Comerica personal banking gives you more than just a place to keep your money. It combines helpful service, smart digital tools, and a wide range of account options to fit your life.

Whether you’re starting out or managing long-term goals, Comerica offers the support and flexibility you need. In this review, we’ll explore all their personal banking products to help you see if it’s the right choice for you in 2025.

Overview of Comerica Personal Banking

Comerica Bank is a long‑standing regional bank in the United States. Unlike nationwide banks, Comerica focuses on five main states: Arizona, California, Florida, Michigan, and Texas. If you live in one of these areas, you are more likely to see their branches and ATMs.

The bank’s story began back in 1849 in Detroit. From a small local bank, Comerica has grown steadily over the years. Today, it manages around 499 physical branches and serves both personal and business customers.

Comerica personal banking is designed to give you more than just a place to manage your money. It’s about giving you the tools, advice, and personal support you need to feel confident with your finances.

So, what makes Comerica personal banking different from others? That is because:

- Personalized service: At Comerica, you’re not just another account number. You get real help from real people, experienced bankers who take the time to understand your financial goals. Whether you’re asking about opening a basic account or planning for retirement, you’ll get honest advice that fits your situation.

- Powerful digital tools: Comerica’s online and mobile banking platforms are easy to use and packed with helpful features. From paying bills and transferring money to depositing checks and checking balances, you can manage your money anytime, anywhere.

- Full-service banking: Comerica offers a wide range of personal banking solutions from simple checking and savings accounts to credit cards, loans, and even investment guidance. Everything you need is under one roof.

- Proven reputation: In 2025, Newsweek named Comerica one of America’s Best Regional Banks. That recognition is based on customer satisfaction, trust, and service.

- Experience you can count on: With over 170 years in business, Comerica knows how to help customers through every stage of life. That kind of stability is rare and valuable.

Now, let’s take a closer look at the Comerica personal banking products, first start with Comerica personal checking account options.

Comerica Checking Accounts

Comerica offers 4 types of checking accounts, each designed for different financial needs and life stages. Whether you want something basic or premium, Comerica personal banking has a solution that fits.

Access Checking

Access Checking is a great everyday account for anyone who wants easy banking without the extra fees.

Key Features:

- No monthly maintenance fee if you keep at least $1,000 in the account daily

- Comes with a free Statement Savings Account

- Access to Comerica Web Banking and Web Bill Pay

- Free Comerica Debit or ATM card

- Check safekeeping service included

This account is best for people who want a simple, affordable way to manage their day-to-day spending.

Rich Rewards Checking

If you’re ready to grow your money and want more perks, Rich Rewards Checking is a strong step up.

Key Features:

- Earns interest on your balance

- Comes with free Comerica Advantage checks

- Bonus interest rates on new CDs and IRAs (when funded with new money)

- Rate discounts on Comerica Bank personal loans and Home Equity FlexLines when you use autopay

- 25% discount on a safe deposit box (up to $50 value)

- Check the photo option with monthly statements

To waive the monthly fee, you’ll need to keep a daily balance of at least $5,000. This account is ideal if you want to earn interest and take advantage of added banking benefits.

Premier Checking

Premier Checking is built for people with more complex financial needs. If you’re saving for a home, managing investments, or planning for the future, this account gives you more tools and flexibility.

Key Features:

- Everything in Rich Rewards, plus:

- Choose a Money Market Investment Account (MMIA) or Statement Savings without a monthly fee

- Better CD and IRA rates, even with existing funds

- Closing cost discounts on Comerica mortgage loans (up to $200)

- 50% safe deposit box discount (up to $50)

- Up to four Comerica ATM fees waived per statement cycle

You’ll need to maintain a minimum daily balance of $7,500 to avoid fees. It’s a good fit if you’re managing larger sums and want to get more from your everyday banking.

Comerica Platinum Circle Checking

This is Comerica’s most exclusive checking account and is designed for high-net-worth individuals or families. If you want the best perks, highest interest, and top-level service, this is the one.

Key Features:

- All the benefits of Premier Checking

- Higher interest on checking, CDs, and IRAs

- Free Comerica checks

- Free safe deposit box (up to $200 value)

- Dedicated customer service line

- Free wire transfers (domestic and international)

- No maintenance fees for accounts opened by household members

- Higher money market interest rates

- One free checking account for a household member

To qualify, you must maintain an average balance of $50,000 in Comerica business accounts or personal accounts, or meet private wealth thresholds such as a $2.5 million total managed asset level.

In 2025, this account was ranked in the “Top 10 Best Premium Checking Accounts” by GoBankingRates.com. It is perfect for those who expect top-tier service, want to grow their wealth, and appreciate premium banking benefits.

Comerica Personal Savings Accounts

Saving money is one of the most important parts of personal finance and Comerica makes it easy with three different savings account options:

Statement Savings Account

This is the most basic savings account at Comerica. It’s great for beginners or anyone who wants a no-fuss place to grow their money.

What You Get:

- Easy to open and use with no complicated rules

- Free online banking with Comerica Web Banking

- FDIC insured, so your money is protected up to legal limits

- Unlimited transfers and deposits into the account

Ideal for: Anyone just starting to build savings, like an emergency fund

If you want a reliable place to store your money with online access, this Comerica personal banking account is a solid first step.

Money Market Investment Account (MMIA)

Looking for a savings account that gives you more control and better interest? The MMIA blends the features of checking and savings accounts.

Key Benefits:

- Earns interest that increases as your balance grows

- Check-writing ability, write up to six checks per month

- No penalties on deposits or transfers into the account

- FDIC insured for peace of mind

- Online access with full mobile banking tools

Best for: Savers with $2,500+ who want better returns and some spending flexibility

It’s perfect if you’re already saving and want your money to work harder while staying accessible.

High-Yield Money Market Investment Account (HY MMIA)

If you’ve built up significant savings and want to maximize your earnings, this account is made for you.

Why It’s Special:

- Tiered interest rates

- Check-writing privileges, just like the standard MMIA

- Online and mobile access so you can manage your funds easily

- FDIC insured like all Comerica savings products

Best for: Savers with $15,000 or more looking for high growth potential

This Comerica personal banking account is ideal for long-term savers or those managing large cash reserves who still want access to their funds.

CDs (Certificates of Deposit)

Want a low-risk way to grow your money with a guaranteed return? Comerica’s Fixed-Rate CDs could be a great option. CDs allow you to earn higher interest by locking in your funds for a set period of time.

Key Features:

- Earn up to 4.25% APY depending on your term and deposit amount

- Fixed interest so your rate won’t change over time

- Flexible term options to match your goals (from a few months to several years)

- Bonus rates for customers with Rich Rewards, Premier, or Platinum Circle Checking accounts

- FDIC insured, so your money is safe

If you’re saving for something in the future like a car or down payment, a CD gives you predictable growth without market risk.

Comerica Credit Cards

Comerica offers a full lineup of Visa credit cards, each with different benefits. Whether you want to earn rewards, save on interest, or build your credit, there’s a card for you. Top Comerica credit card options include:

- Visa Platinum Card

- Low introductory rate

- Great for balance transfers or large purchases

- No rewards, just savings on interest

- Visa Max Cash Preferred

- Earn cash back in categories you choose (like groceries or gas)

- Redeem for cash, gift cards, or deposits

- Comes with a bonus for new cardholders

- Visa Everyday Rewards+

- Earn points on common purchases like groceries and gas

- Redeem points for travel, merchandise, or cash back

- Visa Travel Rewards+

- Perfect for frequent travelers

- No caps or limits on points

- Redeem for flights, hotels, and more

- Visa Reserve Rewards+

- Premium rewards card with a metal design

- Higher point earnings and exclusive benefits

- Great for big spenders who want luxury perks

- Visa Max Cash Secured / Visa Secured Card

- Ideal for people building or rebuilding credit

- Secured with a savings deposit

- Earn rewards while improving your credit score

- Visa College Real Rewards

- Designed for students

- Earn flexible points on everyday purchases

- Great way to build credit responsibly

Besides special features for each card, all Comerica personal credit cards have a common range of built-in features:

- Contactless payments and EMV chip technology for security

- Fraud monitoring and protection

- Mobile wallet support (Apple Pay, Google Pay, Samsung Pay)

- Optional overdraft protection when linked to your Comerica checking account

- Travel assistance and emergency support

No matter which card you choose, you’ll get convenience, security, and flexible features to support your lifestyle.

Comerica Home Loans and HELOCs

Buying a home or tapping into your home’s equity? There are Comerica personal loans to help you reach your goals, whether you’re buying, refinancing, or remodeling:

Comerica Home Mortgages

Whether you’re a first-time buyer or a seasoned homeowner, Comerica personal banking offers flexible home loan options backed by personalized advice.

Features Include:

- Fixed-rate or adjustable-rate mortgages

- FHA and VA loan options

- Fast, smooth application process

- Expert mortgage specialists to guide you

- Closing cost discounts for some checking account holders

- Apply online, by phone, or at any Comerica banking center.

Home Equity FlexLine (HELOC)

A HELOC is a revolving line of credit that lets you borrow against the value of your home. It’s a smart way to cover big expenses at lower rates than most personal loans or credit cards.

Why People Choose Comerica HELOCs:

- Borrow what you need, when you need it

- Only pay interest on what you use

- Option to lock in a fixed rate for part or all of your balance

- Use for home repairs, tuition, debt consolidation, or large purchases

- Access your funds easily through checks or a Premier Equity Access Card (not available in Texas)

- Competitive interest rates that help you save

It’s financial flexibility with the power of your home behind it.

Comerica Personal Banking Fees

Of course, Comerica personal banking products come with fees, but there are clear ways to avoid most of them. Here’s a simple breakdown:

| Fee Type | Fee Amount | How to Waive |

|---|---|---|

| Access Checking fee | $13/month | $1,000 balance, $250 deposit, or eligibility criteria |

| Rich Rewards Checking fee | $18/month | Eligible linked accounts |

| Premier Checking fee | $22/month | $7,500 or $20,000 across accounts |

| Statement Savings fee | $5.50/month | $500 balance or age/direct deposit or linked checking |

| Money Market fee | $12/month | $50 balance or linked checking |

| High Yield Money Market fee | $12/month | $2,500 daily balance |

| Overdraft fees | $26–$38 per item | Optional protection link |

| ATM fee (non‑Comerica) | $2.50 | Use Comerica or Moneypass ATMs |

Comerica Personal Banking Digital Tools

Comerica personal banking brings together the personal touch of traditional banking and the convenience of modern technology. Whether you prefer using your computer or your phone, Comerica’s digital tools give you full control of your finances anytime and anywhere.

Comerica Web Banking

Comerica Web Banking lets you handle all your day-to-day finances from the comfort of your home or office. It’s secure, fast, and easy to use.

What You Can Do:

- Check your balances in real time

- Review past transactions to track your spending

- Transfer money between Comerica personal accounts

- Pay your bills online safely and securely

- Access eStatements instead of paper statements

- Send money to others with Person-to-Person transfers

- Move money between banks using External Transfers

Whether you’re managing one account or several, Web Banking gives you the tools to stay organized and in control.

Comerica Mobile Banking

Always on the go? Comerica’s mobile app puts the bank right in your pocket. Download it on your iPhone or Android device and take all your Comerica personal banking with you wherever life leads.

Top Features Include:

- Deposit checks by snapping a photo with your phone

- Get alerts and updates through push notifications or text

- Transfer money instantly between your accounts

- Send and receive money with Zelle

- Use e-wallets such as Samsung Pay, Google Pay, and Apple Pay.

The app makes it quick and easy to send money to pals or pay your bills without having to go to an ATM or branch.

How to Start with Comerica Personal Banking

Opening an account with Comerica is straightforward and flexible, but most of their services require you to visit a local branch to begin.

- You can start your Comerica personal banking journey by visiting a nearby branch. Comerica has strong branch networks in states like Arizona, California, Florida, Michigan, and Texas so finding a location is easy if you live in these areas.

- Before you go, be sure to bring a few important documents with you:

- A valid government-issued photo ID (like a driver’s license or passport)

- Your Social Security Number or Individual Taxpayer Identification Number

- Proof of your U.S. address, such as a utility bill or rental lease

- Once you’re at the branch, a banker will meet with you to understand your needs and goals. They’ll help you choose the right accounts, whether you need a basic checking account, a high-yield savings option, or even a credit card.

- After selecting your accounts, you’ll make your opening deposit and set up your preferences. This includes things like choosing paperless eStatements, linking direct deposit, ordering your debit card, and activating online banking. The whole process is personal, guided, and designed to set you up for success.

Only a few Comerica personal banking services are available for online application. These include credit cards (but only if you’re already a Comerica customer) and the Home Equity Line of Credit (HELOC). You can visit Comerica’s official website to learn how to apply directly online.

Comerica Personal Banking Customer Service

With Comerica personal banking, you get real help from real bankers. Whether you prefer talking to a real person or using self-service tools, support is always within reach:

- Talk to a Representative: Call 800-266-3742 to speak directly with a specialist for personal, business, or commercial banking needs.

- 24/7 Self-Service Banking: You can use Comerica’s automated system any time to check balances, transfer funds, stop a check, report fraud or lost cards, or reset passwords. Just call 800-266-3742 and follow voice prompts or use a 6-digit code.

- Lost or Stolen Card?

- Debit/ATM (24/7): 800-572-6620 or +1-734-632-5181 (outside U.S.)

- Credit Cards: 866-486-1015

- Loan Assistance

- Existing Comerica Bank consumer loans: 855-451-9201

- Mortgage help: 800-867-5188

- Disaster loan help: 855-770-7841

Here’s what makes Comerica’s personal banking customer support different:

- Friendly and knowledgeable staff who listen and offer custom solutions

- Dedicated support lines for premium customers

- Wealth advisors and specialists are available for advanced planning

- Strong in-branch service when you prefer face-to-face conversations

Comerica’s dedication to personal service has earned them major recognition. In 2025, Coalition Greenwich named Comerica a top bank for small business services, highlighting its strong relationship banking. And Newsweek’s award as one of America’s Best Regional Banks reflects high customer satisfaction across the board.

Comerica Personal Banking Special Offers and Extras

One more reason to consider Comerica personal banking? Their ongoing promotions and perks. Whether you’re a new customer or already have an account, Comerica often has extra incentives to help you save or earn more.

Here are a few common offers:

- Bonus rates on CDs when you also have a checking account

- Loan discounts when you use automatic payments

- Cash back offers with selected Comerica credit cards

- Limited-time savings promotions, like higher interest on deposits

These deals can change throughout the year, so it’s worth asking your local banker or visiting the Comerica website to see what’s available now.

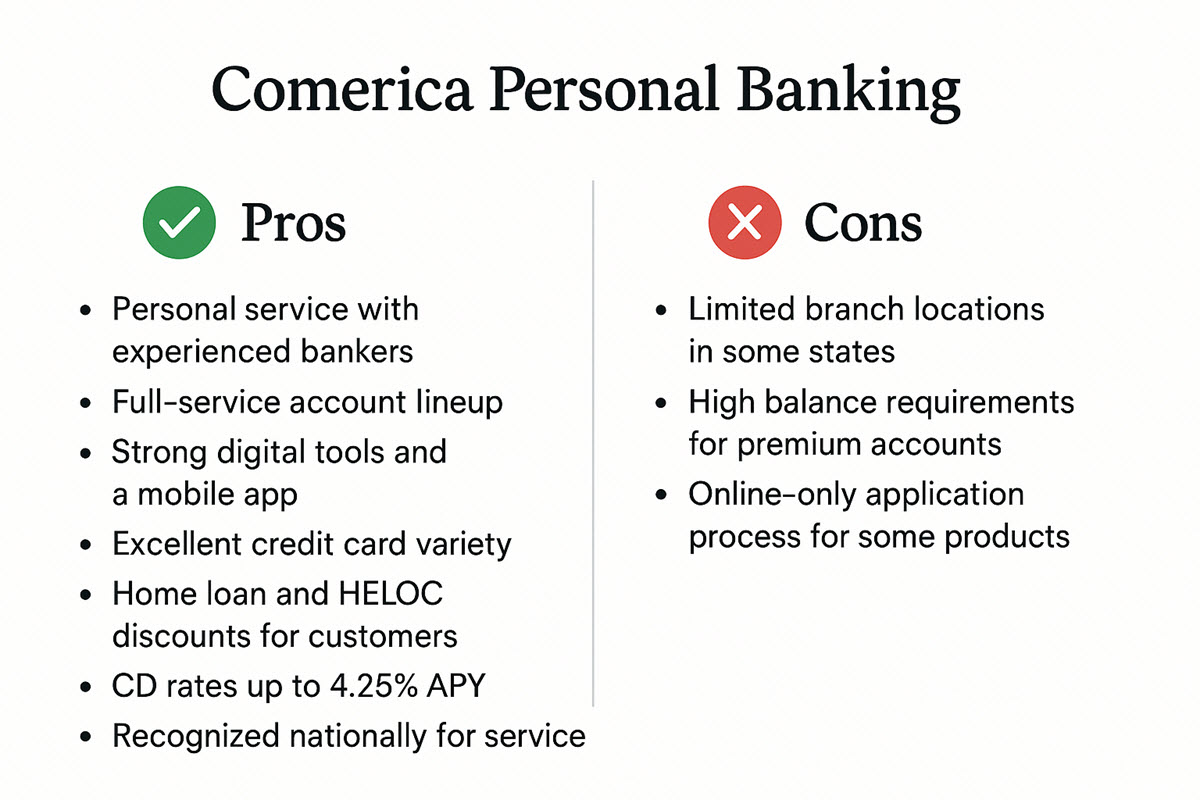

Comerica Personal Banking Pros & Cons

Here’s a quick look at the biggest advantages and potential drawbacks of using Comerica personal banking for your needs:

Pros:

- Personal service with experienced bankers

- Full-service account lineup

- Strong digital tools and a mobile app

- Excellent credit card variety

- Home loan and HELOC discounts for customers

- CD rates up to 4.25% APY

- Recognized nationally for service

Cons:

- Limited branch locations in some states

- High balance requirements for premium Comerica personal accounts

- Online-only application process for some products

If you’re looking for a bank that combines personal attention with strong digital tools, Comerica is a top contender. However, you might not find as many physical locations as national banks.

Comerica Personal Banking FAQs

Are Comerica accounts FDIC-insured?

- Yes, all Comerica personal deposit accounts are FDIC insured up to the legal limit of $250,000 per depositor, per ownership category.

Is Comerica good for wealth management?

- Yes. Comerica offers private banking, financial advisory, and high-net-worth account solutions.

How do I contact Comerica customer service?

- Call their 24/7 line or reach out via the Comerica Mobile Banking app.

Does Comerica use Zelle for money transfers?

- Yes, Comerica personal banking offers Zelle through its mobile and online banking platforms for fast, secure person-to-person payments.

Does Comerica have 24/7 customer support?

- Comerica has a 24/7 automated phone system and an online banking portal. Live support is available during extended business hours but not around the clock.

Comerica Personal Banking can be a solid choice if you meet fee waiver criteria, live near a branch, or qualify for premium accounts. It offers a wide product lineup and decent business services. However, its interest rates are low, fees can be steep if you don’t meet thresholds, and customer service reviews often raise red flags.