Buying a home is a big deal. And in 2025, mortgage rates play a huge role in your decision. First Citizens Bank mortgage rates are worth a close look, especially as borrowers seek stability and value amid rising costs.

With a wide range of loan options from fixed to FHA and jumbo, this lender offers flexible solutions for many. In this guide, we’ll break down everything you need to know about First Citizens Bank mortgage rates to decide if this bank is the right fit for your mortgage needs.

Understanding First Citizens Bank Mortgage Rates

Before exploring the different types of First Citizens, it’s essential to first understand who First Citizens Bank is and how First Citizens Bank mortgage rates work. This overview will walk you through the key fundamentals so you can build a clear and confident foundation.

Mortgage Basics

A mortgage is a loan helping individuals buy or refinance real estate, such as a house, land, or other property. Since most people don’t have enough cash to purchase a home outright, mortgages make homeownership more accessible by allowing buyers to borrow money and repay it over time.

When you take out a mortgage, you agree to repay the lender in fixed installments over a set period, known as the mortgage term. This term typically ranges from several years to as long as 30 years. Each payment includes both a portion of the loan’s principal (the amount you borrowed) and interest. Interest is essentially the cost of borrowing, and the rate you receive depends on various factors, including your credit score, income, loan type, and overall market conditions.

Mortgage rates refer to the interest rates charged by lenders on home loans. They determine the cost of borrowing money to purchase, build, or refinance a property. Expressed as a percentage, mortgage rates are applied to the loan balance and affect how much a borrower pays each month in interest.

Who Is First Citizens Bank?

First Citizens Bank is one of the oldest and most respected financial institutions in the United States. It was founded in 1898 and is headquartered in Raleigh, North Carolina. Over the past century, it has grown from a small regional lender into a major national bank. As of 2025, First Citizens ranks among the top 20 U.S. banks, managing over $200 billion in assets.

The bank is known for offering a wide range of financial services for both personal customers and businesses, but one of its core strengths is home lending. Whether you’re a first-time buyer, upgrading to a larger home, or refinancing an existing mortgage, First Citizens has options to meet your needs.

Overview of First Citizens Bank Mortgage Rates

First Citizens Bank offers mortgage rates that are competitive, reliable, and designed to help people reach their homeownership goals. As one of the most trusted banks in the country, they’ve been helping families buy homes for over 100 years. With a strong focus on customer service and community support, they make the borrowing process feel more personal.

Their mortgage rates are built to match different financial needs and life situations. Whether you’re buying your first home, building a new one, or refinancing an existing loan, First Citizens Bank has options to make the process smoother and more affordable. What makes their mortgage offerings stand out is the mix of stable rates, flexible programs, and helpful guidance every step of the way.

Here are some of the loan programs they offer:

-

Fixed-rate mortgages (15, 20, 30 years)

-

Adjustable-rate mortgages (ARMs)

-

Home Construction Loans

-

Renovation Loans

-

Medical Professional Mortgages

-

Government-backed (FHA, VA, USDA)

-

Jumbo loans

-

Mortgage Refinancing

-

Special Purpose Credit Program

First Citizens Bank Mortgage Rates Today

As of July 2025, First Citizens Bank does not publish real-time mortgage rates directly on its website. Instead, borrowers must go through a quick pre-qualification process to receive a personalized rate quote. This helps ensure the rate you’re offered reflects your credit profile, loan amount, and financial situation.

However, several trusted third-party sources have reported the bank’s average rates based on current market data. Here’s a general idea of what borrowers can expect:

- 30-year fixed mortgage: Around 7.00% (APR approximately 7.07%)

- 20-year fixed mortgage: Around 6.875% (APR approximately 6.96%)

- 15-year fixed mortgage: Around 6.375% (APR approximately 6.48%)

These First Citizens Bank mortgage rates are in line with national averages for mid-2025. For example, 15-year fixed mortgages are typically hovering between 6.0% and 6.5%, while 30-year fixed rates range from 6.8% to 7.2%. So, First Citizens Bank is offering competitive options, especially for buyers looking for long-term stability.

Estimated Current First Citizens Bank Mortgage Rates in Mid-2025

| Mortgage Product | Estimated Interest Rate (APR) | Loan Term | Down Payment Requirement | Ideal For |

|---|---|---|---|---|

| 30-Year Fixed-Rate Mortgage | ~7.00% | 30 years | As low as 5–10% (typical) | Long-term buyers want payment stability |

| 15-Year Fixed-Rate Mortgage | ~6.30% | 15 years | As low as 5–10% (typical) | Buyers wanting to pay off their home faster |

| 5/6 ARM | ~6.10% (initial) | Adjustable after 5 years | 5–10% | Short-term owners or refinancers |

| 7/6 ARM | ~6.25% (initial) | Adjustable after 7 years | 5–10% | Buyers who plan to sell/move in 5–7 years |

| 10/6 ARM | ~6.35% (initial) | Adjustable after 10 years | 5–10% | Buyers wanting lower rates with a longer fixed term |

| FHA Loan | ~6.50%–6.75% (with MIP) | 15–30 years | As low as 3.5% | First-time buyers or limited credit |

| VA Loan | ~6.25%–6.50% (no PMI) | 15–30 years | 0% (for eligible veterans) | Active-duty or retired military |

| USDA Loan | ~6.50% (est.) | 30 years | 0% (income and location limits) | Rural and low-to-moderate income buyers |

| Jumbo Loan | ~7.25%–7.50% | 15–30 years | Typically 20%+ | High-value home purchases |

| Refinance (Fixed-Rate) | Matches fixed-rate terms above | 15–30 years | Varies by loan type | Lowering the current rate or switching loan terms |

| Cash-Out Refinance | ~7.25%+ | 15–30 years | Typically, 20%+ equity needed | Accessing home equity as cash |

Disclaimer: The table of First Citizens Bank mortgage rates is for informational purposes only. These rates can change daily based on economic trends, inflation data, and Federal Reserve policy. To get the most accurate rate, it’s best to speak directly with a mortgage advisor or begin the pre-qualification process online.

Are First Citizens Bank Mortgage Rates Competitive?

When it comes to affordability, First Citizens Bank earns high marks because of its offering competitive mortgage rates along with flexible, low-down payment options. This makes it a solid choice for both first-time buyers and experienced homeowners looking for good value.

However, as mentioned above, First Citizens does not publish its exact interest rates on its website. That may seem inconvenient, but it’s actually quite common because mortgage rates often vary based on your specific financial situation.

The rate you receive will depend on several key factors:

- Your credit score

- The size of your loan

- Your down payment or loan-to-value (LTV) ratio

- The type of loan you choose

- Where the property is located

As of mid-2025, national averages for a 30-year fixed mortgage fall between 6.8% and 7.2%, depending on market conditions. These First Citizens Bank mortgage rates tend to fall at or slightly below these averages, which is a good sign for borrowers.

Keep in mind that broader economic forces, like inflation, Federal Reserve interest rate changes, and trends in the bond market, also influence mortgage rates. So it’s always smart to compare a few lenders to see which one offers the best deal for your situation.

Diverse First Citizens Bank Mortgage Types

When evaluating First Citizens Bank mortgage rates, it’s essential to understand the range of loan products they offer and how each one aligns with different financial goals. Whether you’re looking for predictable long-term stability or flexible short-term savings, First Citizens provides a variety of tailored mortgage solutions to suit your unique situation.

Adjustable-rate Mortgages

One of the most flexible choices within First Citizens home loans is the adjustable-rate mortgage (ARM). It offers a lower starting interest rate, usually fixed for 5, 7, or 10 years. After that, your rate adjusts every six months based on market conditions. These loans can be a smart choice if you plan to move or refinance before the rate changes.

To protect borrowers from excessive rate hikes, First Citizens places caps on how much interest rates, a key part of First Citizens Bank mortgage rates can increase during each adjustment period and over the life of the loan. Additional benefits include seamless online payments when connected to a First Citizens checking account, plus potential access to down payment assistance that can significantly lower your upfront costs.

Benefits of adjustable-rate mortgages:

- Lower initial payments and interest rates

- Rate caps help limit how much First Citizens ARM rates can increase

- Useful for short-term stays or early refinancing

Caution: Even with rate ceilings, your monthly payments may rise significantly after the fixed term. Make sure to evaluate future affordability.

Fixed-rate Mortgages

Fixed-rate mortgages are ideal if you want consistent payments that won’t change over time. With this option, your First Citizens Bank mortgage rate stays the same for the entire term, whether it’s 15, 20, or 30 years. This makes monthly budgeting easier and protects you from future rate hikes.

While the exact First Citizens Bank mortgage rates aren’t listed online, industry data as of summer 2025 shows their fixed-rate loans are slightly below the national average, around 7.00% for a 30-year term and about 6.30% for 15 years.

Why should you choose a fixed-rate?

- Your rate and monthly payment stay the same

- It’s easier to plan long-term finances

- Great if you plan to stay in the home for many years

What to consider:

- Rates can be higher than adjustable options

- You need to lock in early before market rates rise

Construction Loan

As part of the broader suite of First Citizens Bank mortgage rates, rates of new home construction loans help you finance the building of a residential property from the ground up. Unlike traditional long-term mortgages, these are short-term loans with just up to one year. These loans are used to cover construction costs during the build phase.

During the building phase, you only pay interest on the amount drawn, helping you manage costs while the home is being completed. Once construction is done, the loan transitions into a regular mortgage, making the process seamless.

Key benefits of a construction loan:

- Finance both the build and final mortgage in one loan

- Interest-only payments during construction

- Loan amounts available up to $3 million

If you’re working with a builder and want a simple way to finance the entire project, this option keeps things flexible and efficient.

Jumbo Loan

As part of the comprehensive First Citizens home loan portfolio, jumbo loans are designed for buyers seeking financing that exceeds conventional loan limits set by the Federal Housing Finance Agency (FHFA). These loans are ideal for those purchasing luxury homes or high-value properties that require more borrowing power than standard conforming mortgages can provide.

You can choose a fixed or adjustable interest rate, and borrow up to $5 million with as little as 10% down, depending on your credit and financial profile.

Highlights of a jumbo loan:

- Flexible loan terms to fit your goals

- Higher loan limits than conventional mortgages

- Available for both primary and secondary homes

However, qualifying may require strong income, assets, and credit history, but the benefits are worth it if you need more room to borrow.

Medical Professional Loans

If you’re a doctor, dentist, nurse, or other healthcare professional, First Citizens offers a special mortgage program just for you.

This medical professional mortgage recognizes your career path, letting you qualify even with limited work history or student debt. You can access higher loan amounts and flexible approval terms to help you settle into your first home or relocate quickly for work.

Advantages of medical professional loans:

- Fixed and adjustable-rate options available

- May qualify without a long employment record

- Higher borrowing limits tailored to your profession

It’s a practical and supportive option for professionals who’ve spent years in school and are now ready to invest in a home.

Mortgage Refinancing

If you already own a home, refinancing can be a smart way to improve your financial situation. The bank offers a variety of refinancing options with good First Citizens Mortgage refinance rates to help you achieve different goals, whether you’re looking to lower your monthly payment, pay off your loan faster, or tap into your home’s value.

Here’s how refinancing can benefit you:

- Access your home equity

- Switch to a longer or shorter loan term to fit your financial plan.

- Replace multiple monthly payments with one, often at a lower interest rate.

- Stabilize your rate

Refinancing gives you the flexibility to reshape your mortgage as your life and financial needs evolve.

Renovation Loans

Whether you’re updating an outdated kitchen or fixing major structural issues, a home renovation loan from First Citizens can help you fund your vision.

These loans can be used on your main residence or a second home, and you can borrow up to $3 million, depending on your renovation plan. The bank pays your contractor in phases as the work progresses, giving you peace of mind and financial control.

What you get:

- Fixed or variable rate options

- Use funds for repairs, remodeling, or upgrades

- Smooth payment process to your builder

This is ideal if you’ve found a home with great potential or want to add value to your current one.

Special Purpose Credit Program

For customers who meet certain criteria, First Citizens provides a Special Purpose Credit Program, designed to expand access to homeownership for underserved communities.

You can finance up to 100% of the home’s value, get credits toward your down payment or closing costs, and use alternative credit histories to qualify.

Program perks:

- No traditional credit required in some cases

- Helps reduce upfront costs

- Focused on financial inclusion

This is a helpful tool if you face challenges with traditional loans but are ready to own a home.

FHA, VA, and USDA Loans

First Citizens provides several government-backed mortgage options that make homeownership more accessible:

- FHA loans: Just 3.5% down for qualified buyers

- VA loans: No down payment for eligible veterans and service members

- USDA loans: 100% financing available for homes in eligible rural areas

These loans are easier to qualify for, especially if you have limited savings or a modest credit history.

First Citizens Mortgage Fees & Closing Timeline

In addition to First Citizens Bank mortgage rates, when taking out a mortgage with First Citizens, you should be prepared for standard closing costs. These typically include origination fees, underwriting, home appraisal, title services, and state or local taxes. The total can range from $3,000 to $6,000, depending on your loan size, property value, and location.

The closing process usually takes 30 to 45 days from start to finish, which is in line with national averages. However, this timeline can vary based on how quickly you provide required documents and whether any property-related issues arise.

First Citizens also supports remote closing options, including e-signatures and e-notarization, making the experience more convenient, especially for busy or out-of-state borrowers.

While there’s no public mention of prepayment penalties, it’s a good idea to confirm this detail directly with your loan officer during the early stages of the process.

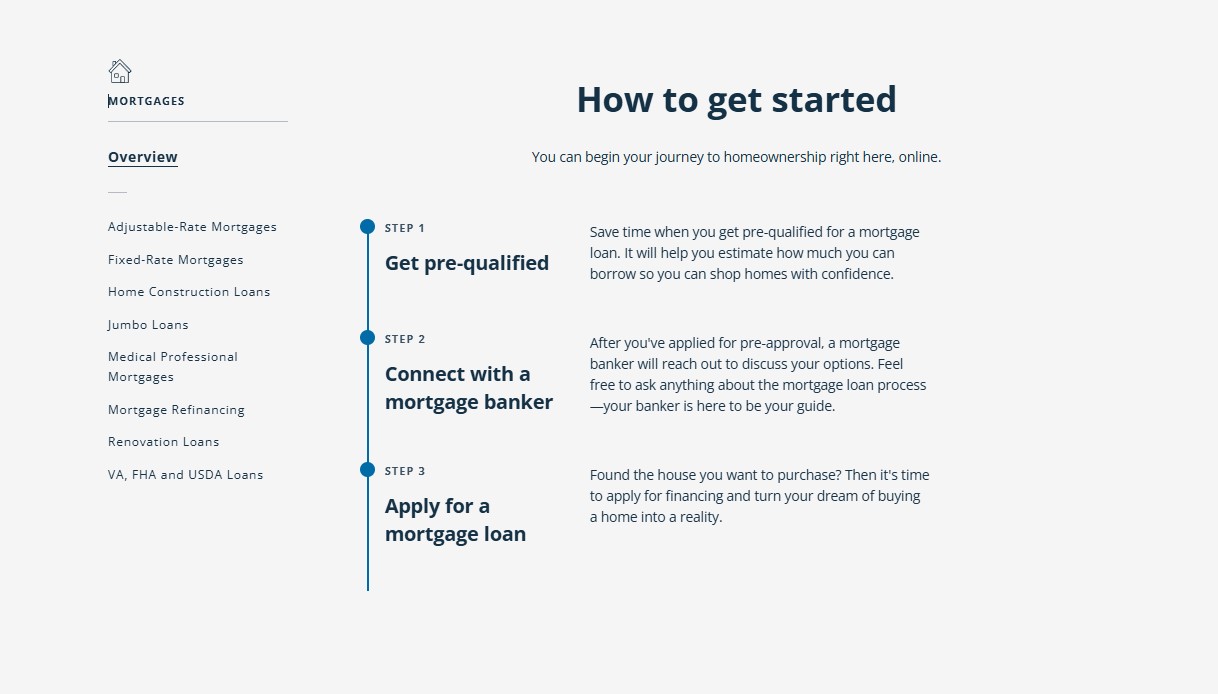

How to Get Started with a First Citizens Bank Mortgage

Getting a mortgage with First Citizens Bank is a step-by-step process that’s designed to be simple and flexible. Here’s how to begin:

- Visit the Mortgage Page: Head over to the official First Citizens Bank website and explore their mortgage section. You’ll find details about loan types, calculators, and helpful guides.

- Pre-Qualify Online: Use their secure online form to get pre-qualified. This gives you an idea of how much you might be able to borrow, without affecting your credit score.

- Speak with a Loan Officer: Once you’re pre-qualified, it’s a good time to talk to a mortgage banker. Ask about detailed First Citizens Bank mortgage rates, APRs, discount points, and loan options that fit your needs.

- Compare Your Options (optional): Don’t stop with one loan option or one lender. Get quotes from at least two or three banks to make sure you’re getting the best rate and terms available.

- Choose the Right Mortgage Product: Based on your goals and budget, you’ll pick the loan that fits best.

- Lock Your Rate and Apply: When you’re ready, you can lock in your mortgage rate to protect it from rising while your loan is being processed.

- Complete the Application and Move toward Closing: Once your rate is locked, you’ll submit paperwork, schedule an appraisal, and prepare to close on your home.

Getting a rate quote is easy and helps you plan better. Just remember that the sooner you start, the sooner you’ll know what’s possible for your budget.

FAQs About First Citizens Bank Mortgage Rates

Do First Citizens mortgage rates vary by state?

- Yes. First Citizens customizes mortgage rates based on your property location, because state regulations, taxes, and market conditions can affect lending. To get a precise rate, contact a local loan officer who can provide a quote tailored to your area.

Does First Citizens Bank offer any discounts on mortgage rates?

- Yes, they do. If you sign up for automatic payments and paperless billing, you may qualify for a 0.125% discount on your mortgage rate. This small savings can add up over the life of the loan.

Can I apply online and get pre-approved right away?

- You can pre-qualify online, which gives you a general estimate of how much you can borrow. However, full pre-approval, which includes an official rate quote, comes after you complete the full mortgage application and submit financial documents.

Does First Citizens offer refinancing options?

- Yes, they offer both rate-and-term refinancing (to reduce your interest rate or change your loan term) and cash-out refinancing (to borrow against your home equity). As of mid-2025, refinance rates are around 6.75%, depending on your credit and loan details.

If you’re seeking a wide range of mortgage products, down-payment help, and remote closing convenience, First Citizens deserves serious consideration. First Citizens Bank mortgage rates are competitive, especially their 15-year fixed. Just keep in mind you’ll need to begin the pre-qualification process to access precise pricing. Your mortgage is a long-term deal. Small rate differences can mean large savings over time.