In today’s fast-paced world, unexpected expenses and personal milestones often demand immediate financial resources. Whether you’re managing debt, upgrading your home, or planning a once-in-a-lifetime event, Wells Fargo Personal Loans provides the quick, reliable funding solution you need.

As one of the most trusted banks in the U.S., Wells Fargo offers unsecured personal loans tailored to your individual needs, featuring no hidden fees, flexible terms, and potential same-day funding to help you seize life’s important moments. Let’s discover this service in the following post.

Introduction to Wells Fargo Bank & Co.

Wells Fargo & Co. is one of the most well-known financial institutions in the United States, serving millions of customers with various banking and financial services. With a strong national presence and nearly two centuries of history, the bank has built a reputation for both reliability and innovation.

History of Wells Fargo & Co.

Wells Fargo was founded in 1852 by Henry Wells and William Fargo during the height of the California Gold Rush. The bank originally provided express mail and banking services, using stagecoaches to transport gold, money, and parcels across the western frontier of the United States. Its signature stagecoach logo remains a symbol of its pioneering legacy.

Over the decades, Wells Fargo evolved through multiple mergers and acquisitions, becoming one of the “Big Four” banks in the U.S. It played an instrumental role in supporting economic development across various regions of the country, especially the American West.

Despite encountering regulatory and reputational challenges in the 2010s, Wells Fargo has since undertaken significant reforms and regained customer trust. Due to improved transparency, customer service, and digital innovation. Today, it continues to be a key player in the global financial system, offering services in personal, commercial, and business banking.

General Services of Wells Fargo

Wells Fargo provides a full spectrum of banking services designed to meet the needs of individuals, families, and businesses. These services include:

- Personal Banking: Checking and savings accounts, debit and credit cards, and everyday financial tools.

- Lending Solutions: Home mortgages, auto loans, personal loans, and credit lines for both individuals and businesses.

- Wealth & Investment Management: Financial advisory, retirement planning, and investment platforms like WellsTrade.

- Corporate Banking: Treasury management, commercial lending, and institutional financial services.

- Business Banking: Dedicated products such as business checking accounts, credit and financing solutions, merchant services, and digital tools like Zelle for Business.

With a focus on digital transformation and customer-first innovation, Wells Fargo continues to support both personal and commercial clients through accessible, secure, and comprehensive financial solutions.

Wells Fargo Personal Loans Service

When it comes to managing personal expenses, having access to fast, unsecured financing can make all the difference. That’s why Wells Fargo personal loans have become a popular solution for individuals.

Why Wells Fargo Personal Loans stand out?

Unlike secured loans that require collateral, Wells Fargo personal loans are unsecured. This means you can borrow money based solely on your creditworthiness, income, and financial history. So, this gives you more freedom and less risk. These loans are ideal for a wide range of needs. Such as consolidating high-interest credit card debt, covering medical expenses, financing home improvements, or even funding a wedding.

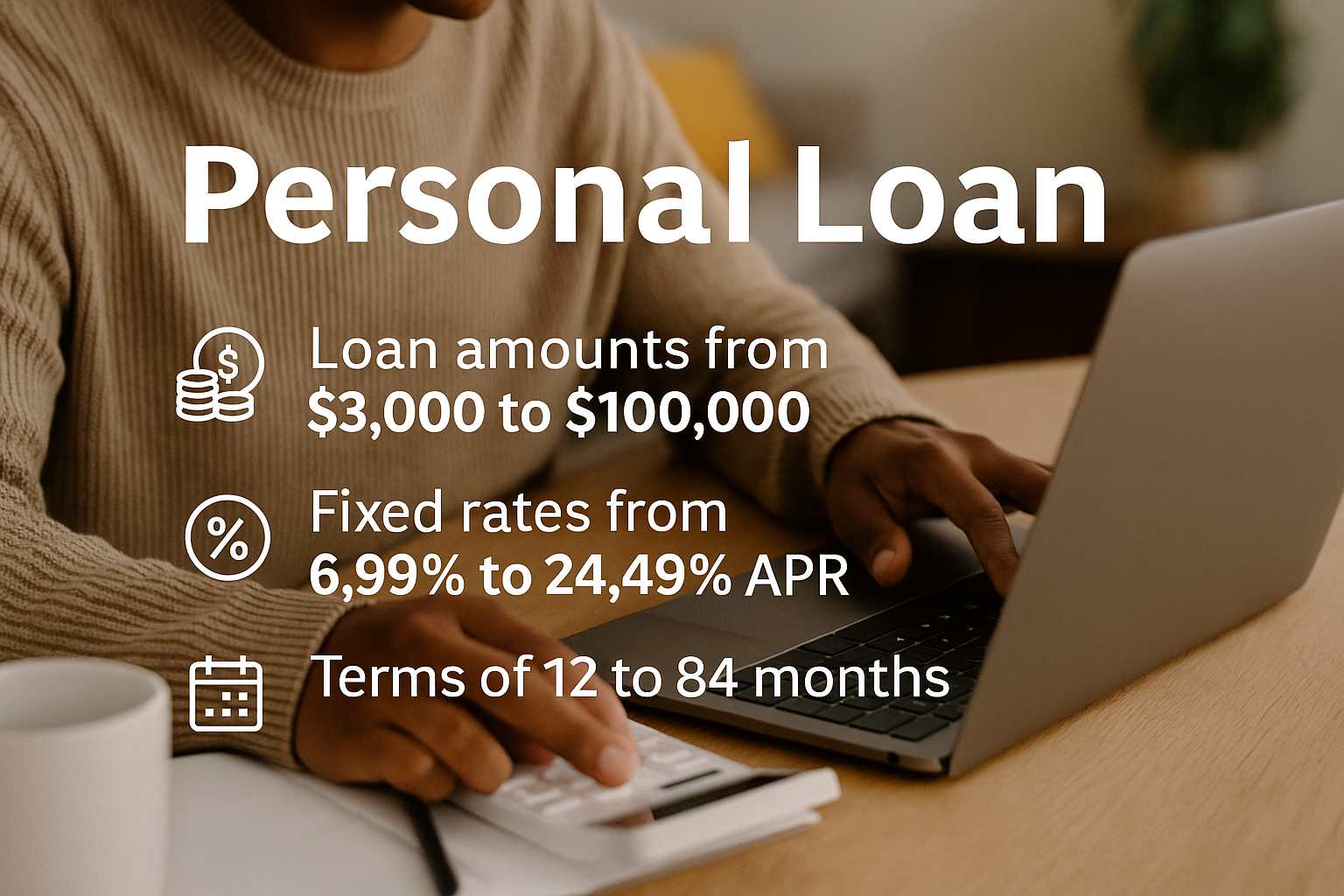

Wells Fargo offers a personal loan product that combines transparency, convenience, and competitive terms. Here are the highlights:

- Loan Amounts: Borrow as little as $3,000 or as much as $100,000, depending on your qualifications and financial needs.

- Repayment Terms: Choose from flexible terms ranging from 12 to 84 months, so you can repay your loan at a pace that fits your budget.

- Fixed Interest Rates: Enjoy predictable monthly payments with APRs starting as low as 6.99%, up to 24.49% depending on your credit profile.

- No Extra Fees: Pay with peace of mind. No origination fees, no closing costs, and no penalties for early payoff.

- Fast Funding: Once approved, you may receive your funds as soon as the same business day.

Why choose Wells Fargo Personal Loans?

With so many loan providers on the market, you might wonder why you should go with Wells Fargo. The answer lies in the convenient process, trusted brand, and customer-first benefits that set this service apart.

- Easy Application: The online application process is fast, user-friendly, and in many cases delivers instant decisions.

- Prequalification Available: You can check your potential interest rate using a soft credit check, which won’t affect your credit score.

- Relationship Discounts: Existing Wells Fargo customers can enjoy an APR discount of 0.25% when enrolling in autopay from a Wells Fargo account.

- Strong Reputation: Backed by a long-standing, nationally recognized bank, this loan product comes with the trust and reliability of Wells Fargo’s legacy.

Whether you’re managing short-term financial hurdles or taking the next step in a major life event, Wells Fargo Personal Loans provide the security and support you need, without the complexity. If you’re also interested in building wealth for the future, don’t forget to explore the mortgage, which offers long-term solutions for homeownership and refinancing.

Wells Fargo Personal Loans: Eligibility

Before applying for any loan, it’s essential to understand whether you meet the basic qualifications. Wells Fargo Personal Loans are designed to be accessible to a broad range of borrowers. But there are a few important criteria you need to satisfy before submitting your application.

Borrower Eligibility for Personal Loans

Wells Fargo has set clear and reasonable eligibility conditions to ensure that applicants can responsibly manage their loan obligations. The requirements focus mainly on your financial profile and your relationship with the bank.

To qualify for a Wells Fargo personal loan, you must meet the following conditions:

- Be a U.S. citizen or permanent resident

- Be 18 years of age or older

- Have a Wells Fargo checking or savings account that has been open for at least 12 months. If you don’t have one, you can open a checking account.

- Maintain a good credit history and demonstrate a stable source of income

- Apply individually, as co-signers are not permitted for this loan product

These conditions help Wells Fargo ensure that borrowers are financially prepared and can handle repayment without hardship. Additionally, having an established relationship with the bank allows for a faster, more streamlined approval process.

Property or Collateral Requirements

Because Wells Fargo personal loans are unsecured, you are not required to offer any property or assets as collateral. This is a significant advantage for many borrowers who may not own high-value assets or who want to avoid putting their property at risk. The absence of collateral also shortens the approval timeline and simplifies the paperwork involved.

In summary, the loan approval is based on your creditworthiness and financial profile, not on the value of your home, car, or other assets. This structure offers more flexibility and less risk for responsible borrowers. Thinking of building your credit before applying for a loan? Consider credit cards—perfect for new users or those rebuilding their credit history.

Wells Fargo Personal Loans: Documents & Procedures

Once you’ve confirmed your eligibility, the next step is to complete the application process. Fortunately, applying for Wells Fargo Personal Loans is quick, convenient, and can be done entirely online or in person, depending on what suits you best.

Necessary Documents for Personal Loans

To begin your application, you’ll need to gather a few basic documents that verify your identity, income, and financial obligations. These are standard requirements for most unsecured loans and help Wells Fargo assess your creditworthiness accurately.

Required documents include:

- A valid government-issued photo ID, such as a driver’s license or passport

- Proof of income, which may include recent pay stubs, W-2 forms, or tax returns

- Your current employment details, including employer name, address, and contact information

- A summary of your existing debts, especially if you are using the loan for consolidation

By preparing these documents ahead of time, you can speed up the approval process and avoid unnecessary delays.

Application Process for Personal Loans

Wells Fargo has simplified the personal loan application into a five-step process, making it accessible even for first-time borrowers. You don’t need to visit a branch unless you prefer in-person support.

Step-by-step application process:

- Check Your Rate: Use the online prequalification tool to view your personalized interest rate. This step uses a soft credit check that doesn’t affect your credit score.

- Submit the Application: Complete your loan application online or by contacting Wells Fargo customer service.

- Upload Required Documents: Provide the documentation listed above and verify your identity.

- Receive a Decision: In many cases, Wells Fargo delivers a credit decision within minutes or the same day.

- Access Your Funds: If approved, the loan amount may be deposited into your Wells Fargo account as quickly as the same business day.

This process ensures that Wells Fargo Personal Loans are not only accessible but also time-efficient, helping you get the funds you need without unnecessary stress.

Want to estimate your monthly payments before applying? Try Wells Fargo’s Personal Loan calculator, a free tool designed to help you budget more accurately based on loan amount, term, and credit profile.

Wells Fargo Personal Loans: Terms & Rates

Understanding how much a loan will cost and how long you’ll have to repay it is important when evaluating any financial product. With Wells Fargo Personal Loans, borrowers benefit from clear repayment timelines and competitive, fixed interest rates, designed to make borrowing both predictable and manageable.

Loan Terms for Personal Loans

One of the standout features of Wells Fargo Personal Loans is their flexibility in repayment duration. Whether you want to pay off your loan quickly or spread payments over time, the bank gives you multiple options to fit your financial situation.

Here’s what you need to know about the terms:

- Repayment periods range from 12 months (1 year) to 84 months (7 years)

- Shorter terms typically result in lower overall interest paid

- Longer terms reduce monthly payments but may increase total cost over time

- Fixed monthly payments provide predictability and ease of budgeting

These flexible options help ensure that your loan complements, not disrupts, your financial plan. Looking for a long-term loan for a car? Wells Fargo also provides adjustable auto loan options.

Interest Rates & Costs

Cost is always a deciding factor when borrowing money. Fortunately, Wells Fargo Personal Loans offer fixed APRs and zero hidden fees, so you can make decisions with confidence.

Here’s a breakdown of what you’ll pay:

| Feature | Details |

| APR Range | 6.99% – 24.49% (Fixed) |

| Origination Fee | None |

| Prepayment Penalty | None – pay off your loan early with no extra charges |

| Rate Discount | 0.25% APR reduction with autopay from a Wells Fargo checking account |

| APR Type | Fixed – your rate stays the same for the entire term |

| Total Cost Transparency | No hidden fees; full cost outlined at time of approval |

This simple fee structure, combined with competitive rates, makes Wells Fargo an appealing choice for borrowers who want to avoid surprises and control their total loan cost. Planning to invest in home improvement or debt consolidation? Consider combining your loan with Wells Fargo’s budgeting tools to track payments efficiently.

Factors Affecting Personal Loan Rates

- Credit Score: Higher scores lower APR. Excellent credit often gets the best rates.

- Debt-to-Income Ratio (DTI): The lower your DTI, the better. It shows you’re not overleveraged.

- Income & Employment: Steady, verifiable income from a stable job improves your rate offer.

- Loan Amount: Larger loan amounts may receive lower rates if the borrower’s profile is strong.

- Loan Term: Shorter repayment terms (e.g., 12–36 months) usually qualify for better rates.

- Autopay Setup: Enrolling in autopay from a Wells Fargo checking account earns a 0.25% APR discount.

- Customer Relationship: Existing Wells Fargo customers may receive better offers through internal scoring.

- Loan Purpose (in some cases): Specific uses like debt consolidation or home improvement might influence offers slightly.

Wells Fargo Personal Loans: Additional Benefits

In addition to competitive rates and flexible terms, Wells Fargo personal loans come with a range of added perks that make borrowing more convenient and rewarding, especially for those who already bank with Wells Fargo.

These extra features are designed to enhance your overall experience, simplify financial management, and help you save both time and money. Whether it’s through faster access to funds or smart digital tools, Wells Fargo goes beyond the basics to support your financial goals.

When you choose Wells Fargo personal loans, you can take advantage of several built-in advantages that go beyond the standard lending experience:

- 0.25% APR Discount – Existing Wells Fargo customers can qualify for a rate discount when they set up automatic payments from an eligible Wells Fargo checking account. This not only saves money but also ensures on-time payments.

- Same-Day Funding – In many approved cases, funds are deposited into your account as soon as the same business day, making it ideal for urgent financial needs.

- Digital Loan Tools – Wells Fargo provides loan calculators and budgeting tools to help you estimate your monthly payments and manage your financial plan effectively.

- No Collateral Required – As these are unsecured personal loans, there’s no need to risk your assets like a home or vehicle, which makes borrowing safer and less stressful.

These extras are especially beneficial for Wells Fargo clients who want an integrated approach to personal finance, allowing them to monitor, repay, and manage loans all within the same banking ecosystem.

Already investing through Wells Fargo? You might consider aligning your loan accounts, credit cards, and investments under one platform for seamless money management and a clearer picture of your financial health.

FAQs about Wells Fargo Personal Loans

Still have questions? Here are some of the most common inquiries about Wells Fargo personal loans:

Do I need to be a customer to apply?

- You must have an existing Wells Fargo account open for at least 12 months to be eligible.

How fast will I receive the funds?

- In most cases, approved applicants can receive their funds as soon as the same business day.

Can I use this loan for anything?

- Yes, Wells Fargo personal loans are versatile and can be used for debt consolidation, medical bills, weddings, and more.

Will applying affect my credit score?

- Using the “Check My Rate” tool will not impact your credit. A hard inquiry is only performed after you apply.

Are there fees for early payoff?

- No, there are no prepayment penalties. You can repay the loan early without added costs.

Curious about investment opportunities, too? Discover Wells Fargo’s self-directed investing platform and get started today.

Wells Fargo personal loans offer a convenient, transparent, and fast way to access the funds you need, whether for planned purchases or life’s unexpected events. With flexible terms, competitive rates, and the backing of a trusted institution, it’s an excellent choice for anyone seeking financial peace of mind.

Ready to take control of your finances? Explore broader services, including checking accounts, auto loans, and investing tools to complete your financial journey.