Life throws surprises at us, some exciting, others expensive. Whether you’re consolidating debt, planning a wedding, fixing your car, or paying medical bills, having access to a reliable personal loan can make a huge difference. That’s where the Zions Bank personal loan comes in.

Zions offers flexible options for a wide range of financial needs, with the customer service and community focus you’d expect from a trusted regional bank. In this post, we’ll explore everything you need to know about personal loans at Zions Bank.

What Is a Zions Bank Personal Loan?

A Zions Bank personal loan is a way to borrow money when you need extra funds for important expenses. It’s called an installment loan, which means you receive the money in one lump sum and then pay it back in fixed monthly payments over time. It is offered by Zions Bank, which is a long-standing financial institution that mainly serves communities in Utah, Idaho, and Wyoming.

Zions Bank offers three types of personal financing options:

- Unsecured personal loans

- Secured personal loans

- Personal lines of credit

These options let you borrow for many common situations, such as:

- Paying off high-interest credit card debt

- Covering emergency costs like car repairs or medical bills

- Making large purchases, such as furniture or electronics

- Paying for home improvements, like fixing a roof or remodeling a kitchen

- Handling life events like tuition, travel, or a wedding

Unlike home or car loans, most Zions personal loans do not require you to use an asset as collateral, unless you choose a secured option. This makes them simpler and more flexible for many borrowers.

The 3 Main Types of Personal Loans from Zions Bank

Zions Bank gives you choices so you can find a loan that matches your financial situation. Below is a breakdown of the three main personal loan products:

Personal Unsecured Loans

This is the most popular type of personal loan. It’s called “unsecured” because you don’t need to put down any assets (like a car or savings account) to qualify. Your approval is based on your credit history, income, and ability to repay the loan.

Highlights:

- Borrow between $2,500 and $100,000

- Enjoy a fixed interest rate, your rate won’t change over time

- Make predictable monthly payments, so budgeting is easier

- No prepayment penalty, you can pay off early without fees

- Flexible terms depending on how much you borrow

Save money with a 0.25% interest rate discount if you set up automatic payments from a Zions Bank checking or savings account

Best for: People who want to pay off debt, cover medical bills, make home upgrades, or handle other major expenses without offering collateral.

Personal Secured Loans

A secured loan requires you to back the loan with money you already have in a Zions Bank savings account or Certificate of Deposit (CD). You’re borrowing against your own funds, so while the money stays in your account, it’s used as a form of security for the bank.

Highlights:

- Borrow between $1,000 and $250,000 (or up to your account balance)

- Get lower interest rates compared to unsecured loans

- Still earn interest on your savings or CD while the loan is active

- Choose flexible repayment terms that fit your budget

- Secure a fixed rate for the full loan term

Best for: Borrowers who want to save on interest or who may not qualify for unsecured

loans. Also great for building credit or using your savings without actually withdrawing the money.

Personal Unsecured Lines of Credit (Reddi-Credit)

If you want ongoing access to cash instead of a lump sum, a personal line of credit may be a better fit. This Zions Bank personal loan option gives you the freedom to borrow as needed, up to your credit limit, without reapplying each time.

Think of it like a credit card but with better terms and more flexibility.

Highlights:

- Borrow up to $100,000

- No collateral required

- Revolving credit, as you repay it, use the remaining amount.

- Variable interest rates that may change with the market

- No fixed loan term; borrow and repay on your own schedule

- Access funds via checks, online banking, or mobile app

- Save money with a 0.25% interest rate discount when you set up autopay from a Zions Bank account

Best for: People who want on-demand access to funds for unexpected costs, managing monthly cash flow, or making large purchases over time.

Zions Bank Personal Loan Rates

When applying for a Zions personal loan, it’s important to understand how the interest rate works.

Zions Bank gives you a range of possible rates, but the exact rate you’ll receive, known as the Annual Percentage Rate (APR), depends on a few key things:

- Your credit score

- The amount you borrow

- The length (term) of your loan

- Your income and repayment ability

- Whether you’re using collateral

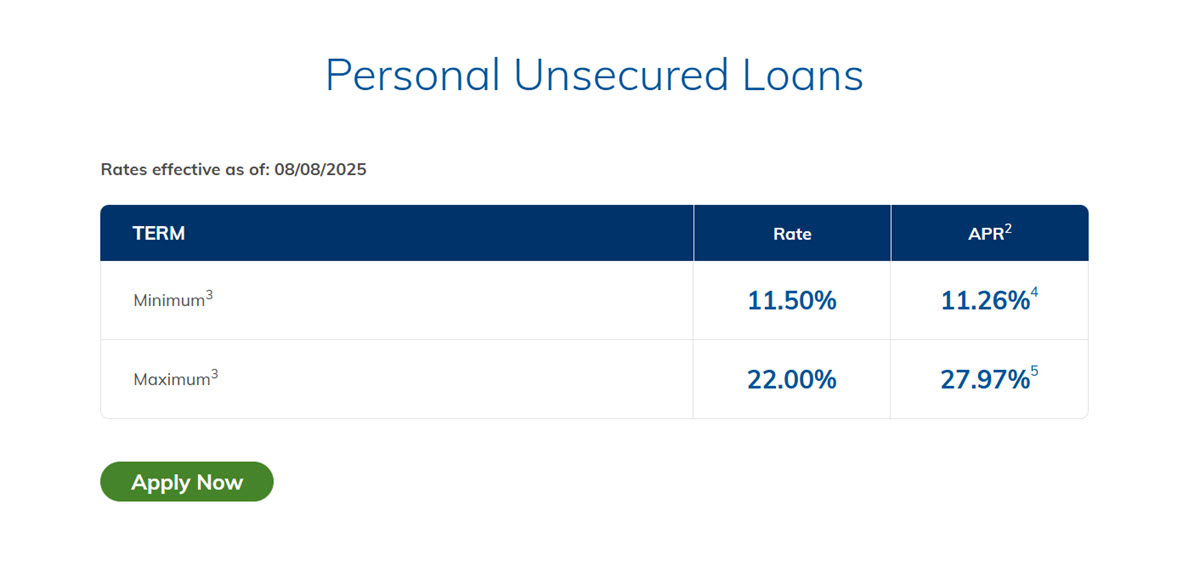

Here’s a general snapshot of Zions Bank personal loan offerings as of August 7, 2025:

| Loan Type | Minimum APR | Maximum APR | Loan Amount Range |

|---|---|---|---|

| Unsecured Loan | 11.26% | 27.97% | $2,500 – $100,000 |

| Secured Loan | Varies (based on CD/savings account rate) | – | $1,000 – $250,000 |

| Line of Credit | Variable | Varies | $10,000 – $100,000 |

Note: All Zions Bank loans are subject to credit approval. The actual APR you qualify for could be higher or lower based on your unique financial profile. Rates may change without notice.

Besides, Zions Bank rewards responsible borrowers. If you choose to set up automatic payments from your Zions Bank checking or savings account, you can earn a 0.25% discount on your interest rate. This may seem small, but over time, it can help you save a good amount on interest, especially on larger loan balances. It’s a simple way to lower costs and stay on track financially.

This discount is available for several loan types, including:

- Personal unsecured loans

- Personal secured loans

- Unsecured lines of credit

- RV loans

Zions Bank Personal Loan Fees & Terms

When taking out a personal loan with Zions Bank, there are a few fees and terms you should know. While exact fees may vary, older sources suggest that borrowers are often charged an origination fee of around $75. Usually, this cost is subtracted up front from the loan balance.

The good news? Zions Bank does not charge a prepayment penalty. That means you’re free to pay off your loan early without extra costs and doing so can save you interest over time.

| Fee Type | Details |

|---|---|

| Origination Fee | Approximately $75 (may vary by loan and applicant) |

| Prepayment Penalty | None – You can pay off the loan early without extra fees |

| Late Payment Fee | Not publicly disclosed; check with bank for current terms |

| Application Fee | None – No fee to apply |

| Returned Payment Fee | Not listed; may apply if automatic payments are returned |

| Collateral Valuation Fee | May apply for secured loans (if appraisal or documentation is needed) |

| Document Signing | In-branch signing required (no additional cost, but in-person visit needed) |

As for the loan term, most personal loans from Zions Bank have a maximum repayment period of 36 months (or 3 years). A shorter loan term helps you pay off the debt faster, though your monthly payments may be slightly higher compared to longer-term loans. Always compare your monthly payment with your budget before applying.

Zions Bank Personal Loan Requirements

To qualify for a Zions Bank personal loan, you’ll need to meet the bank’s credit approval standards. This usually means having a solid credit history, stable income, and the ability to repay the loan on time.

While Zions Bank doesn’t list a minimum credit score, most applicants with a credit score of 670 or higher have a better chance of approval and may qualify for lower interest rates. If your credit is lower, you may still be eligible, especially with a co-signer or if you’re applying for a secured loan.

Some products, especially Private Wealth Loans, are only available to residents of Utah, Idaho, and Wyoming, so your location matters.

During the application, be prepared to provide:

- Proof of income (such as pay stubs or tax returns)

- Employment history

- Credit history

- Social Security Number

- Other personal identification details

Moreover, if you’re applying for an unsecured line of credit, be aware that extra documentation is required for amounts above $15,000. This might include a personal financial statement that outlines your assets, liabilities, and income.

How to Apply for a Zions Bank Personal Loan

Applying for a personal loan may seem complicated, but Zions Bank makes the process straightforward:

- Check Your Credit and Budget: Before applying, review your credit score and monthly budget to make sure a loan fits your financial plan.

- Start Online or In-Branch: Visit the Zions Bank website or stop by a local branch to explore loan options. A banker will guide you through the process, explain your loan options, and answer any questions.

- Choose Your Loan Type: Decide whether you want a lump-sum loan or flexible access to funds (line of credit). If you have savings, you might qualify for a secured loan with lower rates. And if you’re a wealth banking client, a banker can guide you through specialized options.

- Submit Your Application: Provide personal details, income information, and any other required documents.

- Provide Financial Statements (if needed): For lines of credit over $15,000, you may need to submit a full financial statement.

- Get Approved: If approved, you’ll receive a loan offer with the rate, term, and payment schedule. Sign the documents and receive your funds, sometimes as fast as the same day.

Pros & Cons of Zions Bank Personal Loans

When considering a Zions Bank personal loan, it’s helpful to weigh the key advantages and potential drawbacks side by side before making a decision:

| Pros | Cons |

|---|---|

| Multiple loan types to match different needs | Secured loans require collateral |

| Low minimum amounts ($1,000 for secured, $2,500 for unsecured) | Flat origination fee of $75 |

| Competitive APRs based on credit profile | Some products limited to certain states |

| Quick access to funds after approval | More documentation needed for large credit lines |

Loan Use Cases

Zions Bank personal loans are flexible, giving you the freedom to use the funds in many different ways. They are not tied to a single purpose, which means you can adapt them to meet your specific needs.

- Debt Consolidation: If you’re juggling several credit card bills, a personal loan can help you combine them into one single monthly payment. This makes it easier to manage your money and you may even get a lower interest rate, helping you save in the long run.

- Emergency Expenses: Life happens. Whether your car breaks down, you have a surprise medical bill, or your water heater stops working, a personal loan can give you quick cash to handle urgent needs without having to dip into your savings.

- Home Improvements: Want to upgrade your kitchen, add new flooring, or make your home more energy-efficient? A personal loan gives you the funds to take on home projects without needing to use the equity in your home or refinance your mortgage.

- Major Purchases: Sometimes you need to make a big purchase, like buying new appliances, replacing old furniture, or booking a special vacation. With a personal loan, you can buy what you need now and pay it back over time with fixed monthly payments.

- Life Events: Personal loans can help you cover important milestones and unexpected changes. Use it to plan a wedding, pay for a big move, or help with school-related costs for your children. It’s a helpful way to stay financially stable during major life events.

Zions Bank Personal Loan FAQs

Do I need a Zions Bank account to apply for a personal loan?

- Not necessarily, but having a Zions Bank deposit account can qualify you for an interest rate discount and make payments easier.

Can I pay off my loan early?

- Yes! There are no prepayment penalties, so you can save on interest by paying it off early.

Does Zions Bank offer personal loans to self-employed individuals?

- Yes. Self-employed borrowers can apply but must provide proof of income, such as tax returns or bank statements, to verify their earnings.

Will applying affect my credit score?

- Yes, Zions Bank performs a hard credit check during the full application process, which may impact your credit temporarily.

Are rates fixed or variable?

- Personal loans have fixed rates, while lines of credit have variable rates.

If you’re looking for a loan that’s clear, flexible, and backed by a trusted local bank, a Zions Bank personal loan could be the right choice. Whether you need a fast unsecured loan or want to leverage savings for a secured loan, the terms are transparent, rates are fixed, and paying early saves you money. Just make sure to review the loan details, check your credit, and take advantage of any rate discounts.