts based on the market.

- Good fit for short-term homeowners

- Risk: After the fixed period, your monthly payment could increase.

This Fifth Third Bank home loan option offers short-term savings but comes with future uncertainty. It’s ideal for people who expect their financial situation or living situation to change in the next few years.

Jumbo Loans

If you’re buying a high-value property, a standard loan may not be enough. Fifth Third offers jumbo loans for amounts ranging from $762,201 to $3 million.

- Available in both fixed and adjustable-rate formats

- Great for luxury homebuyers or buyers in expensive real estate markets.

Because of their size, jumbo loans often require higher credit scores and larger down payments, but Fifth Third works with borrowers to find flexible solutions.

FHA Loans

FHA loans are insured by the government and are a great choice for buyers with lower credit scores or smaller savings.

- Minimum credit score: 600

- Down payment: As low as 3.5%

- Perfect for: First-time buyers or those rebuilding credit

These Fifth Third Bank home loans are easier to qualify for and come with competitive interest rates, even if your financial history isn’t perfect.

Specialist Mortgage Solutions

Fifth Third also provides custom loan options for unique professionals and groups that may not fit traditional mortgage requirements.

Physician Loans

Medical professionals, including doctors, dentists, veterinarians, residents, and fellows, can take advantage of a physician mortgage with exclusive benefits.

- No down payment required

- No private mortgage insurance (PMI)

- Loan amounts up to $1 million

Even if you’re just starting your career and haven’t built up a large financial cushion, this loan helps you buy a home sooner, without extra fees.

VA & Veteran Loans

For military members and veterans, Fifth Third participates in the VA loan program, offering a range of flexible home financing options.

- Streamlined paperwork and support

- Access to VA IRRRL (Interest Rate Reduction Refinance Loans)

- Tailored service for active duty, veterans, and even Public Health Service officers

These Fifth Third Bank home loans require no down payment or PMI and are backed by the Department of Veterans Affairs, giving borrowers added security.

Construction Loans

If you’re building your dream home from scratch, Fifth Third offers construction loans that combine land purchase and building costs into a single package.

- One-time close simplifies the process

- Tailored to your timeline and budget

This loan helps you finance a custom home without needing to take out separate loans for land and construction.

Affordable & Community-Focused Lending

Fifth Third believes that homeownership should be within reach for more people, not just those with perfect credit or large savings. That’s why they offer lending programs aimed at helping underserved or first-time buyers.

Home Possible and HomeReady Loans

These loan programs are designed for borrowers with modest incomes, retirees, and first-time homebuyers.

- Low down payments make it easier to get started.

- Fixed rates and predictable payments add stability.

- Reduced mortgage insurance helps keep monthly costs down.

They’re great options for anyone who meets income guidelines and is looking for a reliable path to owning a home.

Fifth Third Community Mortgage

This is a specialized loan program with added financial support built in. It’s available to borrowers with limited savings and lower incomes.

- Down-payment assistance: Up to $3,295 or $3,600 (depending on location)

- Income limits: Usually requires household income at or below 80% of the median income in the area.

- Location-based eligibility: Only available in select states

This loan is ideal for buyers who qualify for affordable housing programs and need a little extra help to cover upfront costs.

Fifth Third Bank Refinancing Options

If you’re thinking about lowering your monthly payment, changing your loan terms, or tapping into home equity, Fifth Third has several refinance programs for you:

Refi Possible & RefiNow

These Fifth Third Bank home loan programs are designed for borrowers who have higher debt-to-income (DTI) ratios and may not qualify under standard refinance guidelines.

- Easier qualifications for income and credit

- Helps reduce interest rates and payments

Great for homeowners who may be struggling with high monthly costs but want a fresh start.

Easy Home Refi

This is a simplified refinance program offered directly through Fifth Third.

- Flat $299 closing cost (much lower than traditional refinance fees)

- Available for both rate-and-term or cash-out refinancing

- Quick and simple process for existing customers

It’s a low-cost way to change your loan and save money, without all the typical hassle.

Fifth Third Bank Home Equity Loans

In addition to traditional mortgage loans, Fifth Third offers two ways to access your home equity:

Fifth Third Home Equity Loan (HELOAN)

The home equity loan from Fifth Third is a great option if you prefer predictable monthly payments. It comes with a fixed interest rate, meaning your rate and payment will stay the same throughout the life of the loan.

- Fixed Rate: Lock in your interest rate for up to 30 years.

- Lump Sum: Get a one-time cash payment at closing.

- Loan Size: From $10,000 to $500,000.

- LTV Requirement: Must be 70% or lower.

A Fifth Third Bank home equity loan is ideal for large, one-time expenses, such as home renovations, debt consolidation, or medical bills, where you know exactly how much you need to borrow.

Fifth Third Equity Flexline (HELOC)

The Equity Flexline, Fifth Third’s branded HELOC, offers more flexibility.

- 30-Year Term: Includes a 10-year draw period and 20-year repayment.

- Variable Rate: Tied to the WSJ Prime Rate, but lock options are available.

- Fixed Rate Lock: Lock part or all of your HELOC at a fixed rate for a $95 fee per lock (up to 3 active locks).

- Access Funds Anytime: Use a card, check, or ATM.

- Loan Size: $10,000 to $500,000.

- Annual Fee: $65, waived in year one.

This option is best for ongoing or unpredictable expenses, such as education costs, medical bills, or home improvement projects, where you want access to cash over time.

Unique Features That Set Fifth Third Bank Home Loans Apart

Fifth Third Bank goes beyond traditional home loans. It offers extra features and smart tools that help make the mortgage process easier and more flexible for borrowers.

- Down Payment Assistance: Up to $5,300 in assistance for down payments and closing costs, with no repayment required.

- Low Credit Score Options: FHA loans are available with scores as low as 580.

- Interest Rate Discounts: Get a 0.25% rate reduction when you set up automatic payments from a Fifth Third checking account.

- Rate Drop Protector Program: If rates drop within 6 to 24 months after your loan closes, you can refinance without paying lender-side fees (normally $1,295).

- Smart Online Calculators: Fifth Third’s website includes several user-friendly calculators, such as the Monthly Mortgage Payment Calculator, Affordability Checker, Fifth Third Bank home equity loan calculator, etc. These tools are free to use, easy to understand, and helpful whether you’re buying your first home or thinking about refinancing.

- Educational Resources: Fifth Third also offers a “Borrowing Basics” section on its site. This area breaks down complex mortgage terms and explains different loan types in a way that’s easy to follow. These guides are especially helpful for first-time homebuyers who are just starting their journey with Fifth Third Bank home loans.

Fees and Rates of Fifth Third Bank Home Loans

Understanding the costs of a mortgage is just as important as knowing the loan type. Fifth Third Bank is fairly transparent about its fees and will give you a full estimate before you move forward. Here’s a closer look at what you might pay for Fifth Third Bank home loans:

Typical Fees of Fifth Third Bank Home Loans

When taking out a mortgage, you’ll need to cover some one-time fees at closing. These are normal across all lenders, and Fifth Third Bank home loan fees are competitive, often lower than the national average.

| Fee Type | Typical Cost | What It Covers |

|---|---|---|

| Loan Origination Fee | About 1% of the loan amount | This is charged by the lender to process your loan. |

| Appraisal Fee | $300 – $700 | Pays for a third-party to assess your home’s market value. |

| Credit Report & Processing | $100 – $500 | Covers background checks and paperwork. |

| Title & Legal Fees | $500 – $2,000+ | Pays for title search, insurance, and legal filings. |

| Closing Costs (Total) | Average ~$4,500 | Includes all third-party fees; varies by state and loan. |

| Discount Points (Optional) | 0–2 points (1 point = 1%) | Pay upfront to lower your interest rate over time. |

Overall, these fees are competitive with what other banks charge, though not the lowest in the market. The key benefit is clarity. Fifth Third gives you a detailed breakdown upfront, so there are no surprises at closing.

Fifth Third Home Loan Rates

Mortgage rates at Fifth Third change daily and depend on several personal factors:

- The type of loan you choose (e.g., fixed vs. ARM)

- Your credit score

- The size of your down payment

- The location and value of the property

| Loan Type | Estimated Rate (APR) | Details |

|---|---|---|

| 30-Year Fixed-Rate | Around 6.85% | Best for long-term buyers who want steady monthly payments. |

| 15-Year Fixed-Rate | Around 6.13% | Ideal for those who want to pay off their loan faster and save on interest. |

| Adjustable-Rate Mortgage | Around 6.75% (initial) | Starts with a lower fixed rate for the first few years, then adjusts based on market conditions. |

While the base rates of Fifth Third Bank home loans are generally competitive, they may not always be the lowest compared to online-only lenders or brokers.

However, what sets them apart is their Rate Drop Protector, which lets you refinance within 6 to 24 months with no lender fees if market rates fall. That future flexibility can offset a slightly higher rate today.

Special Rate Features and Fee Savings

Fifth Third Bank provides several ways to help borrowers save money, especially when rates change or when using specific Fifth Third Bank home loan services.

- $300 Bonus: Available for HELOCs or HELOANs of at least $15,000.

- Rate-Drop Protector: If you close on a mortgage and interest rates fall within 6 to 24 months, Fifth Third will waive up to $1,295 in lender closing costs for your refinance. This offer applies to conventional, FHA, and VA loans.

- Auto-Pay Discount: When you enroll in autopay from a Fifth Third checking account, you may get a 0.25% discount on your mortgage rate.

- No Closing Costs for Home Equity Products: For HELOCs and Home Equity Loans, Fifth Third waives all closing costs. The only fee is a $65 annual charge for HELOCs, which is waived in the first year.

- Easy Home Refi Program: Refinance your home loan with a flat fee of only $299. This is great for borrowers who want to reduce their monthly payments or tap into equity without paying thousands in fees.

What You Need to Qualify

The bank offers different types of Fifth Third Bank home loans, and each one has its own set of requirements. However, there are some general rules you can expect:

| Loan Type | Minimum Credit Score | Minimum Down Payment |

|---|---|---|

| Conventional Loan | 620+ | 3–5% |

| FHA Loan | 600+ | 3.5% |

| VA Loan | 620+ (typical) | 0% |

| Physician Loan | 700+ | 0% |

| Jumbo Loan | 700+ | 10–20% |

| Community Mortgage | 620+ | 3% |

In addition to credit score and down payment, other factors also play a role in Fifth Third Bank home loan requirements:

- Your debt-to-income (DTI) ratio

- Employment and income history

- The location and value of the property

If the home you’re buying is located in an eligible low- to moderate-income area, you might qualify for extra assistance through Fifth Third’s Community Mortgage program. This could include a reduced rate, waived private mortgage insurance (PMI), or help with the down payment.

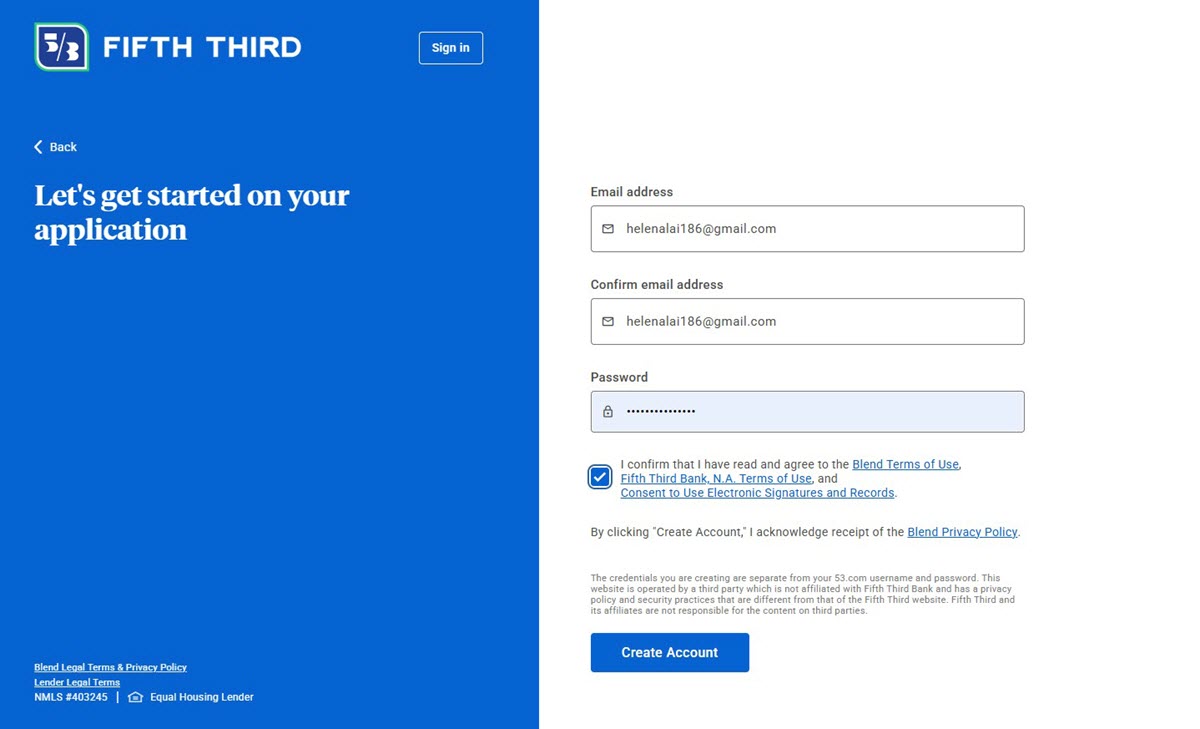

How to Apply for a Fifth Third Bank Home Loan

Fifth Third Bank allows you to apply for a home loan online or by visiting one of its branches, here is the process:

Step 1: Get Prequalified

Start by getting prequalified online. This step is quick, it usually takes just a few minutes.

- There’s no impact on your credit score.

- You’ll get an estimate of how much you may be able to borrow, based on your income and credit.

Prequalification helps you shop for homes with more confidence.

Step 2: Apply for a Home Loan

You can start online, by phone, or in person:

- Online: Begin the application on Fifth Third’s website.

- Phone: Call 1-866-351-5353 to apply or speak with a mortgage specialist.

- In-person: Visit a local branch for a personalized experience.

Step 3: Submit Your Documents

Once you move forward with your loan application, you’ll need to provide documents such as:

- A government-issued photo ID (like a driver’s license)

- Proof of income, recent pay stubs, W-2s, or tax returns

- Bank account statements

- Credit history, Fifth Third will check this automatically

These documents help the bank assess your financial situation and confirm that you meet the loan requirements.

Step 4: Review with a Loan Officer

After you submit your paperwork, a dedicated loan officer will contact you. They’ll:

- Go over your loan options.

- Explain rates, terms, and monthly payments.

- Answer any questions you have.

This step is especially helpful if you’re unsure about which mortgage type is right for you.

Step 5: Close Your Loan

If everything checks out, you’ll move to closing. This is when:

- You sign the final loan documents.

- Funds are released.

You officially become the homeowner!

Most Fifth Third Bank home loans close in 30 to 45 days, depending on your situation and the property. The bank also works directly with real estate agents and title companies to keep things moving smoothly.

Is Fifth Third Bank the Right Home Lender for You?

Fifth Third Bank is a strong choice for borrowers who want personalized support, flexible loan options, and a modern banking experience. They offer several programs that make homeownership more accessible, especially for those who may not qualify elsewhere.

Here’s a breakdown to help you decide if Fifth Third Bank home loans are the right fit for you:

Pros of Fifth Third Bank home loans:

- Specialized Loan Options: Fifth Third offers unique products like Community Mortgage, Physician Loans, and VA Loans that aren’t available at many other banks.

- Rate Drop Refinance: Their built-in Rate Drop Protector can save you thousands in refinance costs later if interest rates fall.

- Strong Customer Support: With more than 1,100 branches, borrowers can get help in person or online. This is great for people who prefer face-to-face service.

- Clear Loan Estimates: They provide upfront cost breakdowns so you know exactly what you’re signing up for.

Cons of Fifth Third Bank home loans:

- Not Nationwide: Fifth Third only lends directly in 11 states, mostly in the Midwest and Southeast. If you live elsewhere, you might need to go through a broker.

- Fees Can Add Up: While competitive, some of their fees, like the origination and underwriting charges, are on the higher side.

- Interest Rates May Require Negotiation: The posted Fifth Third Bank home loan interest rates aren’t always the most competitive unless you have excellent credit or negotiate directly.

That said, Fifth Third is a regional bank, not a national one. So if you live outside their service area (primarily in the Midwest and Southeast), some Fifth Third Bank home loans may not be available to you. The good news is that even if you’re outside their footprint, the Fifth Third Bank home loan rates and fees remain transparent and easy to understand.

In short, if you value personalized service, creative loan solutions, and future flexibility, Fifth Third Bank can be a smart and supportive partner on your homeownership journey.

FAQs About Fifth Third Bank Home Loans

Does Fifth Third offer pre-approval for home loans?

- Yes, Fifth Third Bank offers mortgage pre-approval. This helps you understand how much you can afford and shows sellers you’re a serious buyer. You can start online or by speaking with a loan officer.

Can I get a home loan from Fifth Third if I’m self-employed?

- Yes. Fifth Third works with self-employed borrowers, but you’ll likely need to provide extra documentation, such as 2 years of tax returns, profit and loss statements, and proof of stable income.

How long does it take to close a home loan with Fifth Third Bank?

- On average, Fifth Third Bank home loans close in about 30 to 45 days, depending on the loan type, property, and how quickly documents are submitted. Streamlined refinancing may be faster.

Does Fifth Third Bank charge mortgage applications or origination fees?

- Yes, like most lenders, Fifth Third may charge application or origination fees. The exact amount varies by loan, but many programs offer low or waived closing costs, especially for first-time buyers or refinancers.

How do I contact Fifth Third’s home loan department?

- You can reach their mortgage team by calling 1-866-351-5353 or by scheduling an appointment through their website for in-person or virtual help.

Can I make extra payments on a Fifth Third mortgage?

- Yes. Fifth Third allows you to make extra payments toward your principal at any time without penalty. This helps reduce interest and shortens your loan term.

In conclusion, Fifth Third Bank home loans offer a solid mix of flexible programs, helpful tools, and personalized support, especially for first-time buyers, veterans, and medical professionals. While their rates may not always be the lowest, features like the Rate Drop Protector and in-branch guidance add real value. If you live in one of their service states and want a lender that’s easy to work with and focused on your long-term goals, Fifth Third is worth considering.