If you’re buying a home in 2025, you’ve probably seen Citizens Bank pop up more than once in your mortgage rate searches. As one of the nation’s longest-standing lenders, it offers a wide range of home loan options. But are Citizens Bank mortgage rates truly competitive and worth your time?

In this full review, we’ll break down the current Citizens Bank mortgage rates, loan types, discounts, and what sets Citizens apart from the rest of the mortgage world.

Overview of Citizens Bank Mortgage Rates

When exploring your home financing options, understanding how Citizens Bank structures its mortgage rates can help you decide whether it’s the right fit for your budget and long-term goals.

About Citizens Bank Mortgage

Citizens Bank is a large regional bank based in Providence, Rhode Island. Founded in 1828, Citizens Bank has grown to serve millions of customers across 11 states. While its physical branches are concentrated in the Northeast and Midwest, Citizens offers mortgages in all 50 states. It ranks among the largest mortgage lenders in the U.S., with a national lending platform and a wide range of loan products.

With a reputation for personalized service and a growing suite of digital tools, Citizens has positioned itself as a strong player in both traditional and online banking. It offers fixed-rate and adjustable-rate mortgages (ARMs), jumbo loans, refinance options, and several programs tailored for first-time homebuyers. If you’re already a customer, you could also qualify for rate discounts and faster service.

General Explanation of Citizens Bank Mortgage Rates

Citizens Bank mortgage rates show how much interest you’ll pay on a home loan. These rates change daily based on the economy and your personal profile, like your credit score, down payment, and loan type.

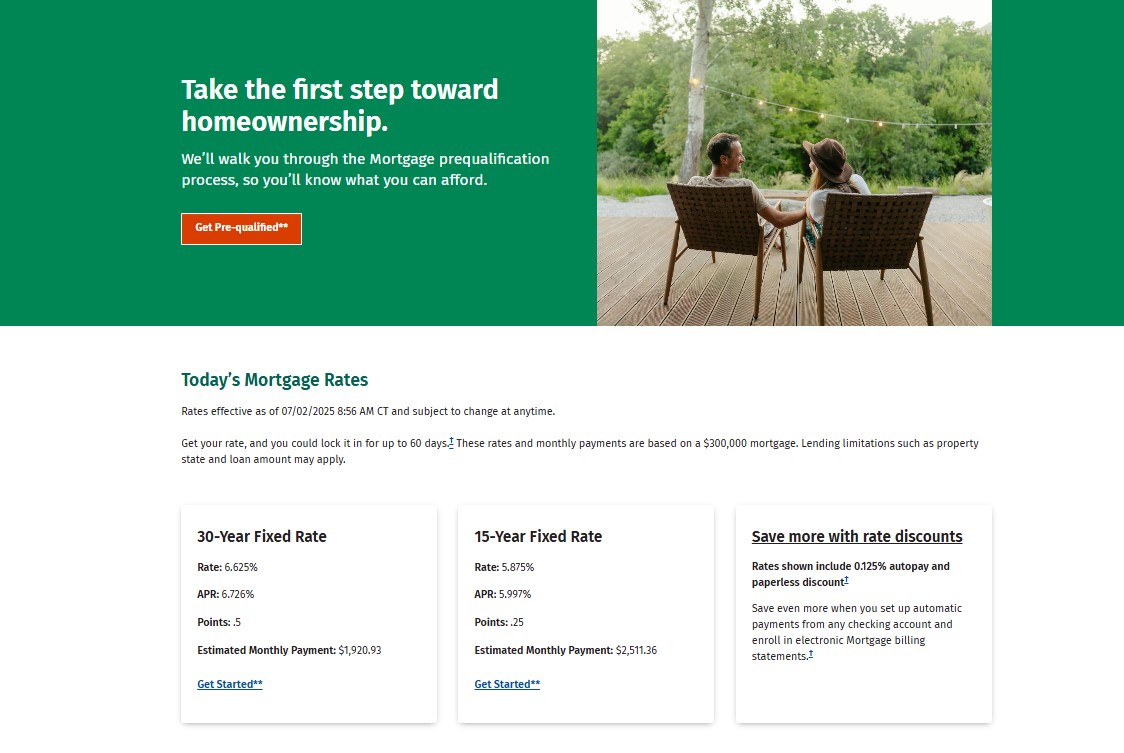

As of mid-2025, sample rates for a $300,000 loan include:

- 30-year fixed: 6.625% (APR 6.726%)

- 15-year fixed: 5.875% (APR 5.997%)

These Citizens Bank mortgage rates apply to standard loans and include a 0.125% discount if you use autopay and paperless billing with a Citizens account. You can lock in your rate for up to 60 days after prequalification.

Current Citizens Bank Mortgage Rates (As of July 2025)

Here are the most recently published Citizens Bank mortgage rates for qualified borrowers as of July 2025:

| Loan Type | Rate | APR | Down Payment |

|---|---|---|---|

| 30-Year Fixed | 6.625% | 6.702% | 20% |

| 15-Year Fixed | 5.875% | 6.095% | 20% |

| 7/6 ARM (Adjustable) | 6.250% | 6.742% | 20% |

| Jumbo 30-Year Fixed | ~6.73% | Varies | 20%+ |

Note: These rates assume excellent credit, automatic payments, and are subject to change. Rates are subject to change daily and can vary by state and loan amount, so you should always request a personalized quote from Citizens Bank before making any decision.

Discounts for Citizens Bank Mortgage Rates

Citizens Bank offers a rate lock for up to 60 days, which gives you peace of mind while you finalize your home purchase. Unlike some lenders, they also provide a rate discount program for borrowers who enroll in automatic payments and go paperless, an easy way to shave down your monthly bill.

Here’s how you can save your mortgage rate:

- 0.125% rate discount when you set up automatic payments and enroll in paperless mortgage statements

- Additional relationship perks if you have other Citizens Bank accounts (checking, savings, etc.)

This may seem small, but over a 30-year term, it could mean thousands in savings.

Types of Citizens Bank Mortgage Services

Citizens offers a full suite of mortgage options, making it suitable for first-time buyers, repeat homeowners, and even real estate investors. Here’s a look at what’s available:

Fixed-Rate Mortgages

Citizens’ most popular option is the 30-year fixed-rate mortgage, currently offered at around 6.625%. This product is ideal for buyers planning to stay in their home long term, as the monthly payment won’t change.

The 15-year fixed is also worth considering. With a lower interest rate (5.875%) and faster payoff timeline, it’s a great fit for buyers with stable incomes or those downsizing. Just be prepared for higher monthly payments.

Pros:

- Predictable monthly costs

- Easier budgeting over the life of the loan

- No rate surprises

Cons:

- May not be ideal if you plan to move in under 5 years

- Higher total interest cost than shorter loans

Adjustable-Rate Mortgages

Citizens offers ARMs like the 7/6 ARM, which starts with a fixed rate for seven years before adjusting every six months. With Citizens Bank mortgage rates ARM starting at 6.250%, it’s slightly lower than the 30-year fixed, at least initially.

This type of loan works best if you plan to sell or refinance within a few years. But be cautious: once the fixed period ends, Citizens Bank mortgage rates can fluctuate sharply based on market conditions.

Who should consider an ARM?

- Relocating professionals

- Short-term property investors

- Buyers are confident in rising income

Jumbo Loans

Planning to buy a high-value home? Citizens offers jumbo loans, mortgages that exceed the conforming loan limits (usually over $766,550 in most counties).

The loans come with competitive Citizens Bank Jumbo mortgage rates (around 6.73%) and flexible down payment options, especially for well-qualified borrowers. Some programs even allow loan-to-value (LTV) ratios up to 90%.

Jumbo loan highlights:

- Available in 30-year and 15-year terms

- No mortgage insurance required with sufficient down

- Tailored underwriting for high-net-worth buyers

Keep in mind that jumbo loans typically require:

- Strong credit (usually 700+)

- Large down payments (15–20%+)

- Reserves (savings after closing)

Conventional Loans

These are the most common types of mortgage. They are not backed by the government and are usually best for borrowers with solid credit and steady income.

- Minimum credit score required: 620

- Down payment needed: As little as 3%

Who it’s for: Buyers with good credit history who can handle regular monthly payments

Benefits: Lower Citizens Bank mortgage interest rates for qualified borrowers, flexible loan terms.

FHA Loans

FHA loans are backed by the Federal Housing Administration and are designed to help people who may not qualify for a conventional mortgage.

- Minimum credit score: Usually between 580 and 620

- Down payment required: 3.5%

Who it’s for: First-time buyers, people with lower credit scores, or those who have a smaller savings account

Benefits: Easier to qualify for, lower down payment, more forgiving credit standards

VA Loans

These loans are backed by the U.S. Department of Veterans Affairs and are available to eligible veterans, active-duty military members, and some surviving spouses.

- Down payment: None required

- Private mortgage insurance (PMI): Not required

Who it’s for: Military members or veterans who want to buy, build, or refinance a home

Benefits: No down payment, no PMI, and usually lower interest rates

Construction Loans

If you’re building a home from the ground up, a construction loan may be right for you. These loans cover the cost of building a house.

- Purpose: Finance the building of a new home

- Payments: Often interest-only during the construction phase

Who it’s for: Buyers building a custom home or working with a builder

Benefits: Designed to meet the unique needs of construction projects

Citizens Bank Mortgage Refinancing

Already own your home but want better terms? Citizens offers both rate-and-term and cash-out refinancing.

As of July 2025, the 30-year refinance rate sits around 5.750% APR, making it a solid option for homeowners locked into older, higher rates.

Citizens also provides a handy refinance calculator, helping you estimate your break-even point—the time it takes for savings to outweigh closing costs.

Benefits of refinancing with Citizens:

- Potential for lower monthly payments

- Switch from ARM to fixed-rate

- Tap home equity through cash-out

Special Mortgage Programs from Citizens Bank

In addition to traditional home loans, Citizens Bank offers several unique mortgage programs that make homeownership more affordable, especially for first-time buyers and those with limited savings. These special programs offer lower down payment requirements, reduced or no mortgage insurance, and in some cases, financial assistance or interest rate discounts.

Here’s a closer look at the standout options:

Your Home Rewards

This is a cash rebate program designed for home buyers and sellers. When you work with a participating real estate agent from the Citizens Home Rewards network, you can receive up to $9,500 back after your transaction closes.

Available for both buyers and sellers

- You don’t need to take a mortgage with Citizens to participate

- Must live in a state where commission rebates are allowed

This program is a smart way to reduce your out-of-pocket costs after closing, especially if you’re buying or selling in a qualifying state.

ONE Mortgage Program (Massachusetts only)

This program is one of the most affordable mortgage options for first-time homebuyers in Massachusetts. It’s tailored for low- to moderate-income borrowers and comes with several important benefits:

- Only 3% down payment required

- No private mortgage insurance (PMI)

- Discounted fixed interest rate, often below market rates

- Partial interest subsidy may be available for the first 7 years if you qualify by income

- A portion of the down payment can be a gift, though some of your own funds are still required

Borrowers must complete a first-time homebuyer education course and meet income and location eligibility. This program helps reduce monthly payments and upfront costs for those who qualify.

Destination Home Mortgage

This program is designed to make buying a home easier in low- to moderate-income areas. It’s especially helpful if you have limited funds for a down payment.

- Down payments as low as 3% for 1–2 unit homes, and 5% for 3–4 unit properties

- No monthly PMI payments, which lowers your monthly costs

- No income limits if the home is in a qualifying area

- Community assistance may be available for down payment or closing costs

- A 0.125% rate discount is offered if you use autopay and paperless billing from a Citizens checking account

This program is ideal for buyers who want to reduce their monthly housing expenses and take advantage of area-specific homeownership incentives.

HomeReady Mortgage

Citizens also offers access to the HomeReady program, a Fannie Mae-backed mortgage option with flexible requirements. It’s designed for buyers who have modest incomes or less-than-perfect credit.

- Down payment as low as 3%

- Available for single-family primary homes

- Reduced mortgage insurance requirements when financing over 90% of the home’s value

- Allows the use of gift funds and seller contributions to cover upfront costs

- Requires homebuyer education for at least one borrower

- Income limits may apply depending on the property location

This is a great choice for buyers who want a low down payment, but still need competitive rates and flexible options to qualify.

Low Down Payment Solutions

Citizens Bank also offers general low-down payment mortgage options that aren’t tied to a specific government or specialty program. These solutions are open to many borrowers and allow:

- As little as 3% down for home purchases

- Up to 97% loan-to-value (LTV) financing on primary homes

- Fixed interest rates for predictable monthly payments

- No income limits in most cases

- Available for both new purchases and refinancing

This flexible option is especially useful if you’re a first-time buyer who doesn’t have 20% saved, or simply wants to keep more cash on hand for moving expenses and home improvements.

Requirements and Documents Needed for Citizens Bank Mortgage

To successfully apply for a mortgage with Citizens Bank and receive better Citizens Bank mortgage rates, you’ll need to meet certain eligibility criteria and provide documentation. Having these items ready will speed up the process and improve your chances of approval.

Basic Requirements

- U.S. citizenship or permanent residency

- Steady income and employment history for at least 2 years.

- Good credit score (typically 620+ for conventional loans, and 580–620 for FHA loans)

- A valid Social Security Number

- Sufficient funds for a down payment and closing costs (as low as 3% for conventional loans, 3.5% for FHA loans, and 0% for VA loans)

- Debt-to-Income (DTI) Ratio should ideally be under 43% of your gross income.

Required Documents

To begin processing your loan, Citizens Bank will ask you to submit the following:

- Proof of Income

- Recent pay stubs (last 30 days)

- W-2 forms (last 2 years)

- Tax returns if self-employed (2 years)

- Documentation for other income (bonuses, child support, etc.)

- Assets and Banking Information

- Recent bank statements (typically last 2 months)

- Retirement or investment account statements (if using those assets)

- Debts and Liabilities: List of all existing monthly debt payments (credit cards, car loans, student loans, etc.)

- Identification

- Valid government-issued ID (e.g., driver’s license or passport)

- Social Security Number

- Property Information

- Purchase agreement or contract (if you’re already under contract)

- For refinancing, the current mortgage statement

- Citizens may also require a home appraisal as part of the process

- Other Possible Documents

- Proof of homeowners insurance (before closing)

- Gift letter (if any part of your down payment is a gift from a relative)

- Rent payment history (if you’ve been renting and have little credit history)

Before applying, it’s smart to check your credit report for any errors or surprises. If your score is above 700, you’ll likely qualify for lower Citizens Bank mortgage rates. If your credit is on the lower end, you may still qualify through FHA or VA programs.

Being organized and responsive can make a big difference in speeding up your approval. Citizens may also request additional documents depending on the type of loan you choose, such as jumbo or FHA loans.

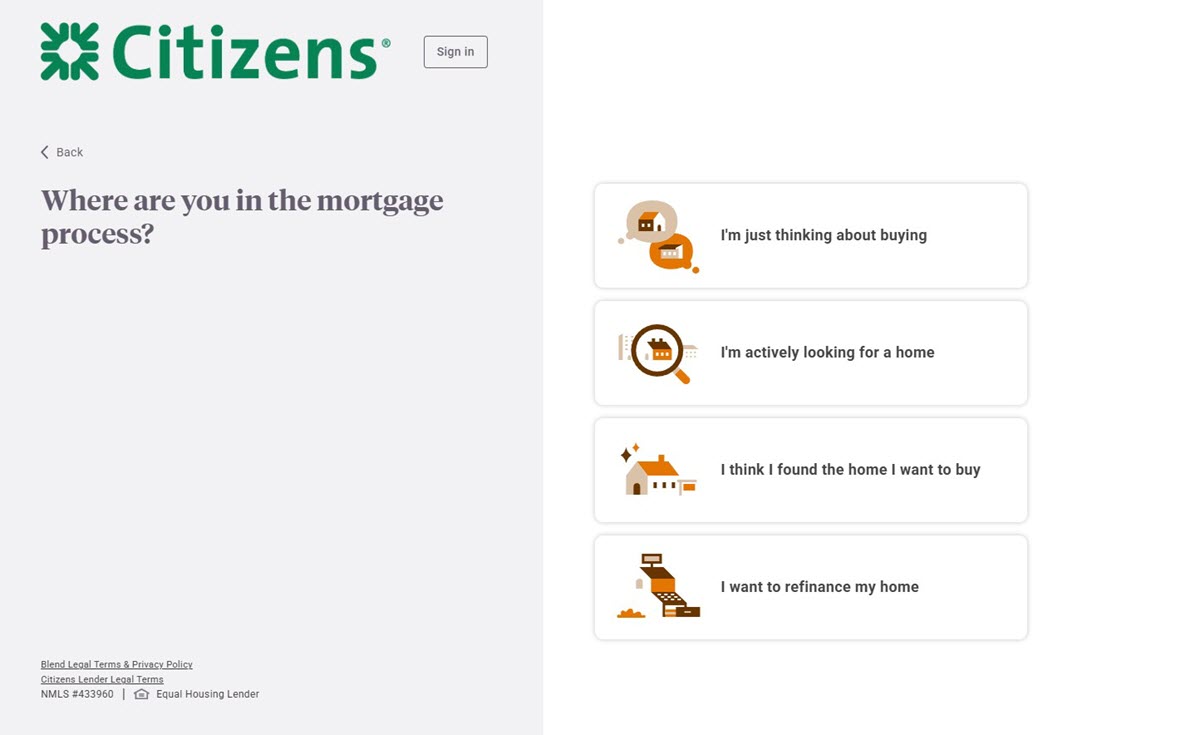

How to Apply for a Mortgage with Citizens Bank

Getting a mortgage from Citizens Bank is designed to be smooth and mostly digital. Whether you’re buying your first home or refinancing, the process is easy to follow and accessible even if you’re not tech-savvy.

You can start by getting prequalified online, a quick step that gives you a loan estimate without impacting your credit score. This helps you understand how much you may be able to borrow, so you can shop for homes confidently.

Once you’re ready to move forward, you can apply through whichever channel works best for you:

- Online: Visit citizensbank.com and complete the mortgage application form.

- In-person: Visit a Citizens Bank branch if you live in a state where branches are available.

- By phone: Call 1-888-514-2300 to speak with a home loan advisor directly.

The most popular way is to complete a full application through Citizens’ secure online portal. You’ll be able to:

- Upload documents directly from your computer or phone

- Track the status of your application in real time

- Message or call the loan officers if you have questions

You’ll be asked to create an online profile and answer questions about your income, employment, home type, and financial goals. Once submitted, a loan officer will reach out to guide you through the next steps.

On average, the mortgage process, from application to closing, takes around 30 to 45 days, which is in line with most lenders in the U.S.

Are Citizens Bank Mortgage Rates Worth It?

Choosing the right mortgage lender means weighing the pros and cons, not just the interest rates, but also the programs, fees, and many other factors.

Why Citizens Bank Rates Are Attractive:

- Built-in rate discounts: You get a 0.125% rate discount if you use autopay and paperless billing.

- Low down payment options: Pay as little as 3% down with conventional loans, 3.5% for FHA, and 0% for VA loans.

- Helpful programs for first-time buyers: Options like the Destination Home Mortgage and ONE Mortgage help reduce costs and avoid PMI.

Where They May Fall Short:

- Citizens Bank mortgage rates aren’t always the lowest: Some reports show Citizens Bank mortgage rates are average or slightly above other lenders.

- Stricter credit for FHA: You’ll need at least a 620 credit score for an FHA loan, while other banks may allow 580.

- Unclear fees: Citizens doesn’t publish lender fees online, you’ll need a Loan Estimate to know the full costs.

How Does Citizens Compare:

Let’s look at how Citizens Bank mortgage rates stack up against other major lenders:

| Lender | 30-Yr Fixed Rate | APR | Highlights |

|---|---|---|---|

| Citizens Bank | ~6.625% | ~6.702% | Autopay discount, jumbo loans |

| Bank of America | ~6.750% | ~6.810% | Broader branch access |

| Rocket Mortgage | ~6.750% | ~6.820% | Fully online, faster closings |

| First Citizens Bank | ~6.625% | ~6.690% | Competitive jumbo rates |

Citizens shines for borrowers who value a mix of local service and digital convenience, without paying a rate premium.

In short, Citizens Bank mortgage rates are really competitive for many borrowers.

Citizens Bank offers competitive mortgage rates that hold up well against national lenders. The autopay discount and robust jumbo loan offerings add extra value, especially if you qualify for their assistance programs.

While the online application process is smooth, some borrowers may find the lack of upfront fee transparency a drawback. Still, if you’re shopping for a mortgage in 2025, Citizens Bank is absolutely worth including in your rate comparison.

FAQs About Citizens Bank Mortgage Rates

What are the Citizens Bank’s current mortgage rates?

- As of July 2025, Citizens Bank offers around 6.625% for a 30-year fixed loan and 5.875% for a 15-year fixed loan. Rates may vary by credit score and location.

Does Citizens Bank offer competitive mortgage rates?

- Yes. Citizens Bank mortgage rates are generally in line with national averages and often include rate discounts for autopay and paperless billing.

How do I qualify for the lowest mortgage rate at Citizens Bank?

- To get the best rate, you’ll need excellent credit, a strong income, a down payment of at least 20%, and you should enroll in autopay and paperless statements.

Can I get prequalified for a mortgage with Citizens Bank online?

- Yes. Citizens Bank offers a free online prequalification tool that doesn’t affect your credit score and gives you an estimate of what you may borrow.

Does Citizens Bank charge prepayment penalties on mortgages?

- No. Citizens Bank does not charge prepayment penalties, so you can pay off your mortgage early without extra fees.

Citizens Bank mortgage rates are competitive, especially with autopay discounts and strong options for first-time buyers. While not always the lowest, they offer value through flexible programs and personal service. Just be sure to compare fees and rates before you commit.