For more than 130 years, Northern Trust has served people with complex financial needs. Known for its wealth management expertise, Northern Trust Personal Banking offers tailored solutions to help customers handle their finances with confidence.

In this review, we’ll explore how their personal banking services work, from deposit accounts and lending to powerful digital tools like Private Passport, and what makes the overall experience unique.

Overview of Northern Trust

Northern Trust Corporation is a well‑known financial institution with a long history. It was founded in Chicago in 1889 and has grown into a global company. Today, Northern Trust works with wealthy families, individuals, businesses, and institutions all over the world.

The company is best known for three main areas: banking, wealth management, and trust services. These services are designed to help clients grow, protect, and pass on their wealth. This bank is also one of the largest custodian banks in the United States. This means it helps safeguard and manage trillions of dollars in assets for its clients.

Over the years, Northern Trust has earned a strong reputation for safety and expertise. It often appears on Fortune rankings and receives awards from the financial industry. Many high‑net‑worth clients and family offices choose Northern Trust Private Bank because of its focus on personal service and its experience in managing complex financial needs.

What Is Personal Banking at Northern Trust?

If you’re looking for more than just a place to park your money, personal banking at Northern Trust may be a smart choice. Northern Trust personal banking is part of its wealth management services. Instead of being a basic, everyday banking service, it is built for clients who want a more private and tailored experience.

Each client is paired with an experienced advisor who takes time to understand your full financial picture, from your income and investments to your long-term goals. The goal is to build a banking plan that fits your life, not just open an account.

These services include:

- High‑yield deposit accounts and cash management tools designed to keep your money safe while still earning interest.

- Private lending solutions for financing major purchases, real estate, or investments.

- Personal guidance from experienced banking advisors who create plans based on your specific goals.

This type of banking is not aimed at the general public. But if you want a bank that offers more than just transactions, one that truly partners with you to support your financial future, Northern Trust personal banking could be the right fit.

Personal Deposit Services

Northern Trust’s deposit services are designed for clients who want flexibility, growth, and smart cash management. These accounts aren’t mass-market products. Instead, they are tailored to help you manage wealth efficiently while still offering everyday convenience.

Checking and Savings Accounts

Northern Trust offers secure and flexible checking and savings accounts that fit into your broader financial plan.

While they may not advertise flashy perks, these Northern Trust accounts come with:

- Competitive interest rates that help grow your funds

- FDIC insurance for peace of mind

- Seamless integration with your investment and lending accounts

- This makes it easier to move money when needed and manage everything in one place.

Money Market Accounts

If you’re looking to earn more on your savings while keeping easy access to your funds, a money market account from Northern Trust personal banking can help. These accounts offer:

- Higher yields than traditional savings accounts

- Liquidity so you can use your money when opportunities arise

- Risk-aware structure designed for capital preservation

They are especially useful for clients who want to earn more without locking their money away.

Certificates of Deposit (CDs)

For clients who prefer predictable returns, Northern Trust personal banking offers a variety of CDs. You can choose different terms and lock in a fixed interest rate for the duration. These accounts are ideal if:

- You don’t need immediate access to the funds

- You want guaranteed growth over time

- You value stability and simple interest-based earnings

- CDs can be a great addition to a long-term cash management strategy.

Debit Cards and Everyday Banking

Even with a wealth-focused approach, Northern Trust personal banking still covers your day-to-day banking needs. Every personal banking client gets a debit card that works anywhere, along with access to:

- ATM withdrawals worldwide

- Online banking and transfers

- Bill pay services for recurring or one-time payments

- Zelle to send money quickly to family, friends, or vendors

All of these tools are designed to make banking easier without sacrificing the high level of service Northern Trust is known for.

Cash Management Tools

Northern Trust personal banking offers a set of cash management services that are designed to help clients make better use of their money. These tools are useful for people or families who have large amounts of cash that they do not want sitting idle.

- Sweep Programs: With a sweep, any extra money in an account at the end of the day can automatically be moved into another account or investment that earns a return. This way, your cash is not just sitting still but can generate some income while remaining easy to access when needed.

- Custom Cash Strategies: Northern Trust also works with clients to create custom cash strategies. These strategies may combine checking accounts, savings accounts, short‑term investments, and lending lines so that clients always have enough cash available but are also earning something on the money they do not immediately need.

- Liquidity Planning: This involves looking at your goals, such as buying a property, investing, or covering family expenses, and planning how much cash you need available at different times. The aim is to balance safety and flexibility with the chance to earn a better return on funds that are not being used right away.

These cash management tools are ideal for high‑net‑worth clients who keep large balances and value safety, flexibility, and careful planning.

Personal Lending Services

Instead of standard loans, Northern Trust personal banking offers a wide range of lending solutions customized to the unique needs of wealthy individuals and families. Whether you’re looking to fund a new project, make a luxury purchase, or unlock liquidity from existing assets, their lending advisors can help you structure the right type of loan.

Custom Lines of Credit

Northern Trust offers flexible credit lines that can be backed by your investment portfolio or real estate holdings. These lines are especially useful for clients who want quick access to cash without disrupting their long-term investment strategy.

You can use a line of credit for:

- Covering short-term cash flow gaps

- Seizing time-sensitive investment opportunities

- Making large purchases without selling assets

- Managing tax payments or other one-time expenses

The key advantage is flexibility. You borrow only what you need, when you need it, and repay it at your own pace.

Real Estate Lending

If you’re looking to purchase or refinance high-value property, Northern Trust personal banking has specialized mortgage solutions that go beyond what most banks offer. Their real estate lending services include:

- Jumbo mortgages for primary or secondary homes

- Bridge loans to help you buy a new home before selling your current one

- Construction financing for custom home builds or major renovations

These home loans are tailored to your cash flow and asset structure, making the approval process more personalized and less rigid than traditional mortgage lending.

Specialized Asset Lending

This is where Northern Trust really sets itself apart. They offer lending against non-traditional assets, something few banks are equipped to do.

Types of collateral may include:

- Private equity holdings

- Large concentrations of stock

- Ownership in a family business

- Luxury assets like fine art, aircraft, and yachts

These loans are ideal for ultra-high-net-worth individuals who have significant wealth tied up in unique or illiquid assets. Northern Trust Private Bank uses its deep expertise to help clients unlock value from these holdings without being forced to sell them.

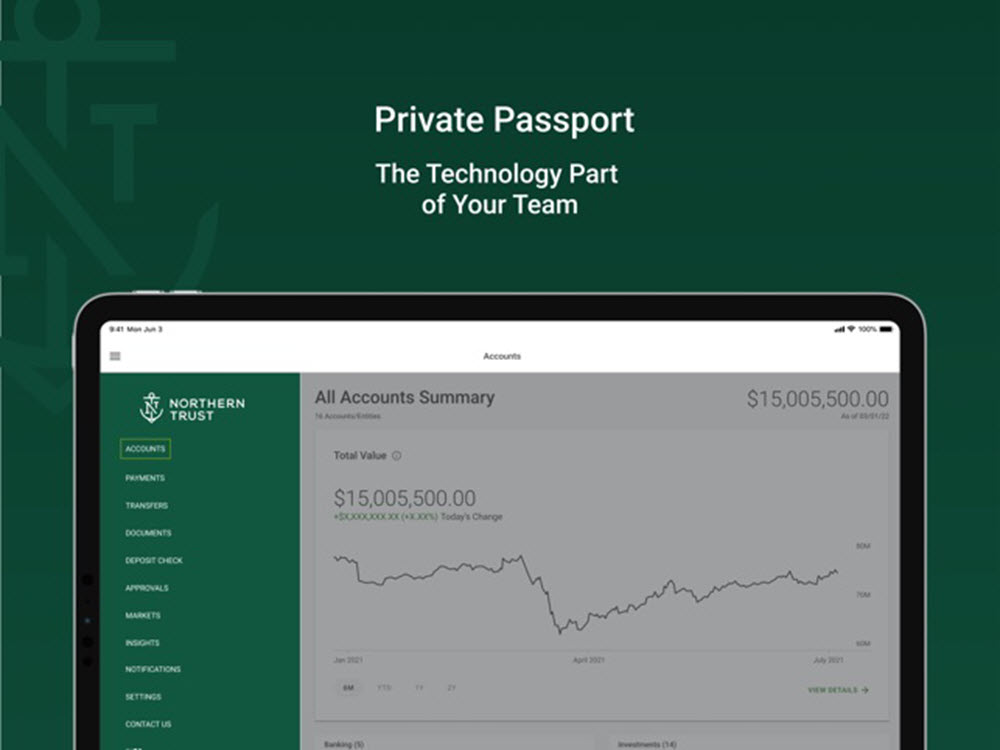

Private Passport Digital Platform

Managing your finances shouldn’t require multiple logins or trips to the bank. That’s why Northern Trust created Private Passport, a powerful online and mobile platform designed to simplify personal banking and wealth management.

Features of Northern Trust Private Passport

Private Passport combines everyday banking tools with high-level investment insights. It works seamlessly across all your devices, whether you’re on a desktop, tablet, or smartphone.

With a Northern Trust personal passport, you can:

- Check account balances and review transaction history

- Analyze your portfolio with detailed asset allocation reports

- Move money between accounts or to external institutions

- Deposit checks using your phone or tablet

- Pay bills online with ease

- Send money via Zelle quickly and securely

- Set up account alerts, paperless statements, and more

It’s a one-stop solution that allows you to stay on top of your finances no matter where you are.

Strong Security Measures

Your security is a top priority at Northern Trust. Northern Trust personal passport uses multiple layers of protection to keep your data and assets safe, including:

- Advanced encryption technology

- Voice ID verification for added safety

- Automatic logouts to prevent unauthorized access

Clients can also contact Northern Trust’s support team seven days a week for help with anything from login issues to service questions.

Northern Trust Personal Banking Security & Trust

When it comes to managing wealth, trust and security are everything, and Northern Trust has built a long-standing reputation on both. The bank has been in business for over 135 years and has successfully guided clients through multiple financial crises, recessions, and market cycles.

Clients choose Northern Trust because they know the company takes a conservative, risk-aware approach to protecting assets. This doesn’t just apply to Northern Trust investments, but also to day-to-day banking. Here’s what adds to their strong reputation:

- Named one of Fortune Magazine’s Most Admired Companies for 17 consecutive years

- Voted “Best Private Bank” by the Financial Times Group in 13 of the previous 16 years

- Continues to serve some of the world’s wealthiest families, year after year

In terms of banking protection, Northern Trust personal banking offers:

- FDIC insurance for eligible deposit accounts

- Multi-layered fraud prevention, including advanced monitoring and identity verification

- Private Passport with bank-grade encryption and real-time alerts

Strict internal controls and cybersecurity standards backed by a global team of professionals

Whether you’re managing everyday cash or financing complex deals, this bank gives you the confidence that your money and your privacy are safe.

Northern Trust Personal Banking Fees

Northern Trust takes a different approach to banking fees. Instead of charging standard fees like most retail banks, their pricing is based on your overall relationship with the bank, including the assets you hold, the services you use, and your long-term goals.

That said, here’s a breakdown of typical fees you might see with Northern Trust personal banking products:

| Account Type | Features | Fees |

|---|---|---|

| Free Checking | Basic checking with standard banking services | – $0 monthly fee – No minimum balance required |

| Platinum Checking | Interest-earning account with added perks | – No fee if daily balance ≥ $2,500 – $10/month or $8 with e-statements |

| Platinum Savings | High-yield savings account with flexible access | – $50 minimum deposit – $0 monthly fee – $5 per withdrawal after 6/month |

| Super Money Market | Higher-yield savings with daily liquidity | – No fee if daily balance ≥ $15,000 – $10/month if under minimum – $15 per transaction beyond 6/month |

| Certificates of Deposit (CDs) | Fixed-rate savings option over a set term | – No monthly fees – $15/year IRA maintenance fee (if applicable) |

For clients with large assets or multiple Northern Trust services (such as investment management or lending), many of these fees can be waived or discounted. However, full fee details are not posted online and are usually discussed during your onboarding process.

Northern Trust Personal Banking Requirements

Northern Trust personal banking is designed for individuals with significant financial assets and complex needs. There isn’t a publicly listed, fixed dollar minimum to open an account, as eligibility often depends on your overall relationship with the bank, such as wealth, investments, and income.

In general, prospective clients should expect:

- A minimum asset threshold, typically hundreds of thousands to over a million dollars in investable assets or cash.

- Strong documentation standards for identity verification, such as a government‑issued ID, Social Security Number or ITIN, proof of address, and often financial statements if you hold assets outside Northern Trust.

- Existing relationships with other advisors (like wealth managers or tax professionals) may be beneficial since their team‑based service model emphasizes collaboration across your financial advisors.

If you’re curious about specific eligibility terms, the best approach is to contact a Northern Trust representative directly, especially if you’re exploring U.S.-based or international private banking solutions.

How to Start with Northern Trust Personal Banking

Getting started with Northern Trust is a personal and guided process, built around your unique financial situation. Here’s a simple step-by-step overview:

- Reach Out: Contact Northern Trust through their website or a local office to connect with a personal banking or relationship advisor.

- Meet Your Advisor: You’ll have an initial conversation about your finances, including income, savings, credit needs, and long-term goals. Be ready to provide documents like ID and proof of assets.

- Tailored solutions: Based on your needs, advisors will suggest specific account types, lending options, or cash strategies that fit your goals.

- Complete the Paperwork: If you’re a good fit, you’ll fill out forms to open accounts, activate services, and enroll in Private Passport, their secure online banking platform.

- Go Digital with Northern Trust Private Passport App: Use your phone, tablet, or computer to manage accounts, move money, pay bills, and track investments.

- Ongoing Support: Your advisor stays with you long-term, helping align your banking with your broader financial plan and connecting with your wealth, tax, or estate team as needed.

This step‑by‑step process ensures that every client receives a banking plan that is built around their personal and financial objectives.

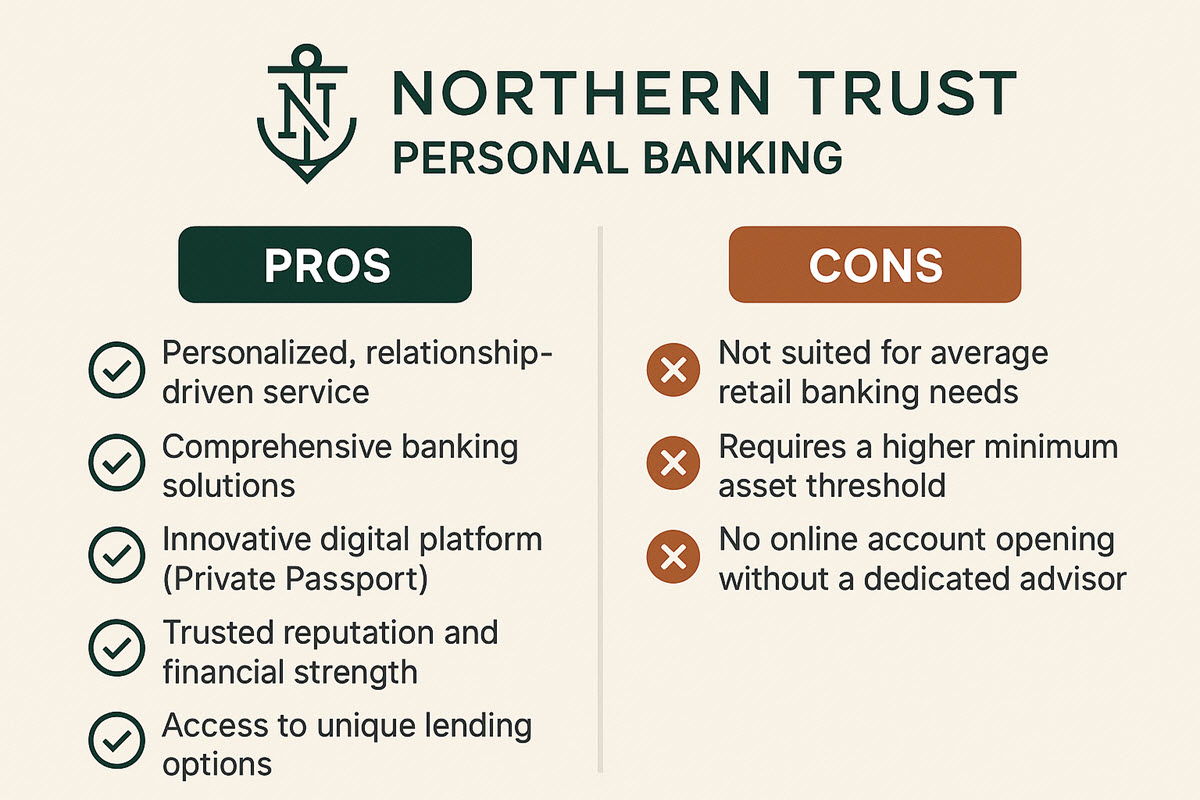

Pros and Cons of Northern Trust Personal Banking

Like any financial service, Northern Trust personal banking has its strengths and limitations, here’s a quick look:

Pros:

- Personalized, relationship-driven service

- Comprehensive banking solutions

- Innovative digital platform (Private Passport)

- Trusted reputation and financial strength

- Access to unique lending options

Cons:

- Not suited for average retail banking needs

- Requires a higher minimum asset threshold

- No online account opening without a dedicated advisor

From the advantages and disadvantages above, we can see that Northern Trust Private Bank isn’t designed for everyday banking needs or casual users. Instead, it’s best suited for individuals and families with significant wealth. This includes business owners, entrepreneurs, and anyone managing complex financial situations, like large estates, investment portfolios, or multiple income sources.

FAQs about Northern Trust Personal Banking

What do I need to open a Northern Trust personal banking account?

- To open an account, you usually need to have a high level of assets, often starting in the hundreds of thousands. Northern Trust looks at your full financial situation, not just your bank balance, when deciding if you’re a good fit.

Can I link other bank accounts to Private Passport?

- Yes. You can easily connect accounts from other banks to your Private Passport dashboard. Once linked and verified, you can view balances and move money between accounts.

Does Northern Trust charge for using Zelle?

- No. You can send and receive money through Zelle inside Private Passport without any fees.

How can I send money from Northern Trust to other banks?

- You can transfer money to outside accounts by using the “Transfer Funds” feature in Private Passport. You’ll need to add and verify the external account first.

How does Northern Trust protect my online banking activity?

- This bank uses several safety features like encryption, voice ID, instant alerts, and automatic logouts to keep your information and money secure.

Northern Trust personal banking is more than just managing your money. It’s about aligning your banking choices with your life goals. From intelligent cash management and yield optimization to lending against fine art and real estate, their services go far beyond what traditional banks offer. Therefore, if you’re seeking discretion, strategy, and a lifelong financial relationship, Northern Trust is a name worth trusting.