Ally Home Loans always seeks to simplify the process of home ownership. This bank made it easier for thousands of borrowers to finance their homes with affordable fees, competitive rates, and an all-online experience.

Though the bank stopped offering new home loans in early 2025, it’s still worth exploring what made Ally home loans stand out and what current borrowers should know before closing.

What Were Ally Home Loans?

Ally Bank entered the mortgage industry in 2016 by offering online-only home loans. It quickly gained attention for its low fees, simple digital tools, and easy application process. For years, Ally was a popular choice among tech-savvy homebuyers who preferred managing everything online.

But things changed in early 2025.

In January 2025, Ally made a big decision: it stopped accepting new home loan applications. This move surprised many customers and financial experts. If you had already started the loan process before that cutoff date, you were allowed to continue. However, all loans in progress had to close by May 27, 2025.

If you didn’t apply before that deadline, you could no longer get a mortgage from Ally.

While Ally no longer accepts new borrowers, it still services existing mortgage accounts. This means if you already have a mortgage with Ally, you can continue making payments and managing your loan through them.

So, Ally has officially exited the mortgage lending business. But what did Ally home loans offer, and what current borrowers should know? Let’s take a deeper look below.

Why Ally Exited the Mortgage Market

In January 2025, Ally officially announced it was leaving the mortgage lending business. After that date, they stopped accepting new home loan applications. This change was surprising to many, especially given Ally’s strong presence in digital banking.

But the decision wasn’t random. Several key factors played a role:

- High Mortgage Rates: Interest rates for home loans reached 6% to 7% in early 2025. This made monthly payments more expensive for buyers and slowed down the housing market overall.

- Credit and Demand Concerns: With high rates came stricter credit conditions. Fewer people qualified for mortgages, and fewer wanted to borrow in the first place. As a result, Ally witnessed increased lending risks and decreased demand.

- Federal Reserve Policy: In late 2024, the Federal Reserve cut interest rates three times. But in 2025, the Fed took a more cautious approach, saying they expected only gradual reductions going forward. So, mortgage rates remained high, even as economic uncertainty grew.

Together, these factors led Ally to pull back from mortgage lending entirely, at least for now.

Therefore, if you’re a borrower or were considering Ally for a home loan, here’s what you need to know:

- If You Applied Before January 2025: You could still complete your loan, as long as everything closed by May 27, 2025. Ally honored existing applications that were already in the system before the cutoff.

- If You Already Have a Mortgage with Ally: You can keep making your payments through Ally, alongside your regular Ally personal banking services. They’re still servicing loans for existing customers. Nothing changes unless your mortgage is transferred to another loan servicer, which is common in the mortgage industry.

- If You’re Starting Fresh in Mid-2025: Unfortunately, Ally is no longer an option for new home loans, so you should consider other lenders. We also recommend some strong alternatives at the end of this post.

Managing Your Mortgage After Closing

Once you finalized your home purchase and closed the deal, Ally home loans continued to offer a modern, online-friendly experience. You didn’t need to visit a bank or deal with piles of paperwork just to manage your loan. Everything was available in one convenient place: the Ally “Snapshot” portal.

Here’s what homeowners could easily do through this digital platform:

- Set up autopay: You could schedule your mortgage payments to automatically withdraw from your bank account each month. This helped avoid late fees and gave peace of mind.

- View your loan status anytime: The portal showed your current balance, how much of your payment went to principal vs. interest, and how many years remained on your loan.

- Download tax forms and escrow details: When tax season rolled around or you needed to check your escrow account, you could grab all the documents online, no waiting for the mail.

- Message support securely: If you had a question about your payment, interest rate, or escrow changes, you could send a secure message right from the portal.

- Make payments in different ways: Aside from autopay, you could choose to pay by:

- One-time online payments

- ACH bank transfers

- Sending a physical check by mail

This kind of flexibility was especially helpful for people managing multiple bills or inconsistent income. It allowed borrowers to stay on top of their mortgage without stress.

However, it’s worth noting that customer support was only available by phone during certain business hours, not around the clock. For urgent issues or after-hours help, some borrowers felt limited by the lack of live chat or in-person support.

Mortgage Assistance Options

Life doesn’t always go as planned. Job loss, illness, or personal emergencies can hit hard, and when they do, keeping up with mortgage payments becomes difficult. That’s why Ally home loans offered support options for borrowers going through tough times.

Here are some of the ways Ally helped:

- Forbearance Plans: If you were facing a short-term financial issue, like being between jobs or dealing with a medical emergency, Ally could pause or reduce your payments for a limited time. You wouldn’t owe the missed payments immediately, but they would be added to the loan balance or repaid later.

- Loan Modification Programs: In more serious cases, and if you qualified, Ally might change the terms of your loan. This can involve extending the loan term to lower monthly payments or lowering your interest rate.

- Emergency Support: Whether the hardship was due to illness, disaster, or income loss, Ally encouraged early communication. They provided access to housing counselors and loan advisors who could walk borrowers through their options.

To request help, borrowers could:

- Log into the Ally Mortgage Assistance Portal

- Complete an online hardship application

- Upload supporting documents like income changes or medical bills

- Speak with an Ally representative by phone

The most important message from Ally was clear: Don’t wait until you miss a payment. By reaching out early, borrowers had a better chance of qualifying for support and avoiding long-term damage to their credit.

Types of Ally Home Loans

Ally home loans were built around a clear, simple idea: less confusion, more focus. Instead of offering a wide range of loans, Ally concentrated on a few main types that met the needs of most conventional borrowers.

- Conventional Fixed-Rate Loans: These loans came with terms of 15, 20, or 30 years. Monthly payments stayed the same throughout the life of the loan, making them a stable option for long-term homeowners. This was ideal for borrowers who valued predictability.

- Adjustable-Rate Mortgages (ARMs): Ally also offered ARMs in 5/6, 7/6, and 10/6 formats. These loans had a fixed interest rate for the first few years, after which the rate adjusted every six months. For people who planned to move or refinance before the rate adjusted, ARMs could offer lower initial payments.

- Jumbo Loans: For buyers in high-cost areas or those purchasing luxury properties, Ally provided jumbo loans. These were designed for home amounts that exceeded the standard loan limits set by Fannie Mae and Freddie Mac. Borrowers typically needed a higher credit score and a larger down payment to qualify.

What Ally didn’t offer was just as important to understand. There were no government-backed loans like:

- FHA loans, for buyers with lower credit or small down payments

- VA loans, for veterans and active-duty military

- USDA loans, for homes in rural areas

- No home equity loans or HELOCs (home equity lines of credit)

This focused approach worked best for people with solid financial backgrounds, like good credit, steady income, and the ability to meet standard lending guidelines. If that was you, Ally’s streamlined product list was a plus, not a minus.

Key Benefits of Ally Home Loans

Even though the choices were limited, Ally offered several features that helped it stand out from traditional lenders:

- No Lender Fees: One of Ally’s biggest selling points was its zero-lender-fee policy. This meant you didn’t have to pay for application, origination, or underwriting fees, which could save you thousands of dollars compared to other lenders.

- Helpful Online Tools: Ally Bank home loans were designed for the digital age. Their online platform gave you:

- Instant rate quotes

- Mortgage calculators

- Easy online preapproval process

- A user-friendly dashboard to upload documents and track your loan status

- Verified Pre-Approval Letters: Ally offered pre-approval letters that were good for up to 90 days. This was helpful when house hunting, you could show sellers you were a serious buyer with financing in place.

- Grants for First-Time and Low-Income Buyers: Ally also launched a special grant program. If you were a low- or moderate-income buyer in cities like Detroit, Charlotte, or Philadelphia, you could receive up to $5,000 toward your down payment or closing costs.

- Discounts for Existing Customers: Already an Ally Bank customer? You could receive a $500 discount on closing costs just for using Ally for your home loan. This reward made it especially attractive for people who already used Ally checking, savings, or investing services.

- Available Nationwide: Unlike some lenders that only operate in certain states, Ally offered home loans in all 50 U.S. states.

Ally Home Loan Application Process

One of the most appealing things about Ally home loans was how modern and fast the application process felt. There were no paper forms, long meetings, or bank visits. Instead, everything happened online, and it was designed to be smooth from day one.

Here’s what the Ally home loan application looked like:

- Check Your Rate Instantly: You could go to Ally’s website and get a personalized rate estimate in minutes without hurting your credit score. This helped borrowers understand what they could afford before committing.

- Fast Online Preapproval: You could get pre-approved in just a few minutes by answering basic questions and uploading financial documents. No paperwork. No office visits.

- Submit Documents Digitally: Instead of printing and mailing forms, you uploaded tax returns, W-2s, bank statements, and your ID through a secure portal. Everything was tracked in one place.

- Real-Time Progress Updates: Ally’s dashboard showed exactly where you were in the loan process. Need to send more paperwork? It told you. Waiting on approval? You could see the status live.

- E-signatures and Online Closing: For many loans, you didn’t need to visit a title office. Signatures were done electronically, and documents were stored online for easy access.

Ally partnered with Better Mortgage, a well-known digital mortgage company, to process applications quickly. Most home purchases closed in about 35 days, which was competitive with traditional banks.

Borrowers said this process saved time and reduced stress. Instead of chasing loan officers or waiting on mail, they could move forward at their own pace and on their own schedule.

Rate Competitiveness & Costs of Ally Home Loans

When Ally Home Loans was still active, it was known for offering competitive mortgage interest rates. In many cases, their annual percentage rates (APR) were lower than the national average, especially if borrowers chose to pay discount points (an optional upfront fee to lower your rate).

For example, if you were willing to pay a bit more at closing, you could often lock in a lower monthly payment for the life of your loan.

Ally stood out for its affordable loan structure, especially due to its no-lender-fee policy. According to Bankrate, Ally received an impressive 4.9 out of 5 stars for affordability. That rating was mostly thanks to zero fees for loan applications, origination, or underwriting, costs that many traditional lenders charge.

However, it’s important to remember that low fees don’t always mean the lowest rate. Some other lenders, especially large banks or regional mortgage companies, sometimes offered slightly better base interest rates, depending on the borrower’s profile and location.

Here’s a practical reminder for anyone comparing loan rates:

- Ally home loan credit score is a significant consideration, as a minimum score of 620 was usually required for a conventional Ally loan. For jumbo loans, you likely need a score of 700 or higher.

- The loan amount, type of property, and where you live also impact your final rate.

- Whether or not you pay discount points will also affect the APR.

So, even if Ally showed a lower advertised rate, your exact number depended on your full financial picture.

Customer Support and Reputation

Ally did not have any physical branches, which could be a downside for some borrowers who prefer face-to-face service.

Customer support was offered by phone and chat only. If you need any help with your current case, you can call Ally Home Loans phone number 1-866-401-4742. Most borrowers had a smooth experience, but online reviews were mixed. Some praised Ally’s convenience, while others said response times could be slow, especially during busy times.

It’s worth noting that most online lenders receive similar feedback since they don’t offer in-person guidance, your experience depends heavily on how comfortable you are with technology.

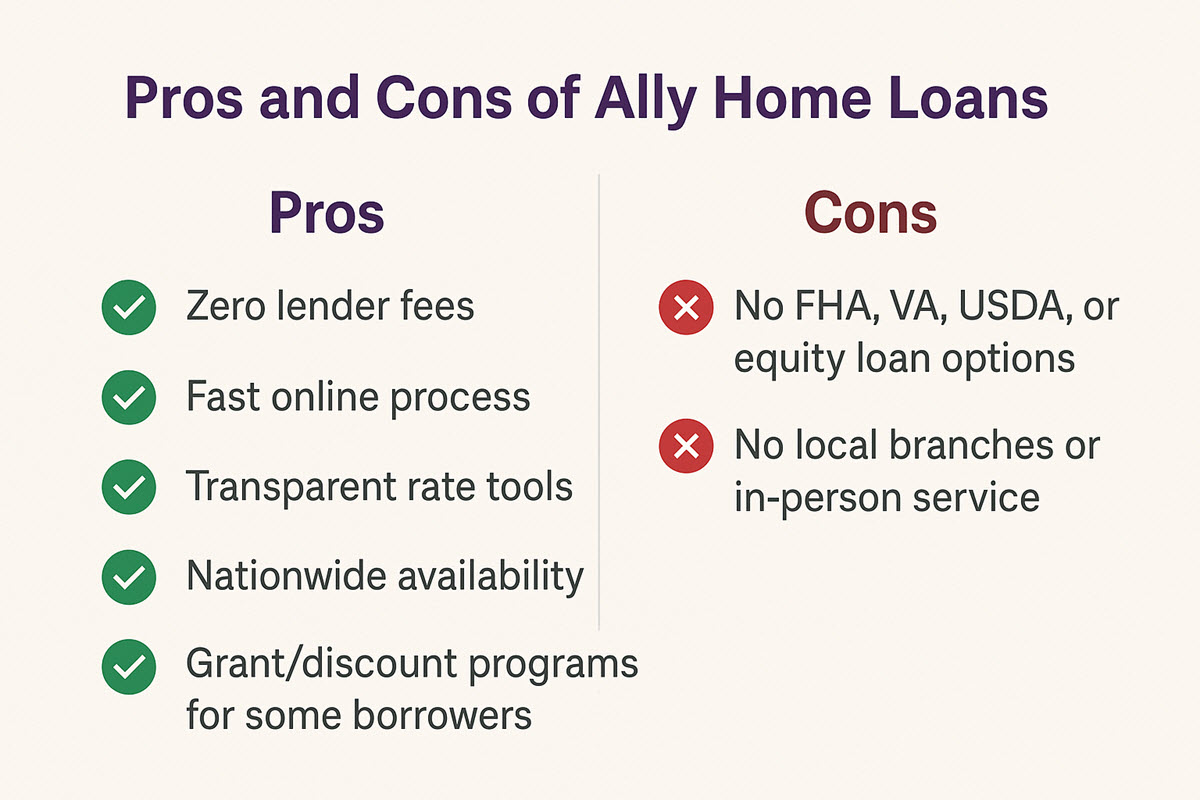

Pros and Cons of Ally Home Loans

Before Ally exited the mortgage market, their home loans came with several strong benefits, but also a few key drawbacks. Here’s a quick summary to help you see the full picture:

Pros of Ally home loans:

- Zero lender fees

- Fast online process

- Transparent rate tools

- Nationwide availability

- Grant/discount programs for some borrowers

Cons of Ally home loans:

- No FHA, VA, USDA, or equity loan options

- No local branches or in‑person service

Alternatives to Ally Home Loans

Since Ally home loans stopped accepting new applications in early 2025, borrowers now have to explore other lenders when searching for a mortgage. There are plenty of strong alternatives out there, each offering different benefits depending on what you need.

Here are five well-known banks to consider, each with its own style and strengths:

Chase

Chase is one of the largest mortgage lenders in the U.S. and offers a wide variety of home loan options, including conventional, jumbo, FHA, and VA loans. If you want to apply in person or work with a local loan officer, Chase has thousands of branches across the country. They also offer online tools for prequalification and mortgage tracking, making it a good choice for both tech-savvy and traditional borrowers.

Bank of America

Known for strong customer service and competitive rates, Bank of America is a solid option for homebuyers at any stage. They offer fixed and adjustable-rate mortgages, jumbo loans, and programs for first-time buyers. If you’re already a Bank of America customer, you may qualify for discounts through their Preferred Rewards program, an added perk for loyal users.

KeyBank

KeyBank provides individualized care and a more localized banking experience. It provides a range of mortgage products, including FHA and construction loans, which are great for buyers looking to build or renovate. Their digital platform is easy to use, and many borrowers appreciate the hands-on support from KeyBank’s local mortgage advisors.

Wells Fargo

Wells Fargo has a long-standing reputation in the mortgage industry. They offer flexible loan terms, including fixed-rate, ARM, jumbo, and government-backed options. Their strength lies in their wide branch network and detailed online resources. However, some borrowers have reported mixed experiences, so reading reviews and comparing quotes is a smart move.

BMO (Bank of Montreal)

BMO has been growing its presence in the U.S. mortgage market. It offers straightforward loan products with competitive rates and strong support for first-time homebuyers. BMO’s mortgage advisors are known for offering step-by-step guidance, making it a good fit for those who want a personal touch during the buying process.

Ally home loans once played a strong role for digitally‑driven borrowers. But now the business is closed to new applicants. If you had an open file before January 2025, you could still close it until May 27, 2025. Otherwise, it’s time to compare modern lenders while mortgage rates hover near 7%. Be proactive. Watch your credit. And find the right lender and loan type that fits your financial plan.