Choosing the right credit card in 2025 means more than just picking one with decent rates. You should find the perfect match for your lifestyle, spending habits, and financial goals. Fifth Third Bank credit cards offer a range of options designed for simplicity and everyday value, whether you’re looking to earn flat-rate cash back or streamline your business expenses.

But are they truly competitive in today’s crowded market? In this review, we’ll break down the key features, benefits, and limitations of Fifth Third Bank credit cards to help you decide if one of these cards deserves a spot in your wallet.

About Fifth Third Bank

Fifth Third Bank is a well-established regional bank that has been serving customers in the United States for over 160 years. It operates under the larger financial group called Fifth Third Bancorp, with its headquarters in Cincinnati, Ohio. Today, the bank has more than 1,100 branches and 2,400 ATMs spread across 11 U.S. states, mainly in the Midwest and Southeast. Some of its key markets include Ohio, Michigan, Florida, Illinois, and North Carolina.

Over the years, Fifth Third has grown into a full-service financial institution, offering a wide range of banking products for both individuals and businesses. From checking and savings accounts to auto loans, mortgages, and investment services, it provides solutions to help customers manage their money more effectively. Among its many offerings, Fifth Third Bank credit cards stand out as useful tools for people who want to earn rewards, build credit, or simplify business spending. The bank designs its cards with user-friendly features, aiming to make credit access more flexible and rewarding.

Fifth Third Bank Credit Card Portfolio Overview

Fifth Third offers a small but focused collection of credit cards designed to fit different financial needs. Here’s a breakdown of the current lineup:

For Personal Use:

- 1.67% Cash/Back Card: Earns a flat 1.67% cash back on all purchases, no rotating categories or limits. This is ideal for people who prefer consistent rewards without tracking spending types.

- 1% Cash/Back Card: Offers unlimited 1% cash back, plus a 0% introductory APR on purchases and balance transfers for a set period. A good option if you’re looking to pay off a large purchase interest-free while still earning rewards.

- Preferred Cash/Back Card: Available only for Fifth Third Preferred Banking clients, those who maintain a higher balance with the bank. This card earns 2% cash back on every purchase, making it one of the most rewarding options for eligible customers.

- Secured Card: Designed for people who are new to credit or trying to rebuild it. You provide a refundable security deposit, and in return, get access to a credit line.

- Private Bank World Elite Mastercard: This is a premium card tailored for high-net-worth individuals who use Fifth Third’s private banking services.

For Business Use:

- Simply Business Card: A straightforward credit card for small businesses, offering 1.67% cash back on all purchases and a 0% intro APR on purchases and balance transfers. It also includes helpful tools for tracking business expenses.

- Fifth Third Commercial Card: Designed for larger businesses or corporations with more complex financial needs. This card provides centralized expense management, customizable employee spending limits, detailed reporting tools, and integration with enterprise accounting systems.

Most of these Fifth Third Bank credit cards come with no annual fee, which makes them more appealing to cost-conscious users.

Fifth Third Bank Personal Credit Cards Unpacked

Fifth Third Bank offers a small but useful collection of personal credit cards. Each card is designed to meet specific financial goals. Let’s explore each card in more detail to help you figure out which one suits your needs best.

Fifth Third 1.67% Cash/Back Card

This is the bank’s flagship cash-back card. It’s cleverly named, Fifth divided by Third equals 1.67, and it earns 1.67% unlimited cash back on every purchase.

Key Benefits:

- 1.67% cash back on all purchases

- No annual fee

- No foreign transaction fees

- 0% intro APR on balance transfers for 12 billing cycles

- Cell phone protection

- Contactless payment support and compatibility with digital wallets

- Mastercard ID Theft Protection, plus $0 fraud liability if your card is lost or stolen.

Drawbacks:

- No sign-up bonus

- APR ranges from 16.24%–27.24% (variable)

When it comes to using your rewards, Fifth Third gives you flexibility. You can redeem cash back as a statement credit, direct deposit into your checking or savings account, request a check by mail, or even trade it in for gift cards or travel. This card is best for anyone looking for consistent cash back without having to track spending categories.

Fifth Third 1% Cash/Back Card

This card is very similar to the 1.67% version but focuses more on helping you manage large purchases or existing debt.

Key Benefits:

- A 0% introductory APR for 15 months on both purchases and balance transfers

- APR will adjust to a variable rate, 19.24% – 30%, depending on your credit.

- 1% unlimited cash back on every purchase.

- No annual fee

- No foreign transaction fees

- Same digital features and fraud protection as the 1.67% card

Drawbacks:

- Lower rewards rate compared to other cards (like 1.67% or 2% options)

- No sign-up bonus

- Requires good credit to qualify

While the rate is lower than 1.67%, this card is best suited for people who need a long interest-free period more than they need a high rewards rate. If you’re planning a major purchase or need time to pay off a balance without interest, this card is a good option, especially if you want to keep earning cash back at the same time.

Fifth Third Preferred Cash/Back Card

This card offers a flat 2% cash-back rate, but it’s only available to Fifth Third Preferred Banking clients. To qualify, you’ll need at least $100,000 in combined Fifth Third deposits or investments.

Key Benefits:

- Unlimited 2% cash back

- No annual fee

- Cell phone insurance

- No foreign transaction fees

- 0% APR on purchases and balance transfers for 12 months

Drawbacks:

- No welcome bonus

- Exclusive to Preferred clients

If you qualify, this card becomes one of the few no-annual-fee cards on the market to offer flat 2% cash back, putting it in the same league as top-rated cards like Wells Fargo Active Cash and Citi Double Cash. However, since it’s limited to Preferred clients, not everyone will be able to apply.

If you’re already a Preferred client or thinking of becoming one, this card can be a powerful way to turn everyday spending into long-term rewards without paying a dime in fees.

Fifth Third Private Bank Credit Card

This premium card is available to clients with a Private Bank relationship, typically requiring $1 million or more in assets with Fifth Third. It earns 2% on all spending, just like the Preferred card, but adds premium travel benefits.

Key Benefits:

- 2% unlimited cash back

- No annual fee (waived for Private Bank clients)

- 24/7 travel concierge

- Access to the Tournament Players Club (TPC) golf outing

- Trip cancellation, travel accident, and lost luggage insurance

- Cell phone protection

- No expiration on rewards, as long as the account remains open and in good standing.

Drawbacks:

- Requires a Private Bank relationship

- No sign-up bonus

This Fifth Third Bank credit card is not available to everyone. It’s designed for business clients who are part of Fifth Third’s Private Bank, typically requiring a significant relationship with the institution. If that’s you, this card offers both convenience and prestige, ideal for frequent travelers or executives.

Fifth Third Secured Credit Card

If you have no credit history or are working to rebuild your credit score, this card is designed specifically for you. It requires a minimum $300 deposit, which determines your credit limit. That deposit is held in a Fifth Third Momentum Savings Account.

Key Benefits:

- Reports to major credit bureaus

- Helps improve credit score with responsible use

- Mastercard ID Theft Protection

- Zero Liability protection for unauthorized charges

Drawbacks:

- $24 annual fee

- No Fifth Third Bank credit card rewards program

- High APR of 28.24%

- Requires a Fifth Third savings account

This card doesn’t earn rewards, but that’s not its main purpose. It’s a stepping stone toward building better financial habits and improving your credit profile. If you’re starting from scratch or recovering from past credit mistakes, it’s a practical and reliable tool.

Fifth Third Bank Business Credit Cards

Fifth Third Bank doesn’t just support individual cardholders. It also provides practical Fifth Third Bank credit cards for small businesses and larger commercial operations. These business credit cards are designed to help companies earn rewards, control expenses, and manage cash flow more efficiently.

Let’s break down the key business credit card options from Fifth Third:

Fifth Third Simply Business Card

The Fifth Third Simply Business Card was designed to make business spending easier and more rewarding. It offered a flat 1.67% cash back on every purchase, no need to worry about rotating categories or spending limits. Whether you were buying office supplies, paying for travel, or covering vendor bills, you earned the same rate every time.

Key Features:

- 1.67% unlimited cash back on all purchases

- No annual fee, helping businesses save more

- A 0% introductory APR on purchases and balance transfers for the first 12 billing cycles

- Built-in business tools like expense tracking and reporting, employee card options

- Mastercard benefits, including ID theft protection and extended warranties

Although this card is no longer open to new applicants, existing users still enjoy its straightforward rewards and helpful features. It’s especially useful for small business owners who want predictable cash back without the hassle.

Fifth Third Commercial Card

The Fifth Third Commercial Card is made for larger businesses with high spending needs. It’s a charge card, not a credit card, which means the full balance must be paid off each month, with no revolving debt. This structure gives businesses tighter control over cash flow and spending.

Features Include:

- Spending limits by department or individual to prevent overspending

- Advanced fraud monitoring for added security

- Detailed expense reports for better budget management

- $250 annual fee, automatically waived if your business spends $350,000 or more per year

This Fifth Third Bank credit card is ideal for companies that want better oversight of employee expenses and flexible management tools. It also integrates with accounting software and offers centralized billing, making it easier to track and manage corporate purchases.

Real Life Rewards Program

All Fifth Third Bank rewards credit cards participate in the Real Life Rewards program. With this program, you earn 1 point for every $1 spent, and each point is typically worth 1 cent when redeemed. That means 2,500 points equal $25 in value.

One of the best features of this program is that your points never expire, as long as your account remains open and in good standing. This gives you the flexibility to save up for larger redemptions over time.

You can redeem your points in several ways, including:

- Cash back as a statement credit

- Direct deposit into a Fifth Third checking, savings, or even a 529 college savings account

- Gift cards from major retailers and restaurants

- Travel such as flights, hotels, and car rentals

- Merchandise like electronics, appliances, and more

- Charitable donations

- Mortgage or loan payments through Fifth Third Bank

If you prefer not to think about redemptions, you can activate auto-redemption. Once your points balance hits 2,500 points, the system will automatically apply a $25 deposit to your linked Fifth Third account. This hands-free approach makes it easy to use your Fifth Third Bank credit card rewards consistently.

Interest Rates & Fees of Fifth Third Bank Credit Cards

Understanding the cost of carrying a credit card is just as important as the rewards. Fifth Third Bank credit cards are fairly competitive when it comes to fees, especially since most of them don’t charge annual fees.

Common Types of Fees

Here’s a breakdown of the most common charges across their current credit card lineup:

- Purchase APR: Variable APRs range from 19% to 29%, depending on your credit score and the card you choose. These rates are typical for many cash-back and rewards cards.

- Introductory APR Offers:

- 1.67% Cash/Back Card: 0% intro APR on purchases and balance transfers for the first 12 billing cycles

- 1% Cash/Back Card: 0% intro APR for up to 15 billing cycles

- Preferred Cash/Back Card: Offers special promotional APRs for qualified Preferred clients

- Balance Transfer Fee: $5 or 4% of the transfer amount, whichever is greater

- Cash Advance Fee: $10 or 5% of the advance amount, whichever is greater

- Foreign Transaction Fee: $0 on most cards, making Fifth Third cards a solid choice for international travel

- Late Payment Fee: Up to $40 if you miss a Fifth Third Bank credit card payment deadline

- Returned Payment Fee: Up to $39 if a payment bounces

- Penalty APR: May jump to 29.99% if you miss two payments within a six-month period. This rate stays in place until six consecutive on-time payments are made.

Quick Summary of Rates and Fees

Here’s a simple table summarizing the typical interest rates and fees across Fifth Third Bank credit cards:

| Card Type | APR (Purchases) | Intro APR | Balance Transfer Fee | Foreign Transaction Fee | Annual Fee |

|---|---|---|---|---|---|

| 1% Cash/Back Card | 19.24% – 29.99% (Variable) | 0% for 15 billing cycles | $5 or 4% (whichever is greater) | $0 | $0 |

| 1.67% Cash/Back Card | 19.74% – 29.74% (Variable) | 0% for 12 billing cycles | $5 or 4% | $0 | $0 |

| Preferred Cash/Back Card | Similar to 1.67% card | 0% for 12 billing cycles | $5 or 4% | $0 | $0 |

| Private Bank Credit Card | Similar to Preferred | N/A | $5 or 4% | $0 | $0 (waived for Private Bank clients) |

| Secured Card | 28.24% (Variable) | None | $5 or 4% | 3% per transaction | $24 |

| Simply Business™ Card | Similar to 1.67% card | Not available | $5 or 4% | $0 | $0 |

| Commercial Card (Charge Card) | N/A – must pay in full | None | N/A | $0 | $250 (waived with $350K annual spend) |

Fifth Third Bank Credit Cards: Application & Approval

Applying for a Fifth Third credit card is designed to be quick and accessible, especially if you’re already a bank customer:

General Requirements

- For most cards, you’ll need to have a Fifth Third checking or savings account. This helps the bank confirm your identity and financial standing.

- You should have a good to excellent credit score (typically 690+) to qualify for Fifth Third Bank credit cards like the 1.67% Cash/Back and 1% Cash/Back cards.

- The Preferred Cash/Back Card requires you to be a Preferred Banking client, meaning you maintain a higher combined balance, usually $100,000 or more in eligible accounts.

- The Secured Card is more accessible. You can apply even with limited or poor credit, as long as you’re able to provide a security deposit of $300 or more.

How to Apply for a Fifth Third Bank Credit Card

- Check Your Eligibility: You must live in one of the states where Fifth Third operates (such as Ohio, Michigan, Florida, or Tennessee). You also typically need an existing Fifth Third checking or savings account.

- Choose the Right Card: Decide which card fits your needs. Want cashback? Try the 1% or 1.67% card. Have higher assets? Go for the Preferred or Private Bank card. Building credit? The Secured Card works well.

- Visit the Website or Branch: You can apply online using Fifth Third’s official site. Or, visit a local branch, and the staff can help and answer questions.

- Fill in Required Details: You’ll share basic info: name, address, Social Security number, date of birth, income, and employment details. For secured cards, be ready to add your deposit amount. For Preferred or Private Bank cards, you’ll need to show proof of account balances or assets.

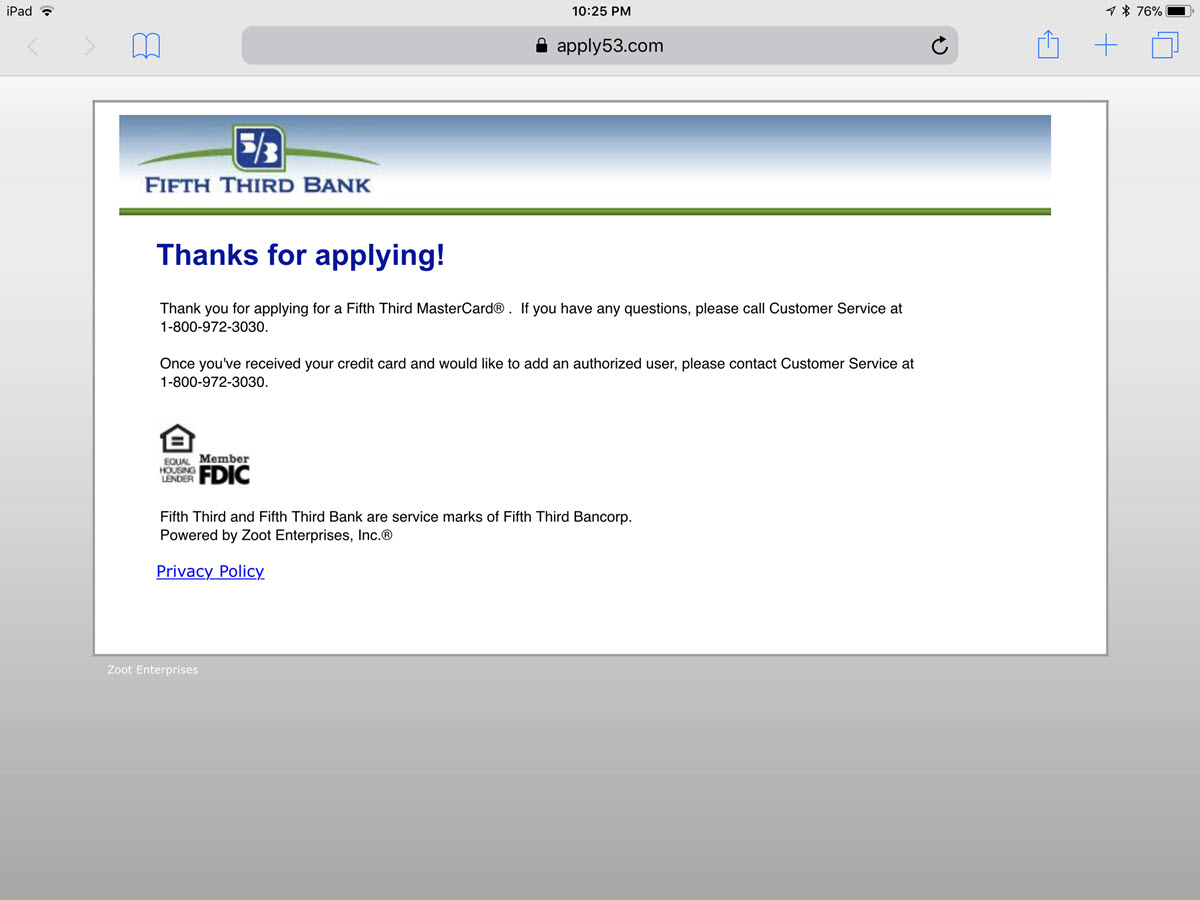

- Submit Your Application: Double-check your information and hit submit. Most decisions are instant unless your card type needs extra review (like higher‑tier cards).

Approval Speed of Fifth Third Bank Credit Cards

In most cases, Fifth Third Bank offers instant or same-day credit decisions, especially when applying online. Here’s how it typically breaks down:

- Instant Decisions: Many applicants get a decision within seconds after submitting their application online.

- Same-Day Review: If more information is needed, your application might be reviewed manually. In this case, you’ll usually get a decision within 1 business day.

- High-Net-Worth Cards (like Preferred or Private Bank): These may take 2–3 business days since the bank may need to verify your assets or account relationships.

Once approved, your physical card typically arrives by mail in 7–10 business days. You’ll get email or app notifications with tracking details. If you have any questions or issues during the application and approval process, you can contact Fifth Third Bank credit card customer service at 1-866-671-5353.

Which Fifth Third Credit Card Is Best?

With several card options available, you might be wondering which Fifth Third credit card is the best. The answer depends on your financial goals, income, and how you plan to use your card. For example:

| Your Situation | Best Fifth Third Card |

|---|---|

| Want simple, solid rewards and bank locally | 1.67% Cash/Back Card |

| Need intro APR and occasional cash back | 1% Cash/Back Card |

| Already a Preferred account holder | 2% Preferred Cash/Back Card |

| High-net-worth, want premium benefits | Private Bank Credit Card |

| Building/rebuilding credit | Secured Card → upgrade path |

| Own a small business | Simply Business Card |

| Run a large enterprise | Commercial Card |

FAQs About Fifth Third Bank Credit Cards

Can I apply without a Fifth Third account?

- No, most cards require a Fifth Third checking or savings account.

Which card has the best 0% APR?

- The 1% Cash/Back and Simply Business cards offer 0% APR for around 15 and 12 months, respectively.

Does Fifth Third Bank offer credit cards for bad credit?

- Yes. Fifth Third Bank offers a Secured Card designed for people with poor or no credit history. You’ll need to provide a refundable security deposit of at least $300. The card reports to major credit bureaus, which helps build or rebuild your credit over time.

How do I redeem rewards from Fifth Third Bank credit cards?

- Redeem via online/mobile app as a statement credit, deposit, check, travel, gift cards, or pay down mortgage.

Can I use a Fifth Third credit card internationally?

- Yes, you can. All current Fifth Third Bank credit cards have no foreign transaction fees, which means you can use them abroad without paying extra charges on international purchases.

Fifth Third Bank credit cards stand out for simplicity, transparency, and integration, especially if you already bank there. If you’re eligible and match the bank’s customer profile, these cards are solid, no-fuss options. If you chase maximum points or big travel perks, you may find stronger choices elsewhere.