KeyBank credit cards are a smart choice if you want simple rewards, no annual fees, and solid features from a trusted regional bank. Unlike bigger names like Chase or Amex, KeyBank keeps things straightforward, making their credit cards a great fit for everyday spending.

In this guide, we’ll break down all the details about KeyBank credit cards, from how their rewards work to which card might be best for your financial goals.

Overview of KeyBank Credit Cards

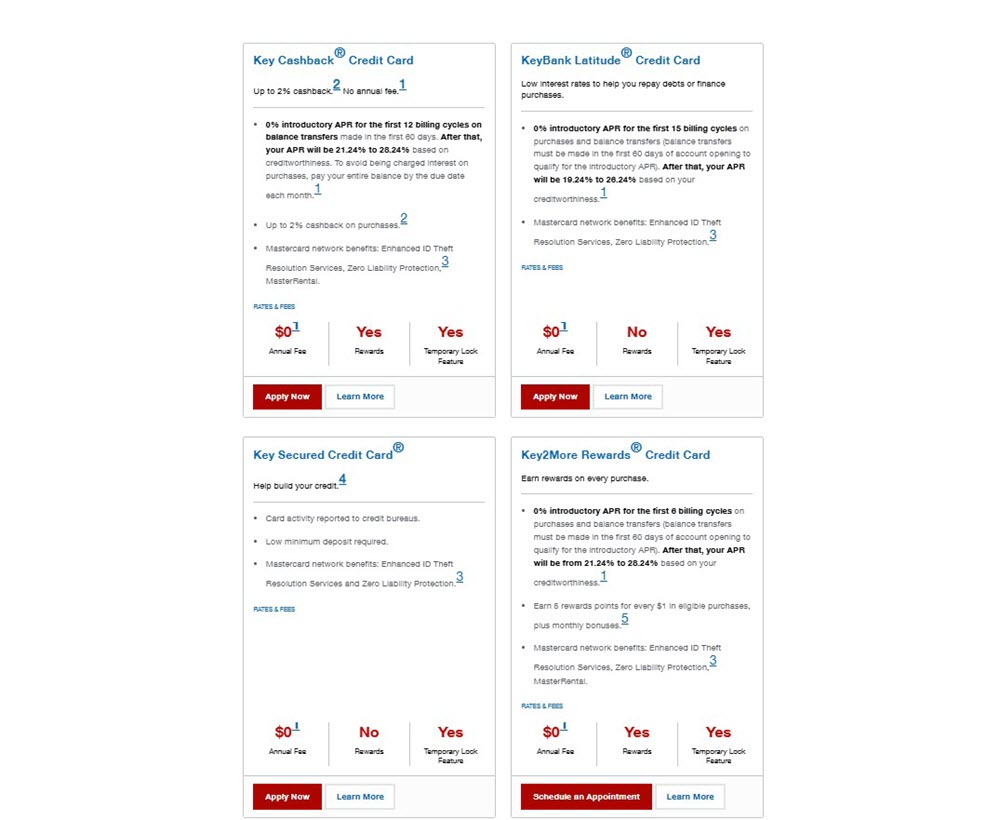

KeyBank offers a selection of four personal credit cards, each tailored to a different type of financial need. Whether you’re trying to build credit, manage existing debt, or earn rewards on your daily purchases, there’s a KeyBank card that can help you meet your goals. Here’s a quick snapshot of KeyBank credit cards:

| Card Name | Best For | APR Range | Annual Fee |

|---|---|---|---|

| Key Cashback® | Everyday cash back | 20.24% – 29.24% | $0 |

| Key2More Rewards® | Points and bonuses | 20.24% – 29.24% | $0 |

| KeyBank Latitude® | Balance transfers & big purchases | 18.24% – 28.24% | $0 |

| Key Secured Credit Card® | Credit building | 29.24% | $0 |

No matter which card you choose, all KeyBank credit cards come with the following benefits:

- No annual fee: You don’t have to pay just to keep the card active.

- Mastercard perks, including ID Theft Protection and Zero Liability Protection, to safeguard your finances.

- Contactless Tap & Go technology for quick, secure purchases.

- Easy access through mobile apps and online banking.

- A temporary card lock in case your card is lost or stolen adds a layer of security and peace of mind.

- FICO Score access for monitoring credit

- Multiple redemption options

Cons of KeyBank credit cards:

- Low redemption value (0.2 cents/point)

- Rewards structure can be complex

- No travel-specific card with enhanced perks

- High APRs after intro periods

Types of KeyBank Credit Cards

Now, let’s break down what each individual KeyBank credit card has to offer.

Key Cashback Credit Card

The Key Cashback Credit Card is a solid choice for people who prefer straightforward rewards with no complicated rules. You can earn cash back on all spending, without worrying about rotating categories or special sign-ups.

Key Features:

- Earn up to 2% cash back on every purchase

- 0% intro APR for the first 12 billing cycles on balance transfers (must transfer within 60 days of opening)

- Variable APR: 21.24% to 28.24%, depending on creditworthiness

- Balance transfer fee: $10 or 4% (whichever is greater)

- Minimum finance charge: $0.50

- Late payment fee: Up to $40

How to earn 2%: You need to have a qualifying KeyBank checking account and make at least 5 eligible transactions per month. If not, you’ll still earn 1% cash back.

Redemption:

Your cashback can be redeemed in two ways:

- As a statement credit to lower your bill

- Or deposited directly into your KeyBank account

If you’re already a KeyBank customer and use your card regularly, this card gives you an easy way to earn real money back, without an annual fee or confusing rules.

KeyBank Latitude Credit Card

The KeyBank Latitude Credit Card is ideal if you’re planning a big purchase or want to transfer a balance and avoid interest charges for over a year.

Key Features:

- For the first 15 billing cycles, purchases and balance transfers are eligible for 0% intro APR.

- Variable APR: 19.24% to 26.24% after the intro period

- Balance transfer fee: $10 or 4% of the transaction

- No rewards program, this card focuses on savings, not points

- No annual fee

With one of the longest 0% intro APR offers available, this card is perfect if you want to pay off a big expense over time or move high-interest balances without racking up more interest.

Key Secured Credit Card

If you have no credit history or are recovering from past financial issues, the Key Secured Credit Card offers a second chance. It requires a refundable security deposit but functions similarly to a standard credit card.

Key Features:

- Credit limit between $300 and $5,000 (based on your deposit)

- Reports to Equifax, Experian, and TransUnion, the three main credit bureaus.

- Variable APR: 27.24%

- Annual fee: $0

- Requires a Key Active Saver deposit account

You’ll be reviewed every few months to see if you qualify for an upgrade to an unsecured card (no deposit required).

If you’re starting over or building credit for the first time, this card provides a safe way to establish a credit history with helpful features and no annual fee.

Key2More Rewards Credit Card

The Key2More Rewards Credit Card is built for people who want to earn points quickly and get even more for spending more each month.

Key Features:

- 5 points per $1 spent on eligible purchases

- Monthly bonus points:

- Spend $1,000–$1,999 and earn 25% more points

- Spend $2,000+ and earn 50% more points

- For the first six billing cycles, purchases and balance transfers are eligible for 0% intro APR.

- Variable APR: 21.24% to 28.24% after the intro offer

- Annual fee: $0

Redemption Options:

You can redeem points for a variety of rewards, including:

- Cash back

- Travel bookings

- Gift cards

- Event tickets and merchandise

- Charity donations

Reward value: Points are worth 0.2 cents each, so 10,000 points = $20 in value.

If you’re a frequent spender who wants to earn more the more you spend, this card can deliver solid rewards. Just keep in mind that the point value is lower compared to some other programs.

KeyBank Credit Card Rates, Fees, and Terms

Before signing up for any credit card, it’s smart to understand the costs that might come with it. KeyBank keeps things relatively simple, but there are still a few important terms and fees to know:

- Standard APRs of KeyBank credit cards are variable and tied to the market’s prime rate.

- Cash advance fees typically are 5% of the amount, with a $10 minimum.

- Balance transfer and convenience check fees are either $10 or 4% of each transfer, whichever is higher.

- Foreign purchases incur a 3% fee after currency conversion.

- Late payment fees can reach up to $40.

- All KeyBank credit cards have a $0.50 minimum interest charge when interest applies.

| Card | 0% Intro APR | Regular APR (Purchases / BT) | Balance Transfer Fee | Cash Advance Fee | Annual Fee |

|---|---|---|---|---|---|

| Key Cashback® | 0% for 12 billing cycles on BT if requested within 60 days | 21.24%–28.24% variable | $10 or 4% of amount, whichever is greater | 5% of advance, $10 min | $0 |

| Latitude® | 0% for 15 billing cycles on purchases & BT (BT request within 60 days) | 19.24%–26.24% variable | $10 or 4% of amount, whichever is greater | 5% of advance, $10 min | $0 |

| Key Secured® | None, secured only, no BT or cash advances | 27.24% variable | Not offered | Not offered | $0 |

| Key2More Rewards® | 0% for 6 billing cycles on purchases & BT (BT request within 60 days) | 21.24%–28.24% variable | $10 or 4% of amount, whichever is greater | 5% advance, $10 min | $0 |

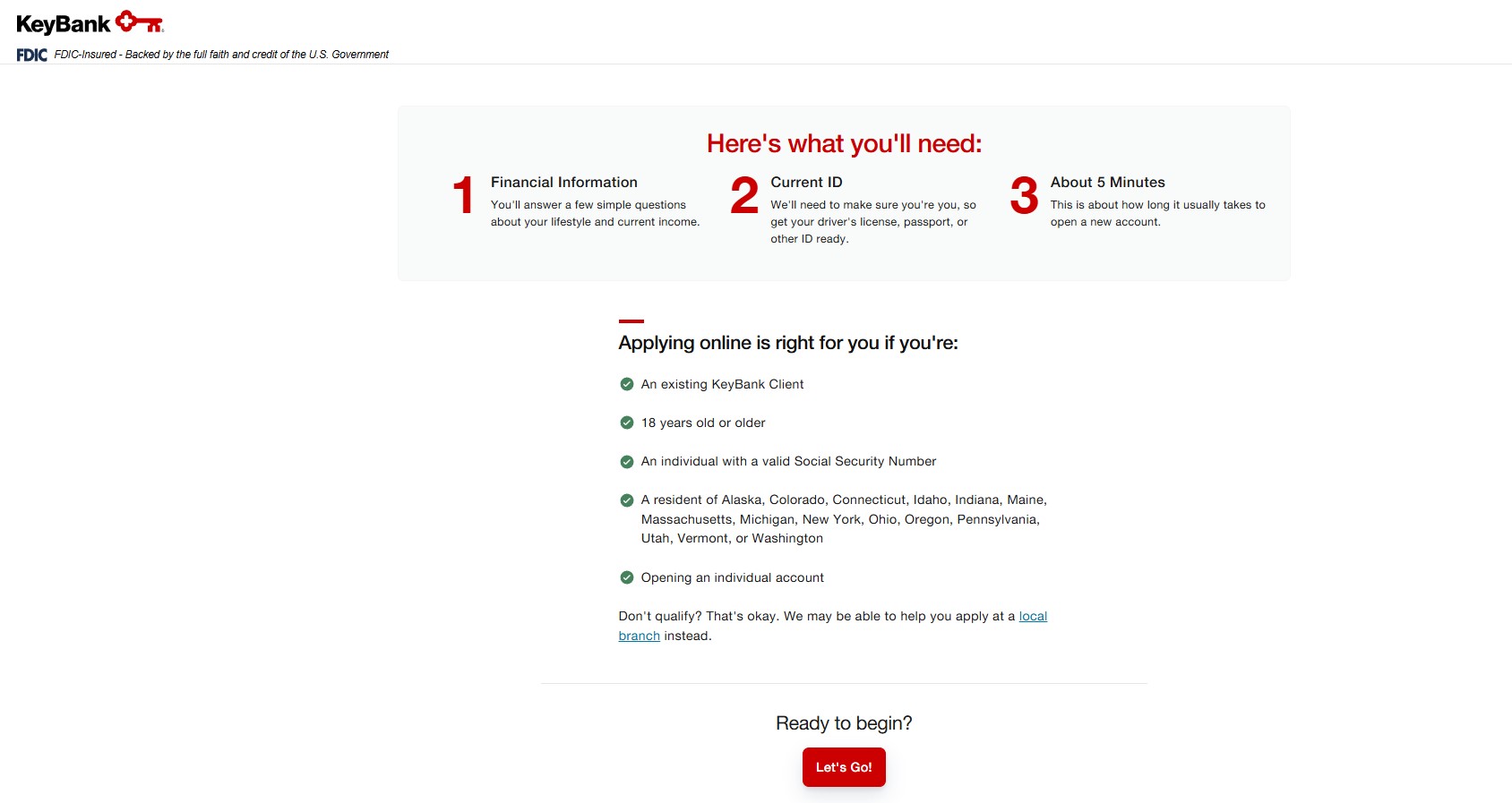

How to Apply for a KeyBank Credit Card

Applying for a KeyBank credit card is a simple process, and if you’re already a customer, it’s even easier. You have three main ways to apply:

- Online through the KeyBank website (if you’ve already a KeyBank client)

- In person at any KeyBank branch

- By phone, by contacting customer service

What You’ll Need to Apply

To complete the application, make sure you have the following:

- Social Security Number (SSN): Used to verify your identity and check your credit.

- A valid U.S. address: You must live in the U.S. and within KeyBank’s service areas.

- Proof of income: This helps the bank determine if you can handle a credit limit.

- A good to excellent credit score: Most unsecured cards require a solid credit history.

If you’re applying for the Key Secured Credit Card, you’ll also need to provide a security deposit. This deposit usually ranges from $300 to $5,000 and acts as your credit limit. It’s refundable, meaning you can get it back if you later close the card in good standing or upgrade to an unsecured card.

Tip: Using your secured card responsibly by paying on time and keeping your balance low can help you build credit fast. After several months, you may qualify for an upgrade.

Step-by-Step to Apply

Applying for a KeyBank credit card is quick and easy. Follow these steps:

- Check Eligibility: KeyBank only serves certain states like Ohio, New York, Colorado, and Indiana. Make sure you live in an eligible area or have an existing KeyBank account.

- Choose the Right Card: Pick a card that fits your needs, for example:

- Key Cashback for everyday cashback

- Key Secured for building credit

- KeyBank Latitude for saving on interest

- Gather Required Info: You’ll need your full name, Social Security number, address, job details, income, and monthly housing costs.

- Apply Online or In Branch: Apply online at key.com or visit a local KeyBank branch. Online applications take around 10–15 minutes.

- Get a Decision: You may get instant approval. If not, expect a response in a few business days. KeyBank may ask for extra documents.

- If approved, you’ll get your card by mail in 7–10 days. Then, activate it online or by phone, and you’re ready to use it.

Helpful Tips Before You Apply

- Check your credit score before applying. Most KeyBank credit cards require at least a fair or good credit score.

- Only apply for one card at a time, as too many credit inquiries can lower your credit score.

- Use prequalification tools if available. This can help you see your approval chances without affecting your credit.

- Bring documents (like ID and income proof) if you apply in person for faster processing.

KeyBank Rewards Program Explained

KeyBank’s rewards program is built to reward you for your everyday spending, and it’s pretty easy to understand. Whenever you use an eligible KeyBank credit card, you earn points for every dollar you spend. There’s no complicated math or confusing tiers. Points are accrued as you use your card more frequently.

Here are some key things to know about the rewards program of KeyBank credit cards:

- No Earning Limit: There’s no maximum number of points you can earn, so you can keep building your rewards month after month.

- Point Expiration: Your points remain valid for 4 years, giving you plenty of time to redeem them.

- Redemption Value: Each point is generally worth about 0.2 cents, so 10,000 points equals around $20.

- Account Closure: If you close your account, you’ll have 30 days to redeem any remaining points.

- Access: You can view and redeem your rewards easily through KeyBank’s online banking platform or mobile app.

KeyBank also gives you bonus opportunities just for managing your account smartly:

- Go paperless: Enroll in e-statements and earn 50 points every month.

- Set up autopay: You’ll earn 50 points per qualifying automatic payment, up to a maximum of 750 points per month.

These small actions can add up over time and boost your rewards without changing your spending habits.

How to Redeem Your KeyBank Rewards Points

Once you’ve earned some points, you have several flexible ways to use them. Whether you prefer cashback, travel perks, or even supporting a cause, KeyBank has you covered. Here’s a breakdown of your options:

- Cash Back: This is the most straightforward and flexible way to redeem your points. You can:

- Use them to lower your credit card balance by applying them as a statement credit.

- Deposit them directly into your KeyBank checking or savings account.

- Use “Pay Yourself Back” to cover recent eligible purchases.

- Cash back typically gives you the best value and the most control over your rewards.

- Travel: Use your points to book flights, hotel stays, or rental cars. There are no blackout dates, making it easier to travel on your own schedule. However, be aware that fulfillment fees may apply when booking through the rewards portal.

- Gift Cards: Redeem points for gift cards from popular retailers, restaurants, or online stores. These cards have fixed values and are easy to use, great for gifting or budgeting. Keep in mind the standard rate of 0.2 cents per point still applies.

- Merchandise: You can shop for electronics, kitchen items, and more through KeyBank’s rewards catalog. However, product prices may be higher than retail, which means you may get less value for your points compared to cash back or gift cards.

- Charity Donations: If you want to make a difference, you can donate your points to approved charities. The redemption rate remains at 0.2 cents per point, and it’s a meaningful way to support causes you care about.

- Event Tickets: Use your points to attend live concerts, sports events, and other special experiences. This option adds a fun element to your rewards, though service fees may apply depending on the event and provider.

Security and Benefits

KeyBank credit cards come with built-in safety features and perks to help protect you and your money.

- Zero Liability Protection: If someone uses your card without your permission, you won’t be responsible for those charges. That’s what Zero Liability means, it gives you peace of mind in case of fraud.

- Real-Time Fraud Alerts: KeyBank keeps an eye on your account. If something looks suspicious, they’ll send you an alert right away. That way, you can catch any issues early and take action fast.

- Lost or Stolen Card Support: Lost your card or think it’s been stolen? You can report it online or by phone. KeyBank will block the card to prevent unauthorized use and send you a replacement quickly.

- Contactless Payments: You can simply tap your card at most stores instead of swiping or inserting it. It’s fast, secure, and more hygienic, especially useful in today’s world.

- Mobile Wallet Compatibility: Want to pay with your phone? KeyBank credit cards work with Apple Pay, Google Pay, and Samsung Pay. You can tap and go as soon as you add your card to your digital wallet.

- Extra Mastercard Benefits: Since all KeyBank credit cards are powered by Mastercard, you get even more built-in perks, including:

- Extended warranty protection on eligible purchases

- Help with identity theft issues, like lost documents or reporting fraud

- Travel accident insurance (availability depends on the card)

These added benefits can be especially helpful in emergencies or when making big-ticket purchases.

FAQs About KeyBank Credit Cards

Does KeyBank offer prequalification for credit cards?

- No, KeyBank does not currently offer an online prequalification tool for its credit cards. You’ll need to submit a full application to check your eligibility, which may result in a hard credit inquiry.

Do I need to be a KeyBank customer to apply?

- Not necessarily, but having an existing relationship might improve approval chances.

How do I check my KeyBank credit card application status?

- To check your application status, call KeyBank customer service at 1-800-539-2968. They’ll verify your identity and give you an update.

Can I redeem rewards as cash?

- Yes. Cashback cards give statement credit or direct deposit. KeyBank points can be exchanged for cash, items, or gift cards.

How do I activate my new card?

- You can activate online, by calling the number on the sticker, or via the mobile app.

What happens if my card is lost or stolen?

- Call KeyBank immediately or log into online banking to report it. You’ll get a free replacement and won’t be responsible for unauthorized charges.

In conclusion, KeyBank credit cards offer a solid mix of options for everyday users, whether you’re looking to build credit, pay down debt, or earn rewards on spending. With no annual fees, helpful Mastercard benefits, and user-friendly mobile tools, these cards are great for those who value simplicity and flexibility. Just be sure to pick the card that fits your financial goals.