When life throws a big expense your way, a First Horizon personal loan can help you handle it without draining your savings. With a range of loan options, competitive interest rates, and a customer-first approach, First Horizon makes borrowing money stress-free.

In this guide, we’ll explore everything you need to know about personal loans from First Horizon, from how they work to how to apply and what makes them unique.

What Is a First Horizon Personal Loan?

First Horizon Bank is one of the oldest financial institutions in the United States, founded in 1864 and headquartered in Memphis, Tennessee. Over the years, it has built a strong presence across 12 southeastern states, including Florida, North Carolina, and Texas.

A First Horizon personal loan is a type of loan that gives you a specific amount of money upfront. You pay it back in equal monthly payments over a set time, usually from 1 to 5 years. These loans are meant to help you handle everyday or unexpected expenses without draining your savings.

There are two main types of personal loans at First Horizon:

- Unsecured personal loans with no collateral required

- Secured personal loans are backed by your savings or CD account

These First Horizon personal loan products are perfect when you need money for:

- Home repairs or upgrades, like fixing your roof or remodeling the kitchen

- Medical bills not covered by insurance

- Travel plans such as a family vacation or a last-minute flight

- Big purchases, like furniture or appliances

- Debt consolidation, especially if you’re stuck with high-interest credit cards

Whether you need just a little cash to get through a rough patch or a larger amount for a big life event, First Horizon has personal loan options to match your needs, credit score, and income.

Why Choose a First Horizon Personal Loan?

First Horizon makes borrowing money simple, fast, and worry-free. Here’s why so many people trust them:

- Flexible loan types to choose from

- Quick application and approval process

- Fixed interest rates

- No prepayment penalties

- Tailored loan terms based on your credit and finances

- Helpful loan advisors ready to guide you

Types of Personal Loans at First Horizon

Now, let’s take a closer look at the different personal loan types First Horizon offers:

Unsecured Personal Loans

With this First Horizon Bank personal loan, you don’t need to put up any collateral, meaning you’re not risking your house, car, or savings if something goes wrong. You borrow a lump sum and repay it in monthly installments.

Key Features:

- Borrow starting from $2,000

- Loan terms from 12 to 60 months

- No asset reserve needed for loans under $15,000

- Requires a credit check and proof of income

- Comes with a fixed First Horizon personal loan interest rate, so your payment never changes

This is a great option if you have a decent credit score and want quick access to cash without using your savings or property as backup.

Unsecured Personal Line of Credit

If you’re not sure how much money you’ll need, or you expect to have repeating expenses over time, this option gives you more flexibility. With a First Horizon personal line of credit, you’re approved for a maximum amount but only borrow what you need, when you need it.

Key Features:

- Minimum line of credit starts at $15,000

- 24-month draw period – borrow anytime within the first 2 years

- 60-month repayment period, pay back over 5 years

- Interest-only payments allowed during the draw period

- Variable interest rate

This option works well if you’re covering unpredictable or ongoing costs like medical bills, tuition, or business expenses.

CD or Savings Secured Loans

If you have money saved in a First Horizon CD or savings account, you can use it as collateral to secure a loan. This allows you to borrow money without withdrawing your savings and often comes with lower interest rates.

Key Features:

- The loan amount is based on how much you have in your CD or savings

- Fixed or flexible repayment options available

- Ideal for those with less-than-perfect credit

- Helps you gradually raise your credit score.

This First Horizon personal loan gives you the confidence of borrowing your own money while keeping your savings intact and working for you.

Credit Builder Loan

If you’re just starting your credit journey or trying to bounce back from past mistakes, a Credit Builder Loan from First Horizon can help you take the right steps forward.

This First Horizon Bank personal loan is different from traditional personal loans. The money you borrow is not immediately in your possession, instead, it goes directly into a Certificate of Deposit (CD) that’s held by the bank. You make regular monthly payments toward the loan, and once it’s paid off, you’ll get access to the money in the CD, plus any interest it’s earned.

How It Works:

- Loan Amount: $2,000 to $5,000

- Term Length: 12 to 36 months

- Collateral: Backed by a First Horizon CD

- Usage: You can’t use the funds until the loan is paid off

- Goal: Build or repair your credit with consistent on-time payments

Plus, your payments are reported to credit bureaus, which means every on-time payment helps improve your credit profile.

Auto, Boat, and RV Loans

Looking to buy a new vehicle, upgrade your boat, or finally take that cross-country trip in an RV? First Horizon also offers specialized loans for large purchases like cars, boats, and recreational vehicles (RVs).

Whether you’re buying new or used, or even refinancing an existing loan, these First Horizon auto loan options are built to give you the freedom to finance your dreams with competitive rates and longer repayment periods.

What You Can Finance:

- Cars: New or used vehicles

- Boats & Yachts: From weekend cruisers to serious sea vessels

- RVs: Including motorhomes, travel trailers, and fifth wheels

Key Loan Features:

- Loan Amounts: Start at $10,000 and go up to $250,000

- Repayment Terms: From 12 months to 20 years (depending on the vehicle)

- Financing Coverage: Up to 90% of the purchase value

- Simple Approval Process: Competitive rates, fast decisions

- Collateral Required: The vehicle itself backs the loan

These vehicle loans are a great fit for big purchases where you want fixed payments and the flexibility to choose terms that match your budget.

First Horizon Personal Loan Amount & Terms

Before you apply for a personal loan, it’s important to understand how much you can borrow and what repayment terms are available:

How Much Can You Borrow?

The amount you can borrow from First Horizon depends on the loan type, your credit profile, and your available collateral (if required). Here’s a quick breakdown:

| Loan Type | Minimum Amount | Maximum Amount |

|---|---|---|

| Unsecured Personal Loan | $2,000 | $50,000+ |

| Unsecured Line of Credit | $15,000 | $50,000+ |

| CD/Savings Secured Loan | $2,000 | Based on your account value |

| Auto / Boat / RV Loan | $10,000 | Up to $250,000 |

| Credit Builder Loan | $2,000 | $5,000 |

Each type is designed for different needs, from covering emergency bills to buying your dream boat.

Loan Terms and Repayment Options

Most First Horizon personal loans come with flexible repayment terms and clear payment structures, so you always know what to expect.

Here’s what you get:

- Fixed or Variable Interest Rates: Fixed rates mean your monthly payment stays the same, while variable rates may go up or down with the market (applies mostly to lines of credit).

- Terms from 12 to 60 Months: You can choose a short-term loan for quick payoff or a longer one to keep payments lower

- Equal Monthly Payments: For most loans, you pay the same amount each month until it’s fully paid off. This makes it easy to budget and plan

- No Prepayment Penalty: Want to pay off your loan early? Go ahead! There’s no extra fee

- Line of Credit Repayments: For lines of credit, you only pay interest during the draw period (first 24 months). After that, you begin full monthly payments on the amount you used.

No matter which loan type you choose, First Horizon gives you clear terms, flexible repayment, and dedicated support every step of the way.

First Horizon Personal Loan Rates & Fees

First Horizon doesn’t post its personal loan interest rates or fee structure publicly. Instead, they provide rates based on each person’s financial situation.

However, in 2025, annual percentage rates (APR) for most unsecured personal loans fall in the range of 8% to 15%. Your exact First Horizon personal loan interest rate depends on a few important things:

- Better credit usually earns lower interest rates

- Secured loans may come with lower rates than unsecured ones

- Bigger or longer loans may have different rates

- First Horizon personal loan rates can shift based on the economy

If you apply for a CD‑secured loan or savings-secured loan, you may be eligible for significantly lower interest rates. These options often come with APRs that are 2–4 percentage points below unsecured loans, making them a cost-effective choice for those with available savings or a certificate of deposit.

As for fees, First Horizon may charge things like:

- Origination fee (a one-time fee for setting up your loan)

- Late payment fee

- Application fee

However, exact amounts for these fees are not listed on the bank’s website. You’ll need to review your loan disclosure documents or ask directly to know which fees apply to you.

First Horizon Personal Loan Requirements

First Horizon wants to make sure their loans are a good fit for your financial situation. To qualify, they’ll review several key factors:

- Your credit score: A higher score usually means better rates.

- Your income: Lenders want to see that you have steady income to make your monthly payments.

- Your debt-to-income (DTI) ratio: This is how much of your income goes toward paying debts. A lower DTI is better.

- Your job history: Stable employment tells the bank you’re likely to repay on time.

- Your savings or investments: For loans above $15,000, you may need to show that you have enough money in your First Horizon accounts to cover 12 months of payments.

If you’re applying for larger loans, the bank may require you to keep a portion of your savings, retirement funds, or investments with them during the loan period. This is called a “reserve.” This helps protect the bank in case you can’t make payments later. The amount you need to reserve depends on how much you borrow:

- For loans between $2,000 and $14,999: You don’t need to keep any reserve funds.

- For loans from $15,000 to $50,000: You must hold enough money in a First Horizon account to cover 12 months of loan payments. This means if your monthly payment is $400, you’d need to keep at least $4,800 in reserve.

- For loans over $50,000: You’re required to keep the full loan amount in reserve. So, if you borrow $60,000, you must have $60,000 in assets saved with First Horizon.

This requirement helps reduce the bank’s risk, especially for larger loans, and may also improve your chance of approval or lower your interest rate.

First Horizon Personal Loan Application Process

Getting started is easy, and the process is designed to be fast and straightforward. Here’s how it works:

- Become a First Horizon customer: Before you can apply, you need to open an account with First Horizon. If you’re not already a customer, visit a branch or sign up online to get started.

- Make sure you meet reserve requirements: If you’re planning to borrow a larger amount (especially over $15,000), check that you have enough savings or investments held in a First Horizon account.

- Speak with a loan specialist: You can’t apply fully online. You’ll need to talk to a loan officer at a local branch and they will guide you through the First Horizon personal loan application.

- Gather your documents: To apply, you’ll need to provide some personal and financial information, including:

- A valid government-issued ID

- Your proof of income

- Proof of address (like a utility bill or lease)

- Account statements showing your reserves (if needed)

- Wait for approval: This process usually takes 7 to 10 business days, but it could take longer depending on how complex your application is.

- Review your loan offer: If you’re approved, you’ll receive a loan offer that includes the interest rate, monthly payment amount, repayment schedule, and any fees. Take time to review all the terms carefully before signing.

- Sign the agreement and set up repayment: Once you’re happy with the loan terms, you’ll sign the agreement. You’ll also set up how and when your monthly payments will be made, usually from your First Horizon checking account.

- Receive your funds: After everything is signed and confirmed, your loan funds will be deposited, typically right into your First Horizon bank account.

How to Manage Your Loan

The bank gives you several simple ways to manage your First Horizon personal loan and stay organized. Whether you’re at home or on the go, you can track everything in one place.

Loan management options include:

- Online banking platform: Log in from any computer to view your loan account

- Mobile banking app: Use your phone or tablet to make payments and check your balance

- First Horizon Personal Loan Customer service: Call 800-615-1933 or visit a branch for help with any questions

What you can do:

- To ensure that you never forget your due date, set up auto-pay.

- View your loan balance and payment history

- See how much you’ve paid and how much you have left

- Get alerts or reminders for upcoming payments

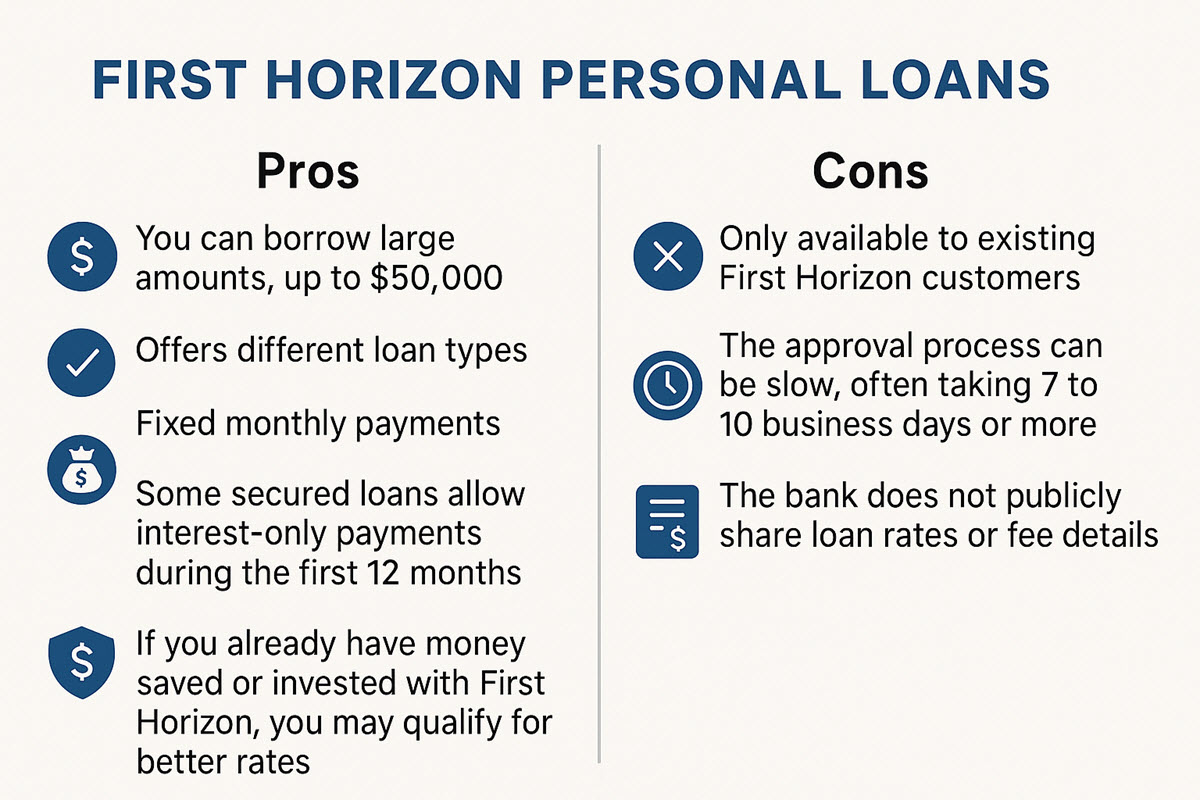

Pros and Cons of First Horizon Personal Loans

Before applying, it’s important to understand both the advantages and drawbacks of choosing a personal loan from First Horizon:

Pros:

- You can borrow large amounts, up to and even over $50,000

- Offers different loan types: unsecured, secured, or backed by your assets

- Fixed monthly payments make it easier to budget

- Interest-only payments are permitted on certain secured loans for the first 12 months

- If you already have money saved or invested with First Horizon, you may qualify for better rates

Cons:

- Only available to existing First Horizon customers

- The approval process can be slow, often taking 7 to 10 business days or more

- The bank does not publicly share loan rates or fee details, making it harder to compare offers

By weighing these pros and cons, you can better decide whether a First Horizon personal loan aligns with your financial goals and timeline.

First Horizon Personal Loan FAQs

Can I get approved if I have fair credit or no savings?

- It might be difficult. First Horizon usually approves people who have good credit and some savings or investments. If your credit is low or you don’t have money set aside, your chances of approval are lower.

Can I pay off the loan early without a penalty?

- Yes, you can. First Horizon doesn’t charge a fee for paying off your loan early. You can make extra payments or pay it off in full anytime to save on interest.

Is a First Horizon personal loan good for debt consolidation?

- Yes. If you qualify, the loan can be a smart way to consolidate high-interest debts into one monthly payment with a fixed rate.

What are asset reserves and how do they work?

- Asset reserves are funds you keep in a First Horizon account to help secure your loan. Depending on how much you borrow, you might need to keep a set amount in a First Horizon investment account, savings, or a CD for the length of your loan.

Does First Horizon offer joint personal loans?

- No, First Horizon currently does not offer joint personal loans. Only individual applications are accepted.

The First Horizon personal loan suite remains a strong choice for borrowers in their service region in 2025. They offer clear, fixed-rate unsecured loans in manageable sizes, plus secured alternatives for credit building. If you value local service and predictability, and meet eligibility, this can be a good match. Just compare offers to ensure you’re getting the best rate and terms available.