Choosing the right bank can shape your everyday finances. With Citizens Bank personal banking, you get a mix of digital convenience and in-branch support across the Eastern U.S.

The bank operates over 1,100 branches and 3,200 ATMs in 15 states, making it a strong regional contender. But does it truly meet your needs? This review breaks down account options, fees, features, and whether it’s the right fit for you.

Overview: Who Is Citizens Bank?

Citizens Bank is one of the oldest financial institutions in the U.S., originally established in 1828 in Providence, Rhode Island. Today, it operates under the umbrella of Citizens Financial Group (CFG), a publicly traded company listed on the New York Stock Exchange (NYSE) under the ticker symbol CFG.

Over the years, Citizens has grown into a large regional bank with a strong presence along the East Coast and Midwest. It runs more than 1,078 physical branches and manages a network of over 3,200 ATMs across 15 states, including Massachusetts, Connecticut, Pennsylvania, New York, New Jersey, Ohio, Michigan, and Florida. This makes it especially convenient for customers who prefer in-person banking but also want digital access.

The bank offers a full suite of retail banking services, including:

- Checking and savings accounts

- Money market accounts (MMAs)

- Certificates of Deposit (CDs)

- Credit cards

- Mortgages and home loans

- Student loans

- Small business accounts

- Investment solutions and wealth management

All Citizens Bank deposit accounts are FDIC-insured up to $250,000 per depositor, giving customers peace of mind. It stands out as a reliable choice for people looking for a mix of digital tools and brick-and-mortar access, especially those living in the Northeastern U.S.

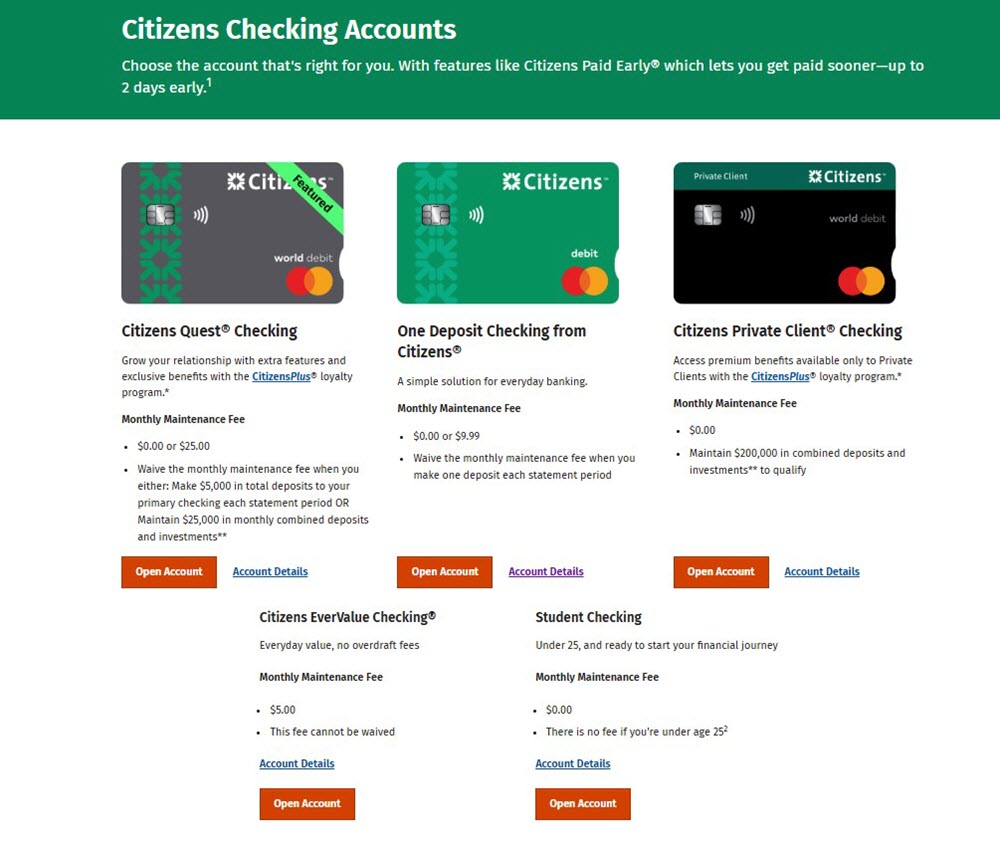

Citizens Bank Personal Checking Accounts

There are a variety of Citizens Bank checking account options designed to suit different lifestyles and income levels. Whether you’re a student, a working adult, or a high-net-worth client, there’s likely a fit for you.

One Deposit Checking from Citizens

This is the most popular and user-friendly option for everyday banking:

- No minimum deposit required to open.

- $9.99 monthly maintenance fee, but you can easily avoid it by making just one deposit each month, of any amount.

Comes with useful features like:

- Zelle for fast, fee-free transfers.

- A contactless debit card for tap-and-go payments.

- Citizens Paid Early, which lets you get your direct deposit up to two days earlier.

Peace of Mind overdraft protection, which gives you a 24-hour grace period to fix negative balances before fees are charged.

This Citizens Bank personal banking account is great for people who want simple, no-hassle banking and want to avoid monthly fees easily.

Citizens Quest Checking

This is a more feature-rich account designed for those with higher balances or regular deposits.

Monthly Fee: $25

How to Waive It:

- Maintain at least $5,000 in monthly direct deposits, or

- Hold $25,000 in combined deposit and investment balances with Citizens

What you get:

- No fees for standard services like cashier’s checks, money orders, and stop payments

- Bonus interest rates on linked savings and money market accounts

- Fraud monitoring and priority customer service

- Paid Early access and Peace of Mind® overdraft options included

It’s best for professionals, high earners, or those who want premium service and added perks for keeping more money with the bank.

Citizens Private Client Checking

This premium account is for high-net-worth individuals. There is no monthly fee, but it requires $200,000+ in combined eligible deposits or investments with Citizens Bank.

You’ll get access to:

- Personalized banking experience

- Priority service

- Exclusive benefits, including Private Client advisors, wealth planning, and reduced loan rates

- Preferred interest rates on savings, CDs, and lending products

This type of account is ideal for high-net-worth individuals looking for white-glove banking services.

EverValue Checking

- Flat $5 monthly fee, which cannot be waived.

- No-frills account designed for people who want predictable costs with basic features.

Great for: Budget-conscious individuals who want a simple, low-cost checking account without worrying about balance requirements.

Student Checking

- Designed for students and young adults under 25 years old.

- No monthly fee, regardless of balance or activity.

- Access to all standard digital tools and features.

Great for: Students who want a no-cost, no-hassle way to manage their money.

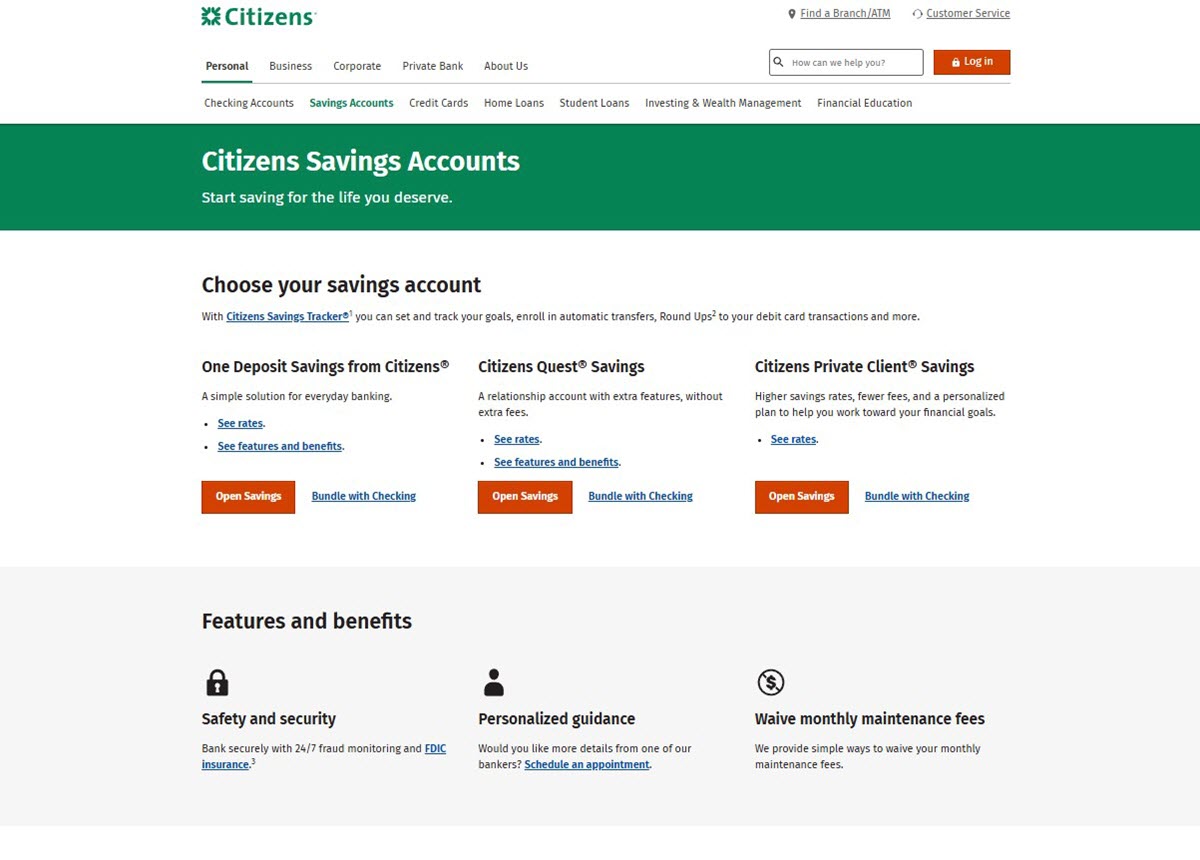

Savings, Money Market, and Certificates of Deposit (CDs)

Citizens Bank Personal Banking also provides several ways to help customers save, whether you’re just starting out or looking for higher-yield options.

One Deposit Savings

This is the standard savings account that pairs well with the One Deposit Checking.

APY: Around 0.01%, which is very low compared to the national high-yield accounts

Monthly Fee: $4.99, but it’s waived if you:

- Make any deposit during the statement cycle, or

- Maintain at least $200 in the account.

- Also automatically waived if you’re under age 25 or over 65

It’s an easy account to open and keep fee-free, but it won’t earn you much interest. This Citizens Bank personal banking account is suitable for beginners or budgeters who want to build a savings habit with minimal effort.

Citizens Quest Savings

This account is linked to your Quest Checking. If you’re a Quest Checking customer, you’ll get added savings benefits.

- No monthly fee, and you get bonus interest rates up to 25% more than standard accounts as part of the Quest loyalty program.

- Works well as part of a bundle that rewards you for being a loyal customer.

- Added Features: Same-day internal transfers, mobile deposit, overdraft protection

This is a smart move if you’re already using Quest Checking and want to maximize your savings potential without jumping to another bank.

Private Client Savings

- Exclusive to Private Client members.

- No monthly fee and offers preferred interest rates.

- Comes with tailored financial advice and access to premium services.

Great for: High-net-worth clients seeking higher returns and personalized banking.

Money Market Accounts (MMAs)

If you’re saving more aggressively and want interest rates that grow with your balance, Citizens’ MMAs are worth a look.

- Personal Money Market

- $10 monthly fee, waived if you maintain a balance of $2,500+.

- Tiered interest rates: the more you save, the more you earn.

- Quest Money Market

- No monthly fee when linked to Quest Checking.

- Includes access to bonus interest rates for loyal customers.

- Private Client Money Market

- No fees.

- Offers premium interest rates and unlimited out-of-network ATM fee reimbursements.

While Citizens’ savings accounts tend to offer lower interest rates (often around 0.01% APY), the money market options tied to Quest or Private tiers can offer yields closer to 2.5%–2.75%, depending on your balance and location.

Certificates of Deposit (CDs)

Citizens Bank Personal Banking offers short-term and promotional CDs that are FDIC-insured and provide fixed returns.

- Terms Available: Typically 6 months to 14 months

- Interest Rates: Modest, with occasional promotional boosts

- Minimum Deposit: Often $1,000

- Early Withdrawal Penalty: Usually $50 or a percentage of interest earned

While not the highest-earning CDs on the market, they offer security and predictability.

Citizens Bank Personal Banking Fees

Like most banks, Citizens Bank charges a range of standard fees for account maintenance and certain transactions. However, the good news is that many of these Citizens Bank personal banking fees can be avoided if you know how the system works.

Common Citizens Bank Personal Banking Fees

Monthly maintenance fee:

- Checking accounts: $9.99/month

- Savings accounts: $4.99/month

These fees are easily waived. For example, the One Deposit Checking waives the fee if you make at least one deposit per month, with no minimum amount required. The savings account fee is waived if you keep a $200 balance or make any deposit during the cycle.

Overdraft fee:

If you spend more than what’s in your account, you could face a $35 overdraft fee. However, Citizens offers a feature called Peace of Mind, which gives you 24 hours to bring your account back to a positive balance before charging the fee. This grace period can save you a lot of money if you occasionally overspend.

ATM fees:

Using ATMs outside Citizens Bank’s network will cost you $2.50 per withdrawal, plus any fees charged by the ATM owner. If you’re a Quest or Private Client customer, these fees may be reimbursed depending on your account type.

Other Citizens Bank personal banking fees:

- Check orders (custom checks)

- Stop payment requests

- Inactivity fees (on unused accounts)

These are typical service fees for most banks and vary depending on the request.

Here is a fee summary table of Citizens Bank personal banking fees to give you a clearer picture:

| Fee Type | Amount | Waiver Details |

|---|---|---|

| Monthly Maintenance (Checking) | $9.99–$25 | Varies by account; waived with deposit, balance, age, or student status |

| Monthly Maintenance (Savings) | $4.99–$10 | Waived with deposit or minimum balance |

| Overdraft Fee | $35 per overdraft | Peace of Mind may delay the fee |

| Non-Sufficient Funds (NSF) Fee | None | Citizens avoids double charging through NSF |

| ATM Out-of-Network Fee | $3 | Charged by Citizens; other ATM fees may apply |

| Paper Statement Fee | $3 | Waived if aged under 18 or over 65 |

Tips to Minimize Fees of Citizens Bank Personal Banking Services

Here’s how you can keep more money in your pocket:

- Make at least one deposit per month into your One Deposit Checking or Savings account to avoid monthly charges.

- Maintain required balances in Quest or Private Client accounts to enjoy fee waivers and perks.

- Enroll in Peace of Mind to get a one-day grace period for overdrafts.

- Use Citizens Bank ATMs to avoid unnecessary ATM fees. If you travel often or withdraw cash frequently, consider upgrading to an account that reimburses ATM surcharges.

While Citizens Bank does charge standard banking fees, they are generally avoidable with basic account activity or minimum balances. The Peace of Mind feature is especially helpful for those who want extra protection from overdraft surprises.

Citizens Bank Personal Banking: Digital & Mobile App

In today’s world, how a bank performs online is just as important, if not more so, than its branch service. Fortunately, Citizens Bank has invested heavily in its digital banking experience, and it shows.

Online & Mobile Banking

You can check balances, view transactions, pay bills, transfer funds, and deposit checks right from your computer or phone. The dashboard is simple and easy to use. Citizens Bank personal banking service also provides interactive guides online to help you with common tasks like setting up payments or freezing your debit card.

Mobile App

Citizens Bank personal banking mobile app is well-rated on both iOS and Android. It includes:

- Zelle for quick money transfers

- Support for Apple Pay, Google Pay, Samsung Pay

- Real-time debit card controls

- Alerts for fraud and account activity

- Reward tracking for eligible accounts

The app is fast, reliable, and packed with useful features for managing your finances on the go.

Early Pay & Overdraft Protection

- Paid Early: Get your direct deposit up to 2 days early

- Peace of Mind: Delay overdraft fees so you have time to fix them

- Overdraft Pass: Covers small overdrafts (up to $5) automatically, with no penalty

These tools give you extra flexibility when your budget is tight.

Open Banking API

Citizens launched a secure Open Banking API in 2025 for business customers, cutting down screen scraping by 95%. Personal banking customers are expected to benefit soon, allowing safer access to apps like Mint and YNAB.

Citizens Bank Personal Banking Customer Services

Citizens offers several ways to get help when you need it:

- Phone support: Phone support for Citizens Bank personal banking services is available Monday through Friday, 7 a.m. to 10 p.m. ET, and weekends from 9 a.m. to 6 p.m. ET

- If you have questions about your Checking, Savings, Money Market, or CD, support is available at 1‑888‑500‑1478.

- For details or help opening a Checking, Savings, Money Market, or CD account, contact the Citizens team at 1‑866‑524‑7253

- If your debit card is lost, not working, or you notice suspicious activity, call 1‑888‑861‑5700.

- Live chat: Accessible through the mobile app or website

- In-branch appointments: You can schedule a Citizens Checkup, a one-on-one meeting with a banker to go over your finances, goals, or account concerns

- 24/7 self-service: Available through automated phone systems, mobile app, and online tools

Overall, Citizens Bank personal banking services give customers plenty of options to manage their money, whether they want hands-on guidance or prefer to handle things themselves online.

Pros & Cons of Citizens Bank Personal Banking

Before choosing any bank, it’s important to weigh the good and the not-so-good. Citizens Bank Personal Banking has several standout features that make it a solid option, especially for people who value both physical branch access and strong digital tools. But it also comes with a few downsides worth considering.

Pros of Citizens Bank Personal Banking:

- Broad East Coast footprint with 1,100+ branches and 3,200+ ATMs

- No minimum opening deposit on most checking and savings.

- Strong digital tools: well-rated app, early pay, overdraft support.

- Good fee structure, no NSF fee, few waivable fees.

- Trustworthy, FDIC‑insured, long-standing bank.

Cons of Citizens Bank Personal Banking:

- Very low interest rates on savings and money market accounts.

- High overdraft fee ($35 per instance).

- Branch closures may impact local convenience

Tips to Get the Most Out of Citizens Bank Personal Banking

To make the most of your experience with Citizens Bank personal banking services, here are a few practical tips:

- Choose One Deposit Checking or Savings: These accounts are easy to manage and help you avoid fees by simply making one deposit per month.

- Set up direct deposit: Not only can this help with waiving fees, but it also gives you early access to your paycheck through Citizens Paid Early.

- Bundle accounts: Having both a checking and a savings account, especially under Quest or Private tiers, can unlock loyalty perks like higher interest rates and lower loan rates.

- Upgrade if you maintain high balances: If you regularly keep larger amounts in your accounts, consider Quest or Private Client for premium benefits, including fee waivers and financial coaching.

- Use Citizens ATMs when possible: Avoid unnecessary ATM charges by sticking to the in-network ATMs or using a premium account with fee reimbursement.

- Check your account activity online: Log into the app or website frequently to avoid inactivity fees, catch errors early, and stay on top of your finances.

Citizens Bank personal banking is straightforward, trustworthy, and effective for everyday Americans. With reasonable fees, simple waiver mechanics, and reliable digital tools, it fits many routine needs. Keep an eye on branch changes and low interest, but for solid regional banking, it’s a strong option.