Getting the right American Express credit card can open the door to numerous rewards, perks, and services for you. Whether you want to earn points for travel, enjoy cash back on everyday purchases, or access premium benefits, American Express offers a variety of options.

In this review, we’ll explore all the options from Gold, Platinum, to Blue Cash Everyday and Delta SkyMiles Gold, so you can see what each card offers, how much it costs, and which one might be the best fit for the way you spend.

American Express Credit Card Overview

American Express, often called Amex, is known for its high-quality service and strong brand reputation. Many American Express credit card options come with luxury perks like airport lounge access, travel insurance, cash back, or reward points. You’ll also find strong security features like 24/7 fraud monitoring, purchase protection, and no-liability policies for unauthorized charges.

Amex is one of the few credit card companies that acts as both the card issuer and the payment network. This gives them full control over how they design rewards, benefits, and customer service. As a result, they can create better offers and build deeper relationships with cardholders.

Customers often rate Amex highly for satisfaction. According to recent reviews, most American Express cards receive ratings above 3 out of 5 stars, with many top-tier cards scoring even higher. Amex users often praise the company for its helpful customer support, generous welcome bonuses, and reliable fraud protection.

American Express credit card products generally fall into three main categories. Each one is designed for different lifestyles and spending habits:

- Travel & Dining Cards: Best for people who travel often or eat out regularly. These cards offer high rewards on travel, flights, and restaurants.

- Membership Rewards Points Cards: Designed for everyday spending. You earn points for every purchase, which you can later redeem for travel, shopping, or gift cards.

- Cash Back Cards: Simple and practical. These cards give you back a percentage of what you spend on things like groceries, gas, and online shopping.

Each category offers a mix of features and fees, so it’s important to choose the one that fits your lifestyle and budget. Go on with us and take a closer look at all of them below!

Travel & Dining American Express Credit Card Options

These are American Express’s flagship cards for people who spend a lot on travel or food. American Express offers three major personal credit cards for travelers and food lovers: the Green Card, Gold Card, and Platinum Card. Each one gives rewards through Amex’s Membership Rewards program, but with different features and annual fees.

American Express Green Card

This American Express credit card is a great fit for people who travel often but don’t need luxury perks. It covers a wide range of spending categories and offers solid value for a moderate annual fee. It’s also good for those looking to get started with Amex rewards.

- Annual Fee: $150

- Welcome Bonus: Earn 40,000 Membership Rewards® points after spending $3,000 in your first 6 months.

- How You Earn Rewards:

- 3× points on travel (airfare, hotels, cruises, car rentals, vacation rentals, tours, campgrounds, etc.)

- 3× points on transit (trains, buses, ferries, rideshares, subways, tolls, parking)

- 3× points at restaurants worldwide (including US delivery and takeout)

- 1× on all other purchases

- Key Benefits:

- Up to $209/year for CLEAR Plus

- No foreign fees

- Travel and purchase protections

- Split purchases with Plan It

- Send & Split with Venmo/PayPal

American Express Gold Card

The Gold Card is a favorite among food lovers and families. With high rewards on groceries and dining, it’s easy to rack up points fast.

- Annual Fee: $325

- Welcome Bonus: Up to 100,000 Membership Rewards® points after spending $6,000 in the first 6 months (actual offer may vary)

- How You Earn Rewards:

- 4x points at restaurants worldwide (up to $50,000 in annual spending)

- 4x points (up to $25,000 annually) at US supermarkets

- 3x points for tickets purchased via AmexTravel.com or directly with airlines

- 2x points on prepaid hotels and other eligible travel booked via AmexTravel.com

- 1x on all other eligible purchases

- Key Benefits:

- $120/year in Uber Cash

- $120/year dining credit (Grubhub, Wine.com, etc.)

- Access to The Hotel Collection

- No foreign fees

- Travel and shopping protection

If you spend a lot on meals or cook at home often, this American Express credit card can really pay off. The monthly credits also help offset the annual fee, making it one of the best all-around Amex cards.

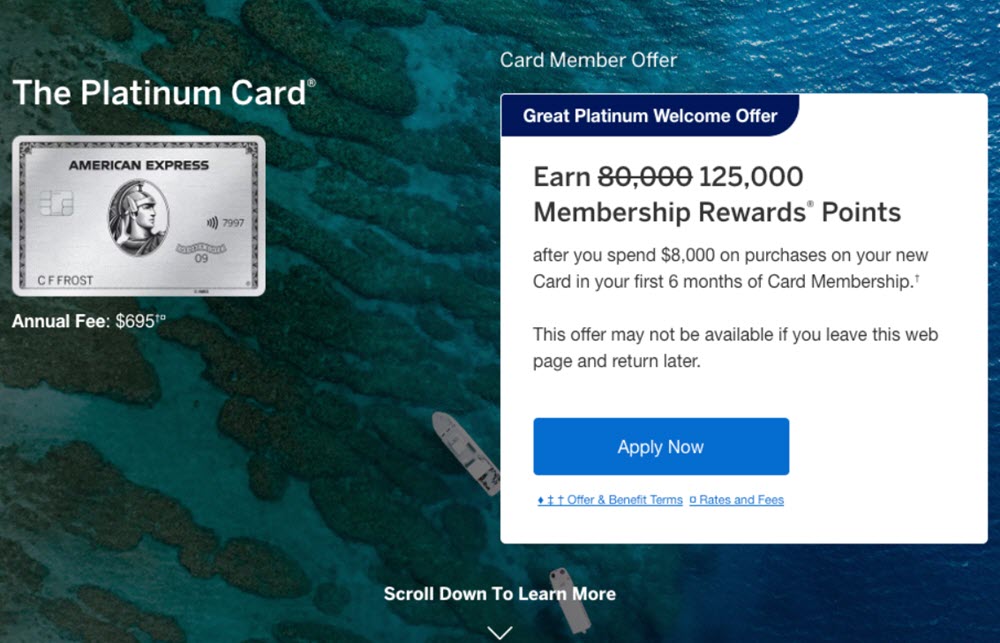

The Platinum Card from American Express

- Annual Fee: $695 (experts anticipate a possible increase to $995 in late 2025)

- Welcome Bonus: Up to 175,000 Membership Rewards® points after spending $8,000 in the first 6 months (offer varies by applicant)

- How You Earn Rewards:

- 5x points on flights booked directly with airlines or via AmexTravel.com (up to $500,000/year)

- 5x points on prepaid hotels booked through AmexTravel.com

- 1x on other purchases

- Key Benefits:

- $200 airline fee credit

- $240 entertainment credit

- $200 hotel credit

- Access 1,400+ airport lounges

- Hilton & Marriott Gold status

- Global Entry/TSA PreCheck credit

- Strong travel insurance and concierge

- No foreign transaction fees

This card is made for frequent travelers who want VIP treatment. Lounge access alone can be worth hundreds of dollars each year. When you combine that with travel credits, hotel perks, and high rewards rates on airfare, the Platinum American Express credit card becomes a powerhouse, if you use the benefits.

However, this is not a card for casual users. If you don’t travel often or won’t take advantage of the credits, the high annual fee may not be worth it.

American Express Cash Back Credit Cards

If you want to earn rewards on everyday spending like groceries, gas, or streaming, American Express cash back credit cards offer simple ways to save money while you shop.

Blue Cash Preferred Card

The Blue Cash Preferred Card is a great choice for families who spend a lot on groceries and streaming. It has a $0 annual fee for the first year, then $95 per year after that. You earn:

- 6% cash back at U.S. supermarkets (up to $6,000 per year)

- 6% on select U.S. streaming services

- 3% on gas and transit, including buses, rideshares, and tolls

- 1% on all other purchases

A welcome bonus of $250–$300 is available as a statement credit if you spend $3,000 within six months. Many people love this American Express credit card because it helps save money on everyday family expenses, especially with grocery prices going up.

Blue Cash Everyday Card

This American Express credit card is a no-annual-fee version of the Preferred card and is good for those who want steady rewards without extra costs. You get:

- 3% cash back at U.S. supermarkets, U.S. online retailers, and U.S. gas stations (up to $6,000 per category each year)

- 1% cash back after hitting the cap or on other purchases

New cardholders can earn a $200 statement credit by spending $2,000 within the first six months. It’s ideal for people who want basic rewards without worrying about annual fees.

American Express Travel Rewards Cards

Amex also has co-branded credit cards that give you more rewards when you stay at certain hotels or fly with specific airlines. These are perfect for loyal travelers.

Hilton Honors Cards

For travelers who frequently stay at Hilton hotels, Hilton Honors credit cards from American Express offer generous points, exclusive perks, and valuable welcome bonuses to enhance every trip.

Hilton Honors Card

- No annual fee

- 7x points at Hilton hotels

- 5x points at U.S. gas stations, supermarkets, and restaurants

- Comes with Hilton Silver status

Welcome bonus: Earn 100,000 Hilton points + $100 statement credit after spending $2,000 in six months

Hilton Honors Surpass Card

- $150 annual fee

- Higher rewards on travel and retail

- 130,000 Hilton points as a welcome bonus after $3,000 in six months

Hilton Honors Aspire Card

- $550 annual fee

- Premium perks including Hilton Diamond status, $250 airline fee credit, Hilton resort credits, and more

- Welcome bonus of up to 175,000 Hilton points

- Best for frequent Hilton travelers who want luxury benefits

Marriott Bonvoy American Express Cards

If you’re a loyal Marriott guest, these Amex credit cards can help you earn big rewards on hotel stays and everyday purchases, while enjoying premium travel benefits.

Marriott Bonvoy Bevy American Express Card

This American Express credit card is ỉdeal for travelers who want to rack up Marriott points quickly through everyday spending.

- Annual Fee: $250

- Rewards:

- 6X points at Marriott Bonvoy hotels

- 4X points at restaurants worldwide and U.S. supermarkets (up to $15,000/year), then 2X

- 2X points on other eligible purchase

- Welcome Bonus: Earn 85,000 points after spending $5,000 in the first 6 months, plus another 50,000 bonus points if you spend an additional $2,000 in the same period.

Marriott Bonvoy Brilliant American Express Card

Otherwise, frequent Marriott travelers looking for luxury perks, high rewards, and dining credits will prefer this card.

- Annual Fee: $650

- Rewards:

- 6X points at Marriott Bonvoy hotels

- 3X points at worldwide restaurants and flights booked directly with airlines

- Dining Credit: Get up to $300 back each year ($25 per month) for restaurant purchases made with the card.

- Welcome Bonus: Earn 100,000 points after spending $6,000 in the first 6 months, plus another 50,000 points after spending an extra $2,000.

These American Express credit card products are ideal for those who stay often at Marriott hotels and want to make the most of their travel expenses.

Delta SkyMiles Cards

Delta SkyMiles credit cards from Amex are perfect for travelers who fly with Delta often. Each Delta SkyMiles American Express credit card offers different perks depending on how often you travel and what benefits you want. If you often fly with Delta, they can help you earn miles faster, enjoy travel perks, and save money on your next trip.

Delta SkyMiles Gold Card

If you fly with Delta a few times a year and want solid travel rewards without a high annual fee, the Gold card is a great place to start.

- $0 annual fee the first year, then $150

- 2x miles on Delta purchases, restaurants, and U.S. supermarkets

- Get 15% off award flights

- $200 Delta flight credit after spending $10,000 annually

- Welcome bonus: Up to 80,000 miles

Delta SkyMiles Platinum Card

The Platinum card is a smart choice for frequent Delta flyers who want more perks like free checked bags, faster status, and more miles.

- $350 annual fee

- First checked bag free, priority boarding, and MQD Boost

- Welcome bonus: Up to 90,000 miles after $3,000 in six months

Delta SkyMiles Reserve Card

And for travelers who want luxury travel benefits and exclusive access, the Reserve card offers premium perks including lounge access and extra rewards.

- $650 annual fee

- Includes Delta Sky Club access, Resy dining credits, and MQD Headstart

- Welcome bonus: 100,000 miles after $5,000 spend

Delta SkyMiles Blue Card

- $0 annual fee

- 2x miles at restaurants worldwide and on Delta purchases

- 1x mile on all other eligible purchases

- No foreign transaction fees

- 20% back on in-flight purchases like food and drinks

- Welcome Bonus: Earn 10,000 bonus miles after spending $1,000 in the first 6 months

This American Express credit card is a great choice if you’re new to travel rewards or want a simple way to earn Delta miles without the commitment of an annual fee.

The Amex “Black Card”

The Centurion Card from American Express, often called the “Black Card,” is one of the most exclusive credit cards in the world. It’s available by invitation only, typically for high-net-worth individuals with large yearly spending. This American Express credit card doesn’t have a preset spending limit, which means your limit adjusts based on your spending habits and payment history. But the real value isn’t in the rewards point, it’s in the incredible lifestyle perks and VIP treatment. This card has:

- No set spending limit

- Travel & Hotel perks:

- Free Delta Platinum Medallion status with upgrades and bonus miles

- Elite status with Hilton, IHG, Jumeirah, Shangri-La, and more

- Perks include free upgrades, breakfast, late checkout, and spa credits

- Airport & Lounge access:

- Entry to 1,700+ lounges worldwide: Centurion, Delta Sky Club, Priority Pass

- Access to The Private Suite at LAX (paid service)

- CLEAR Plus membership credit for you and up to 3 family members

- Fitness & shopping:

- Free Equinox Destination Membership (worth over $3,500/year)

- $1,000/year Saks credit, split into $250 per quarter

- Private shopping hours at select Saks locations

- Concierge & lifestyle:

- 24/7 personalized concierge for reservations, events, and travel planning

- International arrival service with a guide at select airports

- Wine perks, VIP access to Net-a-Porter, and more

- Rewards:

- Earns Membership Rewards points

- No set bonus categories, value is in the exclusive benefits

Fewer rewards per dollar spent, but members don’t choose it for points, they choose this premium American Express credit card for the exclusive lifestyle and elite services.

American Express Credit Card Benefits & Features

When you get an American Express credit card, you can expect a few powerful features that set it apart from other issuers. While different cards offer different perks, most Amex credit cards include these core benefits:

Membership Rewards Points and Cash Back

Amex cards are known for strong rewards programs. Depending on the card, you’ll earn either Membership Rewards points or cash back.

- Membership Rewards Points: These are available on cards like the Amex Gold, Platinum, and Green. You earn points when you spend, and you can use them in many ways, like booking flights, shopping online, transferring to airline or hotel partners, or covering purchases with points. This gives you a lot of flexibility.

- Cash Back: Cards like the Blue Cash Everyday® and Blue Cash Preferred give you cash back instead of points. The cash back usually shows up as a statement credit, which helps reduce your bill. It’s simple, automatic, and a great choice if you prefer direct savings.

Whether you prefer flexible travel rewards or money back on groceries, Amex gives you options that fit your lifestyle.

Welcome Offers

Most American Express credit card options come with a generous sign-up bonus. To get it, you usually need to spend a certain amount within the first few months, like $2,000 in the first 3 months. The reward could be in the form of bonus points or cash back. These offers can be worth $100–$600 or more, depending on the card. It’s a great way to kickstart your rewards.

Amex Offers

Amex Offers are extra deals you can add to your account with just a click. They give you extra cash back or bonus points when you shop at select stores, restaurants, travel sites, or services. You’ll find these offers inside your Amex app or online account, and they’re personalized just for you. Think of them as digital coupons that can save you money on places you already shop.

Pay It and Plan It Tools

American Express gives you smart payment features that help you manage your balance:

- Pay It: Use the Amex app to quickly pay off small purchases right after you make them. This helps you stay on top of your spending.

- Plan It: Choose larger purchases and split them into fixed monthly payments with a set fee. You’ll avoid high interest charges and know exactly how much to pay each month.

These tools are great for budgeting and avoiding surprises on your statement.

Credit Score Requirements

To qualify for most American Express credit cards, you’ll usually need a good to excellent credit score, typically 690 or higher. However, approval isn’t only based on your score. Amex also considers your income, payment history, and current debt. If you’re just starting out, you might want to look for a no-fee card or a card designed for building credit first.

Credit Limits & Spending Power

Some American Express credit card options like the Gold and Platinum don’t have a preset spending limit. This doesn’t mean unlimited spending; it means your limit adjusts based on your purchase habits, payment history, and financial profile. It offers more flexibility than a fixed credit line. For other Amex cards, you’ll receive a set credit limit, just like traditional cards.

Comparison of American Express Credit Cards

With so many American Express credit cards to choose from, it’s important to compare their features, fees, and rewards to find the one that best fits your lifestyle and spending habits.

| Card | Annual Fee | Key Rewards | Best for |

|---|---|---|---|

| Blue Cash Preferred | $0 then $95 | 6% supermarket, streaming; 3% gas/transit | Grocery-heavy households |

| Blue Cash Everyday | $0 | 3% groceries, gas, online | No-fee cashback starting out |

| Amex Gold | $325 | 4x restaurants/groceries, 3× flights | Food & travel earners |

| Amex Green | $150 | 3x travel, transit, restaurants | Mid-tier frequent travelers |

| Amex Platinum | $695 (maybe $995) | 5x travel; lounge access; elite status | Frequent travelers who use perks |

| Hilton Honors Basic | $0 | 7x hotel; 5× gas/retail | Hilton stayers |

| Hilton Honors Surpass | $150 (after year) | More points categories | Hilton regulars |

| Hilton Aspire | $550 | Diamond Status, travel and resort credits | High-tier hotel users |

| Marriott Bonvoy Bevy | $250 | 6x Marriott; 4x dining/grocery | Marriott fans, mid spenders |

| Marriott Bonvoy Brilliant | $650 | 6x Marriott; elite status; dining credit | Premium Marriott travelers |

| Delta SkyMiles Blue | $0 | 2x restaurants, Delta; no foreign fees | New or casual Delta travelers |

| Delta SkyMiles Gold | $0 then $150 | 2x miles; bonus miles; travel savings | Occasional Delta flyers |

| Delta SkyMiles Platinum | $350 | Bag/boarding perks; MQD benefits | Frequent Delta flyers |

| Delta SkyMiles Reserve | $650 | Sky Club access; elite perks | Delta travel elites |

How to Choose the Right Card

Now you have all the necessary information on American Express credit card options and a quick comparison. Then, choosing the right American Express card depends on how you spend, travel, and use card benefits. Here’s a simple guide to help you make a smart decision:

- Match the card to your spending habits: Start by looking at where you spend the most money. For example, if you buy groceries often or spend a lot on food, the Blue Cash Preferred Card or the Amex Gold Card can offer great value.

- Know what perks are worth it for you: Premium Amex credit card products come with high-end benefits, but these perks are only valuable if you actually use them. If you travel just once or twice a year, a lower-cost card might save you more in the long run.

- Don’t overlook the welcome bonuses: Many Amex cards offer large bonuses if you spend a certain amount in the first few months. However, make sure that you can reach the spending requirement with your normal budget, don’t spend more just to earn an American Express credit card bonus.

- Compare the annual fee with your real-life use: Some premium cards charge a high American Express credit card annual fee, up to $695 or more. Before choosing one, make sure you’ll get enough value from it each year. Benefits like grocery credits, Uber cash, and lounge access can offset the fee, but only if you use them regularly.

- Stay updated on card changes: In 2025, American Express and other credit card companies updated several card benefits. That means you might lose access to certain lounges, bonus categories, or credits if you’re not paying attention. Always check the latest terms and updates before you apply or renew your card.

American Express Credit Card Application Process

Applying for an American Express credit card is a simple process, but knowing the right steps can improve your chances of approval and help you choose the best card for your needs:

- Visit the Official Amex Website: First, go to the official Amex website and explore their wide selection of credit cards. They offer options for many needs, so you can choose the one that matches your lifestyle and spending habits after researching carefully.

- Make Sure You’re Eligible:

- Be at least 18 years old

- Meet residency requirements (usually must live in the U.S. or a U.S. territory)

- Have a steady income and good credit history (usually a score of 690 or higher is recommended)

- Fill Out the Online Application: Click “Apply” on your chosen American Express credit card, and then, provide required details, including:

- Full name and date of birth

- Home address and contact info

- Social Security Number

- Total annual income

- Monthly housing/rent expenses

- Employment status

- Pre-Approval (Soft Credit Check): Amex will perform a soft credit pull to check if you qualify, but don’t worry, this won’t affect your credit score. If pre-approved, you can continue to submit your full application

- Final Approval (Hard Credit Check): After submission, Amex performs a hard inquiry to make the final decision. If you’re approved, you’ll receive an email confirmation.

- Receive and Use Your Card: Your physical ASmerican Express credit card will arrive in 7–10 business days. Some cards also offer a digital card number for immediate use after approval.

American Express Credit Card Activation

Before you can use your new Amex credit card, you need to activate it. Luckily, activation is quick and can be done in three easy ways:

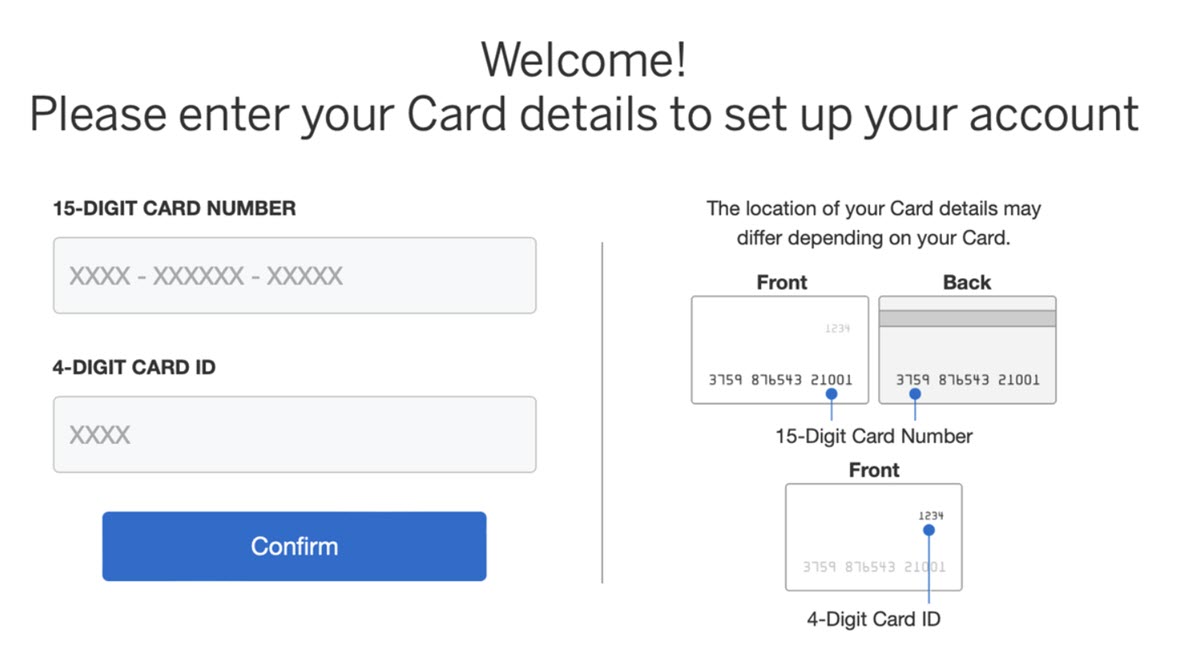

- Online Activation: Go to the Amex card activation page (on the official Amex website). Enter your 15-digit card number and the 4-digit card ID code found on the front of your card. After confirming your identity, your Amex credit card will be activated and ready to use.

- Activate via Mobile App: Download and open the American Express app on your smartphone. Log into your American Express credit card account and tap on the option to activate a new card. Enter the required details and follow the steps shown on the screen. It only takes a few minutes.

- Activate by Phone: Prefer to activate American Express credit card by phone? Just call 1‑800‑528‑4800 (or the number printed on the sticker of your card). Follow the voice prompts and provide your card number and identification details. Once verified, your card will be activated instantly.

Some Amex users may even get access to a virtual card number right after approval. This allows you to shop online or book services while you wait for the physical card to arrive in the mail.

American Express Credit Card Payment

Paying your Amex bill is easy, and you can do it in several convenient ways:

- Online or Mobile App: The fastest way to pay is by logging into your Amex account online or through the mobile app. From there, you can:

- Make a one-time payment

- Set up recurring payments

- Schedule your American Express credit card payment in advance

- Set Up AutoPay: Enroll in AutoPay to make sure you never miss a due date. You can choose to pay either the full statement balance or just the minimum amount. This helps you avoid interest charges and late fees.

- Pay by Phone: Call the number on the back of your American Express credit card to make a payment over the phone. It’s available 24/7. You’ll need to link your bank account in advance.

- Pay by Mail: You can mail a check using the payment address listed on your statement. Just make sure to send it several days before the due date to avoid delays.

- International or Regional Payment Options: If you live outside the U.S., American Express offers local solutions in some countries, for example, PayNow in Singapore or BillDesk in India.

To keep your credit score healthy and avoid extra charges, it’s a good idea to pay more than the minimum and always pay on time. Setting up AutoPay or reminders can help you stay on track.

Tips to Maximize the Value of Your Card

If you want to get the most out of an American Express credit card, it’s important to use it with a plan instead of just swiping it at random. Here are some practical ways to make sure every dollar you spend gives you back the highest value:

- Pay attention to your bonus categories: Each American Express card is designed to reward certain types of spending. If you know which purchases earn more points, you can plan your spending so that your big expenses fall into those categories.

- Take advantage of AmEx Offers and credits: Log in to your American Express account regularly and check the AmEx Offers section. These American Express credit card offers give you cash back or bonus points when you shop with certain stores. Also, don’t forget to enroll in credits such as Uber Cash, dining credits, or Walmart+ before making purchases. These credits work only when activated first.

- Use a combination of cards:

Many cardholders get the best value by using more than one AmEx card. A travel‑rewards card covers flights, hotels, and dining, while a cash‑back card gives a steady return on all other purchases. This pairing ensures you earn something extra on almost every transaction. - Redeem your rewards the smart way:

Membership Rewards points are flexible, but not all redemption options have the same value. With the right transfer, your points can be worth significantly more when you use them for flights or hotel stays.

By planning your purchases, checking your account for offers, and using points wisely, you can turn your American Express credit card from just a payment tool into something that gives you real benefits throughout the year.

American Express Credit Card FAQs

Does American Express have foreign transaction fees?

- Most Amex cards do charge a 2.7% foreign transaction fee, but premium cards like the Platinum Card and Gold Card have no foreign transaction fees.

Can I use my American Express credit card at Costco or Walmart?

- Costco only accepts Visa cards, so Amex is not accepted in-store. Walmart does accept American Express, both in-store and online.

How many Amex cards can I have?

- American Express typically allows up to 5 credit cards and 10 charge cards per person, though approval depends on your credit profile.

What credit score is needed for an Amex card?

- Most Amex credit cards require a good to excellent credit score, usually 690 or higher, but approval also depends on income and existing debt.

Does Amex report to all three credit bureaus?

- Yes. American Express reports your account activity to Experian, Equifax, and TransUnion, which helps build your credit history over time.

American Express offers something for every spender. It excels in travel and dining rewards, and customer support is superb. Just choose one American Express credit card that fits your habits. Use the perks, pay on time, and you’ll get more value than the card costs.